-

Posts

3069 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Posts posted by OctaFX_Farid

-

-

OctaFX.com - 50% deposit bonus!

How to get a bonus!

Step 1:

Deposit your account

Step 2:

My deposit bonuses

Promotion rules

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

FX space key headlines of events - Scotiabank

FXStreet (Guatemala) - Camilla Sutton, CFA, CMT, Chief FX Strategist, Managing Director at Scotiabank noted the main headlines around the FX market.

Key Quotes:

"USD is strong as 10â€yr yields flirt with a break above the 100â€day MA and the market looks to the FOMC minutes for judging a June hike."

"FX markets have been trading in ranges for the last month and it is a break of these ranges that will be important."

"CAD is soft supported by the broad USD move and yield spreads. Oil is still important but correlations suggest shift to rates and USD. "

"EUR is soft but still within yesterdays range. Data was limited but media reports suggest Greece planning to ask for loan extension."

"EUR: ECB to release first set of minutes Thursday at 7:30am EST."

"GBP is strong as employment and wages surprises higher and BoE minutes provide few surprises."

"EUR/GBP reaches fresh lows with ongoing downside risk."

"USD/JPY is flat as the BoJ holds policy and highlights desire for FX stability but risk of further easing are ever present."

"AUD is soft but within Tuesdays range with few developments."

"CNY is flat as China enters holiday week."

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 18,2015

OctaFX.Com News Updates

-

Gold recovers slightly after weak US housing data

FXStreet (Mumbai) - Gold prices erased part of its losses after the weaker-than-expected housing data in the US pushed the Treasury yields lower.

Safe havens rise on US housing data

Gold prices recovered slightly along with a fall in the US Treasury yields after the data in the US showed housing starts fell 2.0%, beating the estimate of 1.7% fall, while building permits fell 0.7% against expectation of a 0.9% rise. Gold prices recovered from the low of USD 1204.3 to trade at USD 1208 levels. Meanwhile, the 10-year Treasury yield fell from the high of 2.164% to trade at 2.122%.

Gold Technical Levels

The metal currently trades at USD 1207.6, down 0.08% for the day. The immediate resistance is seen at 1213.82 (100-DMA) and 1219.6 (50% retracement of 1131.9-1307.8) levels. On the flip side, a break below 1198.9 (61.8% retracement of 1131.9-1307.8) could push the pair down to 1186.3 (Dec. 5th low).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 18,2015

OctaFX.Com News Updates

-

Strong labour data good for GBP, bad warns of weak productivity – BBH

FXStreet (Barcelona) - The Brown Brothers Harriman team reviews today’s UK labour data release, noting that the sterling positive numbers might lead GBP/USD towards 1.5500-1.5600 levels, and further adds that the increase in aggregate work hours warns that productivity remains weak.

Key Quotes

“Strong employment and earnings data in the UK lifted sterling to the upper end of its recent range near $1.5450. A break would quickly target the $1.5500-$1.5600 area.â€

“The claimant count fell by 38.6k, which is about 50% more than the consensus expected, and the December decline was revised to 35.8k from 29.7k.â€

“The unemployment rate fell to a new cyclical low of 5.7% (ILO measure).â€

“Earnings growth, reported with an extra month lag, rose 2.1% at a year-over-year pace in Q4 14. The consensus was for a 1.7% increase.â€

“The jump in earnings comes as the BOE minutes highlighted the expected upward pressure on earnings (toward 4%) and the rise of a jump in inflation when the oil increase drops out.â€

“There are two cautionary elements. First, the increase in aggregate hours worked warns that productivity remains weak. This speaks to the growth capacity of the UK economy.â€

“Second, the labor market may be tightening, but the earnings growth was flattered by bonuses. Excluding bonus, earnings growth actually slipped to 1.7% from 1.8%.â€

“That said, there is probably more room for interest rate expectations to adjust, and that means upward pressure on UK rates, especially at the short end.â€

“Gilt yields are also backing up, and at 1.81% today, the 10-year yield at its highest level this year. This represents about a 50 bp increase since the Jan 30 low.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 18,2015

OctaFX.Com News Updates

-

USD/CAD off highs after data

FXStreet (Edinburgh) - The US dollar is giving away part of recent gains vs. the CAD, taking USD/CAD to the area of 1.2430.

USD/CAD eyes on Fed

Data for the month of January was far from supportive of the greenback, showing producer prices and housing sector releases missing expectations. Next of note will be the Capacity Utilization (79.9% exp.) and Industrial Production (0.3% exp.) followed by the FOMC minutes.

On the other side of the border, Canadian Wholesale Sales jumped 2.5% on a monthly basis in December, leaving behind estimates (0.3%) and Novembers print (-0.3%).

USD/CAD key levels

As of writing the pair is advancing 0.51% at 1.2437 and a surpass of 1.2480 (high Feb.17) would open the door to 1.2493 (21-d MA) and then 1.2529 (Tenkan Sen). On the flip side, the immediate support lines up at 1.2360 (low Feb.17) ahead of 1.2353 (low Feb.3) and finally 1.2302 (Kijun Sen).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 18,2015

OctaFX.Com News Updates

-

OctaFX.com-How IB program works!

How it works

How to become an IB?

Open a partner account at OctaFX.

Receive your referral link in the "IB Area" section of your Personal Area at OctaFX.

That's it, you are now an IB for OctaFX!

IB conditions!

Promo items for IB.

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

Markets taking Greece in its stride - BBH

FXStreet (Guatemala) - Analysts at Brown Brothers Harriman explained that the market appears to be taking in stride the latest setback in negotiations over Greece.

Key Quotes:

"The euro has recouped all the ground lost in thin markets late yesterday when the Eurogroup discussions broke down. Each side has their inviolable principles, and yet some compromise has to be found. It might not be possible to do so on the finance minister level, but may require another heads of state gathering to break the logjam."

"We also note that Greece has been an important catalyst for much of the institutional evolution within Europe since 2010. The framework developed so that Greece can keep its official creditors whole, such as the EFSF and ESM, was rolled out to other countries subsequently. In a similar vein, what is being negotiated now is not only about Greece, but about other anti-austerity parties that may come to power later this year in Spain and Portugal."

"Greece has failed to expose a fissure within the European finance ministers. France and Italy appear somewhat more sympathetic but have not broke ranks. The EC's Juncker and Moscovici reportedly proposed an alternative yesterday that had Greek support met a Eurogroup rejection."

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 17,2015

OctaFX.Com News Updates

-

USD/CAD hitting firm resistance at 1.2445/50

FXStreet (Guatemala) - USD/CAD is currently trading at 1.2437 with a high of 1.2452 (LND open) and a low of 1.2360.

USD/CAD is rallying with the commodity prices coming off, and oil in particular, with WTI dropping over two bucks in the last couple of hours of trade. Support in funds came in initially in the high 1.2300's after the decline from 1.2440 in earlier trade and this rally puts us back to the start again.

Meanwhile, analyst at TD Securities explained that the short-term technical winds here have been transitioning in the past week or so as USD/CAD has failed to gain traction above 1.26. "Trend momentum signals have slowly started to turn negative on the intraday studies." The analysts went onto to suggest that firm resistance is up ahead. "This all suggests that near-term downside risks are building for USD/CAD, we think. Intraday support at 1.2355/60 may hold for now but we would also expect firm resistance intraday around 1.2445/50."

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 17,2015

OctaFX.Com News Updates

-

BI surprises with a rate cut, might cut an additional 50bp – TDS

FXStreet (Barcelona) - Cristian Maggio, Head of Emerging Markets Research at TD Securities, expects Bank of Indonesia to cut rates by an additional 50bp, with the central bank drifting slowly to the dovish bandwagon.

Key Quotes

“Bank Indonesia rocked the boat today announcing a surprise 25bp cut of the BI rate and the FASBI rate to 7.50% and 5.50%, respectively, while the Lending Facility rate was held at 8.00%. Though not completely unreasonable, the decision has come against the unanimous consensus view and our own forecast.â€

“While we need more time to re-assess Indonesia’s interest rate outlook—and perhaps adjust our USDIDR forecast—we believe there’s a reasonable chance that BI will use time at their disposal to ease policy again until the Fed kick off monetary tightening.â€

“We continue to expect a first 25bp hike from the Fed in September, with an incrementally hawkish rhetoric that could defeat any attempt to deliver easing in EMs even before the Fed hikes.â€

“That said, we think BI has clearly drifted towards a more dovish rhetoric. With regard to easing rates, BI mentioned that “Such policy measures were instituted based on Bank Indonesia’s conviction that inflation will remain under control at the lower end of the 4±1% range in 2015 and 2016. The current policy direction is consistent with Bank Indonesia’s efforts to reduce the current account deficit to a more sustainable levelâ€.â€

“The replacement of ‘such policy is consistent’ with ‘the current policy direction is consistent’ allows us to think that more gradual cuts are in store for the next meetings, provided market conditions remain supportive.â€

“We believe that a favourable market response in the coming days will allow BI to cut no less than an additional 50bp, though we need more time to reassess the outlook.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 17,2015

OctaFX.Com News Updates

-

Positive effects of weak yen seen bigger than negatives for now – BTMU

FXStreet (Barcelona) - Lee Hardman, Currency Analyst at Bank of Tokyo-Mitsubishi UFJ, shares the comments that Japanese policy makers prefer a gradual rather than a sharp weakening of the Yen.

Key Quotes

“In an interview with reporters overnight Japanese Economy Minister Amari stated that the positive effects of a weak yen are currently bigger than the negatives. He added that an excessively weak yen would diverge from fundamentals but couldn’t say what line represents an excessive level of yen weakness.â€

“An excessively weak or strong yen, and excessively rapid moves in foreign exchange are not viewed as good for the Japanese economy.â€

“The comments suggest that the Japanese authorities are not yet concerned over the scale of yen weakness.â€

“In a recent report from Bloomberg, it reported that the BoJ views further monetary easing as counterproductive for now with the risk that further yen weakness could undermine confidence in the economy.â€

“Taking the two views together it suggests that the Japanese policymakers would be uncomfortable if the yen was to weaken sharply again, although are not opposed to a further gradual weakening of the yen.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 17,2015

OctaFX.Com News Updates

-

AUD/USD short-term bullish – FXStreet

FXStreet (Barcelona) - Valeria Bednarik, Chief Analyst at FXStreet, notes technicals suggest the short-term outlook for AUD/USD favours the upside, with the pair in need of a push above the resistance at 0.7830 to confirm further advances.

Key Quotes

“The AUD/USD pair surged above the 0.7800 figure, pressuring the top of its latest range, and with the short term picture favoring the upside, as the 1 hour chart shows that the price extends above its 20 SMA and the technical indicators aim higher above their midlines.â€

“In the 4 hours chart the 20 SMA also presents a bullish slope below current price, offering dynamic support around 0.7780, while the indicators bounced strongly from their midlines and maintain their bullish slopes, supporting the shorter term view.â€

“Some follow through above 0.7830 however, is required to confirm further advances today.â€

“Support levels: 0.7780 0.7750 0.7720"

“Resistance levels: 0.7830 0.7865 0.7900â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 17,2015

OctaFX.Com News Updates

-

Expectations for a March rate cut by BoC increasing – BAML

FXStreet (Barcelona) - The Research Team at BofA-Merrill Lynch, forecasts Canada to see a 25bp rate cut in March, with market pricing for the rate cut by BoC increasing significantly to around 60% from previous 20%.

Key Quotes

“In our view, not only would the further decline in oil prices that we expect maintain pressure on CAD valuations, it would also raise risks for the BoC to engage in significant easing.â€

“The BoC eased policy in January to “provide insurance†against downside risks emanating from the oil price shock on growth, inflation, and financial stability. According to the Bank’s January Monetary Policy (MPR) report, its forecast assumes WTI prices of $60/bbl.â€

“Prices still remain over 10% below the Bank’s forecast level, likely meaning the BoC will have to ease further if they stay near current levels or fall further toward our $32/bbl forecasts.â€

“As Senior Deputy Governor Carolyn Wilkins noted last week, “If oil prices were to average $60 per barrel and monetary policy did not respond, gross domestic income would be about 4 1/2 per cent lower by the end of 2016â€1 implying prices below that level would require further easing, consistent with our call for another cut in March.â€

“Since the January meeting, policy expectations have shifted aggressively. Prior to the meeting, less than a 20% chance of a cut was priced in over the next six months. Now, the market is pricing in roughly a 60% chance of a cut at the March meeting.â€

“Given our call for a 25bp cut, we would expect CAD to come under pressure as this gets fully priced.â€

“Additionally, the probability of a further cut (not our base case) is less than 50%.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 17,2015

OctaFX.Com News Updates

-

USD/CAD assaulting 1.2400

FXStreet (Edinburgh) - USD/CAD is extending its bounce off session lows, now looking to retake the 1.2400 key mark.

USD/CAD indifferent on data

The pair continues to trade in the red territory amidst better risk sentiment and a firmer tone from the crude oil prices. Data wise in North America, the manufacturing gauge tracked by the Empire State index dripped to 7.78 during the last month vs. estimates at 8.50; on the other side, Canadian transactions in foreign securities climbed to $13.89 billion during December.

Upcoming results will include the Housing Market index measured by NAHB, TIC Flows and the speech by Philly Fed Plosser.

USD/CAD key levels

The pair is now retreating 0.53% at 1.2398 and a dip beyond 1.2353 (low Feb.3) would open the door to 1.2302 (Kijun Sen) and then 1.2286 (23.6% of 1.0620-1.2800). On the flip side, the initial up barrier lines up at 1.2477 (21-d MA) ahead of 1.2536 (Tenkan Sen) and finally 1.2646 (high Feb.12).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 17,2015

OctaFX.Com News Updates

-

Carry-trade could benefit HUF Danske Bank

FXStreet (Edinburgh) - Chief Analyst at Danske Bank Lars Christensen noted the probable appreciation of the Hungarian currency backed by the countrys good external position.

Key Quotes

Growth has been picking up in Hungary and, after years of stagnation, it is becoming one of the fastest growth economies in central and Eastern Europe.

The HUF has fairly attractive long-term fundamentals and the relatively large current account surplus is particularly helpful.

We continue to believe that Hungarys fairly strong external position is likely to be supportive for the HUF in the medium term.

Furthermore, fairly strong growth and an expected pick-up in inflation are likely to keep the carry on the forint relatively attractive, and we therefore continue to expect near-term appreciation of the forint.

We lower our 1M, 3M, 6M and 12M EUR/HUF forecasts to 305, 305, 300 and 300, respectively from 320, 325, 325 and 320, previously.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 17,2015

OctaFX.Com News Updates

-

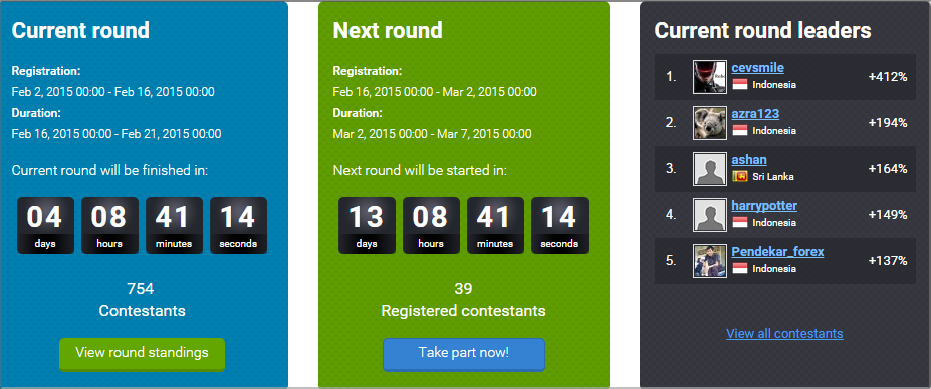

OctaFX.com - Round 35 OctaFX Champions announced!

OctaFX conducts excitingly interesting contests and this is our most popular! Every month more than 3000 traders compete on demo accounts to get into OctaFX Hall of Fame. The aim is simple one should be the most profitable trader to receive withdrawable prize!

We are happy to announce four Champions and their rewards:- 1st place with the award of 500 USD goes to Mr. Susilo Aji from Indonesia

- 2nd place with the award of 300 USD goes to Mr. Alberico Catizone from Italy

- 3rd place with the award of 100 USD goes to Mr. Purwo Atmantyo from Indonesia

- The last runner in the contest, Mr. Nur Faisal from Indonesiais granted 100 USD

Follow our Company News to know the stories of our winners, this month they are promising to be unusually emotional!We would like to thank everyone for participation. The contest was designed for our clients to estimate their abilities, gain experience and have fun competing on demo accounts! The true spirit of healthy competition reigns on the field of OctaFX Champion Demo contest! Take your chance to find your name in the news next time - register in OctaFX Champion Demo Contest Round 37!

Be the Champion with OctaFX!

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

OctaFX.com - Vote for OctaFX in the 2014 FX Empire Awards!

FX Empire announced the nominees for annual FX Empire Awards! OctaFX team is proud to confirm, that this time we have been chosen to represent two categories at once!

OctaFX is nominated for the Best Broker and Most Reliable Broker titles in the year 2014.

We need all your support - to vote for OctaFX click here. We would like to thank you for your appreciation in advance! The voting is open until February 16th, 2015.

We have received 2013 award for Best Customer Service Broker and hope that your votes will bring us new awards from FX Empire this time!

Support your top-notch broker - vote for OctaFX!

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

Varoufakis arrives (late) at Eurogroup meeting to discuss Greece

FXStreet (London) - Greek Finance Minister Yanis Varoufakis has now arrived at the Eurogroup meeting in Brussels, arriving late for the 2:30 GMT start. The discussions focussed on Greece’s continuing membership of the Eurozone and the newly-formed Greek government’s demands for significant haircuts on their existing debts as well as the pressing need for short-term credit service payments are set to commence at 4:30 GMT.

Writing in a New York Times op-ed this morning, Varoufakis said that: “As finance minister of a small, fiscally stressed nation lacking its own central bank and seen by many of our partners as a problem debtor,†adding: “I am convinced that we have one option only: to shun any temptation to treat this pivotal moment as an experiment in strategizing and, instead, to present honestly the facts concerning Greece’s social economy, table our proposals for regrowing Greece, explain why these are in Europe’s interest, and reveal the red lines beyond which logic and duty prevent us from going.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 16,2015

OctaFX.Com News Updates

-

EUR/USD back around 1.1400

FXStreet (Edinburgh) - The European currency is clinging to the positive ground vs. the US dollar on Monday, with EUR/USD now returning to the 1.1400 neighbourhood.

EUR/USD near 1.1400, Eurogroup looms

Spot remains in a sideline pattern ahead of the key second meeting between the Greek finmin Y.Varoufakis and the Eurogroup officials. Despite opinions remain pretty divided in regard of the probable outcome, market participants do agree that another meeting could be necessary later this month.

Ahead in the week, the FOMC minutes on Wednesday and the ECB ‘accounts’ (its version of the minutes) will set the pace in the pair.

EUR/USD levels to consider

At the moment the pair is up 0.05% at 1.1405 facing the next up barrier at 1.1443 (high Feb.13) ahead of 1.1485 (Kijun Sen) and finally 1.1499 (high Feb.5). On the downside, a drop beyond 1.1380 (low Feb.16) would open the door to 1.1367 (200-h MA) and then 1.1303 (low Feb.12).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 16,2015

OctaFX.Com News Updates

-

GBP/JPY is threatening to break below 182.00

FXStreet (Mumbai) - The GBP/JPY pair is threatening to fall below 182.00 levels, as it hovers around 182.10 levels after having hit a low of 182.03 few minutes back.

Pound hit by weak inflation expectation

The British Pound has weakened a day ahead of the data in the UK, which is likely to show inflation in January fell below zero level. The month-on-month CPI in January is seen at -0.8%, down from the previous month’s print of 0.0%. Meanwhile, year-on-year the CPI is seen slowing down to 0.4% from the previous month’s 0.5%.

The Bank of England, in its Quarterly Inflation Report, released last week did express a high possibility of inflation falling below zero levels in the short-term. Consequently, the GBP is being sold amid weak inflation expectations and the absence of fresh fundamental triggers today. On the other hand, the Japanese Yen is moderately up on caution ahead of the Eurogroup meeting.

GBP/JPY Technical Levels

The immediate resistance is seen at 182.31 (5-DMA), above which the pair could re-test 182.50 levels. On the flip side, support is seen at 182.00, under which losses could be extended to 181.78 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 16,2015

OctaFX.Com News Updates

-

EUR/GBP extends gains

FXStreet (Mumbai) - The EUR/GBP pair extended gains to hit a fresh session high of 0.7425 as the British Pound continues to weaken in anticipation of negative inflation data due for release tomorrow.

Gains capped by Greek debt issue

The shared currency managed to strengthen against the British Pound as market price-in an expected fall of 0.8% in UK CPI in January. The data is due for release tomorrow and may show cost of living fell below zero levels in January. Meanwhile, a sharp rise in the Eurozone trade surplus also helped the shared currency strengthen.

However, broader gains have been capped due to uncertainty surrounding the Greek debt issue. The markets expect the Eurogroup to reach a short-term fix, however, caution still persist, which has capped gains in the pair.

EUR/GBP Technical Levels

The pair currently trades at 0.7415. The immediate resistance is seen at 0.7425 and 0.7446 levels. On the flip side, a break below 0.7411 could push the pair down to 0.7390 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 16,2015

OctaFX.Com News Updates

-

ECB minutes this week, an important step in transparency BBH

FXStreet (Barcelona) - The Brown Brothers Harriman Team comments that with a number of central banks scheduled to release its policy meeting minutes, the ECB minutes will likely be the most interesting and also an important step in the transparency, further adding that ECBs review of ELA authorization to Greece this week will also remain in focus.

Key Quotes

The most interesting central bank meeting report will come from the ECB. Until now the ECB has been reluctant to provide some record of its policy making discussions. This is expected to change this week. Neither the content nor format is understood yet, except that individual names will not be cited.

It was at the January meeting that the ECB decided to expand its asset purchase program from about 10 bln euros a month to 60 bln, which will include sovereign bonds.

While recognizing this is an important step in the transparency of the ECB, it is also a new channel of communication. Since the record can only be a partial summary of what happened, the ECB, like other central banks, will reveal what it wants.

The ECB is also expected to review its ELA authorization to Greece. Some claim the ECB's decision to no longer accept Greek government bonds as collateral was aimed not so much at Greece as to force both sides together. However, it took place immediately following Draghi's meeting with Greece's new finance minister and not after Draghi's discussions with Berlin."

Surely the two sides would have been engaged in tough negotiations even if the ECB continued to accept Greek bonds.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 16,2015

OctaFX.Com News Updates

-

OctaFX.com-OctaFX cTrader demo contest one week, 5 prizes, ultimate competition!

The main aim of the competition remains the same while environment changes: trade your cTrader demo account and end the week in highest profit to receive the prize from OctaFX. The contest round lasts one week from Monday Market opening to Friday Market closing! Prize fund of $400 is distributed between five lucky traders.Prize fund of $400 is distributed between five lucky traders:

Contest rules and regulations

View round standings

Take part now!

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

EUR/JPY muted post EMU data

FXStreet (Mumbai) - EUR/JPY little changed during the mid-European session, after EMU Q4 2014 GDP figures showed that the Euro zone economy accelerated during the final quarter of 2014, outpacing estimates.

Hovers below 136 levels

Currently, the EUR/JPY pair traded flat at 135.88 levels, striving for 136 levels. The EUR/JPY traded muted, with no reaction to the upbeat EZ data which showed that the 19-nation bloc’s grew by 0.3% in Q4 2014, following the 0.2% uptick in Q3, beating expectations for a 0.2% expansion. On yearly basis, the bloc's GDP expanded 0.9%, after a 0.8% growth in previous quarter. The reading also managed to outpace forecast of an unchanged figure.

The pair remains stuck below 136 levels as both the EUR and JPY is gaining equally against the USD on a broad based greenback weakness. Meanwhile, traders now focus on the crucial US macro data due later today for fresh cues on the cross.

EUR/JPY Levels to consider

To the upside, the next resistance is located at 136.30 and above which it could extend gains to at 136.70 levels. To the downside immediate support might be located at 135 levels below that at 134.77 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 13,2015

OctaFX.Com News Updates

-

Eurozone GDP slightly stronger than expected in fourth quarter 2014

FXStreet (London) - Seasonally adjusted GDP rose by 0.3 percent in the Eurozone and by 0.4 percent in the EU during the fourth quarter of 2014, compared with the previous quarter, according to flash estimates published by Eurostat, the statistical office of the European Union.

The growth was slightly stronger than expected, with consensus expectations of a 0.2 percent growth in the fourth quarter.

In the third quarter of 2014, GDP grew by 0.2 percent in the Eurozone and by 0.3 percent in the EU. Compared with the same quarter of the previous year, seasonally adjusted GDP rose by 0.9 percent in the Eurozone and by 1.3 percent in the EU in the fourth quarter of 2014, after +0.8 percent and +1.3 percent respectively in the previous quarter.

During the fourth quarter of 2014, GDP in the United States increased by 0.7 percent compared with the previous quarter (after +1.2 percent in the third quarter of 2014). Compared with the same quarter of the previous year, GDP grew by 2.5 percent (after +2.7 percent in the previous quarter). Over the whole year 2014 , GDP rose by 0.9 percent in the Eurozone and by 1.4 percent in the EU.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Feb 13,2015

OctaFX.Com News Updates

OctaFX.com - Keep trading we'll take care of the rest

in Forex Brokers

Posted

OctaFX.com-OctaFX Supercharged REAL CONTEST current position!

Win Tesla Model S, Smart Fortwo or Renault Twizy!

Open a Contest Account and Deposit it.

Trade and receive achievements.

Interact with other traders.

Win one of 10 amazing prizes.

View contest standings

Stand out for outstanding with OctaFX!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!