⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

-

Posts

1,288 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by RBFX Support

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY rally: yen avoids risk The USDJPY pair surged to 148.80, with political imbalance weighing on the yen outlook. Find out more in our analysis for 3 September 2025. USDJPY forecast: key trading points The USDJPY pair is rising rapidly The market is monitoring political issues and pricing in these risks USDJPY forecast for 3 September 2025: 148.90 Fundamental analysis The USDJPY rate climbed to 148.80 midweek. The yen reached a one-month low amid political uncertainty in Japan. Hiroshi Moriyama, secretary of the ruling party and close ally of Prime Minister Shigeru Ishiba, announced his resignation. This fueled speculation about Ishiba’s potential departure, with pressure mounting after his election defeat. Among possible successors is Sanae Takaichi, known for her support of low interest rates. Meanwhile, Bank of Japan Deputy Governor Ryozo Himino emphasised on Tuesday that the central bank will continue to raise rates gradually but noted the persistence of elevated global risks. This signals no urgency in tightening policy. Investors now await fresh wage data, which should provide additional signals on the future course of monetary policy. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

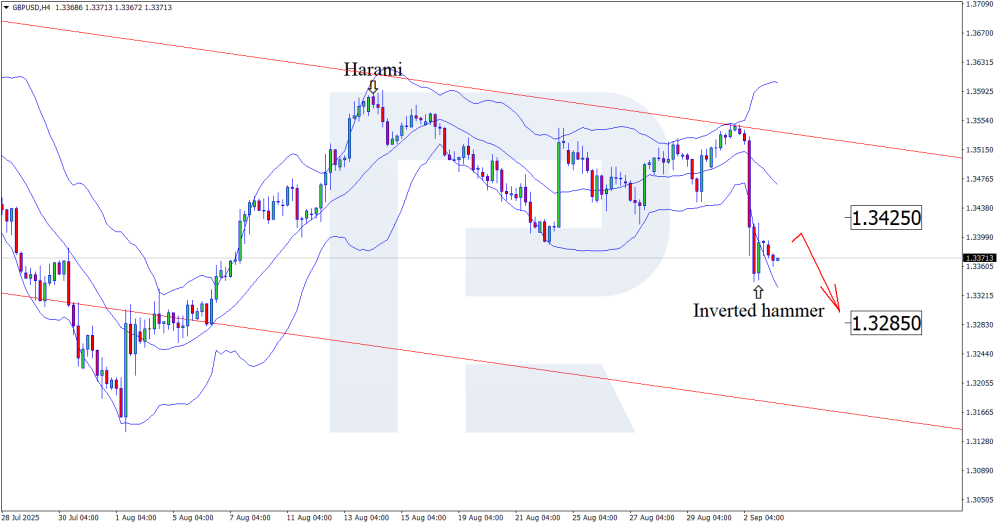

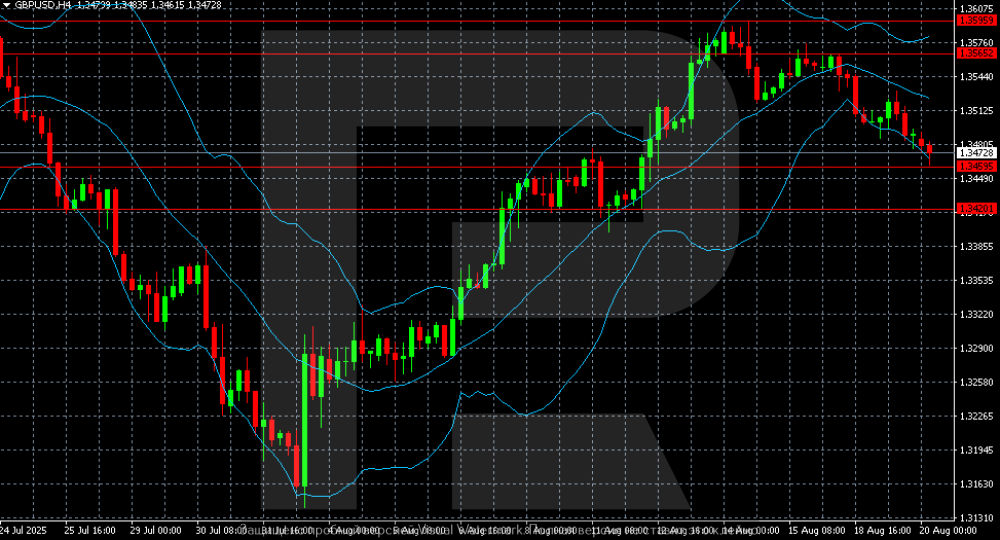

GBPUSD in turbulence zone – what will the Bank of England say The British pound came under pressure again, but ahead of key fundamental data, there is a small chance of a GBPUSD correction towards 1.3425. Discover more in our analysis for 3 September 2025. GBPUSD technical analysis On the H4 chart, the GBPUSD pair tested the lower Bollinger Band and formed an Inverted Hammer reversal pattern. At this stage, the pair may develop a corrective wave following this signal. Given that the price is within a descending channel after a sharp drop, a corrective rebound is likely. The market is waiting for the Bank of England MPC hearings. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

AUDUSD in correction: a pause needed before the next growth wave The AUDUSD pair declined to 0.6540. Australian statistics remain highly mixed. Find more details in our analysis for 2 September 2025. AUDUSD technical analysis The AUDUSD H4 chart shows a strong rebound after the decline in the second half of August. Quotes reached the 0.6550-0.6560 area, from where a minor correction is observed. Support forms at 0.6500-0.6520, while resistance is located around 0.6565-0.6570, where local highs are clustered. The AUDUSD pair entered a mild correction after five days of growth. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: after rebounding from support, the index aims to renew its all-time high The US 500 once again hit a new all-time high within the ongoing uptrend. The US 500 forecast for today is positive. US 500 forecast: key trading points Recent data: The US core PCE price index came in at 2.9% in July Market impact: for the US stock market, this has a mixed effect in the medium term Fundamental analysis The latest figures for the core PCE price index in the US show a yearly increase of 2.9%, in line with forecasts and slightly above the previous 2.8%. This index excludes food and energy components and serves as the Federal Reserve’s preferred inflation gauge when assessing inflation risks and shaping monetary policy. Meanwhile, the cash allocation of US mutual funds has dropped to a record low of 1.4%, below the 1.5% level seen before the 2022 bear market. After a short-lived rise in April, fund cash positions resumed their more than three-year downtrend. For context, between 2008 and 2020, the average cash share was roughly twice as high. With funds almost fully invested and lacking significant reserves to buy on potential pullbacks, the market remains vulnerable if sudden volatility spikes occur. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index enters a downtrend within the correction phase The growth momentum of the DE 40 index has slowed. The DE 40 forecast for today is positive. DE 40 forecast: key trading points Recent data: Germany’s unemployment rate for July 2025 stood at 6.3% Market impact: this supports consumer stocks Fundamental analysis Germany’s unemployment rate for August 2025 came in at 6.3%, in line with both forecasts and the previous reading. The stability of the indicator confirms that the German labour market remains resilient despite internal and external economic challenges. For the German stock market, this stability is highly significant. A steady unemployment rate points to sustained household demand, which underpins domestic consumption. For the DE 40, the impact of this figure varies by sector. The financial sector reacts positively to labour market stability as it reduces credit risks. Industrial companies and exporters benefit indirectly since steady domestic demand can offset fluctuations in external markets. The consumer sector also stands to gain as stable employment supports household solvency and drives demand for goods and services. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

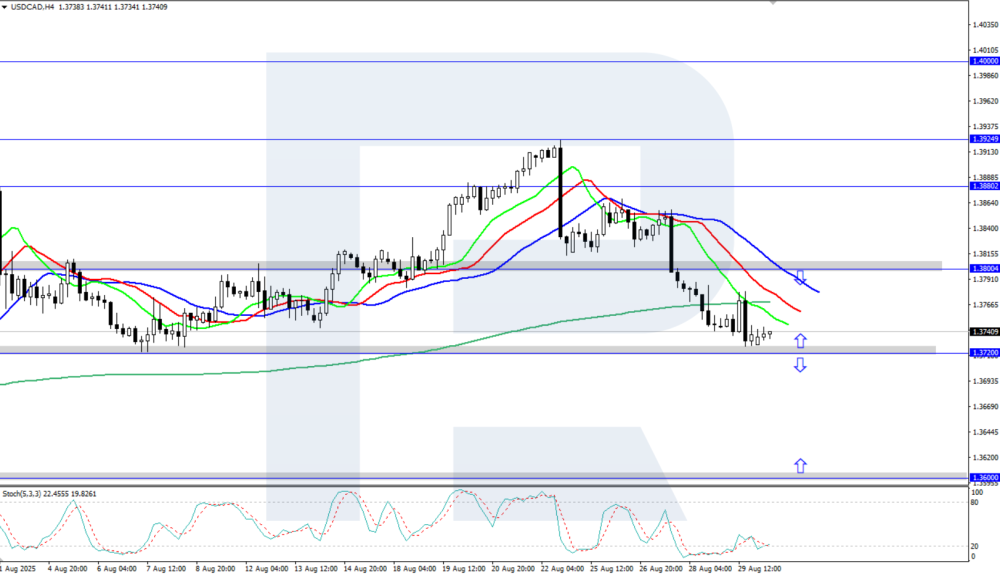

USDCAD drops to support at 1.3720 The USDCAD rate declined towards the 1.3700 area amid the current weakness of the US dollar. This week’s focus is on US labour market data. Discover more in our analysis for 1 September 2025. USDCAD technical analysis The USDCAD H4 chart shows a bearish trend. The Alligator indicator is confidently pointing downwards, confirming the current downtrend. The key support level that could temporarily halt the decline is at the daily level of 1.3720. The USDCAD rate is falling, testing the 1.3720 support level. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

AUDUSD poised to surge: Aussie challenges the dollar amid Fed turmoil With the USD weakening, the AUDUSD pair may continue its upward trajectory towards 0.6580. Discover more in our analysis for 29 August 2025. AUDUSD forecast: key trading points The AUD continues to strengthen against the USD The Australian PMI and retail sales support the Aussie AUDUSD forecast for 29 August 2025: 0.6580 Fundamental analysis Today’s AUDUSD forecast favors the Australian dollar, which continues to recover against the USD, with the pair currently trading near 0.6530. The weakness in the USD is driven by rising expectations of a Fed rate cut in September and political risks surrounding the US central bank. This has created a favorable backdrop for the Aussie’s growth and boosted the chances of a continued uptrend. Australian macroeconomic data also keeps the AUD supported. Inflation accelerated to 2.8% in July, lowering the likelihood of an RBA rate cut. Against this backdrop, the Australian dollar strengthened before entering a correction. The AUDUSD outlook also considers the positive impact of PMI and retail sales data, which sustain domestic optimism and reinforce AUD’s gains against the USD. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

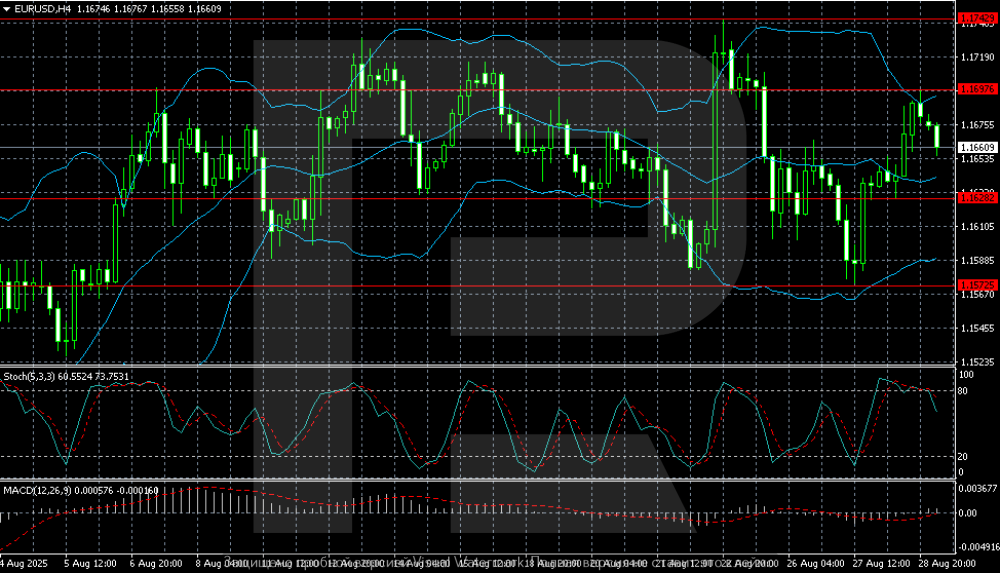

EURUSD: everything is complicated, dynamics depend on US data The EURUSD pair is hovering near 1.1660. The market is weighing US GDP data and awaiting the key PCE report. Find more details in our analysis for 29 August 2025. EURUSD technical analysis The EURUSD H4 chart shows volatile sideways dynamics. The pair is trading within the 1.1581-1.1742 range, where the lower boundary acts as support and the upper as key resistance. In the middle, the 1.1628 level stands out as an intermediate balance point, repeatedly tested in August. The EURUSD pair may break out of its sideways range based on US statistics. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the uptrend continues, but a short-term correction is possible The JP 225 index hit a new all-time high and then entered a correction. The JP 225 forecast for today is negative. JP 225 forecast: key trading points Recent data: Japan’s core inflation rate for July rose by 3.1% year-on-year Market impact: market reaction may range from neutral to moderately negative Fundamental analysis Japan’s national core CPI came in at 3.1% year-on-year, compared to a forecast of 3.0% and the previous reading of 3.3%. The indicator shows that inflation remains above the Bank of Japan’s 2.0% target, although it continues to ease from earlier levels. While risks of persistent inflation remain, the pressure is gradually declining. For the JP 225, this reading may have a mixed effect. On one hand, slower inflation versus the previous month reduces the risk of abrupt monetary tightening and supports risk appetite. On the other hand, a reading above forecast keeps alive the possibility of rate hikes, limiting equity revaluation. Overall, the effect for the JP 225 is neutral to moderately negative in the short term, as expectations for higher rates and bond yields increase. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent under pressure: end of summer season weighs on fuel demand The oil market remains under pressure, with Brent quotes edging lower amid expectations of weaker demand and geopolitical factors, currently standing at 66.76 USD. Find more details in our analysis for 28 August 2025. Brent technical analysis Brent quotes are retreating after rebounding from the 68.50 resistance level, remaining within a descending channel. The current dynamics suggest a strong likelihood of a bearish impulse towards 63.90 USD. Brent quotes continue to face pressure, with expectations of declining US demand and uncertainty over India’s oil imports increasing the risk of bearish dynamics. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold (XAUUSD) rises to the 3,400 USD area XAUUSD prices continue to strengthen, climbing to the 3,400 USD area amid dollar weakness driven by US President Trump’s pressure on the Fed. Discover more in our analysis for 27 August 2025. XAUUSD technical analysis XAUUSD prices are on the rise after rebounding from the 3,300 USD area. The Alligator indicator has turned upwards, confirming potential continuation of the uptrend after a minor correction. Gold confidently rose to the 3,400 USD area amid ongoing dollar weakness. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

GBPUSD under pressure: market full of doubts The GBPUSD pair retreated to 1.3461 midweek. Market focus is on Fed independence concerns and the Bank of England’s strategy. Discover more in our analysis for 27 August 2025. GBPUSD forecast: key trading points The GBPUSD pair corrected after its rally in early August as doubts over US monetary policy resurfaced The market is watching the foundations for potential BoE rate decisions GBPUSD forecast for 27 August 2025: 1.3432 Fundamental analysis On Wednesday, the GBPUSD rate fell to 1.3461. Pressure on US short-term yields and threats to Fed independence created a negative backdrop for the US dollar, supporting the outlook for its weakening over the coming year. The decisive risk factor will be who Donald Trump nominates to replace the vacant Fed Governor seat, which will determine the extent of political influence over monetary policy. Investors are also closely watching developments in France, where the minority government faces a possible dismissal next month. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Double Top pattern increases downside risk for USDJPY The USDJPY rate shows moderate growth, but ongoing expectations of BoJ tightening may intensify pressure on the US dollar. The current quote is 147.73. Discover more in our analysis for 26 August 2025. USDJPY technical analysis The USDJPY rate is retreating from a strong resistance level at 148.00 while staying within the ascending channel. The current dynamics point to a high probability of a correction towards the channel’s lower boundary at 146.70. The current USDJPY fundamentals reflect continued pressure on the US dollar and short-term downside risks. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: after rebounding from support, the index aims to hit its new all-time high The US 500 remains in an uptrend, with quotes poised to break above the resistance level. The US 500 forecast for today is positive. US 500 forecast: key trading points Recent data: US initial jobless claims came in at 235 thousand last week Market impact: this has a dual effect on the US stock market Fundamental analysis US initial jobless claims stood at 235 thousand last week, above the forecast of 226 thousand and the previous reading of 224 thousand. The rise in claims indicates some weakening of the labour market. Higher applications may signal a slowdown in economic activity. Signs of labour market cooling can ease pressure on the Federal Reserve to tighten monetary policy further, supporting expectations of stable or even lower interest rates. For the US 500, this data may trigger a mixed reaction in the short term. The technology and growth sectors may benefit, as they gain from prospects of looser monetary policy, while consumer-focused sectors may come under pressure due to expectations of weaker purchasing power. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD poised for breakout: thanks to Powell and rate-cut expectations The EURUSD pair reached July highs near 1.1721, with market sentiment clearly risk-on. Find out more in our analysis for 25 August 2025. EURUSD forecast: key trading points The EURUSD pair accelerated its rally after Powell’s Jackson Hole speech Markets now expect Fed monetary easing with more enthusiasm than before EURUSD forecast for 25 August 2025: 1.1800 Fundamental analysis At the start of the last week of August, the US dollar came under pressure, while the euro strengthened. The EURUSD pair climbed to 1.1728, marking its highest level since late July. Following Jerome Powell’s speech at the Jackson Hole Symposium, markets sharply revised their Fed rate expectations. The probability of a September cut now stands at 85%, compared with significantly lower odds earlier. By the end of the year, investors are pricing in 54 basis points of easing, up from 48 basis points a week ago. Investors remain focused on the labour market, which, according to Powell, is showing an unusual balance, with both demand for and supply of workers slowing. Employment will serve as the key indicator for future Fed decisions. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

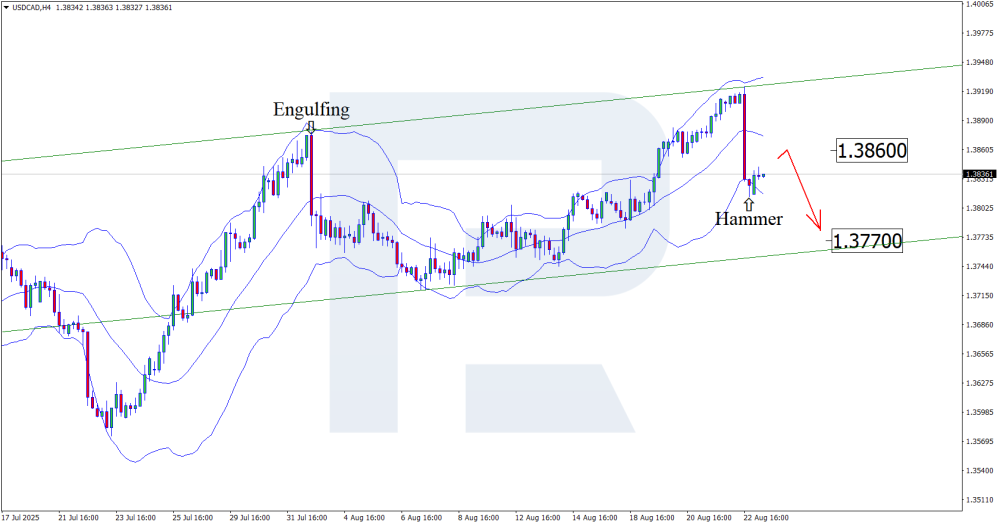

USDCAD under pressure: dovish Fed and strong CAD weigh on USD US monetary policy easing supports the CAD. After completing its correction, the USDCAD pair may decline towards the 1.3770 support level. Discover more in our analysis for 25 August 2025. USDCAD technical analysis On the H4 chart, the USDCAD pair formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, the pair is building a corrective wave based on this signal. Since quotes remain within an ascending channel, a rebound towards the nearest resistance level at 1.3860 is possible. US fundamentals remain unfavourable for the USD. USDCAD technical analysis suggests a decline after the correction. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

AUDUSD decline slows ahead of Powell’s speech The AUDUSD rate continues to fall amid expectations of Fed Chair Jerome Powell’s speech, with the price currently at 0.6417. Find more details in our analysis for 22 August 2025. AUDUSD technical analysis The AUDUSD rate remains within a descending channel. Sellers consolidated below the 0.6440 level, which increases downside pressure on the pair and raises the likelihood of further bearish momentum. The AUDUSD pair continues to fall, but reaching key support and rising business activity create conditions for possible short-term stabilisation Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US Tech forecast: the index continues to rise, but correction risks grow The uptrend in the US Tech stock index has shifted into a downward correction. The US Tech forecast for next week is negative. US Tech forecast: key trading points Recent data: the US manufacturing PMI preliminarily came in at 53.3 in August Market impact: this data strengthens expectations for overall economic momentum, which may be viewed positively by equity investors Fundamental analysis The US manufacturing PMI reached 53.3 points in August 2025, significantly above the forecast of 49.7 and the previous reading of 49.8. A PMI reading above 50 indicates an expansion in manufacturing activity. This result signals that the industrial sector is in a growth phase with increasing demand for goods. Although PMI directly relates to industrial production, its positive reading indirectly impacts the high-tech sector. Rising manufacturing activity requires more automation, digitalisation of processes, and the use of advanced technologies. This boosts demand for semiconductor products, cloud services, software, and industrial robotics. As a result, the tech-heavy index may find additional support. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD holds steady ahead of Jerome Powell’s speech The EURUSD rate is correcting within a sideways range as investors focus on Fed signals. The current quote is 1.1646. Discover more in our analysis for 21 August 2025. EURUSD technical analysis The EURUSD rate is hovering within a Wedge pattern. An attempt to break below the 1.1620 support level has so far failed, keeping chances alive for an upward impulse. The EURUSD pair continues to consolidate, with further movement dependent on Fed signals and market sentiment regarding a rate cut. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: index continues to rise within an ascending channel, correcting after reaching a new all-time high The JP 225 stock index hit a new all-time high and started a correction. Today’s JP 225 forecast is negative. JP 225 forecast: key trading points Recent data: Japan’s Q2 2025 GDP grew by 0.3% Market impact: this is a positive signal for the stock market, as growth exceeded expectations Fundamental analysis Data shown on the chart indicates that Japan’s quarterly GDP growth was 0.3%, above the forecast of 0.1% and the previous figure of 0.1%. Stronger-than-expected GDP growth signals more resilient economic activity in the country. This suggests increased domestic demand, exports, or investments, which creates a positive backdrop for corporate profits and, consequently, the stock market. Stronger macroeconomic data may also reduce recession concerns, reinforcing investor confidence. For the JP225 index, this positive GDP surprise could contribute to further price growth. The strengthening of sustainable economic growth expectations increases the likelihood of stock market gains. However, investors may also consider potential risks of Bank of Japan’s monetary tightening if the positive momentum proves persistent. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) falls ahead of the Fed’s Jackson Hole Symposium Gold (XAUUSD) prices continue to decline, moving towards 3,317 USD. Demand for safe-haven assets has weakened significantly. Find more details are in our analysis for 20 August 2025. XAUUSD forecast: key trading points Gold (XAUUSD) is edging down, preparing to reach a new three-week low Easing geopolitical tensions and a surging USD have drawn part of market interest away from gold XAUUSD forecast for 20 August 2025: 3,311 and 3,265 Fundamental analysis On Wednesday, gold (XAUUSD) prices fell to 3,317 USD per troy ounce, nearing their three-week low. Pressure on the metal came from expectations of easing geopolitical tensions and a stronger US dollar. Earlier, US President Donald Trump stated that he does not plan to send ground troops but admitted the possibility of air support as part of efforts to resolve the conflict with Russia. Investors now focus on the upcoming speech by Federal Reserve Chairman Jerome Powell at Jackson Hole. Additional market cues may also come from the FOMC minutes due later on Wednesday. Rate futures indicate the likelihood of two Fed rate cuts of 25 basis points each by the end of the year, with the first possibly coming in September. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBP awaits inflation, market assesses Bank of England policy outlook The GBPUSD pair dropped to 1.3472. UK inflation data will provide more clarity on the BoE’s policy outlook. Discover more in our analysis for 20 August 2025. GBPUSD technical analysis The GBPUSD pair is correcting after recent growth, trading near 1.3472. Earlier, the pair failed to hold above 1.3565 and rolled back, coming under selling pressure. The nearest support level is at 1.3420, and a breakout could open the way towards 1.3340. The GBPUSD pair is edging lower after recent gains. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: prices approached resistance but failed to break through and reach a new all-time high The US 500 remains in an uptrend, which is highly likely to become medium-term. The US 500 forecast for today is positive. US 500 forecast: key trading points Recent data: the US Producer Price Index (PPI) came in at 0.9% in July Market impact: rising producer costs have a negative effect on the US stock market Fundamental analysis The US PPI for July rose by 0.9% from the previous month, well above the forecast of 0.2% and the previous reading of 0.0%. PPI growth is a significant signal, as it reflects higher producer costs, which may be passed on to the end consumer. Overall, this strengthens inflationary pressure and increases the likelihood that the Federal Reserve will adopt a more hawkish stance in monetary policy. Higher financing rates, in turn, can negatively affect the equity market by making stocks less attractive than bonds and increasing borrowing costs for businesses. For the US 500 index, the effect of such data is likely to be restrictive. Stronger inflation expectations could trigger a correction in the index, particularly in rate-sensitive sectors. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent surges upwards: correction may pave the way for a new price rally Geopolitical risks and possible production increases are playing a tricky role with Brent quotes, which may rise to 68.00 USD. Discover more in our analysis for 19 August 2025. Brent technical analysis Having tested the lower Bollinger Band, Brent prices formed a Harami reversal pattern on the H4 chart. At this stage, prices are following the signal, moving higher. The Brent forecast for 19 August 2025 suggests a growth target of 68.00 USD. The increase in oil production from September may reduce prices in the future, but for now, Brent technical analysis suggests growth towards the 68.00 USD resistance area. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Trump pressures, inflation rises: how Powell will determine the fate of EURUSD The euro continues to strengthen ahead of the Federal Reserve’s interest rate decision, with the EURUSD rate likely to climb further to 1.1800. Find more details in our analysis for 18 August 2025. EURUSD forecast: key trading points The euro continues to strengthen Financial markets await the Jackson Hole Symposium EURUSD forecast for 18 August 2025: 1.1800 Fundamental analysis The euro is holding steady around 1.1700 as markets remain wary of geopolitical developments. The upcoming Jackson Hole Symposium is expected to feature a speech by Jerome Powell, which could shed light on the Federal Reserve’s future actions. Powell is caught between calls for rate cuts (particularly from Trump) and the risks of rising inflation. His ability to maintain the Fed’s independence by relying on data rather than political pressure is crucial. Following strong US fundamentals (growth in wholesale prices and retail sales), markets adjusted expectations for a significant September rate cut. This has provided the euro with additional stability against the dollar, fuelling further EURUSD gains. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with: