⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

-

Posts

1,288 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by RBFX Support

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

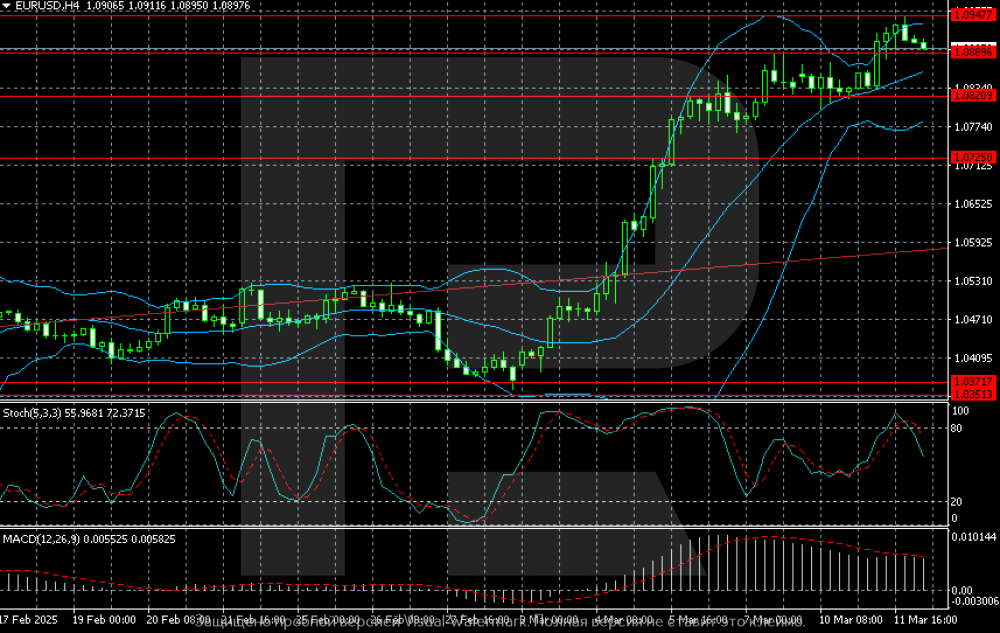

EURUSD is in a strong position thanks to Trump and Germany’s policies The EURUSD pair is on the rise near 1.0900, but it may halt its growth due to the US statistics. Find out more in our analysis for 12 March 2025. EURUSD technical analysis The H4 chart shows that the EURUSD pair maintains its positive momentum, with the price likely to retest the 1.0947 level in the short term. The EURUSD pair is poised for further growth if there are new triggers. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

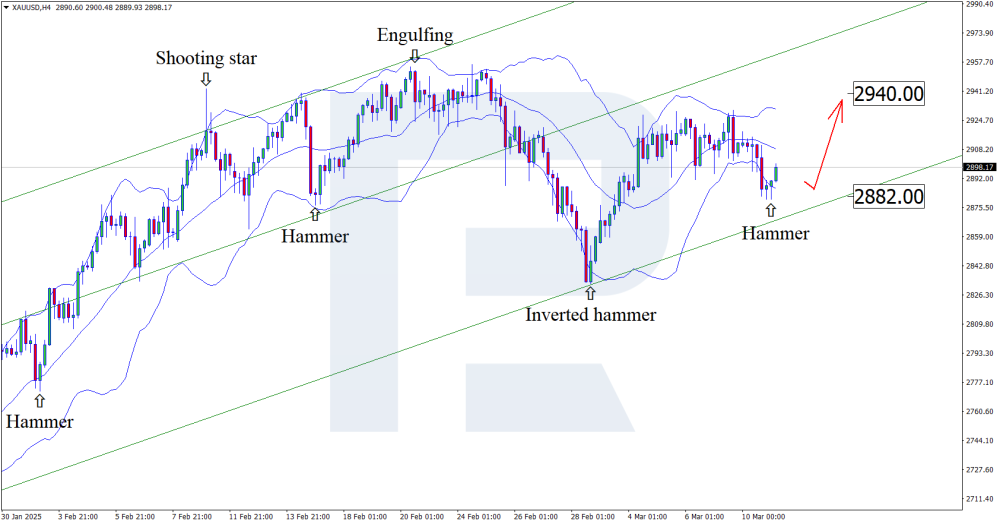

Gold (XAUUSD) continues to strengthen after a correction Active Gold purchases by central banks support Gold, potentially driving the quotes further up to the 2,940 USD level. Find more details in our XAUUSD analysis for today, 11 March 2025. XAUUSD technical analysis On the H4 chart, XAUUSD prices formed a Hammer reversal pattern near the lower Bollinger band. At this stage, they continue their upward trajectory following the signal from the pattern. The uptrend will likely continue as XAUUSD quotes are moving within the ascending channel. The upside target could be the 2,940 USD resistance level. Along with the XAUUSD technical analysis, the decline in US economic indicators suggests a continuation of the uptrend, with the quotes potentially rising to 2,940 USD. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent remains under pressure due to increased output and problems in China Brent quotes are slightly rising, currently standing at 68.95 USD. Discover more in our analysis for 11 March 2025. Brent forecast: key trading points An economic slowdown in China raises concerns about future oil demand The increase in US and Canadian rigs boosts oil supply Brent forecast for 11 March 2025: 66.65 Fundamental analysis Brent quotes are correcting after rebounding from the 68.45 USD support level. Prices are under pressure from global trade tensions, the expected increase in OPEC+ supply, and the uptick in oil production in North America. In February, US rigs added 8 units, reaching 590 rigs, while rigs in Canada increased by 38 units to 247. An additional negative factor is the weakening of the Chinese economy, the largest oil consumer. Rising deflation in the country raises concerns about future oil demand. All these factors combined create an unfavourable environment for oil quotes, which, as part of the Brent price forecast, increases the risks of its further decline. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

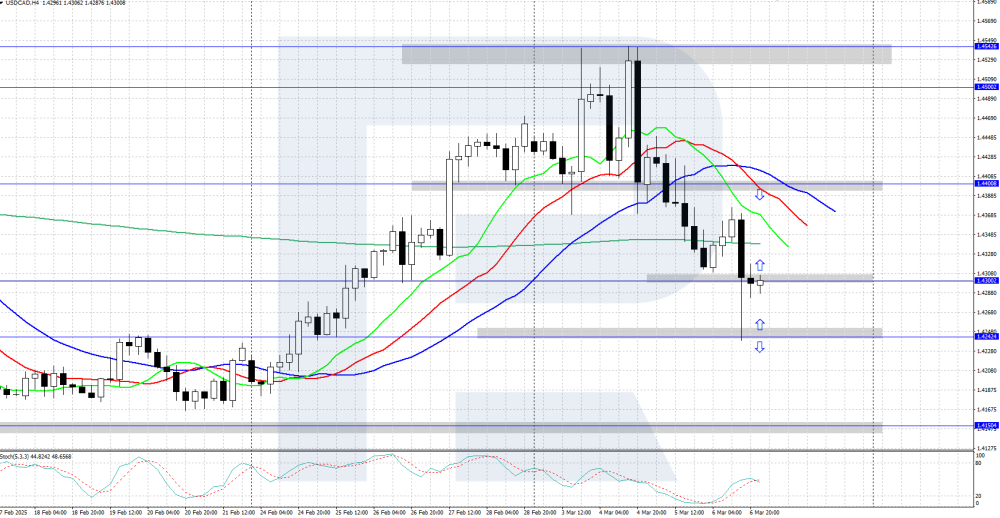

Bank of Canada rate cut expectations support USDCAD growth The USDCAD pair is slightly declining, with the price currently at 1.4365. Discover more in our analysis for 10 March 2025. USDCAD forecast: key trading points Canada’s economy added only 1 thousand jobs, falling short of the expected 20 thousand Expectations of a Bank of Canada key rate cut rose due to weak employment data USDCAD forecast for 10 March 2025: 1.4495 Fundamental analysis The USDCAD rate is correcting after Friday’s surge, primarily driven by a mixed US employment report. In February, the country’s economy added 151 thousand jobs, below the forecast of 160 thousand, while the unemployment rate unexpectedly rose to 4.0%, and wage growth slowed to 0.3%. However, the Canadian labour market was in an even more challenging situation. Unemployment remained at 6.6%, with the economy creating only 1 thousand jobs, falling short of the expected 20 thousand. Such a sharp slowdown compared to the sustainable growth seen since August 2024 heightened expectations of a 25-basis-point Bank of Canada key rate cut at the meeting this week. According to the USDCAD forecast for today, such expectations may support further growth of the currency pair despite the current correction. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

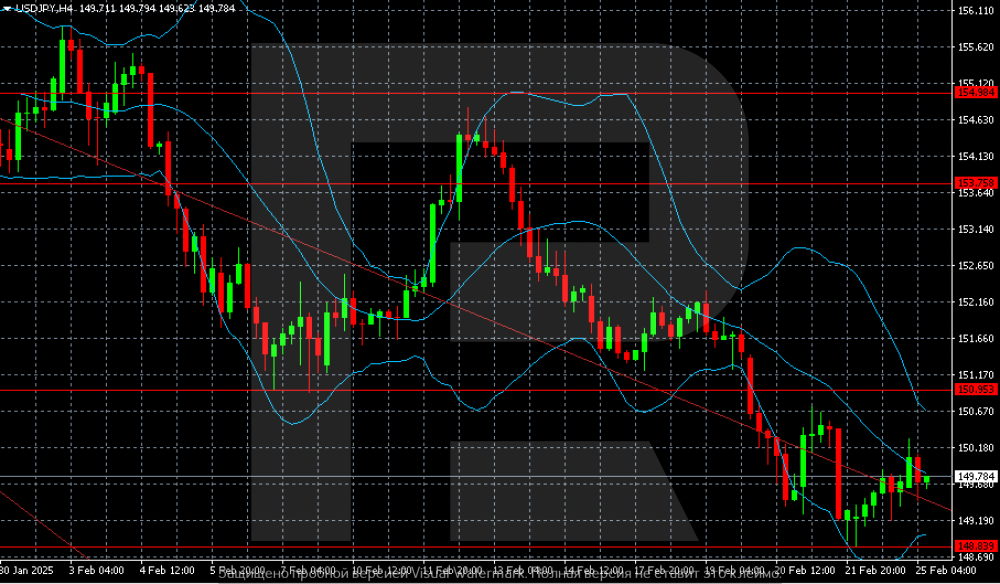

USDJPY forecast: the yen continues to strengthen against the USD Amid economic data from Japan and the US, the USDJPY rate may form a correction before declining to 146.80. Discover more in our analysis for 10 March 2025. USDJPY technical analysis Having tested the lower Bollinger band, the USDJPY price has formed a Hammer reversal pattern on the H4 chart. At this stage, it continues a corrective wave following the pattern signal. Since the quotes have rebounded from the support level and are now moving within a descending channel, they will likely pull back to the resistance level. Amid the economic data from Japan, the USDJPY forecast appears optimistic for the yen, with the USDJPY technical analysis suggesting a correction towards 148.60 before a further decline. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

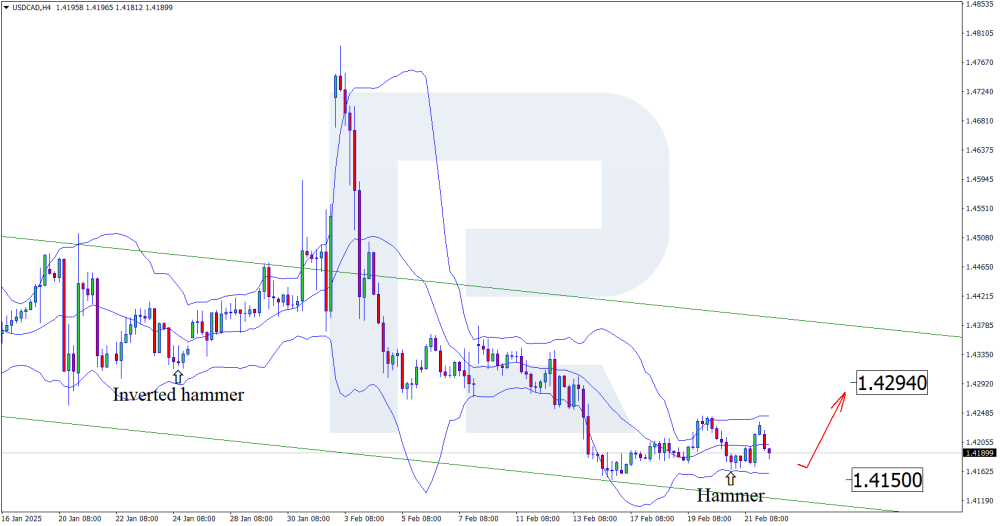

USDCAD forecast: the market awaits the Canadian and US employment statistics today The USDCAD rate is undergoing a downward correction, falling to the area around 1.4300. Today, the market will focus on employment statistics from Canada and the US. Discover more in our analysis for 7 March 2025. USDCAD technical analysis On the daily chart, the USDCAD pair is undergoing a correction within the uptrend; it formed an upward reversal from the 1.4150 support level last week. The quotes have now returned to 1.4300, while the Alligator indicator still confirms the uptrend. The USDCAD pair is correcting, plunging to 1.4300. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY fell to a five-month low: the yen acts as a safe-haven asset The USDJPY pair is hovering around 147.60 on Friday as the market needs safe-haven assets. Discover more in our analysis for 7 March 2025. USDJPY forecast: key trading points The USDJPY pair fell to its lowest level since 8 October 2024 The market is in dire need of safe-haven assets and favours the yen USDJPY forecast for 7 March 2025: 147.29 Fundamental analysis The USDJPY rate fell to 147.60, driven by increased demand for safe-haven assets amid the escalating global trade war and the volatile tariff policy of US President Donald Trump. The market is concerned about the possible impact on the US economy, which prompts investors to shift from the US dollar to the yen and Swiss franc. Domestically, the JPY position and Japan’s government bond yields strengthened on expectations that the Bank of Japan will continue to raise interest rates this year. This week, BoJ Deputy Governor Shinichi Uchida said that the regulator could raise rates further if its economic forecasts prove true. Such comments could be interpreted as the beginning of a withdrawal from a sweeping monetary easing program. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

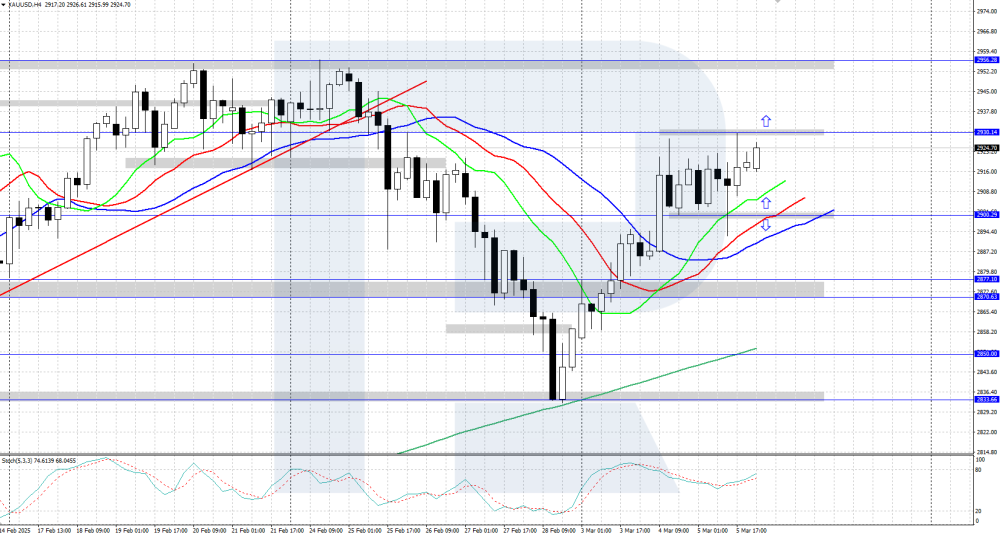

Gold (XAUUSD) forecast: quotes consolidated above 2,900 USD XAUUSD prices are on the rise, surpassing the 2,900 USD level amid weaker-than-expected US ADP employment statistics. Find more details in our XAUUSD analysis for today, 6 March 2025. XAUUSD technical analysis On the daily chart, XAUUSD quotes are on a strong rise, reaching the 2,930 USD resistance level. The Alligator indicator is below the price chart and is moving upwards, confirming the bullish trend, with the pair likely to continue its ascent after some correction. XAUUSD quotes are on the rise, having consolidated above 2,900 USD amid the introduction of US trade tariffs and weak ADP data. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD rallies: parity is forgotten The EURUSD pair is hovering around 1.0806 on Thursday, with the euro reaching the high seen in early November 2024. Find out more in our EURUSD analysis for 6 March 2025. EURUSD forecast: key trading points The EURUSD pair hit highs observed in early November 2024 Germany’s plans and the general positive sentiment about the eurozone outlook support the euro EURUSD forecast for 6 March 2025: 1.0820 Fundamental analysis The EURUSD rate rose to 1.0806, which was last seen by the market on 8 November 2024. The US dollar is under pressure from a strong euro and evolving consequences of President Donald Trump’s tariff policy. New US trade tariffs on Canada, China, and Mexico have provoked retaliatory measures from these countries. This stance raises concerns about escalating trade wars, which could slow down US economic growth. The market is now awaiting fresh US employment statistics. The ADP data showed that the US private sector added just 77 thousand jobs in February, the smallest gain in seven months. The main reports are due on Friday. The euro is rising as the 500 billion euro infrastructure fund proposed by Germany and plans to reconsider borrowing rules have improved the eurozone outlook. The ECB meeting is scheduled for today, with the regulator likely to lower the interest rate to 2.65% per annum from the current 2.90%. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

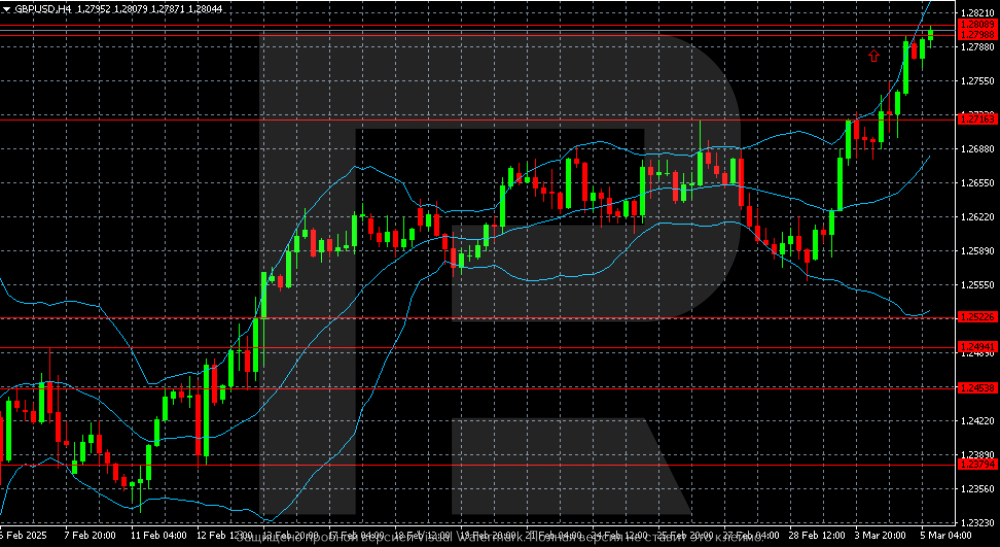

GBPUSD continues to rise: the pound is not afraid of trade wars The GBPUSD pair rose to 1.2794 on Wednesday, marking a new three-month high. Discover more in our analysis for 5 March 2025. GBPUSD technical analysis The GBPUSD pair successfully tested the 1.2800 level yesterday. Against this background, the focus shifts to 1.2900. If the market moves higher, we could say that the pair’s movement has turned into a trend and is no longer just a recovery. The GBPUSD pair continues to rise steadily and hits three-month highs, driven by the UK stable and diverse trade turnover and its isolation from the US. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY forecast: the pair returned to around 150.00, with US ADP employment in focus The USDJPY rate hit this year’s new low of 148.10 yesterday before retracing to 150.00. Market participants are awaiting US ADP labour market statistics today. Discover more in our analysis for 5 March 2025. USDJPY forecast: key trading points Market focus: market participants are awaiting US employment statistics for February today, with the ADP employment change data scheduled for release Current trend: correcting within the downtrend USDJPY forecast for 5 March 2025: 151.00 and 148.10 Fundamental analysis The USDJPY rate hit a new annual low of 148.10 yesterday. The Japanese yen is in demand as market participants expect the Bank of Japan to continue to raise the benchmark interest rate this year amid an unexpected uptick in inflation in Q4 2024 and positive GDP data. Automatic Data Processing Inc. (ADP) will release US employment statistics for February during the American session today. Stronger-than-expected data (+140 thousand jobs) will support the US dollar and the USDJPY pair may form a local upward reversal. Conversely, weaker-than-forecast figures could push the quotes lower. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

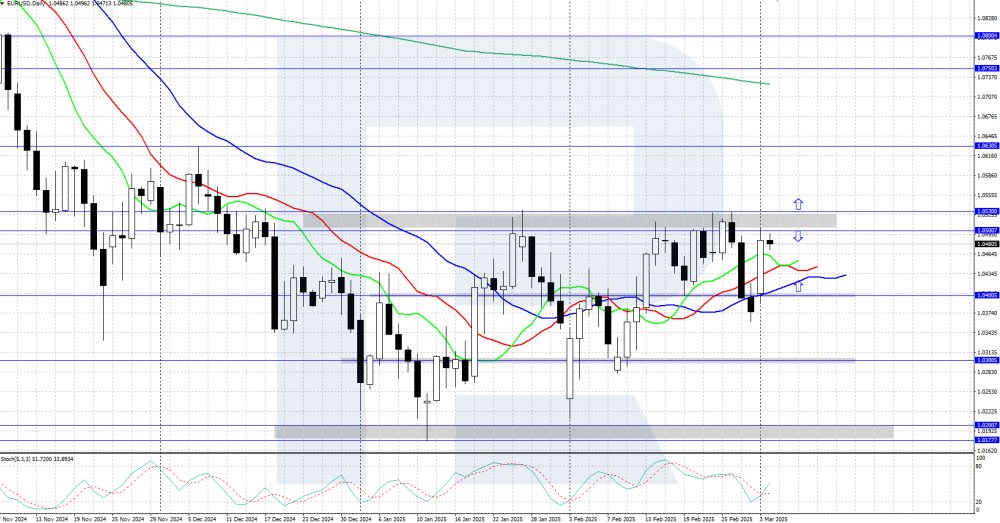

EURUSD forecast: the pair climbed to 1.0500 after inflation data The EURUSD rate is rising, returning to 1.0500 amid slightly higher inflation in the eurozone in February. Discover more in our EURUSD analysis for 4 March 2025. EURUSD technical analysis On the H4 chart, the EURUSD rate is moderately rising, reaching the 1.0500-1.0530 resistance area. Since the beginning of the year, the price has been consolidating in the sideways trading range between 1.0200 and 1.0530. The direction of the price movement out of the range will determine further prospects for the pair’s moves. The EURUSD pair climbed to 1.0500 amid rising inflation in the eurozone in February. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) prices may rise as stock exchanges avoid risk Gold quotes are awaiting news, hovering around 2,888 USD, with the market in great tension. Discover more in our XAUUSD analysis for 4 March 2025. XAUUSD forecast: key trading points Gold (XAUUSD) prices are not rising yet but are poised for a rally The capital market will need safe-haven assets in large quantities XAUUSD forecast for 4 March 2025: 2,895 and 2,921 Fundamental analysis Gold (XAUUSD) prices are consolidating around 2,888 USD on Tuesday. The market is assessing the US steps to impose 25% tariffs on Canada and Mexico and 10% tariffs on China starting today. China has already responded that it would introduce retaliatory tariffs of 15% on some US goods, including beef and soya beans. These measures help expand trade wars. They, in turn, will launch a new round of inflationary growth and a slowdown in global economic development, with both factors strengthening the status of Gold as a safe-haven asset. Yesterday’s statistics showed a slowdown in the growth rate of the US factory activity. This raises concerns that the White House tariffs will undermine the already slowing economy of the country. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) continues to correct, plunging below 2,860 USD XAUUSD quotes are undergoing a downward correction, dipping to 2,860 USD. Market participants are awaiting US inflation statistics today. Find more details in our XAUUSD analysis for today, 28 February 2025. XAUUSD forecast: key trading points Market focus: US consumer inflation data is due today – the PCE price index Current trend: a downward correction XAUUSD forecast for 28 February 2025: 2,833 and 2,870 Fundamental analysis XAUUSD prices went into a downward correction after setting an all-time high of 2,956 USD. Gold prices are now under pressure from a stronger US dollar and the talks on a peaceful agreement to resolve the military conflict in Ukraine. During the American trading session today, market participants will focus on the US inflation data for January, with the PCE price index scheduled for release. The figure is expected to grow by 0.3% month-on-month and 2.6% year-on-year. The Federal Reserve takes into account inflation data when deciding on interest rate changes. Weaker-than-forecast statistics will put pressure on the USD and help Gold strengthen. Conversely, stronger-than-expected growth will support the US dollar, potentially pushing XAUUSD quotes lower. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

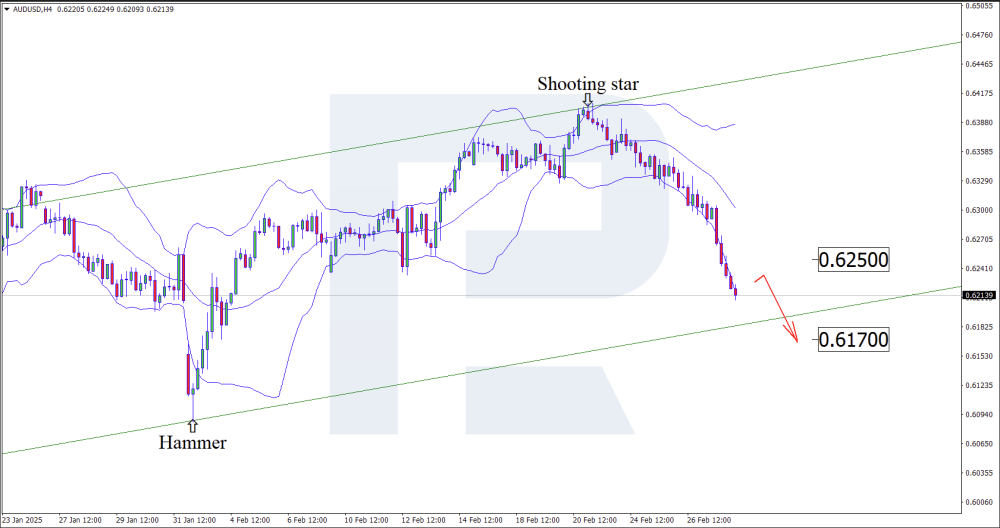

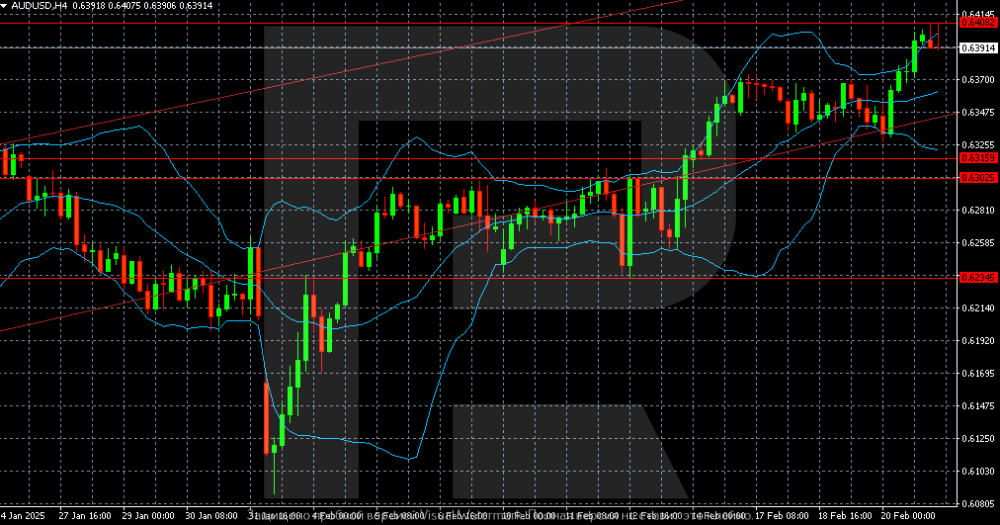

AUDUSD forecast: the Australian dollar continues to lose ground against the USD The US dollar continues to strengthen amid US economic data, with the AUDUSD rate able to decline to 0.6170 in the near term. Discover more in our analysis for 28 February 2025. AUDUSD technical analysis Having tested the upper Bollinger band, the AUDUSD price has formed a Shooting Star reversal pattern on the H4 chart. At this stage, it continues to maintain its downward trajectory following the signal received. Since the quotes remain within the ascending channel, the price could decline to the nearest support level at 0.6170. The Australian dollar continues to fall; the AUDUSD technical analysis suggests a further decline to the 0.6170 support level. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent may end the month with the biggest losses since September 2024 Brent prices fell to 72.75 USD per barrel. The market is concerned about future supply growth. Discover more in our analysis for 27 February 2025. Brent forecast: key trading points Brent prices continue to fall The commodity market is preparing to record the biggest decline in five months in February Brent forecast for 27 February 2025: 71.90 Fundamental analysis Brent prices fell to 72.75 USD on Thursday, reaching the lowest level since December 2024. Oil seems to be preparing to close February with the strongest decline in five months. Investors are still concerned about the prospects for growth in oil supply and pessimistic demand forecasts. The possibility of easing sanctions against Russia may increase global oil supply, putting pressure on prices. An additional negative factor is the US tariff policy. Market participants believe that the White House tariffs on China may slow down economic growth and weaken demand. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY forecast: the pair is trading near the daily support level at 148.60 The USDJPY rate remains under pressure, falling to the 148.60-149.00 support area. Market participants are awaiting US GDP statistics today. Discover more in our analysis for 27 February 2025. USDJPY technical analysis The USDJPY H4 chart shows a steady downtrend, which is confirmed by the Alligator indicator. The pair is trading in a descending price channel, with the price currently hovering at its lower boundary. The key support level is at 148.60. The USDJPY pair fell to a three-month low in the 148.60-149.00 support area. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

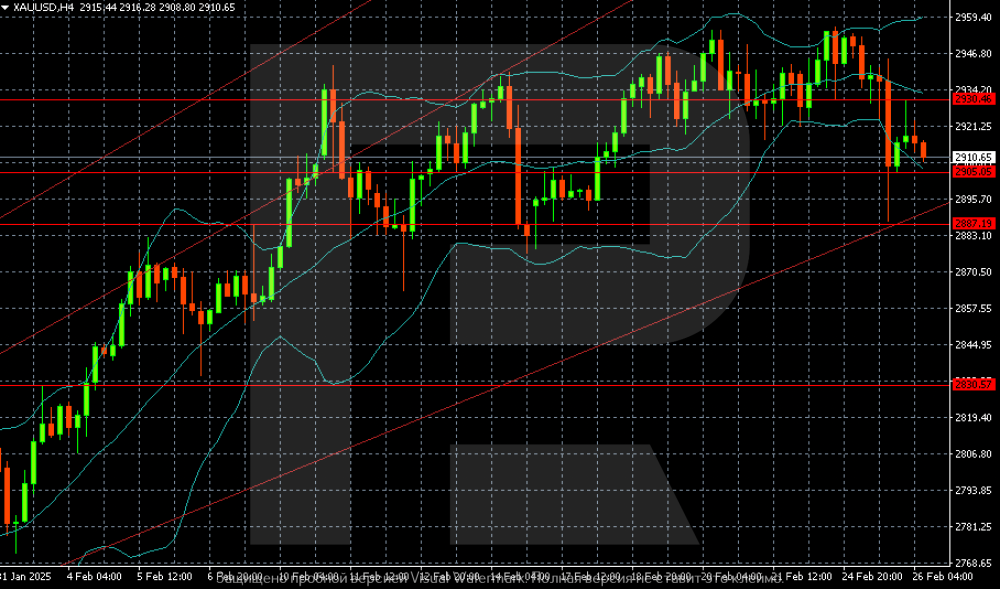

Gold (XAUUSD) prices decline as the market locks in profits Gold (XAUUSD) prices tumbled to 2,915 USD. It is nothing to worry about as the market is simply taking profits. Find more details in our analysis for 26 February 2025. XAUUSD technical analysis On the H4 chart, XAUUSD prices could decline to 2,905 USD. There is an intermediary support level here, which could deter sellers. If the plan does not work out, the new selling target will be 2,887 USD. Gold halted its ascent as the market locked in profits after the previous upward wave. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD forecast: the pair climbed to 1.0500 The EURUSD rate reached 1.0500 amid positive sentiment after the German parliamentary elections. Find out more in our analysis for 26 February 2025. EURUSD forecast: key trading points Market focus: Germany’s GDP declined by 0.2% in Q4 2024, as expected Current trend: consolidating in a sideways range EURUSD forecast for 26 February 2025: 1.0400 and 1.0530 Fundamental analysis The EURUSD pair is rising moderately after the conservative Christian Democrats won the German elections. Investors perceived the election outcome positively and are now interested in the details of how the new government plans to stimulate the growth and development of Europe’s largest economy. Tomorrow, market participants are awaiting US GDP data for Q4 2024 and the report from the latest ECB monetary policy meeting. Investors hope to see hints about the regulator’s further plans: whether the ECB will continue to cut rates or it is poised to pause the monetary policy easing cycle. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) corrects after record peaks, but demand for the precious metal remains strong XAUUSD prices are declining after rebounding from the 2,950 USD resistance level. Find more details in our analysis for 25 February 2025. XAUUSD forecast: key trading points Global economic risks remain high, fuelling the upward momentum in Gold All eyes are on the release of the US PCE price index Investors expect the Federal Reserve to postpone an interest rate cut XAUUSD forecast for 25 February 2025: 2,970 and 3,000 Fundamental analysis XAUUSD prices are edging down today after reaching a record high on Monday. Demand for the precious metal remains as investors seek safe-haven assets amid market uncertainty. Gold was additionally supported by substantial inflows into the world’s largest gold-backed exchange-traded fund. Experts note that as long as global economic risks remain high, XAUUSD will maintain its upward momentum. A crucial factor for the market will be the release of the US PCE price index on Friday, which is a key inflation gauge for the Federal Reserve. Most economists expect the Federal Reserve to postpone rate cuts until the next quarter despite forecasts of a potential policy easing as early as March. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY is at a 12-week low: the sell-off is not over yet The USDJPY pair is hovering around 149.70 on Tuesday. The market is expecting another rate hike by the Bank of Japan. Discover more in our analysis for 25 February 2025. USDJPY technical analysis On the H4 chart, the USDJPY pair has grounds to move even lower to 148.83. At the same time, the pair is clearly going beyond the sideways trading channel between 148.83 and 150.95. The USDJPY pair has fallen markedly recently, hovering now at a 12-week low. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD is in positive territory again: another rise is likely The EURUSD pair continues to rise and has already reached 1.0509. The market is interested in risk again. Discover more in our analysis for 24 February 2025. EURUSD forecast: key trading points The EURUSD pair rose amid improved expectations for the eurozone The market is interested in risk but is still cautious EURUSD forecast for 24 February 2025: 1.0529 Fundamental analysis The EURUSD rate strengthened, reaching 1.0509. The euro fully recouped Friday’s losses after the conservative Christian democrats won the German elections. The preliminary elections were largely in line with investor expectations. The market is now focused on the timing of forming a coalition. Conservative opposition leader Friedrich Merz intends to create one within the next two months. Strong and cohesive management is considered essential to push through much-needed fiscal reforms, especially amid economic stagnation in Germany and trade tensions over US tariff policy. Reform of the debt system, which has restrained investments for years, is expected to support both the eurozone’s stocks and the EUR rate. The latest data showed that private sector activity in the eurozone remained stable in February. The PMI decreased to 50.2 points, below the expected 50.5. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDCAD forecast: the pair may continue to rise after consolidation The Bank of Canada Deputy Governor’s speech may drive the USDCAD pair up to 1.4294. Discover more in our analysis for 24 February 2025. USDCAD technical analysis On the H4 chart, the USDCAD price formed a Hammer reversal pattern near the lower Bollinger band. At this stage, it attempts to rise following the signal received. The pair will likely climb to the nearest resistance level at 1.4294 as the price remains within the descending channel. Along with the USDCAD technical analysis, the potential for improvement of US economic indicators suggests growth to 1.4294. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

AUDUSD rose to a ten-week high but the rally is not complete The AUDUSD pair appears overpriced. The market believes the RBA will not lower interest rates rapidly. Discover more in our analysis for 21 February 2025. AUDUSD technical analysis On the H4 chart, the AUDUSD pair still has grounds to climb to 0.6408. If the market secures above this level, the next upside target could be 0.6420. The AUDUSD pair rose and hit a two-month high amid expectations of the RBA keeping relatively high interest rates. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY forecast: the pair declines amid rising inflation in Japan The USDJPY rate plunged below 150.00 amid the release of Japan’s stronger-than-expected inflation statistics for January. Discover more in our analysis for 21 February 2025. USDJPY forecast: key trading points Market focus: Japan’s national Consumer Price Index (CPI) rose by 4.0% in January Current trend: the downtrend USDJPY forecast for 21 February 2025: 150.00 and 148.60 Fundamental analysis According to today’s statistics, Japan’s annual national inflation rate rose by 4.0% in January 2025 from 3.6% in the previous month, marking the highest level since early 2023. The core annual CPI increased by 3.2% from 3.0% in December. The USDJPY quotes fell to the price area around 149.00 during the Asian session, hitting a two-month low. The Japanese currency is strengthening amid rising GDP and inflation in the country, with investors expecting the Bank of Japan to tighten monetary policy further. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with: