⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

-

Posts

1,288 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by RBFX Support

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

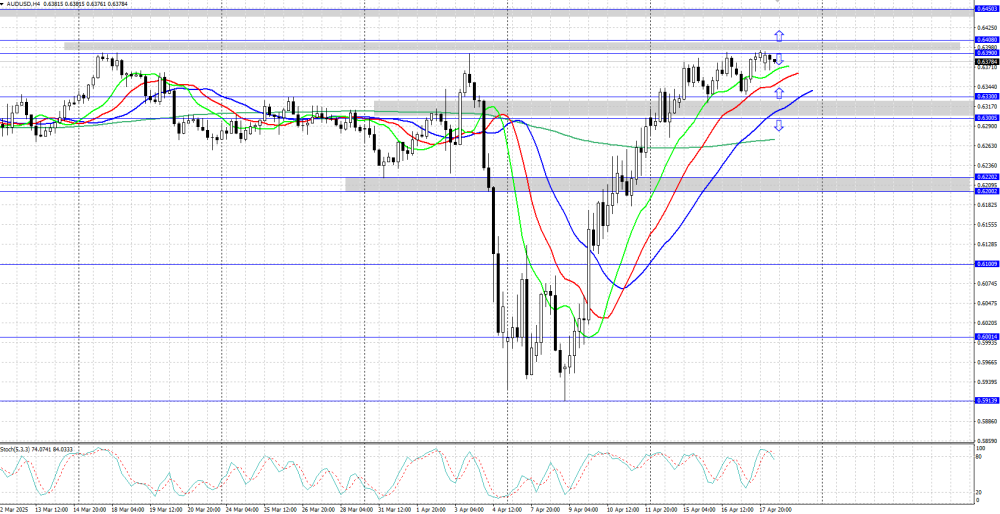

AUDUSD eyes breakout — yearly high under pressure AUDUSD is trading near its yearly high at 0.6408, continuing a strong uptrend. Further gains are likely. Full analysis for 18 April 2025 below. AUDUSD technical analysis AUDUSD is advancing within a clear bullish trend and is currently trading just below 0.6400. The Alligator indicator confirms the strength of the upward impulse. AUDUSD remains firmly in an uptrend, supported by USD weakness and strong commodity prices. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

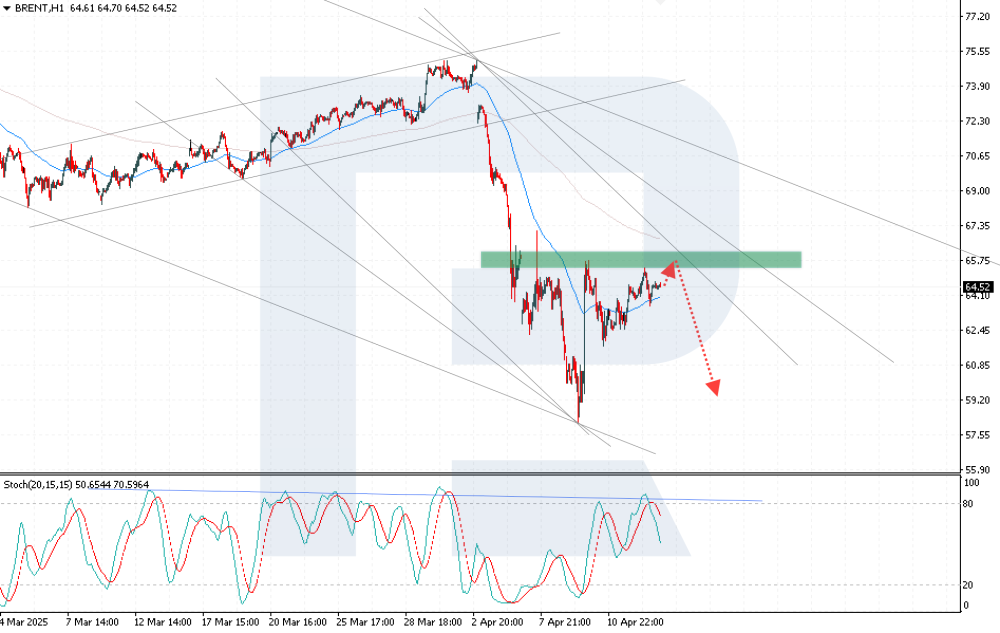

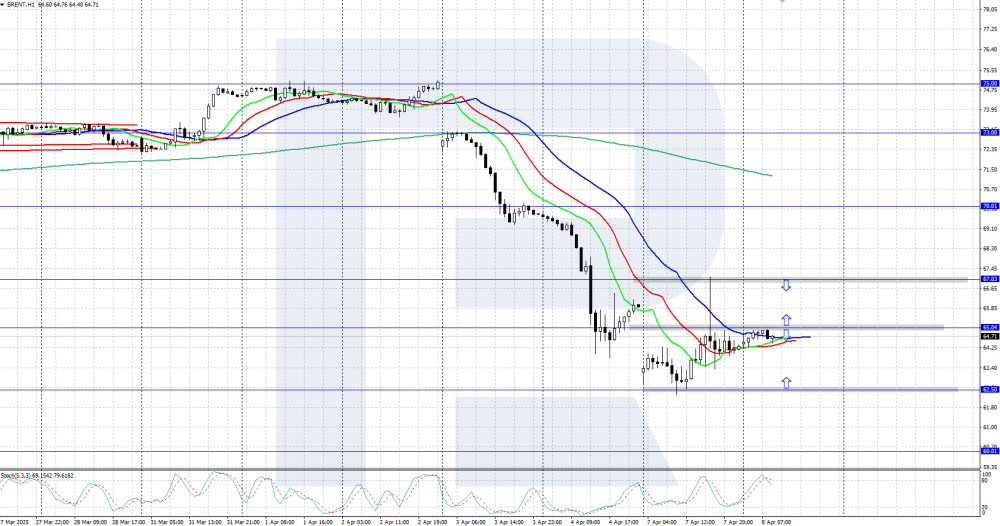

OPEC and US sanctions light the fuse – Brent targets new highs The outlook for Brent appears bullish, with prices gaining momentum amid US dollar weakness and likely to reach the 67.70 USD resistance level. Find more details in our analysis for 17 April 2025. Brent forecast: key trading points Brent crude oil continues its upward move Philadelphia Fed Manufacturing Index (US): previously at 12.5, projected at 2.2 Brent forecast for 17 April 2025: 67.70 USD Fundamental analysis Today’s fundamental analysis for Brent takes into account that prices are rising steadily, trading near 66.85 USD per barrel, its highest level since the start of the month. The recent rally is driven by new US sanctions targeting Iran’s oil exports, including penalties on a Chinese refinery. Prices are also supported by additional voluntary oil output cuts announced by some OPEC members, such as Iraq and Kazakhstan. According to the forecast for 17 April 2025, the Philadelphia Fed Manufacturing Index is expected to drop sharply to 2.2 from the previous 12.5. Such a decline would signal weakening US industrial activity, likely weighing on the US dollar. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY: correction complete? The yen loses ground under Fed pressure The USDJPY rate has risen to 142.77 after weak Japanese data and hawkish remarks from Jerome Powell. Discover more in our analysis for 17 April 2025. USDJPY technical analysis The USDJPY rate has climbed after rebounding from the lower boundary of a bearish channel. Today’s USDJPY forecast suggests the current recovery could stall near 142.75, followed by bearish momentum and decline towards 140.20. The yen is under pressure from hawkish Fed signals and weak Japanese export data. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD is poised for growth: the market awaits weak US sales The EURUSD pair is rising aggressively, currently trading around 1.1370. Find out more in our analysis for 16 April 2025. EURUSD forecast: key trading points The US dollar is declining amid market caution ahead of the Fed chair’s speech US March retail sales data is expected today Weak data may support further EURUSD upside EURUSD forecast for 16 April 2025: 1.1565 Fundamental analysis The EURUSD rate is gaining momentum following yesterday’s bearish correction. Buyers are actively pushing towards the 1.1380 resistance level – a breakout here could open the way to new local highs. The US dollar is weakening as markets turn cautious ahead of today’s speech by Federal Reserve Chairman Jerome Powell. Traders are waiting for signals regarding the Fed’s next steps amid an economic slowdown and persistent inflation concerns. All eyes are also on today’s US retail sales data for March. The consensus forecast suggests a 0.2% decline, which may add to pressure on the US dollar and further strengthen the ongoing bullish trend in the EURUSD pair. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

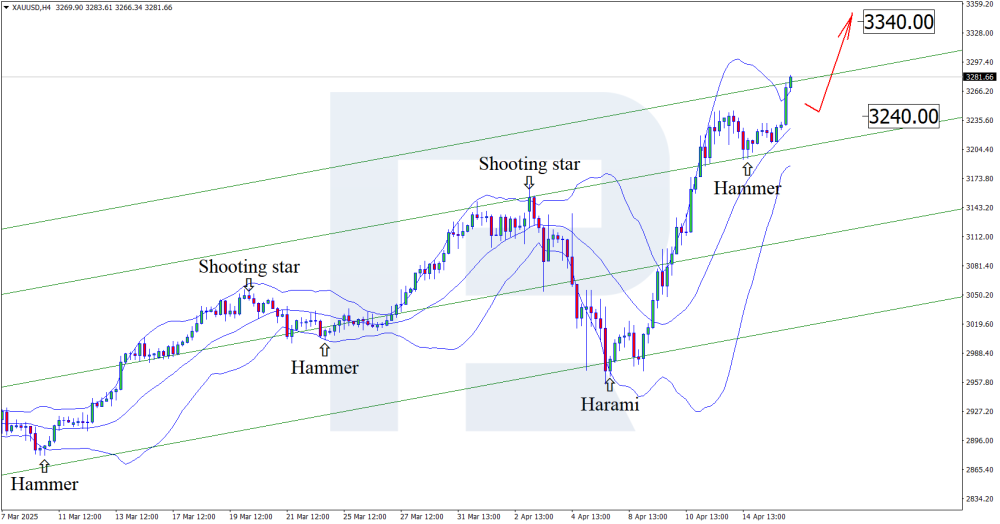

USD loses ground, traders flock to Gold (XAUUSD) Gold has set a new all-time high amid weak US industrial output. A short-term correction may follow, with a target at the 3,240 USD support level. Discover more in our analysis for 16 April 2025. XAUUSD technical analysis On the H4 chart, XAUUSD prices have formed a Hammer reversal pattern near the middle Bollinger band. The pair is currently building a bullish wave following the pattern signal. Having broken out of the ascending channel, XAUUSD quotes are likely to extend their rally. The decline in US industrial production may weigh on the US dollar, while stronger retail sales highlight improved consumer activity. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) holds bullish momentum — US risks keep safe havens in demand Gold is moving steadily toward 3,220 USD as global demand for safe-haven assets remains high. Full details in our analysis for 15 April 2025. XAUUSD forecast: key trading points Gold (XAUUSD) continues its upward trend, pausing only for brief consolidations Global investors remain focused on safe-haven assets XAUUSD forecast for 15 April 2025: 3,246 Fundamental analysis Gold (XAUUSD) is trading near 3,220 USD on Tuesday. The primary driver for gold remains the heightened level of market uncertainty linked to US trade policy. While new tariffs are currently on pause and trade talks are ongoing, the Trump administration has shifted focus to auto parts — considering removing them from the list of high-tariff items. Still, that remains speculative. Meanwhile, attention has shifted to key import sectors like pharmaceuticals and semiconductors, which may soon face increased tariffs. These sectors are substantial, and the prospect of new duties has fuelled demand for safe-haven assets like gold. Another solid support for gold comes from expectations of a Federal Reserve rate cut — markets are currently pricing in around 86 basis points of easing in 2025. Lower interest rates typically benefit gold by reducing the opportunity cost of holding non-yielding assets. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Trump and Chinese data hold Brent above water — but pressure remains Brent crude is strengthening but remains capped below key resistance at 65.60 USD. Full outlook in our analysis for 15 April 2025. Brent technical analysis Brent continues to consolidate below strong resistance at 65.60 USD. Today’s forecast anticipates a test of this resistance, followed by a possible pullback toward 61.40 USD. Brent prices remain under pressure from the 65.60 USD resistance level, despite temporary support from US trade concessions and stronger crude demand from China. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

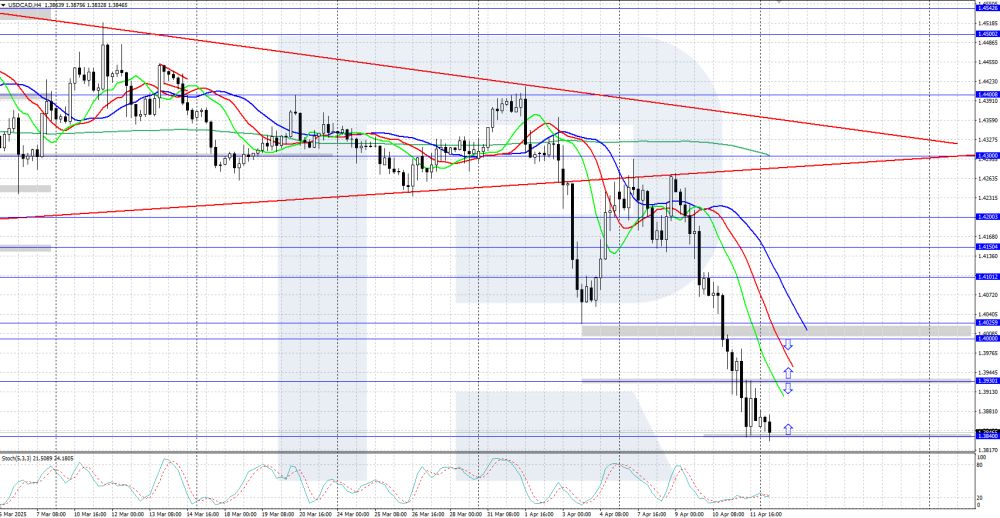

USDCAD falls to a 5-month low; will the decline continue? The USDCAD rate slipped below 1.3900, hitting a five-month low amid a pause in US trade tariffs and ongoing US dollar weakness. Discover more in our analysis for 14 April 2025. USDCAD technical analysis On the H4 chart, the USDCAD pair is clearly in a downtrend, currently trading around the 1.3840 support level. The Alligator indicator confirms the bearish trend. However, the Stochastic Oscillator is in a deep oversold area, suggesting a possible upward correction. The USDCAD pair plunged below 1.3900 amid a 90-day tariff pause and the current USD weakness. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY falls sharply – yen takes centre stage as safe-haven asset The USDJPY pair plummeted to 142.41, with chances to reach new lows being high. Find more details in our analysis for 14 April 2025. USDJPY forecast: key trading points The USDJPY pair is testing six-month lows and may go lower The market is focused on the upcoming US-Japan tariff negotiations The Japanese yen is performing strongly as a safe-haven asset USDJPY forecast for 14 April 2025: 142.06 Fundamental analysis The USDJPY rate fell to 142.41 on Monday, approaching its lowest level in six months. Escalating global uncertainty driven by trade conflicts has increased demand for safe-haven assets. Markets are closely watching the upcoming trade talks between Washington and Tokyo. Japan’s chief negotiator, Akazawa Ryosei, is set to meet this week with US Treasury Secretary Scott Bessent and US Trade Representative Jamieson Greer. Japan currently benefits from a reduced 10% tariff rate and aims to secure more favourable terms in ongoing discussions. The USDJPY forecast is negative. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD hits a three-year high: the US dollar is not in demand The EURUSD rate is testing the 1.1285 level and setting a new peak at 1.1383, with the market concerned about the impact of the US trade war. Find out more in our analysis for 11 April 2025. EURUSD forecast: key trading points The EURUSD pair hits a three-year high and shows no signs of slowing The market remains focused on tariff-related risks and sees reasons for a decline in US GDP US core inflation for March gives reason for the Fed to cut interest rates EURUSD forecast for 11 April 2025: 1.1384 Fundamental analysis The EURUSD rate touched the 1.1384 level but is now hovering around 1.1285. The dominant market driver working against the US dollar is concern over the state of the US economy. Investors fear that aggressive tariffs will slow down US growth despite the current 90-day tariff pause. US inflation data for March came in mixed. The core CPI rose just 2.8% year-on-year, marking the slowest increase since March 2021. This gives markets further reason to anticipate a rate cut from the Federal Reserve. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

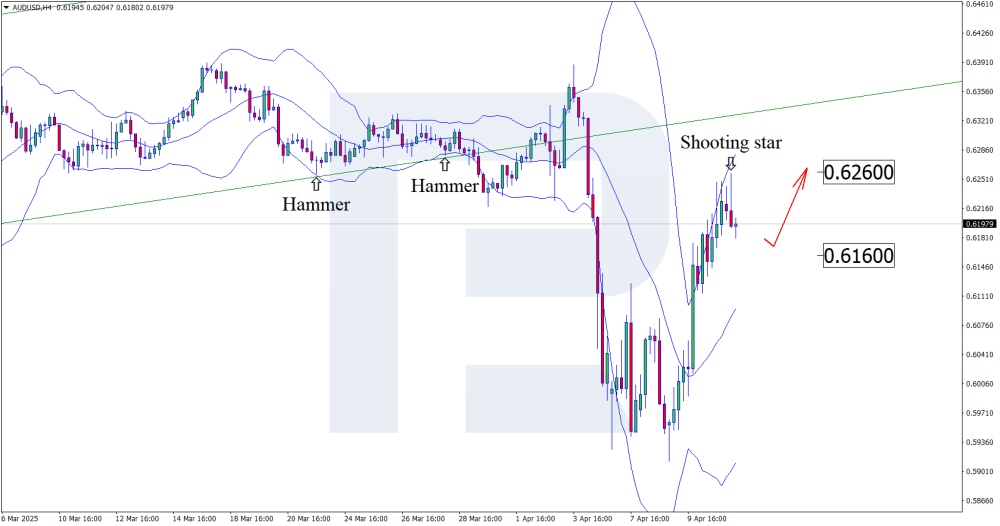

Today is AUDUSD’s moment – sentiment slump does not stop the rally Australia’s PCSI decline and a potential increase in the US PPI may become a trigger for the AUDUSD rate, with quotes likely to continue their ascent to 0.6260 after a correction. Discover more in our analysis for 11 April 2025. AUDUSD technical analysis Having tested the upper Bollinger band, the AUDUSD price has formed a Shooting Star reversal pattern on the H4 chart. It is initiating a corrective wave following the received signal. Given strong gains in recent trading sessions, the pair will likely continue its upward trajectory to the next resistance level at 0.6260. Despite a dip in Australian consumer confidence to 49.30, fundamental drivers, including a potentially stronger US PPI, create a favourable backdrop for the AUDUSD pair. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent remains highly volatile: new stress ahead? Brent crude prices are falling again, sliding towards 64.90 USD after a 4% rally in the previous session. Find more details in our analysis for 10 April 2025. Brent forecast: key trading points Brent gained 4% in the previous session but has now stalled Trump’s temporary tariff compromise supported prices, but the outlook remains uncertain, potentially curbing growth Brent forecast for 10 April 2025: 64.80 and 64.00 Fundamental analysis Brent prices are hovering around 64.90 USD. On Wednesday, prices rose by over 4% as investor sentiment improved following the US decision to pause tariff hikes for most countries. US President Donald Trump announced a 90-day period during which import tariffs would be lowered to 10% in an effort to support ongoing trade talks. The move helped reduce fears of a full-blown trade war, which could trigger a global recession and suppress oil demand. However, markets remain cautious as China was excluded from this deal, and its tariff rate was raised to 125%. The latest data from the US Department of Energy showed a larger-than-expected drop in gasoline and distillate inventories, helping offset a moderate rise in crude oil stockpiles. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Triangle on EURUSD: is the market ready for a breakout to 1.1175? The EURUSD rate is strengthening, with buyers testing the 1.1000 resistance level. Find out more in our analysis for 10 April 2025. EURUSD technical analysis The EURUSD rate is consolidating within a Triangle pattern. Despite yesterday’s decline, the pair remains within an uptrend, as confirmed by the Moving Averages. Today’s EURUSD forecast suggests a bullish breakout above the Triangle’s upper boundary, targeting 1.1175. The fundamental background supports the current EURUSD growth as markets price in Fed rate cuts amid tariff uncertainty and inflation expectations. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) rises, supported by the Fed stance and market demand Gold (XAUUSD) has climbed to 3,028 USD, with safe-haven demand continuing to drive the metal higher. Discover more in our analysis for 9 April 2025. XAUUSD forecast: key trading points Gold (XAUUSD) prices continue to recover following recent volatility Despite April's dip, Gold (XAUUSD) quotes have gained 13% year-to-date XAUUSD forecast for 9 April 2025: 3,046 Fundamental analysis Gold (XAUUSD) prices rose to 3,028 USD on Wednesday amid growing safe-haven demand. The escalating trade war fuels fears of global recession and rising inflation. The US government confirmed that additional tariffs on imports from multiple countries will take effect today, with no exemptions at this stage. China faces the steepest tariff hike of 104% after it refused to comply with US demands to lift its retaliatory duties on US goods by the deadline. US President Donald Trump also announced that a significant tariff on pharmaceutical imports is expected soon. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBPUSD surges on US economic worries The GBPUSD rate is correcting after rebounding from the 1.2855 resistance level. Find more details in our analysis for 9 April 2025. GBPUSD technical analysis The GBPUSD rate is rising despite persisting pressure from sellers. Today’s GBPUSD forecast suggests a continued upward correction, with the potential to reach 1.2945. The Stochastic Oscillator supports the bullish outlook, rebounding from the ascending support line, indicating buyers may be ready to push further. The GBPUSD rate is strengthening amid trade risks and expectations of Federal Reserve rate cuts. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Strong data from Japan keeps USDJPY from rising further The USDJPY pair is slightly declining, currently trading at 147.70. Find more details in our analysis for 8 April 2025. USDJPY forecast: key trading points Donald Trump announces readiness to begin trade talks with Japan Japan posts a record current account surplus in February 2025 USDJPY forecast for 8 April 2025: 146.25 Fundamental analysis The USDJPY rate is retreating after Monday’s sharp rally, where the pair tested the key resistance level at 148.00. The Japanese yen temporarily weakened against the US dollar amid growing uncertainty around global trade — typically a driver of safe-haven demand. On the political front, Donald Trump confirmed his readiness to start trade negotiations with Japan following a phone call with Prime Minister Shigeru Ishiba. The upcoming talks will address a wide range of issues, including tariffs, currency policy, and state subsidies. Robust economic data keeps the yen from further weakening. In February 2025, Japan recorded a record current account surplus of 4.0607 trillion yen, driven by strong export growth amid high external demand and a decline in imports due to lower energy prices and subdued domestic consumption. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent crude oil – a pause before further decline? Brent prices corrected to around 65.00 USD after falling to 62.50 USD on Monday. Today, market focus shifts to US crude oil inventory data from API. Discover more in our Brent analysis for 8 April 2025. Brent technical analysis Brent quotes corrected towards the 65.00 USD resistance level after the decline triggered by another escalation of the tariff war. The daily chart shows strong downward momentum. After the current correction, the decline may continue, with a key support level at 62.50 USD. Brent crude recovered to the 65.00 USD area after a sharp drop, but the risk of further decline persists. During the American session, markets will closely monitor API US crude oil stock data. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

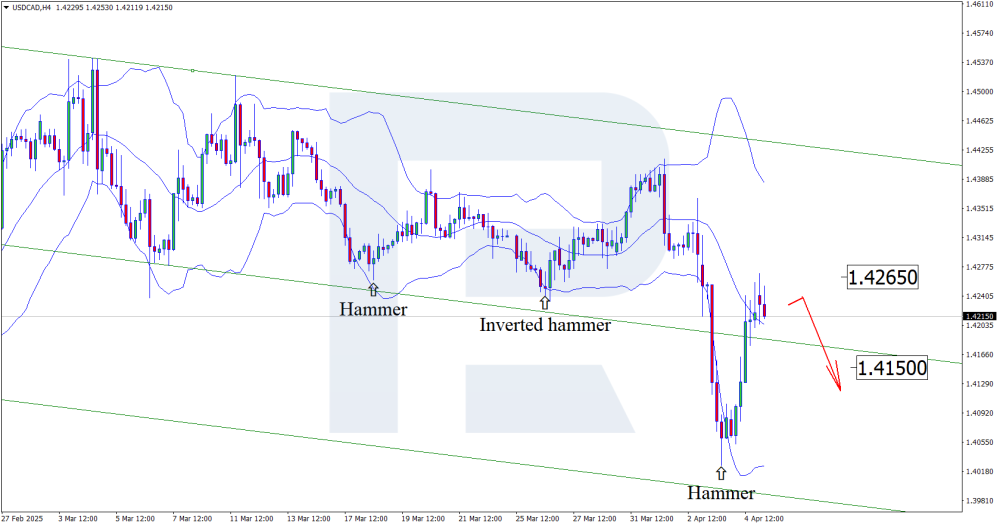

USDCAD: monetary policy pivot – one report could change everything for the CAD Following the release of the Bank of Canada's Business Outlook Survey, the USDCAD pair could continue its decline towards the 1.4150 support level. Discover more in our analysis for 7 April 2025. USDCAD technical analysis On the H4 chart, the USDCAD pair has formed a Hammer reversal pattern near the lower Bollinger band. At this stage, it continues to correct following the pattern signal. Since the price remains within the descending channel, a correction to the nearest resistance at 1.4265 is likely. A rebound from this level may open the door for further downside momentum. The upcoming release of the Bank of Canada’s Business Outlook Survey and the CB Employment Trends Index could heighten volatility in the USDCAD pair. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD remains in the eye of the storm: tariff fears dominate the market The EURUSD rate is hovering around 1.0990 on Monday as market chaos continues. Discover more in our analysis for 7 April 2025. EURUSD forecast: key trading points The EURUSD pair is moving more actively than usual Investors remain concerned about global trade tensions, although the White House maintains its stance EURUSD forecast for 7 April 2025: 1.1146 Fundamental analysis The EURUSD pair is trading around 1.0990 on Monday. Volatility remains above average. Investors are assessing the impact of Donald Trump’s tariff policy on inflation and economic growth. The global trade war is only escalating. Despite the market panic, the White House stands firm on its decision to impose retaliatory tariffs. On Sunday, Trump compared the tariffs to medicine you have to take to fix something. Previously, China agreed on a 34% tariff on all US-made goods, which may prompt similar measures from other countries. The unfolding tariff saga has intensified fears over US inflation and economic growth, complicating the Fed’s policy path. Markets are now pricing in a total of 100 basis points in rate cuts for 2025. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

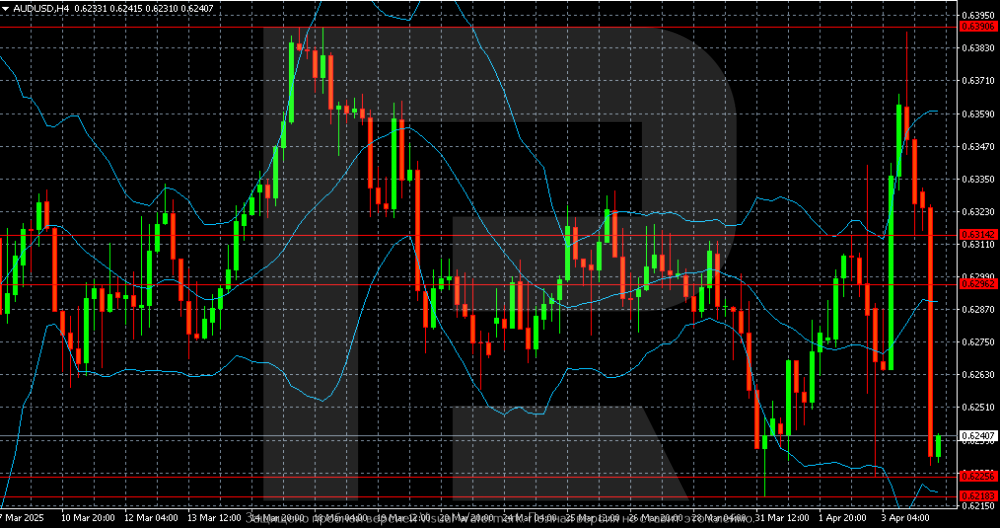

AUDUSD falls along with the rest: external backdrop leaves no options The AUDUSD pair has fallen to 0.6232 as investors avoid risk. Find more details in our analysis for 4 April 2025. AUDUSD technical analysis On the H4 chart, the AUDUSD pair shows potential for a continued decline towards 0.6218, with an intermediate support level at 0.6225. The AUDUSD pair has dropped significantly amid investors’ risk aversion and overall bearish market sentiment. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Friday chaos – Nonfarm Payrolls to shake up Gold (XAUUSD) again A decline in US Nonfarm Payrolls may boost XAUUSD quotes towards 3,160 USD. Discover more in our analysis for 4 April 2025. XAUUSD forecast: key trading points US Nonfarm Payrolls: previously at 151 thousand, projected at 137 thousand US unemployment rate: previously at 4.1%, projected at 4.1% Current trend: moving upwards XAUUSD forecast for 4 April 2025: 3,160 and 3,075 Fundamental analysis According to the XAUUSD forecast for 4 April 2025, US Nonfarm Payrolls may decline to 137 thousand from the previous 151 thousand. If the actual figure aligns with expectations, the market may see heightened volatility and a temporary weakening of the US dollar. The Nonfarm Payrolls release consistently generates strong market reactions and can either support the US dollar or make it lose ground. Today’s XAUUSD analysis also considers that the US unemployment rate for March is expected to remain unchanged at 4.1%. The lack of changes from the previous period would be a neutral factor for the USD. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent crude oil corrects, but downside risks remain Brent prices are rising after bouncing off the 72.25 USD support level. Discover more in our analysis for 3 April 2025. Brent technical analysis Brent prices consolidated below the Moving Averages, indicating the dominance of sellers and increasing the likelihood of a continued downtrend. Prices are currently testing the 73.05 USD resistance level. Today’s Brent forecast suggests a rebound from this level and a move down towards 70.30 USD. Brent quotes are recovering from the decline, but concerns over the global economic outlook and rising US crude inventories continue to weigh on the market. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD soared above 1.0900 after Trump imposed new tariffs The EURUSD rate has climbed above 1.0900 following the introduction of new US trade tariffs. Find out more in our analysis for 3 April 2025. EURUSD forecast: key trading points Market focus: US ADP employment data showed an increase of 155 thousand Market focus: Donald Trump imposed new tariffs on US trading partners Current trend: an uptrend is in place EURUSD forecast for 3 April 2025: 1.0800 and 1.0955 Fundamental analysis Yesterday, US President Donald Trump introduced a 10% baseline tariff on all imports, with even higher duties targeting key trading partners: 34% on China, 20% on the EU, and 24% on Japan. Additionally, a 25% tariff on foreign cars took immediate effect. Commenting on the move, Trump described the tariffs as a strategy to support domestic manufacturing and reduce the trade deficit. In response, the EURUSD pair surged as the US dollar came under pressure due to concerns over a potential US economic slowdown triggered by ongoing trade wars. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD: economic storm on 2 April – what will Lagarde and Trump say, and how will it hit the dollar Speeches by the ECB head and the US President may boost the EURUSD pair to 1.0880. Find out more in our analysis for 2 April 2025. EURUSD technical analysis On the H4 chart, the EURUSD price formed an Engulfing reversal pattern near the lower Bollinger band. At this stage, it continues its upward trajectory following the received signal. Since the pair remains within an ascending channel, the price could rise to the nearest resistance at 1.0880. In anticipation of ECB President Lagarde’s speech and Trump’s remarks, combined with the EURUSD technical analysis, the forecast suggests a potential correction followed by growth towards the 1.0880 resistance level. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY seeks direction as investors weigh risks The USDJPY pair is consolidating around 149.75. The market is closely watching the trajectory of the US dollar. Find more details in our analysis for 2 April 2025. USDJPY forecast: key trading points The USDJPY pair remains in consolidation The market avoids risk-taking while waiting for the first signals from the new round of US trade wars USDJPY forecast for 2 April 2025: 149.95 Fundamental analysis The USDJPY rate is hovering around 149.75 on Wednesday. The Japanese yen continues to move sideways as the market stays in wait-and-see mode ahead of the new round of US President Donald Trump’s tariff wars. Bank of Japan Governor Kazuo Ueda has warned that US tariffs could significantly impact global trade and economic growth. Earlier this week, data revealed a deterioration in Japanese business sentiment for Q1. This has raised concerns about the potential effects of US tariffs on Japan’s export-driven economy. The baseline forecast expects the Bank of Japan to raise interest rates by the end of 2025. However, fears over global trade and domestic economic uncertainty still cloud the outlook. The USDJPY forecast is neutral. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with: