-

Posts

3069 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Posts posted by OctaFX_Farid

-

-

USD/JPY starts week close to 120 – MP

FXStreet (Barcelona) - Kenny Fisher, Currency Analyst at MarketPulse shares that the USD/JPY pair trades steady on the start of the week following a week of sharp losses, close to the 120 line after it broke the resistance at 119.83 levels.

Key Quotes

“USD/JPY is steady on Monday, following a week of sharp losses for the wobbly Japanese yen. USD/JPY is trading close to the 120 line late in the European session.â€

“On the release front, it’s a very quiet start to the week, with just two releases. In Japan, the BOJ released its monthly report, a minor event. Over in the US, we’ll get a look at Existing Home Sales. The markets are expecting the indicator to soften in November, with an estimate of 5.21 million.â€

“Prime Minister Shinzo Abe won a convincing electoral victory last week, but he will have little time to savor the win as he grapples with a struggling economy. Growth and inflation remain well below the government’s target and the BoJ’s radical monetary easing scheme has ravaged the yen, which remains close to the 120 level.â€

“With the BOJ expected to maintain or even ease its monetary stance, we’re unlikely to see much improvement from the Japanese currency in the near futureâ€

“USD/JPY edged higher in the Asian session. The pair has been steady in European trade and broke above resistance at 119.83.â€

“119.83 has reverted to a support role as the pair has posted slight gains.â€

“120.63 is an immediate resistance line.â€

“Current range: 119.83 to 120.63â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 22, 2014

OctaFX.Com News Updates

-

EUR is up off its lows, focus still on ECB QE – Scotiabank

FXStreet (Barcelona) - Camilla Sutton CFA, CMT, Chief FX Strategist at Scotiabank, notes that EUR is up 0.3% in the NA open after Friday’s lows, further adding that with limited data in sight the focus still remains in the ECB QE.

Key Quotes

“EUR is up 0.3% into the NA open; however the core takeaway is that EUR fell to fresh lows on Friday, flirting with a break below 1.22. News reports continue to focus on the German stance on potential ECB QE, with several reports suggesting that those close to Chancellor Merkel are not in favour.â€

“European yields continue to fall, with most yields at or close to multiâ€year lows (see table). Preâ€positioning for the potential of ECB QE is helping to suppress yields, which will begin to paint the central bank into a corner. We expect EUR to trend lower in 2015; however warn that this week it could fall victim to liquidity constraints and holiday positioning flows.â€

“EURUSD shortâ€term technicals: bearish—Most technical studies warn of EUR downside risk, warning that EUR is likely to break to fresh lows. We are biased to be short, looking for fresh EUR lows in the nearâ€term.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 22, 2014

OctaFX.Com News Updates

-

CFTC Positioning: USD longs fall to lowest levels since September – Rabobank

FXStreet (Barcelona) - The Rabobank Research Team shares the CFTC positioning data for FX space as at 16th December, 2014, noting that USD longs fell back to lowest levels since September after FOMC meeting.

Key Quotes

“USD long slipped back to their lowest level since early September ahead of last week’s FOMC meeting.â€

“Coincidentally, net EUR shorts dropped substantially back to their lowest levels since August. There is some speculation that full blown QE from the ECB could support the EUR through increased demand for peripheral bonds.â€

“Net JPY shorts continued their retreat. On the back of a bout of safe haven demand, net shorts returned to their lowest level for 5 weeks. The renewed upside climb in spot USD/JPY suggests this pullback in positions is temporary.â€

“For a second consecutive week GBP shorts loss ground aggressively. They have now returned to the lowest levels in 5 weeks.â€

“AUD net shorts dropped back to their lowest levels since late October. CAD short positions, however, lengthened a little. MXN net shorts were extended further.â€

“CHF net shorts dropped significantly in a week in which SNB announced negative rates.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 22, 2014

OctaFX.Com News Updates

-

ECB may announce bond purchase program in early 2015 – BBH

FXStreet (Barcelona) - The Brown Brothers Harriman Team notes that consensus has developed around ECB’s bond purchase program timing, with markets expecting it to begin in early 2015.

Key Quotes

“There appears to be a general consensus that the ECB will announce a sovereign bond purchase program early next year. This anticipation and the decline in oil prices have driven European bond yields to record lows. It has helped ensure that the Greece's political uncertainty stays localized. Economic data alone will not persuade the market otherwise. That said, money supply data and credit data, due December 30, will be important for assessing the next phase of the TLTROS, which require banks to increase their lending books.â€

“A non-binding opinion of the European Court of Justice on the OMT program is expected on January 14. It is not seen as an obstacle.“

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 22, 2014

OctaFX.Com News Updates

-

Quiet range expected for EUR/USD FXStreet

FXStreet (Barcelona) - Valeria Bednarik, Chief Analyst at FXStreet, explains that the overall bearish trend for EUR/USD remains firm, but with holiday season in, the pair will likely remain confined to the 1.22/23 range.

Key Quotes

The EUR/USD pair bounced from its year low of 1.2219, extending up to 1.2272 early in the European session. But volume has gone on holidays and the pair trades in slow motion within Fridays range. From the fundamental side, the only data released in the EZ was German import price index, down yearly basis 2.1%, below market expectations of a 1.9% drop.

Technically, the 4 hours chart shows indicators recovering from oversold levels, but well below its moving averages, with 20 SMA presenting a strong bearish slope above currently around 1.2300. The overall bearish trend remains firm in place, although not much action should be expected these days, with the pair most likely confined to the 1.22/23 range.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 22, 2014

OctaFX.Com News Updates

-

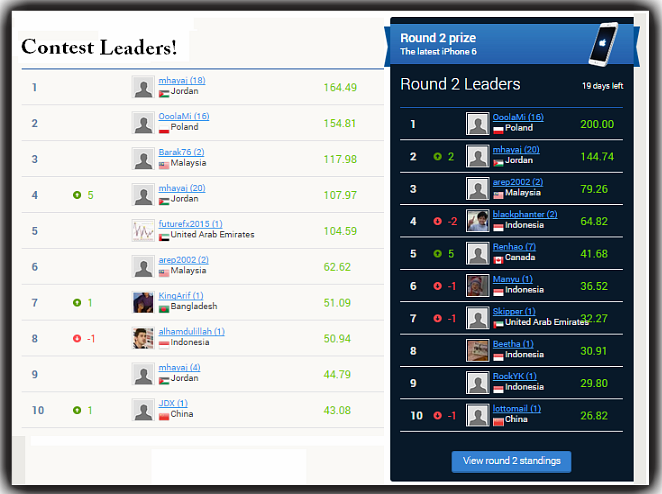

OctaFX.com-OctaFX Supercharged REAL CONTEST current position!

Win Tesla Model S, Smart Fortwo or Renault Twizy!

Open a Contest Account and Deposit it.

Trade and receive achievements.

Interact with other traders.

Win one of 10 amazing prizes.

View contest standings

Stand out for outstanding with OctaFX!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

USD/CHF consolidates around 0.9800

FXStreet (Córdoba) - USD/CHF steadied in a quite narrow range Friday after reaching a 2 ½-year high the previous day following the unexpected decision of the Swiss National Bank to set negative interest rates to defend the CHF cap.

USD/CHF has spent the day consolidating within 0.9780 - 0.9820 after hitting its highest level in over 2 years at 0.9847 as the franc weakened broadly after the SNB announcement. With investors gearing up for Christmas holidays, the pair might extend its consolidative phase during the next hours. At time of writing, USD/CHF is trading at 0.9790, virtually unchanged on the day.

USD/CHF levels to watch

As for technical levels, resistances are seen at 0.9823 (daily high), 0.9847 (2014 high Dec 18) and 0.9872 (Aug 3 2012 high). On the flip side, supports could be found at 0.9780 (daily low), 0.9721 (Dec 18 low) and 0.9700 (psychological level).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 19, 2014

OctaFX.Com News Updates

-

EUR/CAD running into supply post Canadian CPI

FXStreet (Guatemala) - EUR/CAD is trading at 1.4264, up 0.11% on the day, having posted a daily high at 1.4296 and low at 1.4203.

EUR/CAD has dropped back post the highs and rally thats came in the form of a spike post the Canadian CPI arriving at 2% and missing the 2.2% expectations. The main fall in process came from gasoline year on year by 5.9%.

The 1.53 handle is a congested area where strong offers are placed and coinciding with EUR/USDs recent fall out from the top of the 1.24 handle. The current price is at the (Daily 100 SMA) and just ahead we have 1.4285 (Weekly Classic PP), 1.4288 (Daily Classic PP) and 1.4341 (Hourly 200 SMA).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 19, 2014

OctaFX.Com News Updates

-

US treasury 30y yields 35bp away from all-time yield lows RBS

FXStreet (Barcelona) - The RBS Research Team observes that the 30y treasury bonds are only 35bp away from seeing all-time lows for bonds at around 2.50%, further noting that its daily momentum is strongly bearish.

Key Quotes

The back end of the yield curve appears uniquely vulnerable to an overbought correction right now. At the end of the day on Wednesday the Treasury 5's-30's curve tested and swiftly rejected significant support at 111bp, a level derived by the tights in this curve in mid-2008 and then again at the start of 2009. I illustrate this support level in today's first chart while the second chart shows that daily momentum turned in favor of further steepening in the past few days.

The upshot is that those crowded into the long end of the curve may have some rough sledding in the coming weeksperhaps failing to beat the forwards in their flattening trades or just losing money on outright longs in bonds.

With 30yr yields roughly 35bp away from the all-time yield lows in American history (2.50% in December 2008 and again in July 2012), it may be a good time for the longs in bonds to ask themselves what are playing for with 120bp of rally behind us and 35bp left before all-world resistance emerges.

5s (1.65%) Next support comes in at 1.70% (where we were Monday last week) and then it gets stronger at 1.80% and just above. First resistance emerges at 1.47% and then major resistance lines up at ~1.27%. Daily momentum is bearish again.

10s (2.20%) Next resistance comes in at the flash crash lows ~1.86%. Next support comes in ~2.40% with major support at 2.66% after that. Daily momentum is bearish.

30s (2.83%) Bonds don't have any solid support until 3.105%, the November "lows." Next resistance is at ~2.50%, the all-time rate lows for bonds. Daily momentum is solidly bearish.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 19, 2014

OctaFX.Com News Updates

-

Canadian data today may deliver mixed signals on the economy TDS

FXStreet (Barcelona) - According to Shaun Osborne and Martin Schwerdtfeger, FX Strategists at TD Securities, todays Canadian data is expected to deliver mixed signals on the economy and will unlikely help to resolve the short-term uncertainty for funds.

Key Quotes

The market already feels like it is starting to dial it down ahead of the holidays. The CAD ignored a late sell-off in crude oil yesterdayending the brief consolidation in the market and driving WTI back to a little shy of the mid-week lowsand maintained a somewhat better bid tone versus a generally stronger USD into the close Thursday.

USDCAD looks heavy but it really should be moving the other way. Its hard for us to ignore twousuallyfairly decisive drivers of the CADs performance; spreads and commodities. US-Canada 5-year spreads remain elevated (new cycle highs) and soft crude is a clear CAD negative.

Our FV estimate for USDCAD based on these variables is tracking obstinately higher (1.1870 today) even as the spot rate is trying to push onto a 1.15 handle.

Technically, we can see grounds for a little more softness in USDCAD near-term, with the USD well capped in the upper 1.16s this week. But fundamentally, we see little reason for optimism on the CAD; something will have to giveeither spreads and commodities improve in the CADs favour or the CAD will shortly be trading at new lows versus the USD.

Todays Canadian datawhich we expect to deliver some mixed signals on the economyis unlikely to help resolve the short-term uncertainty for funds on the basis of our forecasts (see above).

Broadly, the numbers should reinforce the trading range that has developed in the past few sessions but our gut feeling is that slippage in USDCAD should remain limited and that minor dips remain a buy.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 19, 2014

OctaFX.Com News Updates

-

Morgan Stanley: Where to target EUR/USD in 2015? eFXnews

FXStreet (Barcelona) - The eFXnews team, notes Morgan Stanley anticipates EUR to come under pressure over 2015, forecasting the EUR/USD pair to extend downwards towards the 1.12 area.

Key Quotes

The renewed pressure on the EUR does not end with monetary policy expectations and market indicators. Political uncertainty is also likely to build following the first round of the Greek presidential election.

As a result, we expect the EUR to come under continued pressure over the coming year and reiterate our view of EURUSD extended towards the 1.12 area. This base case projection assumes no QE from the ECB and is formed around the scenario that the current announced measures are set to weaken the EUR via portfolio outflows, increased bank lending (EUR used as a funding currency) and currency hedging of outstanding positions.

However, if the ECB does move to QE in the coming months, this would likely take us to our 1.12 target more rapidly and put the focus on our EUR bear case scenario, where we project EURUSD down to 1.05 for end-2015.

This content has been provided under specific arrangement with eFXnews.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 19, 2014

OctaFX.Com News Updates

-

AUD/USD retreats, unable to rise above 0.8200

FXStreet (Córdoba) - AUD/USD is moving sideways on Friday, on a quiet session so far. The pair moved to the upside during the Asian session but found resistance below 0.8200. From 0.8190 it moved to the downside but managed to find support slightly above 0.8145 (yesterdays American session low) and it was trading 0.8155/60, marginally lower for the day.

The aussie remains steady on Friday against the US consolidating near 4-year lows, headed toward the fourth weekly decline in a row.

AUD/USD technical levels

To the upside resistance levels might be located at 0.8190 (daily high) and above here at 0.8205 and 0.8235 (Dec 17 high). On the opposite direction, support levels could lie at 0.8140, 0.8115 and below here at 0.8100/05 (Dec 17 low).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 19, 2014

OctaFX.Com News Updates

-

GBP/USD at days low as UK public sector net borrowing rises

FXStreet (Mumbai) - The GBP/USD pair has slipped to the days low after the official data in the UK showed the budget deficit widened again in November, although by far less than had been expected by economists.

The pair is now down 0.13% to trade at 1.5651 levels, after failing to extend gains above 1.5680 levels. Public sector net borrowing - excluding state-controlled banks - was GBP 14.1 billion last month, from a revised figure of GBP 7.1 billion in October. Economists had forecast borrowing to increase to GBP 15.1 billion. Earlier this month, the Office for Budget Responsibility raised its forecast for borrowing this year to GBP 91.3 billion from GBP 86.6 billion previously. Earlier today, the Pound was also weighed down by the disappointing Gfk consumer confidence data.

GBP/USD Technical Levels

The pair has an immediate support located at 1.56, under which losses could be extended to 1.5547 levels. Meanwhile, resistance is seen at 1.5682 and 1.5750 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 19, 2014

OctaFX.Com News Updates

-

GBP/USD at days low as UK public sector net borrowing rises

FXStreet (Mumbai) - The GBP/USD pair has slipped to the days low after the official data in the UK showed the budget deficit widened again in November, although by far less than had been expected by economists.

The pair is now down 0.13% to trade at 1.5651 levels, after failing to extend gains above 1.5680 levels. Public sector net borrowing - excluding state-controlled banks - was GBP 14.1 billion last month, from a revised figure of GBP 7.1 billion in October. Economists had forecast borrowing to increase to GBP 15.1 billion. Earlier this month, the Office for Budget Responsibility raised its forecast for borrowing this year to GBP 91.3 billion from GBP 86.6 billion previously. Earlier today, the Pound was also weighed down by the disappointing Gfk consumer confidence data.

GBP/USD Technical Levels

The pair has an immediate support located at 1.56, under which losses could be extended to 1.5547 levels. Meanwhile, resistance is seen at 1.5682 and 1.5750 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 19, 2014

OctaFX.Com News Updates

-

Stay short European currencies vs. the USD SG

FXStreet (Barcelona) - Kit Juckes, Global Head of Currency Research at Societe Generale, sees the equity-sensitive EM and high-beta currencies staging a relief rally with global equities continuing to rally, further suggesting to go short on European currencies vs. the USD and long for USD/JPY.

Key Quotes

Global equities are continuing to rally and US Treasury yields are moving higher, with the longer end under-performing as negative-carry flatteners are cut back ahead of years end. Its a neat trick to have rates markets reacting to a more hawkish than expected FOMC and the equity market rallying in relief that they were not too hawkish. This tells us about market positioning as much as anything else."

The FX reaction is to see equity-sensitive EM and high-beta currencies stage relief rallies, while the more rate-sensitive ones are relatively vulnerable. Stay short European currencies vs. the US dollar and most of all, stay long USD/JPY.

The US rate move has seen sharp widening in relative spreads with Euros, notably at the front end of the curve where the 2-year rate spread is wider that it was in October now. Some relief in European risk sentiment provide a bit of support for the Euro but the trend is firmly lower.

Meanwhile, the SNB rate cut/introduction of negative deposit rates had a big initial impact on EUR/CHF that has already been partially reversed but does reinforce the case for longs in USD/CHF and also in GBP/CHF.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 19, 2014

OctaFX.Com News Updates

-

Short stable period expected in the FX Space ING

FXStreet (Barcelona) - The ING Bank Research Team sees the somewhat stabilized FX markets and the lack of any new data in the coming week to keep the markets calm during Christmas, and comments on the Greek election outcome and the data ahead.

Key Quotes

Greek lawmakers failed to elect Stavros Dimas as the countrys next President in the first round vote on December 17, securing only 160 votes from parliamentary deputies out of 300 when 200 votes are required. Another ballot is to be held on December 23 and he is again likely to fall short. This means it will come down to an all-important third vote on December 29 when the requirement drops to 180 votes.

Given the polarised nature of parliament this will not be easily achieved and if he doesnt get enough votes then a snap parliamentary election will be called with radical Left wing Party, SYRIZA, currently leading in the polls. If SYRIZA do win it could reignite fears of a Eurozone break-up given that they are advocating a huge restructuring of Greek debts and large increases in government spending, which would be heavily resisted by other Eurozone countries.

Elsewhere in the Eurozone it will be a quiet week, although consumer confidence will be in focus to see whether lower fuel costs and aggressive ECB action are being felt by households. It is a similar story in the UK where GDP revisions and public finance numbers will be the highlight.

In the US, 3Q GDP may be revised a touch higher, but consumer confidence may be mixed. On the one hand it should be supported by rising employment and incomes, but recent equity market losses are a downside threat. Regional business surveys should be in decent shape, as should durable goods orders, while inflation pressures will be depressed by falling energy costs.

All in all the data should point to a very positive outlook for the US economy with the Federal Reserve leading the monetary policy tightening cycle next year.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 19, 2014

OctaFX.Com News Updates

-

OctaFX.com - 50% deposit bonus!

How to get a bonus!

Step 1:

Deposit your account

Step 2:

My deposit bonuses

Promotion rules

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

OctaFX.com-OctaFX Christmas and New Year trading schedule!

Due to the approaching holidays, we would like you to be aware of our special Christmas and New Year trading schedule and Customer Support operating hours. Please, consider this schedule while planning your trading:

OctaFX Technical Department would also like you to be informed that due to Christmas and New Year holidays, we have altered trading schedule for XAU/USD and XAG/USD trading instruments.For your convenience, we provide you with this timetable (all times are EET, Server time):

Please, consider the fact that any open trades upon closure of trading hours will be rolled into the next day.

We would like to apologize for any inconvenience caused. Please, contact our Customers Support in case you have any questions. If any failures occur, please report immediately to [email protected]

Happy Holidays & Profitable Trading with OctaFX!

Stand out for outstanding with OctaFX!

Thank you for choosing OctaFX as your top-notch Forex Broker!

-

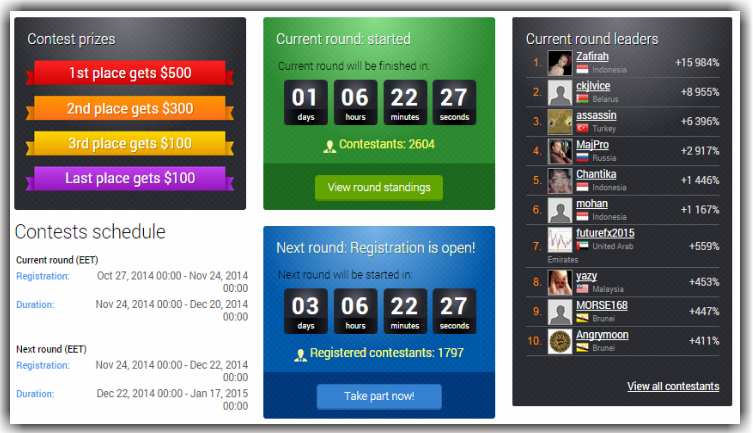

OctaFX Champion - A Splendid Demo Contest from your top Broker!

Champion Demo Contest! *Currently our top contestant Zafirah from Indonesia has piled up with Equity/Balance $160 837.39. So, come and snatch the opportunity and be the part of matchless traders.

Current update of OctaFX

Contests schedule

Current round (EET)

Registration: Oct 27, 2014 00:00 - Nov 24, 2014 00:00

Duration: Nov 24, 2014 00:00 - Dec 20, 2014 00:00

Next round (EET)

Registration: Nov 24, 2014 00:00 - Dec 22, 2014 00:00

Duration: Dec 22, 2014 00:00 - Jan 17, 2015 00:00

Please visit here to see full contestants list http://www.octafx.com/contests/octafx-champion/rating/

Stand out for outstanding with OctaFX!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

United States CB Leading Indicator (MoM) above expectations (0.5%) in November: Actual (0.6%)

Read more in Forex News

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 18, 2014

OctaFX.Com News Updates

-

EUR/GBP drops further below 0.7860

FXStreet (Córdoba) - EUR/GBP weakened after better-than-expected economic data from the United Kingdom and fell further after Wall Street opening bell. Recently printed a fresh weekly low at 0.7835. While the pound remains resilient in the market, the euro is among the worst performers affected by expectations of more easing from the European Central Bank.

The pair is falling for the third day in a row and is having the worst decline since February. Currently trades at 0.7839, down more than 1%.

EUR/GBP eyes December lows

From Monday’s high the pair dropped 165 pips and approached an important support area located around 0.7830, where December lows lie. Below here, the next potential support could be located at 0.7795 (November lows).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 18, 2014

OctaFX.Com News Updates

-

Russia Central Bank Reserves $ down to $414.6B from previous $416.2B

Read more in Forex News

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 18, 2014

OctaFX.Com News Updates

-

Wall Street likely to extend Post Fed rally

FXStreet (Mumbai) - After positing gains in the previous session, the stock markets in the US appear poised for another positive day as indicated by the action in the US index futures.

At the time of writing, the DJIA futures are up 1.30%, while the S&P 500 futures are up 1.28%. The NASDAQ futures advanced 1.41%, along with a 1.40% gain in the Russell futures. Accordingly, the VIX futures declined 4.27%.

The stocks would also be buoyed by a report from the Labor Department showing an unexpected drop in initial jobless claims in the week ended December 13th. Initial Jobless claims slipped to 289K, a decrease of 6,000 from the previous week's revised level of 295K.

In overseas trading, Asian stocks moved mostly higher, with Nikkei gaining more than 2%, while Hong Kong's Hang Seng Index ending 1.1% higher. Meanwhile, major European markets are also seeing significant strength on the day. The German Dax Index is up by 2.1%, while the French Cac is up 2.7%, while the London’s Ftse is up 1.3%.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 18, 2014

OctaFX.Com News Updates

-

The 10-yr Treasury yield in the US rises above 2.2%

FXStreet (Mumbai) - The 10-yr yield Treasury in the US extended gains post an upbeat US weekly jobs data to trade above the 2.2% mark.

The 10-yr yield is now up 6.5 basis points at 2.215%, after having recovered from a low of 2.009% hit on Tuesday. Yields shot up after the Federal Reserve indicated possibility of a sooner-than-expected policy tightening in the US in case the economy continues to recover rapidly. Meanwhile, yields extended gains after the Initial Jobless claims slipped to 289K, a decrease of 6,000 from the previous week's revised level of 295K.

The yields may extend gain if the preliminary Markit US services PMI in December prints higher than the median estimate of 56.3.

10-yr Treasury yield Technical Levels

The immediate resistance is seen at 2.236% (Dec. 4 low), above which gains could be extended to 2.273% (Nov. 10 low). Meanwhile, support is seen at 2.15% (Dec. 1 low) and 2.10% respectively.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 18, 2014

OctaFX.Com News Updates

OctaFX.Com - Financial News and Analysis

in Fundamental Analysis

Posted

USD/JPY may test 121 in near-term – Scotiabank

FXStreet (Barcelona) - Camilla Sutton CFA, CMT, Chief FX Strategist at Scotiabank, anticipates the USD/JPY pair to test 121 levels in the near term as technicals point towards a building upside momentum.

Key Quotes

“USDJPY is flat, but seems to be adhering to last week’s upward trend. There were no major data releases today, however Japan is the only major who will release top tier data on Christmas Day, with CPI. Governor Kuroda’s comments were inline with previous ones, accordingly there was limited market reaction.â€

“USDJPY shortâ€term technicals: mixed—however upside pressure and building momentum leave USDJPY upside risk as the core theme into the open."

"We’d expect a nearâ€term test of 121 and eventually fresh highs above the December 8th 121.85.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 22, 2014

OctaFX.Com News Updates