-

Posts

3069 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Posts posted by OctaFX_Farid

-

-

CNB might not devalue the Koruna more – KBC

FXStreet (Barcelona) - The KBC Bank Research Team expects CNB to refrain from any more devaluation of the Koruna in the event of another fall in demand and inflation, meanwhile it might wait for further euro data and ECB’s action.

Key Quotes

“Our baseline scenario still envisages that the CNB will not eventually resort to more devaluation and, in the event of another unexpected fall in demand and inflation, as a first step the Bank Board would rather be another extension of its commitment to intervene against the koruna.â€

“It is also possible that the CNB Board will be satisfied with weakening the koruna through verbal communication as was recently delivered by CNB’s viceâ€governor TomÅ¡Ãk in his commentary for the Czech business daily.â€

“In the meantime, the CNB might wait and watch for more macroeconomic data from both the Czech Republic and the euro area and for another ECB’s policy action.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 09,2015

OctaFX.Com News Updates

-

Mexico Consumer Confidence s.a dipped from previous 94.9 to 93 in December

Read more in Forex News

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 09,2015

OctaFX.Com News Updates

-

US Dec labour report, something for everyone, but weak wages dominate – ING

FXStreet (Barcelona) - Rob Carnell of ING, notes that the US NFP print came in at 252k, better than consensus, but hourly earnings dropped to 1.7% from previous 1.9%, further sharing that the strong unemployment rate and payroll numbers might provide the necessary ammunition for a Fed rate hike.

Key Quotes

“There was, as is often the case, something for everyone in the latest US labour report for December. Non-farm payrolls were slightly stronger than the consensus at 252K (240K consensus) though with substantial upward revisions to the previous months’ data, it does now look as if the payrolls trend is beginning to lift a little.â€

“There was, in addition, a bigger than anticipated decline in the unemployment rate, which fell 0.2pp to 5.6%, helped by a 111K bounce in the household survey of employment and a drop in labour force participation.â€

“But hourly earnings were a real disappointment. Just when it looks as if the US is about to see a step up in the wages figures, not only do you get a weak figure (-0.2%mom) but large revisions to past data, and the wages growth rate has plunged back to 1.7%YoY from 1.9% (2.1% unrevised last month).â€

“If you want to raise rates, these numbers provide the ammunition you need in terms of payrolls and the unemployment rate. Historically, the Fed always thought full employment was at about a 5.3% rate. So we are insignificantly higher than that now. The rate of payrolls jobs growth is also lending weight to the “hikers†arguments.â€

“Against this, with even less wage inflation than was apparent last month, the doves can argue that the unemployment figures are biased and giving a misleading steer, and argue against any near-term increase in rates.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 09,2015

OctaFX.Com News Updates

-

Non-farm Payrolls increase by 252k, December revised upwards, unemployment rate declines to 5.6 percent

FXStreet (London) - Total non-farm payroll employment rose by 252K in December, and the unemployment rate declined to 5.6 percent, the U.S. Bureau of Labor Statistics reported today.

The BLS reported that job gains occurred in professional and business services, construction, food services and drinking places, health care, and manufacturing.

The unemployment rate declined further than expected - down 0.2 percentage point to 5.6 percent in December, and the number of unemployed persons declined by 383,000 to 8.7 million. Over the year, the unemployment rate and the number of unemployed persons were down by 1.1 percentage points and 1.7 million, respectively.

In December, average hourly earnings for all employees on private nonfarm payrolls decreased by 5 cents to USD24.57, following an increase of 6 cents in November. Over the year, average hourly earnings have risen by 1.7 percent. In December, average hourly earnings of private-sector production and nonsupervisory employees decreased by 6 cents to USD20.68.

The change in total nonfarm payroll employment for October was revised from +243K to +261K, and the change for November was revised from +321K to +353K. With these revisions, employment gains in October and November were 50K higher than previously reported.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 09,2015

OctaFX.Com News Updates

-

Canada Building Permits (MoM) below expectations (1%) in November: Actual (-13.8%)

Read more in Forex News

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 09,2015

OctaFX.Com News Updates

-

OctaFX.com - 50% deposit bonus!

How to get a bonus!

Step 1:

Deposit your account

Step 2:

My deposit bonuses

Promotion rules

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

US data coming in mixed of late - watch for volatility - BTMU

FXStreet (Guatemala) - Derek Halpenny, European Head of Currency Strategy at the Bank of Tokyo Mitsubishi UFJ noted that the data from the US has become a little more mixed of late.

Key Quotes:

“This may well fuel speculation that the drop in crude oil prices will show up in a slowing of US economic growth. We maintain that the overall net impact for the US economy is certainly positive and the boost to real incomes for US consumers will be far more important than the impact of knocked out shale production in key energy-intensive states."

“But how that plays out in the flow of economic data releases is admittedly more uncertainâ€.

"It is feasible that the data flow becomes more volatile that may mean a period of monetary policy expectations being pared back before we see the clear net benefits of the boost to real incomes from the fall in crude oil prices."

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 07,2015

OctaFX.Com News Updates

-

USD/JPY bulls taking the 119 handle in its stride

FXStreet (Guatemala) - USD/JPY currently trades 119.44 with a high at 119.66 and a low of 118.36, currently up on the US shift by 0.81%.

USD/JPY remains in a wide range overall while risk aversion threatens the bulls down to 115.50 vs the grain that is to the upside and targets the 120 psychological handle. The price action has been on the bid and pairing back recent losses that tested the less committed bulls down to the 118 handle.

The Yen will remain supported due to the heightened growth concerns, one of which remains with the price of oil. It is the sheer momentum and steepness of the decline that has heightened investor concerns that displays a lack of global demand for the black stuff and thus implies slower global expansion ahead.

Technically, USD/JPY has moved back into a neutral formations in the short term and moves back into the territory of the Dec formed cloud. 118.00 is key and guards the outlook for a breaths run down to test Dec lows of 115.50. Next up to test the commitment of the bulls are the FOMC minutes - looking for signals within the language around the proposed first rate hike.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 07,2015

OctaFX.Com News Updates

-

USD/JPY bulls taking the 119 handle in its stride

FXStreet (Guatemala) - USD/JPY currently trades 119.44 with a high at 119.66 and a low of 118.36, currently up on the US shift by 0.81%.

USD/JPY remains in a wide range overall while risk aversion threatens the bulls down to 115.50 vs the grain that is to the upside and targets the 120 psychological handle. The price action has been on the bid and pairing back recent losses that tested the less committed bulls down to the 118 handle.

The Yen will remain supported due to the heightened growth concerns, one of which remains with the price of oil. It is the sheer momentum and steepness of the decline that has heightened investor concerns that displays a lack of global demand for the black stuff and thus implies slower global expansion ahead.

Technically, USD/JPY has moved back into a neutral formations in the short term and moves back into the territory of the Dec formed cloud. 118.00 is key and guards the outlook for a breaths run down to test Dec lows of 115.50. Next up to test the commitment of the bulls are the FOMC minutes - looking for signals within the language around the proposed first rate hike.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 07,2015

OctaFX.Com News Updates

-

EUR/USD threatens 1.1800

FXStreet (Córdoba) - EUR/USD made marginal new lows and continues to move toward the 1.1800 area as strong US data and negative Eurozone CPI weighed further on the pair.

EUR/USD remains on downtrend, printing lower highs and lower lows on daily basis pressured by divergent monetary policies outlooks in the US and the Eurozone, with the euro having scored a fresh 9-year trough of 1.1802 so far today. If EUR/USD breaks below the 1.1800 psychological level, next target would be 1.1777, which is Dec 30 2005 low.

At time of writing, EUR/USD is trading at 1.1805, recording a 0.69% loss on the day, as investors also await for clues from the FOMC meeting minutes, to be published at 19:00 GMT.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 07,2015

OctaFX.Com News Updates

-

FOMC minutes outlook: Dependent on data — CA

FXStreet (Guatemala) - Analysts at Credit Agricole take a view on the FOMC minutes.

Key Quotes:

"In the December FOMC meeting minutes, the discussion behind the forward guidance changes will provide a better gauge of the balance of views on the dove-hawk scale with regard to economic conditions and the rate lift-off. We will look for additional clues on the dove-hawk balance in the December FOMC minutesâ€.

“While the December FOMC statement offered a hawkish tone in introducing “patience†in policy normalization the Fed dampened such sentiment by stressing that its guidance remains consistent with the previous statements’ “considerable time†characterisation".

"We find that the altered guidance does not signal a change in the policy outlook, which remains dependent on the data. Yet, somewhat unsurprisingly, it prompted two hawks to dissentâ€.

"Further insight on the Fed’s views on the labour market improvement and disinflationary pressures will be useful in understanding the introduction of “patienceâ€. Downward movement in the median fed funds rate projections added a dovish angle and implies a slower pace in rate hikes, so any more information on postlift-off normalisation will be helpful as well. Discussion about the impact of declining energy prices on domestic inflation and financial stability will be of particular interest, given recent oil price movements and financial market volatilityâ€.

"As Chair Yellen noted in her press conference that the normalisation process is unlikely to begin for “at least the next couple of meetings,†any additional comments on the timing may be offered in the minutes. Finally, the minutes likely offered more discussion on segregated accounts, other interest rate tools and the Fed’s balance sheet normalization process".

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 07,2015

OctaFX.Com News Updates

-

Gold under pressure ahead of Fed minutes

FXStreet (Mumbai) - Gold prices decline ahead of the December Federal Reserve (Fed) minutes release, tracking the strength in the Treasury yields in the US.

The yellow metal trades 0.61% lower at USD 1212/Oz levels, compared to the previous session’s close at USD 1219.40/Oz levels. The metal is taking cues from the strength in the US treasury yields. The 10-year yield is up 2.4 basis points at 1.987%, while the 30-yr yield is up 3.1 basis points at 2.554%. Interestingly, the 2-yr yield, a barometer of short-term interest rate expectations, is trading largely unchanged at 0.633% amid widespread belief the minutes would hint at policy tightening in 2015. Gold may extend decline if the 2-year yield starts rising as we move closer to Fed minutes release.

Gold Technical Levels

Gold has an immediate support located at 1209.76 (50-DMA), under which prices may fall to 1205.50 levels. Meanwhile, resistance is seen at 1214.18 (10-DMA) and 1218.4 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 07,2015

OctaFX.Com News Updates

-

NZD/USD drops to 0.7720

FXStreet (Córdoba) - NZD/USD dropped below 0.7730 after the release of the ADP report in the US and bottomed at 0.7721, hitting a fresh daily low.

The pair is moving off session lows, currently trading at 0.7737, down 0.47% for the day so far. The kiwi erased most of yesterday's gains when it rose supported by higher diary prices.

Today the US dollar gained momentum across the board after ADP reported that the US private sector created 241.000 jobs in December; above expectations. Commodity currencies are falling modestly versus greenback buy climbing against its European counterparts, as crude oil prices recover ground.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 07,2015

OctaFX.Com News Updates

-

USD/JPY follows Treasury yields ahead of Fed minutes

FXStreet (Mumbai) - The USD/JPY pair is slowly rising towards the 5-DMA located at 119.68 levels, tracking the hardening of the 10-year Treasury yields in the US as markets brace up for the December Federal Reserve minutes.

The pair extended gains post the release of an upbeat December month ADP report to clock a high of 119.55 levels. Moreover, the Treasury yield curve has steepened, indicating relatively resilient yields at the long-end 10yr and 30yr of the treasury market curve. The USD/JPY is known to have a direct correlation to the yields at the long-end. Thus, the pair is slowly inching higher tracking the 10-yr treasury yield, which currently trades 3.2 basis points at 1.995%.

USD/JPY Technical Levels

The pair has an immediate resistance located at 119.65 (5-DMA) and 119.83 (10-DMA). Meanwhile, support is seen at 119.24, under which the pair could re-test 118.79 (50-DMA) levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 07,2015

OctaFX.Com News Updates

-

OctaFX.com-How IB program works!

How it works

How to become an IB?

Open a partner account at OctaFX.

Receive your referral link in the "IB Area" section of your Personal Area at OctaFX.

That's it, you are now an IB for OctaFX!

IB conditions!

Promo items for IB.

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

Dec US employment index drops, but keeps Fed hike expectations unchanged – ING

FXStreet (Barcelona) - Rob Carnell of ING, notes that the US non-manufacturing ISM came out weaker than expectations and the employment index registered a marginal dip, keeping the Fed hike expectations on course for a Q2 15 rate hike.

Key Quotes

“The US non-manufacturing ISM index for December (56.2) was somewhat weaker than consensus expectations (58.0, INGf 58.4), and was a little surprising as this contemporaneous indicator of retail strength should be receiving good support from both lower oil prices and a buoyant labour market. Recent car sales strength is a reflection of this.â€

“But in any case, it is the employment index of this survey that we usually look at, and this dipped fairly marginally to 56.0 from 56.7 back in November, and is in our view still consistent with a decent, albeit somewhat less robust payrolls figure in January from the 321K figure initially printed for December.â€

“Consensus is currently looking for a 240K payrolls figure with a slight dip in the unemployment rate to 5.7%, and hopefully a further uptick in the wages growth rate to 2.2%. All of which, if it happens, should keep the Fed on course for a 2Q15 (June rather than April we think) first rate hike.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 07,2015

OctaFX.Com News Updates

-

Dec US employment index drops, but keeps Fed hike expectations unchanged – ING

FXStreet (Barcelona) - Rob Carnell of ING, notes that the US non-manufacturing ISM came out weaker than expectations and the employment index registered a marginal dip, keeping the Fed hike expectations on course for a Q2 15 rate hike.

Key Quotes

“The US non-manufacturing ISM index for December (56.2) was somewhat weaker than consensus expectations (58.0, INGf 58.4), and was a little surprising as this contemporaneous indicator of retail strength should be receiving good support from both lower oil prices and a buoyant labour market. Recent car sales strength is a reflection of this.â€

“But in any case, it is the employment index of this survey that we usually look at, and this dipped fairly marginally to 56.0 from 56.7 back in November, and is in our view still consistent with a decent, albeit somewhat less robust payrolls figure in January from the 321K figure initially printed for December.â€

“Consensus is currently looking for a 240K payrolls figure with a slight dip in the unemployment rate to 5.7%, and hopefully a further uptick in the wages growth rate to 2.2%. All of which, if it happens, should keep the Fed on course for a 2Q15 (June rather than April we think) first rate hike.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 07,2015

OctaFX.Com News Updates

-

MPC losing the footrace versus the Fed – BAML

FXStreet (Barcelona) - The Research Team at Bank of America-Merrill Lynch explains that with BoE continues to lose the race to policy tightening versus the Fed with markets pushing probability of a MPC rate hike into early 2016, and thus anticipate Pound to face lose against the USD in the near-term.

Key Quotes

“It has been an inauspicious start to the year for GBP which has underperformed all of its G10 peers with the exception of the NOK. Sentiment has not been helped by further evidence of a loss of momentum in the UK economy, with both the manufacturing and construction PMI numbers printing on the weaker side of expectations.â€

“Though the USD has made a strong start to 2015, GBP/USD has been particularly hit hard, driven primarily by a further shift in rate differentials in favor of the USD.â€

“With the markets pushing back the chances of UK rate hikes into 1Q16, the Bank of England continues to lose the footrace to policy tightening versus the Fed. GBP/USD is thus likely to remain under pressure in the near-term as these forces continue to dominate sentiment.â€

“EUR/GBP has once again failed to make a sustained break of the 0.7750 level despite significant pressure on the EUR at the start of the year.â€

“The conflicting forces of prospective QE weighing on EUR and softening near-term UK inflationary pressures weighing on GBP suggest that EUR/GBP will trade a range for the time being. But, in our view, with the UK general election on the horizon and continued uncertainty on the outcome, there appears to be no respite for the GBP at present.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 07,2015

OctaFX.Com News Updates

-

Treasuries overbought, but bulls still in control – RBS

FXStreet (Barcelona) - William O’Donnell, Head of US Treasury Strategy at RBS, notes that US treasuries are still overbought but there are not signs yet that the bulls/buyers have lost control of the price action.

Key Quotes

“I still have high confidence that market technicals (long-term momentum work, positioning and sentiment data, etc) will eventually sniff out the beginnings of new bear trends in rates markets, even if the economic data has done a lousy job at it in the past year.â€

“Long term momentum work in Treasury 10's and 30's is into 'overbought' territory but there are no signs yet that the bulls/buyers have lost control of the price action. We've seen ~104 straight days where national gas prices have fallen; a good lesson that trends can persist longer than trend-fighters can remain solvent.â€

“Anyway, it's clear that the brushfires that have pushed safe haven rates lower around the globe still have dry tinder to burn.â€

“Indeed, the just updated CFTC data showed that Specs and Levered $ are near an all-time record short in TU out to WN futures. Specs had a record net short in TY futures of $26bn in TY futures equivalents in the latest numbers.â€

“This is why I've said in recent weeks that it's too early to sell or go short, even if it may be too late to buy the overbought back-end of the US rates curve.â€

“10s (1.99%)–Next major resistance comes in at the flash crash lows ~1.86%. There is some minor resistance at ~2.10% before that. Next support comes in ~2.40% with major support at 2.66% after that. Daily momentum is solidly bullish.â€

“30s (2.56%)– Bonds don't have any solid support until 3.105%, the November "lows." Next resistance is a huge level at ~2.50%, the all-time rate lows for bonds. Daily momentum is bullish but edging into overbought readings.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 07,2015

OctaFX.Com News Updates

-

AUD/USD holds above 0.8100

FXStreet (Córdoba) - AUD/USD failed to extend its recovery above 0.8160 and came under mild pressure, surrendering a portion of its intraday gains at the beginning of the New York session.

The Australian dollar has been on recovery mode over the last sessions after hitting a fresh 4 ½-year low Monday, underpinned by rising gold prices. However, AUD/USD lost momentum after reaching a daily high of 0.8157 and pulled back, but the 0.8100 level contained the downside.

At time of writing, the pair is trading at 0.8115, still up 0.41% on the day, with the US Markit services PMI reading having virtually no effect on the greenback. Still on tap, the more important ISM non-manufacturing PMI will be published at 15:00 GMT.

AUD/USD levels to watch

In terms of technical levels, AUD/USD could find immediate supports are seen at 0.8080 (daily low) and 0.8035 (4 ½-year low Jan 5). On the upside, resistances line up at 0.8157 (daily high) and 0.8200 (psychological level).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 07,2015

OctaFX.Com News Updates

-

AUD/JPY fails to hold above 97.00

FXStreet (Córdoba) - AUD/JPY erased gains and is moving toward yesterdays low that lie at 96.37; if it fall under it would be trading at the lowest since December 18.

During the Asian session the pair climbed to 97.20 but failed to hold and pulled back. On European hours rebounded and the 97.00 offered resistance.

Currently trades at 96.48, down 0.30% for the day weakened by the rise of the yen across the board. The Japanese currency is among the strongest for the second day in a row supported by risk aversion and falling US government bond yields.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 07,2015

OctaFX.Com News Updates

-

OctaFX.com-OctaFX cTrader Weekly demo contest Round 6 winners rewarded!

While Round 7 of cTrader Weekly demo contest runs, OctaFX is happy to present you Round 6 winners and their prizes:1st place with the award of 150 USD goes to Mr. Anggun Febriyanto from Indonesia

2nd place with the award of 100 USD goes to Mrs. Siti Nuraisyah from Indonesia

3rd place with the award of 75 USD goes to Mr. Seteven from Indonesia

4th place with the award of 50 USD goes to Mr. Didik Purnomo from Indonesia

5th place with the award of 25 USD goes to Mr. Bahtiyor Usmonov from Uzbekistan

Mr. Anggun Febriyanto performed the most profitable trade in this round and deserved the first place with a help of his skillful funds management! Congratulations!We thank every trader for participation. The next round of cTrader

Weekly demo contest starts in a week its high time to register and win prizes from OctaFX! Join OctaFX traders in this competition and try out our new cTrader platform while trading demo account! Discover cTrader advantages and win OctaFX prizes!

Choose OctaFX as your top-notch Forex broker!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

Gold rises again; still gains capped at USD 1200.00

FXStreet (Mumbai) - Gold prices recovered losses to trade over and above the 50-DMA located at USD 1191, although the metal is still unable to rise above the USD 1200 mark.

The metal currently trades 0.94% higher at USD 1197.30/Oz levels, after having tested the USD 1200 mark. The metal regained strength due to the weakness in the US treasury yields and the US stock markets. The DJIA has weakened 0.86% to trade at 17,680.50 levels, while the S&P futures are down 0.74% at 2031.15 levels. Meanwhile, the 10-yr treasury yield slipped 3.9 basis points to 2.074%. Consequently, the USD index has cooled down to 91.72 levels from the high of 92.05 hit earlier today.

Gold Technical Levels

Gold has an immediate resistance located at 1200, above which gains could be extended to 1203.23 (100-DMA) levels. Meanwhile, support is seen at 1191.40 (50-DMA) and 1183.40 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 06,2015

OctaFX.Com News Updates

-

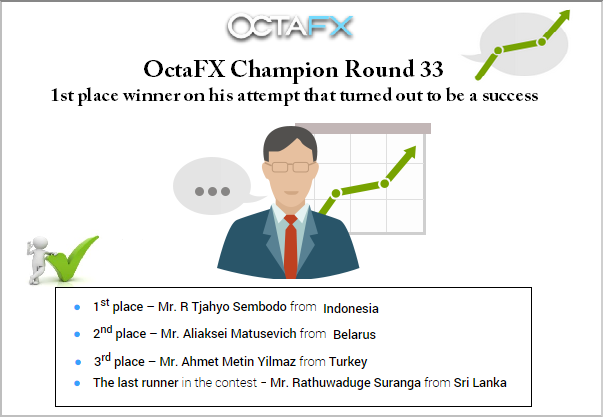

OctaFX.com-OctaFX Champion Round 33: 1st place winner on his attempt that turned out to be a success!

Last round in the year 2014 is finished and we are ready to share winners experience with you! It always makes us proud to receive traders stories and give them a chance to be heard!

Let us remind you the names of our winners:- 1st place Mr. R Tjahyo from Indonesia

- 2nd place Mr. Aliaksei Matusevich from Belarus

- 3rd place Mr. Ahmet Metin Yilmaz from Turkey

- The last runner in the contest Mr. Rathuwaduge Suranga from Sri Lanka

1st place Mr. R Tjahyo from Indonesia on his experience as a winner:

I praise and am thankful to Allah God Almighty and I feel great. After several attempts, I finally found myself exactly where I wanted to be. I actually did not think I could be in first place at least in the first 3 weeks of the round. Last week I saw a chance to occupy 3rd place and I tried to trade safe and be more careful. The last 3 days I was surprised to be the 3rd and I tried to maintain my position. And on a beautiful weekend today, in the last days in the month of December I received an email notification from OctaFX that I achieved the highest position in the contest. Wow I am very excited and happy. Thanks OctaFX for this wonderful weekend.

Now let me tell you about my trading:

I do not always have time to be in front of the computer and analyze every opportunity. I actually have little time to analyze. So I was assisted by a robot in the day-to-day trading.

My technique was scalping with price action guide combined with looking for an opportunity to get a pull back price when the price passed the resistance or support on 5M chart. Yes, I developed a trading robot to help me with these techniques. In addition I did swing trades manually.

This round is my highest achievement after the round 32 contest a month ago: I was in 4th place. Previously, I've experienced a few times a margin call in the demo and live account.

In my opinion everyone can learn the concepts of Forex Trading quickly in a matter of months. However, becoming consistent takes years. Be patient, learn from experience and have a good money management that is the best way to become a good trader and also survive in this business. I would not say I am better than the others.

I prefer to say it was the right time for the right opportunity and the right trading track. Eliminate greed and fear, as it is the key to success. I believe every person has the opportunity to be the best.

2nd place Mr. Aliaksei Matusevich from Belarus:

I am happy to occupy the 2nd position. I tried various techniques. I think I just got lucky, but now I am considering participating in other OctaFX promotions. Practice makes perfect!

3rd place Mr. Ahmet Metin Yilmaz from Turkey:

It was nice and exciting experience and it didnt take much time. Discipline and belief in my system which I developed with time helped me to gain my results. My strategy is based on price action, and yes, I develop this strategy with trying various techniques.

Actually I don't think that I am a good trader. If I occupy the first place in the future, I will think about giving advice to fellow traders.

The last runner in the contest, Mr. Rathuwaduge Suranga from Sri Lanka:

I was trying for 2 years to become the winner and to occupy the first place. However I am happy about your company even being the last. I will try my best to get to the 1st place next round. I have played and learned a lot to improve next time. It will take a long time to become a good trader! I am with you since 2012, but I am still leaning!We thank all the participants for their stories! Feeling inspired by them? Register in OctaFX Champion Demo Contest Round 35!

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

OctaFX.Com - Financial News and Analysis

in Fundamental Analysis

Posted

Consensus on US Job growth met, but big earnings disappointment - BBH

FXStreet (Guatemala) - Analysts at Brown Brothers Harriman explained that the US created 252k new jobs in December, while the October-November series was revised up by 50k.

Key Quotes:

"The participation rate ticked down to match the cyclical low seen last September of 62.7% (from an upwardly revised 62.9% in November). This was behind the decline in the unemployment rate to 5.6%".

"Hourly earnings were an important disappointment. Not only did they fall by 0.2% m/m in December, but the 0.4% rise in November (that was seen as a preliminary sign that the improvement in the labor market was finally seeing upward pressure on wages) was halved to 0.2%. The year-over-year rate slumped to 1.7%, the lowest since October 2012. This will become problematic for the Fed if it persists. As the FOMC minutes suggested, if the labor market continues to improve, which includes broader measures than simply the unemployment rate such as earnings, the Fed could still raise rates even if there is no further progress toward the inflation target".

"The manufacturing sector added 17k jobs, and construction added 48k. These points to a healthy increase in industrial output in December. Business services, leisure, and health care continue to post strong jobs growth. Recent data suggests the US economy may have grown around 3% in Q4".

"The US dollar traded higher across the board in response to the employment figures that we would read a bit more cautiously. The move in the December Eurodollar futures implying the lowest yield since mid-December is more in line with our cautious assessment than the knee-jerk gains in the dollar".

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Jan 09,2015

OctaFX.Com News Updates