⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

-

Posts

1,287 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by RBFX Support

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY strengthens amid weakness of the Japanese yen The USDJPY rate is strengthening amid expectations of changes in Japan’s monetary policy. The current quote stands at 155.93. Details — in our analysis for 18 December 2025. USDJPY technical analysis USDJPY quotes have broken out of the descending channel and continue to move within the formation of a Double Bottom reversal pattern. The USDJPY forecast for today предполагает further growth of the currency pair toward the 157.25 level. The USDJPY pair retains upside potential after rebounding from support at 154.65. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

A decisive moment for GBPUSD: inflation and the Bank of England’s verdict GBP continues to strengthen amid expectations surrounding the Bank of England’s interest rate decision, with GBPUSD trading around the 1.3380 level. Details — in our analysis for 17 December 2025. GBPUSD technical analysis On the H4 chart, GBPUSD tested the upper Bollinger Band and formed a Shooting Star reversal pattern. At this stage, the pair may continue its corrective wave as part of the pattern’s completion. Amid expectations surrounding the interest rate decision, the pound continues to strengthen. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY: the pair has risen above 155.00 USDJPY is showing an upward correction, rising above the 155.00 level after mixed US employment data. Details — in our analysis for 17 December 2025. USDJPY forecast: key trading points Market focus: US unemployment rate rose to 4.6%, the highest level since 2021 Current trend: an upward correction is underway USDJPY forecast for 17 December 2025: 156.00 or 154.35 Fundamental analysis US labor market data for November showed that the unemployment rate increased to 4.6%, the highest level since 2021, although job growth slightly exceeded expectations. Markets currently estimate the probability that the Federal Reserve will keep interest rates unchanged at its January meeting at around 75%. Investors are preparing for the Bank of Japan meeting scheduled for this week. The central bank is expected to raise its interest rate by 25 basis points to 0.75% on Friday. Market attention will be focused on comments from Governor Kazuo Ueda after the meeting, as they may provide guidance on the regulator’s monetary policy outlook for the coming year. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent: prices fall to support at 60.00 USD Brent prices have dropped toward the 60.00 USD area amid peace talks on Ukraine and concerns over excess oil supply in global markets. Details — in our analysis for 16 December 2025. Brent forecast: key trading points Market focus: today the market awaits US employment data for November Current trend: a downward move is observed Brent forecast for 16 December 2025: 58.50 or 64.00 Fundamental analysis Brent prices are declining, falling toward the psychologically important 60.00 USD level, supported by renewed negotiations over a potential peace agreement between Russia and Ukraine. On Monday, US officials signaled that an agreement between Russia and Ukraine is closer than ever, as Washington has agreed to provide security guarantees to Kyiv, although territorial issues remain unresolved. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

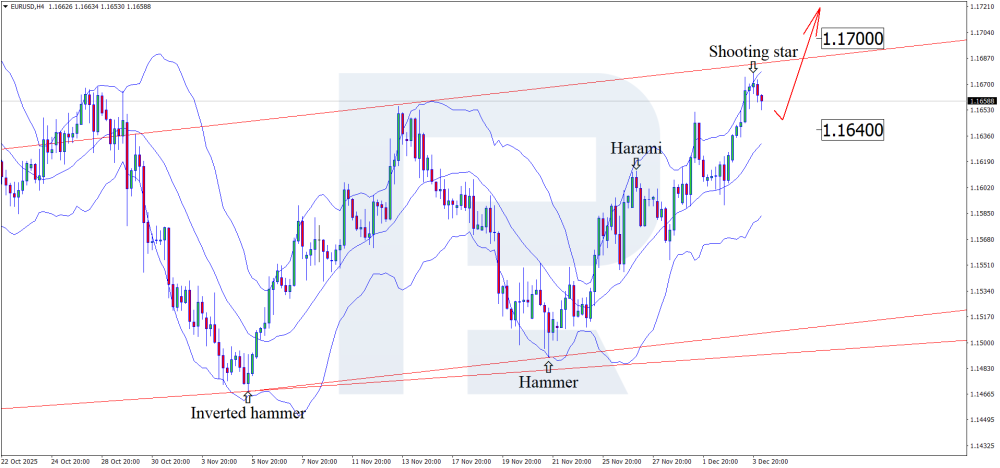

The dollar on thin ice: US labor market data could ignite EURUSD The euro continues to strengthen against the US dollar, with EURUSD quotes testing the 1.1750 level. Details — in our analysis for 16 December 2025. EURUSD technical analysis On the H4 chart, EURUSD has formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, the pair may continue its upward wave as part of the pattern’s follow-through. Given that prices remain within an ascending channel, EURUSD may move toward the 1.1800 level. The euro continues to strengthen amid upcoming US labor market data. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Short-term USDCAD dynamics remain bearish The USDCAD pair continues to decline amid positive macroeconomic data from Canada. The current quote stands at 1.3763. Details — in our analysis for 15 December 2025. USDCAD technical analysis The USDCAD pair is consolidating below the EMA-65, confirming persistent bearish pressure. The price structure points to the formation of a Triangle pattern with a projected target near 1.3680. The USDCAD outlook for today suggests a continuation of the decline, with the nearest target at 1.3690. Short-term USDCAD dynamics remain under pressure. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index reached its target level and corrected The DE 40 stock index has corrected, but the support level has held and the trend remains upward. The DE 40 forecast for today is positive. DE 40 forecast: key trading points Recent data: Germany’s CPI declined by 0.2% m/m Market impact: the data creates a mixed backdrop for the German equity market Fundamental analysis Germany reported a monthly CPI change of -0.2% m/m. The figure matched market expectations (-0.2%) but was significantly lower than the previous reading (+0.3%). In practical terms, this indicates a short-term decline in consumer prices and easing inflationary pressure compared with the previous month. For the German equity market, the key transmission channel is expectations for interest rates and bond yields. Lower inflation generally reduces the likelihood that the euro area will need to maintain high interest rates for an extended period. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

AUDUSD on the verge of a major breakout: fundamentals align perfectly The RBA continues to support the Australian dollar, and AUDUSD may extend its rise toward the 0.6710 level. Details — in our analysis for 12 December 2025. AUDUSD technical analysis On the H4 chart, AUDUSD tested the upper Bollinger Band and formed a Hanging Man reversal pattern. At this stage, prices continue to develop a corrective wave as part of the pattern’s execution. The nearest pullback target is the support level at 0.6635. Overall, the AUDUSD outlook remains favorable for the Australian dollar. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD surges above 1.1700 The EURUSD rate has risen above the 1.1700 level. The euro received support from the Fed’s rate cut and slowing inflation in the eurozone. Details — in our analysis for 12 December 2025. EURUSD forecast: key trading points Market focus: Germany’s consumer inflation for November remained at 2.3% Current trend: an upward impulse is observed EURUSD forecast for 12 December 2025: 1.1800 or 1.1650 Fundamental analysis The US Federal Reserve implemented an expected 25-basis-point rate cut, while simultaneously signaling a likely pause in January as policymakers await additional data to assess the economic outlook. Meanwhile, investors have reduced expectations for further policy easing by the ECB after officials indicated that additional rate cuts may not be necessary in 2026. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

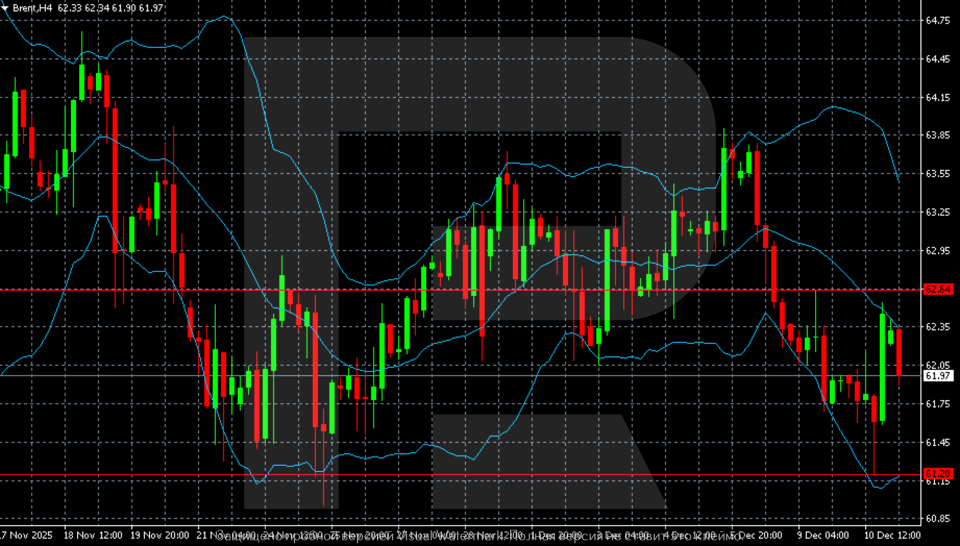

Brent turns lower again: risks are piling up Brent crude slipped to 61.97 USD per barrel. The market is struggling to withstand the pressure. More details in our analysis for 11 December 2025. Brent technical analysis On the H4 chart, Brent maintains a bearish bias after a wave of selling pushed the price toward the support zone at 61.20. This is a key level where previous reversals formed. The current recovery attempt remains weak. Price action is staying below the middle Bollinger Band, indicating seller dominance. As long as Brent trades below the middle Bollinger Band and fails to show a sustainable recovery above the 62.60 area, the overall structure remains bearish. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index continues to rise The JP 225 equity index trades within a narrow corridor between resistance and support. The forecast for JP 225 today is positive. JP 225 forecast: key trading points Recent data: Japan’s GDP contracted by 0.60% quarter-on-quarter Market impact: the effect on the Japanese equity market is moderately negative Fundamental analysis Japan’s GDP decreased by -0.6% quarter-on-quarter, which came in weaker than forecasts and significantly below the previous expansion. The result shows a clear slowdown in economic activity: consumer spending, investment and exports all weakened. This increases investors’ concerns about the pace of economic recovery and the resilience of corporate profits. For Japan’s equity market, such numbers act as a restraining factor. Market participants usually treat a weak GDP print as a signal of elevated risks for companies. JP 225 faces short-term pressure due to concerns about economic momentum. However, further dynamics depend on the stance of the Bank of Japan. If the regulator signals a readiness to support the economy, this could limit the index’s decline and soften the negative effect. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

GBPUSD holds above 1.3300 ahead of the Fed decision The GBPUSD pair has stabilised above 1.3300 ahead of today’s Federal Reserve rate decision. Discover more in our analysis for 10 December 2025. GBPUSD forecast: key trading points Market focus: the market expects the Fed to lower rates by 25 basis points today Current trend: moderate upward momentum GBPUSD forecast for 10 December 2025: 1.3400 and 1.3250 Fundamental analysis Today, market participants expect the Federal Reserve to deliver another 25-basis-point rate cut. Investors will also focus on comments from Fed Chair Jerome Powell, who may take a cautious stance regarding further policy easing amid persistent inflationary pressures. Expectations for next week’s Bank of England rate decision remain largely unchanged, with the likelihood of a rate cut around 84%, despite signs of accelerating wage growth in the UK. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

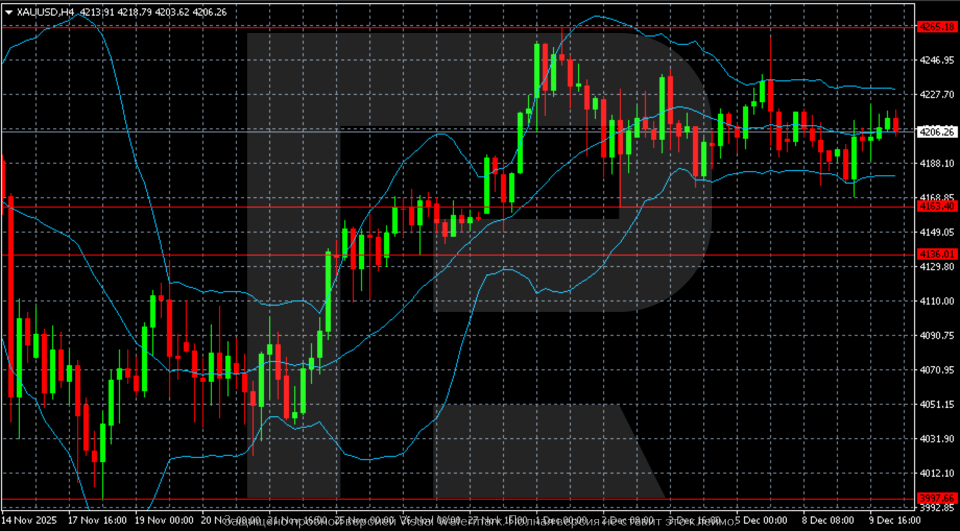

Gold (XAUUSD) in waiting mode: the decision is up to the Federal Reserve Gold (XAUUSD) stalled near 4,210 USD. The Fed will define the near-term outlook. Find out more in our analysis for 10 December 2025. XAUUSD technical analysis On the H4 chart, gold (XAUUSD) continues its sideways movement following the earlier bullish impulse that lifted prices towards the 4,265 resistance level. Quotes continue to fluctuate within the 4,163–4,240 range, without forming a clear trend as the market awaits the Federal Reserve decision. XAUUSD quotes are hovering within a range ahead of the Fed decision. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: the index is once again heading towards a new all-time high The US 500 may enter a correction, but the medium-term uptrend remains intact. The US 500 forecast for today is negative. US 500 forecast: key trading points Recent data: the US core PCE came in at 2.8% year-on-year Market impact: these figures are generally positive for the stock market Fundamental analysis The published core PCE figure came in at 2.8% year-on-year, below the forecast of 2.9% and the previous reading of 2.9%. For the market, this is an important signal, as the core PCE remains the Federal Reserve’s key inflation gauge. The decline shows that inflationary pressure continues to ease, reducing the need for the Fed to maintain a tight monetary stance and increasing the likelihood of a more dovish rate path in the coming months. For the US 500, such data is a moderately positive factor. The market reaction is likely to tilt upwards, as expectations of further easing in inflation reduce uncertainty around the Fed’s decisions. However, the rise is unlikely to be sharp: the figure declined by only 0.1 percentage point, and inflation is already close to the range the Fed considers sustainable. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY awaits the Fed decision The USDJPY pair is forming a correction ahead of the Fed’s interest rate decision, with the price testing the 156.00 level. Discover more in our analysis for 9 December 2025. USDJPY technical analysis On the H4 chart, the USDJPY pair has formed a Hammer reversal pattern near the lower Bollinger Band and is now trading around 156.00. At this stage, the price may continue its upward wave following the pattern’s signal, with an upside target at 156.70. A decline in US job openings partially supports the USD. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index continues to rise, with conditions for a new all-time high in place The DE 40 stock index has formed a strong uptrend, which may enter a correction after reaching a new all-time high. The DE 40 forecast for today is positive. DE 40 forecast: key trading points Recent data: Germany’s factory orders grew by 1.5% m/m Market impact: this data creates a mixed background for German equities Fundamental analysis Factory orders in Germany increased by 1.5% m/m, far exceeding expectations of 0.3%, although slowing from the previous 2.0%. For the market, this is a signal that the industrial sector remains active: companies continue to receive new orders, meaning future revenue and capacity utilisation. The result is significantly better than forecast, so it is a positive surprise for the stock market, despite a slight slowdown compared to the previous month. For the DE 40 index, such data is a supportive factor. Strong orders typically push index futures higher and create a favourable backdrop for growth on the day of the release, especially if external news from the US or China does not interfere. Within the index, movement will likely be uneven: the strongest contribution to growth may come from major industrial and export-oriented companies – the core of the German economy. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDCAD is falling to new lows The CAD continues to strengthen ahead of the Bank of Canada and the Federal Reserve rate decisions, with the USDCAD pair testing the 1.3815 level. Discover more in our analysis for 8 December 2025. USDCAD technical analysis On the H4 chart, the USDCAD pair formed an Inverted Hammer reversal pattern near the lower Bollinger Band. At this stage, the pair may form a corrective wave following the pattern’s signal. The news backdrop favours the CAD. Read more -USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold enters a new rally phase, XAUUSD may soar towards 4,300 USD With markets awaiting US economic data and the upcoming Federal Reserve meeting, XAUUSD may test the 4,300 USD level. Discover more in our analysis for 5 December 2025. XAUUSD forecast: key trading points US core PCE price index: previously at 2.9%, projected at 2.9% Markets await the Federal Reserve’s interest rate decision Current trend: moving upwards XAUUSD forecast for 5 December 2025: 4,300 Fundamental analysis Today’s XAUUSD price forecast shows that gold is undergoing a correction, with prices currently trading near 4,210 USD per ounce. The core PCE price index is a key inflation gauge in the US, tracking changes in prices for goods and services excluding food and energy. It reflects underlying inflation trends and serves as the primary benchmark for monetary policy decisions. The core PCE helps measure real consumer purchasing power and overall economic stability, as it is less affected by short-term volatility. The XAUUSD forecast for 5 December 2025 assumes that the index may remain unchanged at 2.9%. However, it should be noted that this is only a forecast value, and the situation will become clear only after the actual data is published. A weaker-than-expected result would negatively impact the US dollar and trigger XAUUSD growth. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

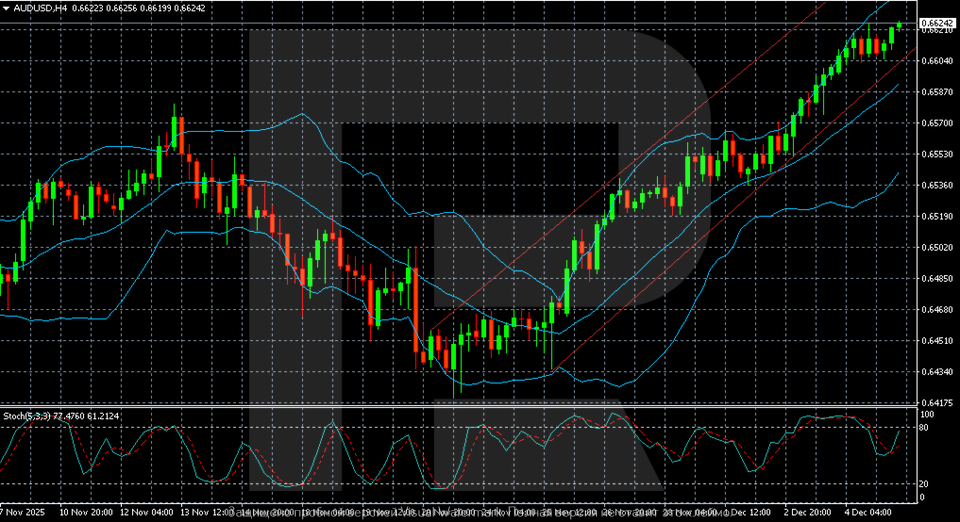

AUDUSD hits a five-week high: this is not the limit yet The AUDUSD pair strengthened to 0.6624. Strong domestic data and upbeat projections are supporting the AUD. Discover more in our analysis for 5 December 2025. AUDUSD technical analysis On the H4 chart, the AUDUSD pair shows a steady upward move within an ascending channel. The price is confidently holding in the upper half of the channel, reflecting strong bullish momentum. The AUDUSD pair is extending its upward movement and appears confident. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent prices stuck in a sideways range Brent quotes show moderate growth, rising to the 63.00 USD area despite an increase in US crude oil inventories according to EIA data. Discover more in our analysis for 4 December 2025. Brent forecast: key trading points Market focus: US crude oil inventories rose by 0.57 million barrels last week Current trend: moving within a sideways range Brent forecast for 4 December 2025: 65.00 or 61.00 Fundamental analysis Brent prices climbed to 63.00 USD per barrel on Thursday, extending gains from the previous session. The move was supported by Ukrainian attacks on Russian oil infrastructure and stalled peace negotiations, which reduced expectations of a recovery in Russian supply. The US has also increased threats against Venezuela’s oil sector, adding to the geopolitical risk premium. However, crude prices remain capped by weak demand and potential oversupply. This is confirmed by EIA data showing a 0.57 million barrel increase in US crude inventories last week, along with rising gasoline and distillate stocks. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD poised for new highs Rising unemployment in the US supports the strengthening of the euro, with the EURUSD pair moving towards 1.1700. Discover more in our analysis for 4 December 2025. EURUSD technical analysis On the H4 chart, the EURUSD pair formed a Shooting Star reversal pattern near the upper Bollinger Band. At this stage, the price may extend a downward wave following the signal. The EURUSD outlook favours the euro. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

The market holds its breath: one report can change the fate of USDJPY Positive US fundamental data may trigger a rally in USDJPY towards 157.50. Discover more in our analysis for 3 December 2025. USDJPY forecast: key trading points Japan’s services PMI in Japan: previously at 53.1, currently at 53.2 US services PMI: previously at 54.8, currently at 55.0 ADP US nonfarm employment change: previously at 42 thousand, currently at 7 thousand USDJPY forecast for 3 December 2025: 154.85 and 157.50 Fundamental analysis The forecast for 3 December 2025 considers that the USDJPY pair continues its correction, trading near 155.80. Japan’s services PMI covers multiple industries, including transport and communications, financial intermediation, business and household services, information technologies, hospitality, and food services. The USDJPY forecast for today appears moderately optimistic for the Japanese yen, with the PMI up to 53.2 from 53.1 previously. At the moment, the PMI is above the 50.0 threshold, which may add support to the yen. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBPUSD strengthens after rebounding from key support The GBPUSD pair is strengthening on the back of a technical reversal and increasing pressure on the US dollar as markets expect a Fed rate cut. The rate currently stands at 1.3234. Find out more in our analysis for 3 December 2025. GBPUSD technical analysis The GBPUSD pair is building bullish momentum after rebounding from the upper boundary of the Double Bottom reversal structure. After a long consolidation, bulls regained control, with the price settling above the EMA-65, forming a sequence of higher highs and higher lows. Strengthening upward momentum in GBPUSD, supported by expectations of a Fed rate cut and general USD weakness, increases the probability of further growth. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

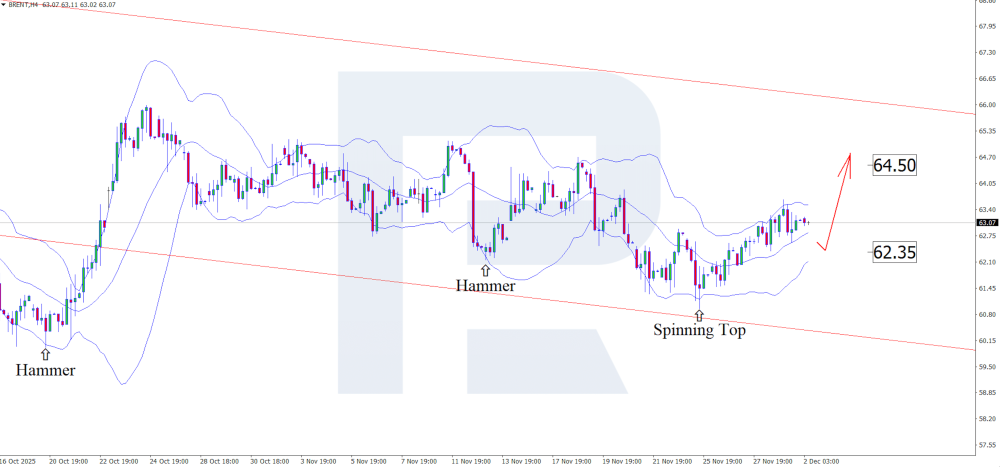

Brent prepares for a surge – what is next The Brent forecast appears positive, with prices likely to maintain their upward trajectory towards 64.50 USD. Discover more in our analysis for 2 December 2025. Brent technical analysis Having tested the lower Bollinger Band, Brent quotes formed a Spinning Top reversal pattern on the H4 chart. They are currently following this signal, forming a bullish wave. Tensions between Venezuela and the United States support crude oil prices. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: the index resumed growth but correction risk remains high US 500 has shifted into an uptrend, but the likelihood of a slight pullback remains high. The US 500 forecast for today is negative. US 500 forecast: key trading points Recent data: US manufacturing PMI for November came in at 52.2 Market impact: these figures are generally positive for the equity market Fundamental analysis The US manufacturing PMI in the latest release came in at 52.2 points versus a forecast of 51.9 and the previous reading of 52.5. This means the manufacturing sector remains in expansion territory (readings above 50.0 indicate growth), but the pace of expansion slowed slightly compared to the previous month. At the same time, the higher-than-expected reading suggests that business conditions are somewhat better than the market anticipated. For the US 500, the impact is cautiously positive. Since the index includes industrial, technology, and consumer companies, a moderately strong PMI supports the soft landing narrative: the economy continues to grow, but without excessive acceleration that could force the Fed back into tightening. Within the index, stocks of real-sector companies sensitive to manufacturing activity may perform slightly better under such conditions. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 410 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with: