⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

-

Posts

1,288 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by RBFX Support

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent is trading below 72.00 USD following the OPEC+ meeting Brent quotes are declining, with sellers testing the 75.50 USD support level. Discover more in our analysis for 20 February 2025. Brent forecast: key trading points According to the American Petroleum Institute, US crude oil inventories rose by 3.34 million barrels There are downside risks for Brent as part of the implementation of the reversal pattern Brent forecast for 20 February 2025: 74.35 and 73.15 Fundamental analysis Brent prices are plunging after rising for three days. The pressure primarily comes from the American Petroleum Institute data, which recorded an increase in US crude oil reserves. According to the API estimates, the country’s oil stocks grew by 3.34 million barrels in the week ended on 14 February. Brent quotes rose earlier, driven by reports that the G-7 countries were discussing the possibility of strengthening the mechanism to limit Russia’s oil prices. Additionally, traders are closely following the negotiations between the US and Russia on the situation in Ukraine, analysing the incoming information in search of prerequisites for easing sanctions that affect the energy sector. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

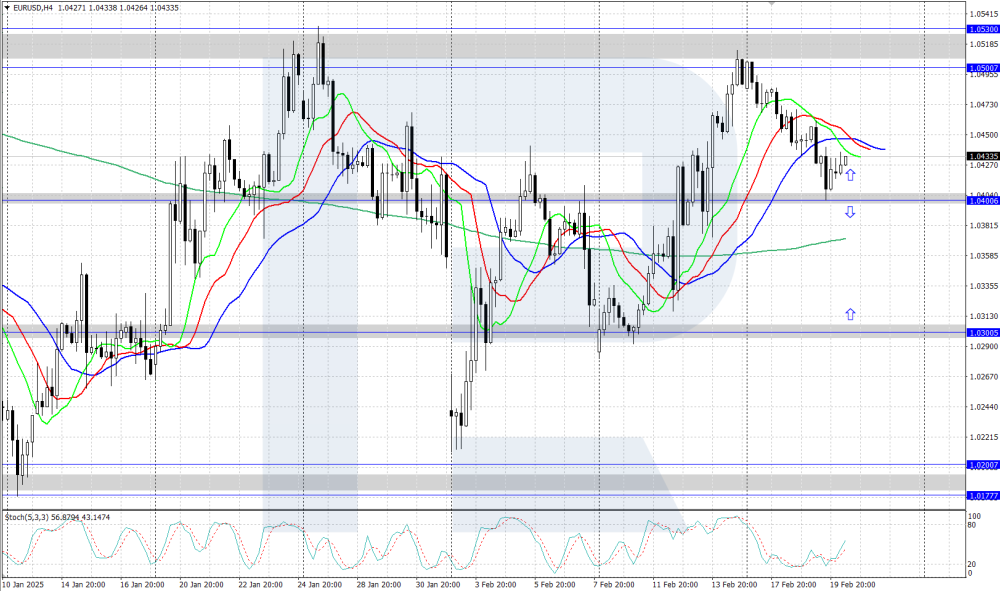

EURUSD forecast: the pair fell to the 1.0400 support level The EURUSD rate corrected towards 1.0400 amid the release of the US Federal Reserve’s January meeting minutes. Find out more in our analysis for 20 February 2025. EURUSD technical analysis On the H4 chart, the EURUSD rate is undergoing a downward correction after rebounding from the 1.0500-1.0530 resistance area. The quotes have found support from buyers at 1.0400 and are now consolidating in the sideways trading range between 1.0200 and 1.0530. The EURUSD pair fell to 1.0400 amid the release of the US Federal Reserve’s January meeting minutes. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Geopolitical uncertainty supports demand for Gold (XAUUSD) XAUUSD prices are poised to break above the key resistance level at 2,940 USD. Find more details in our analysis for 19 February 2025. XAUUSD forecast: key trading points Markets are awaiting the release of the US Federal Reserve minutes, which may affect Gold prices Donald Trump’s trade policy supports demand for Gold as a safe-haven asset XAUUSD forecast for 19 February 2025: 2,065 and 3,030 Fundamental analysis XAUUSD quotes are undergoing a minor correction after a two-day rise. Gold remains under pressure after reaching record highs and in anticipation of new negotiations between the US and Russia to resolve the conflict in Ukraine. Investors continue to monitor the geopolitical situation as uncertainty around the outcome of the talks restrains price movements. Markets also focus on the upcoming release of the US Federal Reserve meeting minutes. If the regulator’s rhetoric remains tough, Gold may plunge due to higher yields on dollar assets. At the same time, Donald Trump’s trade policy continues to drive demand for Gold as a safe-haven asset. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

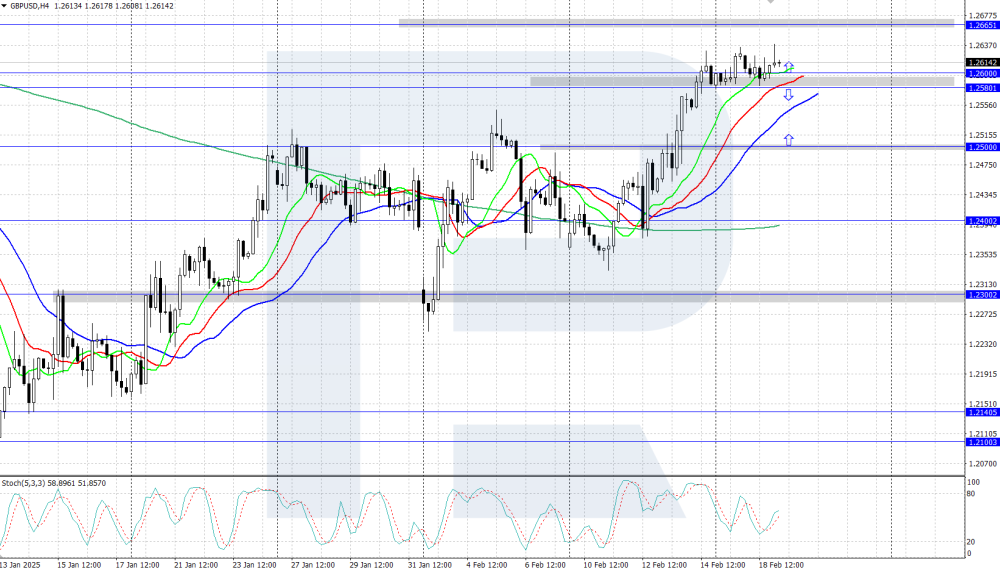

GBPUSD forecast: the pair awaits UK inflation data The GBPUSD rate is consolidating around 1.2600, with market participants awaiting UK inflation statistics today. Discover more in our GBPUSD analysis for today, 19 February 2025. GBPUSD technical analysis On the H4 chart, the GBPUSD pair is experiencing a local upward momentum, rising to the price area above 1.2600. The Alligator indicator also confirms growth. However, the long-term trend is still downward, with the asset likely to continue to decline after the upward movement is completed. The GBPUSD pair is consolidating around 1.2600. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Japan’s GDP growth adds to pressure on USDJPY The USDJPY rate is strengthening after rebounding from the 151.20 support level. Discover more in our analysis for 18 February 2025. USDJPY forecast: key trading points Japan’s economy grew by 0.7% in Q4 2024 BoJ interest rate hike in March remains in question USDJPY forecast for 18 February 2025: 151.60 and 150.20 Fundamental analysis The USDJPY rate is on the rise after falling for three consecutive trading sessions as traders focus on the upcoming release of the Federal Reserve’s January meeting minutes. The regulator is adopting a wait-and-see approach, while the market is more focused on the prospects of an interest rate cut. Meanwhile, the USDJPY pair remains under pressure after unexpectedly strong GDP growth data from Japan. Monday’s quarterly statistics showed that the country’s economy grew by 0.7% in Q4 2024, up from 0.4% in the previous quarter and above the forecast of 0.3%. GDP rose 2.8% year-on-year, aligning with expectations and exceeding 1.7% in Q3. The data reinforces hawkish sentiment towards the BoJ monetary policy. While there is still uncertainty over a potential rate hike in March, further tightening of monetary conditions during the year is considered quite likely, which may help the yen strengthen as part of today’s USDJPY forecast. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

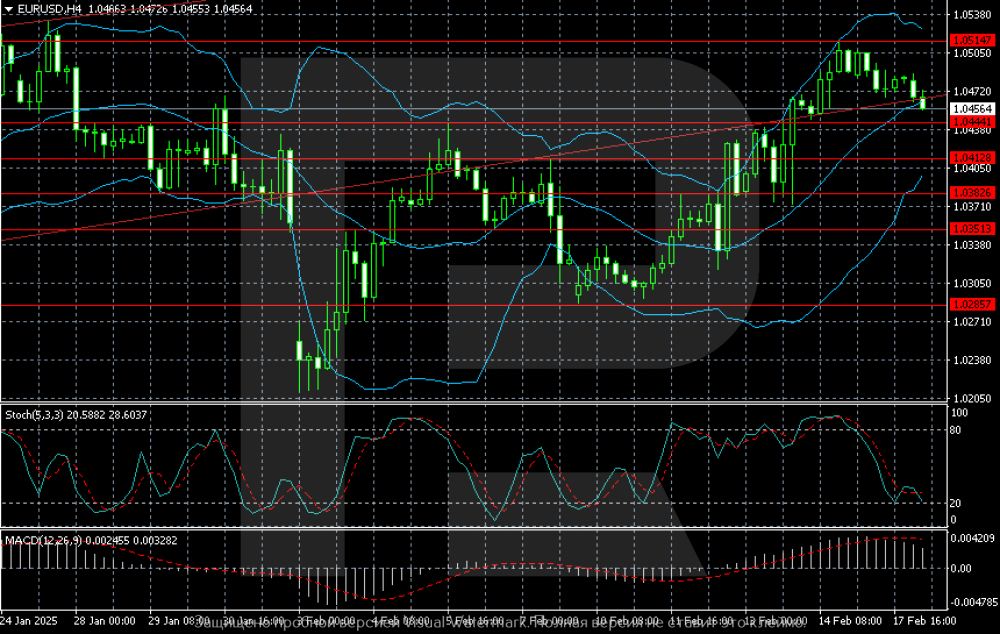

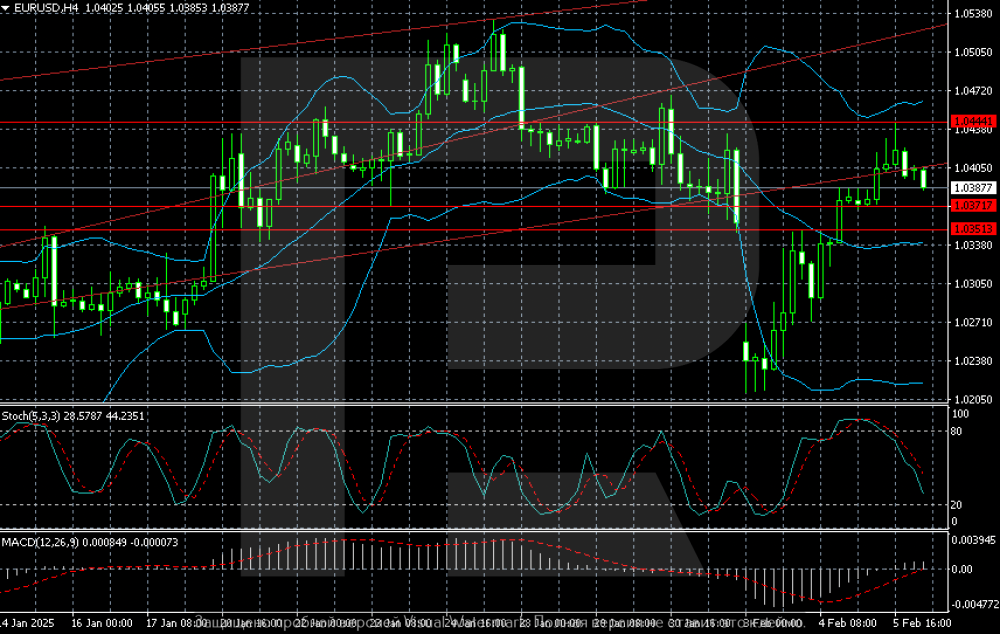

EURUSD is in positive territory: the market is not afraid of risks and is positive The EURUSD pair stabilises around 1.0456 on Tuesday as investors take a pause ahead of the Federal Reserve minutes. Find out more in our analysis for 18 February 2025. EURUSD technical analysis The EURUSD H4 chart shows the possibility of a local correction towards 1.0444. A breakout below this level will open the way towards 1.0418. The EURUSD pair remains around two-month highs but is on hold now in anticipation of the Federal Reserve minutes. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) continues to strengthen after a correction Gold continues to rally towards 2,950 ahead of FOMC members’ speeches. Discover more in our XAUUSD analysis for today, 17 February 2025. XAUUSD forecast: key trading points A speech by FOMC representative Patrick T. Harker A speech by FOMC representative Michelle Bowman Current trend: moving upwards XAUUSD forecast for 17 February 2025: 2,877 and 2,950 Fundamental analysis Today’s XAUUSD analysis shows that Gold prices have corrected towards 2,876 USD, with the pair likely to form another growth wave in the future. On of the main news for XAUUSD (Gold) is that the Federal Reserve Bank of Philadelphia President and FOMC representative Patrick T. Harker is expected to deliver a speech today, 17 February 2025. Earlier, Harker spoke about possible rate cuts in 2025 but emphasised that there was no need for this at present and that further decisions would depend on incoming economic data. FOMC member Michelle Bowman’s report is scheduled after Harker’s speech. Earlier, in September 2024, she advocated for a 0.25 percentage point rate cut, which reflects her cautious approach to monetary policy changes. Given the current economic situation, it is worth paying attention to inflation, the labour market, and the Federal Reserve’s possible future actions. Bowman’s speech may provide additional signals about the direction of US monetary policy and adjust the market sentiment. Based on Bowman’s previous statements and the current economic conditions, she is expected to underscore the need for a balanced approach to interest rate changes, taking into account both the risks of overheating the economy and the need to maintain its sustainable growth. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

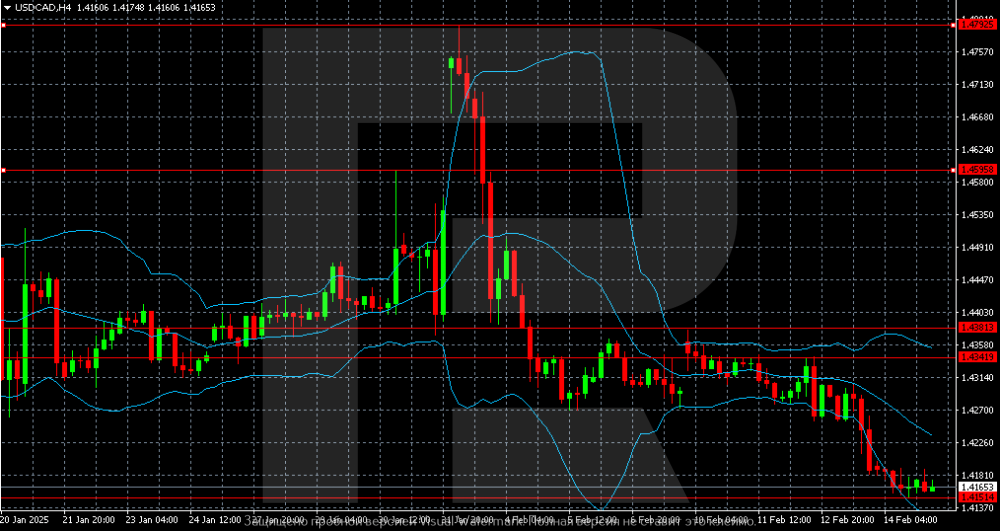

USDCAD continues to plummet: there are new targets for sales The USDCAD pair is hovering around 1.4169 on Monday. Investors have increasingly less faith in Trump’s threats. Find more details in our analysis for 17 February 2025. USDCAD technical analysis On the USDCAD H4 chart, the nearest target for a decline remains at 1.4151. The intermediate support level below it is 1.4140, with the next at 1.4125. The USDCAD pair has fallen to a two-month low and may plunge even lower as the threat of trade implications between the US and Canada has dimished. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD: the pair rises amid talks on Ukraine The EURUSD rate rose to the price area near 1.0500, driven by the beginning of negotiations to end the conflict in Ukraine. Find out more in our analysis for 14 February 2025. EURUSD forecast: key trading points Market focus: the market is awaiting the eurozone’s GDP data for Q4 2024 today Current trend: upward momentum EURUSD forecast for 14 February 2025: 1.0400 and 1.0530 Fundamental analysis The euro rate rose above a two-week high of 1.0400 after US President Donald Trump signed a memorandum to renegotiate reciprocal tariffs with the eurozone without immediately imposing new tariffs, easing concerns about a sharp deterioration of trade relations with the US. Optimism about the euro currency also rose on hopes of an end to the military conflict in Ukraine, as Donald Trump promised to make every effort to start a peaceful settlement and held talks with the presidents of Russia and Ukraine. Today, market participants will focus on the eurozone’s GDP statistics for Q4 2024. The indicator is expected to remain unchanged quarter-on-quarter and rise by 0.9% year-on-year. Stronger-than-expected data will support the euro, with the EURUSD pair likely to continue its ascent. Conversely, weaker figures could send the pair into a correction. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

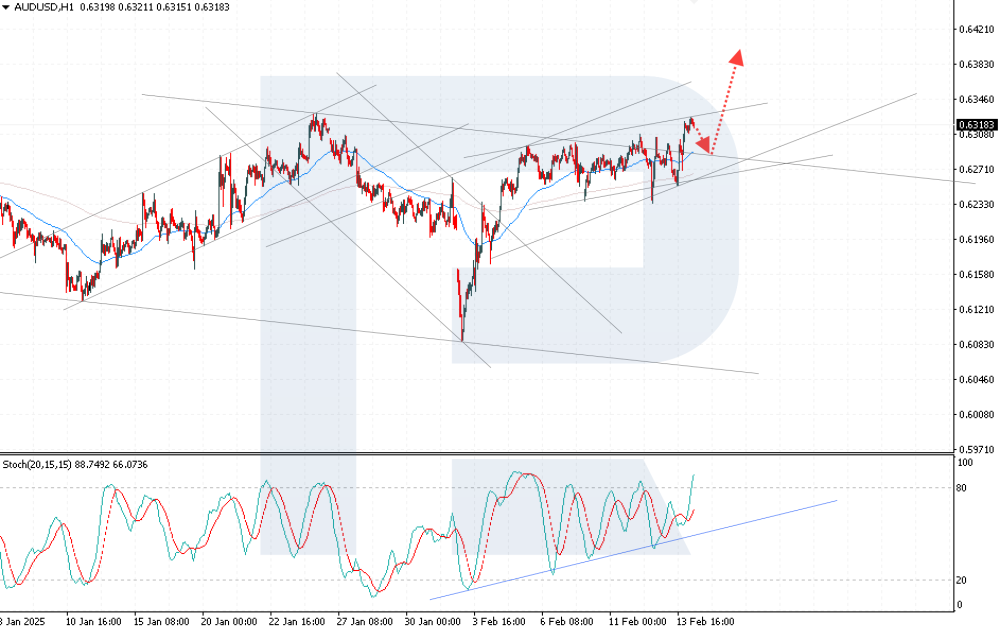

RBA rate cut expectations curb AUDUSD growth The AUDUSD rate is rising for the second consecutive day, with the price currently at 0.6331. Discover more in our analysis for 14 February 2025. AUDUSD technical analysis The AUDUSD rate is moving above the EMA-65 line, reinforcing the bullish scenario. The Stochastic Oscillator has reached the overbought area. However, a rebound from the bullish trendline indicates the potential for further growth. Despite the weakening of the US dollar amid Trump’s decisions, the expected RBA rate cut increases the chances of further strengthening of the Australian dollar. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent reversed downwards, with prices falling below 75.00 USD Brent prices are declining, falling to the support area at 75.00 USD. Find out more in our analysis for 13 February 2025. Brent forecast: key trading points According to the Energy Information Administration (EIA), US crude oil inventories rose by 4.1 million barrels last week OPEC+ maintained its oil demand growth forecast at 1.45 million barrels per day in 2025 Current trend: moving downwards Brent forecast for 13 February 2025: 74.00 and 75.00 Fundamental analysis Yesterday’s US inflation data showed rising inflation risks, with the Consumer Price Index (CPI) up 0.5% month-on-month and 3.0% year-on-year (expected at 0.4% and 2.9%, respectively). Accelerating inflation may negatively impact US economic growth, putting pressure on oil prices. Brent was also affected by the release of the latest EIA report on US crude oil inventories. The data showed that oil stocks increased by 4.1 million barrels last week, exceeding the expected growth of 3.0 million. OPEC+ maintained its oil demand growth forecast at 1.45 million barrels per day in 2025. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

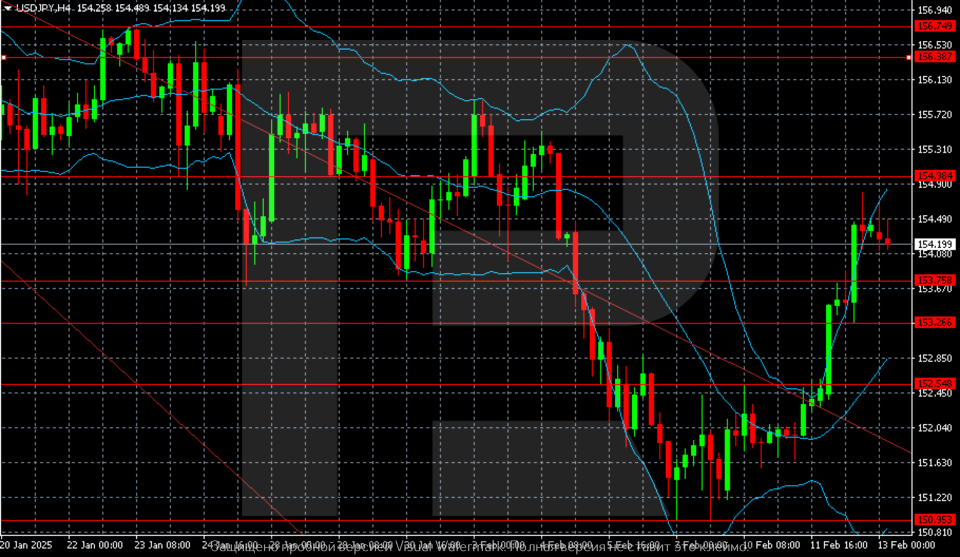

USDJPY rose and stopped: time needed to process data The USDJPY pair is hovering at 154.16 on Thursday as investors change their views on the Federal Reserve’s future interest rate. Find more details in our analysis for 13 February 2025. USDJPY technical analysis On the H4 chart, the USDJPY pair has the potential to extend an upward wave towards 154.98. At the same time, the odds of a correction are increasing, with the first target at 153.75 and the next at 153.26. The USDJPY pair reached a weekly peak and has stopped for now. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) corrected from highs ahead of US inflation data XAUUSD quotes are undergoing a local correction after reaching a new all-time high of 2,942 USD. Today, the focus remains on US inflation statistics. Find out more in our XAUUSD analysis for today, 12 February 2025. XAUUSD forecast: key trading points Market focus: US consumer inflation data will be released today – the Consumer Price Index (CPI) Current trend: the uptrend XAUUSD forecast for 12 February 2025: 2,850 and 2,942 Fundamental analysis XAUUSD prices are moderately correcting after reaching a new all-time high of 2,942 USD. Market participants will focus on US inflation data for January during the American trading session today, with the CPI scheduled for release. The indicator is projected to rise by 0.3% month-on-month and 2.9% year-on-year. The Federal Reserve considers inflation data when deciding whether to change interest rates. Weaker-than-forecast statistics will put pressure on the USD and help strengthen Gold. Conversely, stronger figures will support the US dollar and cause XAUUSD quotes to decline. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

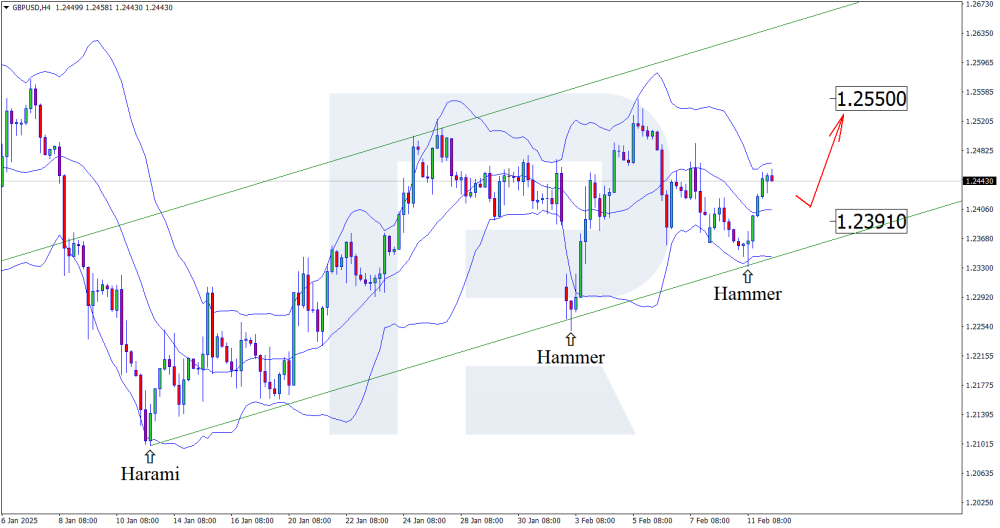

GBPUSD: the British pound continues to strengthen Amid the Fed chair’s speech, the GBPUSD forecast for today appears rather optimistic for the pound, with the price likely to continue its ascent towards 1.2550. Discover more in our analysis for 12 February 2025. GBPUSD technical analysis Having tested the lower Bollinger band, the GBPUSD price has formed a Hammer reversal pattern on the H4 chart. At this stage, it maintains its upward momentum following the signal received. Along with the GBPUSD technical analysis, Powell’s speech suggests further growth to the 1.2550 resistance level. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY: the pair found support at 151.00 The USDJPY rate is consolidating in the price area around 152.00, with the market focus on the Fed chairman’s speech before the US Senate today. Find out more in our analysis for 11 February 2025. USDJPY forecast: key trading points Market focus: Federal Reserve Chairman Jerome Powell’s speech before the US Senate Current trend: the downtrend USDJPY forecast for 11 February 2025: 151.00 and 152.50 Fundamental analysis The Japanese yen has been gradually strengthening its position at the beginning of the year. Bank of Japan’s Board member Naoki Tamura said recently that the BoJ should raise the benchmark interest rate to at least 1% in the second half of 2025. This view was supported by the recent data on wages and household spending in Japan, which showed a stronger-than-expected increase, bolstering expectations of a BoJ rate hike. Investors are currently awaiting the release of Japan’s GDP and inflation statistics next week to assess the future outlook for the BoJ monetary policy. Today, the market will focus on Federal Reserve Chairman Jerome Powell’s speech before the US Senate, in which he could announce the regulator’s further plans. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

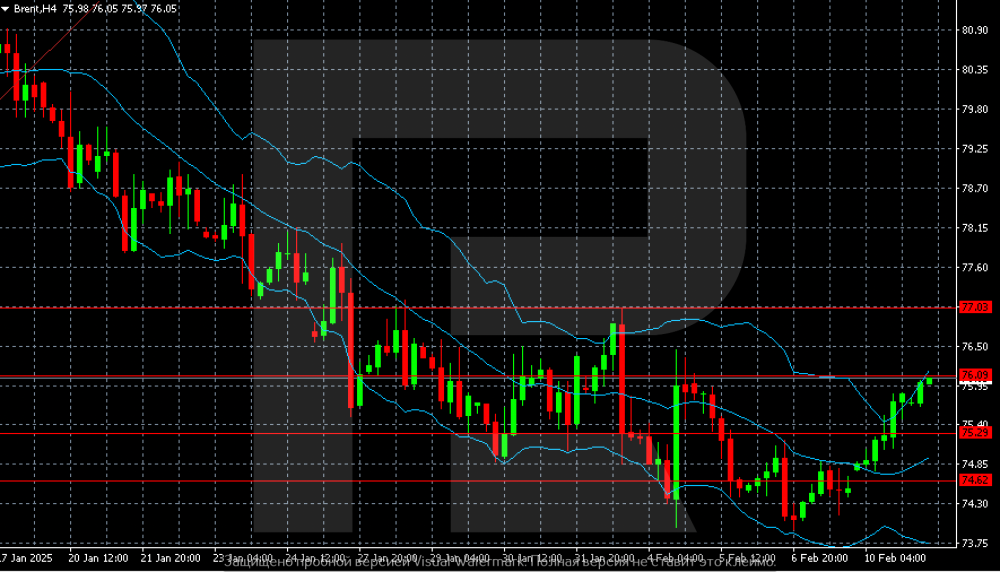

Brent attempts to rise: oil benefits from lower supply Brent prices rose to 76.25 USD. The news flow is attracting attention. Find out more in our analysis for 11 February 2025. Brent technical analysis The Brent H4 chart shows a scenario, where prices could climb to 77.03. This will become possible if the market consolidates above 76.10. If corrective trends are stronger, significant support levels are at 75.29 and 74.62 USD. Brent prices maintain their upward momentum on Tuesday after rising by 1.6% on Monday. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD: the pair declines after the US labour market statistics The EURUSD rate edged down to 1.0300 following Friday’s release of mixed US employment data. Discover more in our analysis for 10 February 2025. EURUSD forecast: key trading points Market focus: ECB President Christine Lagarde will deliver a speech today Current trend: the downtrend EURUSD forecast for 10 February 2025: 1.0200 and 1.0350 Fundamental analysis The US labour market statistics for January became available last Friday, including Nonfarm Payrolls and the unemployment rate. The Nonfarm Payrolls data came in slightly worse than expected at 143 thousand jobs, below the forecast of 170 thousand. Conversely, the unemployment rate data exceeded expectations, showing a decline to 4.0% (previously at 4.1%). The EURUSD pair reacted to the US data release with a moderate decline, falling to the price area around 1.0300. Today, market participants will focus on ECB President Christine Lagarde’s speech, which could shed light on the outlook for the regulator’s monetary policy. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold (XAUUSD) may set another record: the target is 2,900 USD Gold (XAUUSD) quotes rose to 2,878 USD on Monday as the world needs safe-haven assets. Find out more in our analysis for 10 February 2025. XAUUSD technical analysis On the H4 chart, XAUUSD has grounds for maintaining its upward momentum, with the target at 2,887 USD. To achieve 2,900 USD, the market should consolidate above 2,890 USD. If this does not happen, the market interest will shift to selling, with the target at the 2,830 USD support level. Gold (XAUUSD) prices are rising rapidly, bolstered by interest in safe-haven assets and the growing risk of global trade implications due to the US stance. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

AUDUSD: the pair rises moderately ahead of Nonfarm Payrolls data The AUDUSD rate is gradually strengthening this week, rising to the price area around 0.6300. The market will focus on the US employment statistics today. Discover more in our analysis for 7 February 2025. AUDUSD technical analysis On the H4 chart, the AUDUSD pair is undergoing an upward correction after finding support from buyers at 0.6100 this week. The price is now consolidating near a strong resistance area between 0.6300 and 0.6330. The US labour market data could drive further price movements. The AUDUSD pair is undergoing an upward correction, rising to 0.6300. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) rises ahead of crucial US labour market data XAUUSD prices are rising after rebounding from the support level, with the quotes currently at 2,863 USD. Find more details in our analysis for 7 February 2025. XAUUSD forecast: key trading points XAUUSD quotes are rising for the sixth consecutive week amid increased demand for Gold Increased buying is driven by concerns caused by trade uncertainty and the release of the US employment report XAUUSD forecast for 7 February 2025: 2,885 and 2,915 Fundamental analysis XAUUSD quotes have been rising for the sixth consecutive week as demand for Gold has increased amid the current trade uncertainty. Investors are actively buying up the precious metal ahead of the crucial US employment report. According to traders, Gold remains in a strong uptrend, with analysts revising their forecasts upwards, expecting sustainable growth amid US political hyperactivity and massive hedging by global central banks and investors. Markets are now focused on the US employment data, which may provide insight into the outlook for the Federal Reserve’s monetary policy. An economy with full employment, steady growth, and easing inflation will allow the Fed to continue its rate-cutting cycle. Markets expect the regulator to lower the rate by another 100 basis points in the process. This will inevitably lead to a decline in US Treasury bond yields and a cheaper cost of owning Gold. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY is under pressure amid expectations of a BoJ rate hike The USDJPY rate is declining for the fourth consecutive trading session, with the price currently at 152.44. Discover more in our analysis for 6 February 2025. USDJPY forecast: key trading points Expectations of another Bank of Japan interest rate hike are rising Data showed Tokyo wages rose by 0.6% in December Japan’s nominal wages reached the highest level in nearly 30 years USDJPY forecast for 6 February 2025: 150.75 and 149.40 Fundamental analysis The USDJPY rate fell to an eight-week low amid expectations of another Bank of Japan interest rate hike. Minister of Finance Katsunobu Kato said that inflation could rise further, increasing the likelihood of monetary policy tightening and driving the current decline in the currency pair. Additionally, the latest data showed strong wage growth, with Tokyo’s figures rising for the second consecutive month, up 0.6% in December, while analysts expected a 0.7% decline. Nominal wage growth hit the highest level in nearly 30 years, adding to inflationary pressures. These factors strengthen expectations that the Bank of Japan will continue to raise interest rates in 2025. The increasing contrast with the Federal Reserve’s forecasts of two rate cuts before the end of the year may support the yen’s strength as part of today’s USDJPY forecast. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD halted growth: it can only be a pause The EURUSD pair is consolidating around 1.0390. Investors need strength ahead of new US labour sector releases. Find more details in our analysis for 6 February 2025. EURUSD technical analysis On the H4 chart, the EURUSD pair could test 1.0371 and then 1.0351 as part of a corrective decline. If the price fails to break below both support levels, the market could resume buying, with the target at 1.0440. The EURUSD pair has been rising since the beginning of the week but halted its growth on Thursday. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY: the pair declines ahead of the US ADP employment data The USDJPY rate fell below 154.00 on Wednesday amid rising wages in Japan. Today, the market will focus on the US ADP employment statistics. Find out more in our analysis for 5 February 2025. USDJPY technical analysis On the H4 chart, the USDJPY pair is undergoing a downward correction after the previous growth. The pair is trading in a descending price channel, with the price approaching its lower boundary. The key support level is currently at 152.50. The USDJPY rate plunged to the area around 153.00, driven by Japan’s positive economic statistics. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) continues to soar to new price highs The increase in US nonfarm employment does not strengthen the US dollar significantly, with Gold prices continuing their ascent to 2,880 USD. Discover more in our XAUUSD analysis for today, 5 February 2025. XAUUSD forecast: key trading points The US ADP nonfarm employment change: previously at 122 thousand, projected at 148 thousand The US services PMI: previously at 56.8, projected at 52.8 Current trend: moving upwards XAUUSD forecast for 5 February 2025: 2,830 and 2,880 Fundamental analysis The XAUUSD forecast for 5 February 2025 shows that XAUUSD prices have broken above the 2,850 USD level, with the pair likely to continue its upward momentum. The US nonfarm employment change is a national employment report from ADP, which tracks changes in nonfarm jobs based on data from about 400 thousand business sources. The report is published two days before official US employment data. The reading is currently projected at 148 thousand. If the actual data aligns with expectations, the market may see increased volatility. Conversely, worse-than-forecast data may weaken the USD against Gold. The US services PMI is expected to decline to 52.8. A stronger-than-expected PMI reading will provide some support to the US dollar. The XAUUSD price forecast appears rather optimistic as the quotes have the potential to reach 2,880 USD. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD: the pair is recovering after the fall The EURUSD rate returned to 1.0350 as part of a correction after declining at the market opening on Monday. This week, market participants are awaiting US labour market statistics. Find out more in our analysis for 4 February 2025. EURUSD forecast: key trading points Market focus: market participants are awaiting US labour market statistics this week, including ADP data, nonfarm payrolls, and the unemployment rate Current trend: a downtrend EURUSD forecast for 4 February 2025: 1.0350 and 1.0200 Fundamental analysis The EURUSD pair recovered slightly after the fall caused by the introduction of US restrictive tariffs against Canada, Mexico, and China. Investors are concerned about the continuation of trade wars, which may also affect the eurozone. US President Donald Trump earlier promised to consider imposing tariffs on European goods. This week, the market will focus on US employment statistics, with ADP data, nonfarm payrolls, and the unemployment rate scheduled for release. Stronger-than-expected data will support the US dollar, potentially pushing the EURUSD pair lower. Conversely, weaker data could drive growth in the euro. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with: