⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

-

Posts

1,288 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by RBFX Support

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

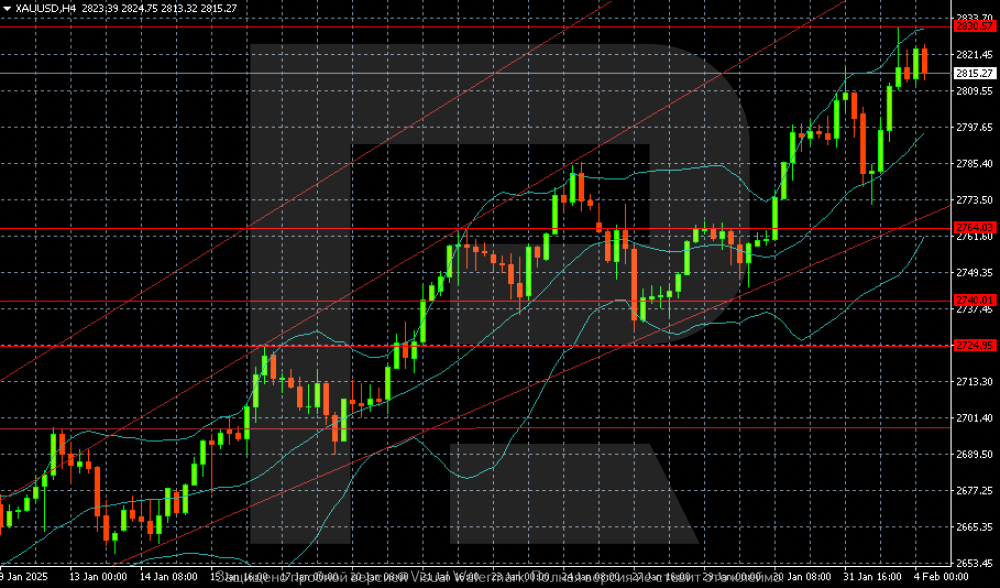

Gold (XAUUSD) rises again: new highs are likely Gold (XAUUSD) prices rose to 2,822 USD, with global demand for safe-haven assets increasing. Find out more in our analysis for 4 February 2025. XAUUSD technical analysis On the H4 chart, XAUUSD quotes are highly likely to rise to 2,830 USD. A breakout above this level will pave the way to the 2,845 and 2,865 USD levels. If the market sentiment changes, a correction could push prices to a significant support level at 2,764 USD, which may restrain selling pressures. Gold (XAUUSD) prices are rising, with the rally likely to continue. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

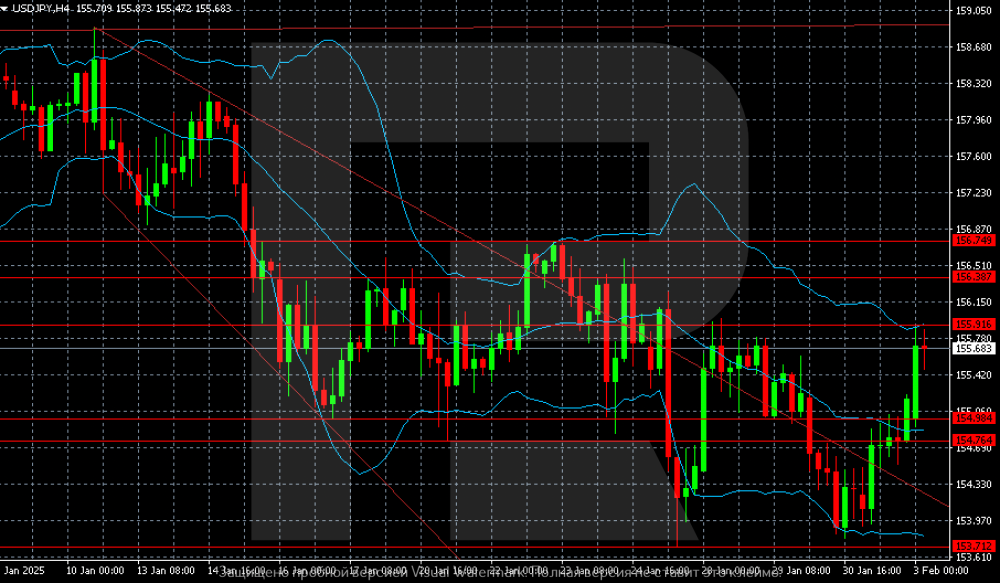

USDJPY rises: the US dollar is in demand due to higher risks The USDJPY pair rose to 155.50 at the beginning of the week. The US imposed trade tariffs on its major partners. Find out more in our analysis for 3 February 2025. USDJPY technical analysis On the H4 chart, the USDJPY pair is gaining local upward momentum to the first crucial target of 155.91. If buyers find a foothold above this level, the next upside target will be 156.38, with the subsequent crucial target at 156.74. The USDJPY pair is rising rapidly on Monday. The market is massively risk-averse as the US launched a new round of trade wars. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDCAD: the pair opened the week with an upward gap The USDCAD rate soared to 1.4800 on Monday due to tariffs imposed by the US on goods from Canada and other countries over the weekend. Discover more in our analysis for 3 February 2025. USDCAD forecast: key trading points The US imposed 25% tariffs on Canadian goods Current trend: a strong uptrend USDCAD forecast for 3 February 2025: 1.4700 and 1.4900 Fundamental analysis The Canadian dollar plunged sharply on Monday after US President Donald Trump introduced new tariffs on major trading partners last weekend. The US imposed 25% tariffs on goods from Mexico and Canada and 10% tariffs on imports from China. In response, Canada announced retaliatory tariffs, and Mexico signalled that it would consider introducing its own duties on US goods. China, in turn, said it intended to file a WTO case. Investors reacted negatively to growing trade tensions, with the US dollar rising and global stock index futures declining. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

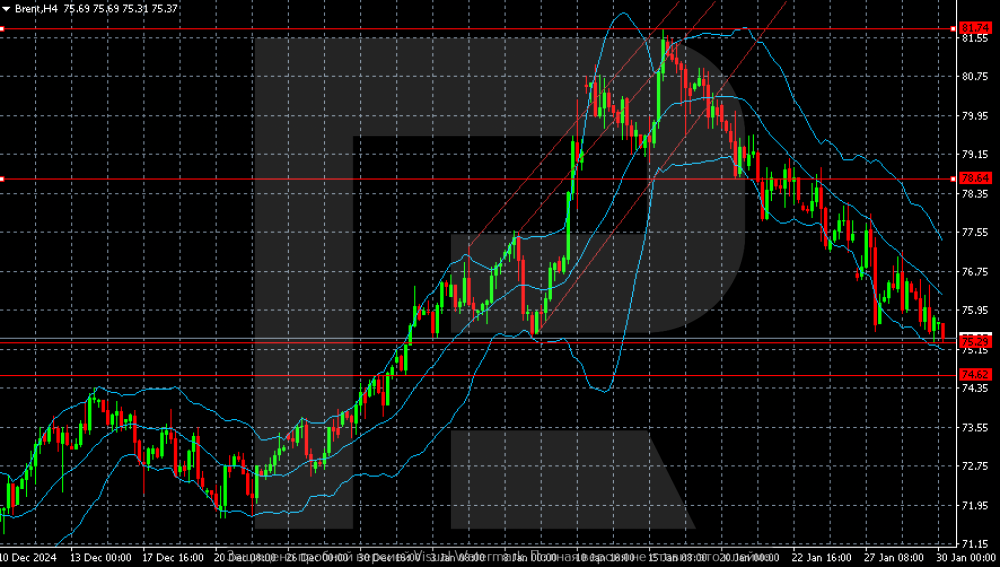

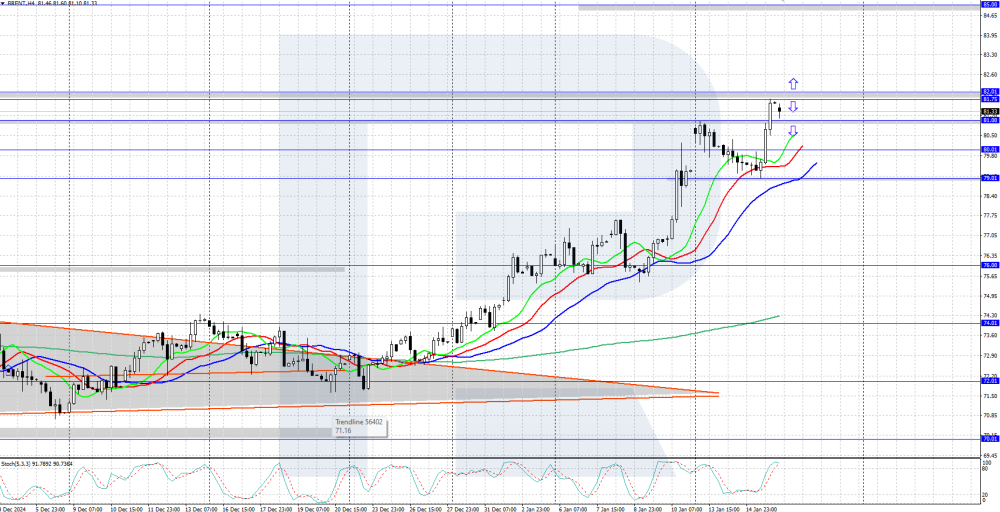

Brent prices are falling: external pressure is too great Brent prices plunged to 76.55 USD, with US oil inventories increasing again. Find out more in our analysis for 30 January 2025. Brent technical analysis Prerequisites for the extension of the selling wave to 74.62 are forming on the Brent H4 chart. After testing this level, the market may turn to 75.30, but additional conditions are needed to move to a more ambitious target of 78.64. Brent prices are falling, without halting this movement yet. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) continues to strengthen Rising US jobless claims and a potential decline in GDP open the potential for XAUUSD growth to 2,790 USD. More details in our XAUUSD analysis for today, 30 January 2025. XAUUSD forecast: key trading point US Q4 GDP: previously at 3.1%, projected at 2.7% US initial jobless claims: previously at 223 thousand, projected at 224 thousand Current trend: moving upwards XAUUSD forecast for 30 January 2025: 2,790 and 2,740 Fundamental analysis The XAUUSD forecast for 30 January 2025 shows that XAUUSD prices are consolidating around 2,761 USD, and the pair could continue to form a growth wave in the future. Today, the US will release Q4 GDP data, which is projected to decrease to 2.7%, down from the previous reading. Given that GDP is the aggregate value of all goods and services produced in a country, calculated only for end products, excluding the costs of raw materials, its decline may indicate an economic downturn. US initial jobless claims represent the number of people who claimed unemployment benefits for the first time during the previous week. This indicator measures the labour market climate, with an increase in initial jobless claims indicating rising unemployment. The previous reading was 223 thousand, and the forecast for 30 January 2024 appears rather optimistic, suggesting an increase in jobless claims to 224 thousand. This is a minor change, and the release of data that aligns with expectations will not have a significant impact on XAUUSD quotes. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

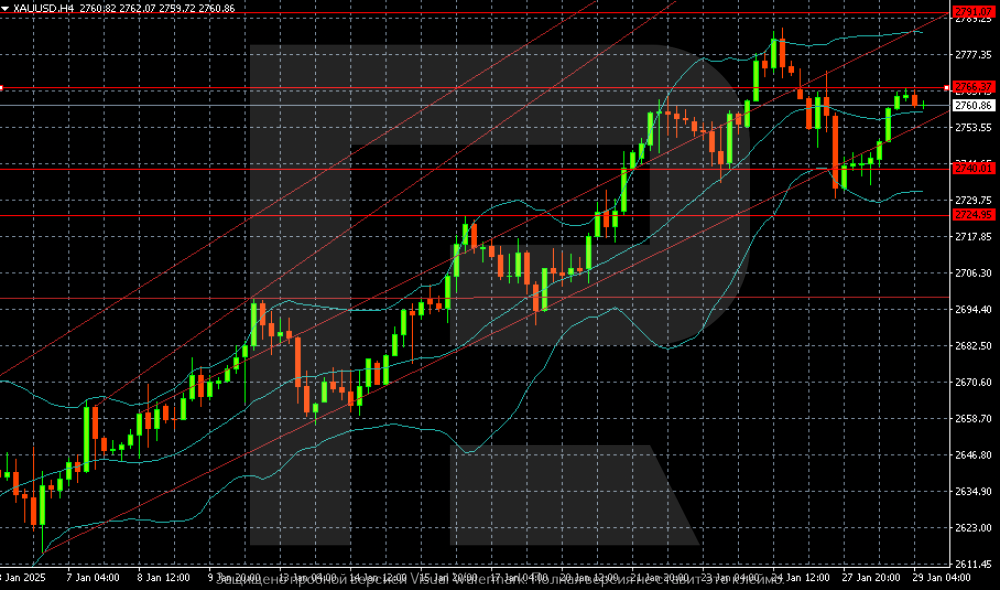

Gold (XAUUSD) rises, driven by demand for safe-haven assets, with a key Fed decision ahead XAUUSD rises to 2,765 USD on Wednesday, with demand for safe-haven assets increasing due to tariff uncertainty. More details in our analysis for 29 January 2025. XAUUSD technical analysis On the XAUUSD H4 chart, a sideways trading range is forming, with boundaries at 2,740-2,766 USD. An upward breakout will open the potential for growth to the previous high of 2,791 USD. With a breakout below the channel, the first selling target will be 2,724 USD. Gold (XAUUSD) prices rose slightly, driven by demand for safe-haven assets, but there are questions about further growth. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY: yen’s attempts to strengthen failed Amid the release of the Bank of Japan meeting minutes and the US Federal Reserve rate decision, the USDJPY pair may continue to rise to the 156.00 resistance level. Discover more in our analysis for 29 January 2025. USDJPY forecast: key trading points Minutes of the Bank of Japan monetary policy meeting The US Federal Reserve interest rate decision USDJPY forecast for 29 January 2025: 156.00 and 154.20 Fundamental analysis Fundamental analysis for 29 January 2025 takes into account that the BoJ released the minutes of its December 2024 monetary policy meeting today. During the discussions, Board members focused on assessing the economy’s neutral interest rate to determine the timing of future rate hikes. One of the meeting attendees noted that the current rate is well below the neutral level and needs to be timely raised. Another one expressed doubts about the use of data from Japan’s long-term deflation period to assess the timing of future rate hikes. Despite keeping the interest rate unchanged in December due to uncertainty about the US economic policy and wage dynamics, the BoJ raised the rate already in January, which significantly impacted the USDJPY rate. Market participants continue to monitor the Bank of Japan's neutral rate estimates, which, according to analysts, ranges between 1% and 2.5% although many believe it is closer to 1%. The USDJPY forecast takes into account that the US Federal Reserve will decide to change the interest rate today. At this stage, analytical agencies are inclined to believe that the interest rate may remain unchanged at 4.5%, and if the actual reading turns out to be different, this will increase volatility in the market. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

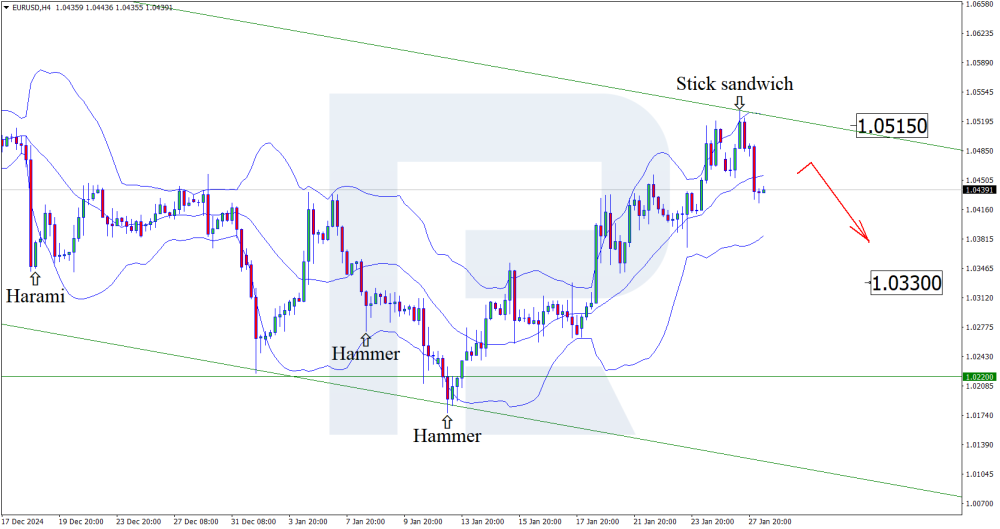

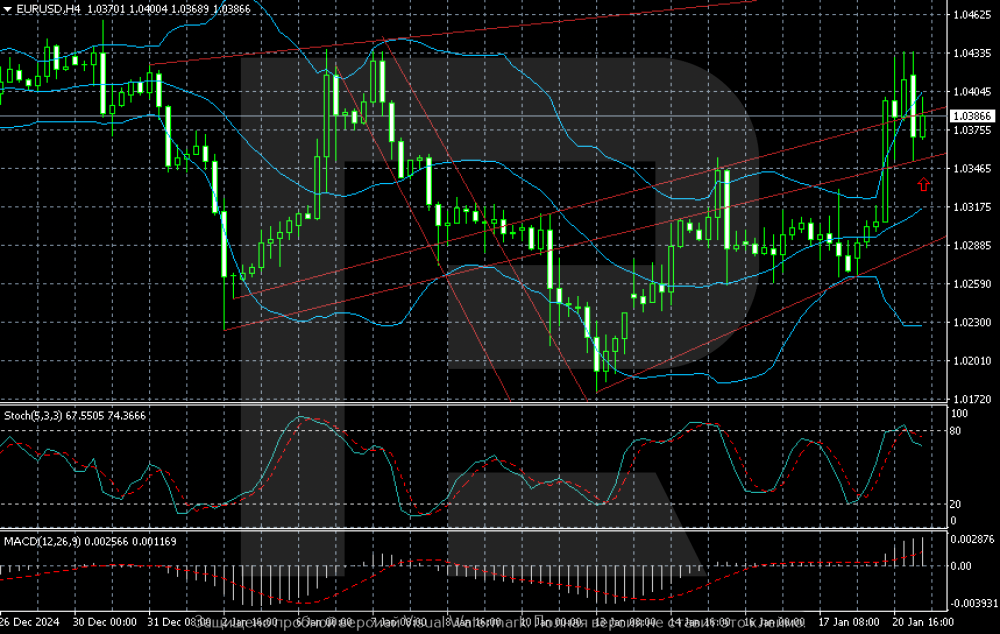

EURUSD: the euro may lose ground again after a correction The ECB President’s speech may impact the current EURUSD forecast and push the price down to 1.0330. Discover more in our analysis for 28 January 2025. EURUSD technical analysis Having tested the upper Bollinger band, the EURUSD price has formed a Stick Sandwich reversal pattern on the H4 chart. At this stage, it continues to develop a downward wave following the signal received. The price will likely decline further to the nearest support level at 1.0330 as it remains within a descending channel. A breakout below this level will open the potential for a more substantial downtrend. Together with the EURUSD technical analysis, US fundamental data and the ECB president’s speech suggest a decline to 1.0330. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent declined to the 76.00 USD support level Brent quotes continue to decline within a downward correction, with the asset finding support from buyers in the 75.60-76.00 USD area yesterday. More details in our Brent analysis for today, 28 January 2025. Brent forecast: key trading points Current trend: a downward correction continues The US oil inventories statistics from the American Petroleum Institute (API) will be released today Brent forecast for 28 January 2025: 75.60 and 77.00 Fundamental analysis Brent prices declined to a two-week low within the current downward correction. Oil prices are under pressure from concerns about falling demand from China, the world’s largest oil importer, and the tough economic policy of Donald Trump, who calls on OPEC to cut oil prices. The US API oil inventories statistics will be published today, with the Energy Information Administration (EIA) data scheduled for release tomorrow. A decrease in oil reserves may support Brent quotes, while growth will push the asset prices lower. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDCAD: the Canadian dollar loses ground against the USD again Lower wholesale sales in Canada and positive US fundamental data may propel the USDCAD pair further to 1.4440. More details in our analysis for 27 January 2025. USDCAD technical analysis On the H4 chat, the USDCAD price formed an Inverted Hammer reversal pattern near the lower Bollinger band. At this stage, it continues developing a growth wave following the signal received. Since the quotes remain within an ascending channel, the upward wave is expected to continue to the nearest resistance level at 1.4440. A breakout above this level would open the potential for a more substantial uptrend. Alongside the USDCAD technical analysis, low fundamental indicators from Canada suggest growth to the 1.4440 resistance level. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD declined: the Fed and Trump’s plans ahead The EURUSD pair tumbled to 1.0464. The market is awaiting the Federal Reserve meeting this week and taking into account the signals from the White House. Find out more in our analysis for 27 January 2025. EURUSD forecast: key trading points The EURUSD pair started the week with a slight decline All eyes are on the outcome of the upcoming Federal Reserve meeting and its intentions regarding March EURUSD forecast for 27 January 2025: 1.0432 and 1.0385 Fundamental analysis The EURUSD rate fell to 1.0464 on Monday. The new week of January will be eventful. On Wednesday, the Federal Reserve will decide on the interest rate. The markets will primarily focus on signals regarding the March meeting. If inflation declines and approaches the Fed target of 2%, the interest rate will have to be lowered. Friday’s US statistics showed a slowdown in business activity to a nine-month low in January. This happened amid rising price pressures. At the same time, data was released showing that existing home sales in the country soared to a 10-month high in December. The market is very positive about Donald Trump’s program “America First”. However, against this backdrop, inflationary pressures have accelerated to a four-month peak. At the same time, companies are hiring at the fastest pace since 2022. The EURUSD forecast is so far neutral. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

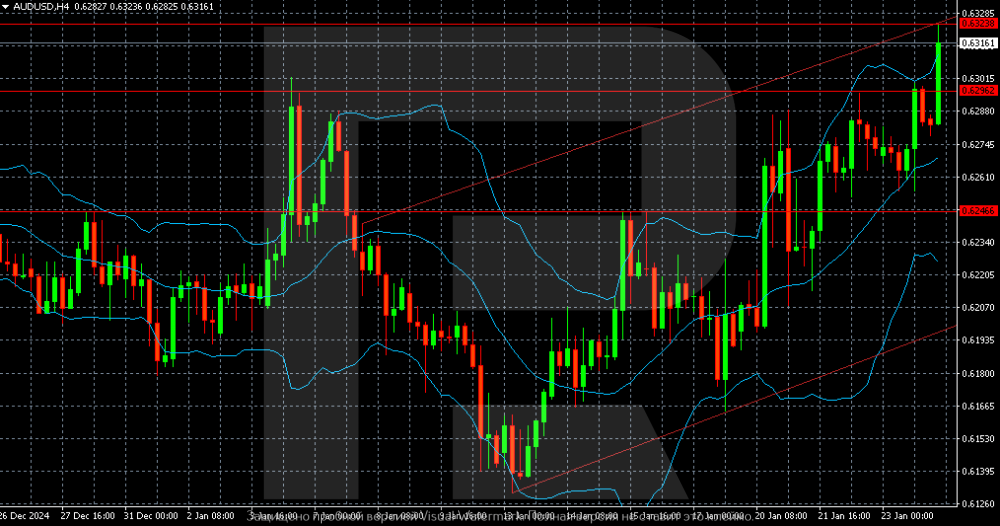

AUDUSD is at a five-week high supported by positive US and Chinese data The AUDUSD pair rose to 0.6314 on Friday. Investors are keeping an eye on the issue of US tariffs on China. Discover more in our analysis for 24 January 2025. AUDUSD technical analysis On the AUDUSD H4 chart, quotes still have an opportunity to consolidate above 0.6323. In this case, a new growth target will be the area between 0.6325 and 0.6350. The AUDUSD pair has markedly strengthened. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

XAUUSD forecast: Gold continues to strengthen against the US dollar A potential rise in inflation and a decrease in the US PMI could support Gold growth to 2,790 USD. More details in our XAUUSD analysis for today, 24 January 2025. XAUUSD forecast: key trading points The University of Michigan US inflation expectations: previously at 2.8%, projected at 3.3% US services PMI: previously at 56.8, projected at 56.4 Current trend: moving upwards XAUUSD forecast for 24 January 2025: 2,790 and 2,750 Fundamental analysis The XAUUSD forecast for 24 January 2025 shows that the pair continues to form a growth wave. The University of Michigan's US inflation expectations will be released at the beginning of the US trading session. The previous reading was 2.8%, and the forecast for 24 January 2025 suggests that inflation may rise to 3.3%, affecting XAUUSD prices. The US services Purchasing Managers’ Index (PMI) is projected to decrease to 56.4 given that it has been gradually increasing over the past three months. A weaker-than-forecast actual reading may lead to the weakening of the US dollar. A stronger-than-expected PMI could support the US dollar to some extent. The XAUUSD price forecast appears rather optimistic, with prices having the potential to reach new highs. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

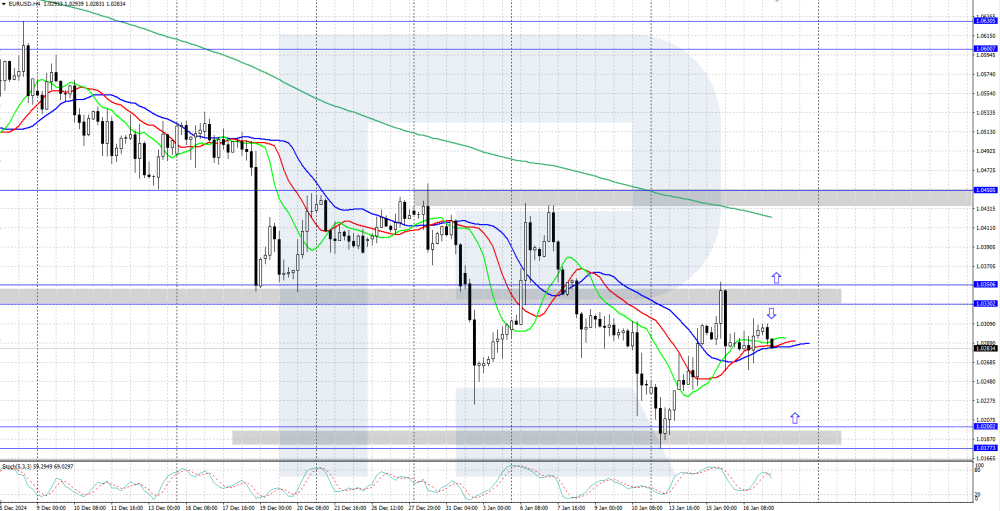

EURUSD: the pair failed to breach the 1.0450 resistance level The EURUSD pair is undergoing an upward correction after forming a local low. The bulls were unable to surpass the 1.0450 resistance level immediately. Find out more in our analysis for 23 January 2025. EURUSD forecast: key trading points Donald Trump has not yet imposed new trade tariffs on the European Union Current trend: upward correction EURUSD forecast for 23 January 2025: 1.0450 and 1.0350 Fundamental analysis The EURUSD rate strengthened, rising to a five-week high of 1.0450, following news that US President Donald Trump held off on imposing stricter trade tariffs on the European Union. Nevertheless, concerns remain about potential near-term restrictions from the US. In her speech, ECB President Christine Lagarde urged Europe to prepare for possible US trade sanctions. Regarding monetary policy, the ECB is expected to continue easing by reducing the benchmark interest rate by 25 basis points next week. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

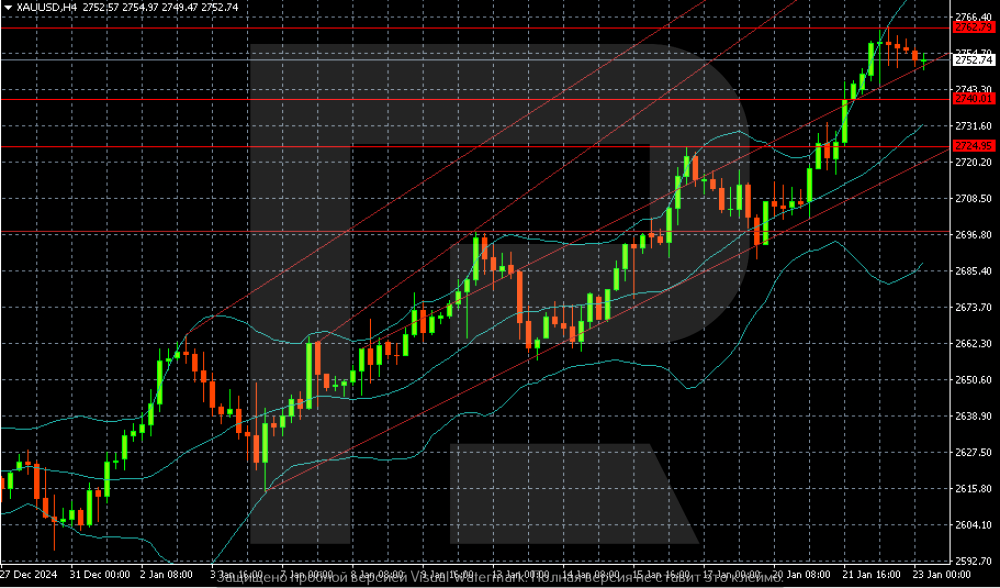

Gold (XAUUSD) will continue to rise after a minor correction Gold (XAUUSD) is hovering near 2,752 USD per troy ounce, supported by demand for safe-haven assets and the relative neutrality of the US dollar. Discover more in our analysis for 23 January 2025. XAUUSD technical analysis On the Gold (XAUUSD) H4 chart, conditions indicate a potential corrective decline to 2,740 USD. If prices reach this level, the next selling target may be 2,724 USD. The Gold (XAUUSD) forecast for 23 January 2025 suggests that the first support level will likely be sufficient to trigger a correction. Gold (XAUUSD) prices have temporarily paused their upward trajectory, but the global outlook remains positive. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

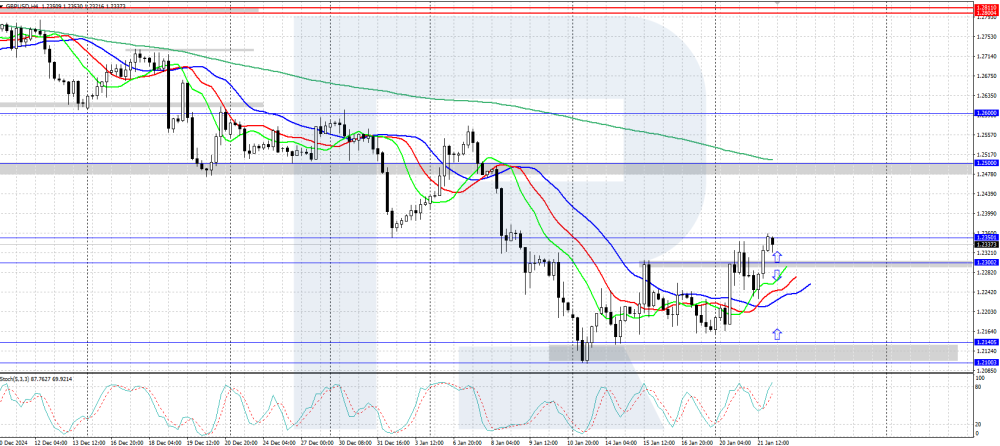

GBPUSD: the pair reversed upwards, securing above 1.2300 The GBPUSD rate has established a local low on the price chart and is rising within an upward correction this week. Find out more in our analysis for 22 January 2025. GBPUSD technical analysis On the H4 chart, the GBPUSD pair is experiencing an upward correction after rebounding from the 1.2100-1.2140 support area, with the Alligator indicator pointing to growth. The daily trend remains downward, suggesting the price could continue to decline once the current correction is complete. The GBPUSD pair has risen above 1.2300 within the current upward correction. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY holds steady ahead of the Bank of Japan meeting The USDJPY pair is hovering around 155.80, with the market focus on the future BoJ interest rate decision. Discover more in our analysis for 22 January 2025. USDJPY forecast: key trading points The USDJPY pair is subdued, awaiting news The market forecasts a Bank of Japan interest rate hike at the upcoming meeting USDJPY forecast for 22 January 2025: 155.85 and 156.59 Fundamental analysis The USDJPY rate stands at 155.80 on Wednesday. The Japanese yen has paused its recent rally as investors conserve their strength for future movements. Market attention is focused on the upcoming Bank of Japan meeting this week. Supported by hawkish statements from certain monetary policymakers, baseline stock market expectations indicate that the BoJ will increase the interest rate. The rate hike would raise Japan’s short-term borrowing costs to 0.5%, marking the highest level since the 2008 financial crisis. The Bank of Japan meeting is more crucial than external events. The US dollar is in a weak position, as the excitement over trade tariffs and inflation stabilisation offers little support to the US currency. The USDJPY forecast appears neutral. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD rose and paused: trade tariffs are still a key concern The EURUSD quotes are hovering near 1.0391 on Tuesday. Trump’s first day in office has been eventful. Find out more in our analysis for 21 January 2025. EURUSD technical analysis The main near-term scenario on the EURUSD H4 chart suggests growth to 1.0433. It is worth monitoring the 1.0349-1.0377 channel. If the pair remains above its upper boundary, the likelihood of further price rises will increase. The EURUSD pair has rebounded following a local improvement in risk sentiment in capital markets. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY is under pressure ahead of the BoJ decision The USDJPY rate is correcting, though the currency pair remains under pressure, with the price currently at 155.50. Discover more in our analysis for 21 January 2025. USDJPY forecast: key trading points The Japanese yen has strengthened for the second consecutive week, driven by market expectations of a BoJ interest rate hike The Bank of Japan officials have made hawkish statements, increasing confidence in monetary policy tightening Kazuo Ueda’s press conference is the market’s key event USDJPY forecast for 21 January 2025: 154.30 and 153.15 Fundamental analysis The USDJPY rate shows signs of growth after rebounding from the 154.90 support level. Nevertheless, the Japanese yen is strengthening for the second consecutive trading week amid rising expectations of a Bank of Japan interest rate hike. This was triggered by hawkish comments from the bank’s officials, which increased market confidence in monetary policy tightening. The Bank of Japan is expected to announce an interest rate hike on Friday, pushing short-term borrowing rates to 0.5%, the highest level since the global 2008 financial crisis. As the rate hike is almost inevitable, the market’s attention is turning to BoJ Governor Kazuo Ueda’s press conference. Investors will closely follow his comments to gain insight into the regulator’s future plans regarding the pace and timing of interest rate hikes. Japan’s inflation remains above the 2.0% target, with the weak yen continuing to pressure import prices. In this situation, Ueda will likely emphasise the regulator’s resolution to proceed with tightening monetary conditions to curb inflationary pressures. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDCAD temporarily declines, but the CAD forecast remains bearish The USDCAD pair begins the week with a decline to 1.4448. This does not change the trend, but the market needs a pause. Find out more in our analysis for 20 January 2025. USDCAD technical analysis The USDCAD H4 chart shows that the price has declined over the last two periods, which is insufficient for a full correction. For the price to reach the intermediate support level at 1.4381, it must first break below 1.4403. The USDCAD pair has temporarily paused its growth, but its medium-term outlook remains unchanged. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) continues to strengthen against the US dollar XAUUSD quotes continue to rise ahead of the US presidential inauguration. More details in our XAUUSD forecast for today, 20 January 2025. XAUUSD forecast: key trading points Today is a holiday in the US due to the Birthday of Martin Luther King Jr. The inauguration of US President Donald Trump Current trend: moving upwards XAUUSD forecast for 20 January 2025: 2,689 and 2,733 Fundamental analysis Today’s XAUUSD analysis shows that the pair is completing a correction and may start forming a new growth wave. As of 20 January 2025, Gold prices continue their upward momentum, reaching 2,700 USD per troy ounce. This rise is driven by persisting geopolitical tensions, especially given the recent developments in the Middle East and uncertainty in the global economy. The XAUUSD forecast for 20 January 2025 considers that amid Trump’s inauguration and some strengthening of the US dollar, XAUUSD prices may continue to grow. The outlook for the USD relative to Gold for the coming months does not look optimistic. Given the current trends and increased demand for the precious metal, gold prices may exceed 3,000 USD per troy ounce. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD: the pair could rise above the 1.0350 resistance level The EURUSD rate is experiencing an upward correction within a downtrend. The bulls failed to overcome the 1.0350 resistance level on their first attempt. More details in our analysis for 17 January 2025. EURUSD technical analysis On the H4 chart, the EURUSD pair is experiencing an upward correction after forming a local trough in the 1.0177-1.0200 support area. On Wednesday, the bulls attempted to overcome resistance at 1.0350 but encountered significant selling pressure and retraced, with the price currently consolidating slightly below 1.0300. The EURUSD pair failed to surpass the 1.0350 resistance level within its upward correction. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) rises: the market favours buyers Gold (XAUUSD) prices have risen to 2,715 USD amid strengthening demand for safe-haven assets. Find out more in our analysis for 17 January 2025. XAUUSD forecast: key trading points Gold prices maintain their upward trajectory The market’s demand for safe-haven assets boosts interest in Gold as such XAUUSD forecast for 17 January 2025: 2,727 and 2,730 Fundamental analysis Gold (XAUUSD) quotes continue their ascent, reaching a monthly high of 2,715 USD. Two key factors are driving Gold prices upward. The first is the prospect of a US Federal Reserve interest rate cut larger than expected. This outlook became apparent following the release of this week’s economic data. The second factor is the heightened demand for safe-haven assets, as investors seek risk-averse strategies ahead of potential US White House measures to introduce stricter trade tariffs. The Gold (XAUUSD) forecast appears positive. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent consolidated above 81.00 USD Brent continues to rise steadily, with quotes surpassing the 81.00 USD level yesterday. More details in our analysis for 16 January 2025. Brent technical analysis After surging on Wednesday, Brent quotes are consolidating slightly above 81.00 USD today. The asset is trading in a strong uptrend on the daily chart, with the Alligator indicator below the price chart and directed upwards, confirming the asset’s current strengthening trend. Brent prices rose above 81.00 USD amid slowing inflation and reduced US crude oil reserves. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY declines: the yen catches an opportunity in an attempt to strengthen The USDJPY pair is hovering around 155.76 on Thursday, marking the second day of decline, with the yen aggressive. Find out more in our analysis for 16 January 2025. USDJPY forecast: key trading points The USDJPY pair is rapidly declining on the currency market The market is receiving signals that the Bank of Japan is ready to raise the interest rate at the next meeting USDJPY forecast for 16 January 2025: 155.14 Fundamental analysis The USDJPY rate is rapidly falling, moving towards 155.76. The yen’s position improved significantly after comments from the Bank of Japan Governor Kazuo Ueda. The monetary policymaker said the regulator would discuss an interest rate hike next week based on its quarterly GDP and inflation forecasts. Ueda also noted that the political prospects for the new US administration and wage negotiations with trade unions in Japan are becoming key factors influencing the decision to raise borrowing costs. The very probability of a rate hike is important to the JPY. The USDJPY forecast is unfavourable. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with: