-

Posts

3069 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Posts posted by OctaFX_Farid

-

-

No OPEC output cut this month – Kuwait Oil Minister

FXStreet (Mumbai) - Kuwait Oil Minister Ali Al-Omair contradicted market expectation yesterday by stating that the Organization of Petroleum Exporting Countries (OPEC) will not cut its output in order to stabilize the falling Crude prices.

Speculations have been rife that the OPEC group, at its Nov. 27 meeting, may announce an output cut due to the rout in Crude prices. However, Saudi Arabia cut its price of Oil to the US, which did signal that the OPEC members do not intend to cut their output.

As per Bloomberg data, the OPEC, which has a production target of 30 million barrels a day, pumped 30.974 million barrels a day in October. “I don’t think there will be any cut in the production,†Al-Omair said at a conference in Abu Dhabi in the United Arab Emirates. “We feel prices will settle down once surplus oil is absorbed.â€

The Oil Minister also stated that Kuwait has no plans to cut its own crude production. As per Bloomberg data, Kuwait produced 2.85 million barrels a day in October.

WTI Crude is trading 0.08% lower at USD 77.36/barrel, while Brent Crude for December delivery is trading 0.38% lower at USD 82.64/barrel. Brent futures fell to a four-year low earlier today on the increased threat of a supply glut.

Brent Crude Technical Levels

Brent has an immediate support located at 82.20, under which the prices can fall to 81.85 (daily low). Meanwhile, Brent may rise to 83.38, if the immediate resistance at 82.80 is breached.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 11, 2014

OctaFX.Com News Updates

-

AUD/JPY breaks above 100.00, 1-year high

FXStreet (Córdoba) - AUD/JPY broke above 100.00 for the first time since May 2013 and printed a fresh high at 100.09. A weak yen in the currency market boosted the pair.

Ahead of Wall Street opening bell amid a US holiday, the pair is hovering around 100.00 rising for the fourth day in a row as USD/JPY continues near multi-year highs around 116.00 and as AUD/USD erases losses and rises back above 0.8600.

AUD/JPY and the best day of the month

The aussie is having the best day since the beginning of the month against the yen and has risen so far more than a hundred pips. AUD/JPY accelerated to the upside after rising above 99.30 and broke 99.70 (last week high) without making a pause.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 11, 2014

OctaFX.Com News Updates

-

Uncertainties Weigh on JPY – TD Securities

FXStreet (Barcelona) - The Forex Research Team at TD Securities view the USD/JPY path higher to be risky in lieu of the uncertainties revolving around the BoJ policy outlook.

Key Quotes

“Concerns that Japan’s fiscal reform efforts are stalling and that PM Abe may call a snap election if he decides not to push ahead with the second-leg of the proposed sales tax increase in 2015 have weighed on the JPY through the overnight session.â€

“USDJPY traded through 116 briefly, the highest level seen since 2007.“

“These uncertainties are clear JPY negatives on the face of it but the broader outlook for USDJPY will hinge on the BoJ’s response to the government’s fumbling of the sales tax increase—inflation expectations and inflation may edge lower as a result of the delayed sales tax increase but, without more obvious efforts to rein back Japan’s sovereign debt burden, the BoJ may be reluctant to provide further monetary stimulus—as well as where US yields head from here.“

“We think the longer-term direction in USDJPY remains higher but, with US nominal yields reluctant to move up and the BoJ policy outlook perhaps a little more uncertain, USDJPY’s path higher is not without risks.“

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 11, 2014

OctaFX.Com News Updates

-

Yen Weak, USD/JPY stronger - BBH

FXStreet (Barcelona) - Mark Chandler, Global Head of Currency Strategy at Brown Brothers Harriman views the decline in the yen having a nearly immediate effect on the yen-value of the income earned from overseas investments, and sees USD/JPY heading towards 118.

Key Quotes

“The yen is off almost 1% against the US dollar and nearly as much against the euro. The greenback poked through the JPY116 level, after having dipped barely and briefly through JPY114 yesterday. For its part, the euro has bounced from JPY142 yesterday to nearly JPY144 today.“

“Once the US dollar can establish a foothold above JPY116.00, the next target is near JPY118.00. “

“The JPY113.50-114.00 area should now provide support.â€

“Given the higher volatility, the upper Bollinger Band (two standard deviations above the 20-day average), which the dollar had been bumping against last week, is now near JPY117.30.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 11, 2014

OctaFX.Com News Updates

-

GBP/JPY climbs to 184.00

FXStreet (Córdoba) - The decline of the yen across the board pushed GBP/JPY to 184.00, reaching the highest price last Thursday, when it reached 184.30, the strongest level in six years.

The pair was trading below 182.00 during the Asian session but then jumped and climbed rising more than 200 pips in a few hours. The rally found resistance around 184.00 and currently trades at 183.75/80, up 0.96%, headed toward the highest daily close since 2008. The yen is so far the worst performer across the board.

GBP/JPY testing 2014 highs

Last week the pair reached 184.40 but reversed quickly and ended the week below around 181.50. On Monday the pair stabilized and today is soaring, approaching last week highs. A consolidation on top of 184.00, would expose the highs. The area around 184.40/55 is an important long term resistance, followed by 185.70/80.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 11, 2014

OctaFX.Com News Updates

-

GBP/JPY climbs to 184.00

FXStreet (Córdoba) - The decline of the yen across the board pushed GBP/JPY to 184.00, reaching the highest price last Thursday, when it reached 184.30, the strongest level in six years.

The pair was trading below 182.00 during the Asian session but then jumped and climbed rising more than 200 pips in a few hours. The rally found resistance around 184.00 and currently trades at 183.75/80, up 0.96%, headed toward the highest daily close since 2008. The yen is so far the worst performer across the board.

GBP/JPY testing 2014 highs

Last week the pair reached 184.40 but reversed quickly and ended the week below around 181.50. On Monday the pair stabilized and today is soaring, approaching last week highs. A consolidation on top of 184.00, would expose the highs. The area around 184.40/55 is an important long term resistance, followed by 185.70/80.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 11, 2014

OctaFX.Com News Updates

-

OctaFX.com-OctaFX Supercharged REAL CONTEST going to start after 5 days!

Open a Contest Account and Deposit it.

Trade and receive achievements.

Interact with other traders.

Win one of 10 amazing prizes.

Win Tesla Model S, Smart Fortwo or Renault Twizy!

Stand out for outstanding with OctaFX!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

Gold weakens ahead of the US opening

FXStreet (Mumbai) - Gold prices are trading weak after failing to capitalize on the gains witnessed during the Asian session as the US indices futures trade flat with equities at record highs.

Gold declined to USD 1165.50/Oz, down 0.37% for the day after having hit a high of USD 1777.40/Oz levels earlier todays. So far, the metal has been unable to extend the sharp bounce witnessed on Friday post the release of the weaker-than-expected US Non-farm payrolls data. Meanwhile, the S&P futures and the DJIA futures are trading 0.17% and 0.14% higher respectively. Gold is unable to sustain gains despite the US dollar index weakening 0.27% today.

The yellow metal also came under pressure after the official data in China showed price pressures remained flat in October. China’s consumer price index was 1.6% higher from a year earlier in October, unchanged from the previous month and in line with analysts’ expectations. Fall in inflation in the world’s second largest economy is likely to reduce the hedge demand for Gold.

Elsewhere, the yellow metal or XAU/EUR trades 1.17% lower at EUR 934.79/Oz levels. Moreover, the yellow metal is down in EUR terms as the single currency gained strength against the US Dollar post Friday’s jobs data.

Gold (EUR) Technical levels

Gold has an immediate support at 929.5, under which the prices can fall to 925.62. On the flip side, the metal may re-test 945, if the immediate resistance at 939.40 is breached.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 10, 2014

OctaFX.Com News Updates

-

Gold weakens ahead of the US opening

FXStreet (Mumbai) - Gold prices are trading weak after failing to capitalize on the gains witnessed during the Asian session as the US indices futures trade flat with equities at record highs.

Gold declined to USD 1165.50/Oz, down 0.37% for the day after having hit a high of USD 1777.40/Oz levels earlier todays. So far, the metal has been unable to extend the sharp bounce witnessed on Friday post the release of the weaker-than-expected US Non-farm payrolls data. Meanwhile, the S&P futures and the DJIA futures are trading 0.17% and 0.14% higher respectively. Gold is unable to sustain gains despite the US dollar index weakening 0.27% today.

The yellow metal also came under pressure after the official data in China showed price pressures remained flat in October. China’s consumer price index was 1.6% higher from a year earlier in October, unchanged from the previous month and in line with analysts’ expectations. Fall in inflation in the world’s second largest economy is likely to reduce the hedge demand for Gold.

Elsewhere, the yellow metal or XAU/EUR trades 1.17% lower at EUR 934.79/Oz levels. Moreover, the yellow metal is down in EUR terms as the single currency gained strength against the US Dollar post Friday’s jobs data.

Gold (EUR) Technical levels

Gold has an immediate support at 929.5, under which the prices can fall to 925.62. On the flip side, the metal may re-test 945, if the immediate resistance at 939.40 is breached.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 10, 2014

OctaFX.Com News Updates

-

Portugal Global Trade Balance dipped from previous -2.61B to -2.89B in September

Read more in Forex News

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 10, 2014

OctaFX.Com News Updates

-

Portugal Global Trade Balance dipped from previous €-2.61B to €-2.89B in September

Read more in Forex News

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 10, 2014

OctaFX.Com News Updates

-

AUD/USD remains capped by 0.8680

FXStreet (Córdoba) - AUD/USD extended its recovery from multi-year lows during the Asian session, but the advance was capped by the 0.8680 zone, confining the pair to a phase of consolidation.

AUD/USD was underpinned by profit taking Monday, with domestic data on housing finance doing little to change the direction of the Aussie. The pair reached its highest level since Thursday at 0.8682 but lacked follow-through and entered a sideways phase. At time of writing, AUD/USD is trading at 0.8670, up 0.43% on the day.

“The AUD/USD pares last week losses. In the absence of important US/Australian data, the focus remains on Chinaâ€, said Ipek Ozkardeskaya, analyst at Swissquote Bank SA. “We see resistance at 0.8747/90 area (21-dma / MACD pivot) and bet for a re-test of 0.85 supportâ€.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 10, 2014

OctaFX.Com News Updates

-

Bank of Russia abandons exchange rate policy mechainsm

FXStreet (London) - According to a release by the Russian central bank, effective from today, the Bank of Russia abolished the exchange rate policy mechanism through cancelling the permissible range of the dual-currency basket ruble values (operational band) and regular interventions within and outside the borders of this band.

Exchange rate liberalisation

However this move does not constitute a complete rejection of intervention by the Bank of Russia in its currency. It will still intervene in the case of what it perceives to be financial stability threat.

In theory, the removal of the operational band of dual-currency ruble values means that the currency will be free-floating and moves away from the central bank’s policy of the sale of $350 million a day if the rate of the ruble drops below the lower band – a move that was announced this week by Bank of Russia head Elvira Nabiullina. However, the scope of what constitutes a “financial stability threat†is likely to be a wide one, at least in the short to medium-term.

The ruble has declined 25 percent against the dollar in the year-to-date, with the Bank of Russia estimating that capital flight from Russia is set to reach USD128bn this year.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 10, 2014

OctaFX.Com News Updates

-

Brent trades at one-week high

FXStreet (Mumbai) - Brent crude clocked a one-week high today as Chinese exports grew more than expected in October, signaling more demand for Crude in future.

Brent for January delivery is trading at USD 85.23/barrel, compared to the previous session’s close of USD 84.23. The prices rose after official data in China showed exports increased 11.6% from a year earlier, easily exceeding the 10.6% estimate. Meanwhile, the imports rose 4.6%, compared with estimates of 6%. Moreover, Brent prices rose as a rise in export activity means more industrial activity in China and more demand for Crude.

However, the recovery may be technically driven since the commodity has been in the down trend since June 2014. The technical correction is likely to be capped since the concerns of excess supply still dominate the market sentiment.

Brent Crude Technical Levels

Brent has an immediate resistance at 86.39, above which the prices can rise to 87.17. On the flip side, a breach of 84.61 on the downside, can push the prices down to 84.12 levels.

EUR/GBP Technical levels

The pair has a strong resistance at 0.7866, above which it can rise to 0.7885 and 0.7910 levels. On the flip side, a breach of the immediate support at 0.7838 shall push the pair down to 0.7810 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 10, 2014

OctaFX.Com News Updates

-

EUR/GBP stuck near 0.7860

FXStreet (Mumbai) - The EUR/GBP pair made another attempt to test 0.7860 levels today and failed after the Eurozone Sentix Investor Confidence remained near 18-month low in November.

The EUR/GBP pair currently trades at 0.7851, compared to the previous sessions close of 0.7846. Moreover, the pair has made repeated attempts to rise above 0.7860 levels for the last entire week. However, the single currency is unable to extend the gains despite rising occasionally above 0.7860 levels. Moreover, the US Dollar has been strengthening equally against the EUR and the GBP, thereby restricting the EUR/GBP cross to a narrow range.

Meanwhile, the EUR/GBP pair may inch higher if the ECB) bond buying results disappoints market expectations. The bond buying during the first week of the program was just EUR 1.7 billion, which as per analysts is not sufficient to push the ECB balance sheet towards early-2012 levels.

EUR/GBP Technical levels

The pair has a strong resistance at 0.7866, above which it can rise to 0.7885 and 0.7910 levels. On the flip side, a breach of the immediate support at 0.7838 shall push the pair down to 0.7810 levels.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 10, 2014

OctaFX.Com News Updates

-

EUR/JPY weakens ahead of the ECB bond buying results

FXStreet (Mumbai) - The EUR/JPY pair is trading in the red as the markets await the European Central Bank (ECB) bond buying results for the last week. The pair has repeatedly lost steam around 142.80-143.00 levels, due to which the pair has moved lower towards 142.30 levels.

Moreover, the yen has strengthened against the US Dollar tracking the weakness in the US Treasury yields. The single currency appears exhausted as markets expect the Eurozone Sentix Inventor Confidence to have dipped to -13.8 in November. The EUR is also likely to stay weak as investors await the (ECB) bond buying results for the last week. The first week of the program saw a mere EUR 1.7 billion in uptake. The EUR/JPY pair may fall further today, if the ECB announces a sharp increase in the amount of bond buying program of the last week.

Meanwhile, a further fall in the benchmark bond yields across the Eurozone shall tilt the yield spreads in favor of the Yen.

EUR/JPY Technical levels

The pair currently trades 0.35% lower at 142.25, with the immediate support at 141.96, under which the pair can fall to 141.65. Meanwhile, a breach of the immediate resistance located at 142.73, shall open doors for a re-test of 143.48.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 10, 2014

OctaFX.Com News Updates

-

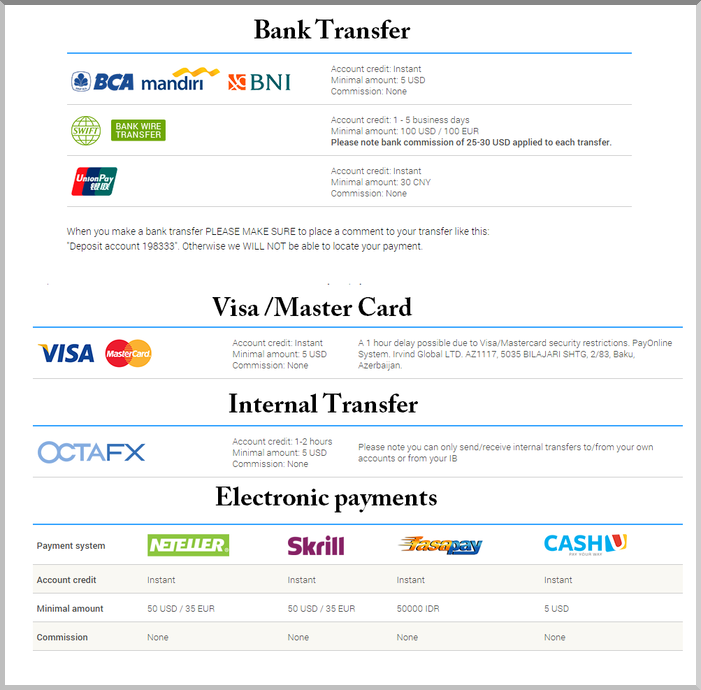

OctaFX.com-How to deposit my account?

How to Deposit!

Step 1:

Open Real account or Login to your Personal Area

Step 2:

Start deposit wizard

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

OctaFX a multi awards winning broker!

-

OctaFX.com-OctaFX congratulates PERSIB Bandung football team on becoming Indonesian Super League Champion!

Our partnership with PERSIB was originally set to inspire our clients to be purposeful, diligent and confident in their abilities! When we first discovered this team, we saw an immense potential and a great deal of willing to become the best! When we asked most prominent PERSIB players how one can acquire success they advised our audience to stay focused, practice and never give up. That is why today we are glad to announce that one more shared dream came true. Today we celebrate PERSIB Bandung earning the title of Indonesian Super League Champion!

It has been a fascinating experience to watch the team progressing through the stages of ISL Championship. We shared both challenging defeats and startling victories, supporting our team on their way to the top of the League. Today we are celebrating together, proud to be the part of this triumph!OctaFX

CEOIndonesian Super League Champions!

OctaFX congratulates the team management, namely Erick Sitorus and Risha Adi Widjaya, coach Djadjang Nurdjaman, and our star team: I Made Wirawan, Supardi, Vladimir Vujovic, Achmad Jufriyanto, Tony Sucipto, Hariono, Firman Utina, M. Ridwan, Makan Konate, Tantan, Atep and Ferdinand Sinaga. We hope that this will only be a glorious starting point in the succession of astonishing accomplishements!

What you did tonight proves that if one sets a goal and does ones best to achieve it, it become not a goal but an accomplishment! That also proves our first impression of the team - champions at heart are always champions on the field!

Join OctaFX and become a Champion!

Stand out for outstanding with OctaFX!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

USD/CHF retreats but remains above 0.9700

FXStreet (Córdoba) - USD/CHF is falling modestly on Friday, ahead of the NFP report but still remains above 0.9700. Yesterday the pair posted the highest close since May 2013.

After Draghi’s press conference the pair jumped, breaking important short term resistance levels and peaked at 0.9737, new 2014 high. Afterwards the pair retreat modestly and continued to pullback on Friday, moving slowly on a clam trading day so far, as traders wait for US employment numbers. Recently printed a fresh daily low at 0.9704.

USD/CHF with strong weekly gains

To erase weekly gains, price would have to fall below 0.9630. It it does not happen, USD/CHF would post the third gain in a row and the second highest weekly close in two years.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 07, 2014

OctaFX.Com News Updates

-

Indian equities decline on profit booking

FXStreet (Mumbai) - Indian equity markets ended lower today as investors booked profits after the benchmark indices rose sharply to record high levels earlier this week.

The Sensex retreated 0.17% to 27868.63, compared to the previous session’s close of 27915.88. Among stocks, HDFC Bank fell most after the stock was removed from the MSCI India Index. Other losers include stocks like Hero MotoCorp Ltd, and Mahindra & Mahindra Ltd. HDFC Bank fell 1.5, while State Bank of India slid 1.4%.

Meanwhile, Motherson Sumi Systems Ltd. and Zee Entertainment Enterprises Ltd. advanced 0.5% and 4.8%, respectively, after MSCI said the two companies will be added to he MSCI India Index from the close of trading on Nov. 25.

The Foreign inflows continue to remain strong in the Indian markets. FIIs bought a net USD 170.5 million of local shares on Nov. 5, taking this year’s inflow to USD 14.4 billion.

Sensex Technical levels

The index has an immediate support at 27,791, under which prices can fall to 27,745 levels. Meanwhile, the index has a strong resistance located at 28,000.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 06, 2014

OctaFX.Com News Updates

-

AUD/USD remains capped by 0.8600

FXStreet (Córdoba) - AUD/USD managed to recover ground after hitting fresh multi-year lows during the Asian session, but the bounce has remained capped by the 0.8605 zone so far.

AUD/USD bottomed out at 0.8540, posting its lowest level since July 2010, and staged a mild recovery to a high of 0.8604 during the European session, although the pair lacked momentum as investors refrain from taking big positions ahead of the US nonfarm payrolls report. NFP forecast calls for a 231K gain in October after 248K the previous month, while the unemployment rate is expected to remain at 6.9%.

AUD/USD technical levels

At time of writing, AUD/USD is trading at 0.8595, 0.45% above its opening price, with immediate resistances seen at 0.8625 (Nov 6 high) and 0.8700 (psychological level), while supports are seen at 0.8540 (2014 low Nov 7) and 0.8500 (psychological level).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 06, 2014

OctaFX.Com News Updates

-

USD/CAD rebounds from 1.1420

FXStreet (Edinburgh) - The greenback is trading on a softer tone vs. the CAD on Friday, pushing USD/CAD to visit the lower band of the range around 1.1420.

USD/CAD focus on US, Canada data

The upside bias continues to prevail in the pair, intensified after last Friday’s BoJ announcements of further easing measures in its monetary policy, boosting the US dollar to multi-year highs around 1.1470 (Wednesday). Ahead in the session US and Canadian labour market figures are due, with US Pyrolls pointing to an increase of 231K jobs in October while the Employment Change in Canada points to a decrease of 5.0K. “On the charts, though, the trend still looks very constructive, and a move towards 1.18 in the coming months appears as a distinct possibility. So, we would buy dips as they arise within a period of consolidation over the next couple of weeksâ€, observed Martin Schwerdtfeger, Strategist at TD Securities.

USD/CAD levels to consider

As of writing the pair is up 0.07% at 1.1435 with the next hurdle at 1.1466 (high Nov.5) ahead of 1.1497 (day uptrend channel) and then 1.1500 (psychological level). On the flip side, a breakdown of 1.1380 (low Nov.6) would aim for 1.1340 (low Nov.4) and finally 1.1300 (psychological level).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 06, 2014

OctaFX.Com News Updates

-

Strong NFP result expected in October - TD Securities

FXStreet (Åódź) - Annette Beacher, Head of Asia-Pacific Research at TD Securities expects anothe rmonth of robust US job gains in October.

Key quotes

"A number of indicators suggest another strong month for the US labour market, including strength in the employment subcomponents of the ISM surveys, cyclical lows in claims and better-than-expected ADP private payrolls."

"We are broadly in line with consensus in expecting 239k jobs created in October and the unemployment rate unchanged at 5.9%."

"We suspect that momentum spillover from Q3 to Q4 will continue to support job growth into year-end."

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 06, 2014

OctaFX.Com News Updates

-

NZD/USD rises to 0.7700

FXStreet (Córdoba) - The kiwi recovered ground during the European session and erased losses against the US dollar ahead of the US employment report. NZD/USD bottomed on Asian hours at 0.7659, the lowest price in two years and then rebounded.

Currently the pair is hovering around 0.7700, slightly higher for the day and moving with bullish momentum. Recently printed a fresh daily high at 0.7703.

NZD/USD outlook

The trend remains bearsih and the pair is still under pressure, trading near the lowest level since June 2012. In the short term, with the NFP report near, the pair managed to turner to the upside. Technical indicators favor the kiwi for the coming hours but employment numbers from the US are likely to increase volatility in the forex and define the next move.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 06, 2014

OctaFX.Com News Updates

OctaFX.Com - Financial News and Analysis

in Fundamental Analysis

Posted

Do not fight the SNB - MP

FXStreet (Barcelona) - Dean Popplewell, Director of Currency Analysis and Research at MarketPulse notes that upcoming SNB referendum could force the Swiss central bank to “rip apart its monetary policy rules.â€

Key Quotes

“A handful of traders have been ignoring that rule and are quietly buying CHF, three weeks ahead of a SNB referendum that could force the Swiss central bank to “rip apart its monetary policy rules.â€

“The EUR/CHF (€1.2025) currently sits atop of its 26-month low – the highly publicized lower limit that has been guarded by the SNB (€1.2000). This is the psychological “line in the sand†that Swiss central banker’s declared that under no circumstance would be breached, a policy that was introduced three-years ago to prevent the market from trading a ‘stronger’ CHF.â€

“Under the new rules (if voted in), would require the SNB to buy gold to balance any EUR purchases. It’s no wonder that Swiss policy makers oppose this particular motion as it would “tie policy makers hands†when trying to conduct standard monetary policy.â€

“There is added pressure on the SNB to defend, especially with the ECB expanding its balance sheet and looking at other assets it can purchase, within its mandate – the downward pressure should be expected to increase, and by default, even more pressure will indirectly be put on the SNB.â€

“A “yes†vote will only invite more aggressive speculation – the SNB would be left with few teeth to weaken the CHF.â€

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Nov 11, 2014

OctaFX.Com News Updates