⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

-

Posts

1,338 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by RBFX Support

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Geopolitical tensions push Brent towards new price records Geopolitics remains the main driver of oil price gains, with Brent quotes currently standing at 93.70 USD. Discover more in our analysis for 12 March 2026. Brent forecast: key takeaways The Strait of Hormuz remains effectively closed The IEA’s record release of strategic reserves proved largely ineffective Brent prices may continue to rise towards 100.00–110.00 USD per barrel Fundamental analysis Brent fundamental analysis for today, 12 March 2026, takes into account that prices are correcting within an overall uptrend, trading around 93.70 USD per barrel. The Brent outlook for 12 March 2026 also factors in that Brent crude remains in the eye of the storm triggered by the escalation of the conflict in the Middle East. The disruption of key strategic shipping routes poses a serious threat to the oil market and is one of the triggers behind the Brent rally. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 436 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

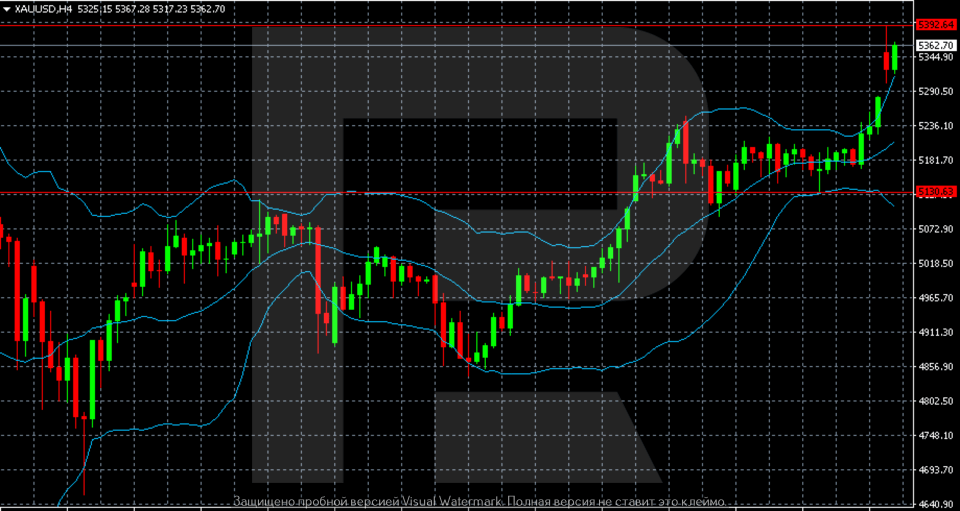

XAUUSD remains under pressure after the release of US inflation data XAUUSD is trading cautiously as investors assess inflation risks and the outlook for US monetary policy, with prices currently at 5,168 USD. Find out more in our analysis for 12 March 2026. Technical outlook XAUUSD quotes are undergoing a correction within an ascending channel. Buyers are holding the 5,115 USD support level, which maintains bullish pressure and limits a deeper bearish correction. Today’s XAUUSD forecast suggests an attempt to recover and form new momentum towards 5,485 USD. The combination of persistent inflation and a stronger US dollar is increasing pressure on XAUUSD, limiting gold’s upside in the near term. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 30 index forecast: recovering after the sell-off The US 30 index is undergoing a correction after a strong decline caused by the escalation of the military conflict in the Middle East. The US 30 forecast for today is negative. US 30 forecast: key takeaways Recent data: US unemployment came in at 4.4% in February Market impact: the data has a mixed effect on the stock market Fundamental analysis The release of the US unemployment rate at 4.4%, above a 4.3% forecast and the previous figure of 4.3%, indicates a slight deterioration in labour market conditions. Although the change is relatively modest, such data traditionally attracts increased attention from financial market participants, as the labour market is one of the key indicators of the US economy’s health. The composition of the US 30 index is particularly important. The index includes large corporations from industrials, financials, technology, consumer sectors, and healthcare. Therefore, labour market macroeconomic data can affect the index through shifts in expectations for future demand for these companies’ products and services. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 436 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

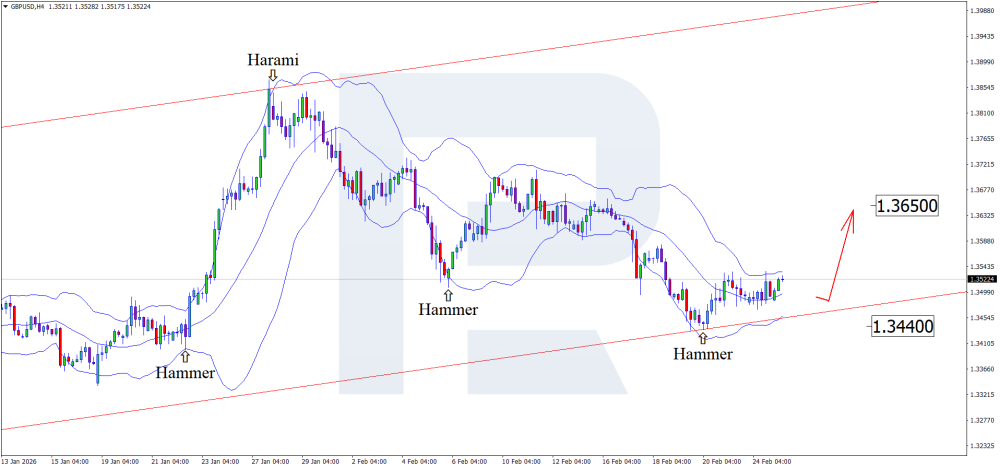

GBPUSD gains, but data releases could change a lot The GBPUSD pair climbed to 1.3450, with the pound supported by geopolitics, while economic data works against it. Find more details in our analysis for 11 March 2026. Technical outlook The GBPUSD H4 chart shows that after a sharp drop in the second half of February, the pair reached a low in the 1.3250–1.3270 area, from which a recovery began. The GBPUSD pair is rising on reduced geopolitical risk premium. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: the index is correcting after the sell-off Amid escalating tensions in the Middle East, the US 500 plunged by 4.5% and is now undergoing a correction. The US 500 forecast for today is negative. US 500 forecast: key takeaways Recent data: US Nonfarm Payrolls came in at -92 thousand in February 2026 Market impact: the impact on the equity market is neutral Fundamental analysis The release of US Nonfarm Payrolls at -92 thousand, below a forecast of a 58 thousand gain, is a clearly negative signal for the equity market. This result means the US economy did not add jobs; on the contrary, employment declined. For the US 500 index, this typically implies stronger short-term pressure, as investors start pricing in weaker economic growth prospects, more cautious corporate guidance, and an increased risk of deteriorating company financial performance in the coming quarters. In this situation, mixed price action is most likely. Pressure may emerge first in cyclical industries whose results directly depend on the pace of economic growth. These include industrials, consumer discretionary (durable goods), transportation, financials, and parts of the materials/commodities segment. The market may begin to price in weaker revenues and slower profit growth specifically in these sectors RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 436 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

