-

Posts

3069 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Posts posted by OctaFX_Farid

-

-

EUR/USD under pressure – TDS

FXStreet (Barcelona) - The TD Securities Team notes that EUR/USD is under pressure and anticipate the pair to trade defensively ahead of the ECB meeting.

Key Quotes

“EURUSD is heading into the end of the year on a weak note—note seasonal swoon for the USD is evident at this point but that is little wonder, considering the headwinds facing the single currency.â€

“Firstly, Fed officials are sounding confident about the economic outlook and yields in the belly and long end of the US curve are responding. Secondly, this morning’s Eurozone PMI data revisions suggest that the block continues to struggle, raising expectations that the ECB will have to come up with more aggressive easing action. In this respect, the EUR will trade defensively ahead of Thursday's ECB meeting where markets will look for President Draghi to signal a willingness to do more—his late November speech suggested a need to move quickly though we do not expect significant new policy steps just yet.â€

“One wrinkle here is that the ECB moves to a 6-week meeting schedule in 2015 so from here, the next opportunity for the ECB to act will not be until late January; that may shift the balance of risks to doing something sooner rather than later very slightly (given Draghi’s sense of urgency)—though we still favour “laterâ€.“

“No significant, new QE steps may see the EUR rally modestly Thursday but, with US jobs data just around the corner, a good ADP report today likely means little more upside potential than the low 1.24s for EURUSD from here. Look to sell modest EUR rallies near-term.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 03, 2014

OctaFX.Com News Updates

-

Autumn Statement: Osborne announces OBR downgrade of UK growth forecasts

FXStreet (London) - Giving his Autumn Statement, UK Chancellor of the Exchequer, George Osborne has announced that the Office for Budgetary Responsibility has downgraded its forecasts, citing the problems facing the Eurozone and Japan.

The OBR forecasts the UK to grow 2.4 percent next year and 2.2 percent in 2016. It forecasts inflation at 1.2 percent in 2015 and 1.7 percent in 2016.

The 2015-16 budget deficit is forecasted at GBP75.9 with the UK expected to run a budget surplus in 2018-2019.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 03, 2014

OctaFX.Com News Updates

-

EUR/USD holding on to 1.2320

FXStreet (Edinburgh) - The shared currency remains immersed in the red territory on Wednesday, putting the 1.2320 level to the test ahead of the ADP report.

EUR/USD weaker, eyes on ECB

Spot now extends its weekly descent to fresh ytd lows amidst worsening data from the euro area and the increasing ECB rhetoric pointing to the likeliness of further easing in the near future, capping upside attempts as a consequence. Ahead in the session, the ADP report will be the first test, with consensus expecting the US private sector to have added 221K during November. In light of the ECB meeting due tomorrow, analysts at Danske Bank argued “One trigger for more easing from the ECB would be that the current measures are not enough to boost the balance sheet, and so far the ECB still expects the balance sheet to move towards its early 2012 dimensionsâ€.

EUR/USD levels to watch

At the moment the pair is losing 0.43% at 1.2328 and a break below 1.2295 (low Aug.20 2012) would aim for 1.2288 (low Aug.17 2012) and then 1.2256 (low Aug.16 2012). On the flip side, the immediate hurdle lines up at 1.2419 (low Dec.1) ahead of 1.2449 (10-d MA) and finally 1.2476 (high Dec.2).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 03, 2014

OctaFX.Com News Updates

-

AUD tumbling – SG

FXStreet (Barcelona) - Kit Juckes, Global Head of Currency Research at Societe Generale, sees AUD/USD likely to test the bottom of the two year declining channel at 0.8330/35 levels, which would add further pressure on the pair.

Key Quotes

“Australia saw real GDP growth slow to 0.3pct q/q, much lower than expected and taking annual growth to 2.7pct. There were downward revisions to back data and as economists ponder whether the outlook is bleak enough to prompt another rate cut in February, the currency market is simply selling the currency. The RBA would prefer a weaker currency than lower rates anyway. AUD/USD is now likely to test the bottom of a two-year declining channel at 0.8330/35. A break of this level would be a powerful bearish signal.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 03, 2014

OctaFX.Com News Updates

-

GBP/USD steady midrange – FXStreet

FXStreet (Barcelona) - Valeria Bednarik, Chief Analyst at FXStreet, notes that GBP/USD trades steadily today due to the better than expected UK Services PMI, avoiding the USD strength for the time being.

Key Quotes

“The GBP/USD trades unchanged on the day, avoiding dollar strength thanks to a better than expected UK Services PMI, showing Britain's services sector expanded faster in November. The pair hovers around the 1.5650 level, with little directional strength according to technical readings, with the pair trading halfway of the daily range.â€

“The 4 hours chart shows 20 SMA offering intraday resistance around the 1.5670 level, while indicators stand flat around their midlines, giving no clues on upcoming direction.â€

“The daily low was so far set at 1.5618, and downward acceleration below it to see the pair gaining bearish strength towards 1.5584 the year low set past week. Above mentioned resistance, next one comes at the 1.5720/40 area, probable top for the day if reached.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 03, 2014

OctaFX.Com News Updates

-

GBP/USD hits daily highs after UK services PMI

FXStreet (Córdoba) - GBP/USD received a boost from better-than-expected UK services PMI and reached fresh daily highs, although it lacked follow-through.

UK Services PMI rose to 58.6 in November from 56.2 and beating expectations of 58.5. The numbers helped the pound, and sent GBP/USD to a high of 1.5667 before pulling back to pre-data levels. At time of writing, the pair is trading at 1.5650, still up 0.1% on the day.

The pair had fallen to the 1.5620 area, but it managed to recover some ground, underpinned by EUR/GBP selling on the back of disappointing European PMIs.

GBP/USD technical levels

As for technical levels, immediate resistances are seen at 1.5667 (daily high), 1.5700 (psychological level) and 1.5742 (Dec 2 high). On the other hand, supports could be found at 1.5618 (daily low) and 1.5600 (psychological level) ahead of 1.5584 (2014 low Dec 1).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 03, 2014

OctaFX.Com News Updates

-

OctaFX.com - 50% deposit bonus!

How to get a bonus!

Step 1:

Deposit your account

Step 2:

My deposit bonuses

Promotion rules

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

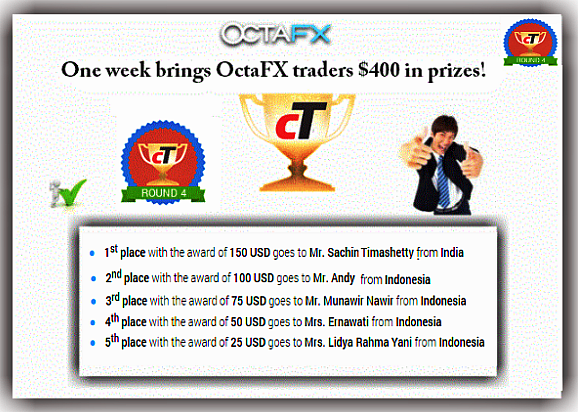

OctaFX.com-One week brings OctaFX traders $400 in prizes!

OctaFX cTrader Weekly demo contest Round 4 is finished!

Today, we congratulate 5 best traders in the round and award them prizes they deserved!- 1st place with the award of 150 USD goes to Mr. Sachin Timashetty from India

- 2nd place with the award of 100 USD goes to Mr. Andy from Indonesia

- 3rd place with the award of 75 USD goes to Mr. Munawir Nawir from Indonesia

- 4th place with the award of 50 USD goes to Mrs. Ernawati from Indonesia

- 5th place with the award of 25 USD goes to Mrs. Lidya Rahma Yani from Indonesia

The number of total profitable trades is stunning! 11950 closed orders were profitable, against just 4982 losing trades!We thank every trader for participation. The next round of cTrader Weekly demo contest

starts in a week its high time to register and win prizes from OctaFX!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

South Africa Total New Vehicle Sales: 51098 (November) vs previous 59384

Read more in Forex News

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 02, 2014

OctaFX.Com News Updates

-

RBA leaves rates on hold – SG

FXStreet (Barcelona) - Kit Juckes, Global Head of Currency Research at Societe Generale, notes that RBA kept rates on hold, while still bemoaning the AUD’s strength.

Key Quotes

“As inflation remains low, the desire for a weaker currency grows. The RBA (and RBI) left rates on hold overnight, the RBA as usual bemoaning the AUD’s strength. The RBA would like a weaker currency much more than they would like to cut interest rates in 2015, though we see more and more economics teams forecast a move down. AUD/USD got a brief lift from the meeting, which is being eroded as I write. 0.80 is still a target.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 02, 2014

OctaFX.Com News Updates

-

Rouble continues to remain soft – DB

FXStreet (Barcelona) - The Deutsche Bank Research Team note that the recent slump in Oil has continued to weigh on the Ruble, as it stands at a 30% decline since September-end.

Key Quotes

“Briefly back to the Oil theme, the effect of the recent slump continues to have a negative impact on the Russian Rouble. The currency was down as much as 6.6% yesterday versus the dollar before paring back some of those intra-day losses to close around 4.5% lower on the day (at 51.65). The currency has now declined 30% since the end of September.â€

“Russia’s 5yr CDS widened a further 26bps yesterday to 344bps whilst the 10y government bond yield finished 15bps higher at 10.76%. The moves also come on the back of an announcement by the Finance Minister Siluanov last week that capital flight may reach $130bn in 2014 - the most since 2009.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 02, 2014

OctaFX.Com News Updates

-

Lower energy prices good news for the global economy says IMF chief – Investec

FXStreet (Barcelona) - The Investec Research Team cites IMF Chief Christine Lagarde’s comments that the lower energy prices will help boost economies in the US and across much of the globe.

Key Quotes

“After London trade, International Monetary Fund (IMF) chief Christine Lagarde said that falling oil prices will help boost economies in the US and across much of the globe, a net positive for a world struggling with slowing growth. "It is good news for the global economy," Ms. Lagarde said at The Wall Street Journal CEO Council annual meeting.â€

“For the US, lower energy prices will help accelerate economic growth to a 3.5% pace next year, Ms. Lagarde said, up from an October forecast of 3.1%.â€

“Oil prices tumbled to multiyear lows last week after the Organization of the Petroleum Exporting Countries (OPEC) decided to maintain its production quotas, rather than lowering its output target.â€

“Lower oil prices are good for most consumers, who pay less for gasoline, although it could cause a short term drop in inflation before the benefits are felt and could squeeze energy companies and the economies of some major producers like Russia, Canada and Norway.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 02, 2014

OctaFX.Com News Updates

-

AUD/NZD re-takes 1.08 handle

FXStreet (Mumbai) - The Aussie rose against the Kiwi today after the Reserve Bank of Australia (RBA) left interest rates unchanged and reiterated that interest rates would stay at record lows for a considerable period of time.

The AUD/NZD pair traded 0.17% higher at 1.0816 at the time of writing. The pair hit a low of 1.0772 levels before rising above the 1.08 levels. Moreover, the pair has declined since last week as the markets priced-in the RBAs decision to hold interest rates at record lows. The Aussie also gained as building approvals rose 11.4% in October, exceeding expectations for an increase of 5.2%. Other data showed Australias current account deficit narrowed to AUD 12.5 billion in the third quarter.

AUD/NZD Technical Levels

The pair has an immediate resistance located at 1.0837 (5-DMA), above which gains could be extended to 1.0848. Meanwhile, support is seen at 1.08 and 1.0772 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 02, 2014

OctaFX.Com News Updates

-

OctaFX.com-OctaFX Supercharged REAL CONTEST current position!

Win Tesla Model S, Smart Fortwo or Renault Twizy!

Open a Contest Account and Deposit it.

Trade and receive achievements.

Interact with other traders.

Win one of 10 amazing prizes.

View contest standings

Stand out for outstanding with OctaFX!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

Gold trades steady ahead of the US PMI readings

FXStreet (Mumbai) - Gold prices steadied around USD 1776.Oz levels as investors await the US manufacturing PMI readings for November from Markit and ISM.

Gold now trades 0.14% higher for the day at USD 1776/Oz levels, after bouncing-off from the day’s low of USD 1141.850/Oz levels. The Markit US PMI is expected to rise slightly to 55.00 levels while the ISM figure is expected to come-in at 58.00. Both figures are still comfortably in growth territory. However, a surprisingly weak figure is likely to push Gold prices higher.

The yellow metal recovered from the day’s low during the European session, tracking weak PMI manufacturing figures across China and Eurozone. The Moody’s downgrade of Japanese debt also helped yellow metal gain strength.

Gold Technical Levels

Gold has an immediate resistance located at 1182.70 on the hourly charts, above which a strong resistance is seen at 1200.00 levels. Meanwhile, a failure to sustain gains at the current levels, shall push the pair down to the day’s low of 1141.80.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 01, 2014

OctaFX.Com News Updates

-

AUD/USD erases losses and rises above 0.8470

FXStreet (Córdoba) - AUD/USD moved toward 0.8500 during the last hours trimming losses favored by the decline of the US dollar across the board.

During the Asian session the pair bottomed at 0.8415, fresh 4-year low and then rebounded but the recovery was limited by 0.8455; hours ago broke above and printed a daily high at 0.8497.

Despite the recovery AUD/USD is trading below the price it close on Friday, keeping a bearish gap still open. Last week finished at 0.8509 and so far it has been unable to trade above 0.8500 on Monday.

AUD/USD technical levels

To the upside, immediate resistance lies at 0.8495 - 0.8500 (daily high) and above here at 0.8527 and 0.8540 (Nov 28 high). On the opposite direction, support might now lie at 0.8475 and below here at 0.8455 and 0.8415 (daily low).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 01, 2014

OctaFX.Com News Updates

-

Policy divergences, decline in commodity prices, and China’s slowdown continue to drive the markets – BBH

FXStreet (Barcelona) - The Research Team at Brown Brothers Harriman have identified three forces that are shaping the investment climate: the economic and monetary divergence that favors the US, the decline in commodity prices, and a slowing of China, which have strengthened and are reinforcing each other.

Key Quotes

“Throughout the last few months, we have identified three forces that are shaping the investment climate: the economic and monetary divergence that favors the US, the decline in commodity prices, and a slowing of China. These forces remain very much intact, and if anything, have strengthened and reinforcing each other. “

“Over the weekend, the PBOC announced it is ready to implement guarantees on deposits (as much as RMB 500,000 or about $81,500). This pushes the agenda towards interest rate liberalization.â€

“The US dollar is mostly softer as North American participants prepare to return from what was a long weekend for many. The greenback had initially moved higher, hitting Â¥119.15, while the euro slipped to $1.2420. The proximate cause was the continued fall in oil prices and news that Moody's cut Japan's credit rating to A1 from Aa3.â€

“However, the dollar shed its gains in the European morning, as falling equity markets sent the dollar to almost JPY118 and the euro recovered to almost $1.2480.â€

“There was little sustained reaction to the EU PMI, which fell to 50.1 from the 50.4 flash reading. Germany's PMI was the lowest since June 2013, and the second sub-50 reading in the past three months.â€

“In the EM space, RUB is again making new lows, falling 4.5% against the basket. Other oil exporters have also been hit heavily, notably Malaysia and Colombia.â€

“Brent futures fell below $68.0 per barrel, but have since recovered back to just under $70.0.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 01, 2014

OctaFX.Com News Updates

-

EUR/GBP dips to lows at 0.7930

FXStreet (Edinburgh) - The good tone from the sterling is weighing on EUR/GBP at the beginning of the week, dragging it to the area of 0.7930.

EUR/GBP softer post-UK data

The bid sentiment around the pound is offsetting the also positive mood in the EUR, sending the cross lower and partially eroding last Friday’s upside to the upper-0.7900s. Good results from the UK docket, with Consumer Credit and manufacturing PMI surpassing estimates are giving extra oxygen to the GBP, already bolstered by a risk-on environment. In light of the upcoming BoE and ECB meetings, Senior FX Strategist at Rabobank Jane Foley commented, “If QE is announced by the ECB in the coming months we expect that the EUR will remain under pressure and we expect a low grind lower in the value of EUR/GBP towards the 0.76 level on a 12 mth viewâ€.

EUR/GBP levels to watch

At the moment the cross is losing 0.29% at 0.7932 with the next support at 0.7900 (psychological level) ahead of 0.7890 (55-d MA). On the upside, a break above 0.7976 (high Dec.1) would open the door to 0.8002 (high Nov.21).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 01, 2014

OctaFX.Com News Updates

-

Nikkei hits seven-year high

FXStreet (Mumbai) - The Japanese stocks advanced today on a surprisingly strong capital spending report and weak Yen.

The Nikkei finished higher0.75% higher at 17,590.10, its highest closing level since July 26, 2007. The stocks opened strong today after the Japanese finance ministry said nonfinancial companies combined capital expenditures in the quarter rose 5.5% year-on-year, compared to the forecast of 1.6%. Meanwhile, weakness in the Yen also supported prices. For a brief moment the USD/JPY pair rose above 119.00 levels today.

Among stocks, Fanuc Corp rose 1.9% and Keyence Corp rose 2.3%. Falling Crude prices pushed ANA Holdings Inc to gain 5.3%, while Japan Airlines Co climbed 7.2%. Other gainers included tire maker Bridgestone Corp and Yokohama Rubber Co. Meanwhile, on the minus side was Sumitomo Metal Mining Co, which fell 1.8% tracking the fall in Gold prices.

Nikkei Technical Levels

The index has a strong resistance located at 17,875 (May 2007 close), above which gains could be extended to 18,000 levels. On the flip side, immediate support is seen at 17,563 (Apr 2006 high), and 17,488 (Oct 2007 high).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 01, 2014

OctaFX.Com News Updates

-

Oil price tumbles 40% since June – Investec

FXStreet (Barcelona) - The Research team at Investec note that Oil prices have fallen 40% since June and it affects both oil-linked currencies as well as near term inflation.

Key Quotes

“Oil prices have been in decline this year, with oil having tumbled almost 40% since June due to the US shale boom and slower economic growth in China and Europe dampening demand. The Organization of the Petroleum Exporting Countries decision last week to hold oil supply steady amid falling prices has acted like a red rag to a bull, as the market sees how low it can push the price of oil before the oil producers are forced to act to protect prices.â€

“Oil-linked currencies such as the Canadian Dollar and Norwegian Krone have fallen in the aftermath. Oil importing countries currencies such as the British Pound, Japanese Yen, and to some extent Euro, have also been hit.â€

“The lower oil price will see a drag on near term inflation at a time when there are concerns about the extent of price slowdown and targeting higher levels of inflation. There will be second round spending effects as the money saved on energy prices is spent by consumers but this will take a while to be seen in the UK and the Bank of England will have to look through a soft patch of inflation that will likely stop them raising interest rates for now.â€

“By Contrast, the US Dollar has been a net winner, more-so by default. Lower pump prices are a shot-in-the-arm for the economy as disposable income increases (due to lower fuel taxes), so the US are likely to be one of the first to receive the second round spending effects that some have likened to a mini-stimulus package. This has been part of the story of the US Dollar continuing to make gains.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 01, 2014

OctaFX.Com News Updates

-

RBI to keep rates unchanged, with rising risks of a surprise – TDS

FXStreet (Barcelona) - Cristian Maggio, Head of Emerging Markets Research at TD Securities, expects the Reserve Bank of India’s Governer Rajan to keep the key rates unchanged and announce the achievement of the 8% CPI target tomorrow.

Key Quotes

“The Reserve bank of India will announce their rate decision tomorrow and we expect Governor Rajan to keep the key rates on hold (repo at 8.00% and CRR at 4.00%). This view is in line with the almost unanimous consensus expectations, but we see increasing risks that a surprise cut may also occur.â€

“The reason for potential easing of policy rates is essentially related to the inflation dynamic, which has been a lot more benign than we had initially expected. This reflects in both a resumption to normal levels of precipitations in the latter months of the summer monsoon season, and the plunge in crude oil prices since July.â€

“In tomorrow’s announcement, rather than a surprise cut, we expect the RBI to communicate more comfort with the achievement of the short-term target of 8% for CPI. The target for January 2016 is 6%, which also seems attainable and which will eventually determine the decision to cut rates in 2015.â€

“If we are right, the decision to hold may give temporary respite to the INR, which has been weakening in line with the general trend in EM FX since July and is currently trading at 62.09 to the dollar, 2% above our Q4 forecast of 60.9.â€

“Rather than with outright longs to the USD, we continue to express our positive view on INR through long INR/KRW in 1m NDFs (target at 19.00), and our oil basket trade (long THB, INR, PHP, TRY—short COP, MXN, BRL) that has gained approx. 2% in spot since November 27.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 01, 2014

OctaFX.Com News Updates

-

UK manufacturing PMI climbs to four-month high in November

FXStreet (Mumbai) - The UK Manufacturing Purchasing Manager’s Index came-in at a four-month high of 53.5 in November, compared to October’s 53.2 and higher than the preliminary reading of 53.00.

The upturn in the manufacturing activity was supported by solid domestic order inflows, which offset subdues trend in new export orders. Meanwhile, Manufacturing employment increased for the nineteenth consecutive month in November, with the rate of job creation reaching four-month high.

Price pressures remained weak in November. The average input prices declined for the third straight month, while the average output prices rose marginally.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 01, 2014

OctaFX.Com News Updates

-

United Kingdom Net Lending to Individuals (MoM) declined to £2.6B in October from previous £2.7B

Read more in Forex News

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 01, 2014

OctaFX.Com News Updates

-

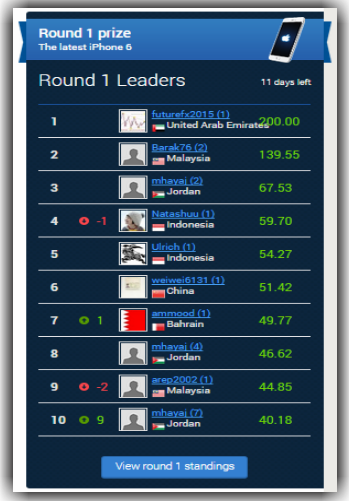

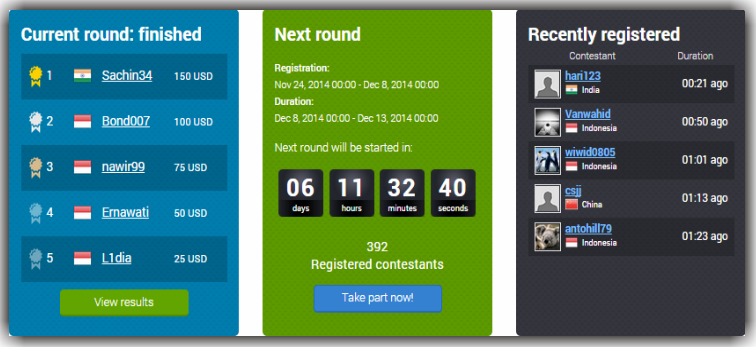

OctaFX.com-OctaFX cTrader demo contest one week, 5 prizes, ultimate competition!

The main aim of the competition remains the same while environment changes: trade your cTrader demo account and end the week in highest profit to receive the prize from OctaFX. The contest round lasts one week from Monday Market opening to Friday Market closing! Prize fund of $400 is distributed between five lucky traders.Prize fund of $400 is distributed between five lucky traders:

Contest rules and regulations

View round standings

Take part now!

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

OctaFX.Com - Financial News and Analysis

in Fundamental Analysis

Posted

Oil to average $70 in 2015 and 2016 – SG

FXStreet (Barcelona) - The Research Team at Societe Generale, notes that oil prices are finding a base after testing the support around 67, and forecast it to average $70 in 2015 & 2016.

Key Quotes

“Oil prices are finding a base, after Brent tested its 67 support. Our commodity strategists now forecast oil prices to average $70 in 2015 and 2016, so there's no good news just around the corner but still, the oil-sensitive currencies may have been battered enough for now. Short AUD/CAD looks mightily attractive, and we are trying to figure out if we're brave enough to re-visit longs in NOK/SEK. The Bank of Canada should keep rates on hold at 1% today.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Dec 03, 2014

OctaFX.Com News Updates