⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

-

Posts

1,288 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by RBFX Support

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY rises as all eyes remain on geopolitics The USDJPY pair started the week climbing towards 147.50. Investors are awaiting signals from the Jackson Hole Symposium. Discover more in our analysis for 18 August 2025. USDJPY technical analysis On the H4 chart, the USDJPY pair is trading near 147.40, holding within a narrow range after sharp moves in late July. The key support level lies around 146.20, the mid-August low. The resistance levels are 147.60 and 148.50, with a higher barrier at 150.95, where the market previously set a peak. The USDJPY pair rises as investors favour a stronger US dollar. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

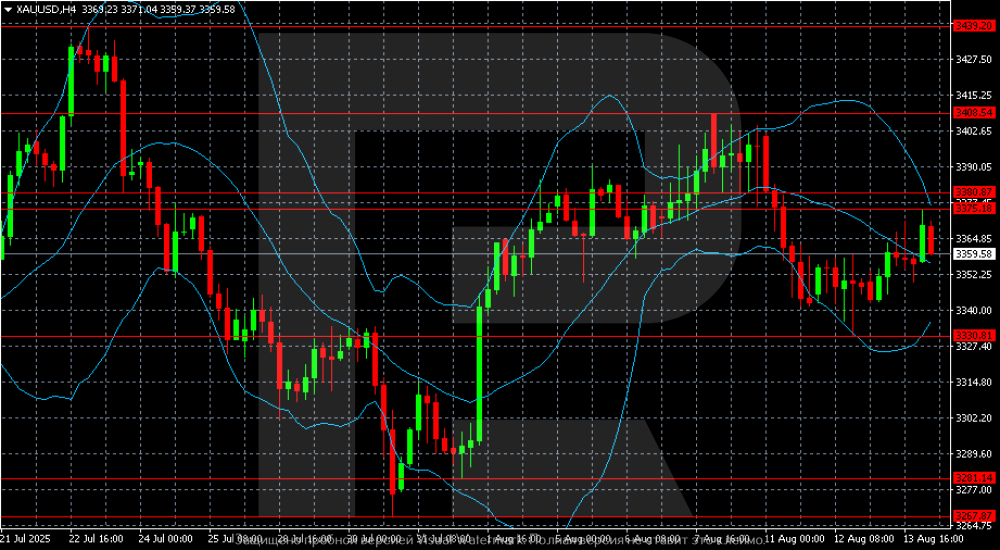

Gold (XAUUSD) targets 3,380: Fed rate outlook supports prices Gold (XAUUSD) prices have been rising for the third consecutive day, hovering near 3,359 USD. Investors are betting on Federal Reserve policy easing and awaiting Friday’s news. Discover more in our analysis for 14 August 2025. XAUUSD technical analysis On the H4 chart, XAUUSD quotes remain within the 3,330-3,380 range. After falling from the July peak of 3,439, prices hit a low of 3,267 at the end of the month, from which recovery began. In early August, gold broke above 3,330 and tested 3,408 but failed to consolidate higher. Gold (XAUUSD) has shown solid growth and retains the potential to climb higher. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index has formed an upward channel and targets a new all-time high The JP 225 stock index hit a new all-time high and continued its upward trajectory. The JP 225 forecast for today is positive. JP 225 forecast: key trading points Recent data: Japan’s current account for July totalled 1.348 trillion JPY Market impact: overall reaction for the broad equity market is neutral to restrained Fundamental analysis While the current account remains in surplus, it is significantly lower than both the consensus and the previous reading. The decline signals less favourable external conditions and higher import costs, which may limit corporate profit margins. At the same time, a likely soft yen partially offsets the effect by supporting exporters. As a result, the balance of factors for the index is mixed: there may be heightened sensitivity to news about global demand and energy prices. For the JP 225, this means a mixed backdrop: export-oriented industries benefit from a weaker yen in the short term, while energy-intensive and import-dependent segments face shrinking margins. The index’s further trajectory will depend on global trade trends, energy price dynamics, yen movements, and the Bank of Japan’s assessment of the balance between policy normalisation and support for economic growth. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY falls below 148.00 The USDJPY pair is declining, moving below 148.00 following the release of US inflation data. Find more details in our analysis for 13 August 2025. USDJPY forecast: key trading points Market focus: the July US Consumer Price Index (CPI) came in line with forecasts Current trend: moving downwards USDJPY forecast for 13 August 2025: 148.50 or 147.00 Fundamental analysis The Japanese yen strengthened after the release of US consumer inflation data, which matched forecasts, rising by 0.2% month-on-month and 2.7% year-on-year. This boosted market expectations for a Federal Reserve interest rate cut next month. In Japan, business sentiment improved for the second consecutive month in August following a trade deal with Washington. The agreement reduced US tariffs on cars and other goods to 15% in exchange for a Japanese investment package worth 550 billion USD. Bank of Japan board members remain divided over the timing and pace of future rate hikes. While some policymakers favour maintaining the current accommodative policy for now, they also pointed to uncertainty over whether current economic forecasts will materialise. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

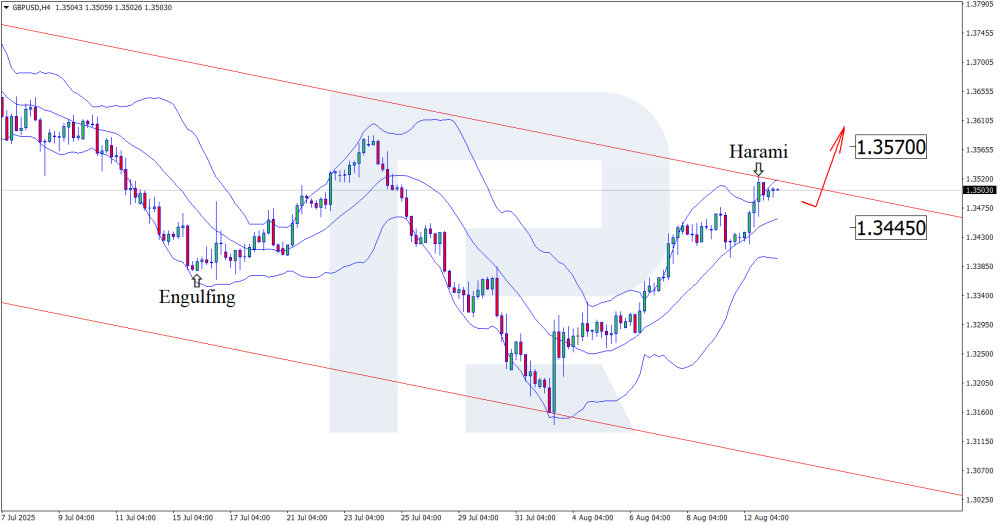

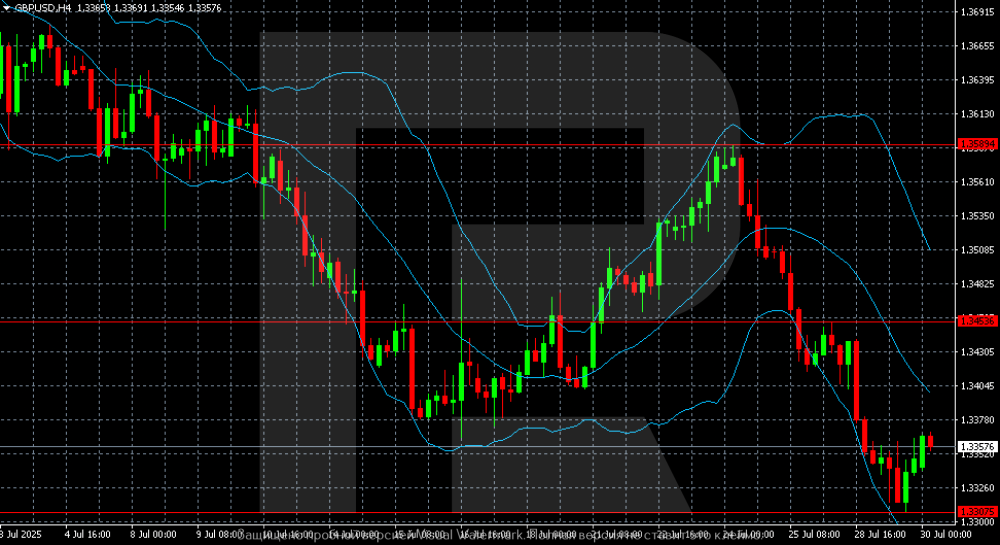

GBPUSD on the rise: September Fed decision could trigger a breakout Ahead of the Federal Reserve’s interest rate decision, the pound continues to strengthen against the USD, with the GBPUSD rate possibly reaching 1.3570. Discover more in our analysis for 13 August 2025. GBPUSD technical analysis Having tested the upper Bollinger Band, GBPUSD formed a Harami reversal pattern on the H4 chart. At this stage, the pair may develop a corrective wave following the signal from the pattern. Given that the price remains within a descending channel, the corrective wave could extend further. The market is awaiting the Federal Reserve’s decision, while GBPUSD technical analysis suggests a correction towards the 1.3445 support level before further growth. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

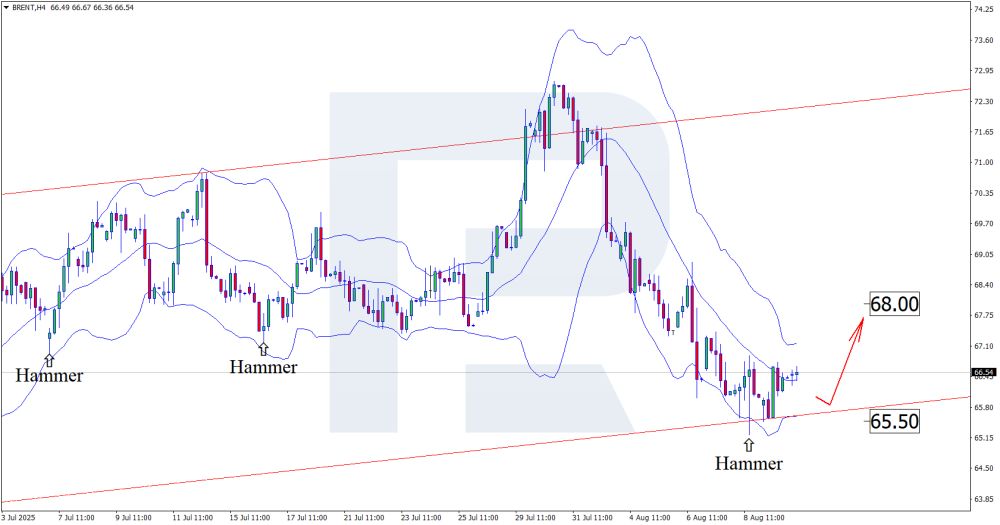

Trade truce boosts market: Brent prices may regain ground After a prolonged decline, Brent quotes may rise towards the 68.00 USD level. Find more details in our analysis for 12 August 2025. Brent technical analysis Having tested the lower Bollinger Band, Brent prices formed a Hammer reversal pattern on the H4 chart. At this stage, they are correcting following the signal. The Brent price forecast for 12 August 2025 suggests the 68.00 USD level as an upside target. Along with the Brent technical analysis, the decline in US crude oil inventories supports a scenario of growth towards the 68.00 USD resistance level. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: quotes approach resistance, but the downtrend continues The US 500 index remains in a downtrend, which is unlikely to be long-term. The US 500 forecast for today is negative. US 500 forecast: key trading points Recent data: the US ISM non-manufacturing PMI came in at 50.1 in July Market impact: for the US stock market, such data has a mixed effect Fundamental analysis The ISM non-manufacturing PMI is a key indicator of the service sector, which accounts for more than 70% of US GDP. The July 2025 reading of 50.1 shows that the economy in the service segment continues to grow, but very weakly, and is almost on the verge of stagnation. The figure came in below the forecast of 51.5 and barely changed from the previous 50.8, indicating a lack of strong growth drivers and possibly declining business confidence in the industry. For the US stock market, such data has a mixed impact. On one hand, weak service sector figures cool expectations for corporate earnings growth in consumer-facing industries and raise concerns about the sustainability of domestic demand. This could put negative pressure on the broad US 500 index, especially in cyclical sectors that depend on economic activity. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

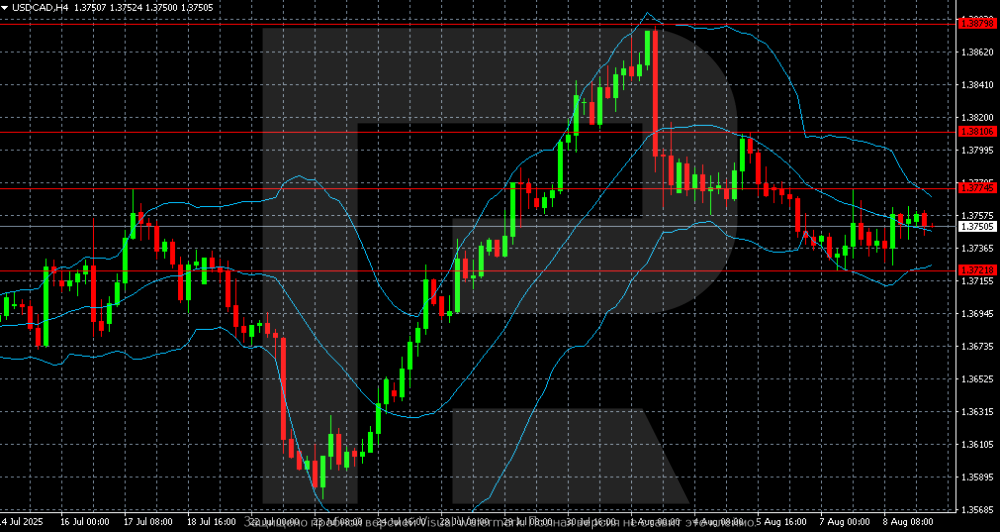

USDCAD pulls lower as risk appetite expands The USDCAD pair remains under pressure. The market is in a risk-on mood and unfazed by weak Canadian employment data. Find out more in our analysis for 11 August 2025. USDCAD technical analysis On the H4 chart, the USDCAD pair is trading at 1.3750 and remains within the 1.3720-1.3775 range. After climbing to 1.3880 in late July, quotes corrected and have mostly been moving sideways since early August. With the USDCAD pair remaining in a sideways range, the market may choose one of two directions. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index has formed a downtrend, but it is likely to be short-term The DE 40 stock index continues to correct after an uptrend. The DE 40 forecast for today is negative. DE 40 forecast: key trading points Recent data: Germany’s balance of trade for June 2025 totalled 14.9 billion EUR Market impact: a decline in the trade balance compared to forecasts and previous figures signals a slowdown in export activity, which will negatively affect the shares of exporting companies Fundamental analysis Germany’s trade balance for June 2025 came in at 14.9 billion EUR, below the forecast of 17.8 billion EUR and the previous reading of 18.6 billion EUR. The trade balance is the difference between a country’s exports and imports over a certain period. A positive figure indicates that Germany exported more goods than it imported. A drop in the trade balance compared to both the forecast and the previous figures signals a slowdown in export activity. This may indicate weak external demand for German goods, which is a negative factor for the German economy and its large export-oriented companies. The DE 40 index, which consists of the largest German companies, will come under pressure due to the worsening trade balance. Since most of the index companies operate in export-driven industries such as automotive, engineering, and chemical, a decline in exports will hurt their financial performance and negatively affect their share prices. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY remains in a narrow range for five consecutive sessions The USDJPY rate remains in a narrow range amid disagreements within the BoJ over the timing of future rate hikes. The current quote is 147.33. Find out more in our analysis for 8 August 2025. USDJPY forecast: key trading points BoJ members are split over the timing and pace of future rate hikes BoJ raised its inflation outlook and improved its economic forecast Growth in household spending in Japan slowed sharply in June USDJPY forecast for 8 August 2025: 150.50 Fundamental analysis Today, the USDJPY rate is rising slightly, while remaining within the range that has held for five consecutive trading sessions. Buyers continue to defend the key 146.65 support level. The US dollar is strengthening after the release of the BoJ’s July meeting minutes, which revealed that board members are divided on the timing and pace of future rate hikes. The central bank kept its interest rate at 0.5%, raised its inflation forecast, and presented a more optimistic assessment of the economic outlook. Some BoJ officials warned of rising inflationary pressures and supported a gradual rate hike to avoid abrupt tightening. Others argued for maintaining the current accommodative stance, citing significant uncertainty over whether economic forecasts will materialise. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

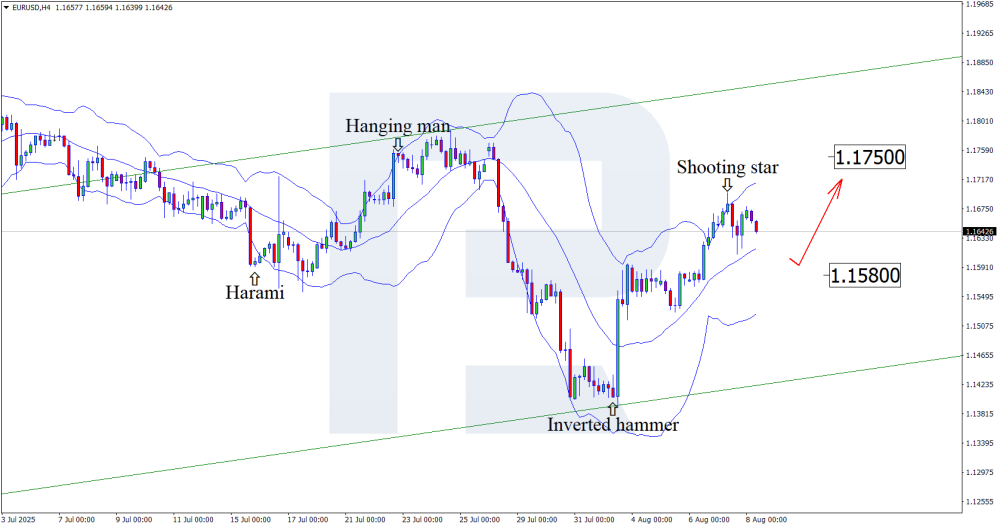

EURUSD holds its breath: what will the ECB decide in September? The USD continues to lose ground against the euro, and with the ECB’s upcoming decision, the EURUSD rate could soar towards 1.1750. Discover more in our analysis for 8 August 2025. EURUSD technical analysis On the H4 chart, the EURUSD pair has formed a Shooting Star reversal pattern near the upper Bollinger Band. At this stage, the pair may continue a corrective wave in line with this signal. Considering the recent sharp rise in quotes, a pullback towards the nearest support level at 1.1580 is possible. A rebound from this support would open the way for a continued upward movement. The appointment of Stephen Miran to the FOMC Board and expectations of Federal Reserve monetary policy easing weigh on the USD. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index set to reach a new all-time high The JP 225 stock index has completed its correction and resumed upward movement. The JP 225 forecast for today is positive. JP 225 forecast: key trading points Recent data: Japan’s current account for June stood at 3.436 trillion JPY Market impact: this indicates a healthy economic structure and currency balance support, which generally boosts investor confidence Fundamental analysis Japan’s latest current account data showed a surplus of 3.436 trillion JPY, well above the forecast of 2.940 trillion JPY and the previous figure of 2.258 trillion JPY. The growth in the current account indicates that Japan exports significantly more goods and services than it imports, or receives substantial income from overseas investments. The JP 225 index, which includes the largest and most liquid stocks on the Japanese market, typically reacts positively to improving macroeconomic indicators. A growing current account reflects external stability, which increases investor risk appetite and supports stock growth, especially in stable and fast-growing sectors of the economy. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

OPEC+ production hike shock sends Brent prices down After a prolonged decline, Brent quotes may correct towards the 68.50 USD area. Find more details in our analysis for 7 August 2025. Brent technical analysis Having tested the lower Bollinger Band, Brent prices formed a Hammer reversal pattern on the H4 chart. The market has partly reacted to this signal with a correction. US tariffs continue to weigh on Brent prices, yet the potential for a return to the uptrend remains. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: index hits new all-time high and begins correction The US 500 index approached the 6,500.0 level, and with each new all-time high, the likelihood of a downward correction increases. The US 500 forecast for today is positive. US 500 forecast: key trading points Recent data: US NFP for July came in at 73 thousand Market impact: slower employment growth and a high unemployment rate create uncertainty, which may trigger volatility and investor caution Fundamental analysis The Nonfarm Payrolls figure came in at 73 thousand, significantly below the expected 106 thousand, although still above the revised previous value of 14 thousand. This reflects a slowdown in job growth and worsening hiring dynamics. The three-month average job growth is just around 35 thousand, marking the weakest level since the onset of the 2020 pandemic. This suggests a notable cooling in the labour market and could signal a broader economic slowdown. This serves as a negative signal for the US 500 index, since weak labour data often correlates with slowing economic activity and declining corporate earnings. The technology sector may come under pressure, as company growth depends heavily on a strong economy and robust consumer demand. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

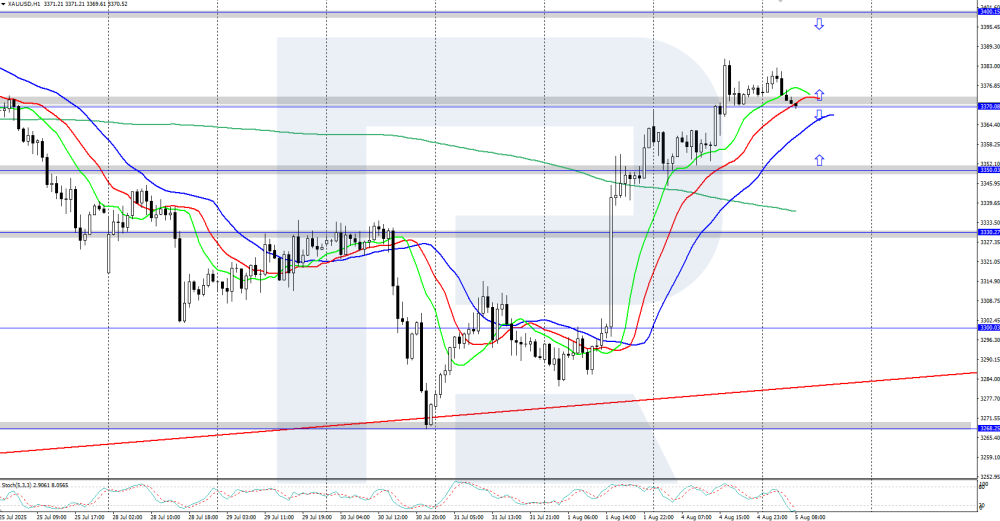

Gold (XAUUSD) rises towards the 3,400 USD area XAUUSD prices continue to strengthen, taking advantage of the weaker dollar after disappointing US Nonfarm Payrolls data. Find more details in our analysis for 5 August 2025. XAUUSD technical analysis XAUUSD prices are rising after reversing upwards from the daily low at 3,268 USD. The Alligator indicator has also turned upwards, suggesting the possibility of continued upward movement after a brief correction. Gold has surged towards the 3,400 USD area amid dollar weakness following disappointing US labour market statistics. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

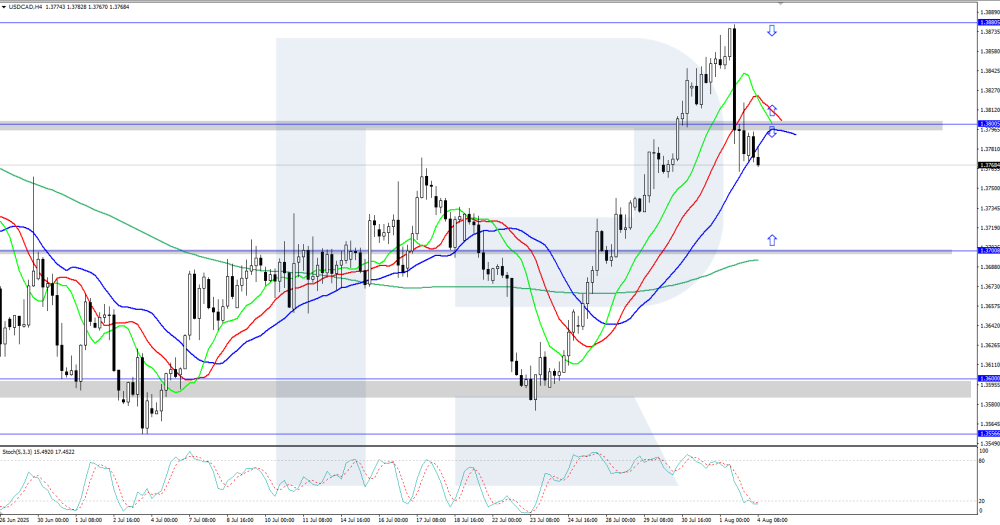

USDCAD drops below 1.3800 after Nonfarm Payrolls data The USDCAD rate reversed downwards and consolidated below 1.3800 following the release of weak US Nonfarm Payrolls data on Friday. Discover more in our analysis for 4 August 2025. USDCAD technical analysis On the H4 chart, the USDCAD pair is reversing down from the local daily high of 1.3880. The Alligator indicator is attempting to turn downwards, indicating a high probability of a continued downward movement. The USDCAD pair reversed lower and dropped below 1.3800, as the US dollar came under pressure following the release of weak Nonfarm Payrolls data. Read more -USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY plunges, Bank of Japan remains silent, while US industrial sector hits negative records The USDJPY outlook is at a tipping point. With US economic indicators pressuring the dollar, a rally towards 149.00 is possible. Find out more in our analysis for 4 August 2025. USDJPY forecast: key trading points US factory orders: previously at 8.2%, projected at -4.9% Current trend: upward impulse remains possible USDJPY forecast for 4 August 2025: 149.00 Fundamental analysis The release of actual US employment data triggered a USD sell-off. After testing the 150.00 level, the USDJPY rate dropped significantly and currently trades around 147.00. Japan’s Ministry of Finance expressed concern over increased yen volatility and sharp rate swings. However, the Bank of Japan believes the current JPY exchange rate does not influence inflation, indirectly hinting that a yen intervention is unlikely in the near term. The central bank also suggests that a change in interest rates is improbable anytime soon. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) strengthens despite pressure from the US dollar XAUUSD quotes are attempting to recover, supported by technical factors and sustained demand. Prices currently stand at 3,292 USD. Find more details in our analysis for 1 August 2025. XAUUSD forecast: key trading points Gold demand in Q2 2025 reached 1,080 tonnes Central banks reduced purchases but remain key buyers Jewellery consumption dropped to 2020 levels XAUUSD forecast for 1 August 2025: 3,375 Fundamental analysis XAUUSD prices are rising for the second consecutive day, with buyers keeping prices above the lower boundary of a large Triangle pattern. Despite this local recovery, the precious metal remains under pressure from a stronger US dollar, which gained after Donald Trump announced plans to impose higher tariffs on several countries. According to the World Gold Council, global gold demand in Q2 2025 reached 1,080 tonnes, up 10% from the same period last year. Central banks continue to play a significant role despite slightly lower purchase volumes. In contrast, the jewellery segment showed weak dynamics, with consumption nearly returning to 2020 pandemic levels. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

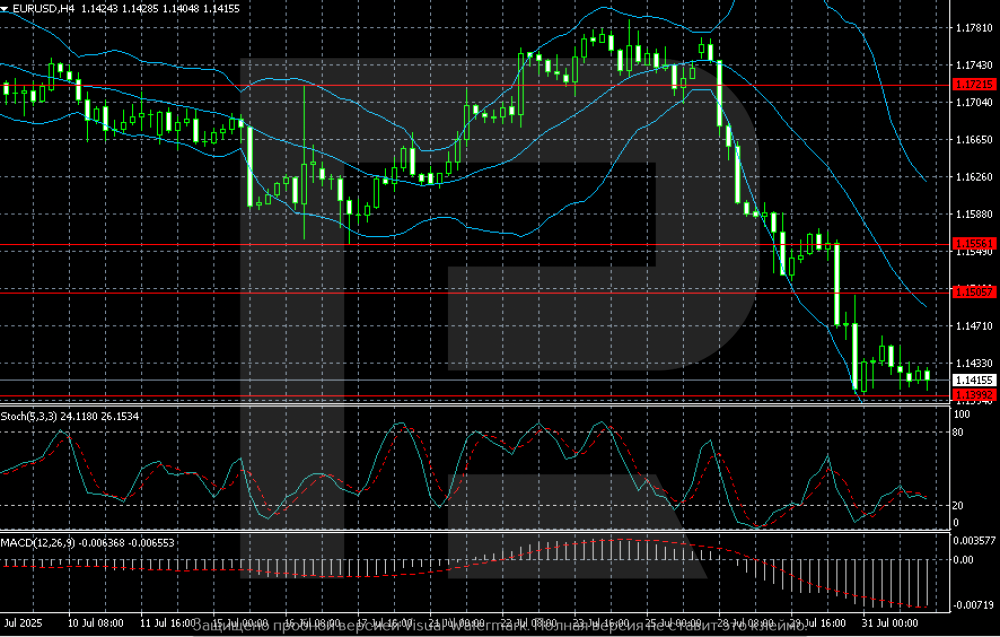

EURUSD takes a breather: news supports the US dollar The EURUSD pair has paused around 1.1416 as the market continues to favour the US dollar. Discover more in our analysis for 1 August 2025. EURUSD technical analysis On the H4 chart, the EURUSD pair consolidates near 1.1415, holding the local support level at 1.1399. After breaking below the 1.1550-1.1505 area in late July, the downward move accelerated, with recovery attempts remaining weak. After a sharp drop, the EURUSD pair appears to have lost direction for the moment. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index enters a sideways channel The JP 225 stock index is completing a downward correction within a broader uptrend. The JP 225 forecast for today is positive. JP 225 forecast: key trading points Recent data: Tokyo core CPI in Japan preliminarily came in at 2.9% year-on-year in July Market impact: inflation falling below expectations may positively impact the stock market, as it reduces the likelihood of the Bank of Japan tightening monetary policy Fundamental analysis The Tokyo core CPI reflects inflation dynamics in Tokyo and serves as an important gauge of inflationary trends across Japan’s economy. The current reading of 2.9% is below both the previous value of 3.1% and the forecast of 3.0%. This indicates that inflationary pressure is easing, which could significantly influence the Japanese stock market, including the JP 225 index. Inflation falling below expectations may boost the stock market as it lowers the likelihood of the Bank of Japan tightening its monetary policy. Investors may interpret this as a sign that the BoJ will continue with a loose monetary stance (low interest rates), which typically supports equities. However, the central bank has previously indicated plans to raise the key rate instead. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent quotes surged to a six-week high Brent prices are correcting after a sharp rally, having reached a six-week high. The current quote stands at 72.05 USD. Find more details in our analysis for 31 July 2025. Brent technical analysis Brent continues to trade within an ascending channel, with prices firmly consolidating above the key 70.55 USD support level, indicating strong buyer pressure. Brent quotes remain under pressure from geopolitical risks and the unexpected increase in US inventories. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: the index set a new all-time high and began a correction The US 500 index approached the 6,500.0 level, and with each new all-time high, the likelihood of a downward correction increases. Today’s US 500 forecast is positive. US 500 forecast: key trading points Recent data: US JOLTS job openings for June came in at 7.43 million Market impact: the effect on the US stock market may be mixed, depending on the Federal Reserve’s interpretation of this data Fundamental analysis The JOLTS job openings figure reflects the number of available positions in the US and serves as a key indicator of labour market health. The current reading is 7.437 million, below both the forecast of 7.510 million and the previous figure of 7.712 million. This suggests weakening demand for labour and a gradual cooling of the economy. For equities, this may have a twofold impact. On the one hand, fewer job openings ease wage pressure and inflation risks, which increases the likelihood that the Federal Reserve will refrain from raising rates and could eventually resume rate cuts. On the other hand, it points to slowing economic activity, which raises investor caution. For the US 500 index, the impact varies by sector. The technology and real estate sectors benefit as a more accommodative Fed stance makes funding more accessible and supports growth stocks. Meanwhile, the financial sector may see reduced profitability due to lower interest rates. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBPUSD at 20 May low: no support from economic data The GBPUSD pair dipped to 1.3357 on Wednesday as weak PMI data and a strong US dollar pressured the pound. Discover more in our analysis for 30 July 2025. GBPUSD technical analysis On the H4 chart, the GBPUSD pair remains under pressure, trading in a downtrend. After failing to consolidate above 1.3589, the pair reversed and reached a local low around 1.3300 by 30 July – its lowest level since the start of the month. The GBPUSD pair has fallen to its lowest since 20 May and appears weak. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent prices jump towards 70.00 USD as trade tensions ease Brent prices are on the rise, reaching the 70.00 USD area amid a trade agreement between the US and the EU. Discover more in our analysis for 29 July 2025. Brent forecast: key trading points Market focus: today, the spotlight is on US crude oil inventory data from the American Petroleum Institute (API) Current trend: trading within a broad sideways range Brent forecast for 29 July 2025: 70.70 or 67.20 Fundamental analysis Oil prices are moderately rising, supported by the US-EU trade deal that introduces a 15% tariff on most European goods. This agreement reduces fears that new tariffs could weigh on global economic growth and energy demand. Today, market focus shifts to the US oil inventory data from the API. An increase in stockpiles may pressure Brent prices, while a decline could offer support. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY under pressure: Trump’s tariff hike and BoJ decision in focus The USDJPY pair consolidates as markets anticipate monetary decisions and US trade statements, with the price currently at 148.23. Find out more in our analysis for 29 July 2025. USDJPY technical analysis Despite a bearish correction, the USDJPY rate remains within the ascending channel. At this stage, the price could correct further towards the 147.80 support level before resuming its upward momentum. Today’s USDJPY forecast suggests a rebound from the support level and a move towards 149.85. The fundamental outlook for USDJPY remains moderately favourable for the US dollar, increasing the likelihood of a renewed upward momentum following the current correction. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team