-

Posts

1009 -

Joined

-

Last visited

About RBFX Support

Profile Information

-

Country

Belize

Recent Profile Visitors

RBFX Support's Achievements

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD: the pair soared above 1.1700 ahead of the FOMC minutes EURUSD rate is rising, climbing above 1.1700 amid expectations of the FOMC minutes publication, which may hint at an imminent rate cut. Details – in our analysis for 9 July 2025. EURUSD technical analysis On the H4 chart, EURUSD quotes show a local upward reversal, rising above the 1.1700 mark. The daily trend for the pair is upward, confirmed by the rising Alligator indicator. It is possible that the downward correction is already ending, and a new upward impulse may follow. EURUSD quotes are moderately rising, climbing above the 1.1700 mark on information about possible agreements on reducing trade tariffs between the US and the EU. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

GBPUSD in an uptrend despite global risks The GBPUSD rate is strengthening but remains under pressure from global tensions and calls for increased defence spending. Current quote – 1.3593. Details – in our analysis for 9 July 2025. GBPUSD forecast: key trading points The UK is working on an agreement with the US to cancel steel tariffs, fearing an increase up to 50% An increase in steel tariffs could have a devastating impact on the British steel industry GBPUSD forecast for 9 July 2025: 1.3770 Fundamental analysis The GBPUSD rate is recovering after three consecutive days of decline. The British pound came under pressure due to rising global tensions and mounting calls for increased defence spending, creating long-term budgetary uncertainty. Despite the current bearish correction, the GBPUSD currency pair continues to move within an uptrend. The Office for Budget Responsibility (OBR) warned that government debt could reach 270% of GDP by 2070, due to demographic changes and rising healthcare and pension costs. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 273 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Trump prepares tariff storm for Japan – what will happen to USDJPY USDJPY reacts specifically to tariffs on goods from Japan; quotes may form a correction towards support around 145.20. Details – in our analysis for 8 July 2025. USDJPY forecast: key trading points Trump imposes a 25% tariff on goods from Japan Investors seek refuge in USD USDJPY forecast for 8 July 2025: 145.20 Fundamental analysis US President Trump announced the introduction of 25% tariffs on goods from Japan from 1 August. The trade confrontation between the US and Japan does not end at this stage. Earlier, Trump spoke of 50% import tariffs, but gradually his fervour is cooling down, and he does not rule out the possibility of easing tariffs and extending their deadlines. Attempts to support US manufacturers through higher import tariffs ultimately affect consumers, who will have to pay these tariffs out of their own pockets. Importers, including Japan, China, and the EU, may eventually increase prices for their goods to compensate for tariffs and gain their own profit. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 273 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent near two-week high: OPEC+ decisions eased Red Sea events Brent price on Tuesday remains around 68.80 USD per barrel. News from Yemen balanced out market pressure. Details – in our analysis for 8 July 2025. Brent technical analysis On the H4 chart for Brent, a recovery is visible after the sharp fall between 21–24 June. After the collapse, quotes stabilised within a sideways range with a lower boundary near 65.74 and an upper at 67.78. Brent crude oil keeps its eye on the two-week high and remains close by. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

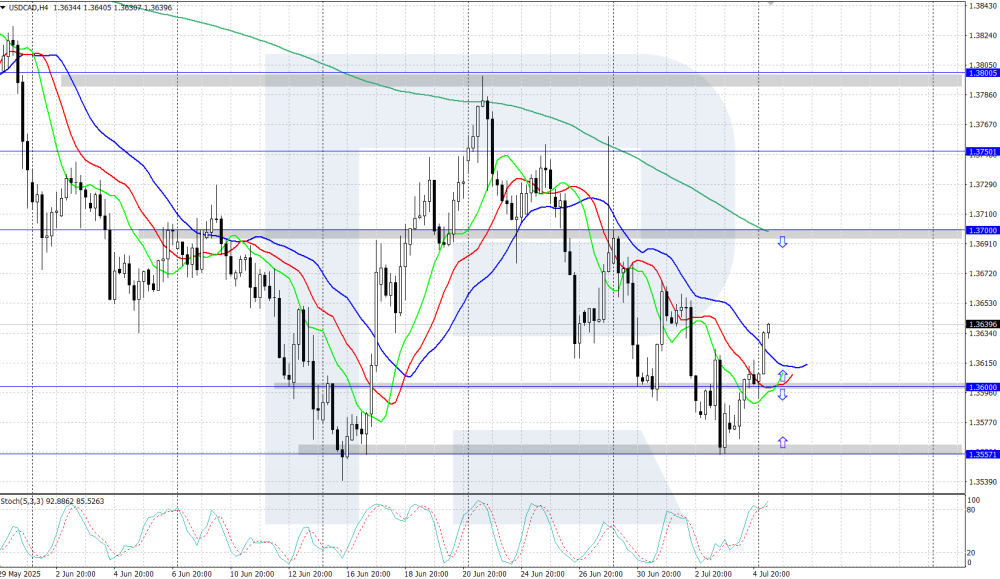

USDCAD: the pair reversed upwards, will growth continue? USDCAD reversed upwards and consolidated above 1.3600 amid weak Canadian economic data published last week. Details – in our analysis for 7 July 2025. USDCAD technical analysis On the H4 chart, USDCAD quotes show an upward correction within a downtrend. Quotes rebounded from daily support at 1.3557 and formed a reversal upwards. In the near term, there is a high probability of the upward correction continuing. USDCAD quotes reversed upwards and rose to an area above 1.3600. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD weekly forecast: US budget deficit and trade wars in focus Last week the euro reached new peaks but EURUSD corrected by week’s end, stabilising amid the US holiday and market readiness to react swiftly to changing conditions. This weekly EURUSD forecast analyses factors that could drive the pair to fresh 2025 highs. EURUSD forecast: key trading points Market focus: Donald Trump signs measures set to push the US budget deficit to its limits. On 9 July maximum trade tariffs come into effect. Current trend: The medium-term uptrend remains intact; short-term consolidation is near 1.1780. EURUSD forecast for 7-11 July 2025: Growth target – retest of the 1.1836 high; support levels – 1.1680 and 1.1439. Fundamental analysis EURUSD fundamentals remain mixed and contradictory. The dollar strengthened after the US jobs report showed 147,000 new jobs created in June – above forecasts and May’s reading. Unemployment fell to 4.1 % despite expectations of a rise. These figures lowered the chance of a near-term Fed rate cut and briefly restored dollar demand as a relatively stable currency. In the UK and eurozone, attention turns to central bank policy. The Bank of England signals readiness to cut rates in August amid fears of overheating and a sharp economic slowdown. The ECB remains more reserved: President Christine Lagarde stated that further steps depend on data and that current rates are near neutral. This gives EUR local stability while the dollar weakens overall. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 273 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

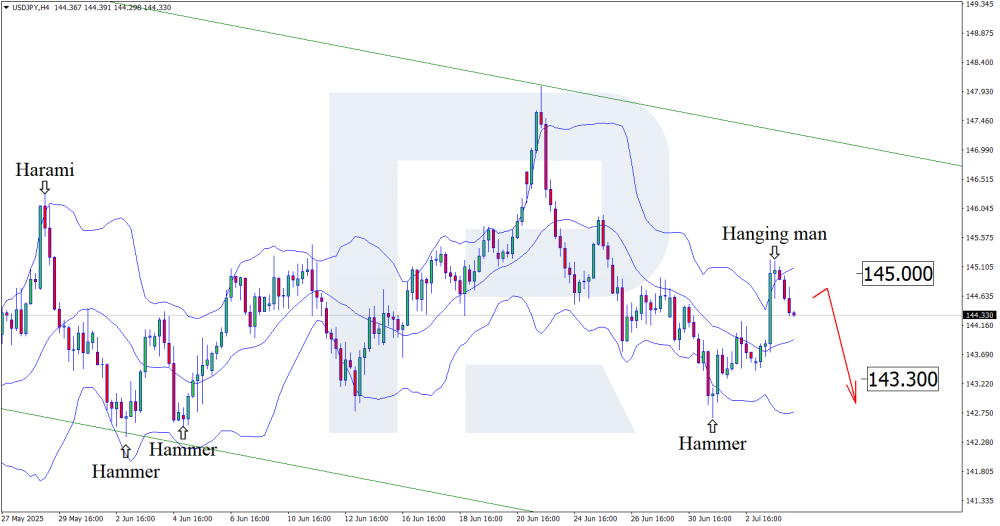

Record Japanese spending pressures the dollar: USDJPY prepares to fall Amid Japan’s economic data, the USDJPY rate may form a downward wave towards 143.30. Details – in our analysis for 4 July 2025. USDJPY technical analysis On the H4 chart, USDJPY, after testing the upper Bollinger Band, formed a Hanging Man reversal pattern and is now near 144.30. At this stage, it continues its downward wave in line with the pattern signal. USDJPY quotes remain within a descending channel, and based on this, it can be assumed that they have every chance of reaching support at 143.30. Against the backdrop of rising Japanese household spending, the USDJPY forecast looks optimistic for the yen. USDJPY technical analysis suggests a decline towards 143.30. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

XAUUSD strengthens after collapse amid strong US employment data XAUUSD quotes are recovering due to rising safe-haven demand amid budgetary and trade risks. Current quote – 3,339 USD. Details – in our analysis for 4 July 2025. XAUUSD forecast: key trading points In June, US companies created 147,000 new jobs US unemployment rate fell to 4.1% instead of the expected 4.3% XAUUSD forecast for 4 July 2025: 3,465 Fundamental analysis XAUUSD price is rising after yesterday’s sharp decline. Gold prices fell following strong US labour market data: in June, US companies created 147,000 new jobs – significantly above the forecast of 110,000. The unemployment rate unexpectedly fell to 4.1% instead of the projected 4.3%. These figures reinforced expectations that the Fed will keep the interest rate at its current level. However, concerns over the growing US budget deficit and persistent uncertainty in trade policy have increased demand for gold as a safe-haven asset. An additional factor was the passage of President Donald Trump’s bill in Congress, which provides for tax cuts and reductions in government spending. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 273 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Bears increase pressure on USDJPY: 143.75 support under threat of breakout USDJPY is correcting near a key support level. Current quote – 144.16. Details – in our analysis for 30 June 2025. USDJPY technical analysis USDJPY continues to decline within a short-term downtrend channel. After breaking the support level at 144.55, the quotes consolidated below the 65-period Moving Average, which increases bearish pressure on the pair. The quotes are trading near the support level at 143.75, with selling pressure persisting. Fundamental factors increase pressure on USDJPY. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Bostic decides the fate of USDCAD: decline or reversal Bostic’s speech could trigger a decline in USDCAD quotes towards 1.3610. Discover more in our analysis for 30 June 2025. USDCAD forecast: key trading points The Canadian government cancelled the digital tax Speech by Federal Open Market Committee (FOMC) member Raphael W. Bostic USDCAD forecast for 30 June 2025: 1.3610 Fundamental analysis Today’s forecast for USDCAD is optimistic for CAD. As part of the resumption of broad trade negotiations between the US and Canada, the Canadian government cancelled the digital tax, thus taking a step towards the US. Against this backdrop, the Canadian dollar continues to strengthen. The USDCAD forecast also considers that Federal Open Market Committee (FOMC) member Bostic will give a speech, which may influence the USDCAD rate. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 273 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

AUDUSD reversed downwards: 90% of traders expect an RBA rate cut The AUDUSD rate is declining after four consecutive days of growth amid expectations of an RBA rate cut. Current quote – 0.6540. Details – in our analysis for 27 June 2025. AUDUSD technical analysis The AUDUSD rate is correcting after rebounding from the upper boundary of the Broadening Triangle pattern. The current price chart structure indicates the completion of the upward impulse and the formation of a bearish correction. The AUDUSD rate came under pressure due to expectations of an RBA rate cut and US dollar strengthening amid easing geopolitical risks. Read more -AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) fell below 3,300 USD amid reduced risks The Gold (XAUUSD) price fell below the support level of 3,300 USD amid the negotiation process in the Middle East. Details – in our analysis for 27 June 2025. XAUUSD forecast: key trading points Market focus: today the market awaits US inflation statistics – PCE Price Index Current trend: a downward trend is observed XAUUSD forecast for 27 June 2025: 3,250 and 3,312 Fundamental analysis The situation in the Middle East is becoming less tense after the announcement of upcoming negotiations between the US and Iran. The parties intend to discuss issues related to Iran’s nuclear programme as well as measures to reduce military confrontation in the region. Today, the key event for the markets will be the publication of the PCE index – a US inflation indicator. A moderate growth of 0.1% is forecast. If the data confirms a slowdown in price pressure, it will strengthen expectations of an imminent easing of the Fed’s monetary policy, possibly as early as the next meeting. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 273 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent crude oil stabilises in range: market needs driver and pause Brent oil prices are consolidating around 66.72 USD, with the phase of extreme volatility being over. Discover more in our analysis for 26 June 2025. Brent forecast: key trading points Brent has reduced its price swings, settling into a narrow range The Middle East factor remains relevant, while focus also shifts to inventory data Brent forecast for 26 June 2025: 66.05 Fundamental analysis Brent prices hold steady at 66.72 USD. While the Middle East remains a relevant theme, it no longer dominates market sentiment. Prices received support from Donald Trump’s statements about maintaining maximum pressure on Iran, including oil export restrictions. At the same time, Trump hinted at a possible relaxation of oversight to help revive Iran’s economy and announced upcoming talks with Iranian representatives. He also expressed support for China, one of Iran’s largest oil buyers, to continue importing Iranian crude. With the ceasefire between Iran and Israel still holding, markets are closely monitoring any further geopolitical developments. US inventory data provided additional support to oil prices. Crude stocks fell for the fifth consecutive week, dropping by 5.84 million barrels to the lowest seasonal level in 11 years. Cushing inventories also hit their lowest point since February. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 273 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

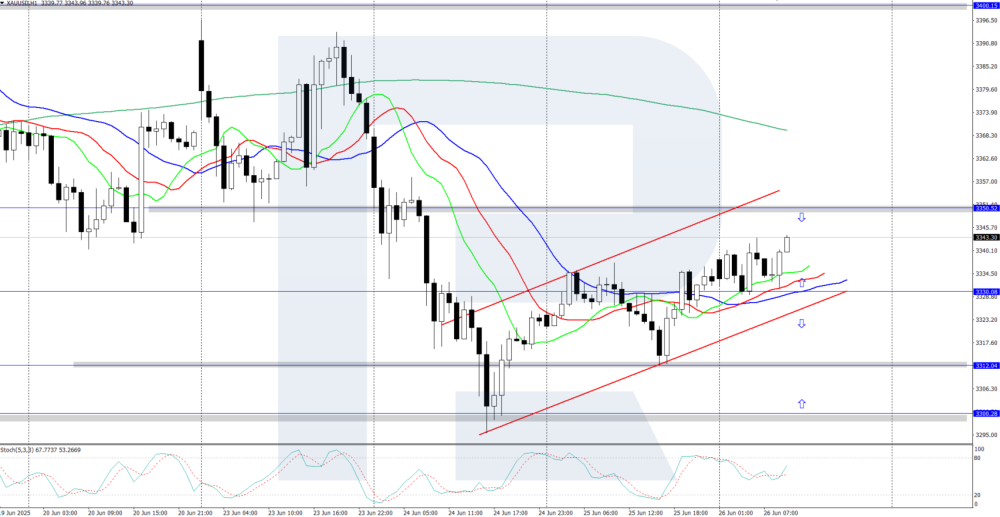

Gold (XAUUSD) rebounds from support at 3,300 USD Gold (XAUUSD) prices rose to the 3,340 USD area, although the pullback may resume as Middle East negotiations begin. Find out more in our analysis for 26 June 2025. XAUUSD technical analysis XAUUSD quotes are undergoing an upward correction after rebounding from the daily support level at 3,300 USD. The Alligator indicator is rising, confirming the current bullish momentum. However, once the correction ends, the precious metal could resume its downward trajectory. Gold is undergoing an upward correction amid the current US dollar weakness. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

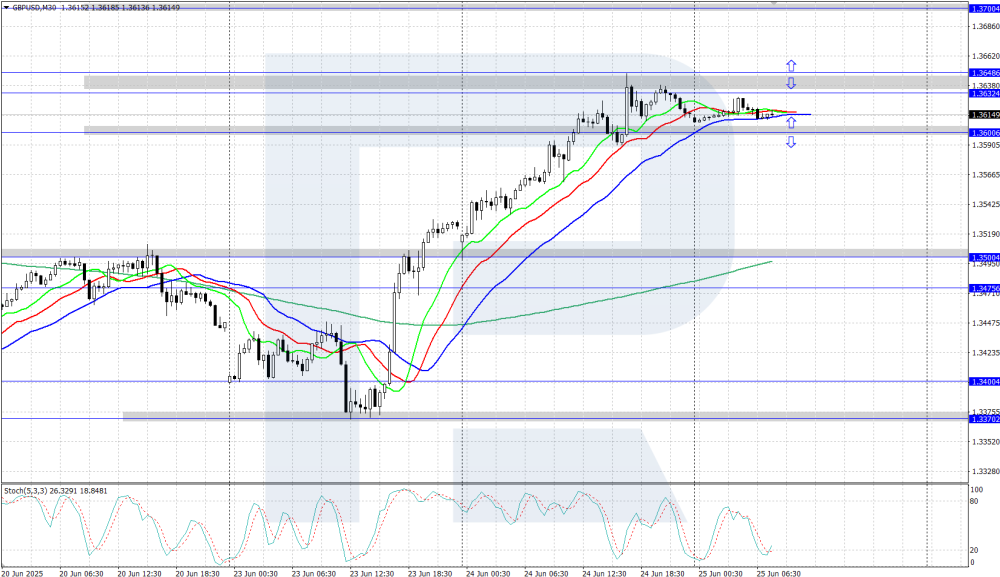

GBPUSD surges higher The GBPUSD rate jumped above 1.3600 as the US dollar weakened amid the ceasefire in the Middle East. Discover more in our analysis for 25 June 2025. GBPUSD technical analysis On the H4 chart, the GBPUSD pair maintains its strong upward trajectory, climbing into a three-year high region. The Alligator indicator is pointing upwards, confirming bullish momentum. The key trend support lies at 1.3370. The GBPUSD pair rose above 1.3600 amid easing geopolitical tensions in the Middle East. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team