-

Posts

3069 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Posts posted by OctaFX_Farid

-

-

CHF shorts largest since mid 2013- SG

FXStreet (Guatemala) - Kit Juckes, Global Head of Currency Strategy at Societe Generale noted that with the US quiet for Martin Luther King Day, a post-SNB, pre-ECB contemplative mood is likely across markets.

Key Quotes:

"CFTC data show us that as of last Tuesday, the speculative end of the FX market was still increasing the size of its euro short while trimming its yen short."

"The US 10-year Treasury short was pared back more aggressively, and for the record, the Swiss franc short position was also increased to its largest size since mid-2013. I'm feeling stupider on that topic by the day."

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 19,2015

OctaFX.Com News Updates

-

Alpari appoints administrators

FXStreet (London) - Richard Heis, Samantha Bewick and Mark Firmin of KPMG LLP were today appointed special administrators to Alpari (UK) Ltd.

Alpari (UK) Ltd applied for insolvency on today following the decision on Thursday by the Swiss National Bank cease to defend the CHF1.200 level against the euro. In a statement issued on Friday, Alpari said that the move “resulted in exceptional volatility and extreme lack of liquidity.

This has resulted in the majority of clients sustaining losses which has exceeded their account equity. Where a client cannot cover this loss, it is passed on to us.â€

After a weekend spent in urgent discussions with various parties with a view to selling the company, these efforts were ultimately unsuccessful.

Commenting on the appointment, Richard Heis, partner at KPMG and joint special administrator, said: "Following the announcement by the SNB last week, Alpari (UK) Ltd sustained substantial losses as a result of negative client balances, and was faced with no other choice but to enter into special administration. We have had a number of enquiries from interested parties in relation to the company's business. We will be speaking with these parties and others over the next few days, and hope to secure a deal to preserve the business and jobs as far as possible."

He continued: "The company holds some USD98.5 million of retail client money which has been segregated and we shall be returning this to clients or making other suitable arrangements in accordance with statute and the regulatory framework at the earliest opportunity."

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 19,2015

OctaFX.Com News Updates

-

BoJ could revise lower the CPI – BTMU

FXStreet (Edinburgh) - Derek Halpenny, European Head of GMR at BTMU, expects the inflation figures in the Japanese economy to be revised lower by the BoJ in its next meeting.

Key Quotes

“The January monetary policy meeting is one in which we get an update on the semiannual GDP and inflation forecasts from the BOJâ€.

“At the meeting on 31st October, the BOJ had a core CPI forecast of 1.7% for FY2015 and 2.1% for FY2016â€.

“Given that oil prices have dropped by 40% since that date, it is highly likely that CPI will now be around 0.5ppt lower than what the BOJ had thoughtâ€.

“Indeed, assuming the crude oil price remains as it is and given the sales tax increase will drop out of annual CPI readings from April, the chances are reasonably high that core CPI could fall close toward zero percent over the summer monthsâ€.

“That will put increasing pressure on the BOJ to do more. This week’s meeting may see (as we stated last week) two lending programs being extended beyond the current deadline of Marchâ€.

“At this stage and given what’s happening in terms of the outlook for CPI, an extension of these programs would not be a surpriseâ€.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 19,2015

OctaFX.Com News Updates

-

Stronger Dukascopy Bank looks for acquisitions - FXStreet.com mistake

FXStreet (London) - After having passed through the effects of the Swiss National Bank’s surprise decision on Thursday 15 to cease defending the CHF1.200 level and the ensuing high volatility and low liquidity conditions, Dukascopy Bank has reported a 100 percent increase in account applications and looks to acquire brokers in trouble.

FXStreet announcement dated 16 January 2015 according to which Dukascopy Bank would have suffered USD 40 million losses was mistaken. Our news has been corrected here and we apologize for the confusion.

Below is the public announcement of Dukascopy Bank dated 16 January 2015:

Dukascopy Bank

CHF dramatic shift

Dukascopy Group announced that it has safely passed through the CHF dramatic price shift. It was achieved thanks to advanced execution technology, careful risk management policy and reduced leverage on EURCHF till level of 1:10.

The scenario of such shock had been anticipated four months in advance as shown in Dukascopynews published on 3rd of October 2014: "Due to the possibility of a break of the 1.2000 floor in EUR/CHF which may see significant price gaps and cause negative equity on client accounts, Dukascopy Bank is forced to implement a maximum leverage for EURCHF exposures of 1:10 as of 12 October 2014".

Dukascopy well known ECN business model and careful risk management approach proved once again to be reliable and trustworthy.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 19,2015

OctaFX.Com News Updates

-

EUR/CHF looks to the ECB – Danske Bank

FXStreet (Edinburgh) - Senior Analyst at Danske Bank Lars Christensen argued that the following next steps by the European Central Bank could prove to be crucial for the cross.

Key Quotes

“The SNB’s surprise removal of the 1.20 EUR/CHF floor has brought volatility back to global FX markets and this is likely to persist for a while, as CHF markets learn about the SNB’s new reaction functionâ€.

“The CHF will now be subject to much less predictable SNB policy moves and we cannot rule out that the SNB will have to do more (rate cuts and/or intervention) to match an upcoming ECB QE moveâ€.

“Indeed, the SNB will have a hard time justifying continued CHF strength, as deflation remains an entrenched issue for the Swiss economyâ€.

“We stress, however, that the ECB policy will be crucial for EUR/CHF in the near termâ€.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 19,2015

OctaFX.Com News Updates

-

Brent trades below USD 50/barrel

FXStreet (Mumbai) - Brent Crude prices fell below USD 50/barrel today after Iraq announced record oil production, thereby increasing concerns of supply glut.

The march futures traded 1.64% lower at USD 49.35/barrel at the time of writing, compared to the previous sessions close at USD 50.17/barrel. Prices fell from the session high of USD 50.34 on concerns of increased supply from Iraq. Iraqi Oil Minister Adel Abdel Mehdi said on Sunday Iraq pumped 4 million barrels per day (bpd) of oil in December, its highest ever.

Meanwhile, Brent was also hit by expectations of a weak Q4 GDP print in China, due for release tomorrow. The country is expected to report GDP at 7.2% year-on-year, its weakest since the 2008 crisis.

Brent Technical Levels

The immediate support is seen on the hourly charts at 49.27, under which losses could be extended to 48.73 levels. Meanwhile, resistance is seen at 50.02 and 50.34 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 19,2015

OctaFX.Com News Updates

-

OctaFX.com-Round 2 OctaFX Supercharged winner is aimed at victory!

As OctaFX Supercharged real contest grips attention of more and more traders, OctaFX team awards the second winner of the monthly prize brand new iPhone 6!

Aleksandra Michałowicz-Goc from Poland, the second monthly winner have plenty of thoughts to share with her fellow contestants and traders, who havent yet joined the spectacular race for Tesla Model S:

The competition is great! Yes, my main target is to win the main prize Tesla Model S.

I spend a lot of time at the laptop, investing in the forex, and this competition is just one of the many things I do during the day. Patience helped me a lot, I can say it is one of the major factors of my success. The other one is courage I am not afraid of either risks or losses.

My strategy is an investment with the trend. Thats how it works - I am looking for a correction and open orders at high risk, the balance is my SL(stop loss). When I am wrong and the assumptions are good, I open another account and repeat orders. It will normally imply 2-5% risk.

I slightly changed my strategy during the contest and achieved the greatest gains and the greatest losses in individual transactions: my most spectacular gain - 700% in a few days, considerable loss - 100% in a few minutes.

Aleksandra was happy to give OctaFX traders some advice!

You have to invest a lot, invest wisely, analyze errors and fix them. When you stop losing money, it will be the beginning of the road to good trader. And to my fellow contestants I say Do not look at what others are doing, set yourself a goal and implement it.Aim for Tesla S or Renault Twizy it doesn't matter! The title of OctaFX Supercharged real contest winner is priceless! Its 20 days left to win next iPhone 6 register in OctaFX Supercharged real contest now!

Electrify your trading with OctaFX!

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

USD/CHF attempts to stabilize above 0.8500

FXStreet (Córdoba) - The Swiss franc resumed the rise versus the dollar during the American session after a brief correction following yesterday outstanding rally triggered by the SNB.

USD/CHF reached a high of 0.8800 during the European trade but failed to sustain that level and retreated toward the 0.8450 zone in recent dealings. The pair has spent the day zigzagging in a wide range, without a clear direction as investors overcome yesterday’s SNB shock.

At time of writing, USD/CHF is trading at the 0.8500 zone, 16% below yesterday’s highs scored above 1.0200 before the SNB decided to remove the EUR/CHF floor.

The unprecedented turmoil unleashed by the Swiss National Bank crushed Swiss stocks, with the nation’s index losing 13% over the last two sessions, and yields on the 10-year government bonds falling below zero for the first time ever.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 16,2015

OctaFX.Com News Updates

-

SNB creates shockwaves - Rabobank

FXStreet (Guatemala) - Analysts at Rabobank noted that after more than 3 years, the SNB this week abruptly stopped trying to protect the EUR/CHF 1.20 floor.

Key Quotes:

"The SNB claimed that the overvaluation of the CHF has decreased in the past three years. In contrast, we would argue that protecting the EUR/CHF1.20 floor became too difficult in the face of renewed demand for the CHF as a safe haven asset in addition to the continued weakness of the EUR."

"The news, which was accompanied by a decision to push interest rates further into negative territory, came just one week ahead of an anticipated pledge by the ECB to launch quantitative easing which could further pressure the EUR."

"The SNB’s decision has had far reaching implications, one of which is to accelerate the broad-based downtrend in the EUR. As a consequence we have lowered our forecasts for many EUR crosses."

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 16,2015

OctaFX.Com News Updates

-

US divergent growth factors - BNP

FXStreet (Guatemala) - Alexandra Estiot, analyst at BNP Paribas explained factors around the US growth outlook.

Key Quotes:

"Plunging oil prices and a surging dollar are holding down inflationary pressures".

"In the past, these trends have had divergent effects on growth: positive for falling oil prices and negative for a stronger dollar".

"The United States has become the leading fossil fuel producing country. Consequently, it is no longer all that easy to evaluate the consequences of declining crude oil prices. Moreover, many of its trading partners will be

hard hit by falling commodity prices".

"All in all, these effects, though only temporary, will have a bigger impact on prices than on growth".

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 16,2015

OctaFX.Com News Updates

-

GBP/USD heading for weekly lows?

FXStreet (Guatemala) - GBP/USD is currently trading at 1.5113 with a high of 1.5237 and a low of 1.5112 and down 0.39% on the day.

GBP/USD is weak, or rather, the greenback is strong. The pair has been making fresh lows this month and penetrating the 1.51 handle for the low of 1.5034 made on the 8th and attempts to the upside have been capped at 1.52671.

The recent turmoil in markets post the SNB has seen the dollar start to benefit as analyst begin to predict that the outcome of the events are likely dollar favourable while positive data underpins a bullish bias in the currency. Earlier today, CPI was released at 0.8% vs 0.7% consensus and the recent release of the Michigan Consumer Sentiment beat expectations at 98.2 vs 94.1 expected.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 16,2015

OctaFX.Com News Updates

-

Reuters/Michigan consumer sentiment index jumps to 98.2

FXStreet (Córdoba) - Reuters/Michigan consumer sentiment index rose to 98.2 in January, according to preliminary estimates, recording its highest level in more than 10 years.

The index rose 4.6 from a final December reading of 93.6, also beating market’s consensus of 94.1.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 16,2015

OctaFX.Com News Updates

-

EUR/USD drops to 1.1540

FXStreet (Edinburgh) - EUR/USD accelerated its downside following further US data releases on Friday, meandering around multi-year lows near 1.1540.

EUR/USD looking for direction

The pair quickly left behind the post-SNB lows in the 1.1570 region, unable to pick up pace despite both the Industrial Production and Capacity Utilization in the US economy came in below consensus. Industrial Production contracted 0.1% inter-month in December while the Capacity Utilization decreased to 79.7% during the same period, vs. 80% expected and previous. The Reuters/Michigan index is due next, with surveys expecting an improvement to 94.1 for the present month, up from 93.6.

EUR/USD key levels

At the moment the pair is losing 0.64% at 1.1544 and a breach of 1.1505 (low Nov.12 2003) would expose 1.1445 (low Nov.11 2003). On the flip side, the initial barrier lines up at 1.1647 (hourly high Jan.16) followed by 1.1792 (high Jan.15) and finally 1.1805 (200-h MA).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 16,2015

OctaFX.Com News Updates

-

OctaFX.com-OctaFX proves its reliability in the light of recent events!

Due to the unprecedented market events on 15.01.15 caused by the changes of Swiss National banks policy resulting in high volatility in CHF cross pairs quotes many traders encountered considerable losses. During these events, OctaFX demonstrated its high reliability: being devoted to our clients, we didnt inflict any changes upon CHF cross clients trades. However, following the usual company policy we restored all negative client balances that occurred due to the fact that clients were unprepared to these rapid changes.

All the deposit and withdrawal requests are processed by the Financial department following the normal procedure. If you have any questions, dont hesitate to contact our award-winning Customer Support: [email protected].

OctaFX remains fully reliable and solvent despite the recent events. All the trades are performed according to the operational company standards. We are proud to confirm our stability and integrity. We thank our clients for staying with us and welcome new traders to try out our highly valued services!

Stand out for outstanding with OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

Swiss deflationary risks have increased- Rabobank

FXStreet (Guatemala) - Jane Foley, Senior Currency Strategist at Rabobank explained that the press release that accompanied today’s move from the SNB makes the point that the euro has depreciated considerably against the US dollar and this, in turn, has caused the Swiss franc to weaken against the US dollar.

Key Quotes:

"In these circumstances, the SNB concluded that enforcing and maintaining the minimum exchange rate for the Swiss franc against the euro is no longer justified."

"While there is sense in the central bank maintaining an optimistic spin to provide some support to inflation expectations, it is difficult to accept that the SNB wasn’t forced into today’s decision."

"Switzerland’s effective exchange rate has continued to push higher since the middle of last year in reflection of the downward pressure on EUR/CHF."

"Even assuming that the SNB may have to intervene some more to help EUR/CHF stabilise, the deflationary risks facing Switzerland appear to have increased."

"In an environment in which low interest rates are no longer proving an effective tool to counter deflation, the failure of the SNB’s floor should be lamented by policy-makers who appear to be increasing running out of policy tools."

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 15,2015

OctaFX.Com News Updates

-

Natural Gas declines after inventory data

FXStreet (Mumbai) - Natural gas prices in the US trade declined from the session highs after the data in the US showed a larger than expected drawdown in the inventories during the last week.

The February futures traded 1.76% higher at USD 3.29/mmBtu, compared to the previous session’s close at USD 3.233/mmBtu. Gas prices eased from the session high of USD 3.35 hit ahead of the data , in anticipation of a drop in the inventories. Thus, we are witnessing a classic “buy the rumor, sell the fact†trade as prices inched lower after the data confirmed a larger drop in the inventories. The EIA data showed inventories dropped 236 billion cubic feet (Bcf), beating the estimated drop of 224 Bcf, and higher than the previous week’s drop of 113 Bcf.

Natural Gas Technical Levels

The immediate resistance is seen at 3.349, above which gains could be extended to 3.4 levels. Meanwhile, support is seen at 3.236, under which Natural gas could fall sharply to 2.97 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 15,2015

OctaFX.Com News Updates

-

Silver restricted around Dec 2014 highs

FXStreet (Mumbai) - Silver advanced today, tracking the gains in Gold prices, although the metal once again finds itself stuck around the December 2014 high of USD 17.33.

Silver currently trades 0.77% higher for the day at USD 17.11/Oz levels, compared to the previous session’s close at USD 16.84/Oz levels. The metal has seen failure near Dec 2014 highs for the third consecutive session today. On the other hand, Gold prices have been able to rise above the 200-DMA levels today; trading 2% higher for the day. Moreover, Silver being a semi-industrial metal, has been unable to extend gains due to the weakness seen in other industrial metals.

Silver Technical Levels

The immediate resistance is seen at 17.21, above which the prices could test 17.33 (Dec. 10 high). Meanwhile, support is seen at 16.81 (5-DMA) and 16.5460 (100-DMA) levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 15,2015

OctaFX.Com News Updates

-

Gold at day's high after dismal US data

FXStreet (Mumbai) - Gold prices rose to a day high of USD 1264.30/Oz levels before settling slightly lower, after the regional manufacturing index in the US showed sharp decline in the activity.

The yellow metal hovers at USD 1261.51/Oz levels; up 2.11% for the day. The Philadelphia Federal Reserve manufacturing activity index declined to 6.3, missing the expected print of 18.7, and down from December’s 24.3. Earlier today, the labor department data also showed initial jobless claims rose sharply to 316K for the week ended Jan. 10, beating the estimate of 290K. Moreover, with the exception of New York Fed’s general business conditions index, all other data releases have been dismal, which supports gains in the yellow metal.

Gold may extend gains if the US stock markets extend slump later in the day.

Gold Technical Levels

The immediate resistance is seen at 1272.40, above which gains could be extended to 1282.90 levels. Meanwhile, support is seen at 1255.10 and 1244.40 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 15,2015

OctaFX.Com News Updates

-

GBP/USD wavers around 1.5200

FXStreet (Córdoba) - GBP/USD has had a quiet day considering the turbulence in FX markets triggered by Swiss National Bank decision to abandon the franc cap.

Cable fell to a low of 1.5156 as immediate reaction, but it managed to erase intraday losses and climbed to fresh daily highs at the 1.5265 area. GBP/USD has steadied a few pips above 1.5200, where it trades little changed on the day, despite GBP/CHF strong slump toward the 1.2740 zone, level last seen in 2011.

GBP/USD technical outlook

“The 1 hour chart shows price below its 20 SMA as indicators head lower around their midlines, while in the 4 hours chart the price holds above a bullish 20 SMA whilst indicators continue to aim higher after bouncing from their midlines, keeping the downside limited for nowâ€, said Valeria Bednarik, chief analyst at FXStreet.

Bednarik locates immediate resistance levels at 1.5220, 1.5275 and 1.5320, while she sees supports at 1.5180, 1.5145 and 1.5100.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 15,2015

OctaFX.Com News Updates

-

US equities to see early buying

FXStreet (Mumbai) - The stock markets in the US are likely to open higher on mixed bag of US data. The action in the major index futures indicates early buying is likely to be seen on Wall Street.

At the time of writing, the DJIA futures traded 0.26% higher at 17,409.50, while the S&P 500 futures traded 0.21% higher at 2011.00. Meanwhile, the NASDAQ futures and the Russell 2000 futures are trading 0.14% and 0.24% higher at 4151.10 and 1176.80 levels respectively. Consequently, the S&P 500 VIX futures are trading 0.49% lower at 20.53 levels.

On the data front, the labor department data showed producer prices fell by slightly less than expected in the month of December. Meanwhile, initial jobless claims climbed to 316,000 in the week ended January 10th, an increase of 19,000 from the previous week's revised level of to 297,000. Elsewhere, New York Federal Reserve released a report showing a rebound in regional manufacturing activity in the month of January.

In overseas trading, the European markets witnessed a high volatility after the Swiss National Bank surprised markets by abandoning the EUR/CHF floor at 1.2, while it reduced interest rates to -0.75%. Earlier today, most stock markets across the Asia-Pacific moved back to the upside.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 15,2015

OctaFX.Com News Updates

-

EUR/USD fall in reaction to QE might be short-lived – Growth Aces

FXStreet (Barcelona) - The Growth Aces Team expects the medium-term EUR/USD outlook to be bullish, and further add that the fall in the pair in anticipation of QE might be short lived.

Key Quotes

“The EUR/USD traders are waiting now for U.S. CPI data tomorrow. Lower-than-expected reading will probably strengthen the EUR/USD and this could be a good opportunity to get short ahead on the EUR/USD.â€

“Our baseline scenario assumed that a fall of the EUR/USD in reaction to the QE programme will be short-lived and profit-taking could lift the rate soon. We expected the medium-term outlook for the EUR/USD is slightly bullish due to possible delaying rate hikes by the Fed. However, this scenario is under threat after today’s decision of the SNB. There is a risk that a strong crisis in Europe that may be the consequence of the SNB decision may make investors turn into safe-haven assets. This means that the EUR may depreciate further against the USD."

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 15,2015

OctaFX.Com News Updates

-

USD/JPY remains below 117.00 after US data

FXStreet (Córdoba) - USD/JPY edged a few pips higher but remained capped by the 117.00 level, following the latest string of mixed US data.

US initial jobless claims rose by 19,000 to a 4-month high of 316,000 in the week ending Jan 9, above the 295,000 expected and marking its first reading above 300,000 since Thanksgiving. On the other hand, producer price index rose by 1.0% in December beating the 1.0% expected and NY Empire State manufacturing index climbed to 9.95 vs 5.00 of consensus, outweighed the negative employment reading.

USD/JPY climbed to an hourly high of 116.93 but lacked momentum to regain the 117 mark. At time of writing, the pair is trading at 116.85, still 0.38% below its opening price.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 15,2015

OctaFX.Com News Updates

-

OctaFX.com-Swap free trading with OctaFx!

OctaFX offers swap-free accounts to their clients. Whether or not your beliefs or trading strategy require swap-free trading, you can always open a swap-free account at OctaFX .

You can always apply for a swap-free account at registration, no matter whether you choose a Micro or ECN account. No overnight charges will be applied to your account. OctaFX respects various trading strategies and does its best to meet every possible client's requirements and expectations. To apply for a swap-free account please check the box "Swap-Free" when opening your account. Your account will be automatically assigned swap-free status.

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

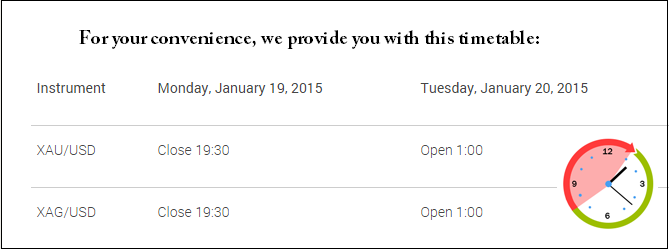

OctaFX.com-OctaFX Martin Luther King Holiday trading schedule!

OctaFX Technical Department would like you to be informed that due to the coming Martin Luther King Holiday we have altered a trading schedule for XAU/USD and XAG/USD trading instruments. Please, consider the following schedule while planning your trading: Monday, January 19, 2015 the trading on the above mentioned instruments closes at 19:30 (EET) and re-opens Tuesday, January 20, 2015 at 1:00 (EET).

Please, consider the fact that any open trades upon closure of trading hours will be rolled into the next day.

We would like to apologize for any inconvenience caused. Please, contact our Customers Support in case you have any questions. If any failures occur, please report immediately to [email protected]

Thank you for choosing OctaFX as your top-notch Forex Broker.

Stand out for outstanding with OctaFX!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Wishing you luck and profitable trading, yours truly, OctaFX!

Wishing you luck and profitable trading, yours truly,

Wishing you luck and profitable trading, yours truly,

OctaFX.Com - Financial News and Analysis

in Fundamental Analysis

Posted

Canadian dollar and crosses in technical snapshot - TDS

FXStreet (Barcelona) - Analysts at TD Securities gave us a snapshot technical analyses on the Canadian dollar and crosses.

Key Quotes:

"USD/CAD retains a positive technical bias but trend momentum has stalled in the short-term."

"EUR/CAD trades heavier, pressures low end of range."

"AUD/CAD rebound extends into former consolidation range."

"GBP/CAD tracks higher but lacks momentum for a break above key resistance at the moment."

"CAD/JPY tries to pull out of December/January dive."

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 19,2015

OctaFX.Com News Updates