-

Posts

3069 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Posts posted by OctaFX_Farid

-

-

Another Doji on the daily charts for EUR/AUD

FXStreet (Mumbai) - The EUR/AUD pair is on its way to witness a second consecutive Doji candle on its daily chart, as the pair hovers largely unchanged for the day.

The pair currently trades at 1.5040, compared to the previous sessions close of 1.5033. The pair has swung on both sides and is likely to settle largely unchanged for the day, similar to the moves witnessed on Tuesday, The gains were capped after a strong weekly jobless data in the US pushed the EUR/USD back below 1.22 levels, thereby erasing gains in the EUR/AUD cross. Meanwhile, the AUD/USD has inched marginally higher by 0.13%, which further capped gains in the EUR/AUD pair.

EUR/AUD Technical Levels

The immediate resistance is seen at 1.5062 and 1.5082 (10-DMA). Meanwhile, support is seen at 1.4989 and 1.4978 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 25, 2014

OctaFX.Com News Updates

-

Strong weekly US jobs data pushed EUR/USD back below 1.22 levels

FXStreet (Mumbai) - The fourth consecutive decline in the US weekly jobless claims pushed the EUR/USD below 1.22 levels, after having clocked a high of 1.2220 ahead of the data.

The EUR/USD pair now trades 0.20% higher for the day at 1.2198 levels. The pair fell from the days high immediately after the labor department in the US reported the initial jobless claims for the past week at a 7-week low of seasonally adjusted 280,000. Moreover, the strong labor market data comes a day after the commerce department in the US confirmed US third quarter GDP at 5.0%.

EUR/USD Technical Levels

The pair has an immediate resistance located at 1.2220, above which another resistance is seen at 1.2247 levels. Meanwhile, support is seen at 1.2164 and 1.2132 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 25, 2014

OctaFX.Com News Updates

-

US Treasury yields extend post US GDP gains

FXStreet (Mumbai) - The yields across the short-end and the long-end of the treasury market curve extended gains today after recovering losses witnessed in the Asian session.

The yields have extended gains witnessed in the previous session after a surprisingly strong US third-quarter GDP report increased bets of sooner-than-expected interest rate hike in the US.

The 10-yr yields in the US rose 2.7 basis points to 2.284%, while the 30-yr yield is up 1 basis points to 2.861%. Moreover, the 10-yr yield had gained more than 10 basis points in the previous session to finish at 2.26%.

Meanwhile, at the short-end, the 2-year yield, a barometer of short-term interest rate expectations, continues to hover around the 3.5 year high of 0.747%. However, the 1-year yield has inched slightly lower to 0.242%.

The yield may continue to rise on bets of a sooner-than-expected interest rate hike as the markets lack fresh fundamental trigger as we move into the new year.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 25, 2014

OctaFX.Com News Updates

-

OctaFX.Com - MASSIVE Spread Reduction at OctaFX!

We have reduced major currency spreads!

This is a revolution in lowering the spreads that happened in OctaFX!

Now you can enjoy trading with as low as 0.2 pip spreads. Theyve never been that tight.

Stand out for outstanding with OctaFX!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

EUR/USD downside pressure mounting

FXStreet (Guatemala) - EUR/USD is trading at 1.2190, up 0.15% on the day, having posted a daily high at 1.2221 and low at 1.2167.

Us yields have sky rocketed due to the robustness in US data in the form of the GDP and highest growth since 2003. Analysts at TD Securities noted that the US 2-year bond yields at 0.73/0.74% reflect the highest returns at this point on the curve since 2011 and the widest (most USD-supportive) EZ-US spreads since early 2007; “This helped push the EUR/USD exchange rate to the lowest in two yearsâ€.

“Contrasting growth and policy prospects keep EURUSD on track for a retest of the 2012 EZ Sovereign crisis low of 1.2047 sooner rather than later but we rather suspect that the contrasting EZ-US growth and policy outlooks means that there is substantially more downside risk for EUR/USD than that in the months ahead. Look to sell modest EUR/USD rallies from hereâ€.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 24, 2014

OctaFX.Com News Updates

-

NZD/USD remain in bearish territory

FXStreet (Guatemala) - NZD/USD is trading at 0.7721, up 0.19% on the day, having posted a daily high at 0.7739 and low at 0.7699.

NZD/USD has remained offered into the closes ahead of Christmas day. It’s the theme around the greenback that is leading the majors and dragging the Kiwi lower that had been supported previously by the NZ trade deficit that narrowed faster than expected in November from NZD -908 million to -213 million (vs. -575mn exp).

But the last run of US data took back those gains when the US GDP surprised in 3Q yesterday by 5% q/q annualized vs. 4.3% consensus and 3.9% previous. US 10-year yields are around 2.25% and towards three-week highs keeping the greenback bid. Below the 21-dma & Ichimoku conversion line (0.7775/76) NZD/USD remains offered into the New Year.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 24, 2014

OctaFX.Com News Updates

-

USD/CAD shows signs of life, pushes higher

FXStreet (Córdoba) - USD/CAD is one of the few FX pairs showing signs of activity in extremely thin market conditions Wednesday, with the pair briefly falling to levels sub-1.1600 only to bounce back and erase daily losses.

USD/CAD climbed half a cent from daily lows and has even pushed to fresh daily highs at 1.1640 zone in recent dealings. At time of writing, USD/CAD is trading at 1.1637, recording a 0.20% gain on the day.

The loonie continues to trade near 5-year lows versus the greenback as oil resumes the fall after a short-lived correction. US government's Energy Information Administration reported inventories rose by 7.3 million barrels in the week ending Dec. 19, sending oil prices to fresh session lows.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 24, 2014

OctaFX.Com News Updates

-

Strong weekly US jobs data pushed EUR/USD back below 1.22 levels

FXStreet (Mumbai) - The fourth consecutive decline in the US weekly jobless claims pushed the EUR/USD below 1.22 levels, after having clocked a high of 1.2220 ahead of the data.

The EUR/USD pair now trades 0.20% higher for the day at 1.2198 levels. The pair fell from the day’s high immediately after the labor department in the US reported the initial jobless claims for the past week at a 7-week low of seasonally adjusted 280,000. Moreover, the strong labor market data comes a day after the commerce department in the US confirmed US third quarter GDP at 5.0%.

EUR/USD Technical Levels

The pair has an immediate resistance located at 1.2220, above which another resistance is seen at 1.2247 levels. Meanwhile, support is seen at 1.2164 and 1.2132 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 24, 2014

OctaFX.Com News Updates

-

GBP/USD recovery falters, enters holiday lethargy

FXStreet (Córdoba) - The dollar has cut some of yesterday's gains versus major competitors and entered a consolidation phase Wednesday in extremely thin market conditions.

GBP/USD managed to recover from fresh 2014 lows sub-1.5500 but the bounce was capped by the 50-hour SMA confining the Cable to a phase of consolidation. At time of writing, the pair is trading at 1.5540, still up 0.16% on the day.

On Tuesday contrasting GDP figures in UK and US pushed GBP/USD to a fresh 16-month low of 1.5485.

US jobless claims declined to 280K from 289K the previous week and down from the 290K expected.

GBP/USD levels to watch

As for technical levels, next resistances are seen at 1.5555 (daily high), 1.5607 (Dec 23 high) and 1.5660 (21-day SMA). On the flip side, support could be found at 1.5485 (2014 low Dec 23) and 1.5462 (Aug 30 2013 low).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 24, 2014

OctaFX.Com News Updates

-

US Treasury yields extend post US GDP gains

FXStreet (Mumbai) - The yields across the short-end and the long-end of the treasury market curve extended gains today after recovering losses witnessed in the Asian session.

The yields have extended gains witnessed in the previous session after a surprisingly strong US third-quarter GDP report increased bets of sooner-than-expected interest rate hike in the US.

The 10-yr yields in the US rose 2.7 basis points to 2.284%, while the 30-yr yield is up 1 basis points to 2.861%. Moreover, the 10-yr yield had gained more than 10 basis points in the previous session to finish at 2.26%.

Meanwhile, at the short-end, the 2-year yield, a barometer of short-term interest rate expectations, continues to hover around the 3.5 year high of 0.747%. However, the 1-year yield has inched slightly lower to 0.242%.

The yield may continue to rise on bets of a sooner-than-expected interest rate hike as the markets lack fresh fundamental trigger as we move into the new year.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 24, 2014

OctaFX.Com News Updates

-

US mortgage applications increase on lower rates

FXStreet (London) - Data released by the US Mortgage Bankers Association showed that mortgage applications increased in the week ending 19 December, with its index rising by 0.9 percent after falling 3.3 percent the previous week.

The increase in applications was helped by a decline in rates as the average 30-year fixed rate loan declined to a one-year low at 4.02 percent, down from 4.06 percent.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 24, 2014

OctaFX.Com News Updates

-

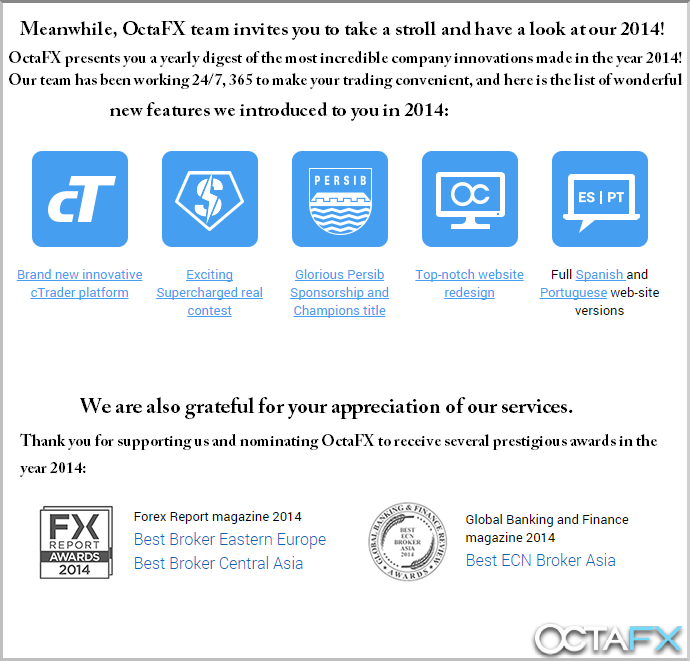

OctaFX.com - We wish you a Merry Profit and Happy New Trades!

Holidays are approaching and we would like to congratulate OctaFX clients celebrating Christmas and New Year all over the world! We hope you will spend your holidays with your family and friends in a festive atmosphere!

OctaFX wishes you Merry Christmas and we hope you stay with us in 2015 to witness novel exciting promotions, improvements of our trading conditions and introduction of groundbreaking services and new payment options!

Let your trades be more profitable, your experience with us always positive, and your trading success inevitable!

Thank you for sharing year 2014 with us and see you in 2015!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

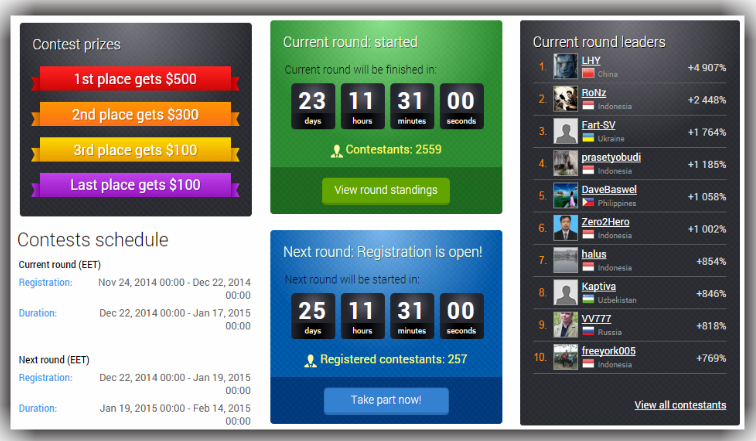

OctaFX Champion - A Splendid Demo Contest from your top Broker!

Champion Demo Contest! *Currently our top contestant LHY from China has piled up with Equity/Balance $50 069.67. So, come and snatch the opportunity and be the part of matchless traders.

Current update of OctaFX

Contests schedule

Current round (EET)

Registration: Nov 24, 2014 00:00 - Dec 22, 2014 00:00

Duration: Dec 22, 2014 00:00 - Jan 17, 2015 00:00

Next round (EET)

Registration: Dec 22, 2014 00:00 - Jan 19, 2015 00:00

Duration: Jan 19, 2015 00:00 - Feb 14, 2015 00:00

Please visit here to see full contestants list http://www.octafx.com/contests/octafx-champion/rating/

Stand out for outstanding with OctaFX!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

US Treasuries yields rise after strong GDP data

FXStreet (Mumbai) - The yields across the treasury market curve in the US shot higher after the stellar US third quarter GDP report raised hopes of a sooner-than-expected policy tightening in the US.

The commerce department in the US revised up its estimate of GDP growth to a 5% from the 3.9% reported in the last month, citing stronger consumer and business spending than it had previously factored in. This is the fastest growth since the third quarter of 2003.

The US 10-yr treasury yield now trades 2.6 basis points higher at 2.188%, while the 30-yr yield has gained 1.9 basis points to 2.768%. Meanwhile, at the short-end, the 2-yr yield is up 1.1 basis points to 0.728%, while the 3-yr yield is up 2.1 basis points to 1.129%.

Moreover, with the strong US GDP data, the probability of a sooner-than-expected policy normalization in 2015 increases; as stated by Federal Reserve (Fed) chair. Yellen in her press conference at the Dec. 17 meet.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 23, 2014

OctaFX.Com News Updates

-

EUR/USD breaks below 1.2200 after strong US GDP

FXStreet (Córdoba) - The dollar strengthened across the board and dragged EUR/USD below 1.2200 to fresh 2 ½-year lows after data showed US GDP growth at the strongest pace since Q3 2003.

US gross domestic product grew at a seasonally adjusted annual rate of 5.0% in the Q3, marking the strongest pace in 11 years. However, durable goods orders fell 0.7% in November, missing by far expectations of a 1.8% gain.

EUR/USD broke below 1.2200 and stops were triggered, sending the pair quickly to its lowest level since August 2012 at 1.2182. At time of writing, the pair is trading at 1.2190, recording a 0.32% loss on the day.

EUR/USD levels to watch

Immediate supports are now seen at 1.2167 (Aug 3 2012 low) and 1.2133 (Aug 2 2012 low). On the other hand, next resistances could be found at 1.2245 (daily high) and 1.2271 (Dec 22 high).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 23, 2014

OctaFX.Com News Updates

-

USD/JPY extends gains on strong US GDP

FXStreet (Córdoba) - USD/JPY pushed a tad higher and printed fresh highs after the release of much better-than-expected US gross domestic product. However, a big miss in durable good orders tempered dollar’s rally.

USD/JPY extended intraday gains and hit its highest level since in two weeks at 120.47 so far. At time of writing, the pair is trading just below recent highs, recording a 0.35% increase Tuesday.

US data showed GDP grew at a seasonally adjusted annual rate of 5.0% in the Q3, up from the Q2 growth rate of 4.6% and the strongest pace in 11 years. However, not all was good news, as durable goods orders fell 0.7% in November, missing by far expectations of a 1.8% gain.

USD/JPY technical levels

As for technical levels, immediate resistances are seen at 121.00 (psychological level) and 121.83 (2014 high Dec 8). On the flip side, supports could be found at 119.95 (daily low) and 119.30 (Dec 22 low).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 23, 2014

OctaFX.Com News Updates

-

US GDP upward revised to 5 percent

FXStreet (London) - The final reading of US GDP, adjusted for price changes, increased at an annual rate of 5.0 percent in the third quarter of 2014, according to the "third" estimate released by the Bureau of Economic Analysis, upwards revised from the second reading of 3.9 percent.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month.

According to the BEA, the increase in real GDP in the third quarter primarily reflected positive contributions from PCE, non-residential fixed investment, federal government spending, exports, state and local government spending, and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, decreased.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 23, 2014

OctaFX.Com News Updates

-

LME Inventory Update

FXStreet (Mumbai) - The warehouse stocks data released daily by the London Metal Exchange (LME) today showed a rise in the inventory levels of Copper and nickel, while the inventory levels of Lead, Zinc and aluminium declined.

Lead and zinc stocks decreased by 25 and 1225 tonnes respectively, while aluminium stocks witnessed another massive fall of 9925 tonnes. Meanwhile, copper stocks increased by 3525 tonnes and nickel inventory went up by 582 tonnes.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 23, 2014

OctaFX.Com News Updates

-

United Kingdom Index of Services (3M/3M): 0.7% (October) vs previous 0.8%

Read more in Forex News

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 23, 2014

OctaFX.Com News Updates

-

OctaFX.com-Swap free trading with OctaFx!

OctaFX offers swap-free accounts to their clients. Whether or not your beliefs or trading strategy require swap-free trading, you can always open a swap-free account at OctaFX .

You can always apply for a swap-free account at registration, no matter whether you choose a Micro or ECN account. No overnight charges will be applied to your account. OctaFX respects various trading strategies and does its best to meet every possible client's requirements and expectations. To apply for a swap-free account please check the box "Swap-Free" when opening your account. Your account will be automatically assigned swap-free status.

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

OctaFX.com - Supercharged real contest OctaFX presents the first monthly prize!

OctaFX Supercharged real contest gathers pace and today we are celebrating first winner in a history of this competition! One month of exceptional performance brings our trader a brand new iPhone 6!

OctaFX Supercharged real contest gathered OctaFX traders in one pursuit participants are chasing our main prize electric sports car Tesla Model S! Unlike most contests in the industry, OctaFX Supercharged real contest offers you a monthly prize before you get to the main finish line!

Meet our Supercharged real contest Round 1 winner its Mr. Motie Hayajneh from Jordan! We are happy to reward him with well-deserved brand new iPhone 6!

We asked Mr. Motie Hayajneh to tell us about his experience during first four weeks of our new Supercharged real contest. We are proud to present you his inspiring comments:

Mr. Motie Hayajneh: Its an amazing contest with great prize. I joined the contest after 13 days of its start. It took a lot of my time. My key factor to success in this round is discipline! I used various techniques to win, with the common feature of riding the trend. This round had its ups and downs, as the trading itself, however I managed to cover any losses I encountered.

I think my experience helps, as I am a forex trader since 2007. If you ask me what my main goal is, I will reply with no hesitation I plan to win Tesla! This is my advice and appeal to all the traders out there be trained and disciplined to obtain good results!

Are you a pro like our winner or a novice trader, looking for new successful investments? Do you think it is important to spend all your time performing short-term orders or do you prefer a few long-term trades? Do you know some techniques that will help you to find yourself on top of our contest?Discover you trading path join OctaFX Supercharged real contest!

Winning OctaFX Supercharged real contest will bring you a double victory top-notch prizes and your real account profit! Its 19 days left to win next iPhone 6 register in OctaFX Supercharged real contest!

Electrify your trading with OctaFX!

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

Brazilian senate report: Bitcoin isn't ready for regulation – CoinDesk

FXStreet (Barcelona) - CoinDesk Analysts share the Brazilian senate’s report which examines the need for regulating cryptocurrencies, further noting that the document suggests Bitcoin should not be regulated at the moment.

Key Quotes

“A new study commissioned for the Federal Senate of Brazil has sought to examine how the spread of bitcoin and other digital currencies could impact Brazil's economy, and whether formal regulation is necessary for the domestic industry.â€

“Authored by Cesar Rodrigues van der Laan, a researcher at Banco Central do Brasil, the 18-page document concludes that Brazil should not immediately regulate bitcoin, arguing that there is not enough activity in local markets to warrant such rulemaking.â€

“The paper goes on to highlight the varied response regulators have taken to bitcoin around the world, citing the stance taken by Russia, which has taken active steps to ban bitcoin, and the US, where state regulators are seeking to establish a framework for the industry.â€

“Notably, the paper advocates that Brazil follow a similar path to the US, if and when it decides to introduce regulation for the industryâ€

“The statement marks the third time a major authority in Brazil has issued a statement on bitcoin this year, following Banco Central do Brasil's warning in February and an April decision by the Receita Federal, the country's tax authority, that it would treat digital currencies as financial assets.â€

“Overall, the paper suggests that bitcoin may hold the most long-term promise as a cross-border payment system, though one that would require a regulatory framework at a later date.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 22, 2014

OctaFX.Com News Updates

-

Bearish bets on the US 10-yr treasury reach a 4-year high - CFTC

FXStreet (Mumbai) - The Commodity Futures Trading Commission (CFTC) released for the week ended Dec. 16 showed traders added to their overall bearish bets on the US 10-yr treasury notes, taking the cumulative bearish bets at a 4-year high.

For the week ended Dec. 16, the non-commercial futures contracts of the 10-year treasury notes, primarily traded by large speculators and hedge funds, totaled a net position of -258,250 contracts, which is a weekly decline of 56,915 contracts, from the previous week’s total of -201,335 net contracts. Contrary to the bearish bets on the treasuries, the yield on the 10-Year treasury note declined from 2.22% to 2.07% during the reporting period.

The rise in bearish bets may have been due to the widespread belief that the Federal Reserve (Fed) at its Dec. 17 meet, shall indicate a sooner-than-expected interest rate hike in the US. The 10-yr yield currently trades at 2.172%; marginally above the 5-DMA located at 2.17%.

10-yr Treasury yield Technical Levels

The yield has an immediate support located at 2.17% (5-DMA), under which losses could be extended to 2.136% (10-DMA). Meanwhile, resistance is seen at 2.20% and 2.225% respectively.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 22, 2014

OctaFX.Com News Updates

-

EUR/GBP recovers ground after 4 days of losses

FXStreet (Córdoba) - The euro bounced off a 2-year low versus the dollar and edged higher against the pound and the yen as risk aversion eased across financial markets.

EUR/GBP is rising after four consecutive trading days of losses, having hit a daily high of 0.7858 in recent dealings. Liquidity remains low and the economic calendar is pretty light for the day offering little inspiration to currencies. Investors will be watching tomorrow’s UK GDP data release.

EUR/GBP levels to watch

At time of writing, EUR/GBP is trading at 0.7848, recording % gain on the day, and with immediate resistances lining up at 0.7900 (psychological level/20-day SMA) and 0.7925 (Dec 19 high). On the flip side, supports are seen at 0.7812 (Dec 19 low) and 0.7800 (psycological level) ahead of 0.7765 (2014 low Sep 30).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 22, 2014

OctaFX.Com News Updates

OctaFX.com - Keep trading we'll take care of the rest

in Forex Brokers

Posted

OctaFX.com-How IB program works!

How it works

How to become an IB?

Open a partner account at OctaFX.

Receive your referral link in the "IB Area" section of your Personal Area at OctaFX.

That's it, you are now an IB for OctaFX!

IB conditions!

Promo items for IB.

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!