-

Posts

3069 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Posts posted by OctaFX_Farid

-

-

Little movement in EUR/USD as markets eye us housing numbers – MP

FXStreet (Barcelona) - Kenny Fisher, Currency Analyst at MarketPulse notes EUR/USD showing little activity today as it trades in the mid 1.25 range.

Key Quotes

“After some volatility during the week, EUR/USD is showing little activity on Wednesday. In the US, we’ll get a look at important housing data, with the release of Building Permits and Housing Starts. The markets are expecting a slight improvement from both indicators.â€

“ECB head Mario Draghi and his colleagues are under strong pressure to “do something†to kick-start the weak Eurozone economy. Deep interest rate cuts haven’t had much effect, so the ECB has purchased covered bonds and asset-backed securities.â€

“So far, these securities have been from the private sector, and the ECB could decide to expand these purchases to government bonds, known has quantitative easing. However, there is resistance to quantitative easing from national central banks, such as the powerful Bundesbank.â€

“If the ECB does move forward with quantitative easing, we could see the wobbly euro lose more ground.â€

“EUR/USD tested support at 1.2518 in the Asian session. The pair is steady in European trade. 1.2518 is a weak support line. 1.2407 is stronger."

“1.2688 is a strong resistance line.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 19, 2014

OctaFX.Com News Updates

-

GBP/USD moves off 14-month lows – TradeTheNews

FXStreet (Barcelona) - The TradeTheNews Team notes that the GBP/USD pair moved off the 14-month lows after the release of less dovish than expected Bank of England (BOE) Minutes.

Key Quotes

“The pair moved from 1.5590 to test above 1.5650 as a result. There had been some speculation on markets that either Ian McCafferty or Martin Weale would climb down from voting for an immediate rise in rates.â€

“EUR/USD remained in a corrective form following the stronger than expected German ZEW investor confidence yesterday and dealers suspected this would continue for the time being.â€

“EUR/CHF currency cross continues to creep lower, the focus is now on any upcoming polls which help markets to put probabilities on a 'Yes' or 'No' voteâ€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 19, 2014

OctaFX.Com News Updates

-

Bank of Japan board probably still divided despite 8-1 vote – Danske

FXStreet (Barcelona) - The Danske Bank Research Team expects BoJ to be on hold in 2015 as they view the presence of considerable disagreements on the BoJ board.

Key Quotes

“First, we think there is still considerable disagreement on the BoJ board and it will be difficult to get a majority for additional easing.â€

“Second, the government’s postponement of the consumption tax hike has also reduced BoJ’s manoeuvring room. With no fiscal headwinds and the support from a substantial weaker yen, the outlook for growth in 2016 is quite strong.â€

“Hence, it looks like BoJ will have to start tapering at some stage in 2016. It should be remembered that even without additional easing BoJ's balance sheet will be expanded aggressively in 2015.â€

“We continue to see a weaker yen in 2015 on the back of a monetary policy that remains very accommodative, even without additional easing.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 19, 2014

OctaFX.Com News Updates

-

GBP/USD higher, eyes on 1.5690

FXStreet (Edinburgh) - The sterling keeps pushing higher on Wednesday, now lifting GBP/USD to the boundaries of 1.5690.

GBP/USD bounces off ytd lows

After hitting multi-month lows in the 1.5590 neighbourhood, the pair sharply rebounded to the current area of 2-day highs near 1.5680 following the hawkish statement from the BoE minutes. Recall that the Committee voted 7-2 to keep rates unchanged and some members argued that risks point to an exhaustion of the slack, giving way to inflationary pressures. The market is now betting the hiking cycle in the UK could start in the last months of next year vs. more optimistic expectations from months back around Q4 2014/Q1 2015.

GBP/USD levels to watch

As of writing the pair is up 0.34% at 1.5684 with the next resistance 1.5737 (high Nov.17) followed by 1.5751 (10-d MA) and finally 1.5769 (Tenkan Sen). On the flip side, a breakdown of 1.5564 (low Sep.6 2013) would aim for 1.5556 (low Sep.4 2013).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 19, 2014

OctaFX.Com News Updates

-

EUR/USD falters ahead of 1.2550

FXStreet (Córdoba) - EUR/USD moved off daily highs and gave up ground, weighed by cross action and a strong drop in Eurozone construction output.

Eurozone construction declined 1.8% in September from August, and a 1.7% from a year earlier. EUR/USD backed away from daily highs but it continues to clinch above 1.2500 ahead of FOMC minutes to be published at 19:00 GMT. The shared currency hit an hourly low of 1.2523 in recent dealings, and it is currently trading at 1.2538, virtually unchanged on the day.

EUR/USD levels to watch

In terms of technical levels, immediate resistances could be found at 1.2576 (Nov 17 high), 1.2600 (psychological level) and 1.2616 (Oct 31 high). On the flip side, supports are seen at 1.2511 (Nov 19 low), 1.2467 (10-day SMA) and 1.2442 (Nov 18 low).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 19, 2014

OctaFX.Com News Updates

-

EUR/GBP retreats from 1-month high after BoE minutes

FXStreet (Córdoba) - EUR/GBP pulled back from fresh 1-month high after the release of BoE meeting minutes, which showed the MPC remained split over the need for an immediate rise in interest rates, with 2 member voting to hike rates.

Overall, minutes were less dovish than expected, giving pound some support. The BoE said there was a risk that any remaining slack might soon be exhausted, causing inflationary pressures to build.

EUR/GBP retreated to a fresh daily low of 0.8005 from a 1-month high of 0.8037 pre-minutes. At time of writing, the pair is trading at 0.8007, a few pips below its opening price.

EUR/GBP levels to watch

As for technical levels, 0.8002 (Nov 14 high) and 0.7954 (Nov 18 & 17 lows) are EUR/GBP support levels, while 0.8037 (Nov 19 high) and 0.8053 (200-day SMA) are immediate resistances.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 19, 2014

OctaFX.Com News Updates

-

OctaFX.com-cTrader weekly demo contest Round 3 is finished!

OctaFX cTrader Weekly demo contest continues! Today, we will tell you 5 names of the traders, who proved to be the best among 1065!

Welcome Round 3 winners:- 1st place with the award of 150 USD goes to Mr. Tri Aziz Saiful Latif from Indonesia

- 2nd place with the award of 100 USD goes to Mr. Abady Bahij from Egypt

- 3rd place with the award of 75 USD goes to Mr. Muis from Indonesia

- 4th place with the award of 50 USD goes to Mr. Medhat Henedy from Egypt

- 5th place with the award of 25 USD goes to Mr. Javed Hossain from Bangladesh

At the end of this round 468 traders finished in profit, and we hope everyone else registered to improve their result in the next Round, which starts November 24 at the Market opening!

starts in a week its high time to register and win prizes from OctaFX!

We thank every trader for participation. The next round of cTrader Weekly demo contest

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

EUR/USD attempts to climb above 1.2500

FXStreet (San Francisco) - The euro is attempting to recover some ground against the US Dollar following a weaker than expected NY Empire Manufacturing index in October. The EUR/USD rose 20 pips in the last few minutes from 1.2485 to trade above 1.2500.

The NY Empire Manufacturing Index bounced in October to 10.16 from 6.17 in September. However, the data was less than the 11.00 expected.

Earlier in the day, the EUR/USD extended its rejection of the 1.2575 area to trade at the 200-hour MA at 1.2485 where the pair found buying interest. Currently, EUR/USD is trading at 1.2501, down 0.21% on the day, having posted a daily high at 1.2575 and low at 1.2480.

The hourly FXStreet OB/OS Index is showing oversold conditions, alongside the FXStreet Trend Index which is slightly bearish.

EUR/USD levels

If the pair breaks above 1.2500, it will find next resistances at 1.2545 and 1.2575. To the downside, supports are at 1.2485, 1.2542 and 1.2400.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 17, 2014

OctaFX.Com News Updates

-

Speculators increase bullish bets in Crude, Long-to-Short ratio falls

FXStreet (Mumbai) - As per the data released by the Commodity Futures Trading Commission (CFTC) on Friday, large speculators increased the net bullish bets on Crude oil futures for the week ended Nov. 11.

The non-commercial contracts of crude oil futures, traded by large speculators, traders and hedge funds, rose by 8,300 contracts to 276,832 contracts. non-commercial long positions in oil futures increased by a total of 6,470 contracts while the short positions fell by 1,830 contracts to total the overall weekly net change of 8,300 contracts. Moreover, non-commercial net position has now gained three out of the last four weeks, after having declined for six consecutive weeks.

Meanwhile, the ratio of long-to-short positions fell from 12:1 to less than 3:1. This ratio was almost 15:1 just three weeks earlier, the biggest since 2006. Moreover, the slump in prices witnessed in the last two weeks was partly driven by the race to dump losing long positions, which accelerated the price fall.

The WTI Crude for January delivery traded 0.97% lower at USD 75.09/barrel at the time of writing, while Brent for January delivery traded 1.205 lower at USD 78.46/barrel.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 17, 2014

OctaFX.Com News Updates

-

Gold gains in EUR terms

FXStreet (Mumbai) - Gold prices are modestly up in the 17-nation currency bloc after the German central bank warned that economic growth will remain weak in the coming months.

Gold in EUR terms or XAU/EUR traded 0.13% higher at EUR 950.38/Oz levels at the time of writing. The yellow metal had recovered on Friday in EUR terms, tracking gains in the EUR/USD pair and the losses in the US treasury yields. The prices remain well supported today since the Germany’s Bundesbank warned in its monthly report today that the outlook for growth in the region’s largest economy was likely to remain weak in the next few months.

However, broader gains in Gold were capped since the report also argues that the European Central Bank should not embark on a larger stimulus program.

Gold (EUR) Technical Levels

Gold has an immediate resistance located at 953.91, above which the prices may rise to 961.34 levels. Meanwhile, a break below 946.17, may push down the prices to 930.00 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 17, 2014

OctaFX.Com News Updates

-

EUR/GBP holds slightly below 0.8000

FXStreet (Córdoba) - >EUR/GBP climbed to 0.8001 reaching the highest price in a month during the Asian session but quickly pulled back. The pair is consolidating near 0.8000, after having last week the best performance in a more than a year.

The euro is testing an important psychological resistance level, around 0.8000; above here the next resistance lies at 0.8030 and above at 0.8045/55 (October highs). Currently trades at 0.7989, at the same price it closed yesterday.

To the downside immediate support might lie at 0.7980/75 (daily low) followed by 0.7955 and 0.7930/35 (November 14 low).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 17, 2014

OctaFX.Com News Updates

-

USD/JPY will see short-term volatility – TD Securities

FXStreet (Barcelona) - The Research Team at TD Securities see the USD/JPY pair experiencing short-term volatility as BoJ meets this week.

Key Quotes

“USDJPY has been all over the shop, reaching an overnight high of 117.06 as Asian equities sold off upon the release of the data, then dropping to 115.46 as the Nikkei sold off, and eventually recovering to 116.30.“

“Prime Minister Abe is said to be evaluating the situation calmly before announcing the widely expected postponement of the sales tax hike and calling snap elections.â€

“The BoJ meets this week, and although they are not expected to introduce any new measures after last month’s announcements, their characterization of the economic outlook for growth and inflation may well weigh on the JPY.â€

“In all, USDJPY will see a fair bit of volatility in the short-term, the overall medium-term trend remains higher.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 17, 2014

OctaFX.Com News Updates

-

AUD/USD downside contained 0.8720

FXStreet (Córdoba) - AUD/USD surrendered intraday gains and dipped into negative territory for the day after being rejected by the 0.8795 area where it peaked during the Asian session.

AUD/USD was weighed by the risk averse mood and dropped more than 70 pips over the last hours to hit a low of 0.8720 before settling in a slim range. At time of writing, AUD/USD is trading at the 0.8730 zone, down 0.23% on the day.

It is a quiet day ahead data-wise, with the NY Empire State manufacturing index and US industrial production data on tap.

AUD/USD technical levels

In terms of technical levels, immediate resistances are seen at 0.8795/0.8800 (Nov 17 high/psychological level), 0.8807 (50-day SMA) and 0.8850 (Oct 31 high). On the flip side, supports could be found at 0.8720 (Nov 17 low), 0.8700 (psychological level) and 0.8674 (10-day SMA).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 17, 2014

OctaFX.Com News Updates

-

USD/JPY may correct to 114.00 and 112.00 in the short-term – FXStreet

FXStreet (Barcelona) - FXStreet Editor and Analyst Omkar Godbole sees the BOJ rally slowing down in the short-term, and mentions the need for a rise in the treasury yields for a further push on the upside.

Key Quotes

“The USD/JPY pair rallied from 108.00 levels to 116.00 levels since Oct. 31 while the US Ten-year treasury yield remained largely in a range of 2.3% to 2.4%.â€

“This is indicative of the fact that the rally in USD/JPY was almost entirely driven by the BOJ’s surprise stimulus. Hence it may have run its course, at least in the short-run.â€

“A further upside move needs support from the rise in the treasury yields, which appears a difficult case in the short-term.â€

“The pair is also overbought on daily as well as weekly charts.â€

“To conclude - a correction up to 114 and 112 level cannot be ruled out in the short-term.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 17, 2014

OctaFX.Com News Updates

-

USD/JPY pushes 117 briefly - BBH

FXStreet (Barcelona) - Marc Chandler, Global Head of Currency Strategy at BBH Global notes USD/JPY breaking the 117.00 level to later return back to 11.6 levels in European Morning.

Key Quotes

“The US dollar is mostly higher to start the week, with two exceptions. The first is the yen. The unexpected contraction in Q3 GDP triggered a stock market slide (Nikkei off 3%, giving back around 40% of this year’s gains) and spurred a dramatic short-covering squeeze in the yen after the greenback first pushed briefly through the JPY117.00 level.â€

“The dollar found good bids near JPY115.50 from where it based and returned to the JPY116.30 area in the European morning. The New Zealand dollar is the other exception, helped by a strong retail sales report (1.5% in Q3 vs. consensus of 0.8%).“

“Dovish comments over the weekend by the BOE’s Carney and Haldine, who played up the disinflation risks, took a toll on sterling. It fell a cent from the Asian high near $1.5735 to return toward the 2014 low set before the weekend.â€

“For its part, the euro traded as high as $1.2580 in Asia, on follow through buying after the construction pre-weekend price action. However, sellers re-emerged; encouraged by comments from ECB’s Mersch suggesting, at least theoretically, a wide range of assets the ECB could buy, including gold shares and ETFs.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 17, 2014

OctaFX.Com News Updates

-

JPY winning the race to the bottom? - Rabobank

FXStreet (Barcelona) - Jane Foley, Senior Currency Strategist at Rabobank sees the huge amount of monetary stimulus currently been pursued by the BoJ, opening the central bank to accusations that it is deliberately following a policy to weaken the JPY.

Key Quotes

“The huge amount of monetary stimulus that is currently been pursued by the BoJ has opened the central bank to accusations that it is deliberately following a policy to weaken the JPY. This policy finds support in the fact that the fiscal position of the Japanese government is in such poor shape.â€

“Insofar as Japan needs to import most of it energy resources, there have been some concerns about the impact of a weaker JPY on fuel bills of Japanese businesses, though weaker oil prices have since lessened these worries.â€

“In response to these concerns, BoJ Kuroda in early September remarked that virtuous cycles in Japan’s economy wouldn’t be derailed by a weaker yen – this is about as candid that BoJ are likely to be with respect to commenting on the exchange rate.â€

“In view of market expectations that the next move in Fed interest rates would be a hike, the BoJ’s recent announcement of more QE was well timed to push USD/JPY higher."

"While the disappointing performance of world growth made hinder the improvement in Japan’s external balance, given the country’s poor fiscal position hand we expect the BoJ to retain its ultra dovish position and look for USD/JPY to continue edging towards the Y120 area.â€

The pair failed to hold to gains, started to retreated and accelerated during the last hours. From the highs it has fallen more than 50 pips and remains near the lows, trading around 0.7910.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 17, 2014

OctaFX.Com News Updates

-

NZD/USD erases gains, retreats toward 0.7900

FXStreet (Córdoba) - NZD/USD retreated further during the European session and recently bottomed at 0.7909, the same price it close on Friday. The pair closed a bullish gap and erased gains.

NZD/USD gains on data but reverses

During the Asian session boosted by retail sales data from New Zealand, that rose above expectation during the third quarter (+1.50% vs +0.85%), the kiwi climbed pushing NZD/USD to 0.7973, reaching the highest price since October 29.

According to analysts from TD Securities, the rise in core retail sales of 4.5% from a year ago in volume terms and 4.2% in dollar terms, plus the drop in NZ oil prices, and most recent credit card transaction data showing a strong start for the Dec qtr, we expect strong momentum in retail to follow.

The pair failed to hold to gains, started to retreated and accelerated during the last hours. From the highs it has fallen more than 50 pips and remains near the lows, trading around 0.7910.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 17, 2014

OctaFX.Com News Updates

-

OctaFX.com-Electrify your trading with OctaFX!

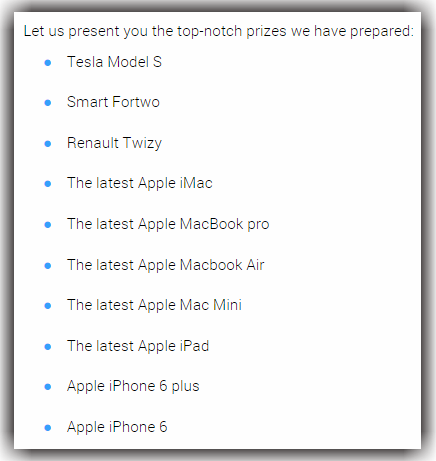

OctaFX announces the greatest real contest since Big Bang! OctaFX team is proud to present you our latest promotion - OctaFX Supercharged real contest! This contest is developed by the qualified team that brought you our celebrated King of the Road real contest! The main aim of the competition remains the same, we have just added more valuable prizes and more fun!

We are glad that we can finally present our new contest to the world! Weve been designing it not to be about your account balance, but about your abilities to trade skillfully! Its all youve been waiting for!

The contest starts on November 17, 2014 at the Market opening and finishes on May 13, 2016 at the Market closure.

Apart from main contest prizes, there is a monthly prize - a brand-new iPhone 6 to award the trader of the month! While chasing Tesla Model S you can now win several rounds of this new real contest! Monthly round starts every 4 weeks. Feel free to consult our How to Win section to know more about point calculation formulas.

Take part in the contest by registering a real account, deposit it by at least $150 and start winning contest points! Trade your real account skillfully, earn achievements, communicate with fellow traders and win one of our amazing prizes! Read the full Rules of the contest here.

OctaFX Supercharged real contest - high-voltage trading brought to you by OctaFX!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

United States Business Inventories came in at 0.3%, above forecasts (0.2%) in September

Read more in Forex News

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 14, 2014

OctaFX.Com News Updates

-

Dollar helps EUR/USD break to the downside - FXStreet

FXStreet (Barcelona) - Valeria Bednarik, Chief Analyst at FXStreet sees better than anticipated US Retail Sales data boosting the dollar and breaking the EUR/USD pair to the downside.

Key Quotes

"Better that expected US Retail Sales up 0.3% in October after a flat growth in September, sent dollar higher against all of its rivals early US session, with the EUR/USD finally breaking to the downside the symmetrical triangle that contained price for all of this week, reaching 1.2398 before bouncing."

"Despite the break lower should signal the bearish trend is ready to resume, the fact is that the pair has been finding buyers around the 1.2400 earlier in the week also, so further declines are still required to confirm the move."

"Short term, the 1 hour chart presents a clear bearish momentum with price moving away from its moving averages, while the 4 hours chart maintains a neutral technical stance amid the weekly range."

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 14, 2014

OctaFX.Com News Updates

-

USD/CAD in fresh lows sub-1.1350

FXStreet (Edinburgh) - After being rejected from the 1.1390 area, USD/CAD has tumbled to the region of session lows around 1.1350/45 on Friday.

USD/CAD softer despite good US data

The recovery from previous lows in sub-1.1360 levels proved to be ephemeral despite US Retail Sales surpassed forecasts during October, growing 0.2% inter-month. Spot is back on the red territory and challenging session lows closer to 1.1350 ahead of the speech by Fed’s Bullard and the Consumer Sentiment gauge by the Reuters/Michigan index. In the opinion of Camilla Sutton, Chief FX Strategist at Scotiabank, technical studies are mixed, “as spot has failed to reach a fresh high, upward momentum has been lost and studies have shifted to a less bullish stance; likely warning of a temporary period of range tradingâ€.

USD/CAD levels to watch

The pair is now losing 0.26% en 1.1344 with the immediate support at 1.1300 (low Nov.13) followed by 1.1294 (Kijun Sen) and then 1.1281 (low Nov.12). On the upside, a break above 1.1402 (high Nov.11) would aim for 1.1450 (high Nov.7) and then 1.1466 (high Nov.5).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 14, 2014

OctaFX.Com News Updates

-

GBP/USD showing no signs of reversal – FXStreet

FXStreet (Barcelona) - Valeria Bednarik, Chief Analyst at FXStreet highlights the important events to take place in the coming week while commenting on GBP sinking to fresh year lows.

Key Quotes

“Indeed, the UK was the economy that more attention gathered these last few days, with Wednesday’s key fundamental readings triggering a selloff in the local currency.â€

“The BOE published its quarterly inflation report: with inflation at a 5-year low of 1.2%, the BOE also downgraded the outlook for inflation, seeing it below 1% in the next six months, also predicting it will slowly rise to normal over the next three years.â€

“The GBP/USD pair sunk to fresh year lows in the mid’ 1.56, and shows no aims of turning back higher.â€

“Early this Friday, German and EZ GDP and inflation readings came in line with current European situation: from weak to doom. The only positive note came from GDP readings, as German one shown a 0.1% growth in the third quarter, and French economy grew by 0.3%, slightly above expected. But EZ inflation failed to achieve the expected 0.4%, and held at its sad lows of 0.3%.â€

“The calendar will be a bit more active next week, and hopefully major pairs will find a reason to set more directional moves.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 14, 2014

OctaFX.Com News Updates

-

USD/JPY extends gains on US retail sales

FXStreet (Córdoba) - USD/JPY extended gains and printed fresh 7-year highs at the beginning of the New York session, lifted by better-than-expected US retail sales data.

Retail sales rose 0.3% from the prior month to a seasonally adjusted $444.49 billion in October, beating expectations of a 0.2% increase. Separated data showed US import prices fell 1.3% from September versus a 1.5% drop expected.

Dollar strengthened across the board and rallied to 116.81 against the yen, recording its highest level since October 2007.

At time of writing, USD/JPY is trading at 116.75, 0.86%, or 100 pips, above its opening price. On the upside, the 117.00 level stands as next resistance, while the 10-hour SMA at 116.33 offers immediate support.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 14, 2014

OctaFX.Com News Updates

-

United States Export Price Index (YoY) fell from previous -0.4% to -0.8% in October

Read more in Forex News

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 14, 2014

OctaFX.Com News Updates

OctaFX.Com - Financial News and Analysis

in Fundamental Analysis

Posted

EUR/USD may test 1.2670 levels ahead of the US CPI data – FXStreet

FXStreet (Barcelona) - FXStreet Editor and Analyst Omkar Godbole sees the EUR/USD pair looking at a probable technical correction towards 1.27 levels as the single currency manages to sustain above 1.24 levels since last week.

Key Quotes

“The pair closed 1.2517 resistance yesterday, opening doors for a further upside in the pair.â€

“The move was supported by positive Price-RSI divergence on the daily chart.â€

“A similar positive divergence is also seen on the weekly chart, although the weekly RSI is yet to rise above 30.00 levels.â€

“Hence, the pair is more likely to test the 50 DMA located at 1.2670 ahead of the tomorrow’s US CPI data.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 19, 2014

OctaFX.Com News Updates