⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

-

Posts

1,287 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by RBFX Support

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

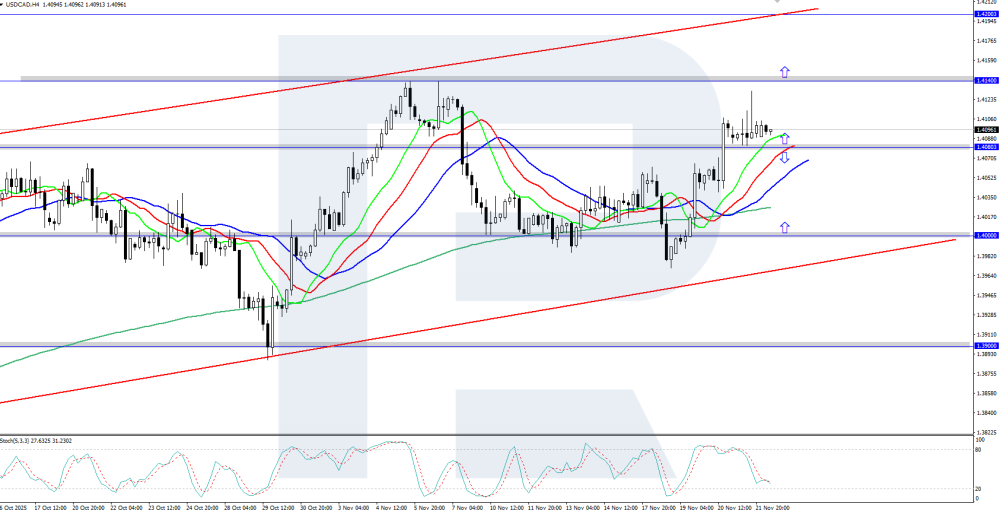

USDCAD hits a four-week low after strong GDP The USDCAD pair dipped to 1.3980 as the market fully priced in strong Canadian data. Discover more in our analysis for 1 December 2025. USDCAD forecast: key trading points Market focus: the USDCAD pair fell to a four-week low after Canada’s GDP release Current trend: the Canadian dollar appears strong thanks to active oil exports USDCAD forecast for 1 December 2025: 1.3937 Fundamental analysis The USDCAD rate fell to a four-week low after stronger-than-expected quarterly GDP data. These figures reduced expectations of additional easing from the Bank of Canada. Over the past week, the CAD gained about 0.9%, marking its best performance since May. The recent weakening of the US dollar also supports demand for the CAD, as markets are betting on a Fed rate cut in December. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold storms the market: XAUUSD is poised for a big move after fresh US data Gold continues to strengthen, with XAUUSD prices crossing the psychological threshold of 4,200 USD and now trading around 4,240 USD. Find more details in our analysis for 1 December 2025. XAUUSD technical analysis On the H4 chart, XAUUSD prices formed an Inverted Hammer reversal pattern near the lower Bollinger Band. Quotes currently continue an upward wave following this signal. Since XAUUSD remains within the ascending channel, the next upside target could be 4,300 USD. The USD is losing ground ahead of the Federal Reserve’s interest rate decision. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

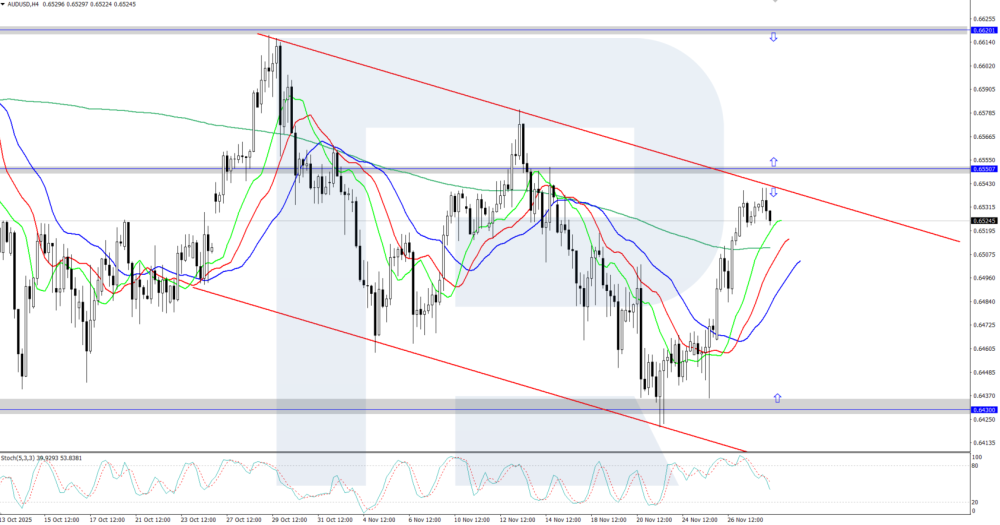

AUDUSD climbed above 0.6500 The AUDUSD rate is moderately rising, having consolidated above the 0.6500 level. The Reserve Bank of Australia does not plan to cut rates in the near term. Discover more in our analysis for 28 November 2025. AUDUSD technical analysis The AUDUSD pair is showing solid growth after reversing upwards from the daily support level at 0.6430. The Alligator indicator is pointing upwards, confirming bullish momentum. The key resistance level is 0.6550. The AUDUSD pair is rising moderately, consolidating above 0.6500. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Falling inflation in Germany breaks EURUSD forecasts The euro, attempting to regain lost ground, has slowed its upward momentum, with the EURUSD pair trading near 1.1580. Find out more in our analysis for 28 November 2025. EURUSD forecast: key trading points Germany’s Consumer Price Index (CPI): previously at 0.3%, projected at -0.2% Markets await the Fed’s interest rate decision EURUSD forecast for 28 November 2025: 1.1540 Fundamental analysis The EURUSD forecast takes into account that today the euro, after attempting to regain lost ground, is forming a correction, with the pair trading near 1.1580. Germany’s Consumer Price Index reflects changes in the cost of goods and services for consumers, helping to assess purchasing trends and the degree of economic stagnation. A lower-than-expected reading will have a negative impact on the European currency. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index resumes growth The JP 225 stock index has bounced off the support level within an uptrend. The JP 225 forecast for today is positive. JP 225 forecast: key trading points Recent data: Japan's inflation rose 3.00% year-on-year in October 2025 Market impact: moderately negative for the Japanese stock market Fundamental analysis Japan’s core Consumer Price Index showed an annual increase of 3.0%, in line with the forecast and slightly above the previous 2.9%. For the market, this indicates that inflation remains above the Bank of Japan’s 2.0% target but is not accelerating more than expected. In other words, the economy is no longer stuck in chronic deflation, but we also see no signs of runaway inflation that would force the regulator to sharply tighten policy. For the JP 225 index, the impact is mixed as it includes many export-oriented companies, for which the key factors are the yen’s exchange rate and borrowing costs. If the market decides that with this level of inflation, the Bank of Japan may afford to slightly raise rates or further loosen its yield-curve control, this could strengthen the yen. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

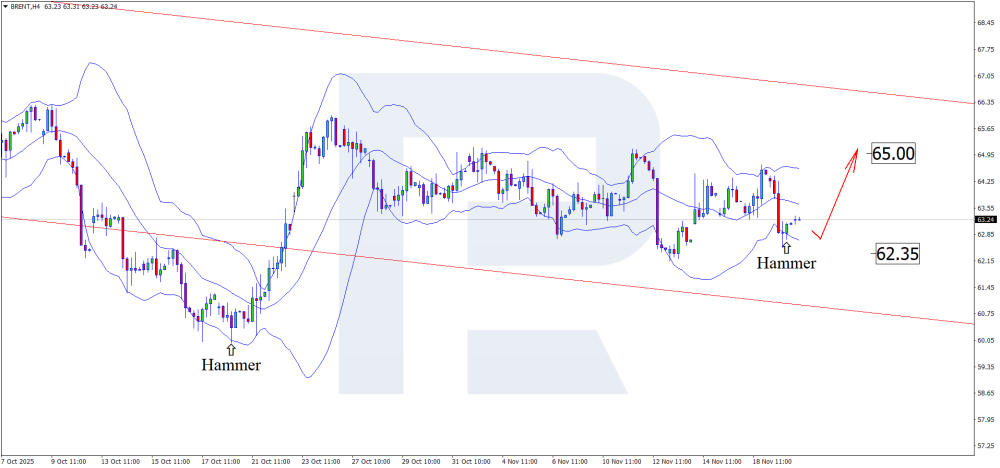

Brent faces oversupply risks in the oil market Brent prices remain under selling pressure, and the market is strengthening its bearish sentiment amid rising US inventories, with quotes currently at 62.11 USD. Discover more in our analysis for 27 November 2025. Brent technical analysis Brent prices are declining within a descending channel. Sellers maintain control, having pushed prices below the EMA-65, which confirms bearish pressure. Current oil price performance highlights strengthening bearish sentiment. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Markets on edge – GBPUSD on the verge of a breakout A decline in US economic indicators may become a trigger for GBPUSD growth towards 1.3250. Discover more in our analysis for 26 November 2025. GBPUSD forecast: key trading points US initial jobless claims: previously at 220 thousand, projected at 226 thousand Core PCE price index: previously at 2.9%, projected at 2.7% GBPUSD forecast for 26 November 2025: 1.3250 Fundamental analysis The GBPUSD forecast for 26 November 2025 is favourable for the pound, with the pair having a good chance to partially regain its positions. US initial jobless claims show how many people filed for unemployment benefits for the first time during the previous week. This indicator reflects the state of the labour market, with an increase in initial jobless claims indicating rising unemployment. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD attempts to reverse upwards The EURUSD pair corrected downwards to the support 1.1500 level, where it met strong buying demand and is now attempting to reverse upwards. Find more details in our analysis for 26 November 2025. EURUSD technical analysis On the H4 chart, the EURUSD pair is attempting to move upwards after receiving buying support near 1.1500. To extend the rise, the price must overcome the 1.1650 resistance level – a breakout would allow the uptrend to continue. The EURUSD pair is moderately rising after reversing upwards from the 1.1500 support level. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent under sellers’ pressure: a new wave of decline may be near Brent crude slips to 62.38 USD on Tuesday. Negotiations involving the US continue. Discover more in our analysis for 25 November 2025. Brent forecast: key trading points Brent crude reacts to geopolitics There is a chance of further price decline due to potential supply growth Brent forecast for 25 November 2025: 61.30 Fundamental analysis Brent prices are falling towards 62.38 USD per barrel on Tuesday, partially correcting the previous session’s gains. The market continues to react to news of a potential peace agreement involving Russia. According to media reports, the 28-point settlement plan proposed by the US has been reduced to 19 points after discussions in Switzerland. It is not disclosed which provisions were removed. Nevertheless, the progress of negotiations fuels expectations that, if an agreement is reached, sanctions against the Russian oil sector could be eased. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

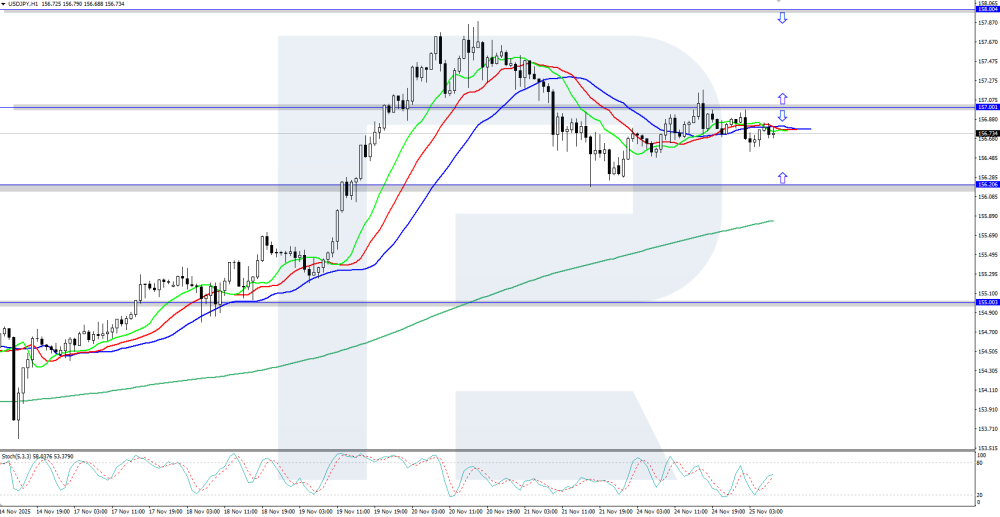

USDJPY corrects down from the highs The USDJPY rate is moderately declining, falling below 157.00 amid concerns about potential Bank of Japan interventions. Find out more in our analysis for 25 November 2025. USDJPY technical analysis The USDJPY rate is declining within the current downward correction. The Alligator indicator has turned downwards, confirming the prevailing bearish momentum. The nearest local support level is located at 156.20. The USDJPY pair dipped below 157.00 as market participants fear that the Bank of Japan may conduct currency interventions to support the yen. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

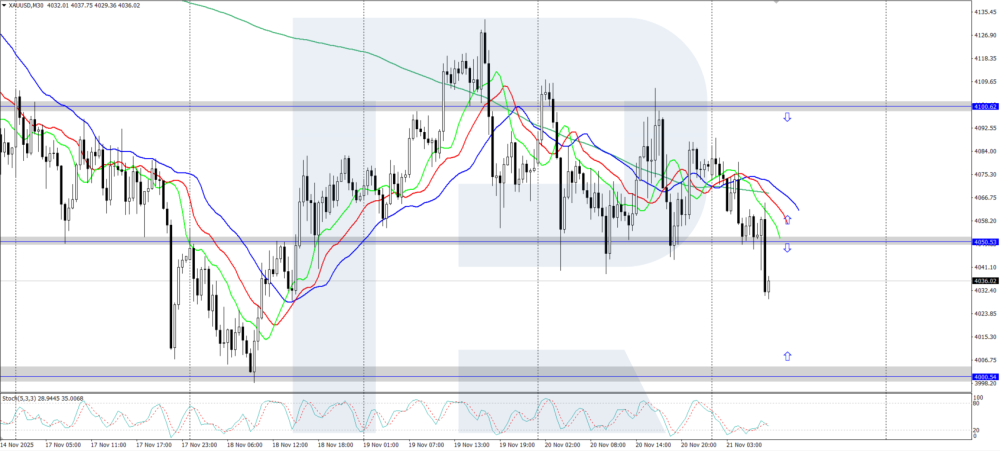

Gold (XAUUSD) enters consolidation: everyone is watching the future Fed rate decision Gold (XAUUSD) prices have declined to 4,050 USD, with the market uneasy about future prospects. Find more details in our analysis for 24 November 2025. XAUUSD forecast: key trading points Market focus: gold (XAUUSD) is tracking shifts in sentiment regarding the Fed interest rate Current trend: despite the pullback, gold remains one of the year’s top performers with a 54% gain XAUUSD forecast for 24 November 2025: 4,040 or 4,100 Fundamental analysis Gold (XAUUSD) fell to 4,050 USD per ounce on Monday, extending Friday’s decline. The market is awaiting new US data that could clarify the Federal Reserve’s monetary policy outlook. This week’s key releases include retail sales and the Producer Price Index for September, due on Tuesday, and weekly jobless claims, scheduled for release on Wednesday. Expectations for a December rate cut shifted noticeably after New York Fed President John Williams expressed support for another reduction in the coming months. The market now estimates the likelihood of a 25-basis-point rate cut in December at roughly 70%, up from about 40% on Thursday after strong labour market data. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDCAD falls to support at 1.4080 The USDCAD rate declined towards 1.4080 during a downward correction amid rising expectations of another Fed rate cut. Discover more in our analysis for 24 November 2025. USDCAD technical analysis On the H4 chart, the USDCAD pair is declining within the current downward corrective phase. The overall daily trend remains bullish, meaning that once the correction ends, the pair may resume its upward movement. The USDCAD pair is moderately declining, approaching the 1.4080 support level. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

AUDUSD enters a correction amid USD strength The AUDUSD rate dipped to the 0.6440 support level amid USD strengthening following US labour market statistics. Discover more in our analysis for 21 November 2025. AUDUSD forecast: key trading points Market focus: the US dollar received support from the Nonfarm Payrolls data Current trend: correcting downwards AUDUSD forecast for 21 November 2025: 0.6400 or 0.6500 Fundamental analysis The Australian dollar came under pressure after the release of US labour market data for September. Despite an increase in the US unemployment rate to 4.4%, Nonfarm Payrolls showed solid growth of 119 thousand. Analysts believe the Federal Reserve will pause and avoid cutting rates in December. Annual wage growth in Australia remained stable at 3.4% in Q3, in line with expectations and highlighting the underlying strength of the labour market. Markets currently price in only a 40% probability of a rate cut by the Reserve Bank of Australia by May next year. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold (XAUUSD) declines after Nonfarm Payrolls XAUUSD prices have fallen towards the 4,030 USD area following the release of US labour market data. Find out more in our analysis for 21 November 2025. XAUUSD technical analysis XAUUSD quotes corrected towards the area around 4,030 USD amid growing doubts about a further Federal Reserve rate cut this year. The Alligator indicator is pointing downwards, meaning the corrective movement may continue. Gold continues its downward correction, dropping to the 4,030 USD area as market participants doubt the Fed will cut rates at the December meeting. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index forms a sideways channel The JP 225 stock index corrected towards the support level, but the global trend remains upward. The JP 225 forecast for today is positive. JP 225 forecast: key trading points Recent data: Japan’s GDP in Q3 2025 decreased by 1.8% Market impact: moderately negative for the Japanese stock market Fundamental analysis Japan’s annualised GDP indicator showed a decline of -1.8% versus the forecast of -2.5% and the previous growth of 2.3%. This means the economy shifted from expansion to contraction, although the downturn turned out to be less severe than analysts expected. Formally, this still signals cooling: companies on average produce and sell less than a year ago, and both domestic and external demand weakened. Such data is generally negative for the Japanese stock market because a weaker economy usually implies cautious consumer and business behaviour, slower investment activity, and pressure on company revenues, especially those focused on the domestic market. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Oversupply or shortage? Brent at the centre of market chaos Brent is forming an upward wave and is trading near 63.20 USD. Find out more in our analysis for 20 November 2025. Brent technical analysis On the H4 chart, Brent prices tested the lower Bollinger Band and formed a Hammer reversal pattern. Quotes are currently following this signal in the form of an upward wave. Ahead of US data releases, Brent is attempting to regain lost ground. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBPUSD in tension: the budget question remains open The GBPUSD pair remains stable near 1.3138. Investors are watching the budget story closely. Discover more in our analysis for 19 November 2025. GBPUSD technical analysis On the H4 chart, the GBPUSD pair is hovering within a narrow sideways range near 1.3135, consolidating after a deep sell-off at the end of October. The current structure remains neutral to bearish, with no impulse for recovery and attempts to grow consistently limited by the resistance level. The GBPUSD pair is moving within the 1.3084–1.3218 range with weak recovery potential. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY confidently holds above 155.00 The USDJPY rate is rising, having consolidated above 155.00. Today, the market focuses on the minutes of the latest US Fed meeting. Find out more in our analysis for 19 November 2025. USDJPY forecast: key trading points Market focus: the minutes of the October Federal Reserve meeting will be published today Current trend: upward momentum USDJPY forecast for 19 November 2025: 156.00 or 154.00 Fundamental analysis On Tuesday, the Japanese government proposed an additional budget exceeding 25 trillion yen to finance Prime Minister Sanae Takaichi’s economic stimulus program – a figure far above last year’s supplementary budget of 13.9 trillion yen. Meanwhile, Bank of Japan Governor Kazuo Ueda informed the prime minister that the central bank is gradually raising rates to maintain inflation at 2% while supporting stable growth. Ueda also told reporters that the prime minister did not make any specific requests regarding monetary policy. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Europe surprises with data, EURUSD gears up for takeoff Growth in US factory orders fails to impress the market, and the EURUSD rate may continue its upward trajectory towards 1.1655. Find more details in our analysis for 18 November 2025. EURUSD technical analysis On the H4 chart, the EURUSD pair has formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, the pair may form an upward wave following the signal. Since the price remains within the descending channel, the EURUSD rate could attempt to break above the upper boundary and move towards 1.1655. Today’s EURUSD outlook favours the euro, with technical analysis suggesting a rise towards the 1.1655 resistance level. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index corrects after resuming the uptrend The DE 40 stock index has rebounded from the lower boundary of the medium-term sideways channel and has entered a new correction phase. The DE 40 forecast for today is positive. DE 40 forecast: key trading points Recent data: Germany's ZEW Economic Sentiment Index came in at 38.5 Market impact: the data creates an ambiguous background for the German stock market Fundamental analysis Germany’s ZEW Economic Sentiment Index reached 38.5 points in November, below both the forecast of 41.0 and the previous value of 39.3. This indicates that analysts and major institutional investors remain optimistic overall, as the index is still well above zero, meaning that the majority of market participants expect an improvement in the economic situation over the coming months. However, the decline from the previous month and weaker-than-expected figures suggest that optimism has faded slightly. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD declines: everyone awaits US data The EURUSD pair fell to 1.1594 as the market awaits a flood of key US statistics. Discover more in our analysis for 17 November 2025. EURUSD forecast: key trading points Market focus: the EURUSD pair is correcting after last week’s active movements Current trend: the market awaits macroeconomic data delayed due to the US government shutdown EURUSD forecast for 17 November 2025: 1.1561 Fundamental analysis On Monday, the EURUSD rate is hovering around 1.1594 as the US dollar gradually recovers from last week’s losses. Investors are preparing for a large block of US data, the publication of which was postponed due to the government shutdown and will now be key to understanding the Federal Reserve’s next steps. The main event is the September labour market report, due on Thursday. In addition, the week will feature the S&P Global PMI figures, existing home sales data, the NAHB confidence index, and the ADP employment estimate. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

CAD under pressure – USDCAD gears up for a new surge The Canadian dollar remains under pressure, with USDCAD trading near 1.4030. Discover more in our analysis for 17 November 2025. USDCAD technical analysis On the H4 chart, the USDCAD pair has formed a Shooting Star reversal pattern near the upper Bollinger Band. The price may now develop a downward wave following this signal. Since the pair remains within an ascending channel, a decline towards the nearest support level at 1.3990 is possible. The Canadian dollar remains under pressure despite the Bank of Canada’s positive inflation outlook. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

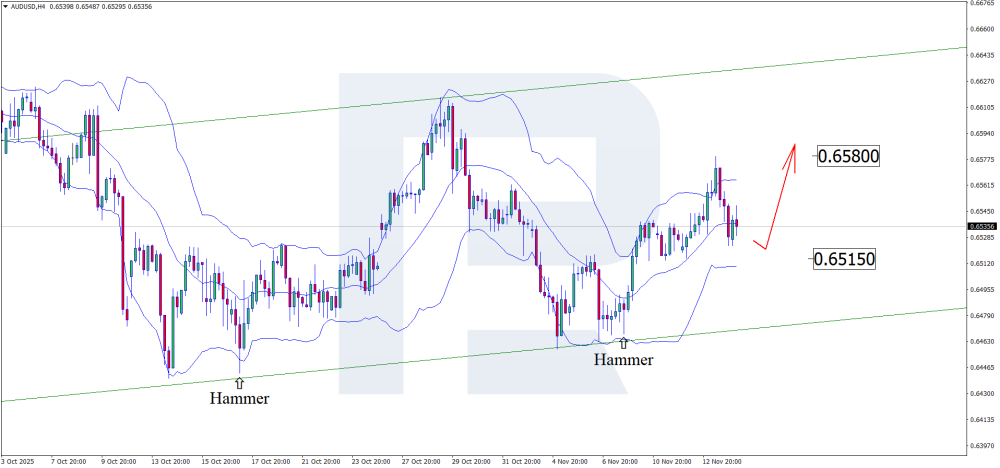

Australian dollar on the offensive: AUDUSD gears up for a strong rally Amid positive economic data from Australia, the AUDUSD pair continues to rise, trading near 0.6535. Discover more in our analysis for 14 November 2025. AUDUSD technical analysis On the H4 chart, the AUDUSD pair formed a Hammer reversal pattern after testing the lower Bollinger Band. The price currently maintains its upward trajectory following the signal. The upside target could be the 0.6580 resistance level. Positive economic data from Australia continues to support the Australian dollar. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) prepares to break above its highs Gold (XAUUSD) prices have resumed growth, reaching 4,190 USD. Further highs remain possible. Find more details in our analysis for 14 November 2025. XAUUSD forecast: key trading points Gold (XAUUSD) appears strong after a brief correction Demand for safe-haven assets will keep gold supported XAUUSD forecast for 14 November 2025: 4,245 Fundamental analysis Gold (XAUUSD) prices climbed back to 4,190 USD per ounce on Friday after an earlier attempt to retest three-week highs. The market reversed amid a broad asset sell-off following the US government’s reopening. The rally at the start of the week was driven by expectations that official data, delayed due to the shutdown, would reveal labour market weakness, reinforcing the case for a Federal Reserve rate cut. However, as Treasury yields rose, demand for non-yielding assets weakened, prompting some investors to take profits. Comments from Federal Reserve officials also cooled expectations, as most emphasised that a December rate cut is not guaranteed. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index may enter a sideways channel The JP 225 stock index is trading within an uptrend, although it is currently undergoing a correction. The JP 225 forecast for today is positive. JP 225 forecast: key trading points Recent data: Japan’s current account totalled 4.483 trillion JPY Market impact: the effect on the Japanese stock market is mostly positive Fundamental analysis Japan’s current account surplus reached 4.483 trillion JPY, well above both the forecast of 2.468 trillion JPY and the previous value of 3.701 trillion JPY. This indicates that the inflow of foreign income – exports minus imports plus overseas investment returns – was stronger than expected. This is a positive sign for the economy: the external balance remains stable, and the country earns more foreign revenue and investment income. For the JP 225 index, however, the effect is mixed. A strong surplus can support the yen, and if the currency strengthens, exporters’ profits converted from USD or EUR into JPY will shrink, creating a short-term headwind for automakers, electronics, and industrial machinery producers. On the other hand, a stronger yen makes imported energy and raw materials cheaper, improving margins for domestic-oriented companies. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with: