-

Posts

3069 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Posts posted by OctaFX_Farid

-

-

US Session Recap: Greenback profits taken off table

FXStreet (Guatemala) - Since the ECB made the deaccession to launch its sovereign QE programme, and with the SNB recent chopping the EUR/CHF floor, investors are liking the US more and more.

The greenback is maintaining the top spot, despite profit taking, although it is losing the competitive edge when it comes to the currency wars, strengthening further vs the euro and subsequently across the board and analysts are now citing parity in 2016/17 - not good for US exporting business. Anyway, Stocks performed well as diversification of cash flows continues to favour the US assets. Stocks were posting scores on the board close to January's highs earlier on in the session. There were a handful of data events at the start of the shift, but thereafter, the session was down to traders to determine ebbs and flows of the currency tides for themselves.

EUR/USD took back some ground lost from down on the lows at 1.1114 and managed a close back on to the 1.12 handle, albeit down from the highs of the recovery drift at 1.1289 down to 1.1207.

GBP/USD is essentially following in the tracks of the EUR and this move from the ECB is dangerous for committed and stubborn Sterling bulls, as where the euro goes the pound will likely follow. Bears stamped on attempts through 1.5020 resistance drowning the pound back below the 1.50 handle to 1.4985, although finishing up on the day close to half a cent.

USD/JPY stuck to a tighter range on the session of a choppy week, and settled into a sideways pattern around 117.80 resistance/support level post an early session recovery from 117.53.

USD/CAD was trading better bid with good retails sales figures and the Bank of Canada Consumer Price Index Core (MoM) (Dec) coming in higher than expected. We went form 1.2377 to 1.2438 in the session.

EUR/CHF was a choppy affair recovering from 0.9791 to 99.11 before dropping back to 0.9843, spiking again to 99.10 and chopping its way down through a drift to 98.50 and recovering for a close at 0.9870.

USD/CHF was volatile with large swings, more so than EUR/CHF but with a load up on dips strategy with a low of 0.8707 for a high of 0.8811.

Key Events:

Bank of Canada Consumer Price Index Core (MoM) (Dec) bullish -0.3 vs -0.4 expected

Canadian Consumer Price Index (MoM) (Dec) bearish -0.7% vs -0.6% exp

Canadian Retail Sales (MoM) (Nov) bullish 0.4% vs -0.2% exp

US Markit Manufacturing PMI (Jan) bearish 53.7 vs 54.0 exp

US CB Leading Indicator (MoM) (Dec) bullish 0.5% vs 0.4% exp

Existing Home Sales Change (MoM) (Dec) neutral 2.4%

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 24,2015

OctaFX.Com News Updates

-

US Session Recap: Greenback profits taken off table

FXStreet (Guatemala) - Since the ECB made the deaccession to launch its sovereign QE programme, and with the SNB recent chopping the EUR/CHF floor, investors are liking the US more and more.

The greenback is maintaining the top spot, despite profit taking, although it is losing the competitive edge when it comes to the currency wars, strengthening further vs the euro and subsequently across the board and analysts are now citing parity in 2016/17 - not good for US exporting business. Anyway, Stocks performed well as diversification of cash flows continues to favour the US assets. Stocks were posting scores on the board close to January's highs earlier on in the session. There were a handful of data events at the start of the shift, but thereafter, the session was down to traders to determine ebbs and flows of the currency tides for themselves.

EUR/USD took back some ground lost from down on the lows at 1.1114 and managed a close back on to the 1.12 handle, albeit down from the highs of the recovery drift at 1.1289 down to 1.1207.

GBP/USD is essentially following in the tracks of the EUR and this move from the ECB is dangerous for committed and stubborn Sterling bulls, as where the euro goes the pound will likely follow. Bears stamped on attempts through 1.5020 resistance drowning the pound back below the 1.50 handle to 1.4985, although finishing up on the day close to half a cent.

USD/JPY stuck to a tighter range on the session of a choppy week, and settled into a sideways pattern around 117.80 resistance/support level post an early session recovery from 117.53.

USD/CAD was trading better bid with good retails sales figures and the Bank of Canada Consumer Price Index Core (MoM) (Dec) coming in higher than expected. We went form 1.2377 to 1.2438 in the session.

EUR/CHF was a choppy affair recovering from 0.9791 to 99.11 before dropping back to 0.9843, spiking again to 99.10 and chopping its way down through a drift to 98.50 and recovering for a close at 0.9870.

USD/CHF was volatile with large swings, more so than EUR/CHF but with a load up on dips strategy with a low of 0.8707 for a high of 0.8811.

Key Events:

Bank of Canada Consumer Price Index Core (MoM) (Dec) bullish -0.3 vs -0.4 expected

Canadian Consumer Price Index (MoM) (Dec) bearish -0.7% vs -0.6% exp

Canadian Retail Sales (MoM) (Nov) bullish 0.4% vs -0.2% exp

US Markit Manufacturing PMI (Jan) bearish 53.7 vs 54.0 exp

US CB Leading Indicator (MoM) (Dec) bullish 0.5% vs 0.4% exp

Existing Home Sales Change (MoM) (Dec) neutral 2.4%

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 24,2015

OctaFX.Com News Updates

-

EUR/DKK hits 3-week high after DNB cuts rates for second time this week

FXStreet (Córdoba) - EUR/DKK rose to fresh 3-week high after the Danish Nationalbank cut its deposit rate to -0.35% from -0.2%, the second cut in 4 days, in response to ECB expanded asset purchase programme. The Danish Central Bank had lowered its deposit rate to -0.2% from -0.05% on Monday.

EUR/DKK climbed to a recovery high of 7.4470 after the ECB and the DNB moves. At time of writing, the pair is trading at the 7.4420 area.

The Danish decision came 90 minutes after the ECB announcement as the DNB fights to prevent the krone to appreciate.

EUR/DKK fell to a low of 7.4283 on Jan 15 in the aftermath of the SNB decision to remove the EUR/CHF floor. Increasing pressure on the euro has supposedly force the Danish Bank to intervene in the FX market and to conduct its second rate cut this week.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 22,2015

OctaFX.Com News Updates

-

ECB meeting: Euro to move lower after a short term squeeze higher Investec

FXStreet (Barcelona) - Jonathan Pryor, head of FX dealing at Investec Corporate and Institutional Treasury, expects euro to move lower and weaken further, supported by the ECB pumping Euro 1trn into the market over the next one and half years.

Key Quotes

"In the short term we risk a squeeze higher in the Euro now all policy is announced and there is no additional stimulus for the market to price in or pre-empty - what traders call buy the rumour, sell the fact. Once the dust has settled, we expect the Euro to move lower from here as the continued effect of negative deposit rates, combined with the flooding of over Euro 1 trillion extra into the market over the next year and a half, should continue to weaken the single currency."

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 22,2015

OctaFX.Com News Updates

-

OctaFX.com - Vote for OctaFX in the 2014 FX Empire Awards!

FX Empire announced the nominees for annual FX Empire Awards! OctaFX team is proud to confirm, that this time we have been chosen to represent two categories at once!

OctaFX is nominated for the Best Broker and Most Reliable Broker titles in the year 2014.

We need all your support - to vote for OctaFX .

.

We would like to thank you for your appreciation in advance! The voting is open until February 16th, 2015.

We have received 2013 award for Best Customer Service Broker and hope that your votes will bring us new awards from FX Empire this time!

Support your top-notch broker - vote for OctaFX!

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

Will 2015 be about the theme of negative yields? – BAML

FXStreet (Barcelona) - Analysts at Bank of America Merrill Lynch share that the Central Banks have now embraced negative deposit rates to ward off excess global liquidity, with 10 countries having negative yielding government bonds.

Key Quotes

“Global monetary policy remains a fluid and evolving narrative.

2013 was the story of low yields.

2014 became the story of no yield.

2015 will be all about the theme of negative yields.â€

“Central banks have crossed the Rubicon of late, embracing negative deposit rate policies in an attempt to induce animal spirits in the banking sector (lend, not hoard) and ward off the inflow of excess global liquidity. The result has been the rapid growth in negative yielding government debt.â€

“ [..] this isn’t just a Eurozone phenomenon. 10 countries now have negative yielding government bonds.â€

“Much has been caused by negative interest rates from central banks (ECB, Switzerland, Denmark and Sweden), but not all. Note that Japan 5yr yields went negative yesterday.â€

“[…] Japan has by far the largest stock of negative yielding debt, reflective of its sizeable government bond market.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 21,2015

OctaFX.Com News Updates

-

EUR quiet, consolidating ahead of Thursday’s ECB meeting – Scotiabank

FXStreet (Barcelona) - Eric Theoret, CFA, CMT, Currency Strategist, at Scotiabank, shares that EUR is quiet and consolidating today as markets keenly await ECB’s meeting tomorrow, with the focus remaining on the recent low near 1.1450 levels.

Key quotes

“EUR is up a modest 0.2% vs the USD, underperforming most of its peers within the context of broad-based USD weakness ahead of the NA session. The absence of data will leave EUR trading on the broader market tone, with an intensified risk of headline-driven movement ahead of Thursday’s ECB meeting.â€

“EURUSD short-term technicals: bearish—all signals are bearish and hint to further downside as we note the confirmation provided by momentum indicators amid recent declines in spot.â€

“Focus remains on the recent low just above 1.1450, below which we look to 1.1213 as the next key long term technical level that represents the 61.8% Fibonacci retracement level of the rally from 2000.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 21,2015

OctaFX.Com News Updates

-

GBP/USD steady after US housing data

FXStreet (Córdoba) - GBP/USD continues to consolidate in a range above 1.5100, having barely moved following the release of mixed US housing data.

On the data front, US housing starts rose 4.4% to 1.089 million in December, beating expectations of 1.040 million, but building permits, a sign of future demand, unexpectedly fell 1.9% in December to 1.032 million.

GBP/USD was unaffected by US data and continues to trade near daily lows. Cable fell as low as 1.5075 earlier during the European session after BoE minutes revealed all 9 MPC members voted to keep rates unchanged. Even though GBP/USD managed to recover from lows, it remained capped by the 1.5135 area.

At time of writing, the pair is trading at the 1.5110 zone, still 0.20% below its opening price.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 21,2015

OctaFX.Com News Updates

-

USD/JPY unchanged after mixed US data

FXStreet (Mumbai) - The USD/JPY pair continues to trade near the day’s low, largely uninspired by the release of the mixed housing data in the US.

The pair trades at 117.36, largely unchanged after the data release, and down 1.23% for the day. The data released in the US showed housing starts rose 4.4% month-on-month in December, beating the estimate of a 1.2% rise, while the Building Permits fell declined 1.9%, missing the estimate of a 0.8% rise. The mixed housing data failed to trigger any moves in the US 10-yr Treasury yields, which remain unchanged at 1.795%; down 1.2 basis points for the day. Consequently, the USD/JPY pair failed to respond to the data. However, the Yen may extend gains during the US session, if the stock markets in the US turn risk averse.

USD/JPY Technical Levels

The immediate support is seen at 116.91, under which losses could be extended to 116.50 levels. Meanwhile, resistance is seen at 117.75 and 118.04 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 21,2015

OctaFX.Com News Updates

-

Gold steadies around USD 1300

FXStreet (Mumbai) - Gold prices have consolidated around USD 1300 levels as we head into the US session with the second tier US housing data due for release.

The yellow metal currently trades 0.67% higher for the day at USD 1302.50/Oz levels, compared to the previous session’s close at USD 1294.20/Oz levels. The metal climbed above USD 1300 mark for the first time since August 2014 as the European Central Bank (ECB) is widely expected to announce a balance sheet expansion program in the form of sovereign QE. Meanwhile, the uncertainty surrounding the Greek vote also supports Gold. An additional support came in the form of Bank of England minutes, which showed two dissenters of the ZIRP switching sides in favor of holding interest rates at a record low.

The metal may extend gains if the US stock markets turn risk averse. Moreover, the major index futures are pointing to a weak opening on Wall Street.

Gold Technical Levels

The immediate resistance is seen at 1309.06 (100-WMA), above which gains could be extended to 1323.2 levels. Meanwhile, support is seen at 1300.00 and 1292.1 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 21,2015

OctaFX.Com News Updates

-

USD/CAD testing lows around 1.2070

FXStreet (Edinburgh) - The US dollar is losing the grip vs. its main competitors on Wednesday, sending USD/CAD to challenge intraday lows registered overnight in the vicinity of 1.2070.

USD/CAD focus on BoC

In the current context of USD-weakness, CAD traders will look for the result from the Wholesale Sales during November (-0.1% exp.) ahead of the key BoC monetary policy meeting and subsequent press conference by Governor S.Poloz. Market participants will scrutinize the BoC statement in light of the ongoing decline in crude oil prices, as well as the growth and inflation prospects in the domestic economy in a scenario of US solid economic recovery.

Strategists at TD Securities commented, “If the BoC does disappoint very dovish expectations, we look for USDCAD to dip briefly but the underlying message of economic softness will help underpin the broader bull trend in funds; look to fade short-term weakness is USDCAD; we expect the market to press on towards 1.22+ near termâ€.

USD/CAD levels to consider

At the moment the pair is losing 0.28% at 1.2071 with the immediate support at 1.1985 (high Jan.19) followed by 1.1959 (Tenkan Sen) and then 1.1940 (low Jan.20). On the upside, a surpass of 1.2115 (high Jan.20) would clear the way towards 1.2200 (psychological level) and finally 1.2265 (high Apr.28 2009).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 21,2015

OctaFX.Com News Updates

-

AUD/JPY drops to 96.20

FXStreet (Córdoba) - AUD/JPY weakened after the Bank of Japan meeting and bottomed during the European session at 96.19, reaching a 2-day low. From 96.20 the pair rebounded and currently is trading slightly above 96.50, almost 50 pips below the price it closed yesterday.

Despite moving off session lows, todays trend continues to point to the downside. Earlier the pair broke a short term ascendant trendline removing bullish momentum.

To the downside below daily lows, the next support level could be located at 96.00, 95.60 (January 7) and 95.20. To the upside, resistance might lie at 96.70, 96.95 and 97.35/40 (January 20 high).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 21,2015

OctaFX.Com News Updates

-

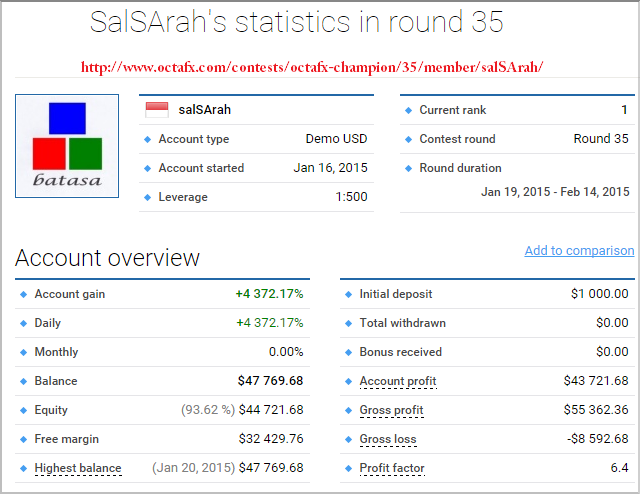

OctaFX Champion - A Splendid Demo Contest from your top Broker!

Champion Demo Contest! *Currently our top contestant salSArah from Indonesia has piled up with Equity/Balance $47 769.68. So, come and snatch the opportunity and be the part of matchless traders.

Current update of OctaFX

Contests schedule

Current round (EET)

Registration: Dec 22, 2014 00:00 - Jan 19, 2015 00:00

Duration: Jan 19, 2015 00:00 - Feb 14, 2015 00:00

Next round (EET)

Registration: Jan 19, 2015 00:00 - Feb 16, 2015 00:00

Duration: Feb 16, 2015 00:00 - Mar 14, 2015 00:00

Please visit here to see full contestants list http://www.octafx.com/contests/octafx-champion/rating/

Stand out for outstanding with OctaFX!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

OctaFX Champion - A Splendid Demo Contest from your top Broker!

Champion Demo Contest! *Currently our top contestant salSArah from Indonesia has piled up with Equity/Balance $47 769.68. So, come and snatch the opportunity and be the part of matchless traders.

Current update of OctaFX

Contests schedule

Current round (EET)

Registration: Dec 22, 2014 00:00 - Jan 19, 2015 00:00

Duration: Jan 19, 2015 00:00 - Feb 14, 2015 00:00

Next round (EET)

Registration: Jan 19, 2015 00:00 - Feb 16, 2015 00:00

Duration: Feb 16, 2015 00:00 - Mar 14, 2015 00:00

Please visit here to see full contestants list http://www.octafx.com/contests/octafx-champion/rating/

Stand out for outstanding with OctaFX!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

GBP/AUD inches closer to 100-DMA

FXStreet (Mumbai) - The GBP/AUD pair rose sharply today as the gains in the UK Gilt yields pushed the Pound higher across the board, while the Aussie weakened on concerns of a slowdown in China.

The pair currently trades 0.71% higher at 1.8536, after having recovered from a low of 1.8344 hit earlier today. The AUD/USD pair declined 0.19%, after the Chinese full year 2014 GDP came-in at 7.4%, the slowest in 24 years. Meanwhile, the gains in the UK Gilt yields at the short-end as well as the long-end of the yield curve helped GBP/USD to recovery early losses to trade 0.53% higher at 1.5192 levels. Thus, the GBP/AUD pair is now within a touching distance from the 100-DMA located at 1.8552 levels.

GBP/AUD Technical Levels

The immediate resistance is seen at 1.8552 (100-DMA), above which gains could be extended to 1.8590 levels. Meanwhile, support is seen at 1.8527 (hourly 200-SMA) and 1.8489 (hourly 100-SMA) levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 20,2015

OctaFX.Com News Updates

-

GBP/USD eases from daily highs

FXStreet (Córdoba) - GBP/USD staged a decent comeback from daily lows and recovered more than 100 pips, although it faced resistance at the 100-hour SMA and retreated somewhat.

GBP/USD managed to climb to the 1.5165 zone, posting a daily high during the European session, but lost momentum and pulled back a few pips. At time of writing, the pair is trading around 1.5150, up 0.28% on the day, having bounced from a low of 1.5056.

Cable has had a volatile day despite the absence of economic data, as investors gear up for tomorrow's UK jobs and earnings data and the latest BoE’s meeting minutes.

GBP/USD technical perspective

“Some follow through above 1.5180 should favor more intraday gains towards 1.5220/30 area, whilst if this last gives up, 1.5270 area comes nextâ€, said Valeria Bednarik, chief analyst at FXStreet. “To the downside, 1.5110 is the immediate support and a break below it once again will likely lead to a retest of 1.5030/50 price zoneâ€.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 20,2015

OctaFX.Com News Updates

-

USD/CAD improves towards 1.2000

FXStreet (Edinburgh) - The greenback is quickly picking up pace on Tuesday, pushing USD/CAD towards the vicinity of the critical 1.2000 barrier.

USD/CAD eyes on US docket

The pair is re-gaining momentum vs. its Canadian counterpart in the first half of the week, looking to retake the 1.2000 handle and beyond. As the USD-strength gathers steam, the next data releases will be Canadian Manufacturing Sales (-0.6% MoM exp. Nov.) followed by the Housing Market index gauged by NAHB (58 exp. Jan), all preceding the more relevant BoC monetary policy meeting due tomorrow.

In the view of Shaun Osborne, Chief FX Strategist at TD Securities, “Intraday charts are neutral but the longer-term charts are bullish and point to a test of 1.22 shortly (76.4% Fibonacci retracement of the 1.30/0.94 drop).

USD/CAD levels to consider

At the moment the pair is up 0.44% at 1.2000 with the next hurdle at 1.2047 (2015 high Jan.16) followed by 1.2070 (low Apr.24 2009) and then 1.2100 (psychological level). On the downside, a break below 1.1940 (low Jan.20) would aim for 1.1934 (low Jan.19) and finally 1.1922 (Tenkan Sen).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 20,2015

OctaFX.Com News Updates

-

GBP/JPY hits 1-week highs

FXStreet (Córdoba) - The recovery of the pound after falling sharply during the Asian session and a weak yen amid risk appetite pushed GBP/JPY to the strongest level in a week.

The pair opened the day trading around 177.60 and broke above 178.40, that was an important short term resistance and soared to 179.60, level last seen in January 13. From last week lows the pound has risen almost 400 pips.

GBP/JPY technical outlook

The pair continues to move within a bearish trend on a wider perspective but in the short term is moving with a bullish bias, on a recovery mode. Currently is testing an important resistance around 179.60/65 (Jan 15 high). The key short term support lies around 178.00, where an ascendant trendline originated at January 16 low stands.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 20,2015

OctaFX.Com News Updates

-

AUD/USD back above 0.8200

FXStreet (Córdoba) - The Australian dollar managed to erase intraday losses and climbed back above the 0.8200 level during the European session, to trade nearly flat on the day.

AUD/USD failed to benefit from better-than-expected Chinese economic growth in the final quarter of 2014 as any optimism over China quickly faded after the IMF downgraded its global growth expectations.

AUD/USD weakened and dropped to a low of 0.8159 during the Asian trade but eventually found buyers, took back losses and climbed to a daily high of 0.8217. At time of writing, the pair is trading at 0.8205, virtually unchanged on the day.

ECB upcoming meeting on Thursday is absorbing most of market's attention, keeping investors cautious and sidelined.

AUD/USD technical levels

As for technical levels, immediate resistances for AUD/USD line up at 0.8217 (daily high), 0.8255 (Jan 16 high) and 0.8294 (Jan 15 high). On the other hand, supports are seen at 0.8159 (daily low), 0.8132 (Jan 15 low) and 0.8100 (psychological level).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 20,2015

OctaFX.Com News Updates

-

EUR/USD clinging to 1.1600

FXStreet (Edinburgh) - The shared currency remains in the upper end of today’s range, with EUR/USD hovering over the 1.1600 neighbourhood.

EUR/USD passed the ZEW test

Auspicious results from the ZEW Survey in both Germany and the EMU gave initial support to the EUR, pushing spot to session highs around 1.1610/20. However, the current context of USD strength appears to cap any bullish attempts, relegating the pair to the 1.1600 surroundings. Next of note in the bloc will be the crucial ECB meeting on Thursday, when apparently everything points to an announce by the central bank of a QE programme worth at least €500 billion of sovereign bond purchases.

EUR/USD levels to watch

As of writing the pair is down 0.16% at 1.1590 and a break below 1.1528 (61.8% of 1.1460-1.1639) would target 1.1460 (11-year low Jan. 16) en route to 1.1445 (low Nov.11 2003) en route to 1.1376 (low Nov.7 2003). On the flip side, the initial hurdle lines up at 1.1649 (high Jan.16) followed by 1.1726 (10-d MA) and finally 1.1792 (high Jan.15).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 20,2015

OctaFX.Com News Updates

-

ä¾æ—§å€¾å‘逢高沽英镑——åŽä¾¨é“¶è¡Œ

FXStreet-åŽä¾¨é“¶è¡Œç–略师Ng称,ä¾æ—§å€¾å‘逢高沽英镑,下行势能犹å˜ã€‚

尽管欧元/美元å弹有é™ï¼Œä½†è‹±é•‘ä¾æ—§è®¾æ³•èµ°å¼ºã€‚

焦点在于明天英央行会议纪è¦ï¼Œç‰¹åˆ«å…³æ³¨é€šèƒ€æ述。

期间,继ç»å»ºè®®é€¢é«˜æ²½è‹±é•‘ï¼Œç›®æ ‡æŒ‡å‘1.5035。

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 20,2015

OctaFX.Com News Updates

-

Germany repatriated 120 tonnes of gold in 2014 - Deutsche Bundesbank

FXStreet (Mumbai) - Deutsche Bundesbank said on Monday it had accelerated its bullion repatriation scheme last year, bringing back German gold from Paris and New York.

The German central bank said it “stepped up†its bullion transfers during 2014, bringing 35 tonnes of its gold from Paris and another 85 tonnes from New York. The repatriation scheme is the country’s effort to bring 674 tonnes, or half of Germany’s total stocks, back to Frankfurt by the end of the decade.

“Implementation of our new gold storage plan is proceeding smoothly. Operations are running very much according to schedule," Carl-Ludwig Thiele, member of the Executive Board of the Deutsche Bundesbank said in a statement.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 20,2015

OctaFX.Com News Updates

-

EUR/USD could test 1.10 in 12-month view Rabobank

FXStreet (Edinburgh) - Jane Foley, Senior Currency Strategist at Rabobank, suggests the value of the European pair could slip to 1.10 in a 12-month horizon.

Key Quotes

By whipping the markets into a frenzy of anticipation ahead of Thursdays policy-meeting, ECB President Draghi has succeeded in squeezing out a huge amount of market impact from the promise of QE and the currency markets are taking the strain.

There is the danger of a sell on the fact reaction which could push the EUR a little higher.

However, Draghi has proved himself in the past to be masterful in directing markets.

The EUR may not be a policy tool of the ECB, but the policy decisions taken since June last year suggest that the central bank is bent on weakening it.

We have revised lower our 12 mth EUR/USD forecast to 1.10.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 20,2015

OctaFX.Com News Updates

-

OctaFX.com-Swap free trading with OctaFx!

OctaFX offers swap-free accounts to their clients. Whether or not your beliefs or trading strategy require swap-free trading, you can always open a swap-free account at OctaFX .

You can always apply for a swap-free account at registration, no matter whether you choose a Micro or ECN account. No overnight charges will be applied to your account. OctaFX respects various trading strategies and does its best to meet every possible client's requirements and expectations. To apply for a swap-free account please check the box "Swap-Free" when opening your account. Your account will be automatically assigned swap-free status.

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

Wishing you luck and profitable trading, yours truly,

Wishing you luck and profitable trading, yours truly,

OctaFX.Com - Financial News and Analysis

in Fundamental Analysis

Posted

US Session Recap: Greenback profits taken off table

FXStreet (Guatemala) - Since the ECB made the deaccession to launch its sovereign QE programme, and with the SNB recent chopping the EUR/CHF floor, investors are liking the US more and more.

The greenback is maintaining the top spot, despite profit taking, although it is losing the competitive edge when it comes to the currency wars, strengthening further vs the euro and subsequently across the board and analysts are now citing parity in 2016/17 - not good for US exporting business. Anyway, Stocks performed well as diversification of cash flows continues to favour the US assets. Stocks were posting scores on the board close to January's highs earlier on in the session. There were a handful of data events at the start of the shift, but thereafter, the session was down to traders to determine ebbs and flows of the currency tides for themselves.

EUR/USD took back some ground lost from down on the lows at 1.1114 and managed a close back on to the 1.12 handle, albeit down from the highs of the recovery drift at 1.1289 down to 1.1207.

GBP/USD is essentially following in the tracks of the EUR and this move from the ECB is dangerous for committed and stubborn Sterling bulls, as where the euro goes the pound will likely follow. Bears stamped on attempts through 1.5020 resistance drowning the pound back below the 1.50 handle to 1.4985, although finishing up on the day close to half a cent.

USD/JPY stuck to a tighter range on the session of a choppy week, and settled into a sideways pattern around 117.80 resistance/support level post an early session recovery from 117.53.

USD/CAD was trading better bid with good retails sales figures and the Bank of Canada Consumer Price Index Core (MoM) (Dec) coming in higher than expected. We went form 1.2377 to 1.2438 in the session.

EUR/CHF was a choppy affair recovering from 0.9791 to 99.11 before dropping back to 0.9843, spiking again to 99.10 and chopping its way down through a drift to 98.50 and recovering for a close at 0.9870.

USD/CHF was volatile with large swings, more so than EUR/CHF but with a load up on dips strategy with a low of 0.8707 for a high of 0.8811.

Key Events:

Bank of Canada Consumer Price Index Core (MoM) (Dec) bullish -0.3 vs -0.4 expected

Canadian Consumer Price Index (MoM) (Dec) bearish -0.7% vs -0.6% exp

Canadian Retail Sales (MoM) (Nov) bullish 0.4% vs -0.2% exp

US Markit Manufacturing PMI (Jan) bearish 53.7 vs 54.0 exp

US CB Leading Indicator (MoM) (Dec) bullish 0.5% vs 0.4% exp

Existing Home Sales Change (MoM) (Dec) neutral 2.4%

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 24,2015

OctaFX.Com News Updates