-

Posts

3069 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Posts posted by OctaFX_Farid

-

-

USD closes 2014 just shy of its cycle-high TDS

FXStreet (Barcelona) - Shaun Osborne and Martin Schwerdtfeger, FX Strategists at TD Securities, share that USD struggled in the morning NA session, and closed lower on the day after seeing a fresh cycle high earlier in the day.

Key Quotes

Equities firmly in the red across the board, lower albeit just moderately US Treasury yields, a stronger JPY, and higher gold prices checked most, if not all the boxes of a risk-off day yesterday.

The USD struggled during the morning NA session and was unable to recover, closing lower overall on the day. However, to put things on perspective, these losses came on the heels of a fresh cycle high for the greenback earlier in the day, and, despite the USDs further modest decline since yesterday, the big dollar will most likely end 2014 just a few points shy of yesterdays multi-year high.

Indeed, it seems the FX market is in full holiday mode already. Otherwise, ECBs Executive Board member Praet comments about the impact of a further decline in crude oil prices since the cut-off date for the December economic projections implying a high risk of negative headline CPI for a good portion of 2015, which in his opinion calls for urgent action, should had seen EURUSD at least a few points lower than where the pair sits now only two points below yesterdays close.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 31, 2014

OctaFX.Com News Updates

-

OctaFX.com-Happy New Year to all!

OctaFX wishes Happy New Year and we hope you stay with us in 2015 to witness novel exciting promotions, improvements of our trading conditions and introduction of groundbreaking services and new payment options!

Let your trades be more profitable, your experience with us always positive, and your trading success inevitable!

Thank you for sharing year 2014 with us and see you in 2015!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

USD/JPY consolidates below 120.00

FXStreet (Córdoba) - USD/JPY dropped sharply from 120.60 and bottomed at 119.16, hitting the lowest price since December 19. Afterwards bounced to the upside, but the recovery was capped by 119.80.

Currently the pair is hovering around 119.50, more than a hundred pips below the price it closed on Monday, having so far the worst day in almost two weeks.

The Japanese currency is the best performer across the board on Tuesday, probably boosted by risk aversion and a bearish correction in the USD/JPY after rallying more than 400 pips since December 17.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 30, 2014

OctaFX.Com News Updates

-

EUR/USD: Little activity as markets eye US consumer confidence – MP

FXStreet (Barcelona) - Kenny Fisher, Currency Analyst at Market Pulse, notes that the EUR/USD pair continues to trade quietly in the mid-1.21 range, as markets await the US consumer confidence report to be released today.

Key Quotes

“EUR/USD continues to trade quietly in the final year of 2014. In Tuesday’s European session, the pair is trading in the mid-1.21 range. The euro is struggling, having lost about 350 points in the past two weeks. On the release front, Spanish CPI posted a sharp decline of 1.1%, while Eurozone Private Loans came in at -0.9%, matching the forecast. In the US, today’s highlight is CB Consumer Confidence. The markets are expecting a strong reading for December, with the estimate standing at 94.6 points.â€

“EUR/USD edged lower in the Asian session, testing support at 1.2143. The pair has reversed directions in the European session and posted gains.â€

“1.2143 is a weak support level. 1.2042 is next. 1.2286 remains a strong resistance line.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 30, 2014

OctaFX.Com News Updates

-

EUR/USD bearish tone prevails FXStreet

FXStreet (Barcelona) - Valeria Bednarik, Chief Analyst at FXStreet, explains that the bearish tone for the EUR/USD pair prevails, which could take the pair towards the 1.2080 price zone if it breaks below its daily low at 1.2123.

Key Quotes

The EUR/USD pair extended its decline down to 1.2123, fresh 2-year low, before profit taking took over the market. The dollar is down across the board albeit limited, in thin winter-holiday markets. Having reached a daily high of 1.2186, the EUR/USD pair trades around former year low at 1.2160, far from suggesting a bottom has been reached.

Technically, the 4 hours chart for the EUR/USD shows that price was unable to overcome its 20 SMA that continues to offer dynamic resistance around 1.2185, whilst momentum holds below 100 and RSI turns south around 37 after correcting oversold readings.

Overall, the bearish tone prevails, with a break below the daily low probably seeing the pair extending its decline down to 1.2080 price zone.

Profit taking and risk aversion on the other hand, may see the pair accelerating north, with a break above the daily high favoring an upward extension up to 1.2220 price zone.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 30, 2014

OctaFX.Com News Updates

-

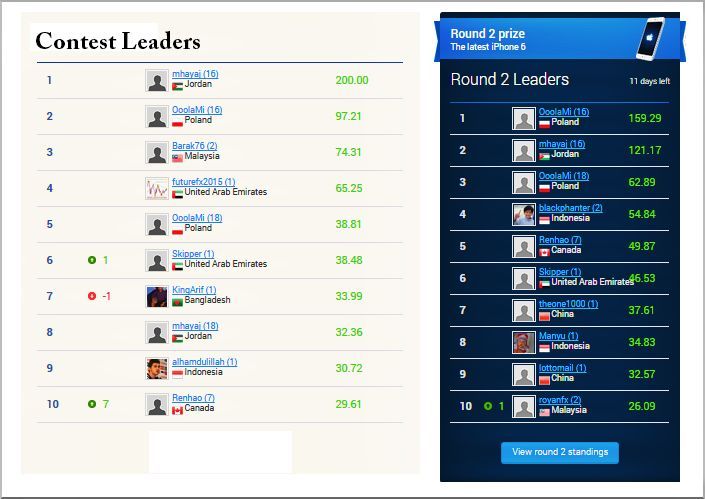

OctaFX.com-OctaFX Supercharged REAL CONTEST current position!

Win Tesla Model S, Smart Fortwo or Renault Twizy!

Open a Contest Account and Deposit it.

Trade and receive achievements.

Interact with other traders.

Win one of 10 amazing prizes.

View contest standings

Stand out for outstanding with OctaFX!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

EUR/USD fails to hold above 1.2200

FXStreet (Córdoba) - EUR/USD came under mild pressure and fell to the lower side of today’s range during the American session amid lack of interest and low volume.

EUR/USD reached a high of 1.2220 during the European trade but pulled back and steadied around the 1.22 mark despite the Greek vote outcome. The euro made a second attempt to consolidate above the psychological level but was rejected and dropped toward 1.2175. At time of writing, EUR/USD is trading at 1.2180, virtually unchanged on the day.

As investors assess the outlook for the Greek economy on the light of the government failure to secure majority and the snap elections, EUR/USD remains dangerously close to its 2 ½-year low scored last week at 1.2165.

EUR/USD levels to watch

In terms of technical levels, EUR/USD could find immediate supports at 1.2164 (2014 low Dec 23), 1.2133 (Aug 2 2012 low) and 1.2118 (Jul 26 2012 low) . On the other hand, resistances are seen at 1.2220 (daily high), 1.2245 (Dec 23 high) and 1.2271 (Dec 22 high).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 29, 2014

OctaFX.Com News Updates

-

AUD/USD attempting to stablise on 0.81 handle

FXStreet (Guatemala) - AUD/USD is trading at 0.8147, up 0.34% on the day, having posted a daily high at 0.8165 and low at 0.8110.

AUD/USD is attempting to stablise still and has been left in familiar ranges on the open of this week with a slight bullish bias. The pair has met supply on attempts to the upside and is blocked at 0.8160 resistance again. To the downside, and along with a strong greenback, below the recent lows in 0.8080 lies the 2010 low at 0.8068 ahead of a long-term double Fibonacci support at 0.7950/30.

Karen Jones, chief analyst at Commerzbank, explained that there are major levels of support for the market and she said she would expect to see signs of recovery down here. “We note the 13 count on the weekly chart and the weekly RSI is down…if short we would tighten stopsâ€.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 29, 2014

OctaFX.Com News Updates

-

AUD/USD attempting to stablise on 0.81 handle

FXStreet (Guatemala) - AUD/USD is trading at 0.8147, up 0.34% on the day, having posted a daily high at 0.8165 and low at 0.8110.

AUD/USD is attempting to stablise still and has been left in familiar ranges on the open of this week with a slight bullish bias. The pair has met supply on attempts to the upside and is blocked at 0.8160 resistance again. To the downside, and along with a strong greenback, below the recent lows in 0.8080 lies the 2010 low at 0.8068 ahead of a long-term double Fibonacci support at 0.7950/30.

Karen Jones, chief analyst at Commerzbank, explained that there are major levels of support for the market and she said she would expect to see signs of recovery down here. “We note the 13 count on the weekly chart and the weekly RSI is down…if short we would tighten stopsâ€.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 29, 2014

OctaFX.Com News Updates

-

USD/JPY downside limited - FXStreet

FXStreet (Barcelona) - Valeria Bednarik, Chief Analyst at FXStreet notes that technicals indicate that the USD/JPY pair is trading well above the moving averages with indicators hovering in neutral territory, suggesting that the downside for the pair is limited.

Key Quotes

“The USD/JPY pair has been trading in a tight 40 pips range since the day started, hovering around current level for most of the European session. Despite Nikkei slide on a suspected case of Ebola in Japan, the pair remains lifeless.â€

“Technically the 1 hour chart shows momentum indicator flat around 100, albeit 100 SMA continues to provide intraday support, now around 120.25.â€

“In the 4 hours chart indicators present a mild negative tone in neutral territory, whilst the price develops well above moving averages, all of which suggests the downside will remain limited.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 29, 2014

OctaFX.Com News Updates

-

USD/JPY downside limited - FXStreet

FXStreet (Barcelona) - Valeria Bednarik, Chief Analyst at FXStreet notes that technicals indicate that the USD/JPY pair is trading well above the moving averages with indicators hovering in neutral territory, suggesting that the downside for the pair is limited.

Key Quotes

“The USD/JPY pair has been trading in a tight 40 pips range since the day started, hovering around current level for most of the European session. Despite Nikkei slide on a suspected case of Ebola in Japan, the pair remains lifeless.â€

“Technically the 1 hour chart shows momentum indicator flat around 100, albeit 100 SMA continues to provide intraday support, now around 120.25.â€

“In the 4 hours chart indicators present a mild negative tone in neutral territory, whilst the price develops well above moving averages, all of which suggests the downside will remain limited.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 29, 2014

OctaFX.Com News Updates

-

USD Index short-term breakout confirmed – Sunshine Profits

FXStreet (Barcelona) - Mike McAra of Sunshine Profits, notes that the USD Index closed the week above 90 and also above the rising short-term resistance line, this confirms the short-term breakout.

Key Quotes

“The USD Index closed the week above 90 and also above the rising short-term resistance line, so the short-term breakout is confirmed. The implications for the next several days are bullish.â€

“The USD Index has just encountered a major resistance line that it needs to surpass before a rally to 92 becomes very probable – the 38.2% Fibonacci retracement levels based on the entire 2002 – 2008 decline.â€

“The Fibonacci retracements have worked for the USD Index many times in the past, so it could be the case that this level will keep the rally in check for some time. If not, and we see a confirmed breakout, then we’ll likely see another big rally – to the 92 level or perhaps even to the next retracement at 96.11.â€

“However, we would first need to see the breakout and its confirmation. For now, we have just seen a move to this critical level.â€

“While the situation in the precious metals market remains bearish, without a breakout in the USD Index, the possibility of another slide in the USD and a rally in gold, silver and mining stocks will be too big for us to think that opening short positions in the precious metals sector is justified from the risk to reward perspective.â€

“The USD Index closed the week above the critical resistance level (the 38.2% Fibonacci retracement level), but it closed only a little above it and for just one day, so the breakout is not confirmed at this time.â€

“Consequently, we don’t think that the move to 92 or higher is very probable for the USD Index at present. The implications for the precious metals market remain rather unclear at this time.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 29, 2014

OctaFX.Com News Updates

-

GBP/JPY consolidates above 187.00

FXStreet (Córdoba) - The pound retreated against the yen during the last hours but managed to hold above 187.00. Earlier the GBP/JPY pair rose to 187.78, reaching the highest price since December 12 but then pulled back.

Recently the pair bottomed at 187.11 and bounced toward 187.50, but failed so far to break above and it was trading slightly above the price it had at the beginning of the day.

During the last hours USD/JPY managed to climbed from 120.20 to 120.50 but the GBP/JPY failed to rise as the pound weakened across the board.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 29, 2014

OctaFX.Com News Updates

-

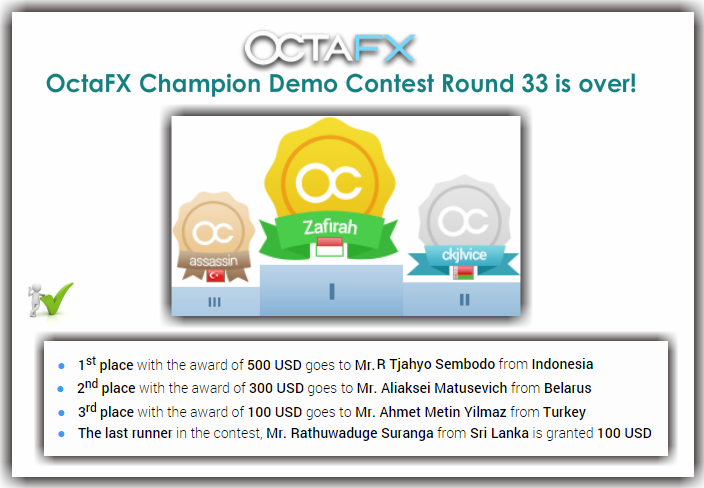

OctaFX.com-OctaFX Champion demo contest Round 33 is over!

This year more than 25000 people took part in the OctaFX Champion demo contest! OctaFX gave away $12000 as prizes and we are happy you enjoy our most long-standing promotion this much!

Today we announce last winners in the year 2014:- 1st place with the award of 500 USD goes to Mr. R Tjahyo Sem**** from Indonesia

- 2nd place with the award of 300 USD goes to Mr. Aliaksei Matusevich from Belarus

- 3rd place with the award of 100 USD goes to Mr. Ahmet Metin Yilmaz from Turkey

- The last runner in the contest, Mr. Rathuwaduge Suranga from Sri Lanka is granted 100 USD

Our winners interviews are to be published very soon! Feel free to check Company News page to get first-hand information on how OctaFX Championsspent their month competing!

We would like to thank everyone for participation. The contest was designed for our clients to estimate their abilities, gain experience and have fun competing on demo accounts! The true spirit of healthy competition reigns on the field of OctaFX Champion Demo contest! Do you want to find your name in the news next time? Register in OctaFX Champion Demo Contest Round 35!

Become the Champion with OctaFX!

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

Boxing Day Update: Euro and Yen trudge lower as Gold gains

FXStreet (London) - While much of the world sits back and enjoys the first of many upcoming turkey and stuffing sandwiches, markets have been trudging along with little in the way of volume or volatility to guide them.

The euro is down against the dollar by -0.4%, with spot dipping holding 1.2200 to where it currently trading at 1.2177. Elsewhere, yen continued to weaken against the dollar, sliding as far as 120.46 before recovering to where spot now sits at 120.39, up 0.24% on the day.

USD/CHF is up 0.42% on the day at 0.9879, offering a mirror to the euros movements, while sterling remains subdued against the dollar, up 0.06% at 1.5560.

AUD/USD is flat on the day at 0.8118 having initially dipped to find support at 0.8105, climbing to 0.8132, before declining again. USD/CAD is down -0.14% at 1.1608.

Metals are the main mover of the day, up 1.77% at $1,194.54, with COMEX Silver up 2.55% at $16.11. Energies are in the red with WTI down -0.27% at $55.69 and Brent -0.22% at $60.11. Natural Gas is below the $3 mark for the first time since 2012, trading at $2.98 , down -1.75%.

In Asia, the Nikkei 225 closed up 0.06% at 17,818.96, while in the US, markets are are all up. The DJIA is up 0.33% at 18,088.87, the S&P 500 up 1.10% at 2,089.80 and the Nasdaq up 0.81% at 4,796.71.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 26, 2014

OctaFX.Com News Updates

-

Boxing Day Update: Euro and Yen trudge lower as Gold gains

FXStreet (London) - While much of the world sits back and enjoys the first of many upcoming turkey and stuffing sandwiches, markets have been trudging along with little in the way of volume or volatility to guide them.

The euro is down against the dollar by -0.4%, with spot dipping holding 1.2200 to where it currently trading at 1.2177. Elsewhere, yen continued to weaken against the dollar, sliding as far as 120.46 before recovering to where spot now sits at 120.39, up 0.24% on the day.

USD/CHF is up 0.42% on the day at 0.9879, offering a mirror to the euros movements, while sterling remains subdued against the dollar, up 0.06% at 1.5560.

AUD/USD is flat on the day at 0.8118 having initially dipped to find support at 0.8105, climbing to 0.8132, before declining again. USD/CAD is down -0.14% at 1.1608.

Metals are the main mover of the day, up 1.77% at $1,194.54, with COMEX Silver up 2.55% at $16.11. Energies are in the red with WTI down -0.27% at $55.69 and Brent -0.22% at $60.11. Natural Gas is below the $3 mark for the first time since 2012, trading at $2.98 , down -1.75%.

In Asia, the Nikkei 225 closed up 0.06% at 17,818.96, while in the US, markets are are all up. The DJIA is up 0.33% at 18,088.87, the S&P 500 up 1.10% at 2,089.80 and the Nasdaq up 0.81% at 4,796.71.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 26, 2014

OctaFX.Com News Updates

-

Boxing Day Update: Euro below $1.2200, as yen weakens

FXStreet (London) - Price action looks sluggish in gaining momentum considering key markets such as Australia, Hong Kong, Singapore, the UK, Canada and much of Europe are all on holiday, although New York will be open for business.

EUR/USD has declined throughout todays European session, following an overnight high at 1.2201. Spot is now down 0.26% on the day and trading at 1.2194.

Cable remains more stable, up 0.02% on the day at 1.5554, trading in near ten-pip range. USD/JPY is up 0.16% as 120.29 with price also range bound between 120.40-120.20. USD/CHF is up 0.22% at 0.9860, just below the daily high at 09864.

Yesterday as much of the world ate turkey, minced pies and sipped sherry, Japan released a barrage of economic data. The National Consumer Price Index (YoY) came in at 2.4%, just below expectations of 2.5% and 2.9% previous. The jobless rate in Japan remain at 3.5%.

Looking to commodities, Gold is up 1.14% on the day at $1,186.90, just below the daily high at 1,188.80. WTI Crude is up 0.77% at 56.25, while Brent sits at 60.46, up 0.37%.

Overnight, the Nikkei closed up 0.06% at 17,818.96. Looking to US futures, we see the potential for a higher open, off the back of all time record highs in the S&P 500 and DJIA prior to Christmas in one the strongest Santa Clause rallies of all time.

The DJIA closed at a new record high of 18,030.21, the 37th record high this year, while the S&P 500 failed to close at a record high, but posted a new intraday record high on Tuesday. Presently, DJIA futures are up 0.21% at 18,025.50 while S&P 500 futures are up 0.19% at 2,082.65.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 26, 2014

OctaFX.Com News Updates

-

Boxing Day Update: Euro below $1.2200, as yen weakens

FXStreet (London) - Price action looks sluggish in gaining momentum considering key markets such as Australia, Hong Kong, Singapore, the UK, Canada and much of Europe are all on holiday, although New York will be open for business.

EUR/USD has declined throughout todays European session, following an overnight high at 1.2201. Spot is now down 0.26% on the day and trading at 1.2194.

Cable remains more stable, up 0.02% on the day at 1.5554, trading in near ten-pip range. USD/JPY is up 0.16% as 120.29 with price also range bound between 120.40-120.20. USD/CHF is up 0.22% at 0.9860, just below the daily high at 09864.

Yesterday as much of the world ate turkey, minced pies and sipped sherry, Japan released a barrage of economic data. The National Consumer Price Index (YoY) came in at 2.4%, just below expectations of 2.5% and 2.9% previous. The jobless rate in Japan remain at 3.5%.

Looking to commodities, Gold is up 1.14% on the day at $1,186.90, just below the daily high at 1,188.80. WTI Crude is up 0.77% at 56.25, while Brent sits at 60.46, up 0.37%.

Overnight, the Nikkei closed up 0.06% at 17,818.96. Looking to US futures, we see the potential for a higher open, off the back of all time record highs in the S&P 500 and DJIA prior to Christmas in one the strongest Santa Clause rallies of all time.

The DJIA closed at a new record high of 18,030.21, the 37th record high this year, while the S&P 500 failed to close at a record high, but posted a new intraday record high on Tuesday. Presently, DJIA futures are up 0.21% at 18,025.50 while S&P 500 futures are up 0.19% at 2,082.65.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 26, 2014

OctaFX.Com News Updates

-

Japan Retail Trade (YoY) came in at 0.4% below forecasts (1.1%) in November

Read more in Forex News

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 26, 2014

OctaFX.Com News Updates

-

Japan Retail Trade (YoY) came in at 0.4% below forecasts (1.1%) in November

Read more in Forex News

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 26, 2014

OctaFX.Com News Updates

-

Japan Unemployment Rate below expectations (3.6%) in November: Actual (3.5%)

Read more in Forex News

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 26, 2014

OctaFX.Com News Updates

-

Japan Annualized Housing Starts declined to 0.888K in November from previous 0.904M

Read more in Forex News

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 26, 2014

OctaFX.Com News Updates

-

Wall street closing: Merry Christmas from Wall Street

FXStreet (Guatemala) - As we close for Christmas, Stocks on Wall Street erased the gains in the last moments of the markets this week.

This put an end to a five-day run of gains in the Dow that crossed above 18,000 for the first time. The S&P 500 ended up at 2,081 falling to just 0.2%.

The US data of late has been the instigator for a positive end to the year while stocks have been supported on the Fed and their intentions for 2015. The focus from here will remain with the Fed and timings of a rate hike in the US while geopolitical tensions may be a risk that we will remain cautious around.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 26, 2014

OctaFX.Com News Updates

-

GBP/USD firming up into the close

FXStreet (Guatemala) - GBP/USD is trading at 1.5552, up 0.30% on the day, having posted a daily high at 1.5559 and low at 1.5500.

GBP/USD has risen back to the support of the 1.5540 level that was broken yesterday when the pair broke down through the 1.56 handle again. US yields improved on the back of the US data flows of this week.

We started out with the Q3 GDP offering the highest growth since 2003. Today we had the fourth consecutive decline in the US weekly jobless claims. This has underpinned the positive outlook for 2015 in the US. In the UK, growth continues to be disappointing. Technically, support lies at 1.5486, while resistance lies at recent congestion of 1.5590.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official pageonnes.

Dec 26, 2014

OctaFX.Com News Updates

OctaFX.Com - Financial News and Analysis

in Fundamental Analysis

Posted

USD/CAD bounces off 2-week lows

FXStreet (Córdoba) - USD/CAD managed to hold support at the 1.1570 area and bounced toward the 1.1600 mark at the beginning of the American session as oil extends its decline weighing on the loonie.

Meanwhile, disappointing US jobless claims data had little impact on the pair. Claims for unemployment benefits unexpectedly rose by 17K to 298K last week, recording the highest level in nearly 2 months and above the 280K expected. USD/CAD is currently trading at the 1.1600 zone, still a few pips below its opening price.

"Overall, the CAD is poised to end 2014 with a loss in excess of 8% against the USD, except for 2009, its largest annual decline since 1992", says the TD Securities team. "We believe more CAD weakness lies ahead, and our 1.19 forecast for end Q3 could come to fruition earlier in the new year, especially if crude oil prices keep sliding. Bottom line, take advantage of dips to extend USD/CAD longs".

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 31, 2014

OctaFX.Com News Updates