⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

-

Posts

1,288 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by RBFX Support

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD poised for reversal: outcome depends on meeting in Brussels Ahead of the Eurogroup meeting, the EURUSD pair may complete its correction and head towards the 1.1330 resistance level. Discover more in our analysis for 12 May 2025. EURUSD technical analysis On the H4 chart, the EURUSD price has formed a Shooting Star reversal pattern near the upper Bollinger Band. The pair is currently undergoing a downward wave in response to this signal. However, since quotes remain within the ascending channel, they could climb to the nearest resistance level at 1.1330 after the correction. With the Eurogroup meeting as today's main market driver, the outlook for EURUSD appears optimistic. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) at weekly low as market bets on good news Gold (XAUUSD) has dropped to 3,275 USD as demand for safe-haven assets fades. The market is awaiting the announcement of a potential deal between China and the US. Find out more in our analysis for 12 May 2025. XAUUSD forecast: key trading points Gold (XAUUSD) prices decline amid expectations of progress in China-US trade talks The market anticipates official statements on the issue as early as Monday XAUUSD forecast for 12 May 2025: 3,258 and 3,223 Fundamental analysis Gold (XAUUSD) prices fell to 3,275 USD on Monday, marking their lowest level in a week, a roughly 1% drop from Friday. The decline is driven by expectations, with the market awaiting an official announcement on progress in China-US trade negotiations early this week. Rumours suggest that productive developments are underway, and confirmation could arrive today. Against this backdrop, investor appetite for safe-haven assets has diminished. Market participants are clearly pricing in a favourable outcome. Although little concrete information has been released, Chinese officials have indicated readiness for formal talks, and Washington has suggested that conditions for progress are in place. In any case, this will be known today. Gold also came under pressure last week following comments from the US Federal Reserve. Speaking after the recent meeting, Fed Chairman Jerome Powell noted that there are no current plans for pre-emptive interest rate cuts. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

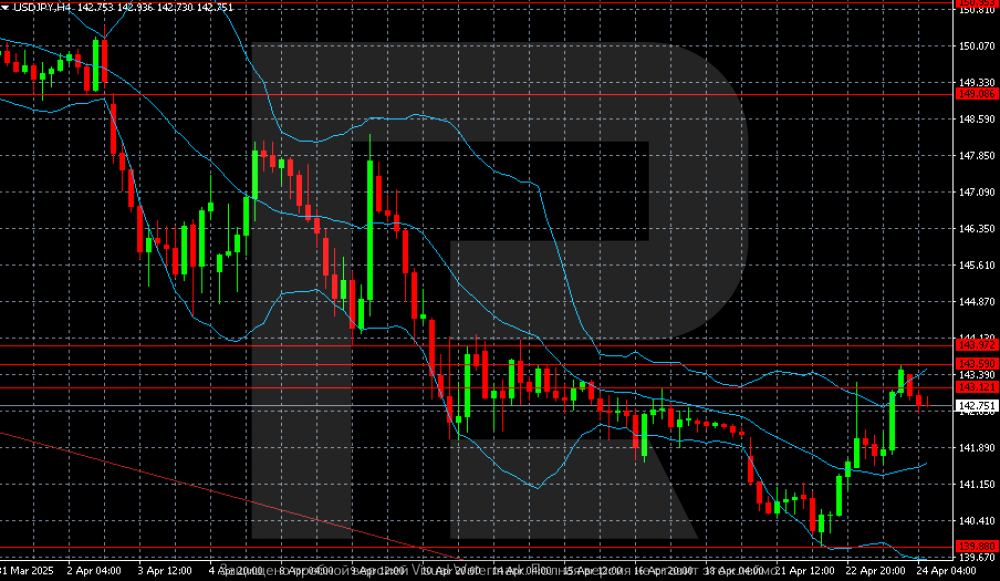

Wedge pattern on USDJPY chart – sellers gear up for downward move The USDJPY rate is currently undergoing a correction but remains under pressure, with the price now at 142.99. Find more details in our analysis for 7 May 2025. USDJPY forecast: key trading points Japan’s services PMI for April was revised upwards from 52.2 to 52.4 New orders in the service sector reached the highest level in nearly a year, indicating strong domestic demand in Tokyo USDJPY forecast for 7 May 2025: 141.45 Fundamental analysis The USDJPY rate is recovering after declining for three consecutive trading sessions, as investors continue to monitor trade negotiations between the US and Japan. Tokyo authorities aim to finalise a bilateral agreement by June, supporting interest in risk assets and currency markets. Last week, the Bank of Japan kept its interest rate unchanged at 0.5% as expected. However, the central bank downgraded its forecasts for economic growth and inflation, reinforcing market expectations that further monetary tightening is unlikely in the near term. