⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

-

Posts

1,286 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by RBFX Support

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) rebounds, but the outlook remains highly uncertain Gold (XAUUSD) prices have partially recovered and returned to 4,850 USD. The market is focused on Fed-related news and overall risk sentiment. Discover more in our analysis for 3 February 2026. XAUUSD forecast: key trading points Gold (XAUUSD) is supported by a solid fundamental backdrop but shows technical sell signals The market still needs gold as a safe-haven asset XAUUSD forecast for 3 February 2026: 4,900 Fundamental analysis Gold (XAUUSD) rose by more than 3% on Tuesday to 4,858 USD per ounce amid renewed buying activity after a sharp decline over the previous two days. The precious metal fell by nearly 5% a day earlier, with Friday’s drop marking the largest single-day decline in more than a decade. The trigger was news that US President Donald Trump nominated Kevin Warsh as the next Federal Reserve chairman. The market perceived him as a more hawkish candidate compared to other contenders, increasing concerns about a potential tightening of monetary policy. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

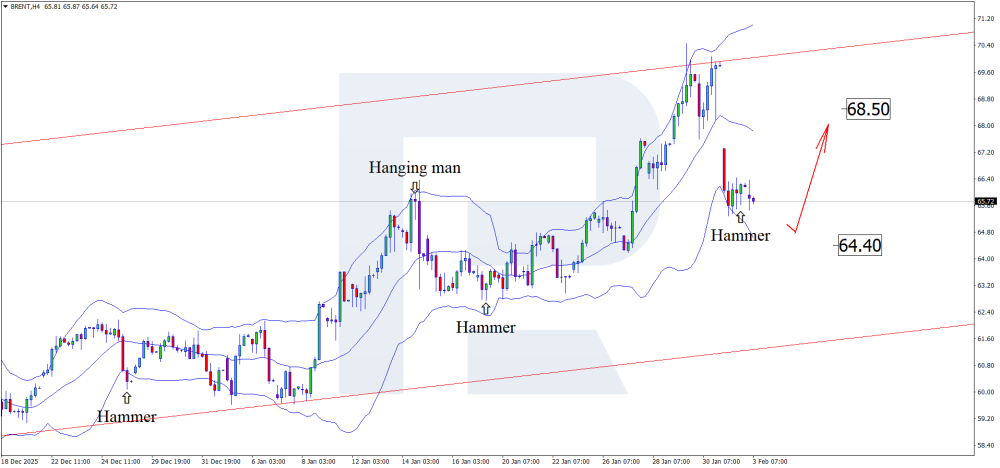

China, OPEC+, and hotspots: will this be enough for Brent to rise? Brent prices are once again attempting to recover, trading around 65.70 USD. Discover more in our analysis for 3 February 2026. Brent technical analysis Having tested the lower Bollinger Band, Brent prices formed a Hammer reversal pattern on the H4 chart. The market may now begin to follow this signal by developing an upward wave. Oil prices continue to depend on geopolitical risks and the situation in the Middle East. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index is testing support The DE 40 stock index may enter a downtrend if the support level is broken. The DE 40 forecast for today is positive. DE 40 forecast: key trading points Recent data: Germany’s inflation rate came in at 2.1% year-on-year Market impact: the data creates a negative backdrop for the German equity market Fundamental analysis Annual inflation in Germany came in at 2.1%, above expectations of 2.0% and up from the previous reading of 1.8%, meaning price growth accelerated and slightly exceeded the forecast. For the equity market, this is important primarily through expectations for monetary policy: higher inflation reduces the scope for rapid policy easing and increases the likelihood that interest rates in the eurozone will remain elevated for longer than the market had anticipated. For the DE 40 index, the effect is more often moderately restraining in the short term. Accelerating inflation does not in itself signal an economic downturn, but it raises the risk of more expensive financing and more cautious profit expectations in sectors sensitive to interest rates and domestic demand. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

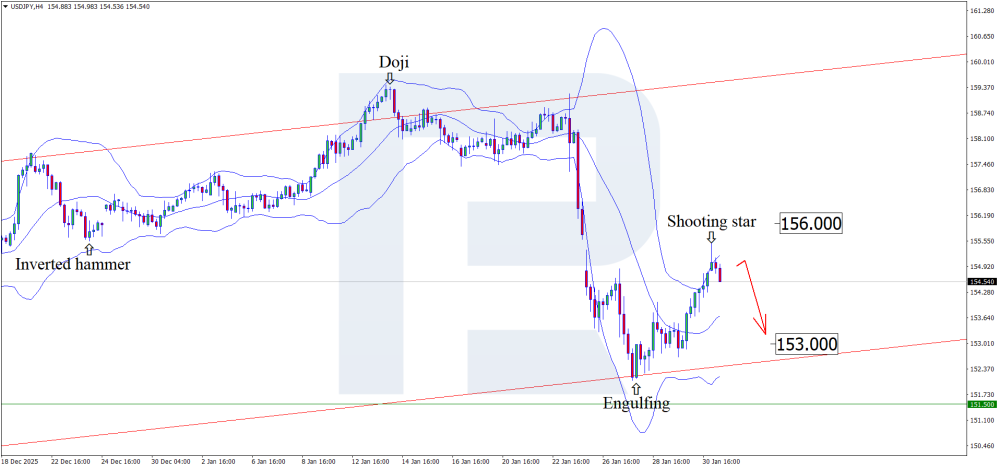

Bank of Japan intervention is no joke: USDJPY continues to decline Positive fundamental data from Japan continues to support the yen, with USDJPY quotes trading around the 154.70 level. Discover more in our analysis for 2 February 2026. USDJPY technical analysis On the H4 chart, the USDJPY pair formed a Shooting Star reversal pattern near the upper Bollinger Band and is trading around 154.80. At this stage, the pair may continue its downward movement as the pattern plays out, with the downside target at 153.00. The yen continues to strengthen amid rumours of intervention. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Profit-taking in XAUUSD after reaching record highs XAUUSD prices remain highly volatile amid a corrective decline, currently trading at 5,165 USD. Discover more in our analysis for 30 January 2026. XAUUSD technical analysis XAUUSD quotes continue their corrective move, but the market is holding above the key support levelat 5,105 USD. This area coincides with the lower boundary of the ascending channel, indicating sustained buying pressure and solid underlying demand. The current decline in XAUUSD is corrective. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

The correction is coming to an end, AUDUSD is poised for a surge The AUDUSD pair is completing a correction amid expectations of US economic data, with prices testing the 0.6985 level. Find out more in our analysis for 30 January 2026. AUDUSD forecast: key trading points Australia’s Q4 Producer Price Index (PPI): previously at 3.5%, currently at 3.5% Current trend: moving upwards AUDUSD forecast for 30 January 2026: 0.7085 Fundamental analysis The AUDUSD outlook for today favours the Australian dollar, which has solid chances to continue recovering against the USD after the correction ends. At this stage, the pair is trading near the 0.6985 level. The Producer Price Index is an inflation indicator that measures the average change in prices received by domestic producers for goods and services. It reflects prices from the sellers’ perspective and covers three production sectors: manufacturing, raw materials, and processing. Since higher production costs may be passed on to consumers, the PPI is often viewed as a leading indicator of consumer inflation. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD strengthens after holding key support at 1.1905 The EURUSD pair is forming a recovery move after a correction amid US dollar weakness and dovish signals from the Fed, with the rate currently at 1.1984. Find out more in our analysis for 29 January 2026. EURUSD technical analysis EURUSD quotes have consolidated above the EMA-65 after a deep correction, indicating an attempt by buyers to regain ground. However, the pair remains within a correction channel, which limits the development of a sustained bullish momentum. Dovish Fed rhetoric and political signals from the White House create fundamental conditions for continued pressure on the USD and support the upside potential of the EURUSD pair Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index approaches resistance The JP 225 stock index may break above the resistance level and reach a new all-time high. The JP 225 forecast for today is positive. JP 225 forecast: key trading points Recent data: the Bank of Japan kept the policy rate at 0.75% Market impact: the effect on the Japanese stock market Fundamental analysis The Bank of Japan’s decision to keep the rate at 0.75%, combined with an upward revision of economic growth and inflation forecasts, should be interpreted as a more hawkish signal than the rate level itself. Improved macroeconomic expectations from the regulator increase the likelihood of further rate hikes and, accordingly, strengthen the influence of rate expectations on the equity market in the current period. Given the JP 225 index’s sensitivity to yen dynamics and its significant share of large exporters, the combination of higher growth and inflation forecasts with a clear hint of further rate hikes increases the likelihood of short-term pressure on the index. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Pound poised for growth: what awaits GBPUSD after the Fed meeting The British pound continues to strengthen against the US dollar, and amid expectations of the Fed’s interest rate decision, the GBPUSD rate may rise towards the 1.3920 level. Discover more in our analysis for 28 January 2026. GBPUSD forecast: key trading points US Federal Reserve interest rate decision: previous value – 3.75%, projected at 3.75% Current trend: moving upwards GBPUSD forecast for 28 January 2026: 1.3920 Fundamental analysis The GBPUSD forecast for today, 28 January 2026, remains favourable for the pound, as prices still have strong potential for further growth after a minor correction. Today, the Federal Reserve will hold its meeting and announce its interest rate decision. The current rate stands at 3.75%. Considering recent comments from Fed officials, US economic data, and prevailing market sentiment, there is a high probability that the rate will remain unchanged. This, in turn, could slightly weaken the US dollar, which aligns with the preferences of the US president. A weaker dollar is beneficial for President Donald Trump, as it supports stronger competitiveness against Chinese manufacturers. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY loses ground amid US dollar weakness The USDJPY pair is correcting after a sharp decline amid the strengthening of the Japanese yen, driven by fundamental factors. The rate currently stands at 152.65. Find out more in our analysis for 28 January 2026. USDJPY technical analysis USDJPY quotes are undergoing a moderate correction within a formed descending channel. Sellers are confidently holding the price below the EMA-65, indicating lingering medium-term bearish pressure. The current USDJPY correction reflects a combination of strengthening fundamental support. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: the index continues to rise and may change trend The US 500 is recovering but remains in a downtrend. The US 500 forecast for today is positive. US 500 forecast: key trading points Recent data: US services PMI for December came in at 52.5 Market impact: the data is moderately positive for the equity market Fundamental analysis The services PMI index reflects how companies assess current business conditions, including demand, order volumes, employment, and overall activity dynamics. The 50 level separates expansion from contraction, so a reading of 52.5 indicates that the US services sector continues to expand. For the US 500 index, this suggests that strong upward momentum from this release alone is unlikely, and the baseline reaction is closer to neutral or slightly negative if the market was expecting a stronger reading ahead of the publication. If market participants conclude that growth in services is sustainable and inflationary pressures may persist, bond yields could rise, which would typically have a restraining effect on the US 500. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent oil under pressure as Double Top forms Brent crude prices are declining due to a combination of technical signals and weakening fundamental support factors. The current price is 64.48 USD. Find more details in our analysis for 27 January 2026. Brent technical analysis Brent prices are undergoing a correction after rebounding from the upper boundary of the Double Top reversal pattern. At the same time, prices remain above the EMA-65, indicating the continued presence of buyers and holding back a sharp decline. Brent remains under pressure after failing to consolidate above 65.35 USD. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index tested support, but the uptrend remains intact The DE 40 stock index has completed its correction and is ready to resume growth. The DE 40 forecast for today is positive. DE 40 forecast: key trading points Recent data: Germany’s ZEW Economic Sentiment Index came in at 59.6 in December Market impact: the data creates a positive backdrop for the German equity market Fundamental analysis Germany’s ZEW Economic Sentiment Index rose to 59.6 points, significantly exceeding the forecast of 50.0 and improving markedly from 45.8 previously. For equity markets, this is primarily a positive signal, as the ZEW index is a leading indicator of sentiment and reflects improving expectations among professional analysts regarding economic dynamics in the coming months For the DE 40 index, the effect is typically more pronounced than for the broader market, as the index has a high weighting of global industrial and export-oriented companies whose performance is strongly linked to growth and order expectations. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

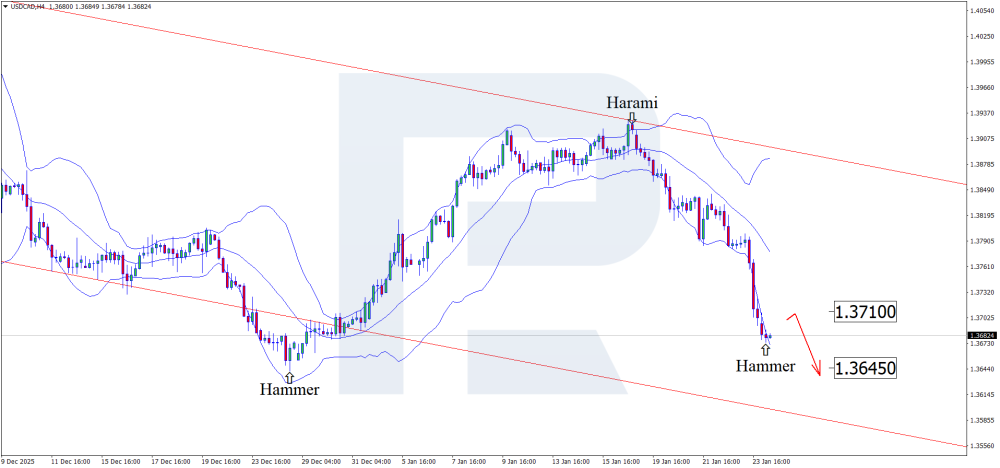

Oil, BoC, and US tariffs: a perfect storm for a USDCAD decline The Canadian dollar continues to strengthen, with the USDCAD rate testing the 1.3690 level. Discover more in our analysis for 26 January 2026. USDCAD technical analysis On the H4 chart, the USDCAD pair formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, it may develop a corrective wave following the signal. Since prices remain within a descending channel, a pullback towards the nearest resistance at 1.3710 can be expected. The Canadian dollar continues to strengthen amid expectations of the BoC interest rate decision. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US Tech forecast: the index enters a sideways trend The US Tech index failed to renew its all-time high and has moved into a sideways range. The US Tech forecast for next week is positive. US Tech forecast: key trading points Recent data: the US core PCE price index increased to 2.8% year-on-year Market impact: the data has a moderately positive effect on the technology sector Fundamental analysis The core PCE price index came in at 2.8% year-on-year, fully in line with market expectations, but accelerated compared with the previous reading of 2.7%. Since the PCE is the Federal Reserve’s key gauge of inflation pressure, the fact that inflation has picked up relative to the prior month is perceived as a moderately negative signal for equities. It increases the likelihood of a more cautious approach to monetary easing and supports the scenario of interest rates remaining relatively high for longer. For the US equity market as a whole, the release can be described as neutral in terms of the headline figure, but slightly negative in trend direction, as an acceleration in core inflation, even by 0.1 percentage point, reduces investor confidence in a rapid decline in borrowing costs. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

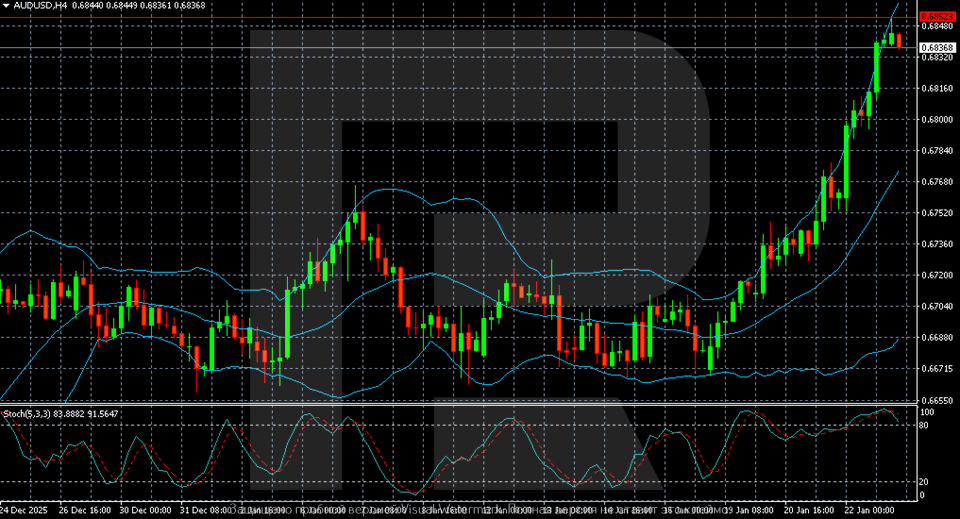

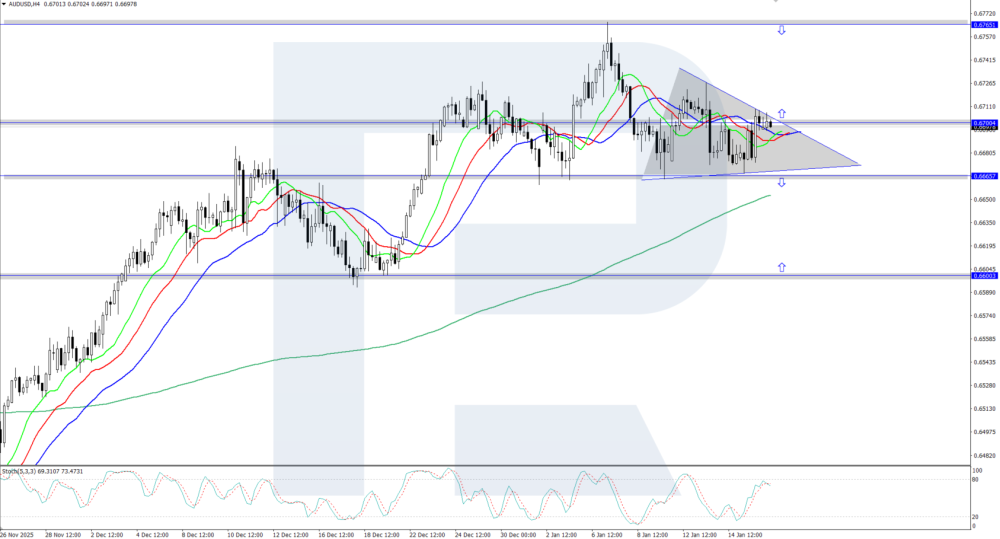

AUDUSD at a 16-month high: the rally is not stopping yet The AUDUSD pair rose to 0.6836, with the Aussie supported by solid domestic data. Discover more in our analysis for 23 January 2026. AUDUSD technical analysis The AUDUSD H4 chart shows a pronounced upward momentum. After an extended consolidation in the 0.6670–0.6720 range, the pair began to accelerate upwards in the second half of the week. Buyers are consistently reaching new local highs, while the price structure is forming a sequence of higher lows and higher highs. The AUDUSD pair continues to rise and shows no signs of slowing. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent on the rise: declining oil inventories and US tariffs support growth After another upward wave, Brent prices are forming a correction and trading near the 64.40 USD level. Find out more in our analysis for 22 January 2026. Brent forecast: key trading points Weekly US crude oil inventories according to the American Petroleum Institute (API): previously at 5.270 million, currently at 3.040 million barrels US crude oil stocks change: previously at 3.391 million, projected at -1.000 million Brent forecast for 22 January 2026: 66.00 Fundamental analysis The Brent fundamental analysis for today, 22 January 2026, takes into account that Brent prices are forming an upward wave and trading near 64.40 USD per barrel. According to the API, weekly US crude oil inventories declined to 3.040 million barrels in the latest reporting period, down from the previous value of 5.270 million. The reduction in inventories increased demand and supported oil prices, with quotes continuing to rise with corrections since 16 December 2025. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY factors in expectations of the BoJ keeping rates unchanged The USDJPY rate continues its confident upward movement amid yen weakness and expectations that the Bank of Japan will maintain a dovish stance, with prices currently at 158.67. Discover more in our analysis for 22 January 2026. USDJPY technical analysis USDJPY quotes continue to rise after breaking out of the downward corrective channel. Buyers breached the upper boundary of the Double Bottom reversal pattern, strengthening the bullish momentum. The current USDJPY dynamics remain upward; however, growth may slow near the 159.05 level. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY continues to rise: what stands behind the strong dollar and weak yen? The USDJPY pair may continue its uptrend after a correction, with quotes currently located near the 158.10 level. Discover more in our analysis for 21 January 2026. USDJPY forecast: key trading points Investors await the BoJ interest rate decision The Fed may take steps to strengthen the USD USDJPY forecast for 21 January 2026: 159.30 Fundamental analysis The forecast for 21 January 2026 appears optimistic for the USD, with the USDJPY pair trading near the 158.10 level after forming a corrective wave. The USDJPY forecast for today takes into account that the USDJPY pair may continue its uptrend, supported by the Fed’s tight monetary policy and yen weakness. Further fluctuations remain possible within the current volatility, but the probability of a continued uptrend persists unless changes occur in BoJ policy or new economic data emerge. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBPUSD maintains a bullish bias despite the correction The GBPUSD pair entered a correction phase; however, a combination of fundamental factors and the technical picture suggests continued potential for renewed growth. The rate currently stands at 1.3437. Discover more in our analysis for 21 January 2026. GBPUSD technical analysis The GBPUSD forecast for today suggests a test of the 1.3380 level, followed by renewed growth towards 1.3625 as part of the reversal pattern’s development. Technical indicators confirm bullish sentiment. Pressure on the US dollar offsets weakness in the UK labour market and limits the pair’s downside potential. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD: the euro gains strength, but what may halt the rise? The euro continues its attempts to strengthen against the USD, with the EURUSD rate currently testing the 1.1660 level. Find out more in our analysis for 20 January 2026. EURUSD technical analysis On the H4 chart, the EURUSD pair formed a Bullish Engulfing reversal pattern near the lower Bollinger Band. At this stage, the price continues its upward momentum, following the pattern signal. Since quotes remain within the ascending channel, they may move towards 1.1710. Amid potential growth in some eurozone economic indicators, the euro continues to strengthen. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Rising uncertainty in global markets supports XAUUSD XAUUSD prices continue to rise amid escalating geopolitical tensions around Greenland, currently trading at 4,710 USD. Discover more in our analysis for 20 January 2026. XAUUSD forecast: key trading points Demand for safe-haven assets strengthened amid the escalation of the situation around Greenland Investors fear the start of a large-scale trade confrontation between the US and Europe Geopolitical risks continue to rise, worsening expectations for global economic growth Fundamental analysis XAUUSD quotes are rising for the second consecutive trading session. Buyers confidently overcame the key resistance level at 4,635 USD, which previously restrained the bullish momentum. Gold receives sustained support due to growing demand for safe-haven assets amid escalating tensions around Greenland. The market reacts to increased pressure from US President Donald Trump, who once again asserts claims over Greenland. Investors fear that such rhetoric may trigger a large-scale trade confrontation between the US and Europe. Analysts emphasise that the current trade tensions differ in nature from last year’s tariff conflicts; however, the level of uncertainty for the global economy remains elevated. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

XAUUSD breaks records: a gold boom amid global instability After hitting a new all-time high, XAUUSD prices are forming a corrective wave and trading around 4,670 USD. Find more details in our analysis for 19 January 2026. XAUUSD technical analysis On the H4 chart, XAUUSD prices formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, quotes may continue to form an upward wave following the pattern signal. Given that XAUUSD quotes remain within an ascending channel, the upside target may stand at the 4,730 USD level. Geopolitical factors continue to support stable demand for gold. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDCAD will continue to rise, but after a pause The USDCAD pair halted at 1.3901, with the market monitoring political developments and oil price fluctuations. Find out more in our analysis for 19 January 2026. USDCAD forecast: key trading points Current mood: trade-related news and US policy weigh on the CAD, while oil prices provide support Market focus: the pair’s growth has slowed, but the market is not yet preparing for a reversal USDCAD forecast for 19 January 2026: 1.3930 Fundamental analysis The USDCAD rate declined to 1.3901 on Monday. Previously, the CAD fell to a six-week low against the US dollar amid news of a trade agreement between Canada and China, as well as expectations surrounding the selection of the next chair of the US Federal Reserve. Additional pressure on the Canadian dollar came from comments by US President Donald Trump, who publicly supported his economic adviser Kevin Hassett. Trump stated that he would like to keep him in his current role. The market interpreted this as a reduced probability of Hassett, considered one of the most dovish candidates, being appointed as Fed chair. This supported the US dollar. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

AUDUSD retreated from the all-time high The AUDUSD rate is undergoing a moderate correction after reaching an annual high of 0.6765 amid rising geopolitical tensions. Find out more in our analysis for 16 January 2026. AUDUSD technical analysis The AUDUSD pair is showing a downward correction following the recent strong rally. The Alligator indicator has turned downwards and continues to decline, so the correction may continue. The key support level is currently located at 0.6665. AUDUSD quotes are moderately correcting after reaching an annual high of 0.6765. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team