⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

-

Posts

1,288 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by RBFX Support

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index slightly recovered, but the decline continues The DE 40 stock index has partially rebounded from its recent losses, but the overall trend remains bearish. The DE 40 forecast for today is negative. DE 40 forecast: key trading points Recent data: Germany’s preliminary manufacturing PMI came in at 49.5 in October 2025 Market impact: the data creates a mixed backdrop for the German equity market Fundamental analysis Germany’s manufacturing PMI for October came in at 49.6 points, slightly above both the consensus forecast of 49.5 and the previous reading of 49.5. The figure indicates that the industrial sector remains in contraction, but with signs of gradual stabilisation near the neutral threshold. For the equity market, this is a moderately positive signal in terms of expectations: the slower pace of decline in manufacturing supports the valuation of future cash flows in cyclical sectors, reduces the risk of margin erosion from underutilised capacity, and may help narrow discounts on industrial assets. However, since the indicator remains below 50, it continues to reflect weakness in domestic and external demand, limiting the upside potential and making it dependent on confirmation of improvement in subsequent data releases. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD rises above 1.1600 The EURUSD rate is moderately strengthening, climbing above 1.1600 as markets are awaiting key US inflation data. Discover more in our analysis for 24 October 2025. EURUSD technical analysis On the H4 chart, the EURUSD pair is undergoing a downward correction, finding strong buying interest around 1.1580. The overall daily impulse remains bullish, suggesting the potential for renewed upward movement once the correction phase is complete. The EURUSD rate is showing moderate strength, trading above 1.1600 as traders are awaiting US inflation data due today. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) pulls back after strong rally XAUUSD prices declined to around 4,100 USD following last week’s sharp rally, when a new all-time high at 4,380 USD was reached. Find more details in our analysis for 24 October 2025. XAUUSD forecast: key trading points Market focus: investors await the outcome of US-China trade talks on tariffs Current trend: moderately correcting XAUUSD forecast for 24 October 2025: 4,380 or 4,000 Fundamental analysis XAUUSD quotes fell by more than 5% this week, marking the largest intraday drop in five years. The sell-off coincided with significant outflows from gold-backed ETFs, which posted their largest one-day decline in assets in five months. Nevertheless, gold remains up approximately 55% year-to-date, supported by ongoing trade tensions, with trade talks between US President Donald Trump and Chinese President Xi Jinping taking centre stage next week. Geopolitical risks remain elevated following the new US sanctions on Russia, aimed at pressuring Moscow to negotiate a ceasefire in Ukraine. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index hits new all-time high After a correction, the JP 225 stock index resumed its upward movement and reached a new all-time high. The JP 225 forecast for today is positive. JP 225 forecast: key trading points Recent data: Japan’s balance of trade for September came in at –234.6 billion JPY Market impact: the effect on the Japanese equity market is moderately negative Fundamental analysis Japan’s latest trade balance data for October 2025 showed a deficit of –234.6 billion JPY, compared with expectations for a 22 billion JPY surplus and a slightly smaller deficit in the previous period. This indicates that imports continue to outpace exports and that the trade gap is not narrowing. Such dynamics are typically interpreted as a sign of weakening external demand for Japanese goods and high sensitivity of the economy to imported energy resources. This raises the likelihood of lower industrial production figures and slower performance in export-oriented industries. The release will likely send the JP 225 index lower. However, the downside potential is expected to be limited, as the negative trade data will be balanced by the Bank of Japan’s commitment to maintain ultra-loose monetary policy. Overall, these results increase the risk premium associated with external trade imbalances. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent awakens: oil prices rise amid new sanctions Brent crude oil prices are once again recovering and trading near 64.20 USD per barrel. Find more details in our analysis for 23 October 2025. Brent technical analysis On the H4 chart, Brent quotes tested the lower Bollinger Band and formed a Hammer reversal pattern. They are currently following the signal in the form of an upward wave. Despite ongoing risks of global oversupply, Brent crude shows signs of recovery. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

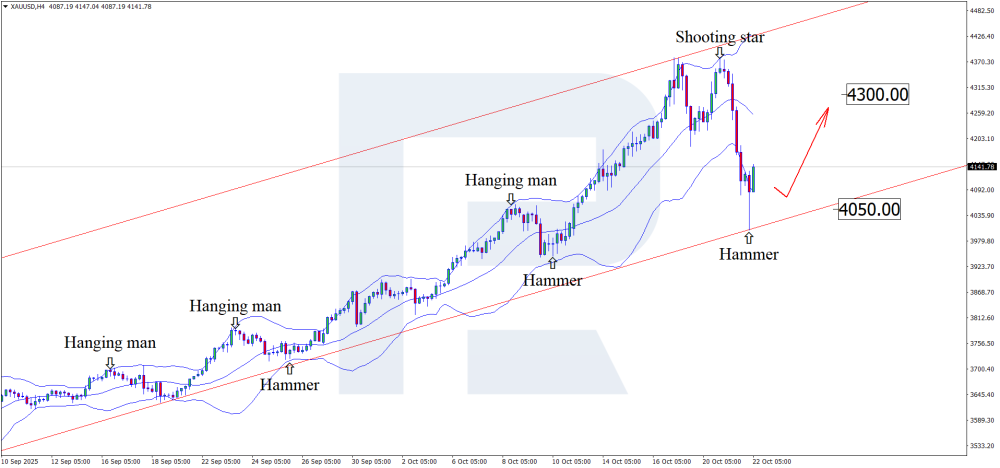

Gold plunges after record high – what is behind the XAUUSD collapse? Gold is undergoing a corrective phase, currently trading around 4,125 USD per ounce. Find more details in our analysis for 22 October 2025. XAUUSD technical analysis On the H4 chart, XAUUSD prices have formed a Hammer reversal pattern near the lower Bollinger Band. Gold is currently forming an upward wave following the signal from the pattern. Since XAUUSD quotes remain within an ascending channel, an upside target could be at 4,300 USD. Profit-taking and temporary US dollar strength triggered a pullback in gold prices. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 30 forecast: the index recovers from the decline and renews its all-time high Volatility in the US 30 index remains elevated, with the trend reversing upwards once again. The US 30 forecast for today is positive. US 30 forecast: key trading points Recent data: the US federal budget balance came in at 198 billion USD Market impact: the data has a moderately positive effect on the equity market Fundamental analysis The latest US federal budget data for October 2025 showed a surplus of 198 billion USD, far exceeding both the forecast of 42.3 billion USD and the previous figure of -345 billion USD. This improvement in the budget balance signals strong revenue inflows from tariffs, which could have a mixed macroeconomic impact on US equities. On the one hand, a positive budget balance reduces the government’s borrowing needs, which can ease pressure on Treasury yields – a development typically seen as supportive for the stock market. For the US 30 index, the short-term reaction is likely to be moderately positive: a stronger fiscal position boosts confidence in the sustainability of public finances and reduces sovereign debt risks. However, in the medium term, the trajectory of the index will depend on whether investors interpret this surplus as a sign of underlying economic strength or not. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent prices fall to support at 60.00 USD Brent crude prices have declined towards the 60.00 USD level, with market focus today on US oil inventory data from API. Find more details in our analysis for 21 October 2025. Brent forecast: key trading points Market focus: US crude oil inventory data from API will be released today Current trend: moving downwards Brent forecast for 21 October 2025: 58.50 or 61.30 Fundamental analysis Brent prices are moderately declining as growing concerns over a global oil supply glut and ongoing uncertainty surrounding US-China trade negotiations keep the market under pressure. Traders are closely monitoring the upcoming talks between US and Chinese officials in Malaysia, which are viewed as a key precursor to the expected summit between President Donald Trump and President Xi Jinping later this month. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Investors buy USDJPY ahead of BoJ policy decisions The USDJPY pair continues to strengthen amid ongoing political uncertainty and expectations of the upcoming Bank of Japan meeting, currently trading at 151.56. Find out more in our analysis for 21 October 2025. USDJPY technical analysis The USDJPY pair continues its upward trajectory after breaking above the upper boundary of a Head and Shoulders reversal pattern. Buyers have confidently held the price above the 151.00 resistance level, confirming a sustained bullish momentum. Political uncertainty in Japan and investor focus on the upcoming Bank of Japan meeting continue to drive demand for the US dollar. Read more -USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDCAD rebounds after positive US news The USDCAD pair starts the week with a recovery attempt after last week’s decline, currently trading at 1.4023. Find more details in our analysis for 20 October 2025. USDCAD technical analysis The USDCAD pair continues to move within an ascending channel despite sellers’ attempts to trigger a correction. After a short-term decline, the price is testing the lower boundary of the channel, indicating that buying interest remains intact. The Stochastic Oscillator shows a rebound from oversold territory, with a potential upward crossover forming, confirming the market’s readiness to resume growth. With the US dollar strengthening and steady investor interest in Canadian assets, the short-term USDCAD outlook remains bullish. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index continues to decline The DE 40 stock index remains under pressure, although the pace of decline slowed significantly at the end of last week. The DE 40 forecast for today is negative. DE 40 forecast: key trading points Recent data: Germany’s PPI decreased by 0.5% in September 2025 Market impact: the data creates a mixed backdrop for the German stock market Fundamental analysis Germany’s latest Producer Price Index (PPI) for September showed a 0.5% month-on-month decline, compared to an expected fall of just 0.1%. This indicates that price pressure at the producer level is easing faster than anticipated. For the stock market, this is a crucial signal on two fronts – capital cost (interest rate expectations) and corporate earnings (balance between demand and costs). If the decline in PPI persists alongside a deterioration in leading indicators such as PMI and industrial orders, the market may need to revise its revenue forecasts – a clear risk for cyclical stocks. For the DE 40 index, the short-term baseline scenario points to a moderately positive reaction. However, the medium-term trajectory will depend on whether leading indicators such as PMI, industrial orders, and exports confirm a sustained weakness in demand. Conversely, if data shows that the PPI drop is temporary and not systemic, while orders remain stable, there will be more room for growth. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

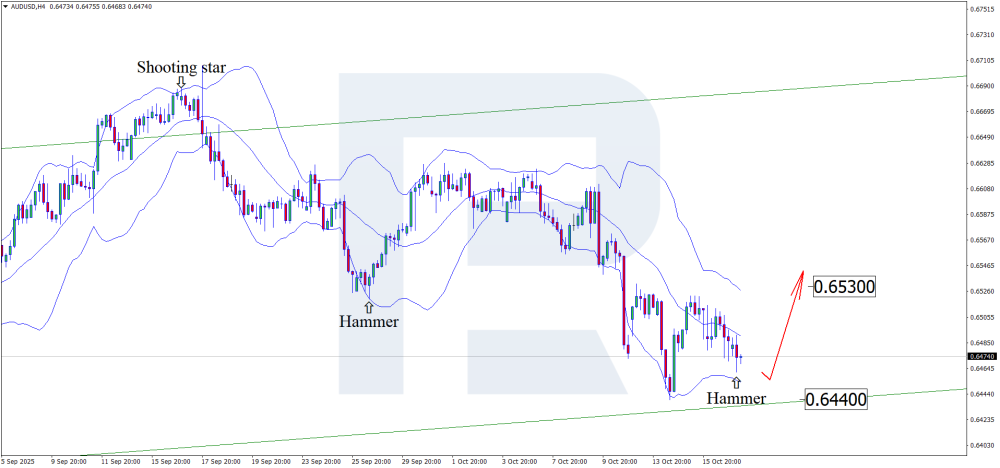

US dollar weakness opens the way for AUDUSD growth US industrial stagnation gives AUDUSD a chance to rise towards 0.6530. Find out more in our analysis for 17 October 2025. AUDUSD technical analysis On the H4 chart, the AUDUSD rate tested the lower Bollinger Band and formed a Hammer reversal pattern. At this stage, prices may develop a corrective wave following this signal, with the target for the pullback at the 0.6530 resistance level. The AUDUSD forecast for 17 October 2025 suggests a potential partial recovery of the Australian dollar. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Rising gold imports into India drive XAUUSD higher XAUUSD quotes continue their steady upward momentum, reflecting a combination of strong fundamental and technical market support. The rate currently stands at 4,365 USD. Discover more in our analysis for 17 October 2025. XAUUSD forecast: key trading points India’s gold imports reached 9.615 billion USD in September 2025 Renewed US-China trade tensions have strengthened demand for gold as a safe-haven asset XAUUSD forecast for 17 October 2025: 4,440 Fundamental analysis XAUUSD prices continue to rise for the sixth consecutive trading session. According to the latest data, India’s gold imports in September 2025 totalled 9.615 billion USD, up 110% from September 2024 and 80% higher than in August 2025. The upcoming festive season, which traditionally fuels demand for precious metals, is providing additional support to buying activity. Growth is also driven by renewed trade tensions between the US and China and growing concerns over the ongoing US government shutdown. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Rising US oil inventories increase pressure on Brent Brent prices continue to react to geopolitical developments and US inventory data, currently trading at 62.18 USD. Discover more in our analysis for 16 October 2025. Brent technical analysis Brent quotes continue to move within a descending channel, remaining under selling pressure. After failing to consolidate above the 62.60 USD resistance level, prices resumed their decline, indicating sustained bearish momentum. Rising US oil inventories continue to weigh on Brent prices. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD maintains bullish momentum amid political uncertainty in the US The EURUSD rate continues to strengthen amid US dollar weakness and expectations of further Federal Reserve policy easing, currently standing at 1.1659. Find out more in our analysis for 16 October 2025. EURUSD forecast: key trading points The US government shutdown continues into its third week, delaying the release of key macroeconomic data Federal Reserve Chairman Jerome Powell noted signs of labour market weakness, reinforcing expectations for a rate cut this month Markets anticipate another cut in December and three more next year Fundamental analysis The EURUSD rate is rising for the third consecutive session, showing a steady recovery after a prolonged correction. Buyers defended the 1.1550 level, increasing the likelihood that the downtrend has ended and a bullish impulse is underway. The US dollar remains under pressure from ongoing trade tensions between the US and China, the prolonged government shutdown, and expectations of further monetary easing by the Federal Reserve. The shutdown, now entering its third week, has delayed the publication of crucial economic reports that could influence policy decisions. In his latest remarks, Jerome Powell highlighted signs of labour market weakness, strengthening investor expectations for a rate cut this month, followed by another in December and three additional cuts in 2026. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY falls after Powell’s comments on a weak labour market The USDJPY rate remains under pressure amid US dollar weakness and rising demand for safe-haven assets, currently trading at 151.19. Discover more in our analysis for 15 October 2025. USDJPY forecast: key trading points Political uncertainty persists in Japan following the collapse of the coalition with the Komeito party Political events in Japan have increased investor interest in the yen China’s refusal to import US soybeans has heightened global trade risks USDJPY forecast for 15 October 2025: 151.30 and 153.20 Fundamental analysis The USDJPY rate is declining for the second consecutive session. Pressure on the US dollar intensified after Federal Reserve Chairman Jerome Powell highlighted signs of labour market weakness in his recent remarks. These comments reinforced expectations of further interest rate cuts, triggering a sell-off in the dollar. The yen also strengthened amid political developments in Japan. Markets are watching whether Sanae Takaichi, leader of the ruling Liberal Democratic Party, can assume the role of prime minister following the coalition’s split with the Komeito party. Takaichi supports higher government spending and a continuation of loose monetary policy – typically a bearish factor for the yen but supportive for the stock market. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBPUSD consolidates above 1.3300 The GBPUSD rate climbed above 1.3300 despite mixed data on UK wage growth. Find out more in our analysis for 15 October 2025. GBPUSD technical analysis On the H4 chart, the GBPUSD pair shows strong upward momentum, holding firmly above 1.3300. The Alligator indicator is directed upwards and steadily growing, so the upward movement may continue. The GBPUSD pair has turned upwards and firmly consolidated above 1.3300. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) soars above 4,100 USD XAUUSD prices continue to strengthen, setting a new all-time high around 4,170 USD amid ongoing US dollar weakness. Find more details in our analysis for 14 October 2025. XAUUSD forecast: key trading points Market focus: the US government shutdown continues Current trend: trending upwards XAUUSD forecast for 14 October 2025: 4,250 or 4,100 Fundamental analysis XAUUSD prices exceeded 4,100 USD per ounce, setting a new all-time record amid escalating trade tensions between the US and China and growing expectations of a Federal Reserve rate cut. Gold’s rally intensified after President Donald Trump reignited trade disputes with Beijing, fuelling concerns among investors and driving demand for safe-haven assets. Traders are now pricing in a 97% likelihood of a Federal Reserve rate cut in October and fully expect another reduction in December. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD drops to support at 1.1550 The EURUSD rate fell to 1.1550 amid a stronger US dollar and political instability in France. Discover more in our analysis for 14 October 2025. EURUSD technical analysis On the H4 chart, the EURUSD pair is edging lower from the 1.1900 resistance level. The market is currently in a local corrective decline, after which growth may resume. The key support level is now seen at 1.1550. The EURUSD rate entered a downward correction, trading below 1.1600. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDCAD prepares for an upward breakout – oil and the Bank of Canada weigh on CAD Following positive data from Canada, the USDCAD pair has entered a correction phase and are preparing to rise towards 1.4050. Find out more in our analysis for 13 October 2025. USDCAD forecast: key trading points The Canadian dollar is attempting to recover its position Employment growth exceeded all forecasts USDCAD forecast for 13 October 2025: 1.3995 Fundamental analysis Today’s USDCAD forecast remains unfavorable for the CAD despite employment growth. Canada’s labour market surprised with a sharp rise in employment, with the Canadian economy adding 60,400 new jobs in September, far surpassing the forecast of 5 thousand. The strong employment data casts doubt on the likelihood of another Bank of Canada rate cut. As a result, the US dollar slightly weakened against the Canadian dollar, and the USDCAD pair entered a corrective pullback after its recent rise. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold gains support from geopolitical risks XAUUSD is rising amid increasing geopolitical tensions and expectations of further monetary easing by the Federal Reserve, currently trading at 4,073 USD. Find more details in our analysis for 13 October 2025. XAUUSD technical analysis XAUUSD prices continue to move within an upward channel. Buyers maintain control after breaking above the 4,050 USD resistance level, confirming the ongoing bullish momentum. The XAUUSD price forecast suggests a correction towards 4,060 USD, followed by a renewed rise targeting 4,120 USD. The technical and fundamental backdrop for XAUUSD indicates a steady upward momentum and retains a strong potential for continued growth towards 4,120 USD after a short-term correction. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY rises to the 153.00 area The USDJPY rate is on the rise, climbing to around 153.00 following the recent elections in Japan. Discover more in our analysis for 10 October 2025. USDJPY forecast: key trading points Market focus: Japan’s PPI rose by 0.3% in September Current trend: upward momentum persists USDJPY forecast for 10 October 2025: 154.00 or 152.00 Fundamental analysis The pair continues its upward trajectory after Sanae Takaichi won Japan’s election for the position of prime minister, reinforcing expectations of increased fiscal spending and a dovish monetary policy stance. Takaichi stated that the Bank of Japan would conduct policy independently while aligning with government objectives, adding that she aims to avoid excessive yen weakening, although her comments failed to support the currency. Markets now estimate the likelihood of a BoJ rate hike in December at less than 50%, with expectations shifting towards March next year. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

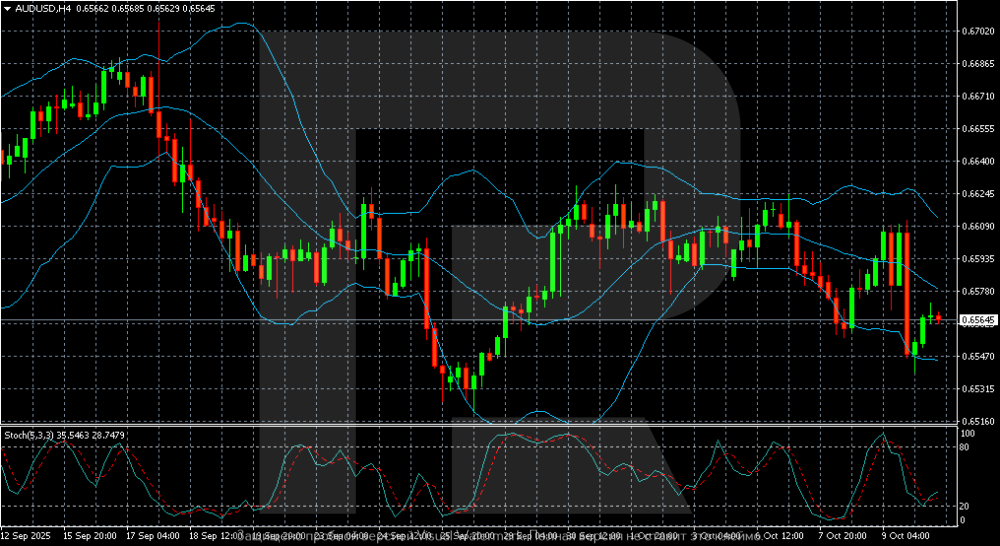

AUDUSD stabilises, but this may be temporary The AUDUSD pair has found a reason to rebound to 0.6564. The market remains tense. Find out more in our analysis for 10 October 2025. AUDUSD technical analysis On the H4 chart, bearish pressure on the AUDUSD pair persists. After declining from 0.6670 to 0.6530 in late September, the pair moved into a sideways range between 0.6540–0.6610. The movement remains limited, and upward attempts are constrained near the middle Bollinger Band line, indicating a continuing downward momentum. The AUDUSD pair remains under selling pressure despite a local rebound. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index hit two consecutive all-time highs The JP 225 stock index continues to rise after reaching a new all-time high. The JP 225 forecast for today is positive. JP 225 forecast: key trading points Recent data: Japan’s current account for August 2025 stood at 3.77 trillion JPY Market impact: the data has a moderately positive effect on the Japanese stock market Fundamental analysis The increase in Japan’s current account surplus indicates a strong foreign economic position: exports of goods and services, along with income from overseas investments, exceed imports and external payments. This reflects the resilience of Japan’s economy and its ability to maintain a positive balance, which is generally viewed as a fundamentally supportive signal. A higher surplus can boost investor confidence in Japan’s economic stability, strengthen the yen, and attract additional capital inflows to domestic markets. For the JP 225 index, the overall effect is moderately positive. Shares of semiconductor-related companies showed elevated volatility. The index hit another all-time high on Monday after the ruling Liberal Democratic Party elected staunch conservative Sanae Takaichi as its new leader on Saturday, paving the way for her to become Japan’s first female prime minister. This political development lifted investor sentiment. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Weak Japanese data supports USDJPY growth The USDJPY rate continues a steady upward movement, supported by weak economic data from Japan and uncertainty surrounding the BoJ’s policy direction. The rate currently stands at 152.96. Find out more in our analysis for 9 October 2025. USDJPY technical analysis The USDJPY rate continues to move within an ascending channel and has consolidated above the upper boundary of a Triangle pattern. Prices are hovering above the Moving Average, confirming ongoing buying pressure and opening the door for further growth. The USDJPY rate continues to show bullish sentiment amid weak economic data from Japan and the BoJ’s cautious stance, further pressuring the yen. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team