⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

-

Posts

1,310 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by RBFX Support

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index has completed its correction The JP 225 stock index has completed its correction after reaching a new all-time high and is poised to climb higher. The JP 225 forecast for today is positive. JP 225 forecast: key takeaways Recent data: Japan’s GDP growth for Q4 2025 came in at 0.2% year-on-year Market impact: the effect on the Japanese equity market is moderately negative Fundamental analysis The published Japanese GDP data, at 0.2% year-on-year, compared to expectations of 1.6%, indicates a significantly weaker economic recovery than the market had anticipated. For the JP 225 index, this typically forms a moderately negative initial signal, as expectations for revenue growth among companies focused on domestic demand deteriorate and investor caution increases regarding the coming quarters. According to Goldman Sachs, hedge funds have purchased the bulk of Asian equities over the past decade. Last week, emerging and developed Asian markets recorded the largest net hedge fund inflows since 2016, supported by optimism surrounding companies involved in artificial intelligence infrastructure. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 422 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

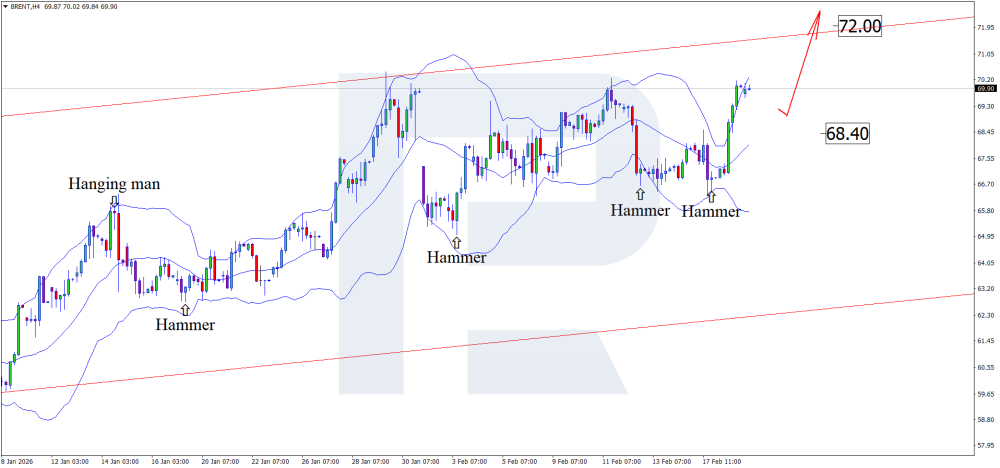

Brent prices on the verge of records: decline in US oil inventories could trigger surge Economic data and a decline in US oil inventories support Brent quotes, which have reached 70.00 USD per barrel. Find out more in our analysis for 19 February 2026. Technical outlook On the H4 chart, Brent quotes formed a Hammer reversal pattern after testing the lower Bollinger Band. At this stage, they continue to develop an upward wave in line with the pattern signal. Amid expectations of US oil inventory data, Brent quotes continue to strengthen. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

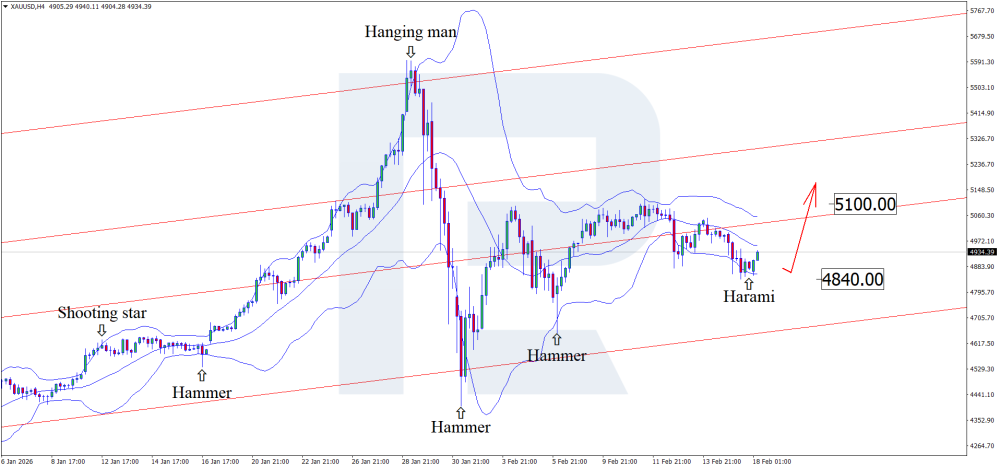

Gold awaits FOMC: Fed minutes may reshape XAUUSD trajectory After a corrective pullback, XAUUSD prices are attempting to recover lost ground, currently trading at 4,930 USD. Find more details in our analysis for 18 February 2026. Technical outlook On the H4 chart, XAUUSD prices formed a Harami reversal pattern near the lower Bollinger Band and may continue an upward wave in line with the pattern’s signal. Since XAUUSD quotes remain within the ascending channel, the upside target could be 5,100 USD. The release of the FOMC minutes may significantly impact XAUUSD performance and trigger increased volatility. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Buyers attempt to stabilise GBPUSD after the sell-off The GBPUSD rate is correcting after a sharp decline, but weak UK labour market data continues to weigh on the pair. The rate currently stands at 1.3557. Find out more in our analysis for 18 February 2026. GBPUSD forecast: key takeaways Weak labour market data increased pressure on the British pound The market strengthened expectations of Bank of England rate cuts in the coming months The unemployment rate rose to 5.2%, the highest since early 2021 Fundamental analysis The GBPUSD pair is undergoing a correction after an aggressive decline in the previous session. However, buyers defended the key support level at 1.3525, allowing the pair to stabilise near local lows. The British pound came under pressure following the release of weak UK labour market data, which reinforced expectations that the Bank of England may shift towards cutting interest rates in the coming months. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 422 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

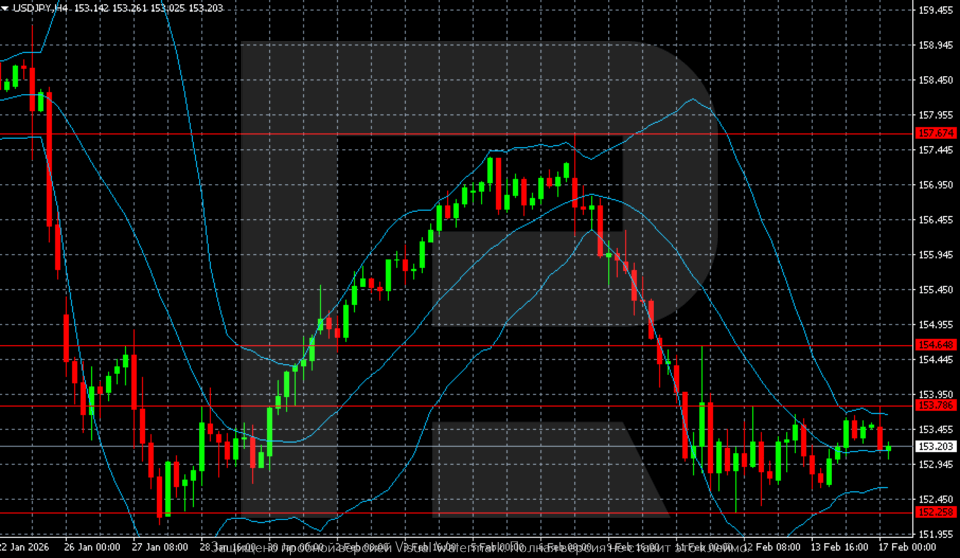

USDJPY: everything is complex and dynamic The USDJPY pair dipped to 153.20, with the market monitoring monetary policy and incoming data. Find out more in our analysis for 17 February 2026. USDJPY technical analysis On the H4 chart, the USDJPY pair is trading around 153.20 after a sharp decline from 157.50–158.00. The chart clearly shows a shift in momentum: after a failed attempt to consolidate above 157.50, an accelerated sell-off began, with the price breaking below the middle line of Bollinger Bands. The USDJPY pair maintains a moderately bearish sentiment. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: the index is trading sideways The US 500 tested the support level and entered a sideways channel, although the downtrend still prevails. The US 500 forecast for today is negative. US 500 forecast: key takeaways Recent data: US Nonfarm Payrolls increased to 130 thousand in January Market impact: the data negatively impacts the equity market Fundamental analysis The release of January US employment data forms a moderately positive yet mixed signal for the US 500 index. Job growth of 130 thousand versus an expected 66 thousand, along with a decline in unemployment to 4.3%, confirms economic resilience. This is important for the equity market, as a strong labour market typically supports consumer demand, corporate revenues, and earnings expectations for the coming quarters. At the same time, this report reduces the likelihood of rapid monetary easing. Stronger employment and lower unemployment imply that the Federal Reserve has fewer reasons to move quickly towards rate cuts. This may be accompanied by higher Treasury yields and an increased cost of capital for businesses. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 422 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Easing US inflation expectations fuel EURUSD growth The EURUSD rate is strengthening amid slower US inflation, which has reinforced expectations of Federal Reserve policy easing. The current quote is 1.1865. Discover more in our analysis for 16 February 2026. EURUSD technical analysis EURUSD quotes are rebounding from the lower boundary of the ascending channel. Buyers are holding the price above the key 1.1845 support level. The pair continues to trade within a range, with the upper boundary near 1.1890. Technical analysis of EURUSD indicates potential growth towards 1.1985 if the price firmly consolidates above 1.1895. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

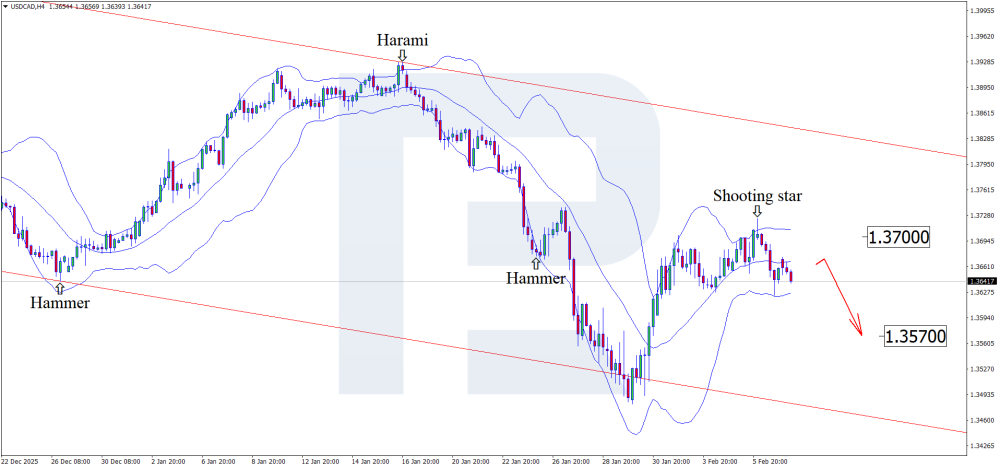

USDCAD in neutral: statistics will determine everything The USDCAD pair stands at 1.3616 on Monday. The focus is on fresh inflation data from Canada. Find out more in our analysis for 16 February 2026. USDCAD forecast: key takeaways The USDCAD pair stabilised after last week’s volatility Investors are focused on Canadian inflation data due on Tuesday USDCAD forecast for 16 February 2026: 1.3490 or 1.3725 Fundamental analysis The USDCAD pair starts the week at 1.3616. Previously, the Canadian dollar declined moderately but managed to retain most of its weekly gains thanks to signals of slowing inflation in the US. The focus is on Canada’s January CPI, scheduled for release on Tuesday. Annual inflation is expected to remain at 2.4%. This could influence expectations regarding the Bank of Canada’s future policy. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 422 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold (XAUUSD) fell sharply without a clear trigger: the week may close in negative territory Gold (XAUUSD) prices returned to 4,960 USD after yesterday’s sharp drop. Markets appear to need liquidity again. Find more details in our analysis for 13 February 2026. XAUUSD technical analysis After January’s surge towards 5,500+, gold (XAUUSD) entered a phase of sharp correction and high volatility. The decline was accompanied by widening Bollinger Bands and long candlestick wicks, reflecting active position redistribution. Gold has recovered after yesterday’s sell-off, although risks remain. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

AUDUSD on the verge of a breakout: how a decline in US CPI and RBA policy may strengthen the AUD After testing the 2023 highs, the AUDUSD pair is forming a correction before a further rise. Quotes are hovering around 0.7050. Discover more in our analysis for 13 February 2026. AUDUSD forecast: key takeaways US core Consumer Price Index: previously at 2.6%, projected at 2.5% Inflation above 3.0% in Australia is unacceptable, according to the RBA AUDUSD forecast for 13 February 2026: 0.7140 Fundamental analysis Today’s AUDUSD forecast favours the Australian dollar, which has strong chances to continue recovering against the USD after completing the current correction. At this stage, the pair is trading around 0.7050. The core CPI measures changes in the cost of goods and services from the consumer’s perspective. This index is a key gauge of consumer purchasing dynamics and inflation. Fundamental analysis for 13 February 2026 takes into account that the actual January core CPI reading may decline to 2.5% compared to the previous period, indicating easing inflationary pressure. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 422 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent forms a reversal at key resistance Brent quotes are showing signs of a reversal amid technical signals and negative US oil inventory data, currently trading at 69.08 USD. Find more details in our analysis for 12 February 2026. Brent technical analysis Brent quotes are correcting within a developing Wedge reversal pattern. Although prices remain above the EMA-65, the risks of further downside movement remain high. The technical and fundamental outlook for Brent highlights reversal risks amid a Double Top pattern. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

XAUUSD continues to rise: why the Fed will not be able to weaken gold in March Employment growth and positive US economic data failed to provide sufficient support to the USD, while XAUUSD quotes continue to rise and are testing the 5,070 USD level. Discover more in our analysis for 12 February 2026. XAUUSD forecast: key takeaways US initial jobless claims: previously at 231 thousand, projected at 222 thousand Change in US Nonfarm Payrolls: previously at 48 thousand, currently at 130 thousand XAUUSD forecast for 12 February 2026: 5,280 Fundamental analysis Today’s XAUUSD forecast indicates that gold prices continue their upward trajectory, trading near 5,070 USD per ounce. US initial jobless claims reflect the number of people who filed for unemployment benefits for the first time during the previous week. This indicator measures the labour market climate, with an increase in initial jobless claims indicating rising unemployment. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 422 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 30 forecast: the index hits new all-time high Despite increased volatility, the US 30 index has reached a new all-time high. The US 30 forecast for today is positive. US 30 forecast: key takeaways Recent data: US retail sales for January showed no growth, coming in at 0.0% Market impact: the data has a mixed impact on the stock market Fundamental analysis The release of US monthly retail sales at 0.0%, below expectations of 0.4% and a previous reading of 0.6%, forms a moderately negative macroeconomic signal for the US 30 index in the short term, as it indicates a noticeable cooling of consumer demand relative to market expectations. This news is generally positive for the US 30 index. The structure of the index is largely oriented towards real-sector companies and cyclical businesses that are sensitive to industrial conditions, domestic demand, and capital expenditure. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 422 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

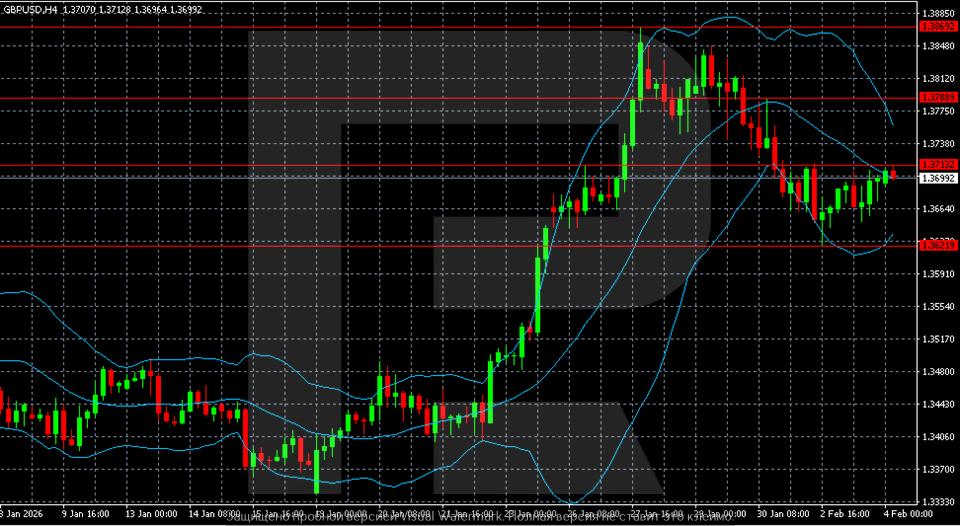

The pound gains strength: will GBPUSD withstand the impact of US employment data Ahead of US employment statistics, the GBPUSD pair is forming an upward wave, with quotes testing the 1.3660 level. Discover more in our analysis for 11 February 2026. GBPUSD technical analysis Having tested the lower Bollinger Band, the GBPUSD pair formed a Hammer reversal pattern on the H4 chart and may continue its upward movement following the pattern’s signal. The current upside target stands at 1.3770. A breakout above this resistance will open the door for continued upward momentum. Amid expectations of US employment statistics, the pound continues to strengthen. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

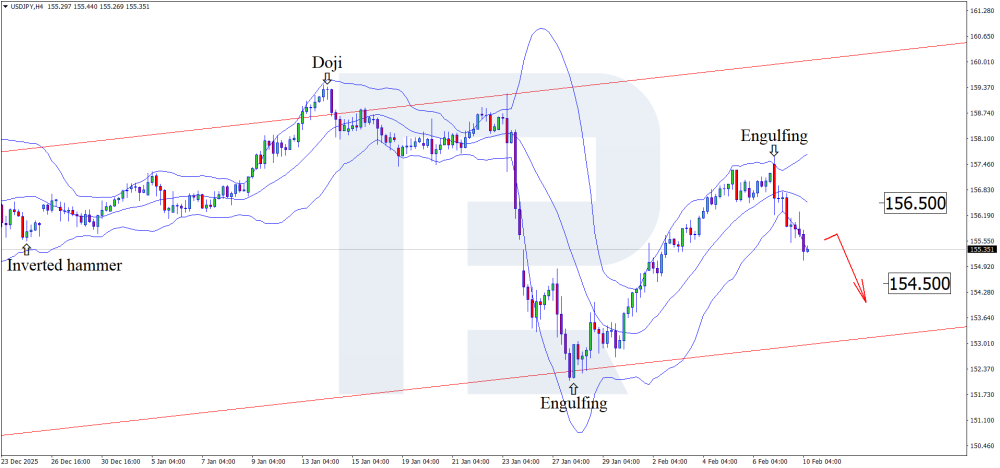

BoJ intervention rumours push USDJPY lower The USD continues to lose ground against the yen, with quotes testing the 156.70 level. Discover more in our analysis for 10 February 2026. USDJPY technical analysis On the H4 chart, the USDJPY pair formed an Engulfing reversal pattern near the upper Bollinger Band and is trading around the 155.40 level. At this stage, the price may continue its downward wave following the pattern’s signal, with the downside target at 154.50. The yen continues to strengthen against the USD, with technical analysis of USDJPY suggesting a decline towards the 154.50 support level. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: the index enters downtrend After reaching its all-time high, the US 500 has entered a downtrend. The US 500 forecast for today is positive. US 500 forecast: key takeaways Recent data: US initial jobless claims totalled 231 thousand last week Market impact: the data has a negative impact on the equity market Fundamental analysis The release of US initial jobless claims (231 thousand versus a forecast of 212 thousand and 209 thousand the previous week) provides a moderately negative short-term signal for the US 500 index, as it points to a more noticeable cooling of the labour market than the consensus expectation. At the same time, it is important to consider the scale: the level of claims remains below crisis levels and closer to the historically normal range. For the US 500 index, the key factor in such conditions is typically the reaction of expectations regarding the Fed’s interest rate. If the market interprets the increase in claims as a factor reducing the likelihood of further monetary tightening, some of the negative impact on stocks may be offset through lower bond yields and improved valuations of companies’ future cash flows. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 422 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index resumed growth after correction The DE 40 stock index continues to recover after the correction, with the uptrend remaining intact. The DE 40 forecast for today is positive. DE 40 forecast: key takeaways Recent data: Germany’s industrial production fell by 1.9% in January compared to December last year Market impact: the data creates a negative backdrop for the German equity market Fundamental analysis German industrial production data represents a significantly weaker-than-expected result, coming in at −1.9% m/m compared to expectations of −0.2% and the previous reading of +0.2%. For the DE 40 index, this typically implies a short-term deterioration in sentiment, as the indicator is directly linked to business activity, capacity utilisation, and future corporate earnings trends in an industry-oriented economy. The short-term impact on the DE 40 is likely to be restraining. The index includes large companies that depend on the industrial cycle, external demand, and business investment activity. Weak output data increases the likelihood of downward revisions to profit expectations in cyclical sectors, which is typically reflected in a more cautious valuation of equities. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 422 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDCAD is falling: what factors could strengthen the CAD Increased volatility in oil prices impacts the USDCAD rate significantly, with quotes testing the 1.3640 level. Discover more in our analysis for 9 February 2026. USDCAD technical analysis On the H4 chart, the USDCAD pair has formed a Shooting Star reversal pattern near the upper Bollinger Band and may continue its downward movement following the pattern’s signal. Since prices remain within the descending channel, a decline towards the nearest support level at 1.3570 can be expected. Risk factors for further USDCAD growth include a potential decline in global risk appetite and sharp fluctuations in oil prices, which may add to pressure on the currency pair. Read more -USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD in doubt: lots of risks, but also lots of confidence The EURUSD pair is hovering around 1.1793 at the end of the week as the US dollar remains in demand as a safe-haven asset. Discover more in our analysis for 6 February 2026. EURUSD forecast: key takeaways The EURUSD pair may resume its upward trajectory after a pause Demand for the US dollar is driven by market interest in safe-haven assets EURUSD forecast for 6 February 2026: 1.1760 or 1.1820 Fundamental analysis On Friday, the EURUSD rate looks uninspiring, hovering around 1.1793. Demand for the US dollar has strengthened amid broad sell-offs in equities, commodities, and cryptocurrencies, which has fuelled interest in the currency as a safe-haven asset. The USD also gained notable support after US President Donald Trump nominated Kevin Warsh as the next Federal Reserve chairman. Markets view Warsh as favouring balance sheet reduction and a more cautious approach to monetary easing. This has also helped ease concerns about the Federal Reserve’s independence. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 422 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

AUDUSD at the start of a rally: buyers are pushing prices higher The AUDUSD pair is gaining upward momentum after rebounding from the key support level, with the price currently at 0.6956. Discover more in our analysis for 6 February 2026. AUDUSD technical analysis The AUDUSD pair is rising after a confident rebound from the 0.6905 support level. Buyers have consolidated above the EMA-65, indicating strengthening bullish pressure and continued upward momentum. The combination of support from the RBA and the holding of the key 0.6905 level. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index hits new all-time high The JP 225 stock index has broken above the resistance level and reached a new all-time high. The JP 225 forecast for today is positive. JP 225 forecast: key trading points Recent data: Japan Tokyo core CPI declined to 2.00% year-on-year Market impact: the effect on the Japanese stock market is moderately negative Fundamental analysis The decline in Tokyo core inflation to 2.0% year-on-year, compared to expectations of 2.2% and the previous reading of 2.3%, is perceived by the market as a signal of easing price pressure. For investors, this indicator is important not only in itself, but also as a guide to the likely trajectory of nationwide inflation and, accordingly, future decisions by the Bank of Japan. For the JP 225 index, this signal is moderately positive in the baseline scenario. If the market concludes that the Bank of Japan will act more cautiously, this supports equity valuations through lower borrowing costs and more favourable financial conditions for businesses. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 422 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

XAUUSD under pressure after Fed signals XAUUSD prices are declining amid a clash between the Fed’s hawkish rhetoric and signs of weakening in the US labour market. The current quote stands at 4,926 USD. Find more details in our analysis for 5 February 2026 XAUUSD technical analysis XAUUSD quotes are rising after rebounding confidently from the lower boundary of the bullish Wolfe Wave pattern. The current pattern structure indicates that directional upward momentum is forming, aiming for the pattern’s upper boundary. The XAUUSD forecast for today suggests the completion of the correction phase and continued growth towards the target of 5,115. Technical analysis of XAUUSD indicates the formation of upward momentum after a rebound from the lower boundary of the bullish Wolfe Wave pattern. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 30 forecast: the index resumes growth The US 30 index sees increased volatility, with the uptrend prevailing once again. The US 30 forecast for today is positive. US 30 forecast: key trading points Recent data: US ISM manufacturing PMI came in at 52.6 in December Market impact: the data has a moderately positive impact on the stock market Fundamental analysis The rise in the ISM manufacturing PMI to 52.6 points, the highest level in approximately the past 40 months and well above the forecast and the previous reading, indicates a transition of the US industrial sector from contraction to expansion. For the US 30 index, this news is generally positive. The index is heavily weighted towards real-sector companies and cyclical businesses that are sensitive to industrial conditions, domestic demand, and capital expenditures. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 422 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBPUSD is neutral as the market awaits Bank of England data The GBPUSD pair remains stable near 1.3700. The calm news background allows the market to wait for new signals. Discover more in our analysis for 4 February 2026. GBPUSD technical analysis On the GBPUSD H4 chart, after prolonged sideways movement in the first half of January, the pair entered a phase of sharp impulsive growth. The breakout above the upper boundary of the range was accompanied by an expansion of Bollinger Bands and accelerated upward movement, indicating buyer dominance. The GBPUSD pair is rising modestly amid a quiet calendar and ahead of the upcoming Bank of England meeting. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) rebounds, but the outlook remains highly uncertain Gold (XAUUSD) prices have partially recovered and returned to 4,850 USD. The market is focused on Fed-related news and overall risk sentiment. Discover more in our analysis for 3 February 2026. XAUUSD forecast: key trading points Gold (XAUUSD) is supported by a solid fundamental backdrop but shows technical sell signals The market still needs gold as a safe-haven asset XAUUSD forecast for 3 February 2026: 4,900 Fundamental analysis Gold (XAUUSD) rose by more than 3% on Tuesday to 4,858 USD per ounce amid renewed buying activity after a sharp decline over the previous two days. The precious metal fell by nearly 5% a day earlier, with Friday’s drop marking the largest single-day decline in more than a decade. The trigger was news that US President Donald Trump nominated Kevin Warsh as the next Federal Reserve chairman. The market perceived him as a more hawkish candidate compared to other contenders, increasing concerns about a potential tightening of monetary policy. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 422 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with: