-

Posts

3069 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Posts posted by OctaFX_Farid

-

-

China FX policy survey: No band widening expected in next 3m – Nomura

FXStreet (Barcelona) - Research Analysts at Nomura, share the results of their China FX policy survey, and further note their forecast for the USD/CNH trading band, and policy rates.

Key Quotes

“On the USD/RMB forecasts and positioning, the largest proportion of survey participants expect the USD/CNY fixing to be 0.5% higher (than the 6.1311 on 9 February) in the next three months, while most see the USD/CNH deviation from its fixing at +2.0% over the same period.â€

“Our view is not much different from this result and we see some value in the forward curves with USD/CNY 3M NDF at 6.2050 and USD/CNH 3M forward at 6.3142 (as of 1930 SGT).â€

“In addition, survey participants expecting a band widening forecast USD/CNH to be trading at +2.2% (on average) above the fix in three months.â€

“On positioning (-5 to +5, +ve implies long USDs), the largest proportion of survey participants expect the market to be long USD/CNY NDF (at +2, based on +/- 5 scale, where positive implies long USDs) and long USD/CNH with a high concentration of participants in the +1 and +2 bucket for USD/CNH.â€

“Lastly, on stimulus, most participants expected a 25bp benchmark rate cut and 50bp RRR cut in the next three months.â€

“Almost all survey participants believe there will be further liquidity injections and lending facilities in the next three months.â€

“Nomura Economics forecasts a 25bp rate cut and 50bp RRR cut in Q2 2015.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 13,2015

OctaFX.Com News Updates

-

GBP/USD retreats from fresh 6-week highs, back below 1.5400

FXStreet (Mumbai) - GBP/USD erased previous gains and edged below 1.5400 levels during the European session largely on US dollar weaknesses following tepid macro data.

GBP/USD declines from 1.5408 levels

The GBP/USD pair trades flat at 1.5385 levels, retreating from fresh six-week highs posted at 1.5419 levels earlier in the day. GBP/USD remained little changed as traders moved past Bank of England's (BoE) inflation report induced gains and now turned their attention towards another set of US data due later today for fresh directions on the pair. Moreover, generalized weakness in the US dollar also failed to lift the GBP/USD pair.

GBP/USD Levels to consider

The pair has an immediate resistance at 1.5420 above which gains could be extended to 1.5500 levels. On the flip side, support is seen at 1.5354 below which it could extend losses to sub 1.5300 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 13,2015

OctaFX.Com News Updates

-

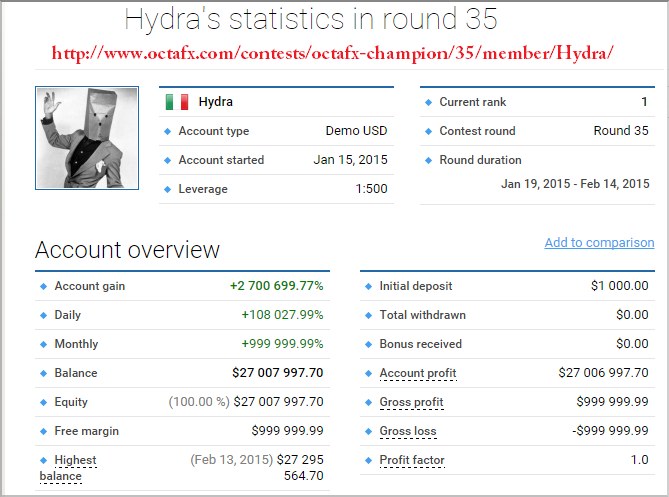

OctaFX Champion - A Splendid Demo Contest from your top Broker!

Champion Demo Contest! *Currently our top contestant Hydra from Italy has piled up with Equity/Balance +2 700 700%. So, come and snatch the opportunity and be the part of matchless traders.

Current update of OctaFX

Contests schedule

Current round (EET)

Registration: Dec 22, 2014 00:00 - Jan 19, 2015 00:00

Duration: Jan 19, 2015 00:00 - Feb 14, 2015 00:00

Next round (EET)

Registration: Jan 19, 2015 00:00 - Feb 16, 2015 00:00

Duration: Feb 16, 2015 00:00 - Mar 14, 2015 00:00

Please visit here to see full contestants list http://www.octafx.com/contests/octafx-champion/rating/

Stand out for outstanding with OctaFX!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

EUR/USD hits 1.1400 amid Greek headlines

FXStreet (Córdoba) - EUR/USD jumped to 1.1400 and scored a fresh 6-day high at the beginning of the New York session as the euro benefitted from a report suggesting Greece is getting an extension of the emergency liquidity assistance (ELA), which the ECB authorized as a temporary expedient when it stopped accepting Greek bonds as collateral for funding last week.

EUR/USD peaked at 1.1400, also supported by a weaker USD following a retail sales miss, but lacked follow-through to break above the psychological level and pulled back. At time of writing, EUR/USD is trading at 1.1370, still up 0.35% on the day.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 12,2015

OctaFX.Com News Updates

-

Pragmatic BOE postures next move in rates is up ANZ

FXStreet (Barcelona) - Brian Martin of ANZ, comments on the inflation and easing expectations for UK whilst reviewing the BOEs inflation report.

Key Quotes

The Bank of England (BoE) expects inflation to fall further, possibly into negative territory in coming months and hover around zero for much of this year, but the central bank is looking through this volatility: as unusual as that is, it arguably isnt the main story. The headlines today mask stronger underlying dynamics which will determine UK output and inflation tomorrow.

..whilst the tone of the report was more upbeat than the market had anticipated, it did contain the usual caveats and the BoE is in no rush to raise interest rates.

The risks to the forecasts remain balanced and the inflation target is symmetric. The BoE cares as much about inflation below target as above target.

With inflation below target and unemployment above its long-run sustainable rate, there is no immediate trade-off between returning inflation to target and supporting economic activity. In fact, to return inflation to target it is necessary to eliminate the remaining degree of economic slack, Carney said before qualifying during the press conference that returning inflation to target would probably require a gentle and gradual rise in interest rates

Acknowledging the pragmatic nature of monetary policy, Carney did state that the BoE is vigilant to the risks that disappointing global growth and evidence that persistently low inflation could negatively impact on inflation expectations. Were those risks to materialise, it could require additional stimulus.

The BoE can therefore respond in either direction, but the inflation report states that under the central case, the MPC judges it more likely than not that Bank Rate will increase over the forecast period.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 12,2015

OctaFX.Com News Updates

-

OctaFX.com-OctaFX Supercharged real contest greet Round 3 winner from Indonesia!

OctaFX congratulates the third monthly winner of the Supercharged real contest! Welcome Master of USD/JPY pair, the holder of Overachiever, Profitmaker and Acquirer achievements Jusliandar Leopardi from Indonesia!

Heres Mr. Leopardis opinion on Supercharged contest:

This is the best trading contest! I know it by comparing it to other contests held by different brokers. And winning Tesla is a dream of each Supercharged participant!

I must admit that I am spending a lot of time trading in the contest because it is interesting! Im no better than the others, my secret is perseverance and maybe a little luck! I think there is nothing spectacular in what I did. In the process of becoming this good at trading, I sometimes lost my investments, but it helped me gain experience, so I think its reasonable.

My advice is continue to learn to be better, no human being is perfect. As traders, we must establish a technique that proved to be efficient, not to try a variety of techniques.

Mr. Leopardi is awarded with brand-new iPhone 6 and we invite you to join him in the competition to win 10 top-notch prizes including Tesla Model S, Smart Fortwo and Renault Twizy!

Are you Supercharged? Enter the competition here!

Stand out for outstanding with OctaFX!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

BoE could hike rates by year-end – Investec

FXStreet (Edinburgh) - The start of the hiking cycle in the UK could start as soon as Q4 2015, according to D.Theodosiou at Investec.

Key Quotes

“Although subject to varied interpretation, interest rate markets point to the first interest rate hike in the UK being priced in for Q2 2016, with a second priced in Q4 2016â€.

“Part of this expectation has likely been skewed by ‘safe haven’ flows, with many countries charging negative yields on deposits and investors looking for safe places to invest, particularly in light of recent Greek eventsâ€.

“Therefore, if the MPC continue to hold the line that medium term inflation goals remain on target, the market could find itself scrambling to adjust expectations more in-line with the Investec Economics team, that are currently looking for a November 2015 first rate riseâ€.

“This would certainly help Sterling trade stronger across the board with investors factoring in higher future yield for holding Pounds. The only question is, if investors sell Gilts (UK Bonds) to price in an earlier rate rise in the UK, then where do they invest instead?â€.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 11,2015

OctaFX.Com News Updates

-

Gold falls below USD 1230/Oz

FXStreet (Mumbai) - Gold prices extended the decline to trade well below USD 1230/Oz levels, after hovering around the 50-DMA located at USD 1234 levels in the last couple of hours.

Gold prices weighed down by USD strength

The latest bout of weakness may have been triggered largely due to an across the board strength seen in the US dollar. The USD index is up 0.31% at 95.16 levels. Meanwhile, the repeated struggle to rise above 50-DMA at USD 1234 could have triggered a technical sell-off as well.

Moreover, Gold and other safe haven assets like the Japanese Yen and the US Treasuries have failed to gain despite the Greek led uncertainty in the markets and concerns of escalating tension in Ukraine. The metal may extend losses even further if the US equity markets manage to recover losses later in the day.

Gold Technical Levels

At the moment, the metal trades 0.59% lower at USD 1224.90/Oz levels. The immediate support is seen at 1223.2, under which a major support is seen at 1207.5 levels. On the flip side, resistance is seen at the 50-DMA located at 1234 and at the 200-DMA located at 1244 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 11,2015

OctaFX.Com News Updates

-

USD/CAD rises to session highs

FXStreet (Mumbai) - The slide in crude prices pushed the Canadian dollar lower, taking the USD/CAD pair to the session high of 1.2645 levels.

Loonie weakens as Crude extends losses

Crude prices in the US fell to a low of USD YSD 49.13/barrel ahead of the weekly supply report in the US, which is expected to show inventories rose by 3.8 million barrels last week. Consequently, the USD/CAD pair rose to a high of 1.2645.

Moreover, the rally in the Canadian dollar stalled as crude prices resumed the fall on fears of rising supply glut and a slowdown in China. Meanwhile, a strong US jobs data and the subsequent rise in the US Treasury yields further added to the bullish momentum in the USD/CAD pair.

USD/CAD Technical Levels

The pair currently trades 0.44% higher at 1.2642 levels. The immediate resistance is seen on the 4-hour chart at 1.2675 levels, above which the pair could rise to 1.2771 levels. On the flip side, support is seen on the 4-hour chart at 1.2589 and 1.2539 (hourly 200-SMA) levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 11,2015

OctaFX.Com News Updates

-

Oil the major driver for CAD’s weakness – Scotiabank

FXStreet (Barcelona) - Camilla Sutton CFA, CMT, Chief FX Strategist at Scotiabank, notes that CAD is weak with a stronger USD, weaker oil prices & a dovish BoC, the risk is ongoing depreciation but oil remains the core driver.

Key Quotes

“USDCAD is higher, flirting with a break above its seven-session range of 1.2352 to 1.2644.â€

“The shift higher has come from falling oil prices, a broadly stronger USD and yesterday’s dovish tone from the BoC’s Wilkins. There are no fundamental releases today.â€

“the economic outlook from the perspective of the BoC is one that likely justifies further interest rate cuts. The market is pricing in a 50% chance of a cut at the March 4th meeting.â€

“As oil comes under renewed pressure we would expect both the expectations for interest rate cuts in Canada to increase and CAD to weaken.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 11,2015

OctaFX.Com News Updates

-

Comex copper erases gains

FXStreet (Mumbai) - Comex Copper has erased part of its gains as investors turn cautious ahead of the Greece’s finance minister Yanis Varoufakis meeting with other finance ministers of the euro zone to discuss a solution to Greece's bailout program.

Trades below 5-DMA and 10-DMA

Copper prices faced rejection at the 5-DMA and the 10-DMA located at USD 2.571 and USD 2.559 respectively. The red metal declined from the session high of USD 2.583 as markets do not expect any long term solution to the Greece’s debt problems from the Eurogroup’s meeting today. However, a short-term fix is likely, which means the Greece-related uncertainty is here to stay for a while.

Meanwhile, the metal remains supported on the expectation of fresh stimulus measures from China, especially after the inflation printed at the lowest level since November 2009.

Comex Copper Technical Levels

The metal currently trades at USD 2.552/pound. The immediate resistance is seen at 2.571 (5-DMA), above which gains could be extended to 2.619 (Feb. 4th high). Meanwhile, support is seen at 2.526 and 2.489 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 11,2015

OctaFX.Com News Updates

-

Japanese inflation might reach BoJ’s 2% target by 2016 – BNPP

FXStreet (Barcelona) - Raymond Van der Putten of BNP Paribas, views that Japanese macro wage growth in 2015 and 2016 might aid inflation to reach BoJ’s 2% target by 2016.

Key Quotes

“In addition to energy prices, wages are an important determinant for price trends. In 2014, they rose by 0.7% higher. All attention is now on the spring wage offensive (shunto).â€

“As last year, the government is calling on enterprises to do their utmost to implement pay hikes. As the labour market has become very tight, we expect that at the shunto wages will be hiked in FY 2015 by an overall 2.6% (against 2.2% in FY 2014). These talks affect union workers only at relatively large companies and account for just 17.5% of the country’s labour force. It is, however, likely that these increases will also spread to other sectors.â€

“Macro wage growth could reach 1.6% in 2015 and 2.8% in 2016. In this scenario, inflation could reach the BoJ’s 2% objective in the course of 2016.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 11,2015

OctaFX.Com News Updates

-

US headline retails sales likely to be depressed BBH

FXStreet (Barcelona) - The Brown Brothers Harriman Team previews tomorrows US data release, expecting the headline retails sales to likely to be depressed due to the fall in gasoline prices.

Key Quotes

In the US, the focus is on tomorrows retail sales. The headline will likely be depressed by the fall in gasoline prices, and we already know there was a slight slowing in auto sales, but the core measure should reverse the 0.4% decline in December.

At the same time, the recent trade and inventory data is spurring economists to cut Q4 GDP estimates toward 2% or just below.

However, the strength of the labor market and the recovery in hourly earnings has seen ideas of a mid-year rate hike strengthen, and this has been encouraged by several Fed officials that have spoken this week.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 11,2015

OctaFX.Com News Updates

-

OctaFX.com - Vote for OctaFX in the 2014 FX Empire Awards!

FX Empire announced the nominees for annual FX Empire Awards! OctaFX team is proud to confirm, that this time we have been chosen to represent two categories at once!

OctaFX is nominated for the Best Broker and Most Reliable Broker titles in the year 2014.

We need all your support - to vote for OctaFX click here. We would like to thank you for your appreciation in advance! The voting is open until February 16th, 2015.

We have received 2013 award for Best Customer Service Broker and hope that your votes will bring us new awards from FX Empire this time!

Support your top-notch broker - vote for OctaFX!

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

GBP/USD retreats from highs

FXStreet (Edinburgh) - After climbing as high as the vicinity of 1.5270, GBP/USD is now running out of steam and returning to the id-1.5200s.

GBP/USD focus on BoE

The pair has picked up pace following a softer tone from the greenback, lifting the sentiment around the risk-associated universe. The sterling keeps consolidating above the 1.5200 handle ahead of the critical BoE Quarterly Inflation Report due tomorrow, followed by a speech by Governor M.Carney.

Spot managed to leave behind mixed results from the Industrial and Manufacturing Production in the UK economy during December, managing to bounce off the area of 1.5210.

GBP/USD significant levels

At the moment the pair is up 0.17% at 1.5243 with the next up barrier at 1.5282 (40-d MA) followed by 1.5353 (high Feb.6) and then 1.5355 (high Jan.5). On the other hand, a breach of 1.5170 (low Feb.5) would aim for 1.5162 (200-h MA) and finally 1.5149 (21-d MA).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 10,2015

OctaFX.Com News Updates

-

GBP/USD: faltering at 55 DMA - CB

FXStreet (Guatemala) - Karen Jones, chief analyst at Commerzbank noted the technical conditions surrounding GBP/USD.

Key Quotes:

"GBP/USDs break of 7 month downtrend was not sustained and the market appears to be faltering at the 55 day ma at 1.5391."

"We note the Elliott wave count on the daily is suggesting that this is already the end of the correction higher."

"Loss of the 20 day ma at 1.5144 should trigger a slide back to the 1.4953 recent low and the 1.4813 2013 low."

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 10,2015

OctaFX.Com News Updates

-

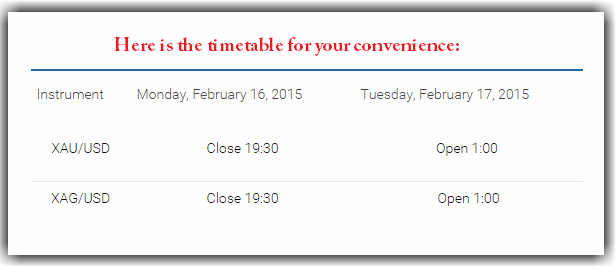

OctaFX.com - US Presidents Day Trading Schedule!

OctaFX would like to inform you of the changes in the trading hours of XAU/USD and XAG/USD on US Presidents day February 16. Trading closes Monday, February 16, 2015 at 19:30 (EET) and re-opens Tuesday, February 17 2015 at 01:00 (EET).

Please, consider the fact that any open trades upon closure of trading hours will be rolled into the next day.

We would like to apologize for any inconvenience caused. Please, contact our Customers Support in case you have any questions. If any failures occur, please report immediately to [email protected]

Thank you for choosing OctaFX as your top-notch Forex Broker.

Wishing you luck and profitable trading, yours truly, OctaFX!

-

Technical outlook for treasuries RBS

FXStreet (Barcelona) - Analysts at RBS comment on the bond market and give the technical outlook for 2s, 5s and 10s treasuries.

Key Quotes

Treasuries have rebounded along with Bunds overnight as Greek exit fears persist along with worries about China (trade data was weaker than expected) and Ukraine developments.

Greek 3yrs yield ~21.5% this morning, up 340bp on the day."

Our overnight US rates flows saw better buying on balance with overseas real$ accounts buying 5's through 10's against selling in 30yrs.

Overnight inter-dealer Treasury volume (4pm to 6am) was 160% of the 10-day average volume for the overnight session.

2s (0.624%) Next major support doesn't emerge until ~0.80% where we found buyers back in the spring of 2011. Resistance seen at 0.40% where we'd close a gap left behind in late October. Daily momentum is bearish.

5s (1.44%) Next major support comes in at 1.80% and just above. Nearby resistance lines up at ~1.155%. Daily momentum is bearish.

10s (1.90%)Next major resistance comes in at ~1.60%, the May 2013 'lows'. Next support comes in ~2.40% with major support at 2.66% after that. Daily momentum is bearish.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 09,2015

OctaFX.Com News Updates

-

Technical outlook for treasuries RBS

FXStreet (Barcelona) - Analysts at RBS comment on the bond market and give the technical outlook for 2s, 5s and 10s treasuries.

Key Quotes

Treasuries have rebounded along with Bunds overnight as Greek exit fears persist along with worries about China (trade data was weaker than expected) and Ukraine developments.

Greek 3yrs yield ~21.5% this morning, up 340bp on the day."

Our overnight US rates flows saw better buying on balance with overseas real$ accounts buying 5's through 10's against selling in 30yrs.

Overnight inter-dealer Treasury volume (4pm to 6am) was 160% of the 10-day average volume for the overnight session.

2s (0.624%) Next major support doesn't emerge until ~0.80% where we found buyers back in the spring of 2011. Resistance seen at 0.40% where we'd close a gap left behind in late October. Daily momentum is bearish.

5s (1.44%) Next major support comes in at 1.80% and just above. Nearby resistance lines up at ~1.155%. Daily momentum is bearish.

10s (1.90%)Next major resistance comes in at ~1.60%, the May 2013 'lows'. Next support comes in ~2.40% with major support at 2.66% after that. Daily momentum is bearish.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 09,2015

OctaFX.Com News Updates

-

Technical outlook for treasuries RBS

FXStreet (Barcelona) - Analysts at RBS comment on the bond market and give the technical outlook for 2s, 5s and 10s treasuries.

Key Quotes

Treasuries have rebounded along with Bunds overnight as Greek exit fears persist along with worries about China (trade data was weaker than expected) and Ukraine developments.

Greek 3yrs yield ~21.5% this morning, up 340bp on the day."

Our overnight US rates flows saw better buying on balance with overseas real$ accounts buying 5's through 10's against selling in 30yrs.

Overnight inter-dealer Treasury volume (4pm to 6am) was 160% of the 10-day average volume for the overnight session.

2s (0.624%) Next major support doesn't emerge until ~0.80% where we found buyers back in the spring of 2011. Resistance seen at 0.40% where we'd close a gap left behind in late October. Daily momentum is bearish.

5s (1.44%) Next major support comes in at 1.80% and just above. Nearby resistance lines up at ~1.155%. Daily momentum is bearish.

10s (1.90%)Next major resistance comes in at ~1.60%, the May 2013 'lows'. Next support comes in ~2.40% with major support at 2.66% after that. Daily momentum is bearish.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 09,2015

OctaFX.Com News Updates

-

IMM Net Speculators Positioning - Rabobank

FXStreet (Barcelona) - The Rabobank Team reviews the IMM Net Speculators positioning data as at 03 February 2014, noting that EUR and AUD net shorts increased while JPY, CHF and GBP shorts edged lower, with USD long positions consolidating near its highs.

Key Quotes

Long USD positions consolidated at their current very high levels in the approach to last weeks US January labour report.

Meanwhile EUR shorts increased even further though they are still below their June 2012 highs. When the SNB stepped away from its EUR/CHF 1.20 floor in mid-January one large EUR buyer was removed from the market. In addition, ECB QE confirmation and Greek political concerns have undermined the EUR.

Net JPY shorts dropped for a third week and are now substantially below last months highs. Geopolitical worries and concerns over world growth have tempered the bears and increased demand for the yen as a safe haven.

Net GBP shorts edged lower. Pre-election uncertainty remains a negative sterling factor. However, signs that UK consumption is being lifted by lower food and energy prices could lend a little support as could the fact that UK assets still offer some yield.

AUD net shorts increased to their highest level since Jan 2013 after the RBA cut interest rates. Net CAD rose again, oil prices remain a dominating factor.

CHF net shorts dropped again following last months SNBs surprise policy decision.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 09,2015

OctaFX.Com News Updates

-

OPEC cuts non-OPEC oil supply forecast

FXStreet (Mumbai) - The Organization of Petroleum Exporting Countries (OPEC) lowered its estimate for non-OPEC supply growth in 2015 as US drillers are expected to pump less oil after the collapse in oil price.

The group lowered its estimate for non-OPEC supply growth by about 400,000 barrels a day, led by a reduction of 130,000 a day in the US. Supply estimates for Colombia, Canada and Yemen were also trimmed. The main factors for the lower growth prediction in 2015 are price expectations, a declining number of active rigs in North America, a decrease in drilling permits in the US and a reduction in the 2015 spending plans of international oil companies, OPECs Vienna-based research department said in its monthly market report.

US supply estimates

The supply from the US will increase 820,000 barrels a day in 2015 to 13.64 million a day, which is the half of the gain recorded in 2014. The estimate for total non-OPEC supply growth in 2015 was cut by 420,000 to 850,000 a day.

The group expects the Global oil demand will increase by 1.17 million barrels a day, or 1.3%, in 2015 to 92.32 million barrels a day

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 09,2015

OctaFX.Com News Updates

-

More easing expected in China, growth to tick lover Deutsche Bank

FXStreet (Edinburgh) - Economists at the German lender Deutsche Bank expect the Chinese growth to slow its pace in H1 and the PBoC to ease further in the upcoming periods.

Key Quotes

The RRR cut is broadly in line with our expectation, though it happened one month earlier than we expected.

We reiterate our view that the economic growth will surprise on the downside in H1. We cut our GDP forecast for Q1 to 6.8% on January 5 (consensus 7.2%), as the economy faces a "double whammy" due to property slowdown and a fiscal slide.

We expect more easing measures to come. We continue to expect another RRR cut of 50bp in Q2. We also continue to expect two interest rate cuts, but we revise our call on timing, and expect the two cuts to happen in March and Q2, instead of Q2 and Q3.

The RRR cut likely releases liquidity of RMB640bn into the bank sector. We think the impact on the real economy is positive but it is not enough to stabilize the economy, as it helps to raise loan supply but loan demand may remain weak.

We expect the fiscal stance to loosen in coming months, with central government fiscal spending picking up and quasi-fiscal spending through policy banks rising. If such fiscal policy loosening does not materialize, we see downside risks to our GDP forecast of 7% for 2015.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 09,2015

OctaFX.Com News Updates

-

EUR/AUD falls to fresh lows, fast approaching 200-DMA

FXStreet (Mumbai) - The shared currency erased previous gains and edged lower versus the Australian dollar as the Euro trades volatile amid escalating Greece worries, while the Aussie rebounds from China data back slump.

Hovers above 1.4480 levels

Currently, the EUR/AUD cross trades at 1.4487 levels, losing -0.18% on the day, close to fresh daily highs posted at 1.4480 levels few minutes ago. The cross traded lower largely on Aussie strength which continues its recovery after a slump in Chinese imports dragged the pair lower in the Asian session. The cross remains pressured as market participants await this week's Euro group meeting and the European Union summit that may ease the Greek situation

At the moment, the AUD/USD pair trades at 0.7809, up 0.13% on the day. While EUR/USD trades flat at 1.1312 levels.

EUR/AUD Technical Levels

The pair has an immediate resistance at 1.4550 levels, above which gains could be extended to 1.4610 levels. On the flip side, support is seen at 1.4470 levels, from here it to 1.4420 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 09,2015

OctaFX.Com News Updates

OctaFX.Com - Financial News and Analysis

in Fundamental Analysis

Posted

EUR/GBP hovers close to fresh highs, Euro zone data eyed

FXStreet (Mumbai) - EUR/GBP bounces off seven year lows and inched higher during the European session, as traders digested surprisingly good German GDP and a ceasefire agreement in Ukraine.

EUR/GBP rises from 0.7413 levels

The EUR/GBP pair trades higher by 0.24% at 0.7430 levels, having posted session highs at 0.7434 levels an hour ago. EUR/GBP rose to fresh session highs, in a delayed reaction to the stellar German growth number confirming that the Euro zone’s economic powerhouse is well away from recessionary phase. On the other side, pound remained flat against the US dollar as BOE Inflation report-backed gains reversed as traders now eyed US macro data.

At the moment, EUR/USD held 0.25% higher at 1.1432 levels, while GBP/USD traded flat at 1.5387 levels.

EUR/GBP Levels to consider

To the upside, the next resistance is located at 0.7460 and above which it could extend gains to at 0.7499 levels. To the downside immediate support might be located at 0.7400 and below that at 0.7383 levels.

OctaFX is nominated for the Best Broker and Most Reliable Broker titles in the year 2014.

Vote for OctaFX in the 2014 FX Empire Awards!

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 13,2015

OctaFX.Com News Updates