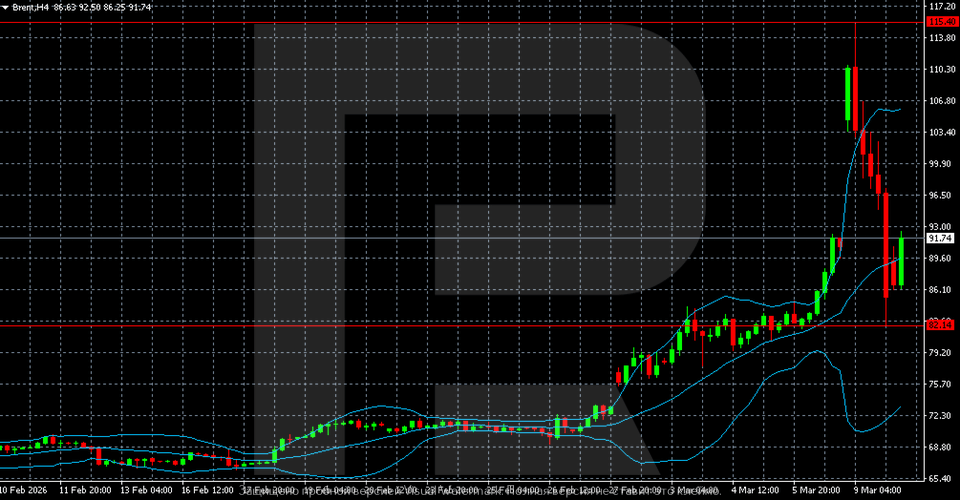

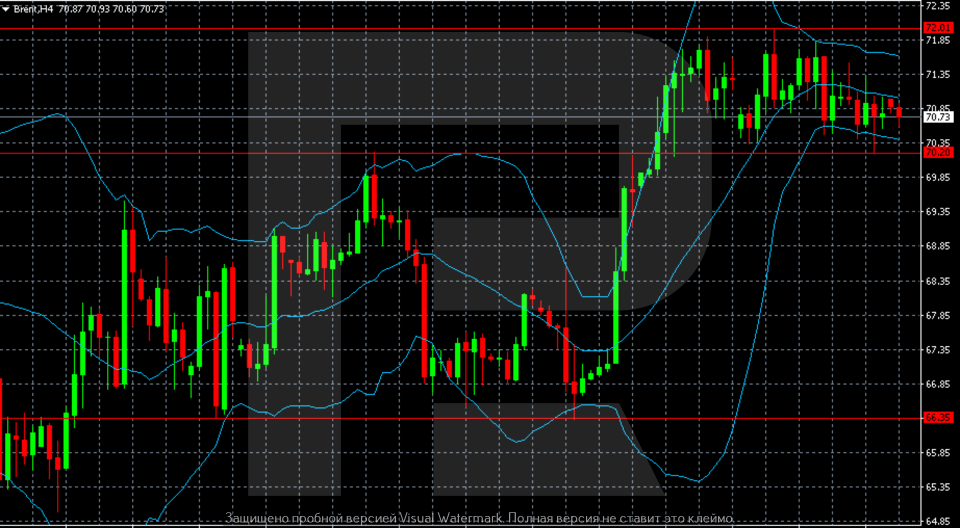

Brent retreated from the peak: all eyes on the Middle East Brent prices are falling amid geopolitical tensions, with the market watching US rhetoric on Iran. Find out more in our analysis for 10 March 2026. Technical outlook The Brent H4 chart shows a sharp increase in bullish momentum in early March. Prior to this, the market had been trading sideways around 70–74 USD per barrel, but then prices surged higher, breaking above the 82.14 level and, over several sessions, reaching an extreme near 115.40. Brent has declined and pulled back from the local high. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

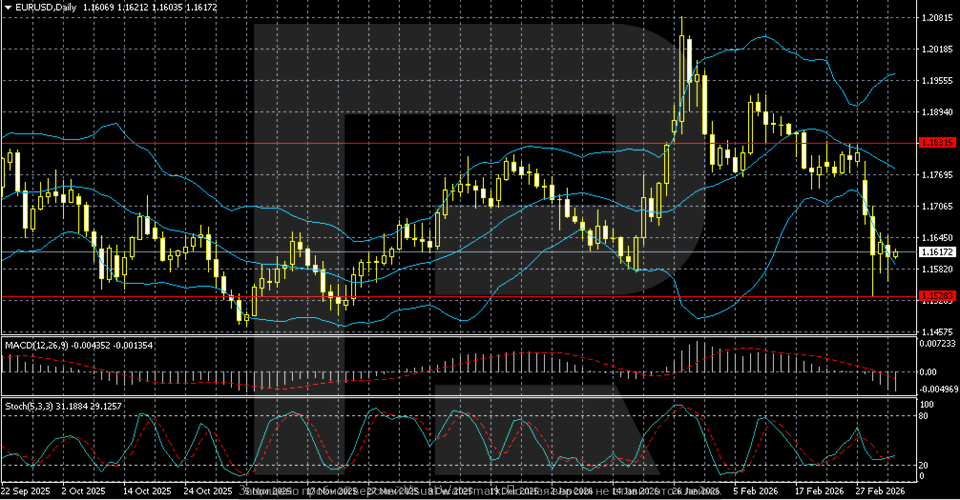

EURUSD weekly forecast: the dollar relies on the Middle East factor The EURUSD pair enters the week of 9–13 March around 1.1617 after declining amid a stronger dollar. The US currency was supported by demand for safe-haven assets due to the escalation of the conflict in the Middle East and rising oil prices. Technical outlook In January, the pair produced a powerful bullish surge, with quotes breaking through several resistance levels and peaking in the 1.2000–1.2050 area. This momentum was accompanied by expanding Bollinger Bands, reflecting rising volatility and accelerating trend strength. The EURUSD pair closed the first week of March around 1.1617. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) weekly forecast: range-bound trading with a positive bias Gold (XAUUSD) enters the week of 9–13 March around 5,170 USD per ounce after rising amid increased geopolitical tensions in the Middle East. XAUUSD forecast: key takeaways Weekly performance: gold (XAUUSD) is hovering around 5,170 USD per ounce after rising amid heightened geopolitical risks. Support and resistance: the daily chart shows a steady uptrend formed back in autumn. Fundamentals and outlook: gold retains its status as a key safe-haven asset and remains sensitive to geopolitics and inflation expectations. Fundamental analysis Gold (XAUUSD) ended the week higher, holding around 5,170 USD per ounce. Prices are bolstered by demand for safe-haven assets amid a sharp escalation of the conflict in the Middle East. The military confrontation between the US, Israel, and Iran continues to intensify. The US and Israel are striking military and infrastructure targets in Iran, while Tehran is responding with missile attacks on some neighbouring countries, including energy infrastructure facilities. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 436 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD in a Triangle: the market gears up for a sharp move The EURUSD pair remains under pressure amid rising inflation risks, which supports demand for the US dollar. The rate currently stands at 1.1607. Find more details in our analysis for 6 March 2026. EURUSD forecast: key takeaways Rising tensions in the Middle East increase instability in global financial markets Higher oil prices fuel concerns about a new wave of global inflation Markets have revised expectations for the timing of the Federal Reserve policy easing Fundamental analysis The EURUSD rate is falling for the second consecutive session, but prices remain within a range with an upper boundary at 1.1645 and a lower boundary at 1.1575. The US dollar is supported by escalating tensions in the Middle East, which increases instability in global financial markets. Higher oil prices fuel concerns about a new wave of global inflation. This raises the likelihood that the Federal Reserve will keep interest rates at elevated levels for longer. Rising inflation risks are weighing on the currencies of major oil-importing countries, which additionally supports the US dollar. Markets have revised expectations for the timing of the Federal Reserve easing. Investors now expect the next rate cut in September or October, whereas previously it was anticipated as early as July. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 436 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

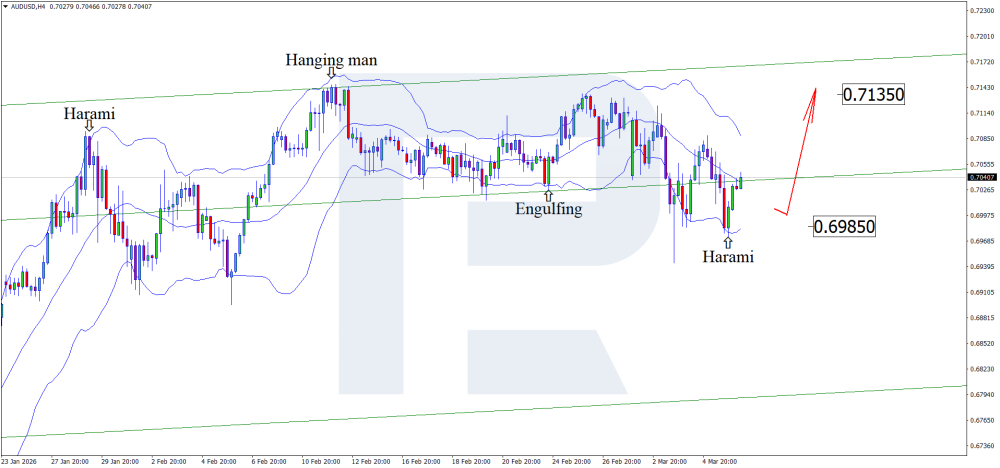

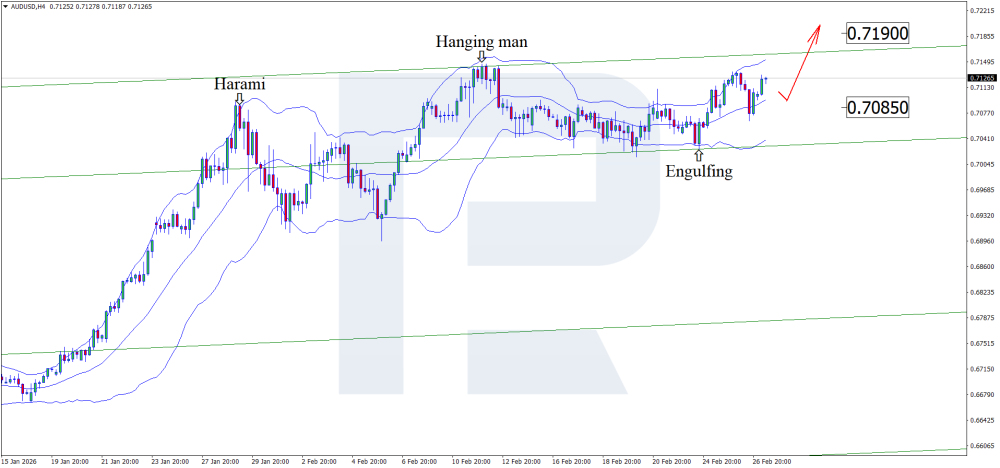

AUDUSD on the rise: weak US data gives the Australian dollar a chance The USD is once again losing ground against the Australian dollar, with the AUDUSD pair testing the 0.7030 level. Discover more in our analysis for 6 March 2026. Technical outlook Having tested the lower Bollinger Band, the AUDUSD pair formed a Harami reversal pattern on the H4 chart. At this stage, quotes continue to develop an upward wave following the signal, with a potential upside target at the 0.7135 resistance level. Ahead of US labour market data, the Australian dollar continues to strengthen against the USD. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Oil storm 2026: Brent surges amid real threat of supply disruptions After testing the 84.24 USD level, Brent prices may continue their uptrend and head towards the 100.00 USD area. Find more details in our analysis for 5 March 2026. Brent forecast: key takeaways The blockade of the Strait of Hormuz continues to support Brent prices Declining global stocks of crude oil and petroleum products are increasing the market deficit Brent forecast for 5 March 2026: 88.00 Fundamental analysis Brent fundamental analysis for today, 5 March 2026, takes into account that quotes continue their upward trajectory, trading around 82.30 USD per barrel. The Brent forecast for 5 March 2026 factors in that Brent remains in the eye of the storm caused by the escalation of the Middle East conflict. The blockade of the Strait of Hormuz has moved from a threat to an actual disruption. Around 20% of the world’s oil passes through the strait, creating a serious risk to the oil market and acting as one of the drivers of Brent’s rally. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 436 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Rising unemployment in the US could trigger EURUSD growth Ahead of US economic data releases, the USD continues to strengthen against the euro, with the EURUSD pair trading around 1.1590. Find out more in our analysis for 5 March 2026. Technical outlook On the H4 chart, the EURUSD pair formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, the pair is forming a correction following the signal from the pattern. The pullback target could be the 1.1670 level. The euro continues to lose ground amid expectations of US employment data. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

GBPUSD at a three-month low: pressure is mounting The GBPUSD pair has dropped to 1.3329, with geopolitical risks and weaker macroeconomic forecasts weighing on the pound. Discover more in our analysis for 4 March 2026. GBPUSD forecast: key takeaways The GBPUSD pair is declining amid external risks and rapid strengthening of the US dollar Weak domestic data is also putting pressure on the pound GBPUSD forecast for 4 March 2026: 1.3253 Fundamental analysis The GBPUSD rate fell to its lowest level since 9 December, reaching 1.3329. Pressure on the British currency is intensified by a stronger US dollar, which is in demand as a safe-haven asset amid tensions in the Middle East. Investors are also reacting to revised forecasts for the UK economic growth. US President Donald Trump stated that the military operation against Iran could last four to five weeks and may be extended if necessary. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 436 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY on the rise: how employment and PMI data could accelerate dollar growth Ahead of US macroeconomic data releases, the USD continues to strengthen against the yen, with the USDJPY pair testing the 157.60 level. Discover more in our analysis for 4 March 2026. Technical outlook On the H4 chart, the USDJPY pair has formed a Hammer reversal pattern near the lower Bollinger Band and is trading around 157.60. At this stage, the price may continue its upward movement as the pattern plays out, with an upside target at 159.35. Ahead of US employment data, the yen continues to lose ground against the USD. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: the index may enter a downtrend Amid escalating tensions in the Middle East, the US 500 has resumed its decline. The US 500 forecast for today is negative. US 500 forecast: key takeaways Recent data: US ISM manufacturing PMI came in at 52.4 in February 2026 Market impact: the data has a neutral effect on the equity market Fundamental analysis The release of the ISM manufacturing PMI at 52.4 points, above a forecast of 51.7, is a moderately positive development for the US 500 index. A reading above 50.0 indicates continued expansion in the manufacturing sector, while a stronger-than-expected figure reduces concerns about a sharp economic slowdown. For the US 500, this typically translates into moderate gains or more confident price action amid improved sentiment, though not necessarily into a sharp rally. It is important to note that a single PMI release rarely changes the broader market narrative. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 436 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

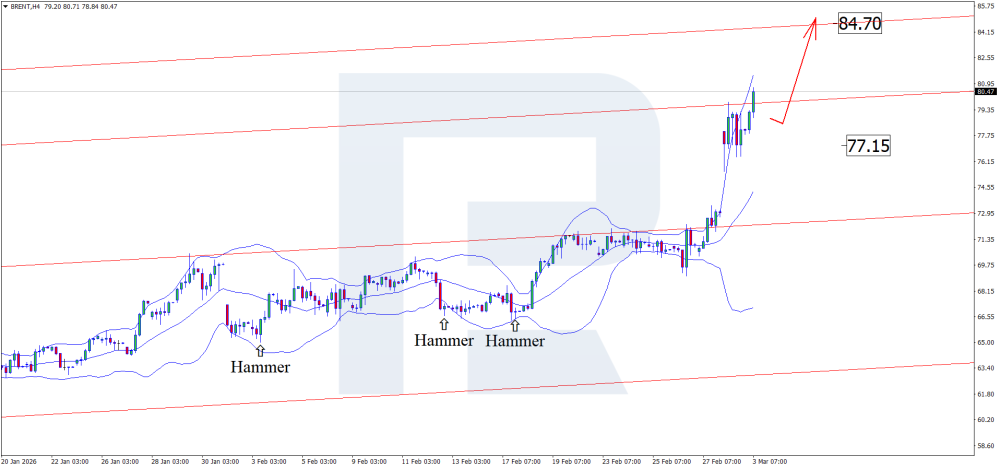

Explosive growth in Brent oil: geopolitical threat pushes prices to new highs Brent crude continues to rise amid geopolitical tensions, with prices breaking above 80.00 USD. Discover more in our analysis for 3 March 2026. Technical outlook On the H4 chart, Brent quotes have formed a Hammer reversal pattern after testing the lower Bollinger Band and continue their upward momentum in line with the signal. Brent crude continues to rise amid escalating conflict between the US and Iran. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDCAD follows oil and gold: the Canadian dollar gains ground The USDCAD pair opened March and the spring season at 1.3649, with the market focused on commodity markets and the trajectory of the US dollar. Find out more in our analysis for 2 March 2026. USDCAD forecast: key takeaways The USDCAD pair is declining in response to rallies in gold and oil Canada’s GDP came in weak, showing the softest performance since 2020 USDCAD forecast for 2 March 2026: 1.3610 Fundamental analysis The USDCAD rate is hovering around 1.3649 on Monday. Last Friday, the Canadian dollar recovered most of its monthly losses amid broad US dollar weakness. Additional support for the CAD came from rising gold prices and a weakening US dollar. The strengthening of the precious metal adds to pressure on the USD, pushing the USDCAD pair lower. Financial flows at the end of the month also played a role, with the Canadian dollar losing about 0.1% in February. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 436 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold (XAUUSD) hedges risk: Middle East tensions alarm the market Gold (XAUUSD) prices have climbed to 5,350 USD as investors are once again seeking safe-haven assets. Find more details in our analysis for 2 March 2026. Technical outlook The XAUUSD H4 chart shows a confident recovery after a decline to the 4,850–4,900 area. From this zone, a consistent upward momentum formed, with a series of higher highs and higher lows. Gold prices have risen sharply. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY in doubt: what will the BoJ ultimately decide The USDJPY pair has declined to 155.79, with the Bank of Japan still providing no clear signals regarding its rate path. Discover more in our analysis for 27 February 2026. USDJPY forecast: key takeaways The USDJPY pair is edging lower, but overall, the yen is set to end the week with losses Disagreements over the appropriate rate level persist within the BoJ and the government USDJPY forecast for 27 February 2026: 155.30 or 157.60 Fundamental analysis The USDJPY rate is retreating to 155.79 on Friday. Although the yen is strengthening intraday, the Japanese currency remains under pressure on a weekly basis and risks posting a second consecutive weekly decline. This is largely due to uncertainty surrounding the Bank of Japan’s policy outlook. The government has nominated two academic representatives to the central bank’s board, both known for favouring a dovish approach. During a meeting with BoJ Governor Kazuo Ueda, Prime Minister Sanae Takaichi expressed concern about possible further rate hikes. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 436 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

AUDUSD surges higher – do not miss the moment The USD continues to lose ground against the AUD, with the AUDUSD rate testing the 0.7125 level. Discover more in our analysis for 27 February 2026. Technical outlook On the H4 chart, the AUDUSD rate formed an Engulfing reversal pattern after testing the lower Bollinger Band. At this stage, the pair continues to develop an upward wave as the signal plays out. The next upside target could be the 0.7190 resistance level. Ahead of key US fundamental data, the AUD continues to strengthen. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index hits new all-time high The JP 225 stock index has once again reached a new all-time high after breaking above the resistance level. The JP 225 forecast for today is positive. JP 225 forecast: key takeaways Recent data: Japan’s core CPI increased by 2.0% year-on-year Market impact: the effect on the Japanese equity market is restraining Fundamental analysis The release of Japan’s core inflation at 2.0% year-on-year, in line with the 2.0% forecast and down from the previous 2.4%, primarily signals a continued slowdown in price pressure and a move closer to the target level. Since the figure matched expectations, there was no surprise factor, and the immediate market reaction is typically limited. For the JP 225 index, this news appears broadly neutral. Slower inflation reduces the likelihood of accelerated tightening by the Bank of Japan and lowers the risk of a sharp rise in domestic bond yields. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 436 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent full of doubts: key events ahead Brent crude has fallen to 70.73 USD. Geopolitics supports growth, while US inventory data weighs on prices. Discover more in our analysis for 26 February 2026. Technical outlook On the H4 chart, Brent prices rebounded from the 66.35 area, formed a strong upward impulse, broke above 70.20, and reached highs near 72.00. The rally was accompanied by widening Bollinger Bands, signalling increased volatility. Brent crude is declining as the market awaits news and technical signals. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 30 forecast: the index is poised for trend reversal In the US 30 index, prices are testing the support level and may break below it, which would signal the beginning of a downtrend. The US 30 forecast for today is negative. US 30 forecast: key takeaways Recent data: US manufacturing PMI came in at 51.2 in February Market impact: the data has a mixed impact on the stock marke Fundamental analysis The release of the US manufacturing PMI at 51.2 points, below expectations of 52.4 and the previous reading of 52.4, is moderately negative for short-term sentiment, as it indicates a slowdown in the pace of industrial activity growth. However, the indicator remains above the 50-point threshold, meaning the sector is still formally expanding; the issue is more about a loss of momentum than a shift into contraction. For the US 30, the impact is typically reflected in moderate pressure, as the index has significant exposure to industrial and cyclical companies, for which production rates, orders, and business confidence are key drivers of financial performance. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 436 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBP remains unfazed by tariffs, GBPUSD continues to rise Expectations surrounding the interest rate decision are supporting the pound, with the GBPUSD rate testing the 1.3520 level. Discover more in our analysis for 25 February 2026. Technical outlook Having tested the lower Bollinger Band, the GBPUSD pair formed a Hammer reversal pattern on the H4 chart. At this stage, the price may continue its upward wave as the signal unfolds, with the upside target at 1.3650. A breakout above the resistance level would open the door for continued upward momentum. The pound continues to strengthen ahead of the Bank of England’s interest rate decision. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent: buyers are building momentum ahead of new price surge Brent crude prices continue to rise amid sustained technical strength and escalating geopolitical tensions, currently trading at 71.50 USD. Discover more in our analysis for 24 February 2026. Brent forecast: key takeaways Investors are pricing in the likelihood of negative scenarios and increasing defensive positions Prices are rising on expectations of escalating risks rather than actual supply disruptions Further movement will depend on news from the US and Iran and overall geopolitical rhetoric Fundamental analysis Brent quotes have strengthened for the second consecutive session, although buyers continue to face strong resistance around 71.65 USD. While attempts to consolidate above this level have so far been unsuccessful, the technical outlook remains bullish. Previously, buyers broke above a Triangle pattern, maintaining the potential for further upward movement. Geopolitics is currently the key market driver. Prices are rising mainly on expectations of escalating risks rather than actual supply reductions. Market participants are proactively pricing in negative scenarios and increasing defensive positions. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 436 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with: