-

Posts

3069 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Posts posted by OctaFX_Farid

-

-

EUR/JPY drops to 7-week lows

FXStreet (Córdoba) - EUR/JPY broke below 144.70 after the release of a weak ISM report in the US that boosted the yen across the board. The pair dropped from 145.00 to 144.33 in a few minutes, hitting the lowest price since mid November.

EUR/JPY levels

The decline found support above the 144.30 area and it was trading at 144.50, down 0.32% for the day. Below support levels might lie at 144.00, 143.65 (Nov 5 high) and 142.95.

To the upside, resistance could be located at 144.70 (Dec 30, 31 low), 145.30 and 145.55 (Dec 31 high).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 02,2015

OctaFX.Com News Updates

-

US ISM disappoints, but job creation remains strong – ING

FXStreet (Barcelona) - James Knightley, Senior Economist at ING, explains that today’s US ISM Manufacturing release disappointed by coming out below than expectations at 55.5, but better employment numbers point towards a decent Labour Report in the coming week, anticipating wages to move higher and unemployment to fall further.

Key Quotes

“The ISM manufacturing index for December has come in at 55.5, down from 58.7 in November. This is disappointing given the consensus was 57.5 and follows the trend seen elsewhere around the world today. Nonetheless, it still suggests that the US economy is growing strongly, roughly at trend of around 3%, which is well above the rate seen in other mature developed economies.â€

“The details show that production fell to 58.8 from 64.4 while new orders declined from 66.0 to 57.3 with net exports dropping to 52 from 55.5. There was better news on employment though, which rose to 56.8 from 54.9. This offers some hope that next week’s Labour Report should be decent. The current consensus is 240,000 versus the 321,000 outcome in November.â€

“We also expect to see wages creep higher next week and the unemployment to fall further so the data remains consistent with very gradual Federal Reserve policy tightening later this year and ongoing dollar strength.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 02,2015

OctaFX.Com News Updates

-

Can US raise rates in 2015 amidst global concerns? – RBS

FXStreet (Barcelona) - The Research Team at RBS notes that today’s ISM release will help determine the answer to whether US will raise rates amidst global concerns.

Key Quotes

“For the US, the critical question of "can the US go it alone amidst these global concerns, and raise rates in 2015, even modestly?" remains. Today's ISM release will help determine if the base case answer in the markets continues to be "yes," and if the ongoing equity market rise continues to send the message that even if the Fed does so, riskier assets should be just fine.â€

“Some of this I believe is the current impression that even as rates rise, it will happen in a "not too hot not too cold" fashion – rate rises won't be too hot or fast given the global outlook and local inflation backdrop, while the cold coming from overseas is to be met with asset boosting stimulus abroad, helping all global assets.â€

“This may end up being the case, but I have doubts that even if it is, we will get there without any volatility, minor market "accidents," or periods of concern that one side of the other will indeed be "too hot" or "too cold.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 02,2015

OctaFX.Com News Updates

-

----------------------------

EUR falls to 4.5yr low, breaking below 1.2043 (2012 low) – Scotiabank

FXStreet (Barcelona) - Camilla Sutton CFA, CMT, Chief FX Strategist at Scotiabank shares that EUR fell to a 4.5yr low, breaking below 1.2043 (2012 low), on soft PMIs & Draghi’s comments that price stability risks have increased, and anticipates the pair to head towards 1.1800 levels towards 2015-end.

Key Quotes

“EUR is weak, having lost a further 0.5% since the close of 2014; breaking below the July 2012 low of 1.2043; opening up the next level of resistance at 1.1877, the 2010 low. The combination of soft PMI data and dovish comments by ECB President Draghi have weighted heavily on the currency.â€

“The final December Eurozone manufacturing PMI came in at 50.6, still in expansion and above the November dip to 50.1, but disappointing the expectation for 50.8. In addition, ECB President Draghi commented in Germany’s Handelsblatt that “the risk that we don’t fulfill our mandate of price stability is higher than it was six months agoâ€, highlighting once again that the ECB is in technical preparations to alter the size, speed and composition of its current asset buying program.â€

“The next ECB meeting is January 22nd and there is already building anticipation as to the action the central bank is likely to take.â€

“We expect EUR to trend lower throughout 2015 and hold a yearâ€end target of 1.1800.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 02,2015

OctaFX.Com News Updates

-

----------------------------

Data ahead: US December ISM Manufacturing PMI expected to decline – TDS

FXStreet (Barcelona) - Shaun Osborne and Martin Schwerdtfeger, FX Strategists at TD Securities, preview the data ahead for US and Canada, and anticipate the US December Manufacturing PMI to decline modestly to 56.3 from previous 58.7.

Key Quotes

“The first US indicator of 2015 will be the final Dec print for Markit’s US Manuf PMI, which is seen rising modestly to 54.0 from a preliminary reading of 53.7.â€

“Nov Construction Spending will be released at 10.00ET, and the market calls for a 0.4% monthly gain (1.1% prior).â€

“The Dec ISM Manuf PMI — also out at 10.00ET — is expected to decline modestly to 56.3 (mkt 57.5) from a particularly strong 58.7 in the prior month, showing some deterioration in momentum but continuing to signal a strong growth handoff into 2015; Prices Paid are expected to fall further to 43.5 (44.5 prior).â€

“In Canada, the RBC Manuf PMI for Dec will be released at 9.30ET; there is no market call, Nov came in at 55.3 and the index has been steadily rising since Jan last year.“

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 02,2015

OctaFX.Com News Updates

-

----------------------------

FX outlook for 2015 – Scotiabank

FXStreet (Barcelona) - Camilla Sutton CFA, CMT, Chief FX Strategist at Scotiabank, shares the FX outlook for 2015, anticipating broad USD strength to create a pattern similar to 2014 among the majors.

Key Quotes

“In 2014, NOK and SEK were the worst performing primary currencies, losing 18% each; followed by JPY and EUR, who lost 12% and then the commodity currencies of AUD and CAD who lost just over 8% each, leaving GBP as the outperformer, having lost just 6% against the USD but gaining ground against all the other majors.â€

“Looking out to 2015, we expect broad USD strength, with a similar pattern among the majors, where EUR and JPY lose the most ground, and GBP weakens against the USD but outperforms both EUR and JPY. AUD and CAD are likely to continue to weaken.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 02,2015

OctaFX.Com News Updates

-

Euro rapidly approaching June 2010 low of $1.1877 – BBH

FXStreet (Barcelona) - The Growth Aces Research Team notes that Draghi strengthened QE bets by commenting that the ECB was in preparations to adjust the QE measures to keep the inflation near its target, leading the EUR to make a fresh low at 1.2035.

Key Quotes

“European Central Bank President Mario Draghi said the risk of the central bank not fulfilling its mandate of preserving price stability was higher now than half a year ago, and reiterated its readiness to act early this year should it become necessary.â€

“Euro zone inflation stands at 0.3%, far below the ECB's target of just under 2%. Draghi said: “We are in technical preparations to adjust the size, speed and compositions of our measures early 2015, should it become necessary to react to a too long period of low inflation. There is unanimity within the Governing Council on this.†He added that government bond purchases were among the tools the ECB could use to fulfill its mandate.â€

“The EUR/USD fell to 1.2035 after Draghi strengthened expectations for quantitative easing in the Euro zone. That was the lowest level since June 2010.â€

“We were looking for a correction in the EUR/USD. However, breaking below the level of 1.2100 fueled bearish sentiment.â€

“Our strategy now is to sell EUR/USD at 1.2180. If our order is filled the target will be 1.1950 (just below daily low on June 6, 2010).â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 02,2015

OctaFX.Com News Updates

-

Euro rapidly approaching June 2010 low of $1.1877 BBH

FXStreet (Barcelona) - The Brown Brothers Harriman shares the FX performance for majors, and suggests that the EUR/USD pair is rapidly approaching the June 2010 low of 1.1877 after it made a fresh low at 1.2035 levels.

Key Quotes

The euro broke below the mid-2012 low to trade at $1.2035, rapidly approaching the June 2010 low of 1.1877. Euro-area final PMI manufacturing for December came in slightly lower at 50.6, but more significantly, Draghi made some more dovish comments during an interview to a German newspaper yesterday. He reinforced the ECBs reediness to act and his concerns about deflation.

The New Zealand dollar is the weakest major currency on the day, falling to $0.7750 against the dollar, but still well within recent ranges.

The pound is also underperforming, falling to a 16-month low of 1.5470 after a weaker UK PMI figure for December, at 52.5 compared with 53.6 expected.

The dollar is back above the ¥120.0 level against the yen, in part supported by comments by BoJ governor Kuroda saying that the bank still has tools to meet the CPI target.

The Indonesian rupiah fell over 1% following a shockingly weak set of trade prints for December. Exports fell -14.5% y/y (exp. -4.5%) and imports were -7.3% (exp. +0.1%), leading to a -$426 mln trade deficit. The ruble is back on the defensive again, falling 1.0% against the basket.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 02,2015

OctaFX.Com News Updates

-

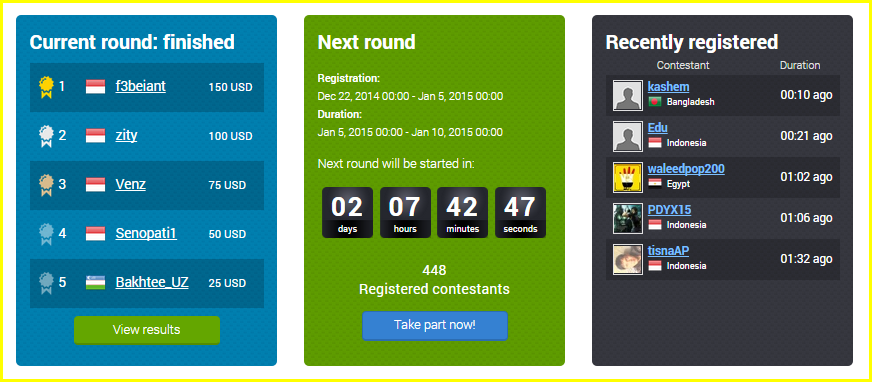

OctaFX.com-OctaFX cTrader demo contest one week, 5 prizes, ultimate competition!

The main aim of the competition remains the same while environment changes: trade your cTrader demo account and end the week in highest profit to receive the prize from OctaFX. The contest round lasts one week from Monday Market opening to Friday Market closing! Prize fund of $400 is distributed between five lucky traders.Prize fund of $400 is distributed between five lucky traders:

Contest rules and regulations

View round standings

Take part now!

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

Peru Inflation climbed from previous -0.15% to 0.23% in December

Read more in Forex News

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 01,2015

OctaFX.Com News Updates

-

ECB won by targeting Foreign Reserves – SG

FXStreet (Guatemala) - Sebastien Galy, analyst at Societe Generale explained that the EUR/USD is now most likely a sell on rallies.

Key Quotes:

“…as foreign reserves reallocate into the higher yielding UST curve helping to cap the back end and likely investing in some key EM curvesâ€.

“This confirms that the ECB won the game on EUR/USD by changing the dynamic of reserve diversification into EUR which had kept EUR very expensive and deflationary pressures considerableâ€.

“Reserve selling should pressure EUR/USD lower the prospect of a Greek election increases credit risk in the Eurozoneâ€.

“It also increases the odds of ECB easing as does ever lower oil prices. Faced with these twin hammers on EUR reserves, the amount of EUR selling may remain considerable helping the downward EUR/USD trendâ€.

“Compensating this partly are hopefully rising export revenues as the EUR weaken. The Japanese experience suggests considerable patience on this mechanismâ€.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 01,2015

OctaFX.Com News Updates

-

EUR/USD falls below 1.2100, ends the year on the back foot

FXStreet (Córdoba) - The EUR/USD’s selloff extended to fresh cycle lows sub 1.2100 in thin trading on New Year’s Eve, putting the euro on track for a 12% annual decline.

EUR/USD pierced the 1.21 mark and hit a low of 1.2096, last seen July 2012, as the dollar received a final boost to bid farewell the 2014. The shared currency remains vulnerable amid divergent ECB/FOMC monetary policy outlooks coupled with political uncertainty in Greece, with the 2012 low of 1.2041 coming closer into sight.

At time of writing, EUR/USD is trading at 1.2105, recording a 0.41% loss on the day. At the same time, the pair is headed for its sixth monthly loss in a row, having fallen all the way from this year peak of 1.3993 struck in May.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 01,2015

OctaFX.Com News Updates

-

EUR/JPY consolidated through moves in the greenback

FXStreet (Guatemala) - EUR/JPY is trading at 144.98, down -0.22% on the day, having posted a daily high at 145.61 and low at 144.82.

EUR/JPY is consolidated through the greenback as its rallies against the Euro, printing new yearly lows into the 1.2000’s, and the Yen is punished back up towards 120.00 vs the US dollar.

Spikes over thin trading have been the theme over the last number of sessions of the year, but significantly, the spikes are hitting key technical levels that will be paid attention to when full markets return and maybe indicating the apatite for a stronger greenback into 2015. The EUR/JPY cross will also be affected by the domestic policies of the ECB and Abenomics for Japan and associated risk events such as the Greek elections and QE. This offers the Yen some support in an environment of weak fundamentals that are offset by the supportive impact of recurring periods of risk aversion, as Eric Theoret, Currency Strategist at Scotiabank explained.

Technically, however, EUR/JPY remains under pressure and changes hands in bearish territory. The cross is on course to test the 2-month support line at 143.90, as signified by Karen Jones, chief analyst at Commerzbank, and notes that the 55-day ma reinforces this at 142.78.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 01,2015

OctaFX.Com News Updates

-

Investors paring back Yen risk - Scotiabank

FXStreet (Guatemala) - Eric Theoret, Currency Strategist at Scotiabank noted the price action surrounding USD/JPY.

Key Quotes

"USD/JPY is consolidating just below 119.50, having attempted and failed to break above Tuesday’s close given the deterioration in broader market sentimentâ€.

“The considerable decline in both long and short JPY positions detailed in Tuesday’s CFTC report suggests that investors are paring back JPY risk in an environment whereby weak fundamentals are offset by the supportive impact of recurring periods of risk aversion, with measures of implied volatility putting JPY between AUD and NZD -currencies typically associated with much greater risk."

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 01,2015

OctaFX.Com News Updates

-

Crude oil hits fresh multi-year lows

FXStreet (Córdoba) - Oil prices extended its decline during the last trading day of the year amid oversupply concerns.

Crude oil fell more than 2% and hit a fresh 5-year low of $52.68 a barrel before recovering somewhat. Oil is trading at $53.35/bbl, still on track to post a 43% loss in 2014, its biggest annual decline since 2008, as the OPEC refrained from cutting output to keep the price high.

The latest US government report on oil inventories showed stockpiles decreased by 1.8 million barrels during the last week. On the other hand, the American Petroleum Institute reported Tuesday US crude inventories rose by 760,000 barrels last week versus expectations of a 100,000 barrels decline.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 01,2015

OctaFX.Com News Updates

-

USD/CHF at highs since July 2012

FXStreet (San Francisco) - The USD/CHF is enjoying its negative correlation with the EUR/USD and after a 35-pip rise from 0.9890, the pair jumped to trade at highs since July 2012 at 0.9925.

Regarding the EUR/USD, it pushed lower and hit a fresh 29-month to bid farewell to the year 2014 as euro weakened following London's close.

Currently, USD/CHF is trading at 0.9910, up 0.20% on the day, having posted a daily high at 0.9928 and low at 0.9879. The hourly FXStreet OB/OS Index is showing overbought conditions, alongside the FXStreet Trend Index which is slightly bullish.

USD/CHF levels

If the pair consolidates gains above 0.9900, next resistances are at 0.925 and 1.0000. To the downside, supports are at 0.9900, 0.9890 and 0.9880.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 01,2015

OctaFX.Com News Updates

-

AUD/USD erased gains and fell below 0.8170

FXStreet (Córdoba) - AUD/USD weakened and reversed the daily trend falling 40 pips during the last three hours. The pair failed to hold above 0.8200 and dropped to 0.8168, reaching a fresh daily low.

The aussie failed to hold to gains after trading at 2-week highs while the US dollar gained momentum across the board, hitting fresh highs after Wall Street opening bell.

AUD/USD technical levels

To the downside, support levels might lie at 0.8155 and below at 0.8120 (Dec 30 low) while to the upside resistance could be located at 0.8190, 0.8215 (daily high) and 0.8255.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 01,2015

OctaFX.Com News Updates

-

OctaFX.com-50% Bonus on each Deposit!

OctaFX is all about making your trading experience convenient and outstanding, driving forex trading to a whole new level. Deposit to your account and we will give you a bonus of 10% to 50% of your deposit for free! This is a perfect way to increase total amount of funds in your account. All you need to do is deposit to your real account and verify it. Please carefully read the promotion rules below

Promotion rules

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

Crude oil hits fresh multi-year lows

FXStreet (Córdoba) - Oil prices extended its decline during the last trading day of the year amid oversupply concerns.

Crude oil fell more than 2% and hit a fresh 5-year low of $52.68 a barrel before recovering somewhat. Oil is trading at $53.35/bbl, still on track to post a 43% loss in 2014, its biggest annual decline since 2008, as the OPEC refrained from cutting output to keep the price high.

The latest US government report on oil inventories showed stockpiles decreased by 1.8 million barrels during the last week. On the other hand, the American Petroleum Institute reported Tuesday US crude inventories rose by 760,000 barrels last week versus expectations of a 100,000 barrels decline.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 31, 2014

OctaFX.Com News Updates

-

USD/CHF at highs since July 2012

FXStreet (San Francisco) - The USD/CHF is enjoying its negative correlation with the EUR/USD and after a 35-pip rise from 0.9890, the pair jumped to trade at highs since July 2012 at 0.9925.

Regarding the EUR/USD, it pushed lower and hit a fresh 29-month to bid farewell to the year 2014 as euro weakened following London's close.

Currently, USD/CHF is trading at 0.9910, up 0.20% on the day, having posted a daily high at 0.9928 and low at 0.9879. The hourly FXStreet OB/OS Index is showing overbought conditions, alongside the FXStreet Trend Index which is slightly bullish.

USD/CHF levels

If the pair consolidates gains above 0.9900, next resistances are at 0.925 and 1.0000. To the downside, supports are at 0.9900, 0.9890 and 0.9880.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 31, 2014

OctaFX.Com News Updates

-

AUD/USD erased gains and fell below 0.8170

FXStreet (Córdoba) - AUD/USD weakened and reversed the daily trend falling 40 pips during the last three hours. The pair failed to hold above 0.8200 and dropped to 0.8168, reaching a fresh daily low.

The aussie failed to hold to gains after trading at 2-week highs while the US dollar gained momentum across the board, hitting fresh highs after Wall Street opening bell.

AUD/USD technical levels

To the downside, support levels might lie at 0.8155 and below at 0.8120 (Dec 30 low) while to the upside resistance could be located at 0.8190, 0.8215 (daily high) and 0.8255.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 31, 2014

OctaFX.Com News Updates

-

USD/CHF rises back above 0.9900

FXStreet (Córdoba) - The US dollar strengthened across the board ahead of the last trading session in Wall Street and pushed USD/CHF back above 0.9900.

The pair printed a fresh daily highs at 0.9910 and approached 2014 highs that lie at 0.9918 (Dec 30). In the US, initial jobless claims rose more than expected to 298.000 last week but despite the economic report, greenback continued to rise in the market.

USD/CHF is rising 0.17% today and over the year has gained more than 11%, having the best year since 2005.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 31, 2014

OctaFX.Com News Updates

-

GBP/USD rejects the 1.5620 and falls to test MA 200 hours at 1.5575

FXStreet (San Francisco) - The rally of sterling against the dollar from 1.5550 found resistance at 1.5620 area, where the pair experienced a selling interest that sent it back to test the level of MA 200 hours of 1.5575.

Currently, GBP/USD is trading at 1.5576, up 0.13% on the day, having posted a daily high at 1.5622 and low at 1.5550. The hourly FXStreet OB/OS Index is showing neutral conditions, alongside the FXStreet Trend Index which is slightly bullish.

Ealier in the day, the GBP/USD rose since it was pressured to the upside from the EUR/GBP decline to lows since October. On a bigger timeframe, pound is on track to post its sixth monthly loss in a row in December and the year nearly 6% lower.

GBP/USD levels

Below the 1.5575, the GBP/USD will find supports at 1.5550 and 1.5500. To the upside, resistances are at 1.5620, 1.5660 and 1.5680.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 31, 2014

OctaFX.Com News Updates

-

EUR/USD approaches 2014 lows

FXStreet (Córdoba) - After hovering around 1.2150 during a few hours EUR/USD broke to the downside and printed a fresh daily low at 1.2130, approaching yesterday’s low that lie at 1.2122.

Economic data from the US showed an increase of initial jobless claims from 281.000 to 298.000, above expectations of 290.000. Despite the worst-than-expected data EUR/USD continued to move to the downside, making no rebound.

The pair remains under pressure, trading slightly above daily lows, as the US dollar gained momentum across the board, with crude oil trading at fresh multi-year lows on the last trading day of 2014.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 31, 2014

OctaFX.Com News Updates

OctaFX.Com - Financial News and Analysis

in Fundamental Analysis

Posted

EUR/USD: Not much in the way until 1.1900 – FXStreet

FXStreet (Barcelona) - Valeria Bednarik, Chief Analyst at FXStreet, shares that with the technical indicators heading south and the daily charts presenting a strong bearish momentum, there is not much in the way for EUR/USD pair until 1.1900 levels if it breaks below 1.2000.

Key Quotes

“The EUR/USD pair debut in this 2015 sees it dangerously close to the 1.2000 level for the first time since June 2010â€

“Data was far from encouraging both shores of the Atlantic, but the dollar rules anyway: as a new month starts, market attention shifts to Central Banks possible movements, with the ECB expected to introduce some further stimulus as deflation and lack of growth become more evident month after month.â€

“The US by opposition, will release next week its employment figures, and there are no signs the strong growth seen on previous months will suffer a setback.â€

“Technically, the weekly chart of the EUR/USD pair shows that price continues to slide below its moving averages, whilst indicators head south below their midlines, with RSI around 25 after a failure attempt of correcting higher, and with no bottom yet confirmed in the indicator.â€

“In the daily chart indicators present a strong bearish momentum also supportive of a continued decline.â€

“The immediate supports stands at the 1.2000 psychological figure, and if broken, there is little in the way down to the 1.1900 level. There’s a possibility this last gives up next week, and it that case the next big long term support stands in the 1.1650 area.â€

“Last December week low around 1.2160 is the immediate resistance level, followed by 1.2250 price zone. Upward movements up to this last are possible but not likely, and market players will see those advances more as selling opportunities than as signs of a bottom.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 02,2015

OctaFX.Com News Updates