⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

-

Posts

1,288 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by RBFX Support

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDCAD will continue to rise, but after a pause The USDCAD pair halted at 1.3901, with the market monitoring political developments and oil price fluctuations. Find out more in our analysis for 19 January 2026. USDCAD forecast: key trading points Current mood: trade-related news and US policy weigh on the CAD, while oil prices provide support Market focus: the pair’s growth has slowed, but the market is not yet preparing for a reversal USDCAD forecast for 19 January 2026: 1.3930 Fundamental analysis The USDCAD rate declined to 1.3901 on Monday. Previously, the CAD fell to a six-week low against the US dollar amid news of a trade agreement between Canada and China, as well as expectations surrounding the selection of the next chair of the US Federal Reserve. Additional pressure on the Canadian dollar came from comments by US President Donald Trump, who publicly supported his economic adviser Kevin Hassett. Trump stated that he would like to keep him in his current role. The market interpreted this as a reduced probability of Hassett, considered one of the most dovish candidates, being appointed as Fed chair. This supported the US dollar. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

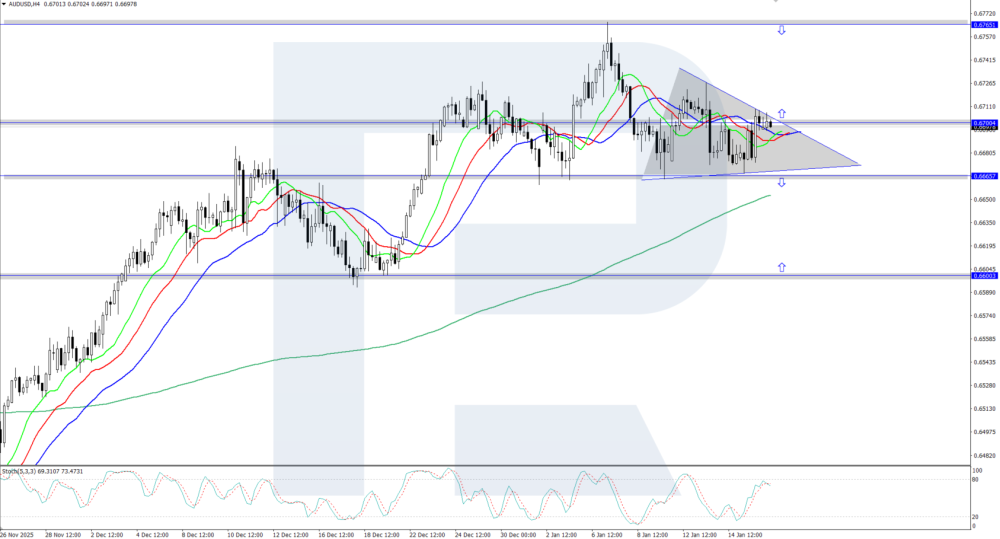

AUDUSD retreated from the all-time high The AUDUSD rate is undergoing a moderate correction after reaching an annual high of 0.6765 amid rising geopolitical tensions. Find out more in our analysis for 16 January 2026. AUDUSD technical analysis The AUDUSD pair is showing a downward correction following the recent strong rally. The Alligator indicator has turned downwards and continues to decline, so the correction may continue. The key support level is currently located at 0.6665. AUDUSD quotes are moderately correcting after reaching an annual high of 0.6765. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD at a crossroads: decline or growth ahead The euro is once again attempting to recover positions against the USD, with EURUSD quotes trading near the 1.1600 level. Discover more in our analysis for 16 January 2026. EURUSD forecast: key trading points Germany Consumer Price Index (CPI): previously at -0.2%, projected at 0.0% The ECB may raise the interest rate this month EURUSD forecast for 16 January 2026: 1.1635 and 1.1565 Fundamental analysis The EURUSD forecast takes into account that today the euro is forming a corrective wave and is trading near the 1.1660 level. The ECB shows interest in strengthening the European currency and may continue tightening monetary policy this month to support the euro. The situation with the dollar currently remains uncertain due to expectations surrounding the Federal Reserve’s interest rate decision. Unlike the ECB, the Federal Reserve may decide to ease monetary policy and cut rates, which could weaken the dollar and provide an impulse for EURUSD growth. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

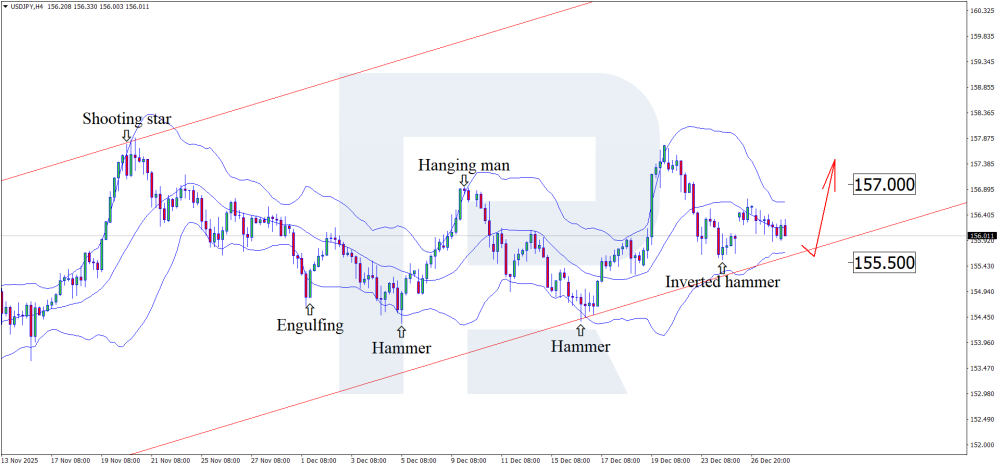

The dollar at a crossroads: how unemployment data and the Fed may affect USDJPY The yen attempts to regain ground, with the USDJPY rate trading near the 158.45 level. Discover more in our analysis for 15 January 2026. USDJPY technical analysis On the H4 chart, the USDJPY pair has formed an Inverted Hammer reversal pattern near the lower Bollinger Band and is trading around 158.45. At this stage, it may continue an upward wave following the pattern signal, with the 160.00 level acting as an upside target in this scenario. US fundamental factors work against the USD, while USDJPY technical analysis suggests growth towards the 160.00 level. Read more - USDJPY Forecast Attention Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index has updated its all-time high The JP 225 stock index has continued its upward momentum. The JP 225 forecast for today is negative. JP 225 forecast: key trading points Recent data: Japan’s current account reached 3.67 trillion JPY Market impact: the effect for the Japanese equity market is moderately positive Fundamental analysis Japan’s current account balance exceeded expectations, posting a surplus of 3.674 trillion JPY, above the forecast of 3.594 trillion JPY and the previous reading of 2.834 trillion JPY. For the equity market, this primarily signals a stronger external position and higher net income inflows from abroad, which fundamentally supports economic resilience and reduces sensitivity to external shocks. For Japanese equities, the impact of a potentially stronger yen is mixed. A stronger yen reduces the value of overseas revenues when converted into yen and may pressure the profits of export-oriented companies, while also weakening their price competitiveness in global markets. At the same time, yen appreciation lowers the cost of imported energy and raw materials. RoboForex Market Analysis & Forex Forecasts Attention Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD attempts to reverse upwards from support The EURUSD rate corrected downwards to the 1.1620 support level, where it met active buying interest and is attempting to reverse upwards. Find more details in our analysis for 14 January 2026. EURUSD technical analysis On the H1 chart, EURUSD quotes are attempting to reverse upwards after receiving support from buyers near the 1.1620 level. For further growth, the pair will need to overcome the 1.1700 resistance level, after which the upward move may continue. The EURUSD pair is attempting to reverse upwards after receiving buyer support at the 1.1620 level. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Pound at the start of a new rally: what lies ahead for GBPUSD on 14 January 2026 The GBPUSD forecast for today favours the GBP, with quotes likely to regain ground and test the 1.3510 level. Find out more in our analysis for 14 January 2026. GBPUSD forecast: key trading points US retail sales: previously at 0.4%, projected at 0.4% Speech by the Bank of England Deputy Governor for Markets and Banking Dave Ramsden GBPUSD forecast for 14 January 2026: 1.3510 and 1.3400 Fundamental analysis The GBPUSD forecast for today, 14 January 2026, is favourable for the pound, with quotes having every chance for further growth after a minor correction. Today, a speech by Dave Ramsden, Deputy Governor of the Bank of England for Markets and Banking, will take place. In his remarks, he may make statements or provide hints regarding the Bank of England’s next steps in monetary policy. In the event of an interest rate hike or the maintenance of a hawkish monetary policy stance, the British pound may strengthen RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

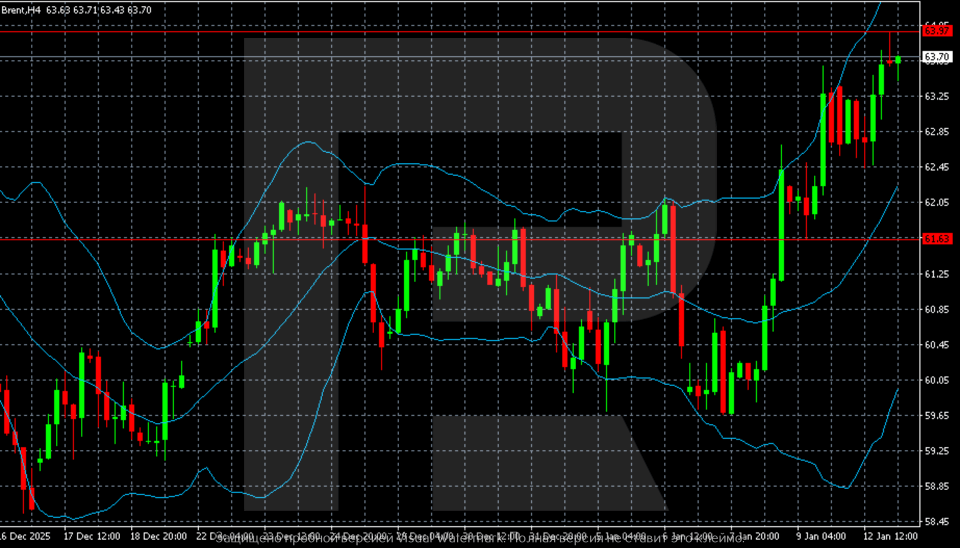

Brent benefits from overall market panic and rises Brent crude oil prices are testing 64 USD per barrel. Buyers have found support in the Iranian factor. Discover more in our analysis for 13 January 2026. Brent technical analysis On the H4 chart, Brent is forming a stable upward movement. The price has confidently exited the late-December consolidation range and accelerated higher, hitting new local highs in the 63.70–64.00 area. Brent crude is rising amid market turmoil, supported by signs of supply instability. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY surges, reaching a new yearly high The USDJPY rate is showing strong upward momentum, rising to the 159.00 area amid political instability in Japan. Find out more in our analysis for 13 January 2026. USDJPY forecast: key trading points Market focus: Japan’s service sector index decreased to 48.6 in December 2025 from 48.7 a month earlier Current trend: trending upwards USDJPY forecast for 13 January 2026: 160.00 or 157.75 Fundamental analysis The Japanese yen fell to around 159 per dollar, reaching its weakest levels since 2024 amid rising political uncertainty fuelled by speculation that Prime Minister Sanae Takaichi may dissolve parliament as early as next month. Takaichi is expected to leverage her strong public support to push through expansionary fiscal policy. Finance Minister Satsuki Katayama stated that she and US Treasury Secretary Scott Bessent shared concerns over the ‘one-sided depreciation’ of the yen following a bilateral meeting held on the sidelines of a multilateral gathering of finance ministers earlier this week. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) at a new peak: higher levels ahead Gold (XAUUSD) prices have tested 4,600 USD, with the market relying on a pool of political risks. Find more details in our analysis for 12 January 2026. XAUUSD forecast: key trading points Gold (XAUUSD) prices surged to a new high A broad spectrum of geopolitical risks supports demand for safe-haven assets US statistics are also bolstering gold Fundamental analysis Gold (XAUUSD) prices rose by more than 1% on Monday and exceeded 4,601 USD per ounce, reaching a new all-time high once again. The rally was driven by rising geopolitical risks and expectations of further interest rate cuts in the US. On Sunday, Iran’s parliamentary speaker warned the US and Israel about the consequences of possible intervention following threats of military strikes by President Donald Trump. The statements came amid mass protests in Iran, which reportedly resulted in hundreds of deaths. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

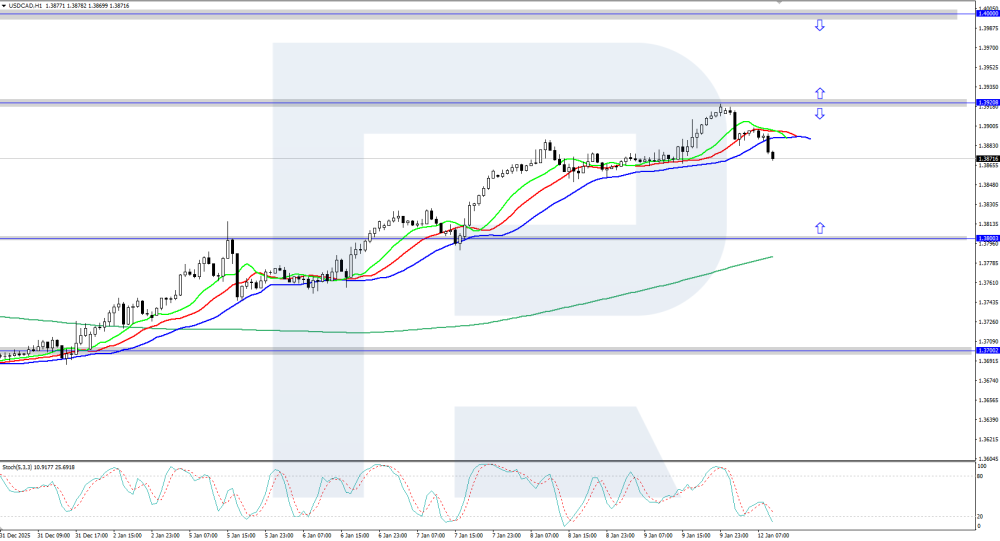

USDCAD rose to the 1.3900 area The USDCAD rate is on the rise, climbing into the area around 1.3900 amid an increase in unemployment in Canada. Discover more in our analysis for 12 January 2026. USDCAD technical analysis On the H1 chart, USDCAD quotes are showing upward momentum, reaching the 1.3900 area. The Alligator indicator is also pointing higher, confirming the current bullish dynamics. After a brief correction, the upward movement may continue. The USDCAD pair is showing upward dynamics, rising to the 1.3900 area. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Fed vs BoJ: policy divergence impacts USDJPY The yen has made another attempt to strengthen against the USD, with USDJPY quotes trading around the 156.00 level. Details — in our analysis for 30 December 2025. USDJPY technical analysis On the H4 chart, USDJPY formed an Inverted Hammer reversal pattern near the lower Bollinger Band and is currently trading around the 156.00 level. At this stage, the pair may continue developing an upward wave as part of the pattern’s realization, with 157.00 acting as the upside target. Amid declining trading volumes ahead of the calendar year-end, the yen continues attempts to strengthen. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: the index has updated its all-time high The US 500 has updated its all-time high and is now correcting. The US 500 forecast for today is positive. US 500 forecast: key trading points Recent data: US Durable Goods Orders in November fell by 2.2% Market impact: the data has a moderately negative impact on the equity market Fundamental analysis The indicator declined by -2.2% month-on-month, which came in worse than the forecast of -1.5% and significantly weaker than the previous reading of +0.7%. This dynamic points to cooling demand for capital-intensive goods and may signal a slowdown in corporate investment plans in the coming months. For the US equity market, this usually acts as a moderately negative signal, primarily for sectors that depend on the industrial cycle and business investment. Investors may factor in more restrained revenue growth for industrial companies and equipment suppliers, which reduces overall optimism. For the US 500 index, the effect is generally constraining. On the one hand, weaker orders worsen expectations for economic growth and profits among cyclical companies, putting pressure on the index. On the other hand, softer data may ease inflation concerns and support expectations of a more accommodative central bank policy, which partially offsets the negative impact. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDCAD finds support at 1.3650 USDCAD has halted its decline and is attempting to reverse higher after receiving buyer support near 1.3650. Details — in our analysis for 29 December 2025. USDCAD technical analysis On the H1 chart, USDCAD is showing a moderate upward correction within the broader downtrend. Prices rebounded from the daily support at 1.3650, forming a local bullish reversal, with buyers attempting to take the initiative. USDCAD has reversed higher from support at 1.3650. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY returns to support near 156.00 USDJPY is declining, slipping into the area around 156.00 amid concerns over possible interventions by the Bank of Japan. Details — in our analysis for 29 December 2025. USDJPY forecast: key trading points Market focus: the yen strengthens amid potential Bank of Japan interventions Current trend: a downward correction is observed USDJPY forecast for 29 December 2025: 155.55 or 157.00 Fundamental analysis A brief summary of the December Bank of Japan meeting showed that policymakers discussed further monetary policy tightening even after last month’s rate hike to a multi-year high. Several committee members argued that policy remains far from neutral in real terms and supported a gradual rate increase to stay ahead of inflation risks. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US Tech forecast: the index continues its recovery The US Tech index continues to rise toward the resistance level with the potential to reverse the trend. The US Tech forecast for next week is positive. US Tech forecast: key trading points Recent data: U.S. Initial Jobless Claims for last week came in at 214K Market impact: the data has a moderately negative impact on the technology sector Fundamental analysis Initial Jobless Claims measure how many people filed for unemployment benefits for the first time during the past week. This is one of the most timely indicators of labor market conditions: the lower the reading, the more stable employment is and the fewer signs there are of economic deterioration. Claims came in at 214K, compared with a forecast of 224K and the previous reading of 224K. In other words, the figure was better than expected and declined from the prior week. This signals that the labor market remains resilient: companies are generally not accelerating layoffs, and consumer demand is typically supported by more stable household incomes. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

AUDUSD: the pair has updated its yearly high AUDUSD is showing strong gains, setting a new yearly high at 0.6717. The Reserve Bank of Australia may raise interest rates in 2026. Details — in our analysis for 26 December 2025. AUDUSD technical analysis AUDUSD is showing strong growth, setting a new yearly high at 0.6717. The Alligator indicator is pointing upward, confirming the bullish price momentum. The key support level is currently located at 0.6600. AUDUSD quotes are rising, having set a new yearly high at 0.6717. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

BoE interest rate and weak USD: triggers for GBPUSD growth Rising unemployment in the US is putting pressure on the USD. Against this backdrop, GBPUSD may continue to rise toward the 1.3590 area. Details — in our analysis for 24 December 2025. GBPUSD forecast: key trading points Primary Jobless Claims in the US: previous value — 224K, forecast — 227K Current trend: moving upwards GBPUSD forecast for 24 December 2025: 1.3590 and 1.3472 Fundamental analysis The GBPUSD forecast for December 17, 2025 is favorable for the British pound, as prices have strong potential for further growth following a minor correction. US Initial Jobless Claims show the number of people filing for unemployment benefits for the first time during the previous week. This indicator reflects labor market conditions, and an increase signals rising unemployment. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD: the pair trades near the yearly high The EURUSD exchange rate is trading near the 1.1800 level, close to the yearly high, amid mixed economic data from the United States. Details — in our analysis for 24 December 2025. EURUSD technical analysis On the H4 chart, EURUSD quotes continue to strengthen, rising toward the 1.1800 level. The Alligator indicator has also turned upward along with price action, suggesting that the euro’s growth may continue. The key support level currently stands at 1.1700. The EURUSD price has climbed to the 1.1800 level amid mixed US economic data. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

New XAUUSD high: U.S. macro data weighs on the dollar The U.S. dollar continues to lose ground against gold, with XAUUSD setting another record after testing the 4,497 USD level. Details — in our analysis for 23 December 2025. XAUUSD forecast: key trading points U.S. GDP Q3: previous value — 3.8%, forecast — 3.2% U.S. CB Consumer Confidence Index: previous value — 88.7, forecast — 83.4 Current trend: moving upwards XAUUSD forecast for 23 December 2025: 4,550 or 4,440 Fundamental analysis Today’s XAUUSD price outlook shows that gold continues its upward trend. At this stage, prices have updated another all-time high and are trading around the 4,480 USD per ounce level. Gross Domestic Product (GDP) represents the total value of all goods and services produced in a country, calculated based on final output without including the cost of raw materials. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent reacts to Donald Trump’s statements on Venezuelan tankers Brent crude oil prices are declining after testing resistance and amid ongoing geopolitical uncertainty. The current price is 61.35 USD. Details — in our analysis for 23 December 2025. Brent technical analysis Brent crude prices remain within a descending channel. After a local rebound, buyers faced resistance at 61.55 USD, which resulted in the formation of a corrective move. The price is once again approaching the upper boundary of the descending channel, where selling activity may intensify. Brent is facing resistance near the 61.55 USD level amid geopolitical risks and a decline in the number of U.S. oil rigs Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDCAD: the pair attempts an upside reversal USDCAD has halted its decline and is attempting to reverse higher, having received buyer support near the 1.3730 area. Details — in our analysis for 22 December 2025. USDCAD forecast: key trading points Market focus: Retail sales in Canada rose by 1.2% in November Current trend: an upward correction is observed USDCAD forecast for 22 December 2025: 1.3730 and 1.3870 Fundamental analysis According to data released on Friday, retail sales in Canada increased by 1.2% month-on-month in November 2025. This marked the strongest growth in five months, rebounding after a 0.2% decline in October. Meanwhile, oil prices are attempting to recover as markets assess the risk of additional U.S. sanctions against Russia and potential supply disruptions linked to the blockade of Venezuelan oil tankers. These factors provide support for Canadian oil exporters. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

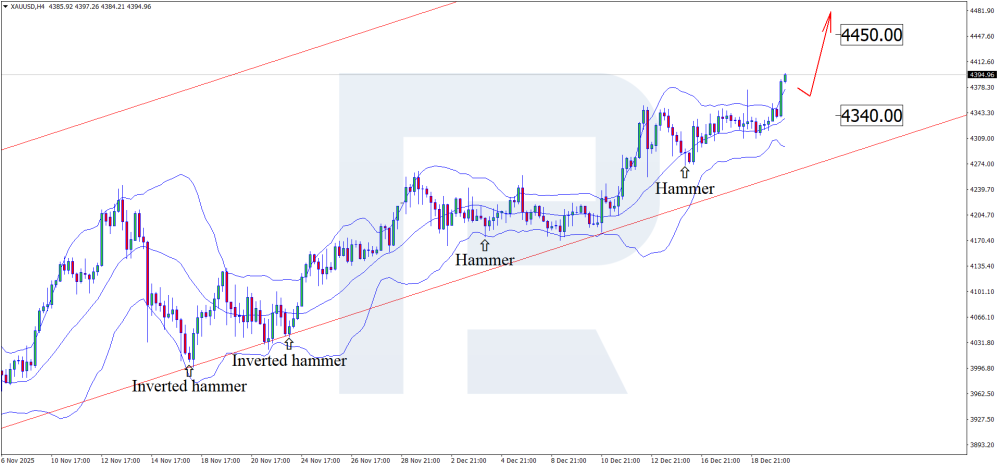

The Fed pushes gold higher: XAUUSD updates its all-time high The Fed’s interest rate cut continues to support gold. XAUUSD has updated its all-time high and is trading near the 4,395 USD level. Details — in our analysis for 22 December 2025. XAUUSD technical analysis On the H4 chart, XAUUSD formed a Hammer reversal pattern near the middle Bollinger Band. At this stage, the price continues its upward wave as part of the pattern’s realization. Given that XAUUSD quotes remain within an ascending channel, the next upside target may be the 4,450 USD level. The XAUUSD forecast for December 22, 2025 is fully bullish for gold. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

AUDUSD loses ground ahead of the regulator’s minutes release The AUDUSD rate has resumed its decline amid investor uncertainty over the RBA’s next policy steps. The current quote is 0.6604. Details — in our analysis for 19 December 2025. AUDUSD forecast: key trading points The Australian dollar remains under pressure ahead of the release of the RBA’s December meeting minutes The market is looking for signals on the future direction of monetary policy AUDUSD forecast for 19 December 2025: 0.6515 Fundamental analysis The AUDUSD rate resumed its decline after yesterday’s corrective rebound. The currency pair is moving lower as part of the implementation of a Head and Shoulders reversal pattern, with the nearest downside target located in the 0.6530 area. The Australian dollar remains under pressure ahead of the publication of the minutes from the Reserve Bank of Australia’s December meeting. Market participants are hoping to obtain clearer signals regarding the future outlook for monetary policy. The document, due to be released next week, is expected to reveal the nature of the board’s discussions on the possibility of policy tightening, as well as the regulator’s level of concern about inflation risks. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold (XAUUSD) failed to renew its all-time high The price of XAUUSD declined toward the 4,300 USD area during a downward correction after an unsuccessful attempt to renew the all-time high, following the release of US inflation data. Details — in our analysis for 19 December 2025. XAUUSD technical analysis XAUUSD quotes corrected toward the 4,300 USD area. The daily trend, confirmed by the Alligator indicator, remains upward, indicating the possibility of a continuation of the bullish move once the current correction is complete. Gold is undergoing a moderate correction after failing to renew the all-time high at 4,381 USD. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team

.thumb.png.d67e27a6d6cd7bbfc627c45bd8508f83.png)