-

Posts

3069 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Posts posted by OctaFX_Farid

-

-

GBP/USD drops near 1.5200

FXStreet (Edinburgh) - After a brief dip to the vicinity of the 1.5200 handle, GBP/USD recovered the 1.5220 area although it remains in the red territory.

GBP/USD eroding gains

Spot is giving away part of last weeks important upside above the 1.5200 mark, bolstered by the steadiness around the BoE and a positive PMI from the Services sector in the UK. However, the pair will remain in the spotlight ahead of the critical BoEs Quarterly Inflation Report due on Thursday and less relevant industrial and manufacturing releases on Tuesday.

From the positioning space, speculative GBP net shorts were trimmed a tad in the week ended on February 3rd, pointing to an extension of the consolidative pattern seen in the last weeks.

GBP/USD relevant levels

The pair is now losing 0.11% at 1.5219 and a breakdown of 1.5200 (psychological level) would open the door to 1.5170 (low Feb.5) and then 1.5169 (10-d MA). On the flip side, the next hurdle lines up at 1.5295 (40-d MA) followed by 1.5353 (high Feb.6) and then 1.5355 (high Jan.5).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 06,2015

OctaFX.Com News Updates

-

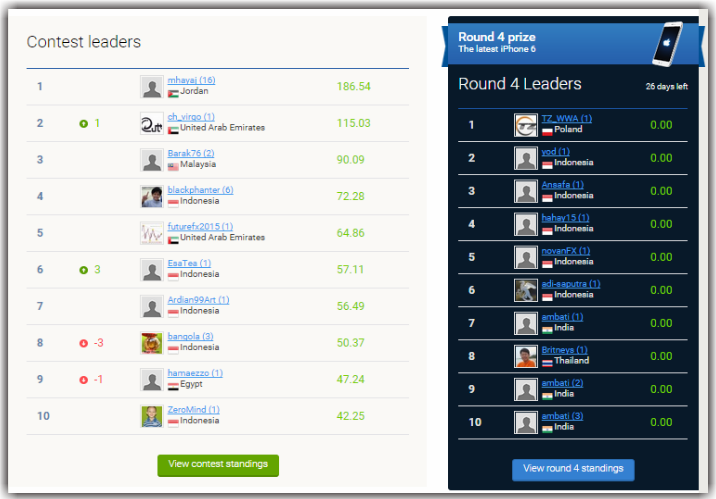

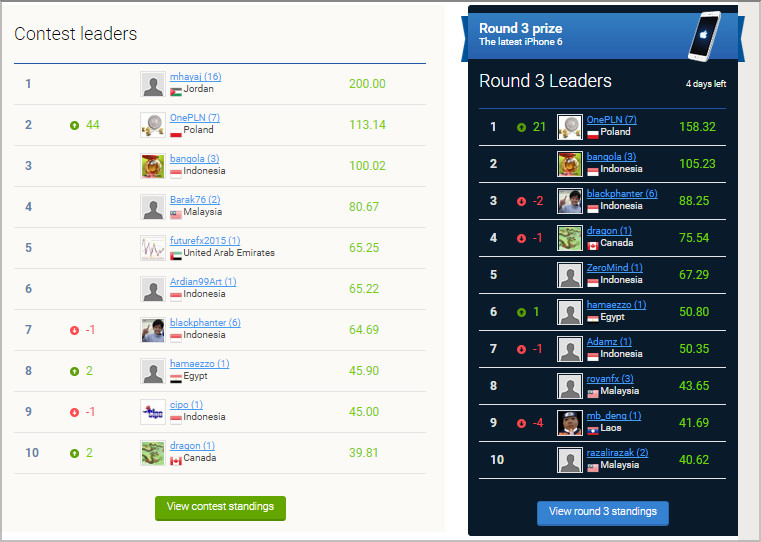

OctaFX.com-OctaFX Supercharged REAL CONTEST current position!

Win Tesla Model S, Smart Fortwo or Renault Twizy!

Open a Contest Account and Deposit it.

Trade and receive achievements.

Interact with other traders.

Win one of 10 amazing prizes.

View contest standings

Stand out for outstanding with OctaFX!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

Natural gas recovers from 2-1/2 year lows

FXStreet (Mumbai) - Natural Gas prices on NYMEX rebounded today after falling to fresh two and a half year lows in the US last session amid abundant supplies as reflected by the Energy Information Administration (EIA) data.

Trades above USD 2.60/mmBtu

The futures currently trade 0.52% higher at USD 2.614/mmBtu. Prices hit a 2-1/2 year low of USD 2.578/mmBtu in the previous session after EIA showed stockpiles fell less than expected last week. Inventories sit at 2.4 trillion cubic feet, up 24% from a year ago and just 1.2% below the five-year average. The rebound in prices is seen on a short-covering rally after the recent slump in prices.

However, the markets now bet on forecasts of near-normal weather which may continue to drag natural gas prices down.

Natural Gas Technical Levels

The immediate support is seen at 2.575 (Aug 2012 low), under which losses could be extended to 2.408 (Sept 2009 low). Meanwhile, resistance is seen at 2.63 and 2.69 levels

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 06,2015

OctaFX.Com News Updates

-

NZD/USD clings on to 0.74 handle ahead of US NFP

FXStreet (Mumbai) - NZD/USD shaved-off Aussie backed gains and traded flat as traders now eagerly await US labour market report due for release in the US session.

Struggles above 0.7400

Currently, the NZD/USD traded flat at 0.7405, wiping out previous gains on the back of solid gains in the Aussie. The kiwi lost ground as the US dollar strengthened versus the major currencies before the release of robust US jobs data.

The US dollar index, measuring the relative strength of the greenback versus six major currencies advanced close to fresh daily highs at 93.92 levels, recording a 0.21% gain on the day.

NZD/USD Technical Levels

To the upside, the next resistance is located at 0.7439 and above which it could extend gains to 0.7454 levels. To the downside, immediate support might be located at 0.7340 levels and below that at 0.7300 levels

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 06,2015

OctaFX.Com News Updates

-

AUD/USD steady above 0.7800

FXStreet (Córdoba) - AUD/USD rose during the Asian session and peaked at 0.7858, reaching the highest price since January 29 and then pulled back modestly. During the last hours it has remained steady trading around 0.7830, on a quiet session as traders await the US employment report.

The aussie is headed toward a weekly gain of around a hundred pips against the US dollar, as it recovers from multi-year lows that reached on Tuesday at 0.7625.

RBA and politics

During the Asian session the Reserve Bank of Australia downgraded its growth and inflation forecast in its monetary policy statement. Political uncertainty jumped in Australia after Luke Simpkins, announced that he would be moving a motion to have the leadership declared open, that could removed from office the current prime minister Tony Abbott, as early as next week.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 06,2015

OctaFX.Com News Updates

-

Rising inventories keep Copper in red

FXStreet (Mumbai) - Copper prices on Comex trades slightly lower today, extending losses from the previous session, however was set for its biggest weekly gain in more than two years ahead of US NFP data.

LME stocks at 13-year High

The red metal trades at 2.588 levels, having previously posted days low at 2.582 and days high at 2.615 levels. Copper prices remains pressured as the metals inventories rose yet another day, adding to signs of a glut in a market that continues to grip the copper markets.

Inventories at LME warehouse jumped 34500 metric tons, or 13%, to 284,600 tons yesterday, the highest in almost a year and sits at 13-year high.

Copper prices are expected to continue its downtrend as less demand from China, the world's biggest user of copper, is leading to excess supplies as economic activity cools-off across the all the sectors. Moreover, manufacturers and other buyers often slow purchases of the metal this time of year before the Lunar New Year holidays.

Copper Technical Levels

Copper prices have an immediate resistance located at 2.60, above which gains could be extended to 2.618 levels. Meanwhile, support is seen at 2.52 levels, below which it can extend losses to 2.50 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 06,2015

OctaFX.Com News Updates

-

OctaFX.com - Vote for OctaFX in the 2014 FX Empire Awards!

FX Empire announced the nominees for annual FX Empire Awards! OctaFX team is proud to confirm, that this time we have been chosen to represent two categories at once!

OctaFX is nominated for the Best Broker and Most Reliable Broker titles in the year 2014.

We need all your support - to vote for OctaFX click here. We would like to thank you for your appreciation in advance! The voting is open until February 16th, 2015.

We have received 2013 award for Best Customer Service Broker and hope that your votes will bring us new awards from FX Empire this time!

Support your top-notch broker - vote for OctaFX!

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

Canada Exports registered at $44.06B above expectations ($42.9B) in December

Read more in Forex News

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 05,2015

OctaFX.Com News Updates

-

OctaFX.com-How IB program works!

How it works

How to become an IB?

Open a partner account at OctaFX.

Receive your referral link in the "IB Area" section of your Personal Area at OctaFX.

That's it, you are now an IB for OctaFX!

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

US Markit Services PMI gains in January

FXStreet (London) - At 54.2 in January, the final seasonally adjusted Markit US Services Business Activity Index picked up from 53.3 in December. The index has now registered above the 50.0 no-change threshold for fifteen consecutive months, but the latest reading signalled that the rate of service sector output growth was still much weaker than the peaks seen in mid-2014.

According to Markit, slower new order growth continued to weigh on the performance of the service economy at the start of the year. The rate of new business expansion has weakened in each month since last October, and the latest rise was the least marked in almost five-and-a half years of data collection. Some firms noted that greater caution among clients had led to more subdued sales growth at the start of 2015. Meanwhile, volumes of work-in-hand (but not yet completed) increased only marginally during January, with the rate backlog accumulation easing to the slowest for six months.

Commenting on the PMI data, Chris Williamson, Chief Economist at Markit said: Markits US PMI surveys accurately anticipated the near-halving in the pace of economic growth in the fourth quarter of 2014, and suggest that the rate of expansion remained little better than 2.0 percent annualised at the start of 2015.

Companies are clearly struggling at the moment, with the surveys recording the smallest increase in new orders seen since the financial crisis six years ago amid weaker US and global economic growth and the strong US dollar.

However, the survey also found that companies remained in hiring mode, pointing to another robust non-farm payroll gain in January. At the same time, cost pressures hit a post-crisis low due to the oil price rout, which should pave the way for further falls in headline inflation in coming months.

Irrespective of the employment gain, the combination of lower inflation and slower economic growth suggests that any lifting of interest rates before mid-year is looking increasingly unlikely.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 04,2015

OctaFX.Com News Updates

-

AUD/USD short-term bearish FXStreet

FXStreet (Barcelona) - Valeria Bednarik, Chief Analyst at FXStreet, comments that technicals suggest AUD/USD outlook remains bearish in the short-term, expecting the pair to resume its decline one a break of 0.7735 levels.

Key Quotes

Australian dollar failed to extend its gains overnight, topping against the greenback around the 0.7850 price zone, and bearish in the short term, according to the 1 hour chart that shows price extending below its 20 SMA and indicators crossing their midlines to the downside.

In the 4 hours chart price is now pressuring a flat 20 SMA whilst indicators are also crossing their midlines, supporting a steadier decline particularly if 0.7735 gives up.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 04,2015

OctaFX.Com News Updates

-

OctaFX.com-OctaFX cTrader demo contest one week, 5 prizes, ultimate competition!

The main aim of the competition remains the same while environment changes: trade your cTrader demo account and end the week in highest profit to receive the prize from OctaFX. The contest round lasts one week from Monday Market opening to Friday Market closing! Prize fund of $400 is distributed between five lucky traders.Prize fund of $400 is distributed between five lucky traders:

Contest rules and regulations

View round standings

Take part now!

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

USD/JPY upside limited FXStreet

FXStreet (Barcelona) - Valeria Bednarik, Chief Analyst at FXStreet, shares the technical setup for USD/JPY, noting that the pairs upside might remain limited in the short-term.

Key Quotes

The USD/JPY trades around its daily opening, having however reached a lower low daily basis at 116.87.

The positive sentiment that sent dollar lower against high yielders, is also affecting safe-haven yen that anyway remains subdued.

The 1 hour chart for the pair shows that indicators aim higher above their midlines, although 100 SMA offers immediate short term resistance around current levels.

In the 4 hours chart indicators turned higher but remain below their midlines, whilst the price remains below its moving average, all of which should keep the upside limited in the short term.

Support levels: 117.30 117.00 116.60"

Resistance levels: 118.10 118.40 118.80

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 03,2015

OctaFX.Com News Updates

-

Recovering oil to lead USD/CAD to retrace lower Scotiabank

FXStreet (Barcelona) - Camilla Sutton CFA, CMT, Chief FX Strategist at Scotiabank, comments that as long as WTI remains above $50 USD/CAD is set to retrace lower, expecting a close below 1.2537 to lead way for 1.2390 levels.

Key Quotes

CAD is strong, having retraced over 2% from its weakest levels.

Oil prices have rallied dramatically, WTI is up 18%, since its $43.58 low. Accordingly for CAD the downward pressure has eased, laying the groundwork for significant short covering.

As long as oil continues to trend higher, there is nearâ€term upside risk for CAD (downside USDCAD).

In USDCAD terms, a close below 1.2537, the high from January 28th is important and opens up a test down to 1.2390.

As long as WTI remains above $50 we expect USDCAD to temporarily retrace lower; however in the medium term USDCAD is still vulnerable to upside risk from a fundamental backdrop that has shifted dramatically.

For the BoC the market is pricing in a 40% chance of an interest rate cut at the March 4th meeting, a 60% chance of an April 15th cut and one full cut priced in by September. This outlook combined with oil prices is imperative for the path of CAD.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 03,2015

OctaFX.Com News Updates

-

SEB: USD/JPY hanging bearishly below resistance – eFXnews

FXStreet (Barcelona) - The eFXnews Team shares SEB’s technical outlook for USD/JPY.

Key Quotes

“The market likes it better below than above dynamic resistance coming with the (Fibo-adjusted) 21day 'Kijun-Sen' and this threatens the low end of the 55day exponentially weighted moving average band (116.64)."

“Further down low points at 115.85 & 115.57 are of interest.â€

“A loss of support at those should lower sights to the lower end of the Fibo-adjusted 'Cloud', now at 114.30.â€

“A move back over 118.87 is needed to defuse downside risks.â€

This content has been provided under specific arrangement with eFXnews.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 03,2015

OctaFX.Com News Updates

-

GBP/USD posts highs around 1.5080

FXStreet (Edinburgh) - The pound continues to trade on a positive mood on Tuesday, now pushing GBP/USD to test intraday highs in the 1.5080 neighbourhood.

GBP/USD boosted by risk, data

Spot keeps extending its bounce off session troughs in sub-1.5000 levels, reclaiming the 1.5070/80 zone and challenging weekly highs at the same time. The auspicious result from the UK Construction PMI during January is collaborating with the upside as well, all against the backdrop of favouring context for the risk-associated universe.

Next of relevance for GBP traders will be the Services PMI due tomorrow (56.3 exp.) followed by the BoE MPC meeting to be held on Thursday.

GBP/USD key levels

The pair is now gaining 0.35% at 1.5076 and a breakout of 1.5100 (psychological level) would aim for 1.5115 (21-d MA) and then 1.5161 (high Jan.29). On the downside, the initial support lies at 1.4972 (low Jan.26) ahead of 1.4952 (low Jan.23) and finally 1.4900 (psychological handle).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 03,2015

OctaFX.Com News Updates

-

WTI set to surge further BAML

FXStreet (Barcelona) - The Research Team at Bank of America-Merrill Lynch, expects WTI Crudes gains to continue towards $54.33 levels.

Key Quotes

Evidence suggests that Friday's surge higher in WTI has further to run. The recent surge in Open Interest, rising approximately 134k contracts since Jan-16, indicates vulnerable short positions (open interest rises when the seller is a new short and the buyer is a new long) which are now at risk of being covered.

With the break of 2m trend line resistance (and weekly hold of 16yr trend line support) gains should continue in the sessions ahead towards the Dec-16 low at 54.33 before renewed stalling.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 03,2015

OctaFX.Com News Updates

-

OctaFX.com - Vote for OctaFX in the 2014 FX Empire Awards!

FX Empire announced the nominees for annual FX Empire Awards! OctaFX team is proud to confirm, that this time we have been chosen to represent two categories at once!

OctaFX is nominated for the Best Broker and Most Reliable Broker titles in the year 2014.

We need all your support - to vote for OctaFX click here. We would like to thank you for your appreciation in advance! The voting is open until February 16th, 2015.

We have received 2013 award for Best Customer Service Broker and hope that your votes will bring us new awards from FX Empire this time!

Support your top-notch broker - vote for OctaFX!

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

OctaFX.com-OctaFX Supercharged REAL CONTEST current position!

Win Tesla Model S, Smart Fortwo or Renault Twizy!

Open a Contest Account and Deposit it.

Trade and receive achievements.

Interact with other traders.

Win one of 10 amazing prizes.

View contest standings

Stand out for outstanding with OctaFX!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

US manufacturing ISM weakens further in January KBC

FXStreet (Barcelona) - The KBC Bank Research Desk reviews todays US ISM manufacturing data release, noting that ISM registered a drop for the third consecutive month, falling to 53.5 due to poor demand from abroad.

Key Quotes

In January, the US manufacturing ISM dropped for a third consecutive month, from 55.1 to 53.5, while only a limited decline to 54.5 was expected. The manufacturing ISM is now again at its lowest level since the start of last year when harsh winter weather weighed on activity.

Looking at the details, new orders dropped sharply (from 57.8 to 52.9) and new export orders even contracted, for the first time in 14 months. Backlog of orders and supplier deliveries weakened sharply too.

A more moderate slowdown was seen in production (56.5 from 57.7), customer inventories (42.5 from 44.5) and employment (54.1 from 56.0), while inventories and imports picked up in January. Prices paid dropped further falling from 38.5 to 35.0.

The drop in the manufacturing ISM suggests that activity in the sector is slowing further at the start of the year, mainly due to poor demand from abroad.

Slow growth outside the US is probably weighing on demand together with the stronger dollar, while lower costs are unable to boost sentiment.

The index remains however close to its LT average, indicating that activity is still moderate.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 02,2015

OctaFX.Com News Updates

-

OctaFX.Com - MASSIVE Spread Reduction at OctaFX!

We have reduced major currency spreads!

This is a revolution in lowering the spreads that happened in OctaFX!

Now you can enjoy trading with as low as 0.2 pip spreads. Theyve never been that tight.

Stand out for outstanding with OctaFX!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

Canadian dollar and cross in a technical snapshot - TDS

FXStreet (Guatemala) - Analysts at TD Securities gave a snapshot technical analyses in the Canadian dollar.

Key Quotes:

"USD/CAD> drops back from early highs but we look for firm support on dips to the upper 1.26s area."

"EUR/CAD tests a major resistance zone around 1.45; we continue to favour range trading here."

"AUD/CAD chops around resistance in the low 0.99 area."

"GBP/CAD reaches our s/t bull target higher levels are still on the cards."

"CAD/JPY extends below support in the high 92s look for more weakness towards 90.50. "

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 30,2015

OctaFX.Com News Updates

-

EUR/USD shows no reaction after US data FXStreet

FXStreet (Barcelona) - Valeria Bednarik, Chief Analyst at FXStreet, shares the technical outlook for EUR/USD, with the pair showing no major reaction post the US and EZ releases.

Key Quotes

The EUR/USD pair cant find a way this Friday, trading around its daily opening and despite key macroeconomic data has been released for both economies.

Earlier on the day, EZ inflation turned out negative, a confirmation of the ongoing deflation in the area. In the US, GDP figures showed the economy expanded at a slower pace than forecasted in the QE, printing 2.6% against an expected 3.3% grow.

The EUR/USD however, continues to trade in the lows 1.13 with the 1 hour chart showing price moving back and forth around 20 and 100 SMAs, both flat in a 10 pip range, while indicators hold in neutral territory.

In the 4 hours chart indicators turn slightly lower but also around their midlines, lacking directional strength at the time being.

Selling interest has surged again earlier on the day near the 50% retracement of the latest bearish run at 1.1365, becoming the critical resistance to break to confirm an upward extension.

The main support on the other hand, stands at 1.1250 a static support as per several intraday lows posted around it during these last few days.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 30,2015

OctaFX.Com News Updates

-

USD/RUB to climb over 75 in a month Danske

FXStreet (Barcelona) - The Danske Bank Research Team, comments on Russian Central Bank decision to cut interest rates by 200bp, and further expects RUB to attain an equilibrium price of 75 with USD.

Key Quotes

Today (30 January 2015) Russias central bank unexpectedly cut its key rate to 15% from 17% p.a., while consensus expected the rate to stay unchanged.

The main reason given by the central bank for the cut was that the previous hike by 650bp in December 2014 calmed inflation and depreciation expectations.

The central bank expects a further decrease in the CPI due to falling economic activity.

We expect that the rouble will be actively trying to what we estimate as its equilibrium price of 75 against the USD, given the current oil price.

New sanctions and the escalation of fighting in Eastern Ukraine will be adding a fear premium to that level.

We welcome the decision to cut, as last years aggressive monetary policy has caused a massive monetary contraction and is likely to send the Russian economy into deep recession this year (we expect GDP to fall -7.9%), with a further -0.8% y/y fall in 2016.

Yet, in current conditions 200bp is still a small cut to help lending growth and support economic activity.

We expect CPI to rise to 20% y/y in H1 15, which leaves no space for further monetary easing. The next meeting of the central bank on the key rate is scheduled for 13 March 2015.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 30,2015

OctaFX.Com News Updates

OctaFX.Com - Financial News and Analysis

in Fundamental Analysis

Posted

Russia to refrain from FX intervention TradeTheNews

FXStreet (Barcelona) - The TradeTheNews Team shares CBRs Governors comments that the Bank of Russia would let markets define an exchange rate and stay from any FX intervention until RUB threatens stability.

Key Quotes

Russia Central Bank (CBR) Gov Nabiullina reiterated to let market define exchange rate and would not impose capital controls; Rate hike was not inevitable on CPI.

She reiterated view that inflation to peak in Q2.

Bank of Russia buys gold to provide ruble liquidity and would not intervene in FX unless the RUB currency threatened stability. Rate outlook depended on risks to economy and prices.

OctaFX is nominated for the Best Broker and Most Reliable Broker titles in the year 2014.

Vote for OctaFX in the 2014 FX Empire Awards!

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 09,2015

OctaFX.Com News Updates