⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

-

Posts

1,287 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by RBFX Support

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

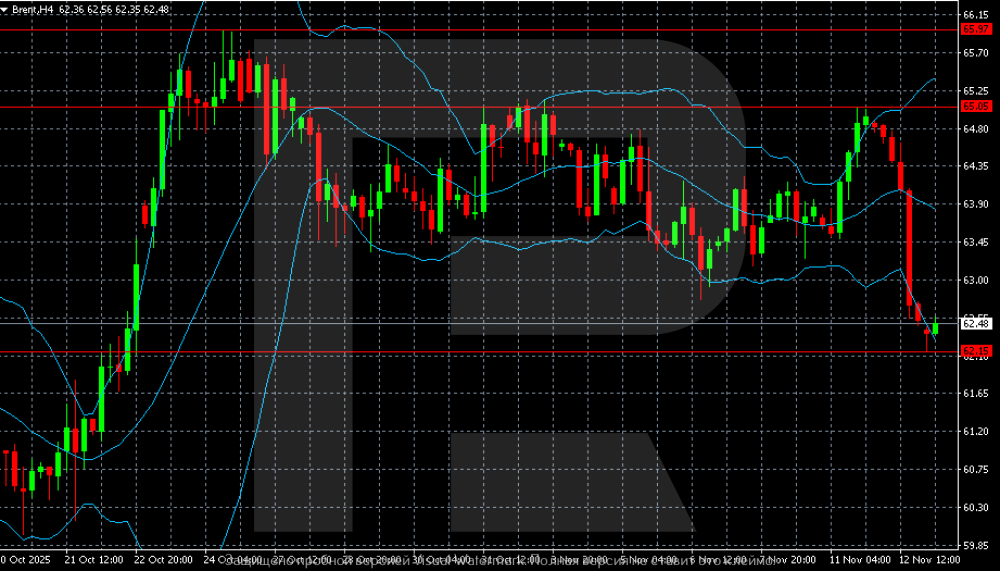

Brent at a three-week low: selling pressure persists Brent crude has fallen to 62.15 USD. The sector is in turmoil as producers push for higher output. Find out more in our analysis for 13 November 2025. Brent technical analysis On the H4 chart, Brent shows a sharp increase in its downward momentum. After a prolonged consolidation phase within the 63.50–65.00 range, prices broke below the lower boundary and dropped to 62.15, a key support area. The current value reflects a mild local rebound following a steep decline. Brent remains weak after a midweek sell-off. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

GBPUSD holds steady above 1.3100 The GBPUSD rate consolidated above 1.3100 despite rising unemployment in the UK. Discover more in our analysis for 12 November 2025. GBPUSD forecast: key trading points Market focus: UK unemployment rose to 5.0% in September Current trend: correcting upwards GBPUSD forecast for 12 November 2025: 1.3100 and 1.3250 Fundamental analysis Weaker-than-expected UK labour market data strengthened expectations of a Bank of England rate cut next month. Regular wage growth slowed to 4.6% in Q3, while unemployment rose to 5.0%, exceeding the forecast of 4.9%. Last week, the Bank of England kept interest rates unchanged but indicated that a rate cut in December would depend on how strong domestic inflationary pressure remains. The market is now awaiting the UK Q3 GDP figures, scheduled for release on Thursday. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

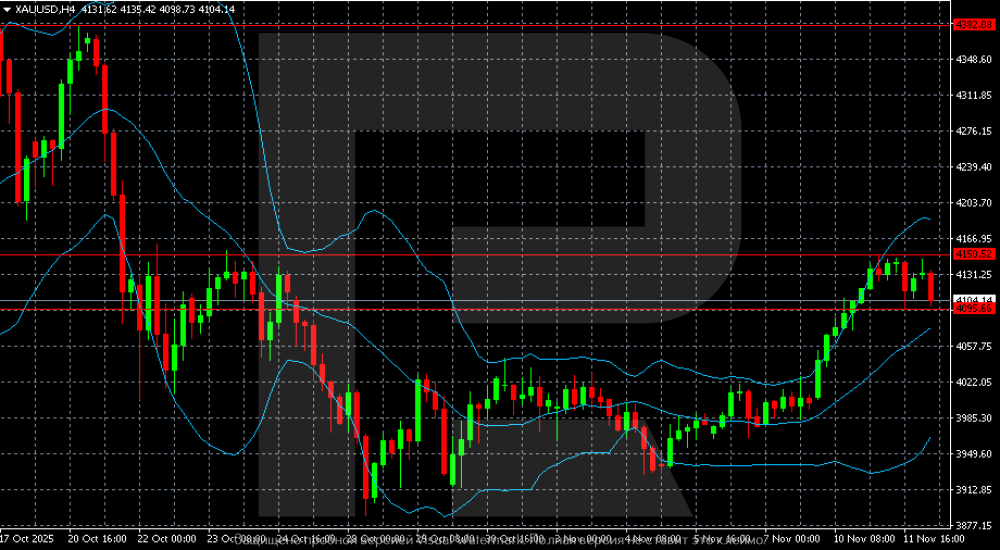

Gold (XAUUSD) on track for the strongest annual rally since 1979 Gold (XAUUSD) prices recovered to 4,130 USD as the market anticipates a Fed rate cut. Discover more in our analysis for 12 November 2025. XAUUSD technical analysis On the H4 chart, after a late-October decline, XAUUSD quotes stabilised within the 3,900–4,000 USD per ounce range, beginning a strong recovery from 8 November. Gold (XAUUSD) maintains a moderately bullish trend. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: the index completed its correction The US 500 recovered after a decline. The US 500 forecast for today is positive. US 500 forecast: key trading points Recent data: ISM non-manufacturing employment in the US came in at 48.2 in October Market impact: the data is moderately positive for the stock market Fundamental analysis The ISM Non-Manufacturing Employment Index stood at 48.2 points, compared with the forecast of 47.6 and the previous reading of 47.2. Although the indicator remains below the neutral 50.0 mark, formally signalling contraction in the services sector’s employment, its uptrend suggests gradual improvement. For the US stock market, this indicates that the pressure on the labour market from the services sector is easing: the rate of job reduction is slowing, which lowers the likelihood of a sharp macroeconomic downturn or a hard-recession scenario. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY hovers above 154.00 The USDJPY rate is rising, consolidating above the 154.00 level amid optimism over a possible end to the US government shutdown. Discover more in our analysis for 11 November 2025. USDJPY technical analysis The USDJPY pair is confidently rising on the H1 chart, consolidating above the 154.00 level. The Alligator indicator is moving upwards, confirming the ongoing bullish momentum. Further growth towards the local resistance area at 155.00 is possible. The USDJPY pair continues its upward trajectory, trading above the 154.00 area. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY rally continues: the yen remains under pressure The USDJPY pair strengthened to a nine-month high of 154.03 as investors await a new economic stimulus package. Find more details in our analysis for 10 November 2025. USDJPY forecast: key trading points Market focus: the USDJPY pair rose to a nine-month high amid an uncertain rate outlook Current trend: the market expects Japan’s cabinet to announce an economic stimulus package USDJPY forecast for 10 November 2025: 154.50 Fundamental analysis The USDJPY rate climbed to 154.03, nearing a nine-month peak. The move comes amid expectations of a large-scale stimulus package from Japan’s new government and the continuation of a loose monetary policy. According to a draft plan, Prime Minister Sanae Takaichi’s cabinet intends to urge the Bank of Japan to give equal weight to economic growth and price stability. The final version of the package, due to be approved on 21 November, includes tax incentives and investment support for 17 key industries. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Canada turns the tables – employment growth drives USDCAD lower The CAD continues to strengthen, with the USDCAD pair trading around 1.4025. Discover more in our analysis for 10 November 2025. USDCAD technical analysis On the H4 chart, the USDCAD pair formed a Shooting Star reversal pattern near the upper Bollinger Band. The pair is now forming a downward wave following the signal from the pattern. The CAD continues to strengthen. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

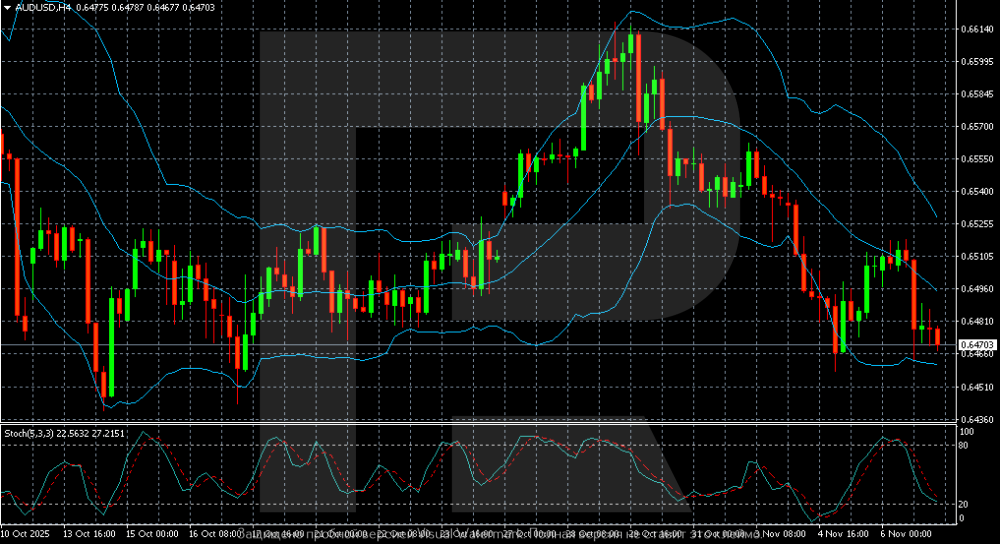

AUDUSD hit by risk aversion and AI-related concerns The AUDUSD pair fell to 0.6470. The sell-off is not over, as sellers remain highly active. Discover more in our analysis for 7 November 2025. AUDUSD technical analysis On the H4 chart, the AUDUSD pair maintains its downward momentum, hitting a new local low. After a brief rally in late October, the market turned downwards, with sellers remaining in control, and the price moving along the lower boundary of the Bollinger Bands range, indicating sustained pressure. The AUDUSD pair remains under pressure and appears weak Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD loses bullish momentum after two days of growth The EURUSD rate remains under pressure after a short-term rise, as signs of a weakening US labour market have strengthened expectations of a Fed rate cut. The current price is 1.1535. Discover more in our analysis for 7 November 2025. EURUSD forecast: key trading points US companies cut 153,000 jobs in October The US dollar remains under pressure amid signs of a cooling labour market EURUSD forecast for 7 November 2025: 1.1470 Fundamental analysis The EURUSD rate is declining after two days of growth. Buyers faced strong resistance around 1.1550, which limited the upward momentum. Despite recovery attempts, the US dollar remains under pressure, as labour market weakness increases expectations of a Federal Reserve rate cut in December. The likelihood of a 25-basis-point Fed rate cut in December rose to 66.9%, up from 62% the day before, reflecting growing expectations of policy easing. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index corrected by more than 6% The JP 225 stock index is trading in an uptrend, although volatility has increased significantly. The JP 225 forecast for today is positive. JP 225 forecast: key trading points Recent data: the Bank of Japan set the interest rate at 0.50% per annum Market impact: the effect on the Japanese stock market is generally positive Fundamental analysis The Bank of Japan’s decision to keep the key interest rate unchanged at 0.50%, fully matching the forecast and previous level, means there was no monetary surprise for the market. For Japanese stock market participants, this signals that accommodative financial conditions will continue: borrowing costs for corporations and households remain low, and the equity risk premium relative to bonds remains attractive. For the JP 225 index, which includes a significant share of exporters, industrial companies and financial institutions, the overall effect of the decision appears moderately positive. The absence of surprises reduces short-term volatility and reinforces the base scenario for valuation models: stable monetary policy, controlled bond yields and favourable conditions for corporate financing. Unless the accompanying BoJ comments point to a faster pace of tightening in the coming quarters, the JP 225 index will likely maintain its upward momentum. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

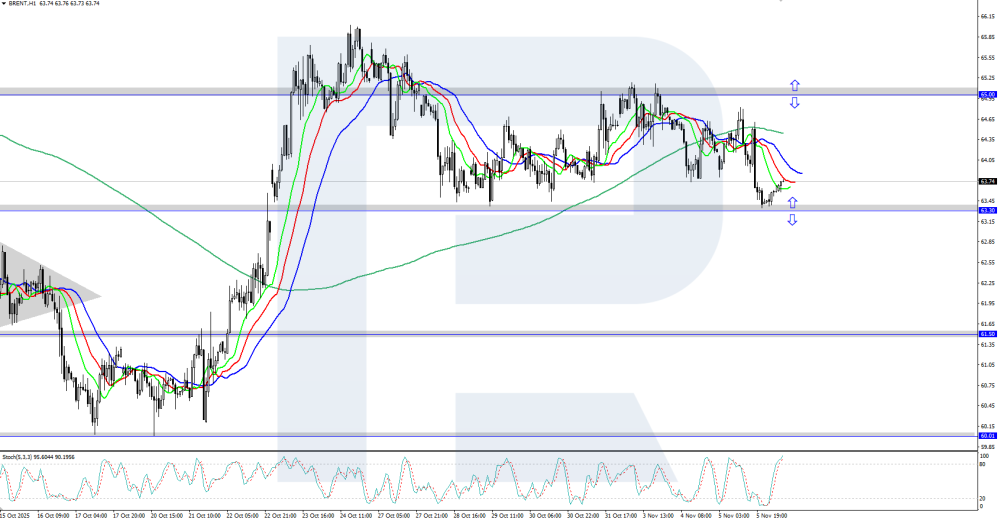

Brent prices declined towards support near 63.00 Brent oil prices fell to the 63.00 USD area amid a rise in US crude oil inventories according to the EIA data. Discover more in our analysis for 6 November 2025. Brent technical analysis On the H4 chart, Brent is moderately declining within a limited sideways range of 63.30–65.00 USD. The direction of the breakout from this price range will determine the future movement of the asset. Brent dipped towards support near 63.00 USD amid rising US crude oil inventories. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

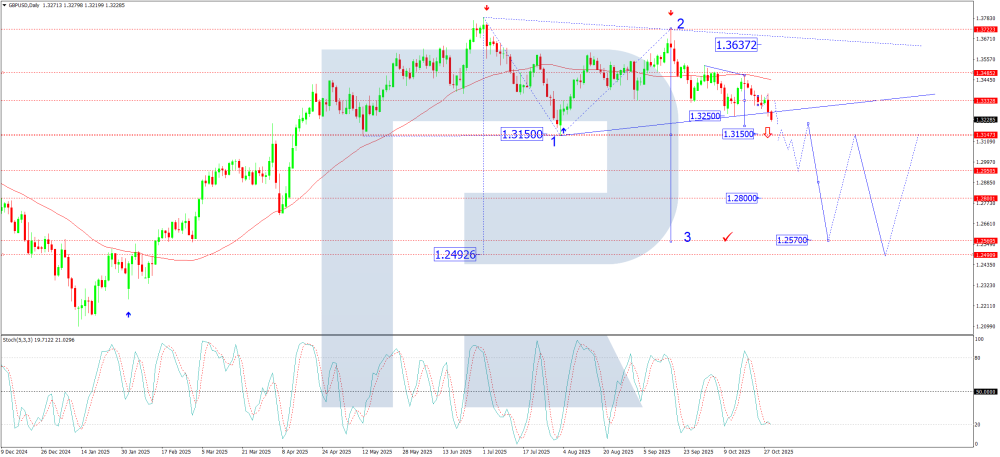

GBPUSD consolidates, but downside potential towards 1.2945 remains high The GBPUSD pair remains under pressure as markets expect the Federal Reserve to keep interest rates unchanged in December, with the rate currently at 1.3027. Find out more in our analysis for 5 November 2025. GBPUSD technical analysis The GBPUSD rate is in a correction phase, remaining within a downward channel. After an aggressive selloff, sellers retain control, while recovery attempts are capped near the 1.3055 resistance level. The current fundamental backdrop favours the US dollar. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 30 forecast: the index enters a correction, but the uptrend remains intact The uptrend in the US 30 index remains strong, suggesting the potential for another all-time high. The US 30 forecast for today is positive. US 30 forecast: key trading points Recent data: US ISM manufacturing prices for October came in at 58.0 Market impact: the data has a moderately positive effect on the equity market Fundamental analysis The ongoing US government shutdown has now become the longest in history after the Senate once again failed to pass a funding bill yesterday. Meanwhile, the ISM manufacturing prices index came in at 58.0, below the forecast of 62.4 and the previous reading of 61.9. This means that prices paid by manufacturers for raw materials and components are still rising (as the index remains above 50.0), but the pace of growth has slowed significantly and fallen short of expectations. This is effectively a disinflationary signal from the manufacturing sector. For the US 30 index, the data is moderately positive. Large industrial companies benefit from easing cost pressures and potentially lower discount rates. However, the short-term reaction will depend on whether investors interpret the data as primarily disinflationary or as a sign of weaker end demand. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDCAD in consolidation, waiting for fresh signals The USDCAD pair gained 0.7% in October, as markets remain tense amid shifting monetary and political factors. Discover more in our analysis for 3 November 2025. USDCAD forecast: key trading points Market focus: the USDCAD pair strengthened following weak Canadian GDP data Current trend: the market is consolidating amid a lack of fresh catalysts USDCAD forecast for 3 November 2025: 1.3977 or 1.4035 Fundamental analysis The Canadian dollar weakened against the US dollar after data showed an unexpected GDP contraction of 0.3% in August. The USDCAD pair is hovering around 1.4020, trading within the 1.3980–1.4035 range. In October, the CAD lost 0.7%, marking its second consecutive monthly decline, despite signals from the Bank of Canada suggesting that the easing cycle may be nearing its end. Last Wednesday, the BoC lowered rates for the fourth time this year and noted that further reductions were highly unlikely. The Canadian dollar briefly strengthened on the statement, but the effect quickly faded after Federal Reserve Chairman Jerome Powell’s hawkish remarks. Adding to the pressure, Canada’s GDP fell by 0.3% in August following a revised 0.3% increase in July, while markets expected it to remain flat. Preliminary estimates point to a 0.1% rebound in September, which could help avoid a recession in Q3. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD weekly forecast: pressure on the euro increases The Fed lowered interest rates, while the ECB left its rate unchanged. The contrast in their rhetoric set the tone for the currency market this week. A December rate cut by the Fed is not guaranteed – this strengthened the dollar and increased pressure on the euro. EURUSD technical analysis On the daily chart, the EURUSD pair continues to trade within a narrow range after an extended decline, holding around 1.1560. Since late August, the pair has hovered between 1.1530 and 1.1730, reflecting a consolidation phase and the absence of a clear trend. The EURUSD pair is consolidating around 1.1560 after a volatile week. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD): volatility eases, but demand persists Gold (XAUUSD) remains volatile around 4,010 USD. While risk sentiment has improved, investor interest in the precious metal persists. Find more details in our analysis for 31 October 2025. XAUUSD forecast: key trading points Reduced geopolitical risk is weighing on gold (XAUUSD) October ends on a positive note, with gold up roughly 50% year-to-date XAUUSD forecast for 31 October 2025: 4,045 Fundamental analysis Gold (XAUUSD) prices have retreated to around 4,010 USD per troy ounce, marking the second consecutive week of losses. The metal remains under pressure due to shifting expectations around the timing of future Federal Reserve rate cuts and news of the US-China trade truce. The two countries reached a one-year agreement on rare earth metals and strategic resources. Donald Trump announced a 10% reduction in tariffs on fentanyl-related products, while Beijing pledged to curb mining output and resume imports of US soybeans. However, the long-term stability of the deal remains uncertain. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

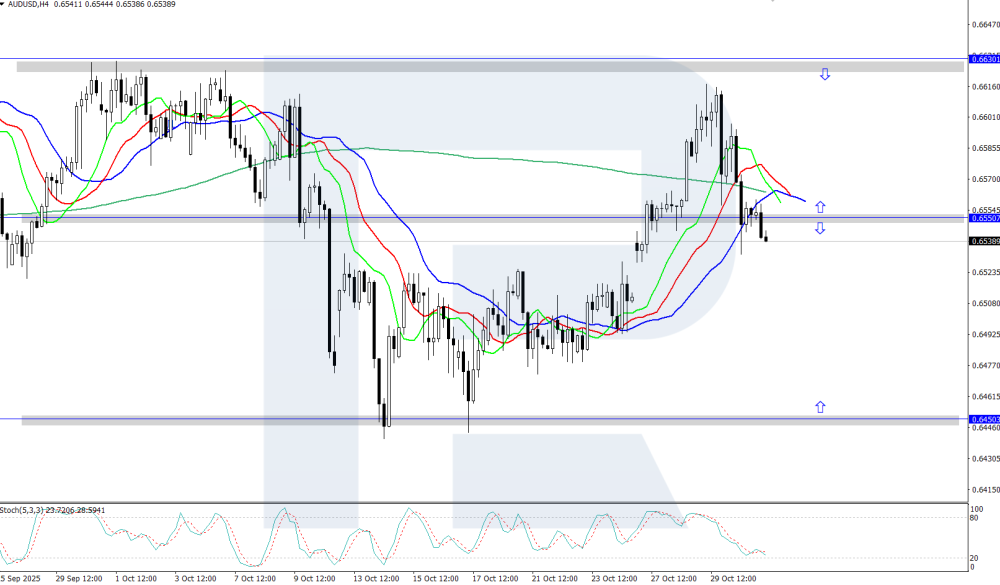

AUDUSD consolidates within a sideways range The AUDUSD rate is trading around 0.6550 amid moderately rising inflation in Australia. Find more details in our analysis for 31 October 2025. AUDUSD technical analysis The AUDUSD pair is trading within a limited price range between 0.6450 and 0.6630 following a period of strong upward momentum. The direction of the next breakout will determine the future trajectory of the pair. The AUDUSD pair is consolidating within a price range between 0.6450 and 0.6630. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD at a crossroads: Fed split and EU CPI data to decide the course Amid expectations of fundamental data from the US and the EU, the EURUSD rate may rise towards 1.1715. Discover more in our analysis for 30 October 2025. EURUSD forecast: key trading points Eurozone Consumer Price Index (CPI): previously at 2.0%, projected at 2.0% Publication of FOMC minutes EURUSD forecast for 30 October 2025: 1.1715 Fundamental analysis The eurozone CPI reflects changes in the cost of goods and services for consumers, helping to assess purchasing trends and the level of stagnation in the economy. A stronger-than-expected indicator would support the euro. The EURUSD forecast for 20 August 2025 suggests that the index may remain flat at 2.0%. However, if the actual figure exceeds the forecast, it could affect the EURUSD rate and strengthen the euro. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY extends gains following central bank decisions The USDJPY pair maintains its upward momentum amid the ongoing monetary policy divergence between the Federal Reserve and the Bank of Japan. The rate currently stands at 153.05. Discover more in our analysis for 30 October 2025. USDJPY technical analysis The USDJPY pair continues to recover after rebounding from the lower boundary of its ascending channel. Prices remain above the EMA-65, confirming bullish momentum and sustained buying interest. The combination of the BoJ’s dovish stance and the Fed’s cautious tone continues to support demand for the US dollar. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBPUSD decline accelerates amid weak economic data The GBPUSD pair continues to weaken amid disappointing UK inflation data and expectations of BoE rate cuts, with the price currently at 1.3220. Find out more in our analysis for 29 October 2025. GBPUSD technical analysis On the daily chart, the GBPUSD pair has completed a wide consolidation range around 1.3485 and resumed its downward movement. The current structure indicates the development of the third wave of a medium-term downtrend. The GBPUSD rate remains under pressure within a descending channel. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY will need strength ahead of central bank meetings The USDJPY pair is consolidating around 151.98 midweek as traders shift their focus towards upcoming Federal Reserve and Bank of Japan decisions. Discover more in our analysis for 29 October 2025. USDJPY forecast: key trading points The USDJPY pair is saving its strength ahead of key policy meetings from the Fed and the BoJ Yen weakness continues to support Japan’s export-oriented sectors USDJPY forecast for 29 October 2025: 151.50–152.50 Fundamental analysis The USDJPY rate edged up to 151.98 on Wednesday as investors await the Bank of Japan’s meeting, where policymakers are widely expected to keep interest rates unchanged. Officials are set to discuss conditions for a potential resumption of the rate-hike cycle, as tariff-related risks gradually ease, although inflationary pressures still complicate the policy outlook. Earlier, the yen strengthened by about 0.5% following a meeting between Japanese Finance Minister Satsuki Katayama and US Treasury Secretary Scott Bessent, who urged Japan to pursue a sound monetary policy. Markets interpreted his remarks as a subtle criticism of Japan’s slow pace in tightening monetary conditions. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent forced to reassess its outlook Brent crude prices have slipped to 65.86 USD per barrel as the market reacts swiftly to changing headlines and shifting sentiment. Details — in our analysis for 28 October 2025. Brent forecast: key trading points Brent continues to decline and may enter a sideways range. Rapid changes in news flow are forcing investors to reassess the outlook. Brent forecast for 28 October 2025: 64.00 and 63.50. Fundamental analysis On Tuesday, Brent crude oil fell for the third consecutive session, dropping to 64.86 USD per barrel amid growing concerns of oversupply following signals from OPEC+ about a potential output increase. According to sources, at the upcoming Sunday meeting, members of the alliance are expected to discuss a moderate production hike for December, with Saudi Arabia reportedly pushing to regain lost market share. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

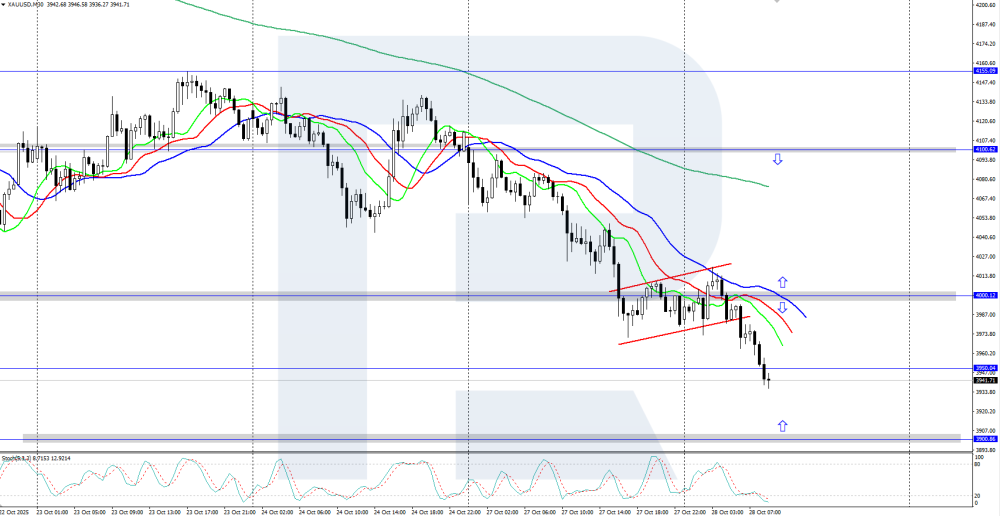

Gold (XAUUSD) falls below 4,000 USD Gold (XAUUSD) has dropped below the key 4,000 USD level amid an ongoing downward correction, as markets await the outcome of U.S.–China trade negotiations. Details — in our analysis for 28 October 2025. XAUUSD technical analysis XAUUSD has corrected lower from its record high of 4,380 USD, following a sharp decline in safe-haven demand. The Alligator indicator remains pointed downward, suggesting that the correction could continue in the short term. Gold (XAUUSD) continues to correct lower, slipping below the psychologically significant 4,000 USD mark as markets focus on U.S.–China trade developments. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDCAD falls below 1.4000 The USDCAD rate has slipped below the key 1.4000 level amid a corrective pullback, as markets anticipate an upcoming interest rate cut from the Federal Reserve. Discover more in our analysis for 27 October 2025. USDCAD technical analysis On the H4 chart, the USDCAD pair continues to move lower within its ongoing correction phase. The broader daily trend remains bullish, suggesting that after the current pullback, the pair could resume its upward trajectory. The USDCAD pair has slipped below the psychologically significant 1.4000 level. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index slightly recovered, but the decline continues The DE 40 stock index has partially rebounded from its recent losses, but the overall trend remains bearish. The DE 40 forecast for today is negative. DE 40 forecast: key trading points Recent data: Germany’s preliminary manufacturing PMI came in at 49.5 in October 2025 Market impact: the data creates a mixed backdrop for the German equity market Fundamental analysis Germany’s manufacturing PMI for October came in at 49.6 points, slightly above both the consensus forecast of 49.5 and the previous reading of 49.5. The figure indicates that the industrial sector remains in contraction, but with signs of gradual stabilisation near the neutral threshold. For the equity market, this is a moderately positive signal in terms of expectations: the slower pace of decline in manufacturing supports the valuation of future cash flows in cyclical sectors, reduces the risk of margin erosion from underutilised capacity, and may help narrow discounts on industrial assets. However, since the indicator remains below 50, it continues to reflect weakness in domestic and external demand, limiting the upside potential and making it dependent on confirmation of improvement in subsequent data releases. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with: