⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

-

Posts

1,288 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by RBFX Support

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 30 forecast: the index hit a new all-time high and entered a correction After reaching a new all-time high, the US 30 index has begun to decline, although the overall trend remains upward. The US 30 forecast for today is positive. US 30 forecast: key trading points Recent data: US services PMI (preliminary) came in at 54.2 in September Market impact: the data has a moderately positive effect on the stock market Fundamental analysis The US services PMI for October 2025 stood at 54.2, slightly above the forecast of 53.9 but marginally below the previous reading of 54.5. A PMI reading above 50.0 indicates an expansion in business activity in the service sector, which remains the primary driver of the US economy. A stronger-than-expected reading signals steady demand and positive sentiment among businesses, supporting expectations of moderate economic growth without signs of overheating. For the equity market, such data is generally viewed positively, as it confirms the resilience of corporate earnings and overall economic activity. However, the slight decline compared to the previous month may be interpreted as a sign that the economy is gradually stabilising after a phase of robust expansion. This reduces overheating concerns but may also temper excessive investor optimism. For the US 30 index, the PMI results are moderately positive. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

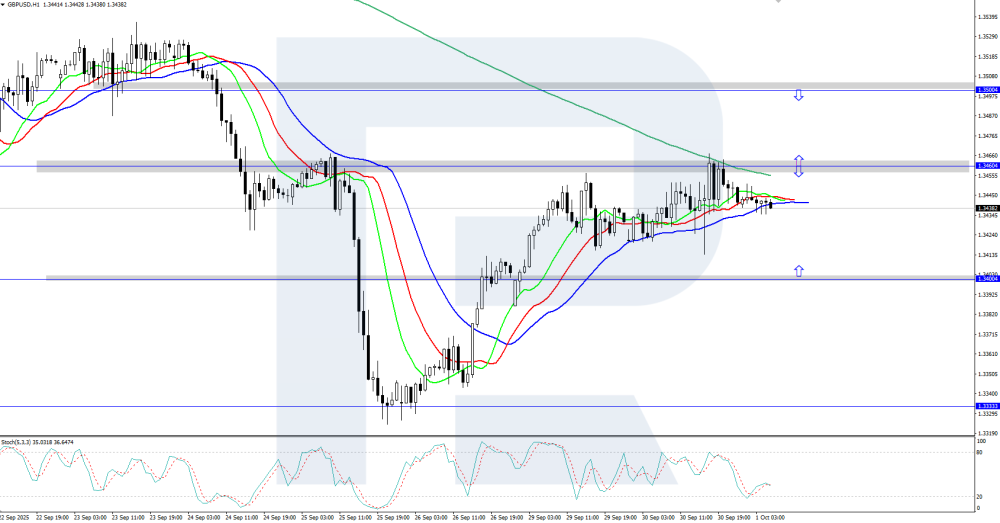

GBPUSD declines amid US economic uncertainty The GBPUSD pair remains under pressure amid a stronger US dollar and ongoing uncertainty caused by the prolonged US budget crisis, currently trading at 1.3389. Discover more in our analysis for 8 October 2025. GBPUSD technical analysis The GBPUSD pair is moving within a descending channel. Quotes have rebounded from the Moving Averages, which strengthens downward pressure from sellers. Against this backdrop, there remains potential for further decline and a bearish outlook for the GBPUSD pair today, with a downside target at 1.3225. The current GBPUSD dynamics indicate persistent pressure from the US dollar, with the market focused on the risks of the US budget crisis and upcoming Bank of England comments Read more -GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: the index hit new all-time high The US 500 index continued to reach new all-time highs within the ongoing uptrend. The US 500 forecast for today is positive. US 500 forecast: key trading points Recent data: the US ISM services prices for September came in at 69.4 Market impact: the data has a moderately negative effect on the US stock market Fundamental analysis The ISM non-manufacturing prices index for October 2025 reached 69.4, slightly above the forecast of 68.0 and only marginally higher than the previous reading of 69.2. Rising prices in the non-manufacturing sector indicate persistent inflationary pressure in the services industry, the key segment of the US economy. For market participants, this is a signal that inflationary processes remain stable despite the gradual cooling of the manufacturing sector. Such dynamics may strengthen expectations that the Federal Reserve will maintain interest rates at elevated levels for longer than previously anticipated. As a result, investors may act cautiously, particularly towards companies sensitive to changes in borrowing costs. For the US 500, the released data could have a moderately negative impact. Elevated prices in the services sector reduce the likelihood of an imminent monetary policy easing, which could limit short-term growth of the index. However, since the figure only slightly exceeded expectations, the market reaction is likely to remain balanced. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

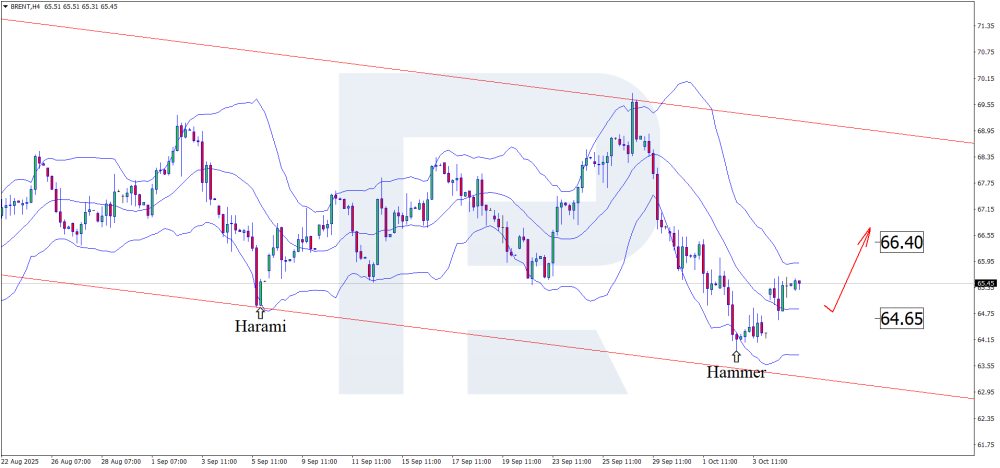

Brent gains momentum: China and OPEC+ are changing the rules of the oil market Brent crude prices are recovering after a decline, with quotes testing the 65.40 USD level. Discover more in our analysis for 7 October 2025. Brent technical analysis Having tested the lower Bollinger Band, Brent prices formed a Hammer reversal pattern on the H4 chart. At this stage, the market is developing a growth wave following this signal. Overall, Brent crude dynamics on 7 October 2025 remain moderately positive. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD on pause: everyone is waiting for US news The EURUSD pair has settled within the 1.1727 range. The market is conserving energy while awaiting news on the US government shutdown. Discover more in our analysis for 6 October 2025. EURUSD forecast: key trading points The EURUSD pair is consolidating sideways amid uncertainty surrounding the US government shutdown With no fresh headlines, investors are watching secondary data releases EURUSD forecast for 6 October 2025: 1.1660 or 1.1780 Fundamental analysis The EURUSD rate remains neutral around 1.1727 amid concerns over the consequences of the prolonged US government shutdown. Congress once again failed to agree on a temporary budget, leading to the suspension of several federal programs and the delay of key macroeconomic reports, including the September Nonfarm Payrolls. On the monetary front, markets continue to price in two Federal Reserve rate cuts in October and December, each by 25 basis points. Recent data have strengthened expectations that the Fed will maintain its policy easing trajectory. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

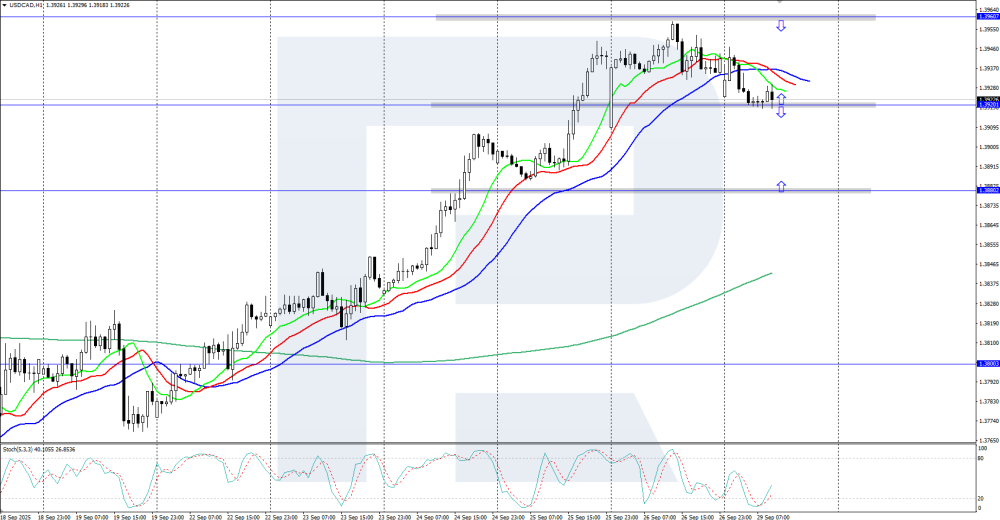

Slowdown in US business activity limits USDCAD growth The USDCAD pair is trading within a correction, reflecting the market’s reaction to the US government shutdown and a decline in business activity indicators. The rate currently stands at 1.3949. Discover more in our analysis for 6 October 2025. USDCAD technical analysis The USDCAD pair continues to move within an ascending channel, currently undergoing a correction while retaining potential for forming a Double Bottom reversal pattern. The current pullback pushed the price to the strong 1.3945 support level, where the asset again found buying interest. The fundamental backdrop reflects ongoing uncertainty: upside potential is limited by the absence of key economic data due to the US government shutdown and signs of a slowdown in the US economy. Read more -USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

AUDUSD consolidates around 0.6600 The AUDUSD rate settled around the 0.6600 level amid ongoing uncertainty over US government funding. Discover more in our analysis for 3 October 2025. AUDUSD forecast: key trading points Market focus: the US Department of Labor postponed the release of unemployment rate and Nonfarm Payrolls statistics Current trend: range-bound trading AUDUSD forecast for 3 October 2025: 0.6577 or 0.6630 Fundamental analysis Treasury Secretary Scott Bessent warned on Thursday that the government shutdown could negatively impact GDP growth, while President Donald Trump threatened mass federal worker layoffs to pressure Democrats. The shutdown has also delayed key economic data as the Department of Labor postponed Friday’s release of the September Nonfarm Payrolls report. The Australian dollar received support from the Reserve Bank of Australia after policymakers warned of higher-than-expected inflation. Markets are now pricing in only about a 45% chance of a rate cut at the 4 November meeting, compared to nearly 100% odds priced in a month ago. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold (XAUUSD) will quickly return to growth Gold (XAUUSD) prices are hovering around 3,860 USD. The correction was needed, but it changes nothing: the rally will continue. Discover more in our analysis for 3 October 2025. XAUUSD technical analysis On the XAUUSD H4 chart, prices remain near all-time highs. After a sharp rise from the 3,627 area, gold tested the 3,897 resistance level, where a local top formed. This was followed by a pullback to the 3,819 zone, which now acts as the nearest support. Gold (XAUUSD) has corrected slightly but remains in a strong position. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: index corrects after hitting new all-time high The JP 225 index is undergoing a correction, although the broader uptrend remains intact. The JP 225 forecast for today is negative. JP 225 forecast: key trading points Recent data: Tokyo core CPI came in at 2.5% year-on-year Market impact: the impact on the Japanese equity market is moderately positive Fundamental analysis Tokyo’s core Consumer Price Index stood at 2.5% year-on-year, below the consensus forecast of 2.8% and unchanged from the prior month. This shows that inflationary pressure in Japan’s largest metropolitan area remains stable and softer than expected. For equity markets, this reduces the likelihood of accelerated monetary policy normalisation by the Bank of Japan. The case for aggressive tightening has weakened, which supports valuations for assets sensitive to discount rates. For the JP 225 index, the overall impact is moderately positive. Softer inflation lowers the risk of sharp rises in yields and capital costs. On the currency side, this increases the likelihood of a weaker yen, which improves overseas revenue conversion for exporters and supports their stock performance, creating a positive ripple across the index. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY falls: BoJ tightening and political coordination weigh on the dollar Strengthening arguments for monetary tightening in Japan continue to support the yen, with quotes currently trading near 147.10. Find out more in our analysis for 2 October 2025. USDJPY technical analysis Having tested the upper Bollinger Band, the USDJPY pair formed a Shooting Star reversal pattern on the H4 chart, currently hovering around 149.70. At this stage, the pair continues its downward wave in line with the pattern signal. The yen continues to strengthen amid anticipation of the Federal Reserve’s rate decision. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBPUSD: pair holds above 1.3400 The GBPUSD pair consolidated above the 1.3400 mark amid the expected U.S. government shutdown and ahead of the ADP U.S. employment data release. Full details in our analysis for 1 October 2025. GBPUSD technical analysis On the H4 chart, GBPUSD shows moderate growth, consolidating above the 1.3400 level. The Alligator indicator is pointing upward, suggesting the bullish movement could continue. The key support for the uptrend is at 1.3333. The GBPUSD pair has climbed above 1.3400. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 30 forecast: the upward trend continues, the resistance level has not yet been breached After reaching a new all-time high, the US 30 index trend remains fragile. The outlook for today is positive. US 30 forecast: key trading points Recent data: US JOLTS Job Openings for September came in at 7.23M Market impact: confirms economic resilience and revenue support for cyclical companies Fundamental analysis The JOLTS report showed 7.23M job openings versus a forecast of 7.19M and 7.21M in the previous month. This points to sustained labour demand and underlines the resilience of the job market. Although the increase was modest, it reduces the likelihood of a swift easing of labour market tightness and could maintain upward pressure on wages and core services inflation. The small upside surprise strengthens the case for the Federal Reserve to take a cautious approach to policy easing. Expectations for aggressive rate cuts in the near term have diminished, while long-term bond yields may stay elevated. This increases the sensitivity of equity markets to rate dynamics and inflation expectations. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent falls into the hands of the bears: rising supply signals nothing good Brent slipped to 66.42 USD per barrel. The market is filled with negativity ahead of additional supply entering the market. Discover more in our analysis for 30 September 2025. Brent forecast: key trading points Brent crude declines under pressure from geopolitics and OPEC+ rhetoric Additional supply on the global market will push prices down even faster Brent forecast for 30 September 2025: 65.40 Fundamental analysis Brent crude fell to 66.42 USD per barrel on Tuesday, extending the decline of the previous session. Prices are under pressure from expectations of increased global supply and discussions of a possible ceasefire in Gaza. Media reports suggest that at Sunday’s meeting, OPEC+ may approve an additional output increase of at least 137,000 barrels per day starting in November. Another factor was the resumption of oil exports from Iraqi Kurdistan. Flows through the Iraq–Turkey pipeline were restored on Saturday after a US-brokered agreement between regional authorities, Baghdad, Turkey, and foreign companies. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Head and Shoulders pattern formation threatens EURUSD bulls The EURUSD rate continues to strengthen amid pressure on the US dollar and growing expectations of further Fed easing. The rate currently stands at 1.1741. Find out more in our analysis for 30 September 2025. EURUSD technical analysis While the EURUSD rate remains within an upward channel, the current strengthening is capped by the resistance zone near 1.1745. The chart shows the formation of a Head and Shoulders reversal pattern. Additional pressure on the pair comes from the Stochastic Oscillator signal, where the indicator lines have approached overbought territory and are showing readiness to turn downwards. Fundamental factors support euro growth; however, technical analysis of EURUSD points to a high risk of a bearish scenario with a breakout below the support level and a decline towards 1.1645. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDCAD corrected towards support at 1.3920 The USDCAD rate fell to the area around 1.3900 amid a possible US government shutdown this week due to suspended funding. Discover more in our analysis for 29 September 2025. USDCAD technical analysis On the H4 chart, the USDCAD pair is declining within the current downward correction. The daily trend is still bullish, so the pair may resume growth after the correction is complete. The USDCAD rate is falling, having reached the 1.3920 support level. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index breaks out of the sideways channel and continues to decline The DE 40 index approached a resistance level, but the downtrend continues. The DE 40 forecast for today is negative. DE 40 forecast: key trading points Recent data: Germany’s ifo Business Climate Index for September 2025 came in at 87.7 points Market impact: the figures create a restrictive backdrop for the German equity market Fundamental analysis Germany’s ifo Business Climate Index for September 2025 stood at 87.7 points, below the forecast of 89.3 and lower than the previous figure of 88.9. This reflects weakening optimism among German companies, with cautious expectations regarding business activity, domestic demand, and external conditions. The decline highlights ongoing pressure from high costs, weak exports, and global economic uncertainty. For the German equity market, these figures form a restrictive backdrop. Declining business sentiment could reinforce investor caution, particularly in industry, machinery, and exports, which are traditionally sensitive to shifts in the business climate. Much will depend on the ECB’s next steps — any monetary easing could help support the German economy. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD disappointed by expectations: the market agrees with the Fed The EURUSD rate is hovering around 1.1677 on Friday. Investors have become more optimistic regarding the Fed’s rate outlook. Discover more in our analysis for 26 September 2025. EURUSD forecast: key trading points The EURUSD pair ends the week with a noticeable decline The overall Federal Reserve rate outlook has turned more optimistic EURUSD forecast for 26 September 2025: 1.1644 Fundamental analysis The EURUSD pair dropped to 1.1677 at the end of the week. Investors are awaiting the release of the PCE price index, the Fed’s key inflation gauge, which should provide new guidance on future policy. On Thursday, data showed a decrease in initial jobless claims by 14 thousand to 218 thousand, significantly better than forecasts. The statistics indicate companies’ reluctance to lay off staff. Revised GDP figures also confirmed 3.8% annualized growth in Q2, marking the fastest pace in nearly two years, supported by strong consumer spending. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY forms a corrective wave: the market awaits determination from the BoJ Amid economic data from Japan, the USDJPY rate may form a downward wave towards the 149.30 area before resuming growth. Find out more in our analysis for 26 September 2025. USDJPY technical analysis On the H4 chart, the USDJPY pair tested the upper Bollinger Band and formed a Shooting Star reversal pattern while trading around 149.70. At this stage, it may continue its corrective wave following the signal from the pattern. The USDJPY rate broke above the upper boundary of the ascending channel, suggesting that there are solid chances for a pullback to the broken level near 149.30. Japan’s economic instability is making its mark; against this backdrop, USDJPY technical analysis suggests a correction towards the 149.30 support level before resuming growth. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Stagnation or growth? US GDP will decide the fate of the AUDUSD rate Amid expectations of US GDP data, AUDUSD quotes may continue to decline towards 0.6555. Find out more in our analysis for 25 September 2025. AUDUSD technical analysis Having tested the lower Bollinger Band, the AUDUSD pair formed a Harami reversal pattern on the H4 chart. At this stage, it continues to develop a corrective wave following the signal received. The target for the pullback may be at the 0.6625 resistance level. The USD continues to pressure the Australian dollar ahead of key US economic data. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index approached the upper boundary of the ascending channel and hit new all-time high The JP 225 stock index continues to rise within the ascending channel. The JP 225 forecast for today is positive. JP 225 forecast: key trading points Recent data: the Bank of Japan policy rate remains at 0.50% Market impact: the effect on the Japanese stock market is moderately positive Fundamental analysis The Bank of Japan kept its benchmark interest rate at 0.50%, in line with forecasts and the previous level. This decision signals continued cautious normalisation of monetary conditions without additional tightening that could significantly increase capital costs for corporations. Short-term uncertainty declines, and the risk premium on Japanese equities generally remains stable. For the JP 225, the impact can be described as neutral to positive. The decision was widely expected, which supports investor appetite for risk assets and allows markets to focus on corporate earnings and global demand. The yen remains a key factor: a stable or weaker currency boosts export revenue conversion, traditionally providing support for the index. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

XAUUSD back in the game: Fed keeps pressing the USD Having set another price record, XAUUSD is forming a correction, after which quotes may rise further to 3,840 USD level. Find more details in our analysis for 24 September 2025. XAUUSD technical analysis On the H4 chart, XAUUSD prices formed a Hanging Man reversal pattern near the upper Bollinger Band. At this stage, they continue a corrective wave following the pattern’s signal. Given that XAUUSD quotes remain within the ascending channel and considering geopolitical factors, the uptrend will likely continue once the pullback is complete. The USD continues to lose ground following Powell’s speech. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

GBPUSD under pressure: domestic news looks unimpressive The GBPUSD pair dropped to 1.3505. Investors are avoiding risks amid worsening conditions. Discover more in our analysis for 24 September 2025. GBPUSD forecast: key trading points The GBPUSD pair declines amid market doubts about the Bank of England’s stance Domestic political contradictions also undermine the stability of the pound GBPUSD forecast for 24 September 2025: 1.3450 Fundamental analysis On Wednesday, the GBPUSD pair is falling to 1.3505 after a survey reflected a slowdown in business activity in the UK in early September. Companies reported a decline in momentum and confidence amid rising risks of tax hikes before the end of the year. The preliminary S&P Global UK composite PMI fell from 53.5 points in August to 51.0 in September. The pound struggles to sustain growth even against the backdrop of positive investor sentiment and British equities at record levels. Markets are pricing in only 7 basis points of Bank of England rate cuts before the end of the year. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent prices fell below 66.00 USD, decline may continue Brent quotes remain under pressure, trading below 66.00 USD amid concerns over increased oil supplies from Iraq. Discover more in our analysis for 23 September 2025. Brent technical analysis On the H4 chart, Brent shows a downward movement after reversing lower from the daily high around 68.00 USD. A Triangle pattern is forming on the chart, which could push quotes further down towards the 60.00 USD area. Brent quotes dropped below 66.00 amid concerns about increased oil supplies from Iraq. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY: dollar strengthens, but gains capped by resistance The USDJPY rate remains in consolidation within a sideways range, with the market focused on upcoming Fed remarks and key US inflation data. The rate currently stands at 147.81. Find out more in our analysis for 23 September 2025. USDJPY forecast: key trading points Bank of Japan kept its key rate at 5% for the fifth consecutive meeting The regulator highlighted a moderate economic recovery in Japan The BoJ pointed to risks associated with global trade policy USDJPY forecast for 23 September 2025: 149.60 Fundamental analysis The USDJPY rate is strengthening while remaining within a sideways range as sellers defend the key resistance level at 148.15. Market focus is on upcoming Fed commentary ahead of fresh US inflation data. Fed Governor Stephen Miran noted that the current federal funds rate is too high and should be reduced to protect the US labour market. Scheduled for Tuesday are speeches by Federal Reserve Chairman Jerome Powell and Vice Chair Michelle Bowman. On Friday, market participants will focus on the August report on US personal income and outlays, which includes the core PCE price index, the Fed’s key inflation gauge. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) storms all-time high XAUUSD prices continue to strengthen, climbing above their all-time high into the 3,720 USD area as the US dollar weakens following the Fed’s rate cut. Discover more in our analysis for 22 September 2025. XAUUSD forecast: key trading points Market focus: gold has set a new all-time high around 3,720 USD Current trend: strong upward momentum persists XAUUSD forecast for 22 September 2025: 3,750 or 3,700 Fundamental analysis XAUUSD quotes reached a new all-time high at 3,720 USD per ounce. Investors are now awaiting key US inflation data and commentary from several Federal Reserve officials this week to assess the outlook for monetary policy. Last week, the Fed cut rates for the first time this year, lowering its benchmark rate by 25 basis points, while signalling room for further easing due to labour market weakness. Markets are currently pricing in two more 25-basis-point cuts this year, with one in October and another in December. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

.thumb.jpg.917df9d5ab258de8a4cbb0435b6a7cce.jpg)