⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

-

Posts

1,288 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by RBFX Support

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) soared above 3,100 USD, setting a new all-time high XAUUSD prices are showing rapid growth, breaking above the 3,100 USD level. This week, the market will focus on US employment data. Find out more in our XAUUSD analysis for today, 31 March 2025. XAUUSD forecast: key trading points Market focus: another wave of the tariff war is expected this week, with Trump planning to impose a 25% tariff on imported cars Current trend: a strong uptrend is underway XAUUSD forecast for 31 March 2025: 3,150 and 3,100 Fundamental analysis Gold continues its rapid growth in the uptrend, now trading above the 3,100 USD mark. The precious metal remains in high demand from investors and central banks amid ongoing tariff wars by US President Donald Trump, who plans to introduce a 25% tariff on imported vehicles and announce a broader reciprocal tariff plan. This week, market focus will shift to US employment statistics, with the ADP report, Nonfarm Payrolls, and the unemployment rate scheduled for release. Stronger-than-expected figures could support the US dollar and trigger a correction in the XAUUSD pair. Conversely, weaker data would allow Gold to continue its upward move. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

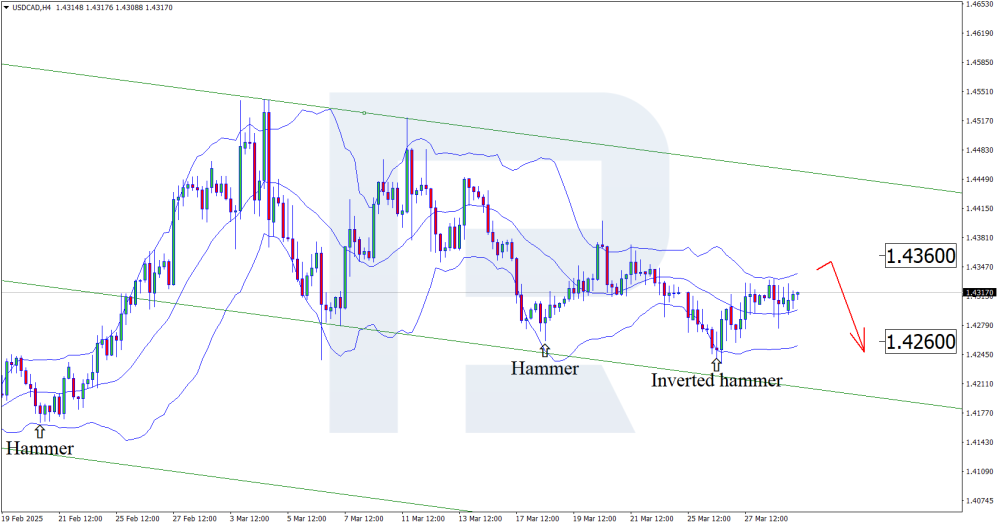

USDCAD: US business activity on the brink – what lies ahead for the market Weakened business activity in Chicago and Dallas could trigger a fall in the USDCAD rate to 1.4260 following a correction. Discover more in our analysis for 31 March 2025. USDCAD technical analysis On the H4 chart, the USDCAD price formed an Inverted Hammer reversal pattern near the lower Bollinger band. At this stage, it continues its upward trajectory following the signal received. Since the price remains within a descending channel, a correction towards the nearest resistance level at 1.4360 is expected. If the price rebounds from this resistance, a downtrend may develop. Weak US economic indicators, combined with USDCAD technical analysis, suggest that the pair may continue its downward trajectory once the correction is complete. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

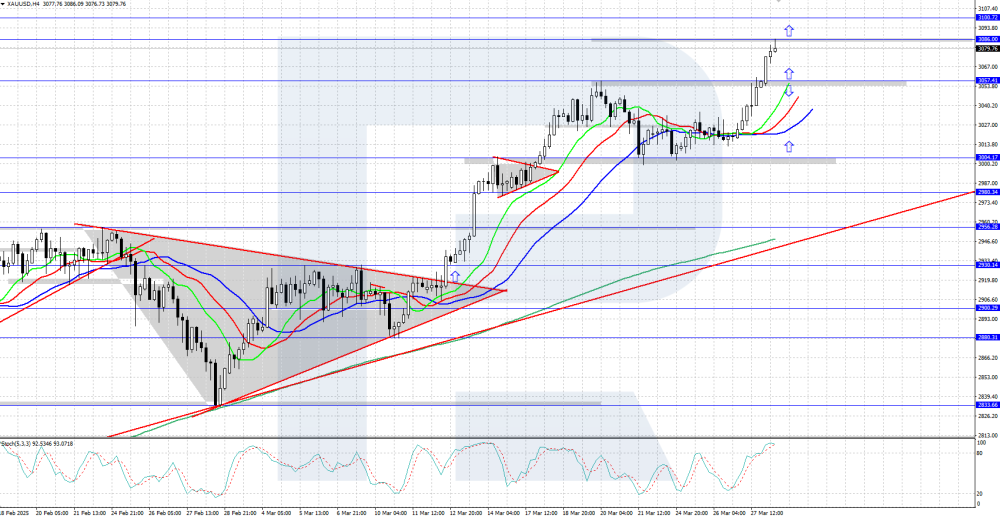

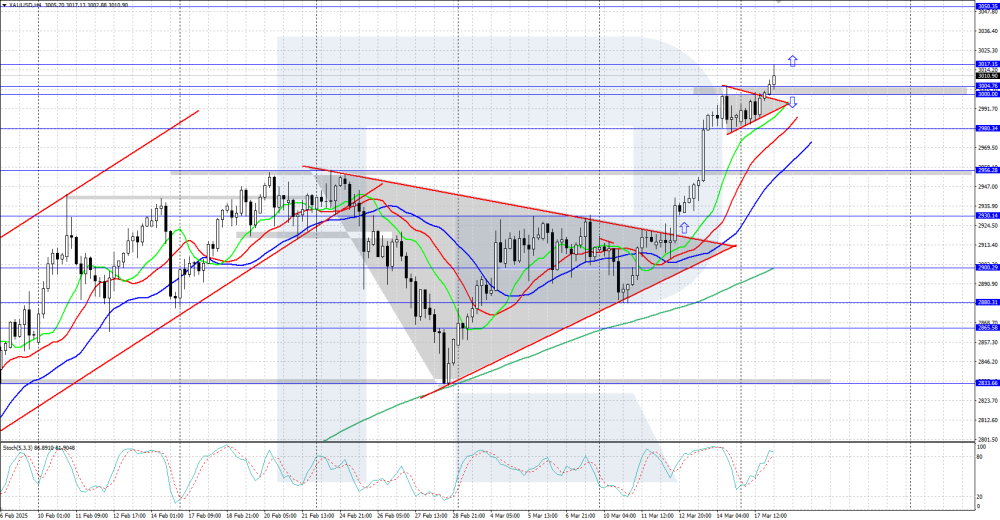

Gold (XAUUSD) hits record highs, surging to the 3,100 USD area XAUUSD prices are rallying sharply, setting a new all-time high at 3,086 USD. Today, the market awaits US inflation data. Discover more in our XAUUSD analysis for 28 March 2025. XAUUSD technical analysis XAUUSD quotes continue their confident upward momentum, setting a new all-time high at 3,086 USD today. The psychologically important 3,000 USD level now acts as key support within the trend. Gold (XAUUSD) is strengthening, reaching a new all-time high of 3,086 USD. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Bearish scenario for USDJPY: the market poised for a Wedge pattern breakout The USDJPY rate is edging lower, but buyers are not retreating from the 151.75 resistance level. Find out more in our analysis for 28 March 2025. USDJPY forecast: key trading points Tokyo inflation accelerated to 2.4%, exceeding the BoJ’s target for the fifth consecutive month Kazuo Ueda confirmed the possibility of further interest rate hikes The formation of a Wedge reversal pattern could trigger yen strengthening USDJPY forecast for 28 March 2025: 149.05 Fundamental analysis The USDJPY rate has slightly declined following the release of the Bank of Japan’s March meeting minutes. The regulator reiterated its commitment to a flexible approach to monetary policy, reinforcing expectations for further rate hikes. This supports the yen and, according to the USDJPY forecast, may prevent a breakout above the key 151.75 resistance level. At the same time, Tokyo’s inflation rose to 2.4%, adding to pressure on the BoJ. This marks the fifth consecutive month that core inflation has exceeded the Bank of Japan’s 2.0% target, strengthening expectations for continued monetary policy normalisation. Nevertheless, earlier this week, BoJ Governor Kazuo Ueda signalled that further rate hikes remain on the table if economic conditions align with the central bank’s outlook. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

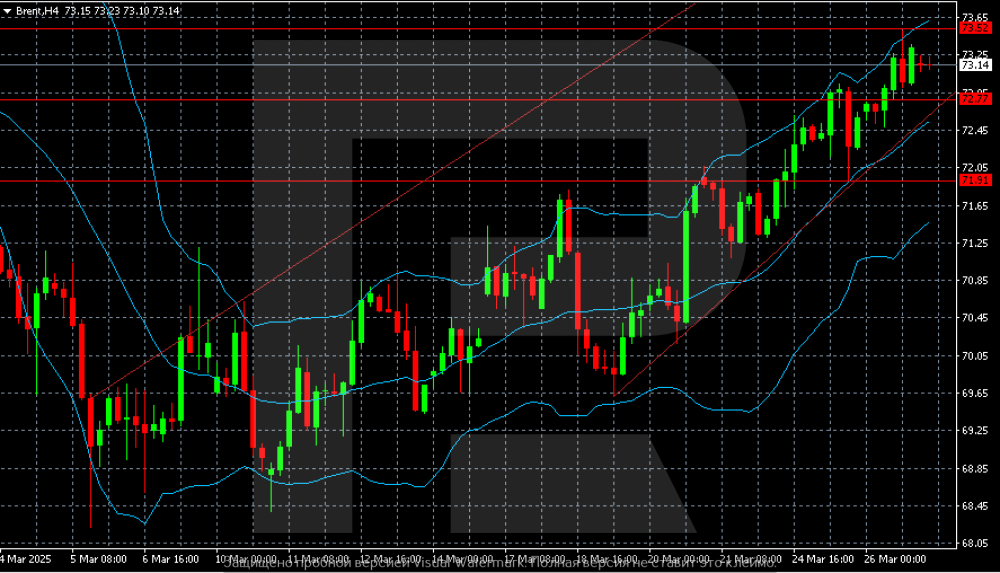

Brent continues to climb: data favours buyers Brent crude oil rose to 73.15 USD. US stockpiles are declining faster than expected. Find more details in our analysis for 27 March 2025. Brent technical analysis On the H4 chart, the primary scenario for Brent suggests a further rise towards 73.52, from where the market could move to 74.00. Brent oil is maintaining its upward momentum. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

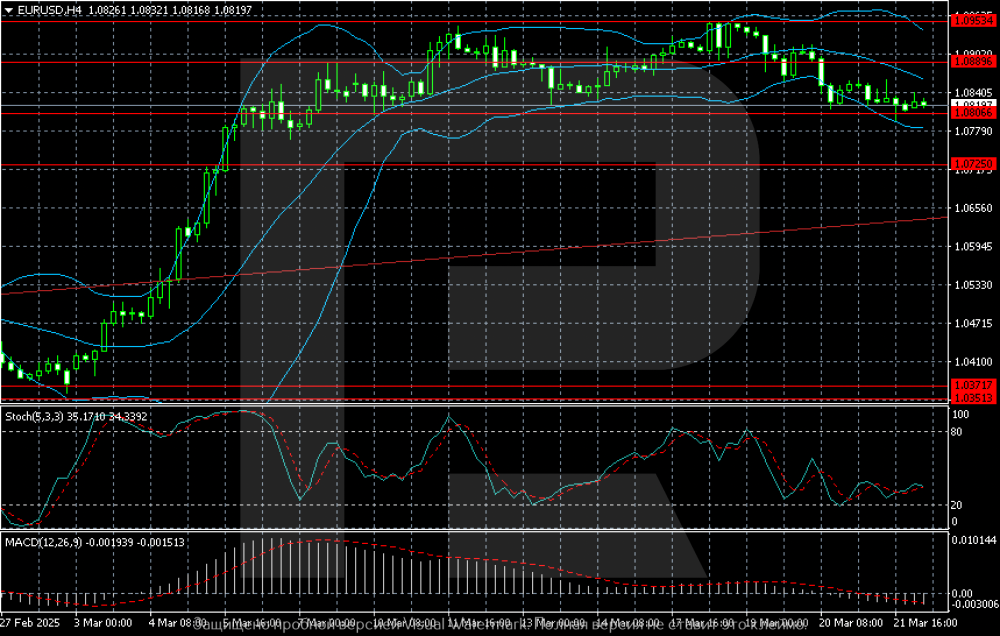

EURUSD rebounds amid Trump’s trade threats The EURUSD rate is rising, with buyers testing the 1.0785 resistance level. Discover more in our analysis for 27 March 2025. EURUSD forecast: key trading points Investors fear that trade restrictions will slow US economic growth US durable goods orders rose by 0.9% in February The Stochastic Oscillator indicates the bearish correction may be ending EURUSD forecast for 27 March 2025: 1.0945 Fundamental analysis The EURUSD rate is recovering after six consecutive trading sessions of decline. The European currency received support following US President Donald Trump’s decision to impose 25% tariffs on imported cars and light trucks. Investor concerns that these trade restrictions could hamper US economic growth and accelerate inflation may support the current EURUSD gains, according to the EURUSD forecast for today. Meanwhile, US durable goods orders data rose unexpectedly by 0.9% in February to 289.3 billion USD, exceeding forecasts. Market focus now shifts to Friday’s PCE price index report, a key inflation gauge for the Federal Reserve, and the mutual tariffs expected to be announced next week. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) resumes growth: market fears US tariffs Gold (XAUUSD) is hovering around 3,020 USD on Wednesday, with investors interested in safe-haven assets. Discover more in our analysis for 26 March 2025. XAUUSD forecast: key trading points Gold (XAUUSD) continues to rise after a brief pause Markets still seek risk protection amid Trump’s tariff wars XAUUSD forecast for 26 March 2025: 3,036 and 3,057 Fundamental analysis Gold (XAUUSD) prices strengthened to 3,020 USD. The market is heading for record levels again as Gold's appeal as a safe-haven asset increases, fuelled by uncertainty over the upcoming US retaliatory tariffs. While President Donald Trump’s tariff plans may be limited and targeted, investors are still pricing in considerable risk. The new round of tariffs set to begin on 2 April will signal an escalation in trade tensions between the US and its key partners. At the same time, geopolitical developments also remain in focus, with the US playing a diplomatic role. This involves potential easing of sanctions against Russia. In the long run, this could reduce investor appetite for Gold. The Gold (XAUUSD) forecast is positive. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBPUSD loses ground amid collapse in US consumer expectations The GBPUSD rate is falling, with sellers holding the 1.2950 resistance level. Discover more in our analysis for 26 March 2025. GBPUSD technical analysis The GBPUSD rate is showing a slowdown in the uptrend as prices have broken below the lower boundary of the bullish channel. The pair is now consolidating within a Triangle pattern. Today’s GBPUSD forecast anticipates a drop towards the 1.2805 level. The Stochastic Oscillator supports the bearish scenario as its values are bouncing off the resistance line. Improved business activity in the UK supports the British pound. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD halted its decline: market remains tense as risks mount The EURUSD pair paused around 1.0819. The market continues to monitor the situation around US trade tariffs. Find more details in our analysis for 24 March 2025. EURUSD technical analysis On the H4 chart, a clear downtrend continues to unfold for EURUSD, with a new selling target at 1.0806. If the price consolidates below this level, the next downside target will be 1.0725. The EURUSD pair has declined significantly, but the risks of further selling persist, with the 2 April deadline lying ahead. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY surges as slump in Japan’s business activity crushes the yen The USDJPY rate is strengthening, with buyers aiming to test the 150.15 resistance level. Find out more in our analysis for 24 March 2025. USDJPY forecast: key trading points The au Jibun Bank Japan Composite PMI fell to 48.5 in March The Bank of Japan’s governor says the regulator will continue to raise interest rates Moving averages confirm the bullish trend in USDJPY USDJPY forecast for 24 March 2025: 151.15 Fundamental analysis The USDJPY rate is rising for the second consecutive session as the Japanese yen remains under pressure from weakening business activity. According to preliminary data, the au Jibun Bank Japan Composite PMI fell to 48.5 in March from 52.0 in February, marking the first contraction in the private sector since October and the sharpest decline since February 2022. Manufacturing has been in decline for the ninth consecutive month, and the services sector has now also entered contraction territory. Meanwhile, Bank of Japan Governor Kazuo Ueda emphasised that the regulator will continue to raise interest rates if core inflation nears 2%. Markets still expect the BoJ to tighten its monetary policy this year amid persistent inflationary pressure and rising wages. According to today’s USDJPY forecast, these factors may limit further weakening of the yen. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

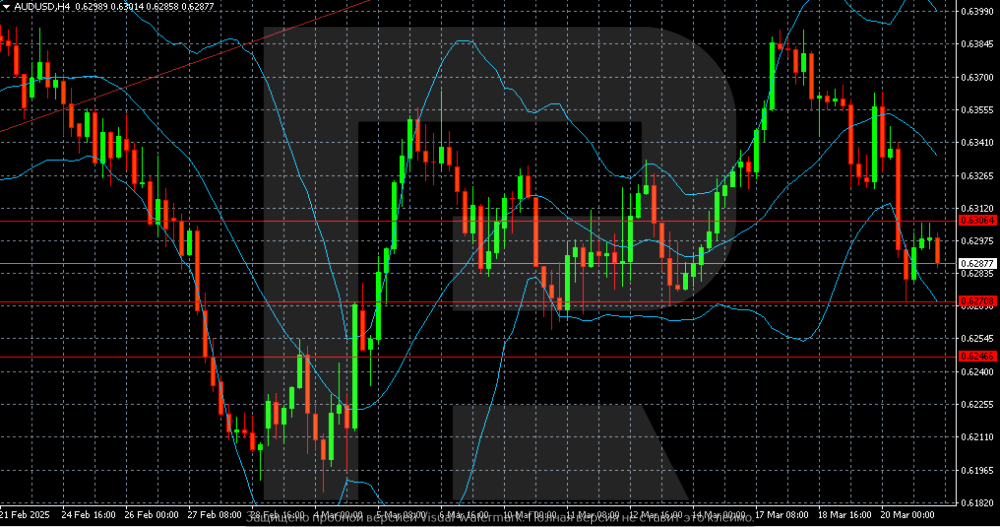

AUDUSD is falling for the fourth consecutive day: no one needs risk The AUDUSD pair is under pressure, hovering at 0.6287. The market is cautious. Discover more in our analysis for 21 March 2025. AUDUSD technical analysis On the AUDUSD H4 chart, the sentiment remains negative and does not rule out the extension of the selling wave towards 0.6270. A breakout below this level will open the way for a decline to 0.6246. The AUDUSD pair is under pressure for the fourth consecutive day, and so far, it is only falling. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

The Fed holds off on rate cuts: is EURUSD set to collapse? The EURUSD pair is falling for the third consecutive trading session, with the price currently at 1.0823. Find out more in our analysis for 21 March 2025. EURUSD forecast: key trading points Easing concerns about an economic downturn put pressure on the EURUSD rate The Federal Reserve kept interest rates unchanged and reiterated plans for two more cuts this year The EURUSD pair is testing the lower boundary of a Double Top reversal pattern EURUSD forecast for 21 March 2025: 1.0680 Fundamental analysis The EURUSD rate is declining as the Federal Reserve has signalled that it is in no rush to lower interest rates. The US dollar receives additional support from easing concerns about an economic slowdown amid US President Donald Trump’s active trade policy. Furthermore, Federal Reserve Chairman Jerome Powell called the imposed tariffs a temporary measure and emphasised that the regulator does not rush to ease monetary policy further. On Wednesday, the Fed held rates steady and reiterated its forecast for two quarter-percentage-point cuts this year, which is in line with the median forecast. Traders are seeing signs of a potential EURUSD reversal, according to today’s forecast. The quotes are currently testing a key support level, a breakout below which may push the currency pair lower. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

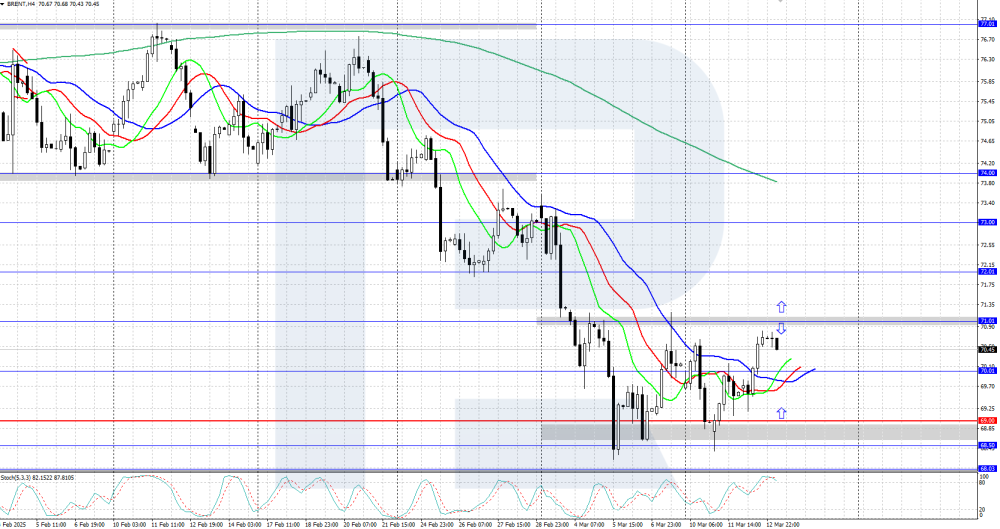

Can a reversal pattern send down Brent prices? Brent prices are strengthening, currently standing at 70.99 USD. Discover more in our analysis for 20 March 2025. Brent forecast: key trading points US gasoline and distillate inventories fell to their lowest levels since early 2025 The Head and Shoulders pattern on the Brent chart indicates a potential price decline Brent forecast for 20 March 2025: 66.65 Fundamental analysis Brent prices continue to rise for the second consecutive trading session. However, buyers cannot surpass the key resistance level at 71.00 USD yet. Brent quotes are supported by US inventory data and escalating tensions in the Middle East, fuelling concerns about possible oil supply disruptions. Wednesday’s data showed a sharp decline in distillate and gasoline stocks to their lowest levels since early 2025 despite an increase in crude oil inventories. Gasoline stocks decreased by 527 thousand barrels, with distillate inventories down by 2.80 million barrels. At the same time, commercial crude oil reserves in the US rose by 1.75 million barrels last week. Investors currently continue to assess the prospects for US economic growth. The Federal Reserve reiterated its forecast for two benchmark interest rate cuts this year, which supports the oil market, according to the Brent price forecast. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

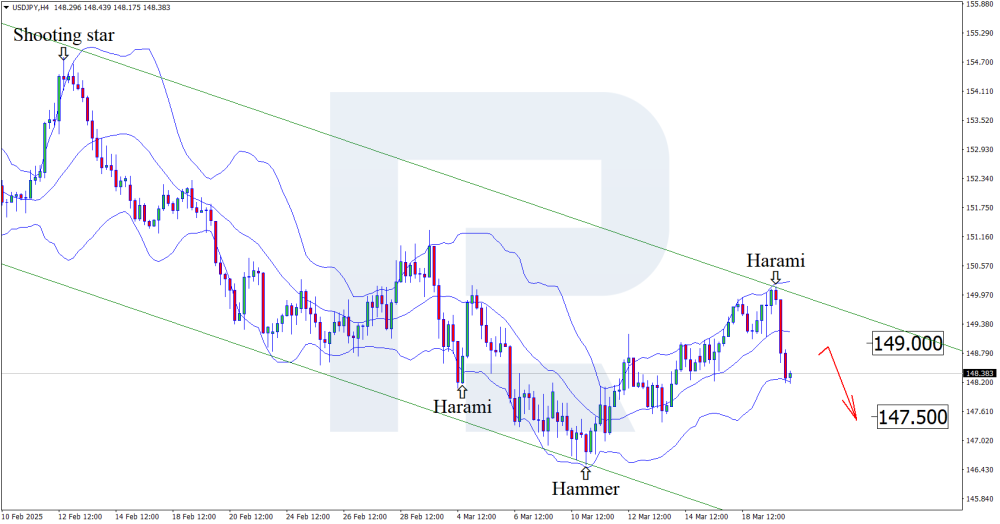

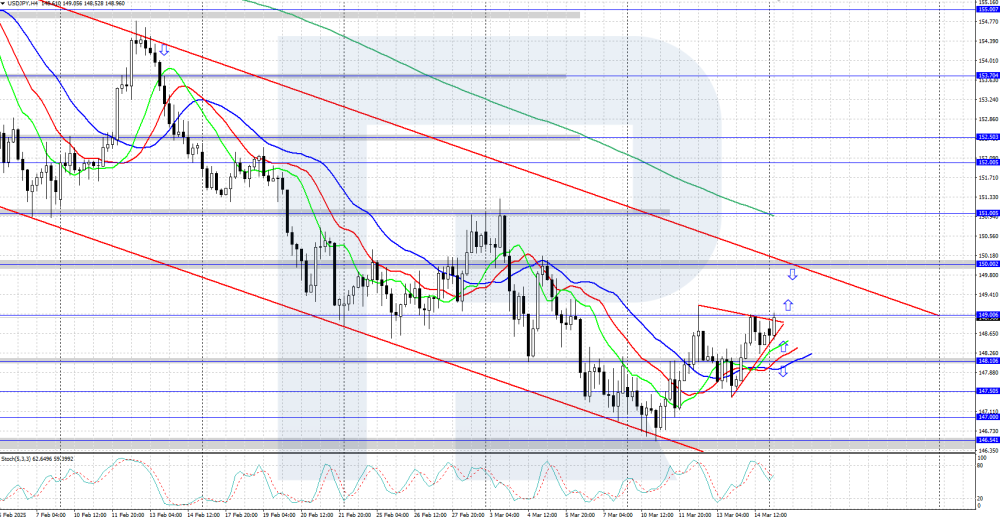

USDJPY: yen vs. dollar – a surprise turn after the Fed decision The US interest rate decision and weaker fundamentals may cause the yen to strengthen and push the USDJPY rate down to the 147.50 support level. Find more details in our analysis for 20 March 2025. USDJPY technical analysis Having tested the upper Bollinger band, the USDJPY price has formed a Harami reversal pattern on the H4 chart. At this stage, it is moving downwards following the pattern signal. Since the quotes have rebounded from the resistance level and continue to move within the descending channel, they are expected to decline further to the support level. The Japanese yen is strengthening despite the public holiday in Japan amid expectations of a BoJ interest rate hike and the Fed’s decision. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

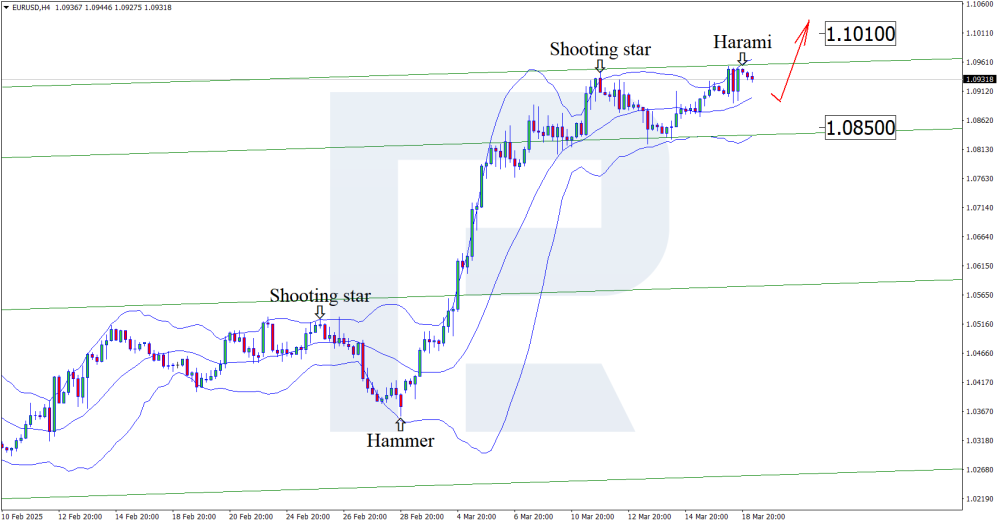

EURUSD forecast: market shock – how the Fed decision and the eurozone’s CPI will change the EURUSD rate The Federal Reserve interest rate change and the eurozone’s CPI data may trigger unpredictable fluctuations in the EURUSD rate, including growth to 1.1010. Find out more in our analysis for 19 March 2025. EURUSD technical analysis On the H4 chart, the EURUSD pair formed a Harami reversal pattern near the upper Bollinger Band. At this stage, it continues a corrective wave following the received signal. Since the price is within the ascending channel, it could pull back to the nearest support at 1.0850. A rebound from this level may open the potential for a continued upward movement. Coupled with the EURUSD technical analysis, the FOMC economic forecasts and the US interest rate decision suggest growth to 1.1010 after the correction is completed. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) sets a new record, with prices aiming for 3,050 USD XAUUSD prices are rising significantly ahead of the Federal Reserve decision, currently standing at 3,043 USD. Discover more in our analysis for 19 March 2025. XAUUSD forecast: key trading points Concerns about an economic slowdown support bullish momentum in XAUUSD Traders are focused on the Fed decision, which may impact further Gold price movements The regulator’s soft stance may fuel demand for the precious metal XAUUSD forecast for 19 March 2025: 3,075 Fundamental analysis XAUUSD prices continue to rise on Wednesday, hitting new all-time highs. Buyers confidently surpassed the 3,037 USD resistance level due to mounting geopolitical tensions in the Middle East. Gold remains a key hedging instrument amid economic uncertainty caused by the US tariff policy, with the unstable trading environment only making it more attractive as a safe-haven asset. Investors’ concerns about an economic slowdown and higher recession risks support bullish momentum, which aligns with the XAUUSD forecast for today. All eyes are on the Federal Reserve’s decision, which will be announced today. If the regulator takes a soft stance, reacting to concerns about the tariff impact on economic growth, this will boost demand for Gold and open the way to the next key resistance level at 3,065 USD. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold (XAUUSD) soared above 3,000 USD, hitting a new all-time high XAUUSD prices are showing rapid growth, rising above the 3,000 USD level. Today, the market is focused on the US industrial production statistics. Discover more in our XAUUSD analysis for today, 18 March 2025. XAUUSD technical analysis XAUUSD quotes continue to show a steady uptrend, reaching a new all-time high of 3,017 USD today. The key support level is currently at the psychologically important level of 3,000 USD. Gold (XAUUSD) is strengthening, hitting another all-time high of 3,017 USD. The US industrial production data could add to asset volatility today. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Market is in suspense: where will Brent head after the API report? In anticipation of the API report, Brent prices are rising and could reach the 72.25 USD level. Discover more in our analysis for 18 March 2025. Brent forecast: key trading points Brent crude oil prices are on the rise Weekly US crude oil inventories from the American Petroleum Institute (API): previously at 4.247 million barrels Brent forecast for 18 March 2025: 70.00 and 72.25 Fundamental analysis Fundamental Brent analysis for today, 18 March 2025, takes into account that oil prices continue their upward momentum. Today, 18 March 2025, Brent prices are slightly rising amid geopolitical tensions in the Middle East and China’s stimulus measures. Brent futures were up 17 cents (0.2%), reaching 71.24 USD per barrel. The US Department of Energy revised its previous forecast, expecting Brent prices to average at 74.22 USD per barrel in 2025. Despite the current price increase, long-term forecasts take into account a possible decline in Brent prices due to global economic factors. According to the API, weekly US crude oil inventories rose significantly in the previous reporting period. The Brent analysis for today takes into account that following the data release, the quotes could maintain their upward trajectory and head towards 72.25 USD. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY forecast: will bulls take control or will bears crush 149.00? The USDJPY rate is consolidating around 149.00; market participants are awaiting the Federal Reserve and Bank of Japan interest rate decisions this week. Discover more in our analysis for 17 March 2025. USDJPY technical analysis On the H4 chart, the USDJPY pair is trading in a descending price channel, with the price currently undergoing a local upward correction after rebounding from its lower boundary. The local target for the upward correction is the 150.00 level, which coincides with the upper boundary of the price channel. The USDJPY rate is undergoing an upward correction, returning to 149.00. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US consumer confidence collapses, EURUSD is set for a leap The EURUSD pair is correcting, with the price currently at 1.0877. Find more details in our analysis for 17 March 2025. EURUSD forecast: key trading points The US consumer confidence index fell to its lowest level since November 2022 US retail sales data is in the spotlight today EURUSD forecast for 17 March 2025: 1.1035 Fundamental analysis The EURUSD rate is declining slightly on Monday. However, the US dollar remains under pressure due to trade uncertainty and growing concerns about the US economy. Friday’s data showed a decline in US consumer confidence and a sharp increase in inflation expectations. The consumer confidence index fell to 57.9 points in March from 64.7 in February, reaching its lowest level since November 2022. Investors are now focused on the release of US retail sales data, which is due today and will provide information on consumer spending. The key event of the week will be the Federal Reserve’s meeting on Wednesday, where the interest rate is expected to remain unchanged. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

AUDUSD remains under pressure despite improvements in the Australian economy The AUDUSD pair is strengthening, with the price currently at 0.6292. Discover more in our analysis for 14 March 2025. AUDUSD technical analysis The AUDUSD pair remains under pressure, with a Triangle pattern currently forming. The AUDUSD forecast suggests a rebound from the 0.6310 resistance level, followed by a decline to 0.6235. The AUDUSD rate remains under pressure due to trade risks and the Federal Reserve’s policy despite strong Australian economic data. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD forecast: the pair corrected towards 1.0800 The EURUSD rate is undergoing a moderate downward correction, falling to 1.0800. Today, the market is focused on the eurozone’s inflation statistics. Find out more in our EURUSD analysis for 14 March 2025. EURUSD forecast: key trading points Market focus: the US Producer Price Index showed no month-on-month inflation growth in February (0%) Current trend: correcting within the uptrend EURUSD forecast for 14 March 2025: 1.0875 and 1.0765 Fundamental analysis The EURUSD pair appears rather confident amid weaker-than-expected US inflation growth in February, with the CPI and PPI below forecast. Today, the market is focused on inflation statistics of the eurozone’s largest countries. The February Consumer Price Index (CPI) for Germany, Spain, and France will be released. A more significant uptick in inflation in the leading European economies will help strengthen the euro, while weaker-than-expected data could cause the EURUSD pair to continue a downward correction. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent prices consolidated above 70.00 USD Brent prices show moderate growth, returning to the area above 70.00 USD after the release of the US inflation and oil inventories statistics. Find more details in our Brent analysis for today, 13 March 2025. Brent technical analysis Brent quotes are undergoing an upward correction, having consolidated above the psychologically important level of 70.00 USD. The Alligator indicator reversed upwards on the H4 chart, confirming the upward momentum. If quotes rise above the 71.00 USD resistance level, a Double Bottom bullish reversal pattern will form, with an upside target at 73.00 USD. Oil prices rose above 70.00 USD amid easing inflation in the US. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) rises amid easing US inflation XAUUSD prices are strengthening on Thursday, currently standing at 2,944 USD. Discover more in our analysis for 13 March 2025. XAUUSD forecast: key trading points Easing US inflation heightens expectations for a Federal Reserve interest rate cut The growing likelihood of a Fed rate cut supports Gold prices XAUUSD forecast for 13 March 2025: 2,970 Fundamental analysis XAUUSD quotes are rising for the third consecutive day as continued uncertainty about tariffs boosts demand for safe-haven assets. The precious metal is additionally supported by easing US inflation, which has fuelled expectations for a Federal Reserve interest rate cut. US consumer prices rose by 2.8% year-on-year in February, below 3.0% in January and analysts’ average forecasts of 2.9%. Easing inflation increases the likelihood of a Fed rate cut, bolstering Gold prices and indicating the potential for their further growth, according to the XAUUSD forecast for 13 March 2025. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY is under pressure amid expectations of tighter BoJ monetary policy The USDJPY pair is rising, with the price currently at 148.40. Discover more in our analysis for 12 March 2025. USDJPY forecast: key trading points Japan’s business sentiment index for large manufacturing companies decreased Weak statistics may heighten expectations of further BoJ monetary tightening USDJPY forecast for 12 March 2025: 145.65 Fundamental analysis The USDJPY rate is rising for the second consecutive session, with buyers aiming to test the crucial resistance level at 148.50. The US dollar is gaining support amid expectations of the latest inflation data. Despite the current growth, the currency pair remains under pressure due to uncertainty in Trump’s tariff policy and increasing risks of the US recession. The yen receives additional support from rising wages in Tokyo, which helps offset inflationary costs, reduce the labour shortage, and increase consumer spending, creating conditions for a possible Bank of Japan interest rate hike. Meanwhile, Japan’s business sentiment index for large manufacturing companies declined to -2.4% in Q1 2025 after rising to 6.3% in the previous quarter. The deterioration of the indicator and weak statistics could fuel expectations for further BoJ monetary tightening, which supports a bearish forecast for USDJPY for today. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with: