⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

-

Posts

1,288 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by RBFX Support

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDCAD: Bank of Canada’s dovish stance supports the US dollar The USDCAD pair remains locked within a Triangle pattern, driven by diverging monetary policies of the Fed and the Bank of Canada. The exchange rate currently stands at 1.3797. Find out more in our analysis for 22 September 2025. USDCAD technical analysis The USDCAD rate is trading within a developing Triangle pattern. The pair recently bounced from the upper boundary of the descending channel and is attempting to hold above the Moving Averages, indicating sustained buying pressure. The combination of the Bank of Canada’s dovish policy and expectations of guidance from the Fed creates conditions for further US dollar strength. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

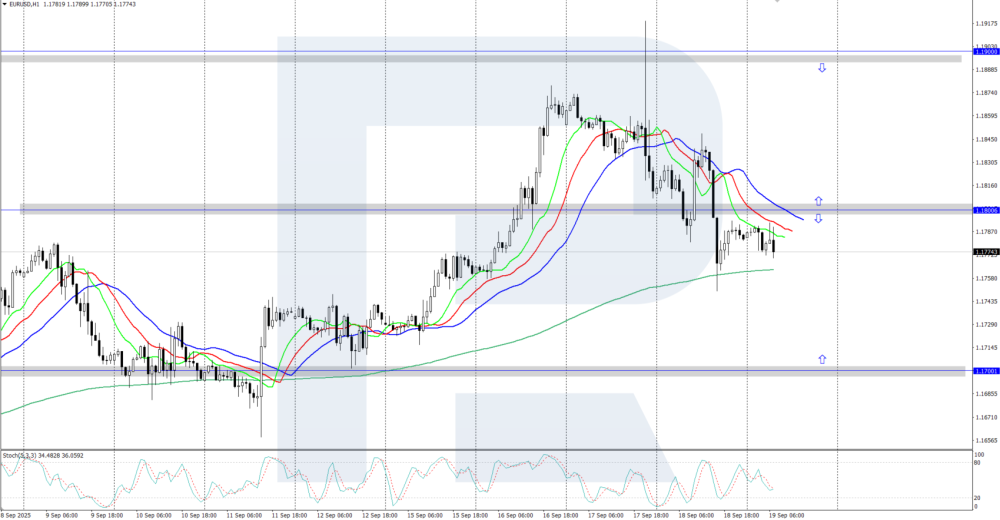

EURUSD dips below 1.1800 The EURUSD pair is correcting after recent gains, slipping below the 1.1800 level as the US dollar strengthens. Discover more in our analysis for 19 September 2025. EURUSD technical analysis On the H4 chart, the EURUSD pair turned lower after failing to break above the 1.1900 resistance level. The market is now in a local correction phase, with growth likely to continue once the correction is complete. The key support level is located at 1.1700. The EURUSD pair is moderately correcting, dropping below 1.1800. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY steady: volatility fades, but risks remain The USDJPY pair has stabilised around 148.00. Although inflation data improved slightly, market tension remains. Find more details in our analysis for 19 September 2025. USDJPY forecast: key trading points The USDJPY pair recouped losses and is stabilising The market awaits the Bank of Japan’s decision and assesses fresh inflation data USDJPY forecast for 19 September 2025: 148.26 Fundamental analysis The USDJPY rate is consolidating at 148.00 on Friday amid expectations of the Bank of Japan decision. The market generally expects the key rate to remain at 0.5%, although the likelihood of a 25-basis-point hike in October is gradually increasing amid economic resilience. Core inflation in Japan slowed to 2.7% in August, the lowest since November 2024. The decline is mainly due to the resumption of government subsidies for electricity and gas, as well as price adjustments for food products. At the same time, the rise in rice prices remains the main factor of inflationary pressure: in August, the price increased by 68.8% year-over-year, following jumps of almost 100% in June and 90.7% in July. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: prices approach the upper boundary of the upward channel The JP 225 index continued to rise within the upward channel and hit a new all-time high. The JP 225 forecast for today is positive. JP 225 forecast: key trading points Recent data: Japan’s balance of trade for August came in at -242.5 billion JPY Market impact: this result carries a positive signal for the Japanese equity market Fundamental analysis Japan’s balance of trade for August 2025 stood at -242.5 billion JPY, better than the forecast of -513.6 billion JPY but weaker than the previous reading of -118.4 billion JPY. Although the trade deficit remained, the gap turned out nearly half as small as expected. This indicates stronger external economic conditions than anticipated and reduces concerns about pressure on the trade sector. For the JP 225 index, the impact is mixed: on the upside, the result exceeded expectations, which supports confidence in Japanese companies’ export activity. On the downside, the deficit still widened compared to last month, reflecting reliance on energy and raw material imports. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

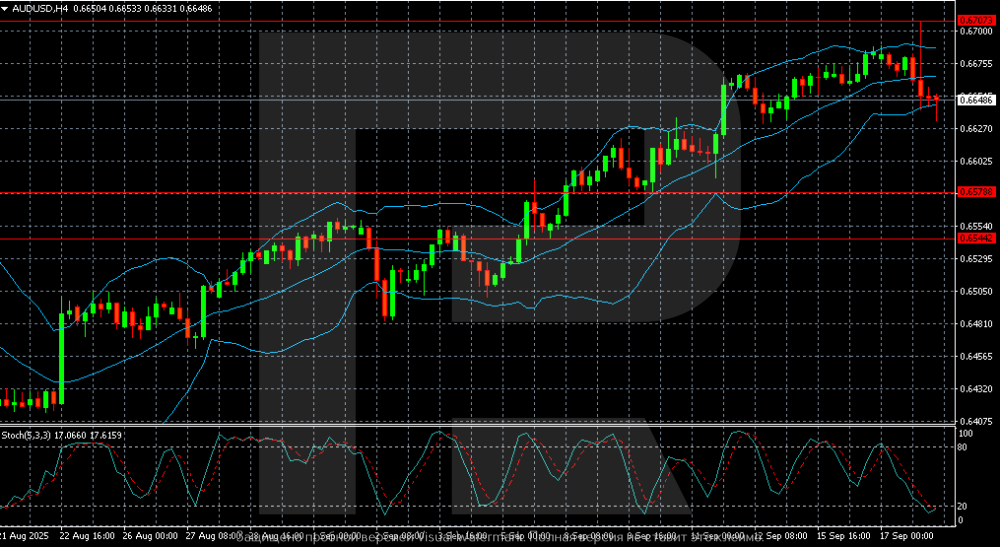

AUDUSD struggles under weak labour market signals The AUDUSD pair slipped to 0.6648, with the Australian dollar pressured by employment data. Find out more in our analysis for 18 September 2025. AUDUSD technical analysis On the H4 chart, the AUDUSD pair shows a downward correction after testing the 0.6707 resistance level. The recent trading range is narrowing. The AUDUSD pair is correcting amid fundamental data. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBPUSD consolidates above 1.3600 ahead of Fed decision The GBPUSD rate has climbed above 1.3600 ahead of key interest rate decisions from the Federal Reserve and the Bank of England. Discover more in our analysis for 17 September 2025. GBPUSD technical analysis On the H4 chart, the GBPUSD pair shows bullish momentum, consolidating above 1.3600. The Alligator indicator points upwards, confirming a continued upward impulse. The GBPUSD pair has consolidated above 1.3600. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 30 forecast: the uptrend continues, resistance remains unbroken After reaching a new all-time high, the US 30 index trend remains unstable. The US 30 forecast for today is positive. US 30 forecast: key trading points Recent data: the US core CPI rose 3.1% year-on-year in August Market impact: the current reading may have a mixed effect on the US equity market Fundamental analysis The US core CPI for August 2025 showed growth of 3.1% year-on-year, matching analysts’ forecasts and remaining unchanged from the previous month. This reflects persistent inflationary pressure in the economy, excluding volatile food and energy categories. The index’s stability at above 3% highlights that inflation remains higher than the Federal Reserve’s long-term target of around 2%. This signals to markets the need to maintain tight monetary policy. For US stocks, the data sets a neutral-to-restrained tone: on the one hand, the lack of deterioration (no sharp inflation spike) reduces the risk of aggressive Fed tightening, but on the other hand, inflation staying above target caps expectations of an imminent policy easing. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Fed, BoJ and political chaos: the fate of USDJPY is being decided right now Political instability in Japan and the Fed’s policy are shaping USDJPY behaviour, with quotes possibly surging to 147.70. Discover more in our analysis for 16 September 2025. USDJPY technical analysis On the H4 chart, the USDJPY pair tested the upper Bollinger Band and formed a Shooting Star reversal pattern, now trading near 147.00. At this stage, the pair may extend its corrective wave in line with the pattern signal, with a potential move down towards the support level around 146.60. The USDJPY pair remains close to 147.00, balancing between political uncertainty in Japan and expectations of a Federal Reserve rate cut. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

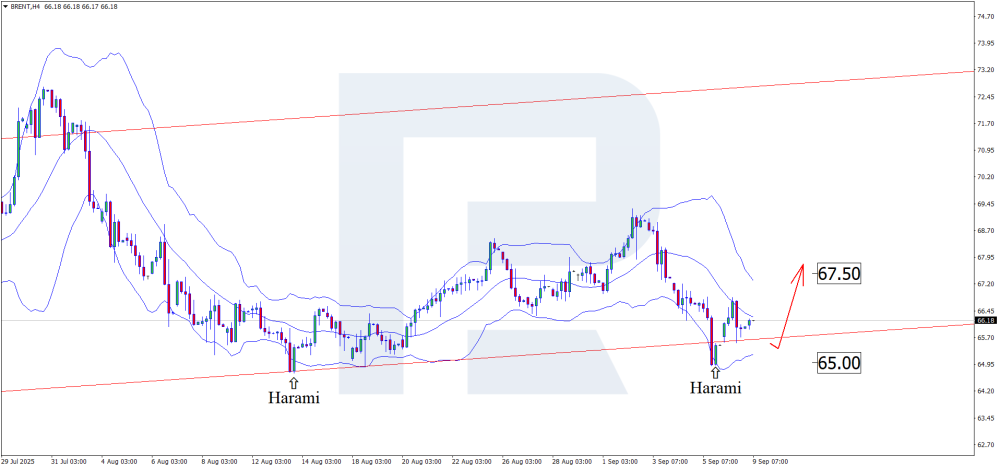

Brent continues upward momentum amid supply disruption risks Brent quotes remain in a phase of steady growth, influenced by geopolitical factors and expectations surrounding the Federal Reserve’s decisions. The exchange rate currently stands at 67.23 USD. Discover more in our analysis for 16 September 2025. Brent forecast: key trading points Investors await the Fed meeting and anticipate an interest rate cut A Federal Reserve rate cut could stimulate economic activity and fuel demand Possible EU sanctions may complicate logistics and reduce crude supply availability on the global market Brent forecast for 16 September 2025: 67.50 Fundamental analysis Brent prices are moderately rising, posting a third consecutive positive trading session after rebounding from the 65.50 USD support level. The market remains under pressure from geopolitical risks linked to Ukrainian strikes on Russia’s energy infrastructure, which heightens fears of supply disruptions and potential global output cuts. An additional supportive factor comes from the expectation of the Federal Reserve’s upcoming meeting. Investors are pricing in a rate cut, which could boost economic activity and fuel demand. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index moves into a sideways channel The DE 40 stock index has entered a sideways channel. The DE 40 forecast for today is positive. DE 40 forecast: key trading points Recent data: the ECB key interest rate remains at 2.15% per annum Market impact: for the German equity market, this signals no additional borrowing cost pressure, which is seen as a stabilising factor Fundamental analysis The ECB decision to keep rates unchanged at 2.15% signals status quo in monetary policy. For the DE 40 index, this reduces short-term uncertainty and helps form a neutral sentiment among investors. The financial sector, including banks and insurance companies, faces limited margin growth potential as lending yields remain stable. Industrial companies and exporters benefit from favourable financing conditions, which support investment in production and external trade. The consumer sector also gains indirect support: unchanged rates keep credit conditions affordable, sustaining household demand. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDCAD surges: Canadian dollar under pressure ahead of the Bank of Canada’s decision Amid expectations of interest rate decisions from the Fed and the BoC, the USDCAD pair may continue its rise towards 1.3880. Discover more in our analysis for 15 September 2025. USDCAD technical analysis On the H4 chart, the USDCAD pair has formed a Harami reversal pattern near the middle Bollinger Band. At this stage, a corrective wave is developing in line with this signal. Since the pair remains within an ascending channel, further growth towards the nearest resistance level at 1.3880 can be expected. The Canadian dollar remains under pressure due to expectations of a BoC rate cut, weak domestic data, and instability in the export sector. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

AUDUSD at a ten-month peak: growth may continue The AUDUSD pair is consolidating around 0.6660 on Friday. The Australian dollar has every chance to close the week with its best result since April. Discover more in our analysis for 12 September 2025. AUDUSD forecast: key trading points The Australian dollar benefits from the weakening of the US dollar Inflation risks in Australia support the RBA’s cautious stance on rates AUDUSD forecast for 12 September 2025: 0.6669 Fundamental analysis The AUDUSD rate has slightly declined, hovering near 0.6660, close to its highest level since early November 2024. The pair is on track to show its best week since April. Support for the AUD has come from improved risk appetite and expectations of an imminent Fed rate cut in the US. US statistics showed stable inflation in August, while a rise in jobless claims confirmed weakness in the labour market. High metal prices, particularly for gold and silver, provided additional support for the Australian currency. Domestic news in Australia showed that consumer inflation expectations rose in September after a decline in the previous month. This signals more resilient demand and renewed inflationary risks. RBA Governor Michele Bullock pointed to signs of somewhat stronger growth in the private sector, calling it a positive for the economy. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

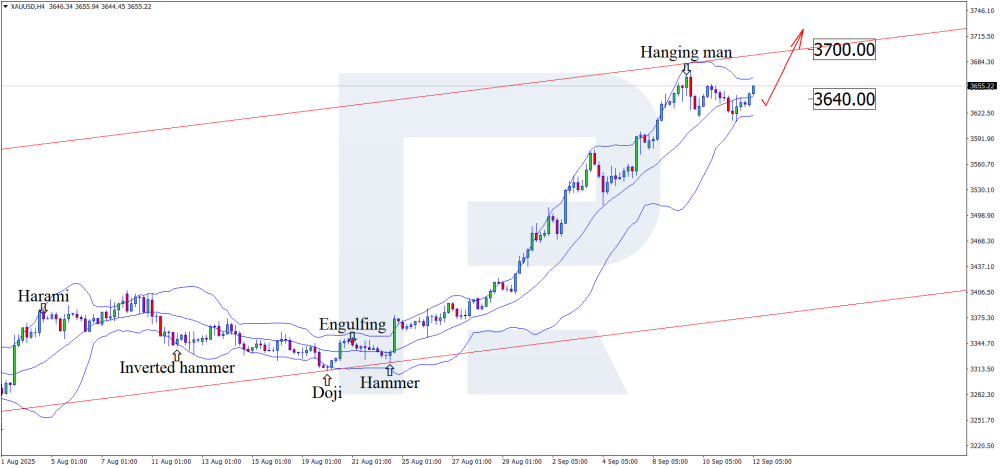

CPI will decide everything: XAUUSD balances between correction and a new all-time peak Amid weak US economic indicators, gold (XAUUSD) may test the 3,700 USD mark. Find out more in our analysis for 12 September 2025. XAUUSD technical analysis On the H4 chart, XAUUSD prices formed a Hanging Man reversal pattern near the upper Bollinger Band. At this stage, it is completing a corrective wave following the signal from the pattern. Considering that XAUUSD quotes remain within an ascending channel and given geopolitical factors, the uptrend will likely continue. Gold is balancing on the edge of an explosion. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the uptrend has returned, with a new all-time high expected The JP 225 index has resumed growth within its upward channel. The JP 225 forecast for today is positive. JP 225 forecast: key trading points Recent data: Japan’s quarterly GDP for August grew by 0.5% year-on-year Market impact: this result is positive for the Japanese equity market Fundamental analysis Japan’s Q2 GDP showed growth of 0.5% quarter-on-quarter, above the forecast of 0.3% and the previous reading of 0.1%. This result signals that the Japanese economy is showing signs of recovery after a slowdown, which can boost investor confidence and support equities. For the JP 225 index, this data is a broadly positive factor. GDP growth indicates stronger domestic demand and more resilient production and export dynamics, directly supporting revenues of Japan’s largest corporations included in the index. The financial sector benefits from rising economic activity, as it increases demand for loans and investment services. Industrial and export-oriented companies also gain support from higher global and domestic demand for Japanese goods. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

AUDUSD consolidates above 0.6600 ahead of US inflation data The AUDUSD rate shows moderate growth, consolidating above the 0.6600 mark. Today, the market focus is on the US CPI data. Discover more in our analysis for 11 September 2025. AUDUSD technical analysis The AUDUSD pair is showing steady growth after rebounding upwards from the daily support level at 0.6420. The Alligator indicator is pointing upwards, confirming the bullish price momentum. The key resistance level is the high at 0.6635. AUDUSD quotes are moderately rising, consolidating above the 0.6600 level. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBPUSD tests 1.3565: US labour market collapsed more than expected The GBPUSD rate maintains its bullish momentum after the downward revision of US employment statistics and growing expectations of a Fed rate cut. The rate currently stands at 1.3538. Discover more in our analysis for 10 September 2025. GBPUSD technical analysis The GBPUSD rate is hovering within an ascending channel and trading above the Moving Average, keeping the advantage on the side of buyers. An attempt to consolidate above 1.3565 again points to the market’s intention to test the key resistance level and extend growth towards 1.3650. The GBPUSD rate is strengthening on the back of revised US labour market data and growing expectations of a Federal Reserve rate cut. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 30 forecast: the uptrend continues, but resistance has not yet been broken After reaching a new all-time high, the trend in the US 30 index remains unstable. The US 30 forecast for today is positive. US 30 forecast: key trading points Recent data: the US PMI for August came in at 55.5 Market impact: for US equities, this result signals a cautious investor sentiment Fundamental analysis The US unemployment rate stood at 4.3% in line with market forecasts but above 4.2% in July. From a macroeconomic perspective, this indicates a gradual cooling of the labour market: a moderate rise in unemployment eases wage pressure and reduces service-sector inflation. In terms of financial conditions, this is generally favourable, as expectations of a softer monetary policy path increase, Treasury yields tend to decline, and funding costs for companies decrease. At the same time, the fact that unemployment is rising points to a slower pace of economic growth. For the US 30, the signal is mixed. If markets interpret the figure as evidence of a soft landing, we may see a short-term improvement in risk appetite driven by lower yields and stronger expectations of Fed easing. However, if focus shifts to risks for growth momentum, the index could show a more restrained performance given its heavy weighting in cyclical sectors. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: prices attempt to break above resistance and set a new all-time high The US 500 continues to rise but has not yet managed to overcome the resistance level. The US 500 forecast for today is positive. US 500 forecast: key trading points Recent data: US Nonfarm Payrolls for August came in at 22 thousand Market impact: for the US equity market, this has a rather positive effect in the medium term Fundamental analysis The latest US Nonfarm Payrolls data for August 2025 showed 22 thousand new jobs, well below the forecast of 75 thousand and significantly weaker than the previous 79 thousand. This result signals a slowdown in labour market dynamics, which has multiple implications for the US stock market. From a macroeconomic perspective, such a weak reading indicates declining demand from employers and potential cooling of the economy. For the US 500, this can act as a double-edged factor. On the one hand, weakness in employment may increase concerns about the sustainability of economic growth. On the other hand, a softer labour market could strengthen expectations that the Federal Reserve will maintain a looser monetary policy than previously anticipated. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent prices recover after collapse – can oil break above the 70.00 USD level? A moderate increase in output agreed by OPEC+ could drive Brent quotes higher towards 67.50 USD. Find more details in our analysis for 9 September 2025. Brent technical analysis Having tested the lower Bollinger Band, Brent prices formed a Harami reversal pattern on the H4 chart. At this stage, the market is following the signal with a recovery wave. Brent crude remains in a zone of uncertainty: restrained growth on the back of OPEC+’s limited decision is countered by risks of price decline. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD gets a chance to rise: weak US labour market undermines the dollar The EURUSD pair maintains a bullish outlook after weak US labour market data, with the price currently at 1.1713. Discover more in our analysis for 8 September 2025. EURUSD technical analysis The EURUSD pair is trading near the lower boundary of the ascending channel, capped by resistance around 1.1725. A fourth unsuccessful attempt to consolidate above this level suggests the likelihood of a short-term correction before a new growth impulse. Weak US labour market data and expectations of two Fed rate cuts before the end of the year add to pressure on the US dollar and support further EURUSD strengthening. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index enters a downtrend within the correction phase The growth momentum of the DE 40 index has slowed. The DE 40 forecast for today is positive. DE 40 forecast: key trading points Recent data: Germany’s factory orders for July 2025 fell by 2.9% Market impact: this signals potential difficulties in industry and mechanical engineering for the German equity market Fundamental analysis Germany’s factory orders for August 2025 showed a sharp decline, with the actual reading at -2.9% versus the forecast of +0.5% and the previous level of -0.2%. This result indicates a significant drop in industrial demand, reflecting weaker domestic and external activity in the country’s key economic sector. For the German equity market, this signals potential challenges for industry and mechanical engineering, which traditionally form the backbone of the economy. Negative orders dynamics lower expectations for future output and exports, reducing the investment appeal of companies linked to heavy industry, machinery, and component supply. For the DE 40 index, the overall impact is assessed as negative. The decline in orders undermines expectations for steady corporate earnings growth and may reinforce investor caution. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY corrects as buyers fail to hold 148.80 The USDJPY pair remains under pressure, while the reduction of US tariffs on Japanese cars strengthens the yen. The current rate is 148.19. Find out more in our analysis for 5 September 2025. USDJPY technical analysis The USDJPY pair is trading near the upper boundary of its sideways range formed by a horizontal resistance level at 148.80. The current correction suggests a potential pullback towards the lower boundary of the ascending channel around 147.80, where a new upside reversal point may form. The USDJPY rate remains under pressure amid weak macroeconomic indicators, but expectations of a BoJ rate hike could trigger a new bullish impulse. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) continues its rally: Fed rate outlook provides support Gold (XAUUSD) prices stand at 3,550 USD by the end of the week. Pressure on the Fed is opening new opportunities for the precious metal. Find more details in our analysis for 5 September 2025. XAUUSD forecast: key trading points Gold (XAUUSD) prices continue to climb, hitting new record highs Expectations of more aggressive Federal Reserve rate cuts provide strong support for gold XAUUSD forecast for 5 September 2025: 3,564 and 3,578 Fundamental analysis Gold (XAUUSD) rose to 3,550 USD per ounce on Friday and remains near record highs, showing a weekly gain of over 3%. Support for the metal comes from expectations of Federal Reserve rate cuts and increased demand for safe-haven assets. Weakness in the labour market – falling job vacancies, rising layoffs, and an increase in initial jobless claims to a two-month high – has strengthened expectations of Fed easing. The market is now pricing in not only a September rate cut but also up to three moves by the end of the year. This is favourable for gold, as lower rates reduce the opportunity cost of holding a non-yielding asset. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold (XAUUSD) corrects after a sharp rally XAUUSD prices are moderately declining after a strong rally and a new all-time high at 3,578 USD. Today, the market focus is on US employment data from ADP. Find more details in our analysis for 4 September 2025. XAUUSD technical analysis XAUUSD prices show a sharp rally on the daily chart, hitting a new all-time high at 3,578 USD. The Alligator indicator is also confidently trending upwards, suggesting the potential for continued bullish movement after a minor correction. Gold is moderately correcting after a sharp rally and a new all-time high at 3,578 USD. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the uptrend has shifted to a short-term downtrend The JP 225 index continues its correction within a downtrend. The JP 225 forecast for today is negative. JP 225 forecast: key trading points Recent data: Japan Tokyo CPI for August rose by 2.5% year-on-year Market impact: this result is positive for the Japanese stock market Fundamental analysis Tokyo’s Consumer Price Index (CPI) rose by 2.5% year-on-year in August 2025, in line with forecasts but lower than the previous reading of 2.9%. For the Japanese equity market, this result matters. Easing inflation signals reduced pressure on consumers and businesses, which may act as a positive factor for domestic demand. However, inflation remains above the Bank of Japan’s target (around 2.0%), supporting arguments for a cautious review of monetary policy. For the JP 225, the sectoral impact is mixed. The consumer sector (retail, restaurants, and everyday goods) benefits from lower inflationary pressure, which supports purchasing power. Export-oriented companies may also gain if expectations of a softer Bank of Japan stance put downward pressure on the yen, improving competitiveness abroad. Conversely, the financial sector may face limits, as slower inflation reduces the likelihood of aggressive interest rate hikes, restraining bank margins. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with: