-

Posts

478 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by RBFX Support

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JPY is declining again. Overview for 17.05.2024 The Japanese yen, paired with the US dollar, is retreating at the end of the week. The current USDJPY exchange rate stands at 155.77. Morning data showed that the Bank of Japan had kept the volume of bond purchases the same, refraining from taking action after reducing the volume earlier in the week. Investors speculated that the Japanese regulator kept the amounts unchanged, believing that the JPY had already received support from the recent weakening of the US dollar. Meanwhile, traders continue to bet that the BoJ will decide to lower bond purchase parameters at its upcoming meeting. It is worth noting Bank of Japan governor Kazuo Ueda’s statement that the central bank has no plans to sell its assets. This week’s statistics showed a slowdown in the Japanese economy. The country’s GDP in Q1 contracted by 2% y/y, falling short of expectations. Private consumption has declined for four consecutive quarters, dragging down the entire system. Such a report presents significant challenges for the Bank of Japan, which must balance supporting the economic system and protecting the weak yen. Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website. Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 13 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

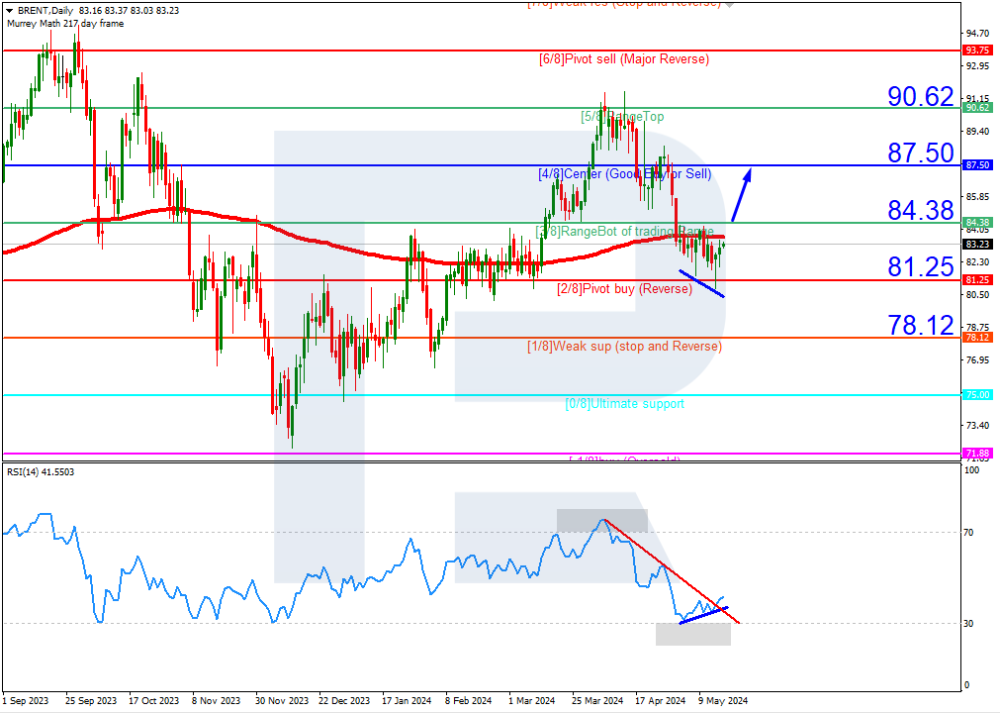

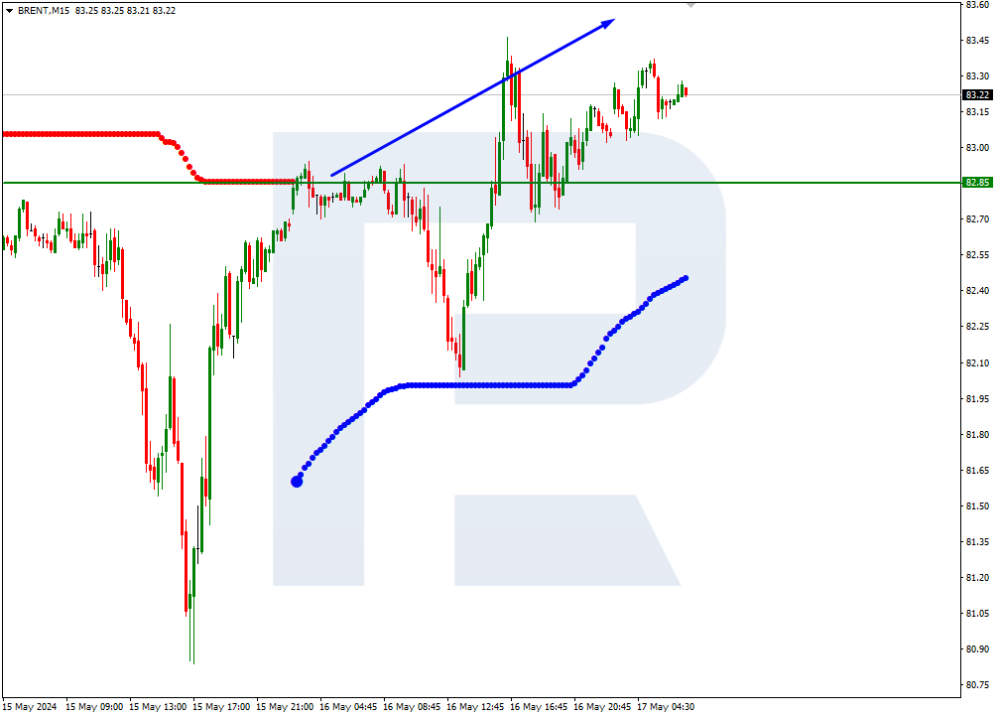

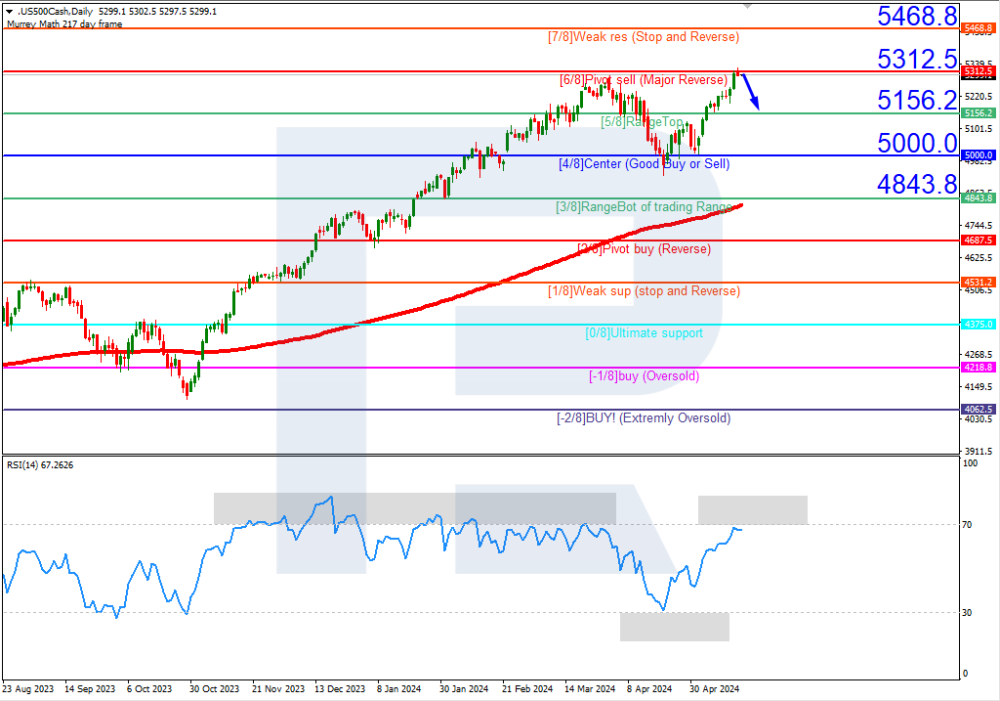

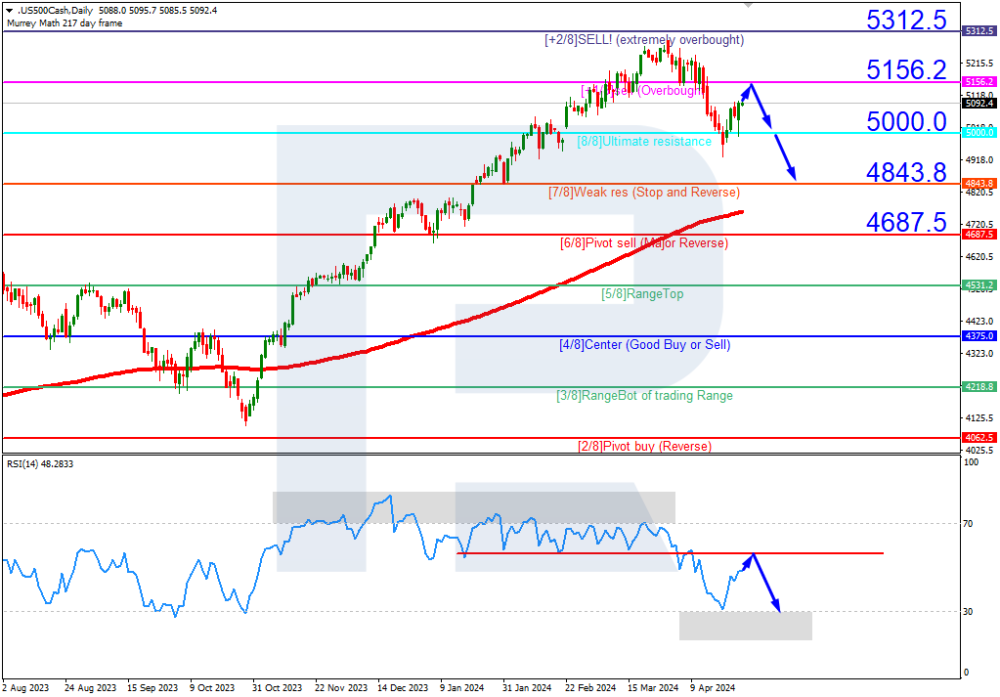

Murrey Math Lines 17.05.2024 (Brent, S&P 500) Brent Brent quotes have broken below the 200-day Moving Average on D1, indicating the potential development of a downtrend. However, convergence has formed on the RSI. As a result, in this situation, the price is expected to surpass the 3/8 (84.38) level and rise to the resistance at 4/8 (87.50). The scenario could be cancelled by breaking below the 2/8 (81.25) level. In this case, Brent quotes might decline to the support at 1/8 (78.12). On M15, the upper line of the VoltyChannel is broken, which increases the probability of a price rise. S&P 500 S&P 500 quotes are above the 200-day Moving Average on D1, indicating a prevailing uptrend. However, the RSI has reached the overbought area. As a result, in this situation, the price is expected to rebound from the 6/8 (5312.5) level and fall to the support at 5/8 (5156.2). The scenario could be cancelled by rising above 6/8 (5312.5). In this case, the S&P 500 quotes might reach the 7/8 (5468.8) resistance level. Read more - Murrey Math Lines (Brent, S&P 500) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

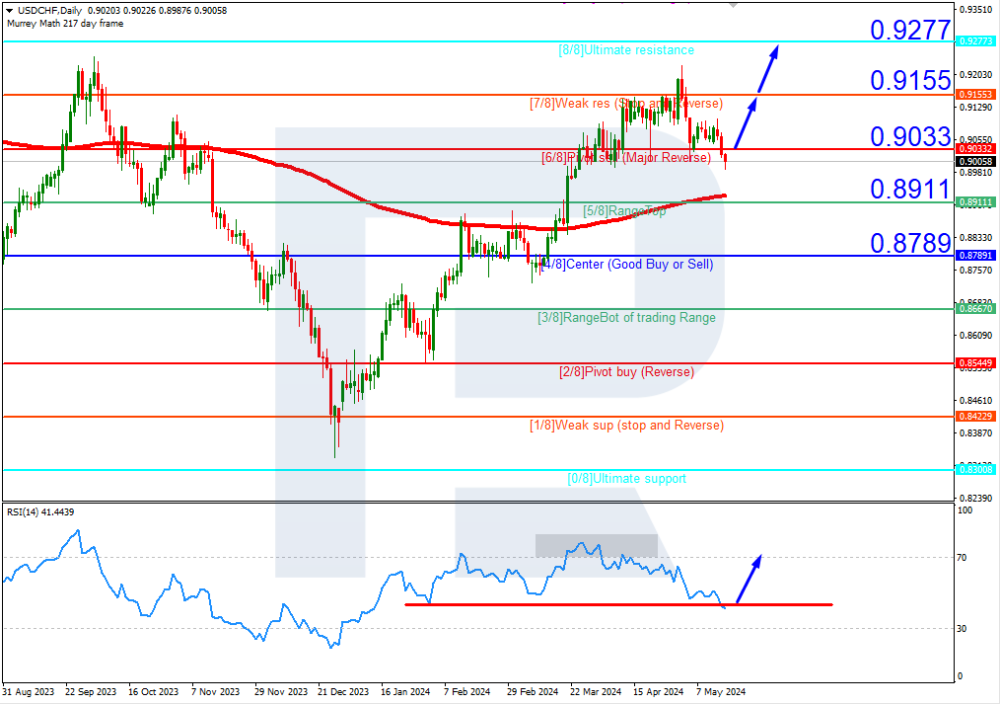

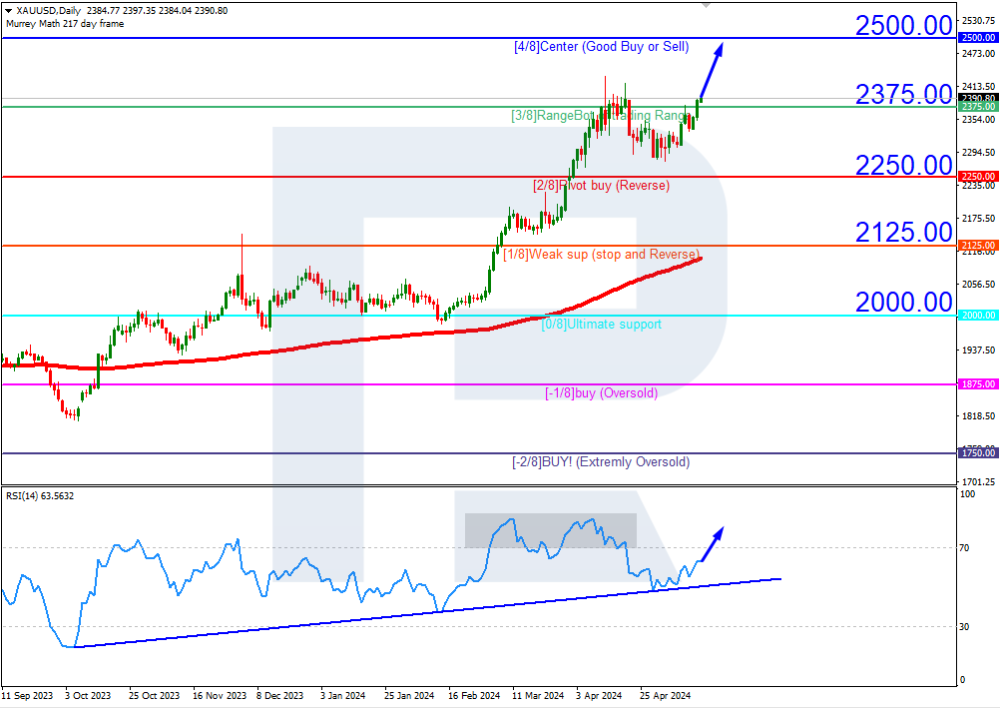

Murrey Math Lines 16.05.2024 (USDCHF, XAUUSD) USDCHF, “US Dollar vs Swiss Franc” USDCHF quotes are above the 200-day Moving Average on D1, indicating a prevailing uptrend. The RSI is testing the support line. In this situation, the price is expected to surpass the 6/8 (0.9033) level and rise to the resistance at 8/8 (0.9277). The scenario could be cancelled by a breakout of the 5/8 (0.8911) level. In this case, the pair might decline to the 4/8 (0.8789) level. On M15, the price rise could be additionally supported by a breakout of the upper boundary of the VoltyChannel. XAUUSD, “Gold vs US Dollar” Gold quotes are above the 200-day Moving Average on D1, indicating a prevailing uptrend. The RSI has rebounded from the support line. In this situation, the price is expected to rise further to 4/8 (2500.00). The scenario could be cancelled by a breakout of the 3/8 (2375.00) level. In this case, Gold prices might fall to the support at 2/8 (2250.00). Read more - Murrey Math Lines (USDCHF, XAUUSD) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JPY “revives”. Overview for 16.05.2024 The Japanese yen, paired with the US dollar, has significantly strengthened. The current exchange rate for USDJPY stands at 153.88. The yen found support as the US dollar fell. Following the release of inflation data the previous day, the likelihood of a Federal Reserve interest rate cut increased markedly. Inflation in April slowed to 3.4% y/y from the earlier 3.5%, with the core CPI dropping to 3.6% y/y from 3.8%. This easing of inflationary pressure provides grounds for anticipating a greater potential for a Fed rate cut in September. Consequently, the dollar retreated, enabling the yen to regain its position. However, the morning’s GDP statistics for Japan failed to inspire confidence. The economy contracted by 2.0% year-on-year in Q1 2024, surpassing the expected 1.5% decline. The downturn was 0.5% on a quarter-to-quarter basis, higher than the projected -0.3%. The report shows that weak private consumption emerged as the primary driver behind the GDP fall, marking a decline for four consecutive quarters. Meanwhile, yen investors remained undeterred by the report, preoccupied with market corrections. Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website. Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 13 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

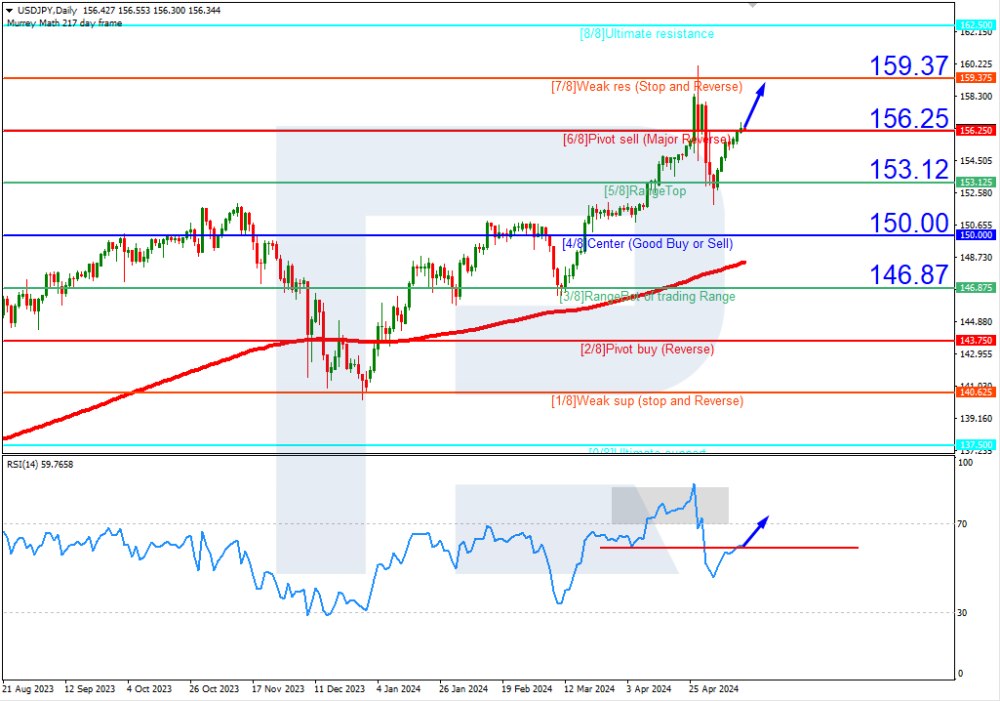

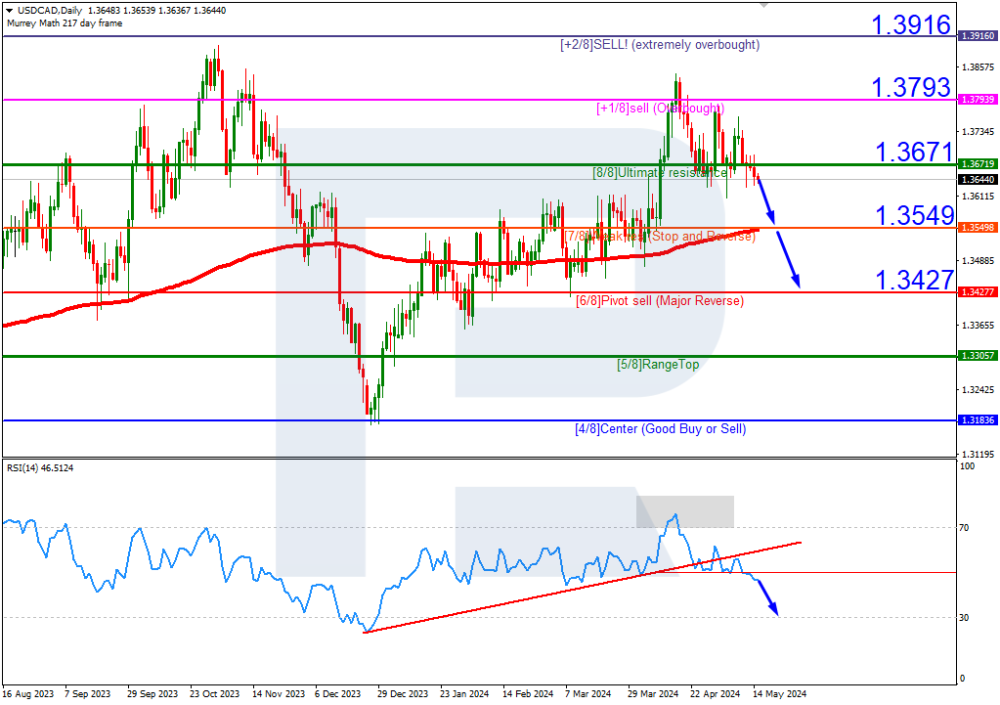

Murrey Math Lines 15.05.2024 (USDJPY, USDCAD) USDJPY, “US Dollar vs Japanese Yen” USDJPY quotes are above the 200-day Moving Average on D1, indicating a prevailing uptrend. The RSI has surpassed the resistance line. In this situation, the pair is expected to rise further to 7/8 (159.37). The scenario could be cancelled by a breakout of the 5/8 (153.12) support level. In this case, the quotes could drop to 4/8 (150.00). On M15, the upper line of the VoltyChannel is broken, which increases the probability of a further price rise. USDCAD, “US Dollar vs Canadian Dollar” USDCAD quotes have breached the 8/8 (1.3671) level and exited the overbought area on D1. The RSI has broken the support line. In this situation, the price is expected to decline further to the 6/8 (1.3427) support level. The scenario could be cancelled by rising above 8/8 (1.3671). In this case, the quotes might return to the +1/8 (1.3793) resistance level. Read more - Murrey Math Lines (USDJPY, USDCAD) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD has reached a new five-week peak. Overview for 15.05.2024 The primary currency pair is advancing on Wednesday. The current EURUSD exchange rate stands at 1.0822. Upbeat comments from Jerome Powell, the US Federal Reserve chair, regarding the state of the US economy weighed on the US dollar. He gave a relatively confident outlook on GDP growth rates. Powell believes that the economy is still growing more vigorously than the trend. Additionally, he is convinced that inflationary pressures will ease. Despite recent statistics that could challenge this confidence, Powell remains steadfast in his optimistic views. This year, high consumer prices have prompted the Federal Reserve to alter its monetary policy trajectory, compelling it to abandon its monetary easing strategy to gather more data. Investors anticipated six interest rate cuts in January, but now, only one is expected. According to the CME FedWatch monitor data, the interest rate may be lowered by a maximum of 45 basis points this year, with the first cut expected in September. Today is crucial as the market awaits inflation and retail sales data for April. Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website. Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 13 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

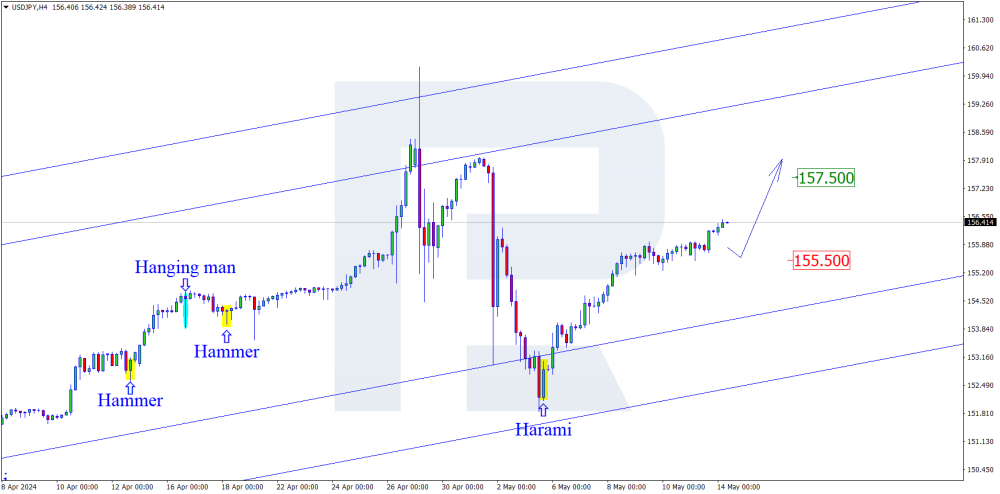

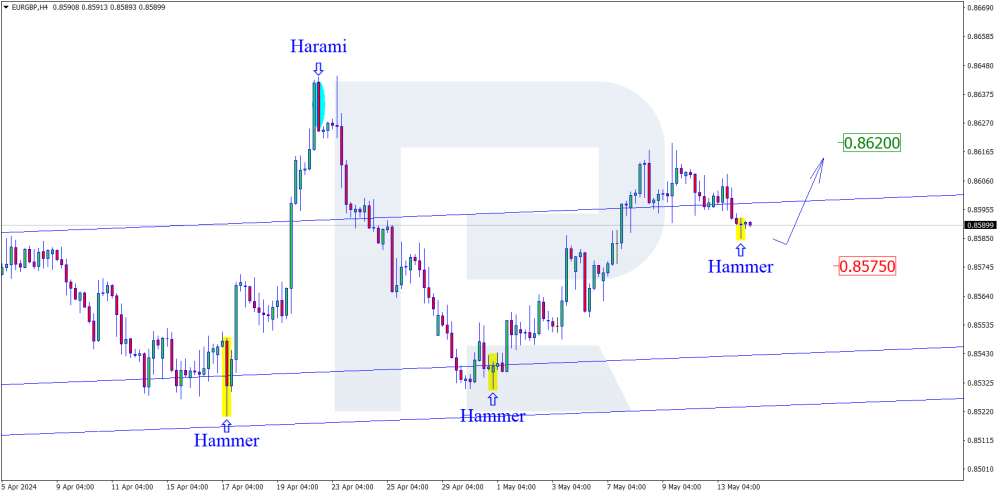

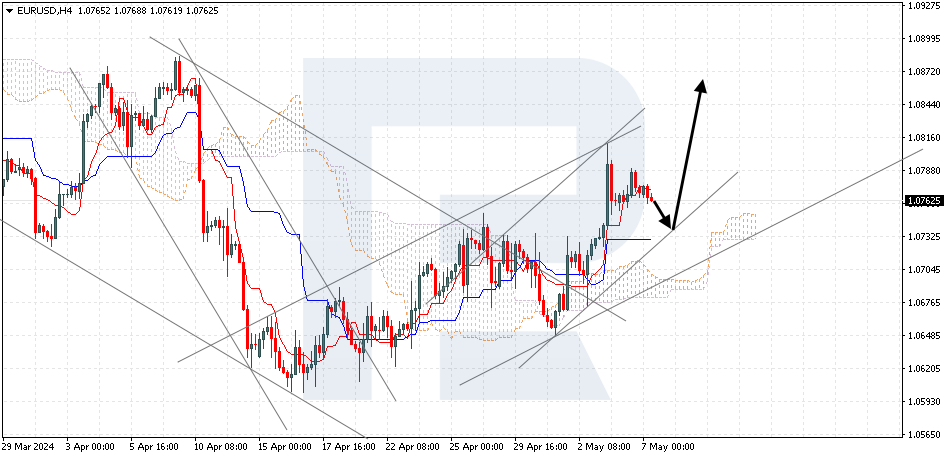

Japanese Candlesticks Analysis 14.05.2024 (EURUSD, USDJPY, EURGBP) EURUSD, “Euro vs US Dollar” EURUSD has formed a Shooting Star reversal pattern near the resistance level on H4. Currently, the instrument is going by the reversal signal in a descending wave. The decline target could be the 1.0740 support level. However, the price could rise to 1.0845 and continue its upward momentum after testing the support. USDJPY, “US Dollar vs Japanese Yen” USDJPY has formed a Harami reversal pattern on H4. Currently, the instrument is going by the reversal signal in an ascending wave. The growth target could be the 157.50 mark. However, the price could correct to 155.50 and maintain its upward trajectory after pulling back to the support level. EURGBP, “Euro vs Great Britain Pound” EURGBP has formed a Hammer reversal pattern on H4. Currently, the instrument is going by the reversal signal in an ascending wave. The growth target could be the 0.8620 mark. After testing this level and breaking above it, the price might continue the uptrend. However, the quotes could pull back to 0.8575 before rising. Read more - Japanese Candlesticks Analysis (EURUSD, USDJPY, EURGBP) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD reached equilibrium. Overview for 14.05.2024 The primary currency pair is consolidating on Tuesday. The current EURUSD exchange rate stands at 1.0784. The currency market is clearly conserving strength ahead of this week's release of the US consumer price index report, projected to provide much insight into the Federal Reserve's interest rate trajectory. According to the CME FedWatch monitor, the likelihood of an interest rate cut at the September meeting is 60%. This week's attention is focused on the US consumer price index, scheduled for release this Wednesday. Core inflation in April is expected to have increased by 0.3% m/m, which is lower than the March value of 0.4% m/m. However, before that, on Tuesday, the US will publish the producer price index statistics for April. The market will meticulously analyse the data to understand how quickly inflation is approaching the 2% target. Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website. Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 13 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

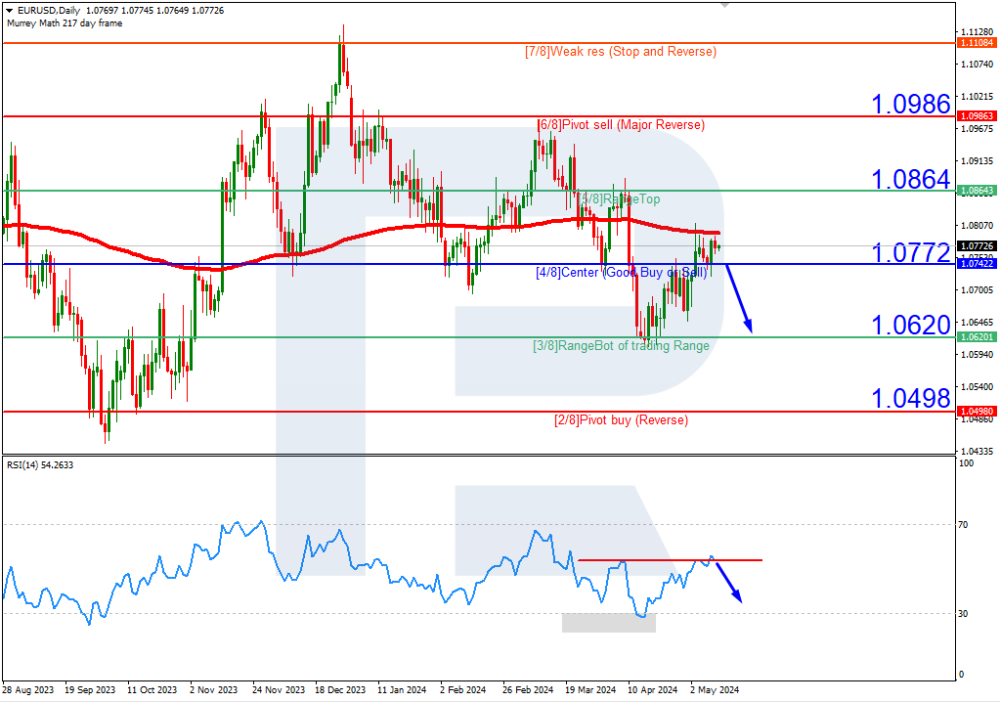

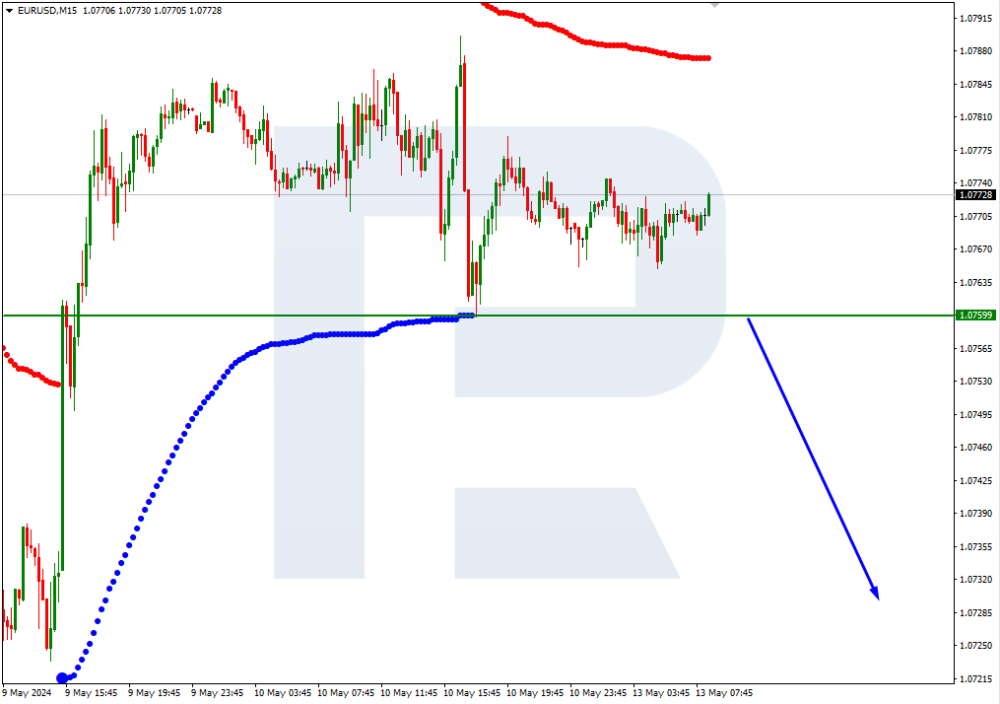

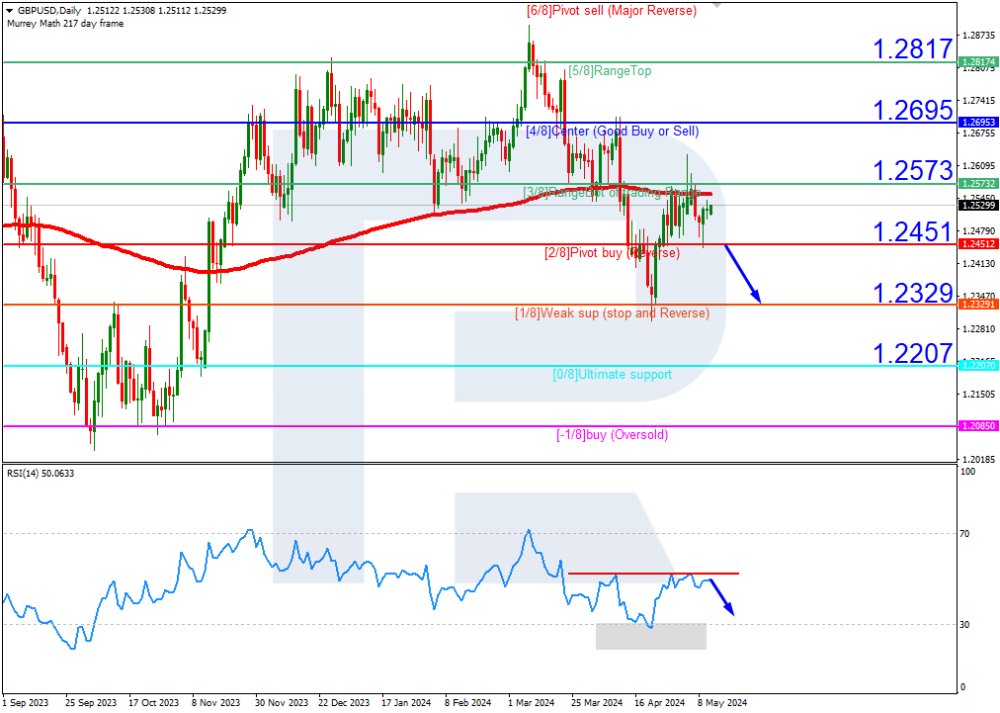

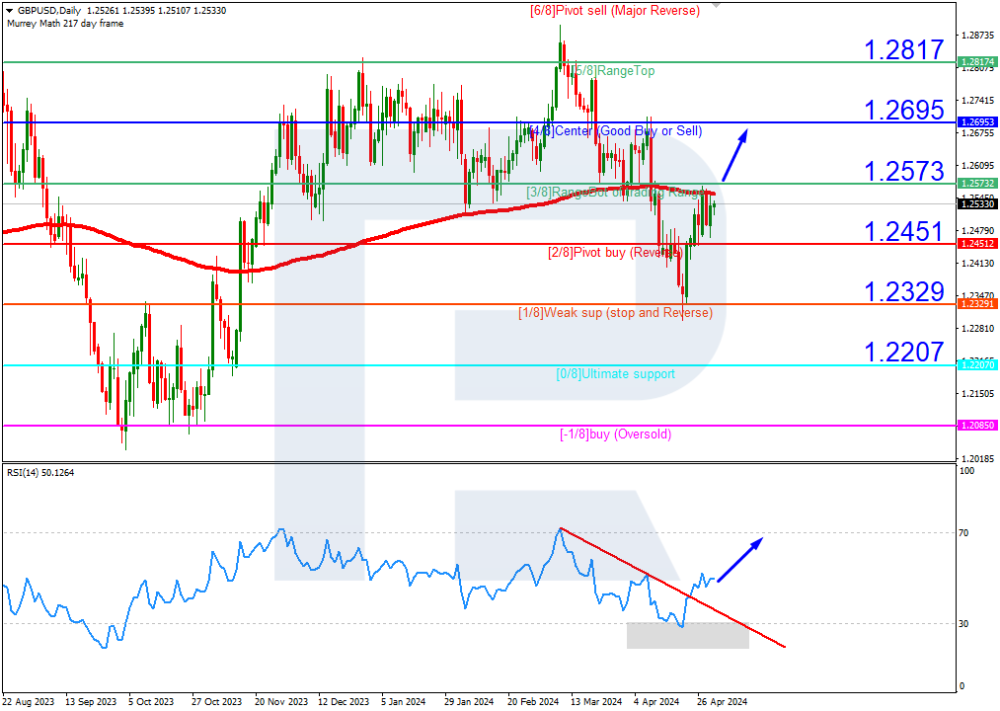

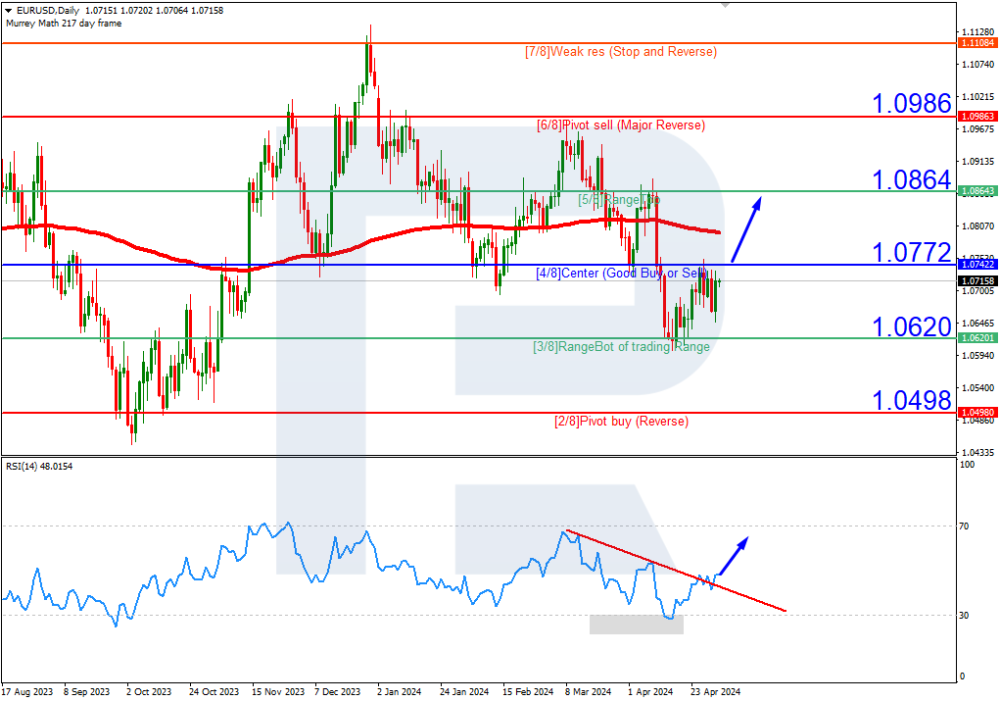

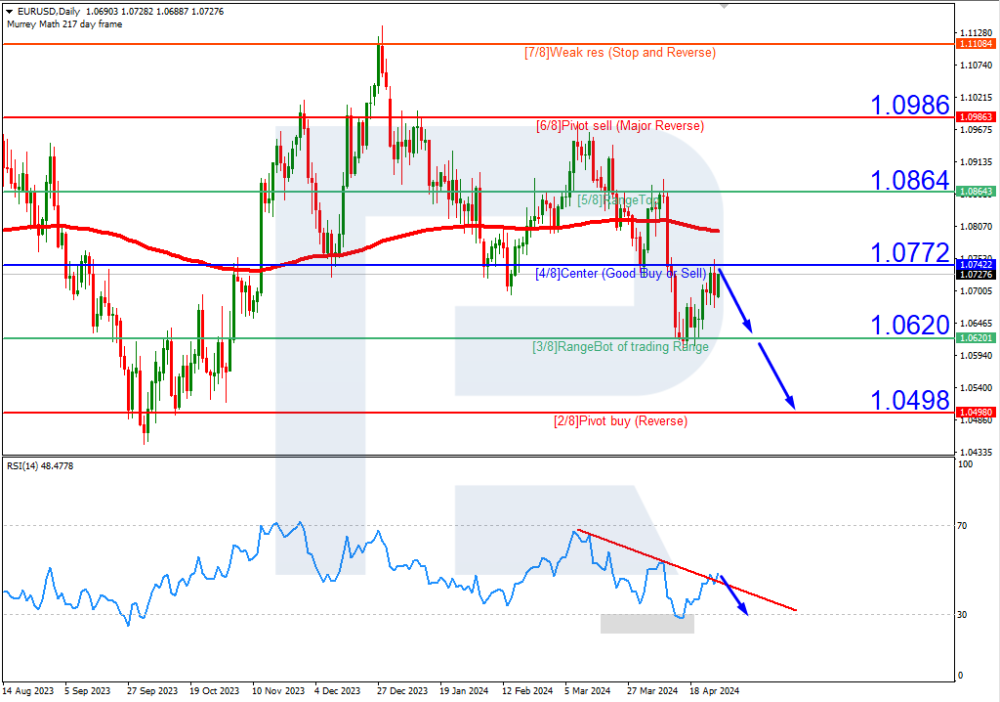

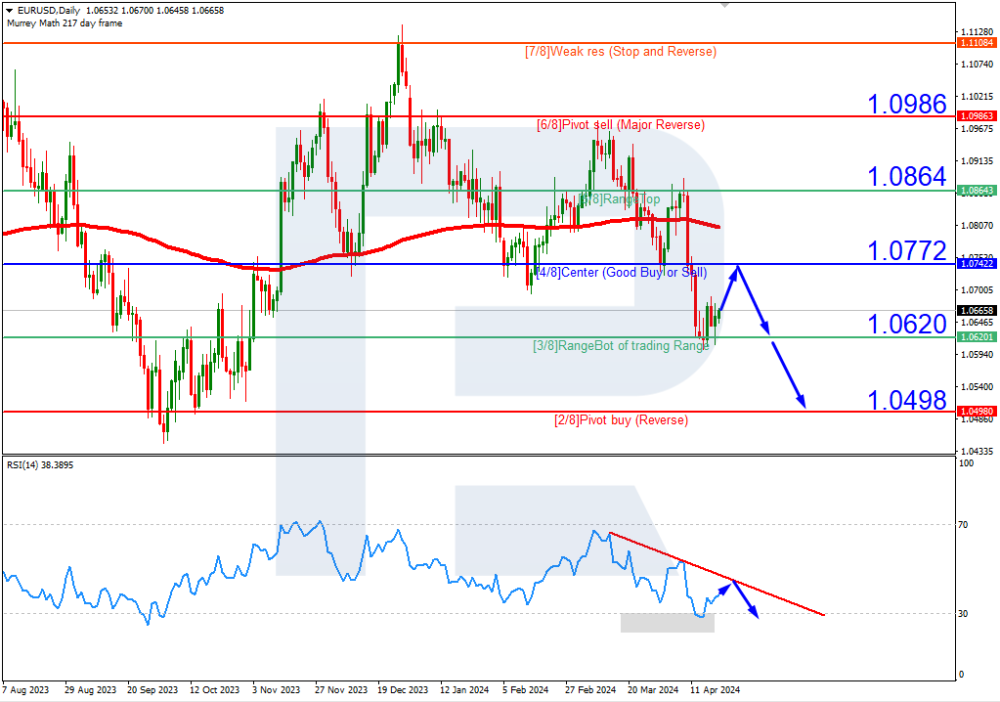

Murrey Math Lines 13.05.2024 (EURUSD, GBPUSD) EURUSD, “Euro vs US Dollar” EURUSD quotes are below the 200-day Moving Average on D1, indicating a prevailing downtrend. The RSI is testing the resistance line. In this situation, the price is expected to break the 4/8 (1.0772) level and decline to the support at 3/8 (1.0620). The scenario might be cancelled by surpassing the 5/8 (1.0864) level, which might lead to a trend reversal, pushing the pair up to the 6/8 (1.0986) resistance level. On M15, a breakout of the VoltyChannel lower line will increase the probability of a price decline. GBPUSD, “Great Britain Pound vs US Dollar” GBPUSD quotes are below the 200-day Moving Average on D1, indicating a prevailing downtrend. The RSI has rebounded from the resistance line. In this situation, the price is expected to break below the 2/8 (1.2451) level and fall to the support at 1/8 (1.2329). The scenario could be cancelled by surpassing the 3/8 (1.2573) level, which might lead to a trend reversal, propelling the pair to the 4/8 (1.2695) resistance level. Read more - Murrey Math Lines (EURUSD, GBPUSD) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

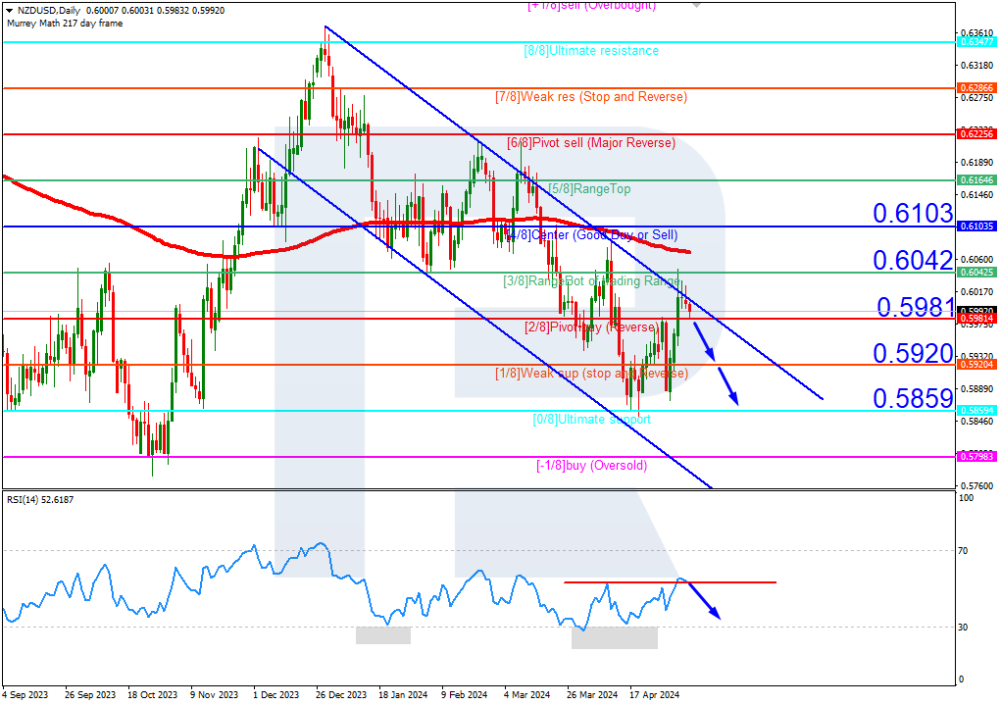

NZD is declining. Overview for 13.05.2024 The New Zealand dollar, paired with the US dollar, is retreating. The current NZDUSD exchange rate stands at 0.6008. The position of the US dollar has stabilised, once again exerting pressure on the NZD. The market focus is shifting to the US inflation statistics, which are scheduled for release this week. The Reserve Bank of New Zealand will hold its meeting next week, with the interest rate expected to remain at 5.5% per annum. The RBNZ intends to maintain its restrictive monetary policy until there are more concrete indications that inflation is approaching the designated 2% target. Overall, the RBNZ's position aligns with the global agenda: monitoring prices, recording economic slowdown facts, and keeping its finger on the pulse to intervene at the right moment. Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website. Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 13 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

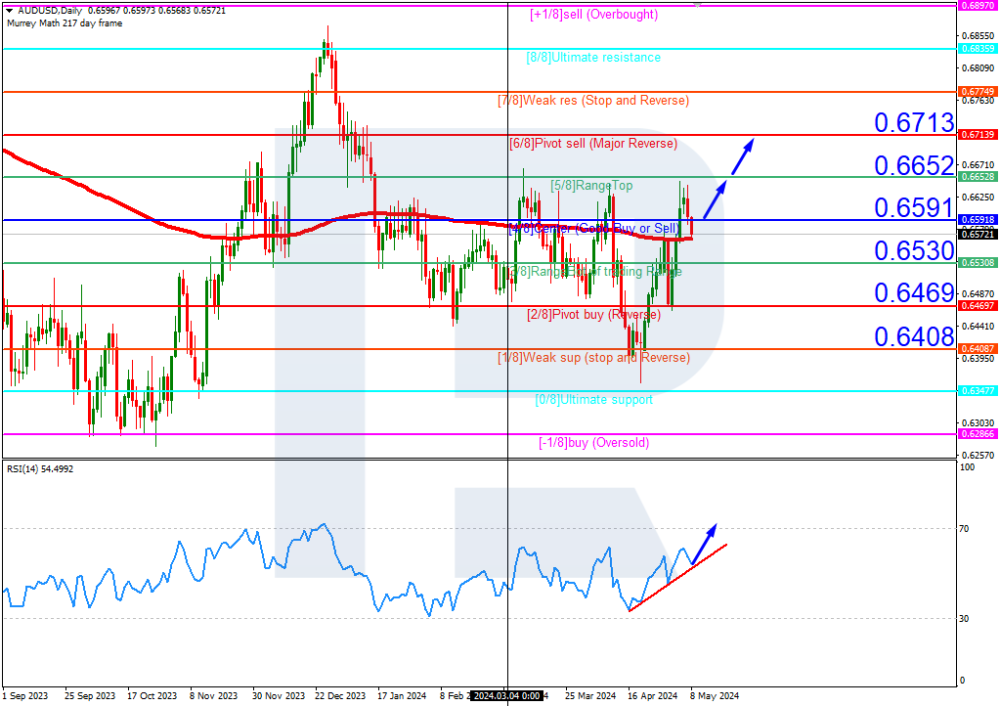

Murrey Math Lines 08.05.2024 (AUDUSD, NZDUSD) AUDUSD, “Australian Dollar vs US Dollar” AUDUSD quotes have broken above the 200-day Moving Average on D1, indicating the potential development of an uptrend. The RSI is approaching the support line. In this situation, the price is expected to surpass the 4/8 (0.6591) level and rise to the resistance at 6/8 (0.6713). The scenario could be cancelled by a breakout of the 3/8 (0.6530) level. In this case, the quotes might retrace to the support at 2/8 (0.6469). On M15, a breakout of the upper line of the VoltyChannel will increase the probability of price growth. NZDUSD, “New Zealand Dollar vs US Dollar” NZDUSD quotes are below the 200-day Moving Average on D1, indicating a prevailing downtrend. The RSI is testing from the resistance line. In this situation, the price is expected to break below the 2/8 (0.5981) level and maintain its downward trajectory to the support at 0/8 (0.5859). The scenario could be cancelled if the price surpasses the 3/8 (0.6042) level. In this case, the quotes might reach the resistance at 4/8 (0.6103). Read more - Murrey Math Lines (AUDUSD, NZDUSD) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

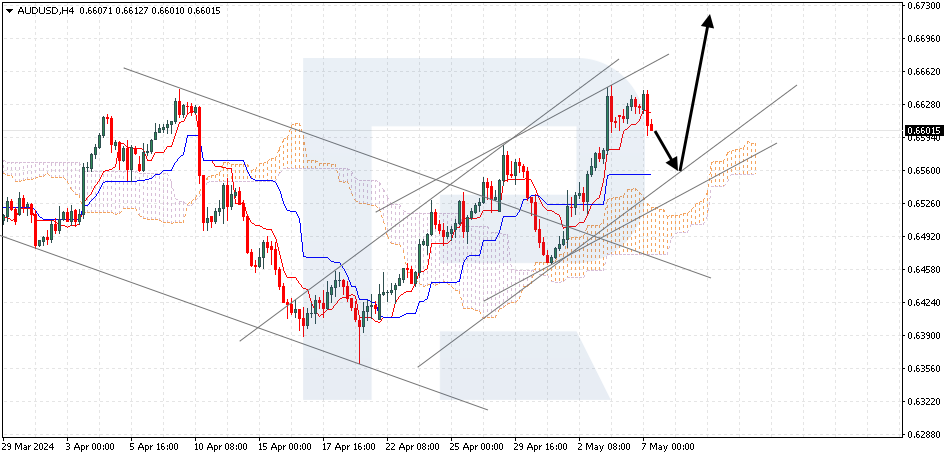

AUD is declining. Overview for 08.05.2024 The Australian dollar, paired with the US dollar, is retreating. The current AUDUSD exchange rate stands at 0.6577. The Reserve Bank of Australia left the interest rate unchanged at 4.35% after its Monday meeting. Overall, the RBA maintained a cautious stance on monetary policy, emphasising the need to monitor developments in its comments. Simultaneously, the regulator has acknowledged an unexpected rise in inflation and a sudden decrease in the unemployment rate. These factors have been reflected in the revised official macroeconomic forecasts, which have led to a downward revision of GDP forecasts. The RBA acknowledged considerable uncertainty regarding short-term interest rates. Monetary policymakers will remain vigilant regarding the risks of mounting inflation. This time, monetary authorities considered the possibility of an interest rate hike alongside other scenarios. The RBA primarily aims to curb inflation without pushing the economy into recession. Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website. Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 13 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

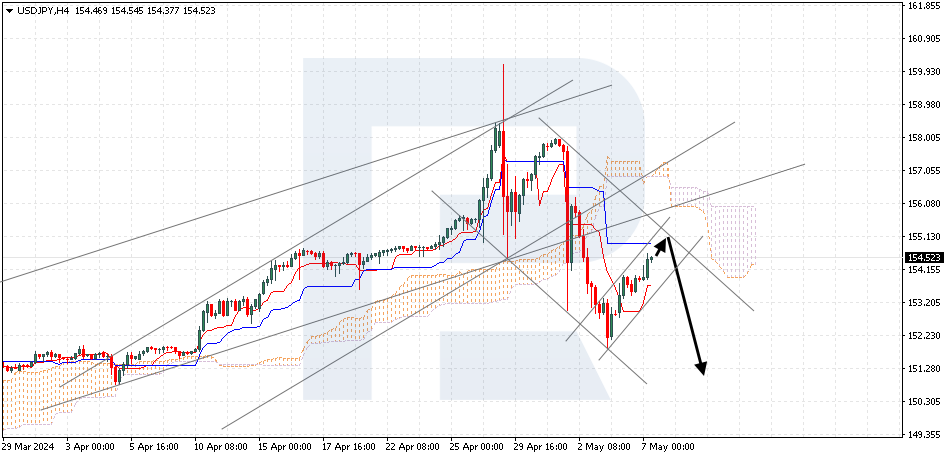

Ichimoku Cloud Analysis 07.05.2024 (EURUSD, AUDUSD, USDJPY) EURUSD, “Euro vs US Dollar” EURUSD is testing the signal lines of the indicator. The pair is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Kijun-Sen line at 1.0745 is expected, followed by a rise to 1.0875. An additional signal confirming the rise will be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud, with the price securing below 1.0660, indicating a further decline to 1.0575. AUDUSD, "Australian Dollar vs US Dollar" AUDUSD is declining following a rebound from the resistance level. The pair is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Kijun-Sen line at 0.6565 is expected, followed by a rise to 0.6725. An additional signal confirming the rise will be a rebound from the lower boundary of the ascending channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud, with the price securing below 0.6445, which will indicate a further decline to 0.6355. USDJPY, “US Dollar vs Japanese Yen” USDJPY is rising within a bearish channel. The pair is going below the Ichimoku Cloud, which suggests a downtrend. A test of the Kijun-Sen line at 155.15 is expected, followed by a decline to 151.25. An additional signal confirming the decline could be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud, with the price finding a foothold above 157.10, which will indicate further growth to 158.05. Meanwhile, the decline could be confirmed by a breakout of the lower boundary of the bullish channel, with the price securing below 153.05. Read more - Ichimoku Cloud Analysis (EURUSD, AUDUSD, USDJPY) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JPY declines again. Overview for 07.05.2024 The Japanese yen, paired with the US dollar, resumes its decline. The current USDJPY exchange rate stands at 154.54. After a series of strengthening moves, the yen came under pressure again amid the statements of a leading monetary policymaker Masato Kanda that the government is ready to fight speculative movements of exchange rates. However, Kanda left unanswered the question of interventions last week. The yen rose by 5.2% from its 34-year lows, with strong growth observed during three sessions but then stopping. As the Bank of Japan data shows, at least 60 billion USD was spent to protect the yen. If these were targeted interventions, it is no wonder that the yen resumed its decline once they were over. Fundamental indicators remain negative for the JPY – the difference between the Bank of Japan and the US Federal Reserve approaches is profound. Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website. Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 13 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Murrey Math Lines 02.05.2024 (EURUSD, GBPUSD) EURUSD, “Euro vs US Dollar” EURUSD quotes are below the 200-day Moving Average on D1, indicating a prevailing downtrend. However, the RSI has surpassed the resistance line. In this situation, the price is expected to test the 4/8 (1.0772) level and break above it, rising to the resistance at 5/8 (1.0864). The scenario might be cancelled by a rebound from the 4/8 (1.0772) level. In this case, the pair could fall to the support at 3/8 (1.0620). On M15, the upper boundary of the VoltyChannel is broken, which increases the probability of a further price rise. GBPUSD, “Great Britain Pound vs US Dollar” The GBPUSD chart shows a similar situation, with the quotes hovering below the 200-day Moving Average on D1, indicating a prevailing downtrend. However, the RSI has surpassed the resistance line. In this situation, the price is expected to break above the 3/8 (1.2573) level and rise to the resistance at 4/8 (1.2695). The scenario might be cancelled by a rebound from the 3/8 (1.2573) level, pushing the pair down to the support at 2/8 (1.2451). Read more - Murrey Math Lines (EURUSD, GBPUSD) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JPY remains highly volatile. Overview for 02.05.2024 The Japanese yen, paired with the US dollar, declines again. The current USDJPY exchange rate stands at 155.82. The market speculates about the reason behind the yen’s strong movements this week. Although the Japanese authorities have not officially confirmed interventions to support the national currency, investors are convinced that there were financial injections, and twice. One of Japan’s monetary policymakers Masato Kanda stated that the government would disclose data on possible interventions at the end of next month. Financial injections are likely to have driven the yen’s short-term rally. Such interventions will not produce a significant effect as the main reason for JPY’s weakness is the difference between the interest rates of the Bank of Japan and the US Federal Reserve. Nothing has changed on this issue. Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website. Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 13 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

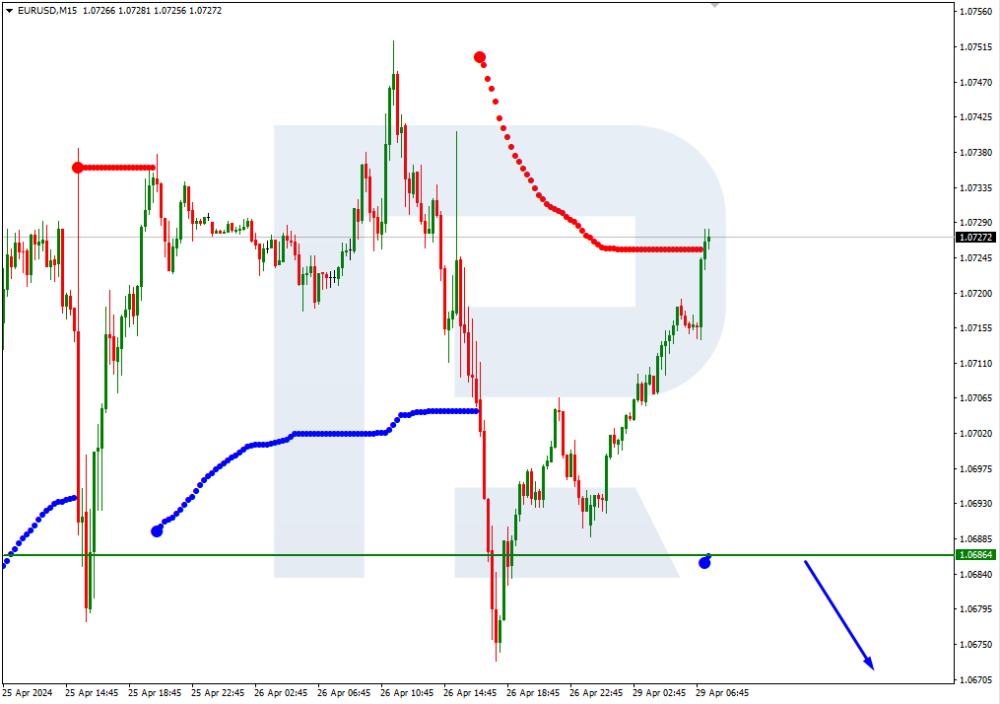

Murrey Math Lines 29.04.2024 (EURUSD, GBPUSD) EURUSD, “Euro vs US Dollar” EURUSD quotes are below the 200-day Moving Average on D1, indicating a prevailing downtrend. The RSI is testing the resistance line. In this situation, the price is expected to test the 4/8 (1.0772) level, rebound from it, and decline to the support at 2/8 (1.0498). The scenario might be cancelled by surpassing the 4/8 (1.0772) level. In this case, the pair could reach the resistance at 5/8 (1.0864). On M15, following a rebound from the 4/8 (1.0772) level, the price decline could be additionally supported by a breakout of the lower line of the VoltyChannel. GBPUSD, “Great Britain Pound vs US Dollar” GBPUSD quotes are below the 200-day Moving Average on D1, which indicates a prevailing downtrend. The RSI is approaching the resistance line. In this situation, the price is expected to test the 3/8 (1.2573) level and rebound, falling to the support at 2/8 (1.2451). The scenario could be cancelled by a breakout of the 3/8 (1.2573) level, which might lead to a trend reversal, pushing the pair up to the resistance at 4/8 (1.2695). Read more - Murrey Math Lines (EURUSD, GBPUSD) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

AUD continues to rise. Overview for 29.04.2024 The Australian dollar appears strong against the US dollar. The current AUDUSD exchange rate stands at 0.6567. The Aussie surpassed a three-week high against its American counterpart as the USD slightly corrected its position ahead of this week's meeting. It is worth noting that the Aussie has surged to its 11-year high against the JPY. The anticipated currency interventions from the Bank of Japan still do not deter anyone. Previous inflation statistics in Australia reinforced expectations that the Reserve Bank of Australia will not embark on monetary policy easing anytime soon. The consumer price index in Q1 declined to 3.6% from the previous 4.1%. However, it remained above the forecasted 3.4%, marking the fifth consecutive quarter of easing inflationary pressure. Meanwhile, the monthly index accelerated in March, reaching 3.5% from 3.4% in February. This week, Australia will publish retail sales and trade statistics, providing further insights into the state of the economy. Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website. Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 13 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

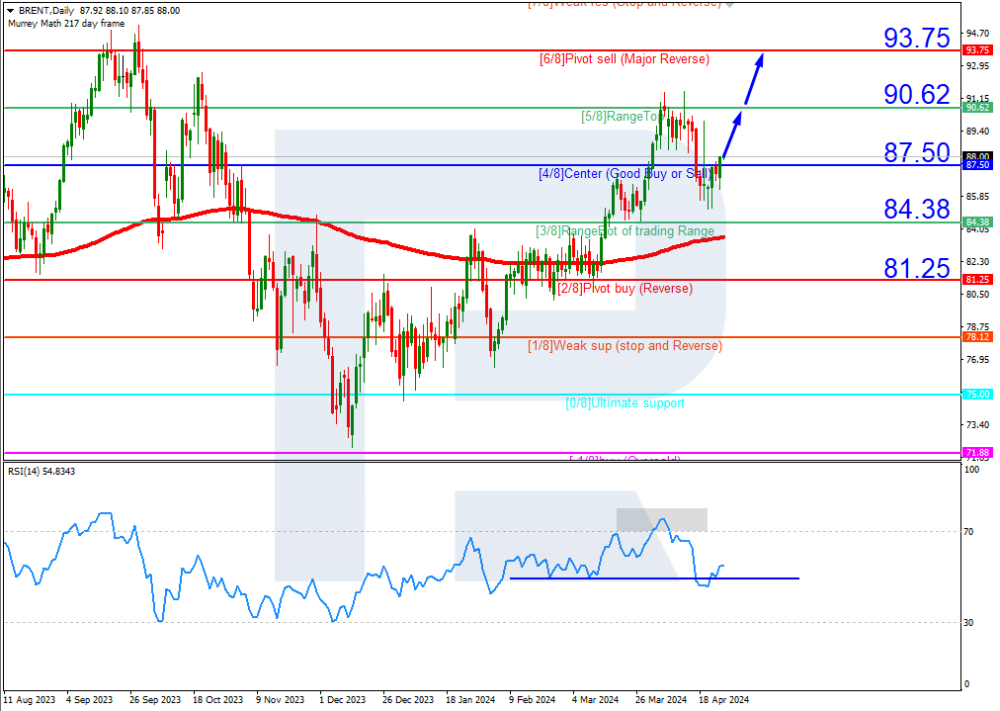

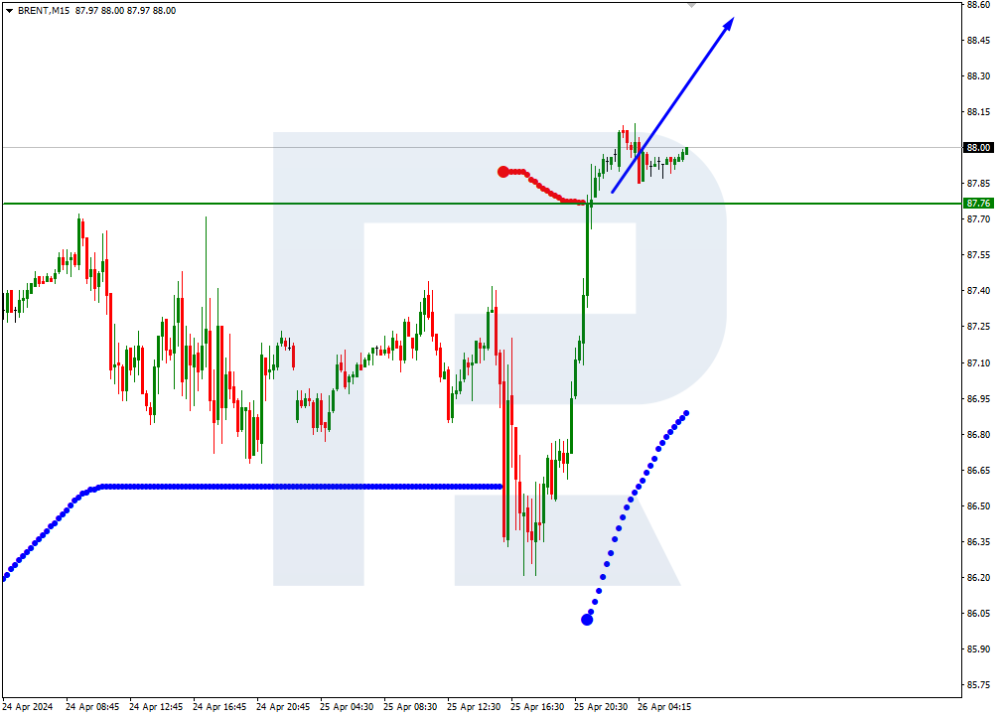

Murrey Math Lines 26.04.2024 (Brent, S&P 500) Brent Brent quotes are above the 200-day Moving Average on D1, which indicates the prevalence of an uptrend. The RSI has rebounded from the support line. In this situation, the quotes are expected to rise above 5/8 (90.62), after which they might reach the resistance at 6/8 (93.75). The scenario could be cancelled by breaching the 4/8 (87.50) level. In this case, Brent quotes could drop to the support at 3/8 (84.38). On M15, the upper boundary of the VoltyChannel is broken, which increases the probability of a further price rise. S&P 500 The S&P 500 quotes are in the overbought area, while the RSI is approaching the resistance line. In this situation, a test of +1/8 (5156.2) is expected, after which the quotes could rebound from this level and drop to the support at 7/8 (4843.8). The scenario might be cancelled by a breakout of the +1/8 (5156.2) level, in which case the S&P 500 quotes could rise to the resistance at +2/8 (5312.5). Read more - Murrey Math Lines (Brent, S&P 500) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EUR is rising smoothly. Overview for 26.04.2024 The primary currency pair demonstrates a modest increase on Friday. The current EURUSD exchange rate stands at 1.0722. The market is uncertain whether the US Federal Reserve has all the necessary arguments to lower the interest rate in the near future. Yesterday's weak US GDP release for Q1 2024 could have been a reason to soften the monetary policy if the Fed were prepared to act. The US economy increased by only 1.6% in January-March, contrary to the expected rise of 2.5%. In Q4 last year, the GDP demonstrated a 3.4% increase. Meanwhile, consumer demand remains high. This factor limits the Fed's actions, compelling it to await a more opportune moment to lower the rate. Today, the macroeconomic calendar is packed with statistics. The focus is on the March Core PCE inflationary component and reports on Americans' income and spending for the previous month. Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website. Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 13 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EUR has paused. Overview for 25.04.2024 The main currency pair paused its ascent on Thursday. The current EURUSD exchange rate stands at 1.0705. Nothing significant happened; the market remains highly sensitive to even the slightest changes in global sentiment. Today, the US will release the GDP statistics for Q1 2024. The economy is expected to grow by 2.5% compared to the previous 3.4%. A local slowdown in economic growth at the beginning of the year may be a normal response to some dip in activity. However, the GDP is forecasted to gain dynamics later on. The market believes the US dollar is emerging as the most effective currency this year. Simultaneously, the fundamental performance of the US economic system compared to other countries suggests that USD could continue rising against other currencies. The US dollar is supported by rising US government spending and high demand for the safe-haven asset. Moreover, the deflationary effect of China's economic decline buoys the USD. Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website. Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 13 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

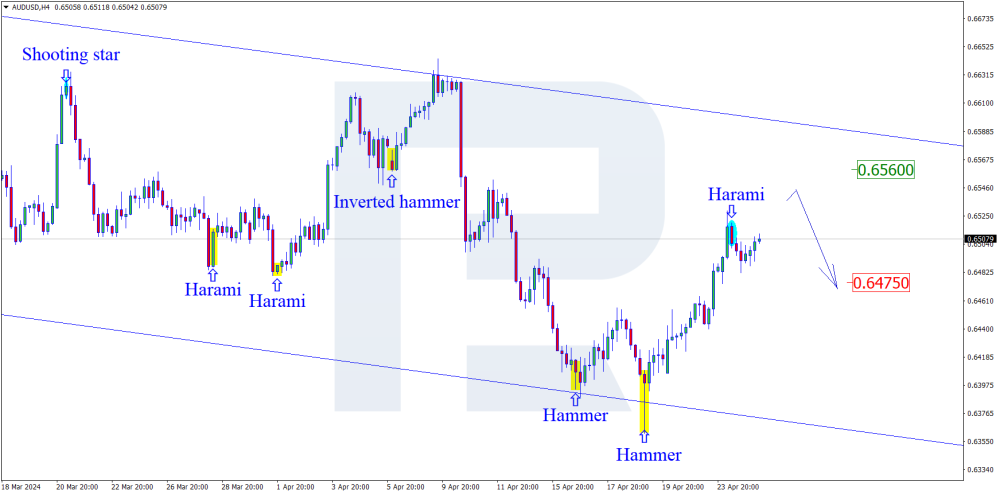

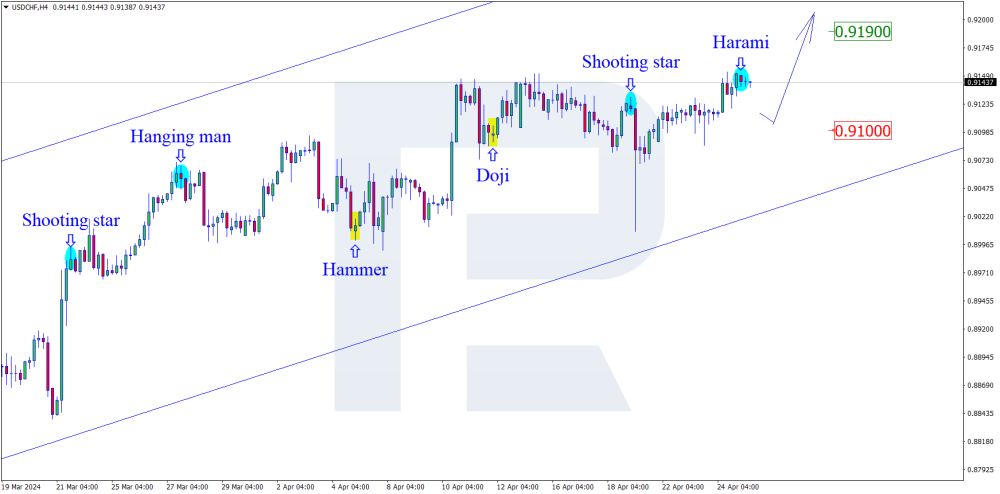

Japanese Candlesticks Analysis 25.04.2024 (USDCAD, AUDUSD, USDCHF) USDCAD, “US Dollar vs Canadian Dollar” USDCAD has formed a Hammer reversal pattern on H4. Currently, the instrument is going by the reversal signal in an ascending wave. The growth target might be 1.3770. Next, the price could break the level and continue developing the uptrend. However, the quotes might correct towards 1.3660 before rising. AUDUSD, “Australian Dollar vs US Dollar” AUDUSD has formed a Harami reversal pattern on H4. Currently, the instrument is going by the reversal signal in a descending wave. The decline target might be 0.6475. Upon testing the support, the quotes could break the level and continue developing the downtrend. However, the quotes might rise to the 0.6560 level before the decline. USDCHF, “US Dollar vs Swiss Franc” USDCHF has formed a Harami reversal pattern on H4. Currently, the instrument might go by the reversal signal in a descending wave. The correction target might be 0.9100. After testing the support, the price could rebound from this level and continue developing the uptrend. However, the quotes might rise towards 0.9190 without correcting to the support. Read more - Japanese Candlesticks Analysis (USDCAD, AUDUSD, USDCHF) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

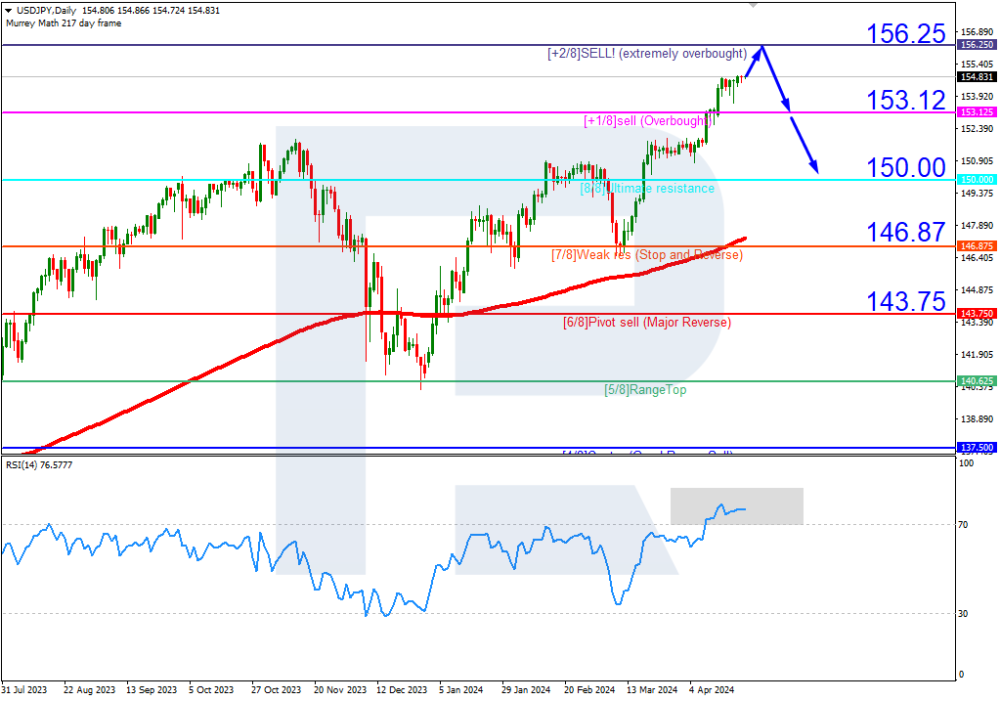

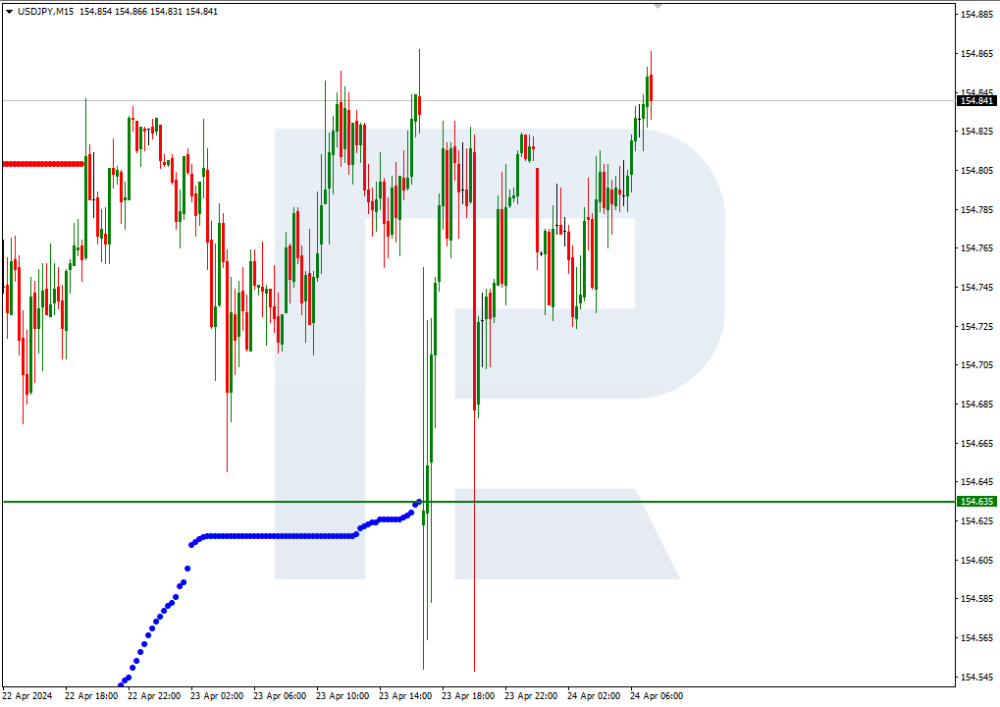

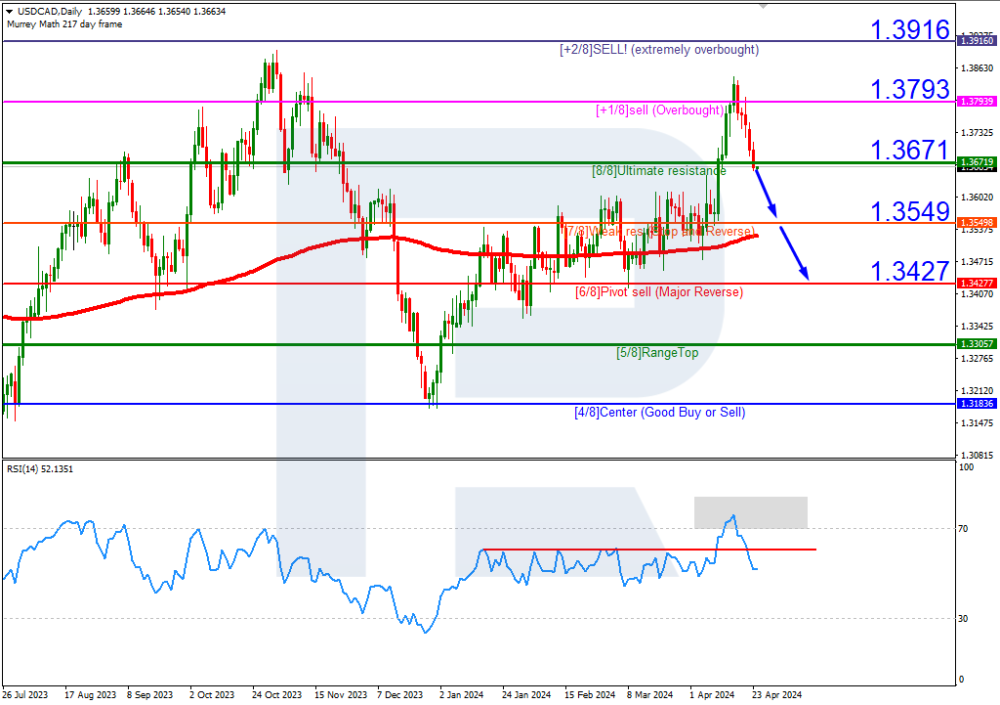

Murrey Math Lines 24.04.2024 (USDJPY, USDCAD) USDJPY, “US Dollar vs Japanese Yen” USDJPY quotes and the RSI remain in the overbought areas on D1. In this situation, the price is expected to test the +2/8 (156.25) level, rebound from it, and decline to the support at 0/8 (150.00). The scenario could be cancelled by surpassing the +2/8 (156.25) level, which might reshuffle the Murrey indication, setting new price movement targets. On M15, following a rebound from the +2/8 (156.25) level on D1, the price decline could be additionally confirmed by a breakout of the lower line of the VoltyChannel. USDCAD, “US Dollar vs Canadian Dollar” USDCAD quotes have breached the 8/8 (1.3671) level and exited the overbought area on D1. The RSI has broken below the support line. In this situation, the price is expected to maintain its downward trajectory towards 6/8 (1.3427). The scenario could be cancelled by rising above the 8/8 (1.3671) level. In this case, the pair might resume growth, with the quotes returning to the +1/8 (1.3793) resistance level. Read more - Murrey Math Lines (USDJPY, USDCAD) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

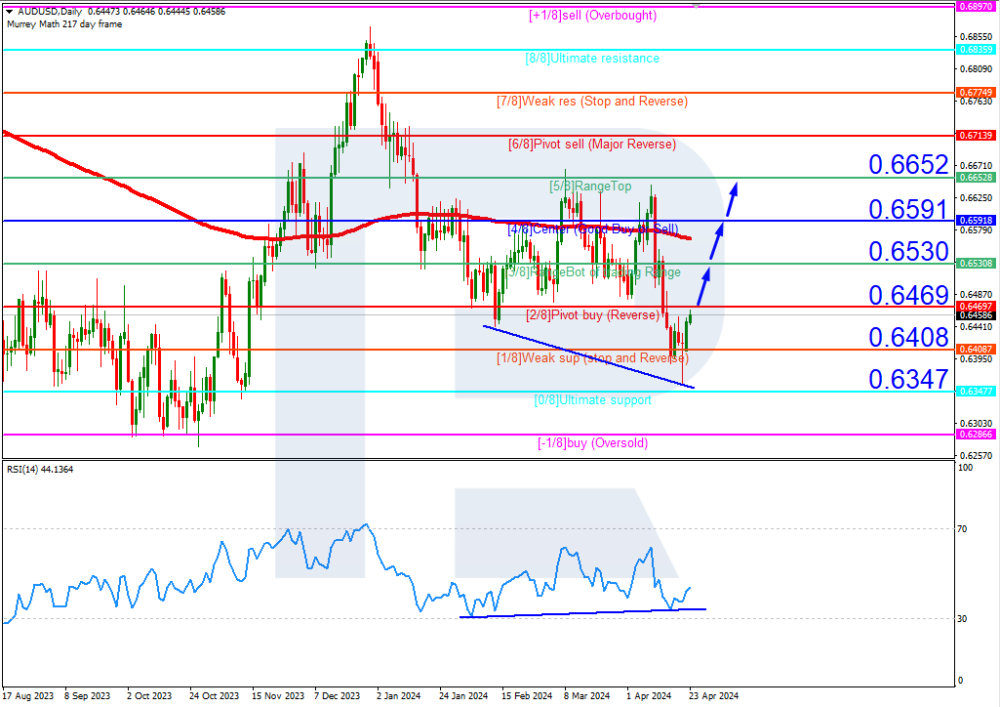

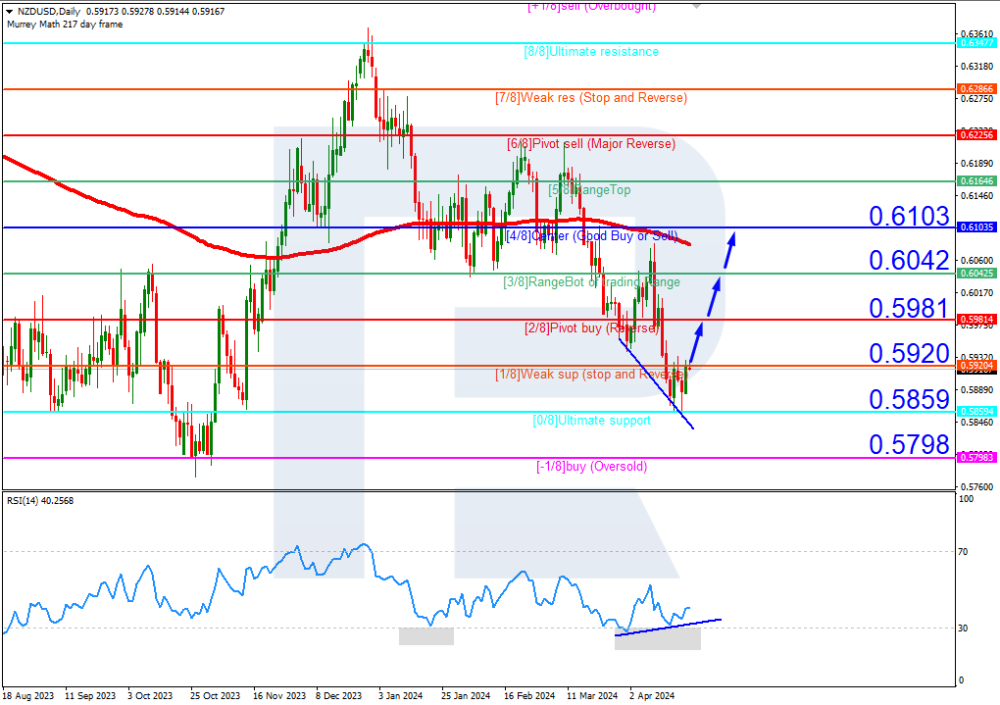

Murrey Math Lines 23.04.2024 (AUDUSD, NZDUSD)[/SIZE] AUDUSD, "Australian Dollar vs US Dollar" AUDUSD quotes are below the 200-day Moving Average on D1, indicating the prevalence of a downtrend. However, a convergence has formed on the RSI. As a result, in this situation, the quotes are expected to rise above 2/8 (0.6469), later reaching the resistance at 4/8 (0.6591). The scenario could be cancelled by a breakout of the 1/8 (0.6408) level. In this case, the price might return to the support at 0/8 (0.6347). On M15, the upper boundary of the VoltyChannel is breached, which increases the probability of a further price rise. NZDUSD, "New Zealand Dollar vs US Dollar" NZDUSD quotes are below the 200-day Moving Average on D1, revealing the prevalence of a downtrend, while a convergence has formed on the RSI. In this situation, the quotes are expected to breach 1/8 (0.5920), subsequently rising towards the resistance at 4/8 (0.6103). The scenario could be cancelled by a breakout of the 0/8 (0.5859) level, in which case the quotes could drop to the support at -1/8 (0.5798). Read more - Murrey Math Lines (AUDUSD, NZDUSD) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

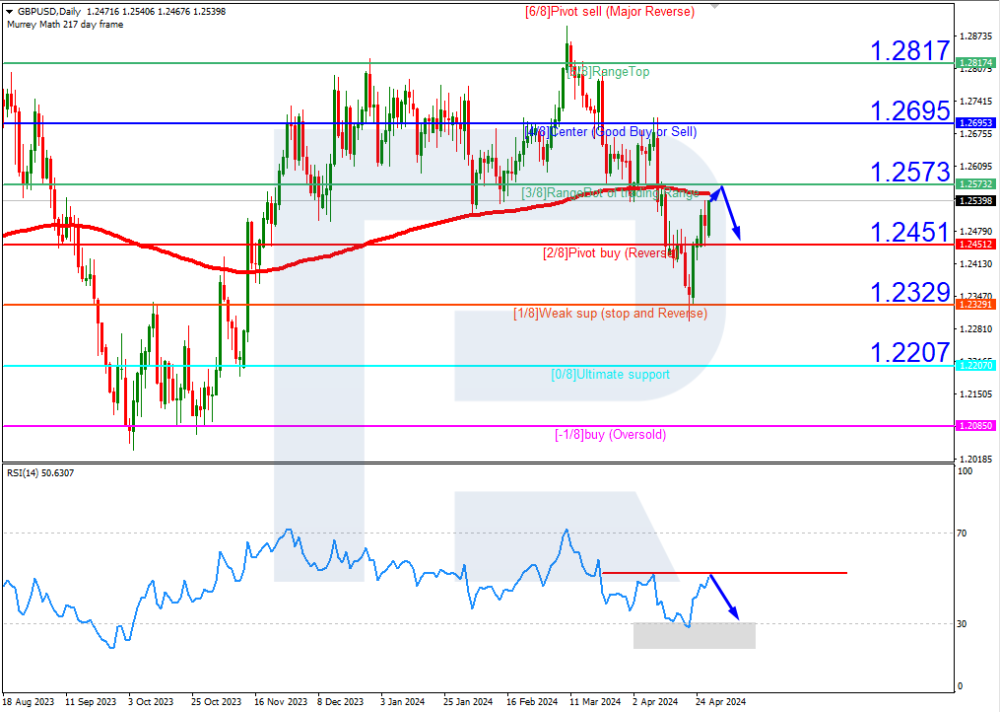

Murrey Math Lines 22.04.2024 (EURUSD, GBPUSD) EURUSD, “Euro vs US Dollar” EURUSD quotes are below the 200-day Moving Average on D1, indicating a prevailing downtrend. The RSI is approaching the resistance line. In this situation, the price is expected to test the 4/8 (1.0772) level, rebound from it, and decline to the support at 2/8 (1.0498). The scenario might be cancelled by a breakout of the 3/8 (1.0620) level. In this case, the pair could maintain its downward trajectory without corrective growth, falling to the support at 2/8 (1.0498). On M15, following a rebound from the 4/8 (1.0772) level, the price decline could be additionally supported by a breakout of the lower line of the VoltyChannel. GBPUSD, “Great Britain Pound vs US Dollar” GBPUSD quotes are below the 200-day Moving Average on D1, which indicates a prevailing downtrend. However, the RSI has reached the oversold area. In this situation, the price is expected to surpass the 2/8 (1.2451) level and rise to the resistance at 3/8 (1.2573). The scenario could be cancelled by a breakout of the 1/8 (1.2329) level. In this case, the pair might decline to the support at 0/8 (1.2207). Read more - Murrey Math Lines (EURUSD, GBPUSD) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team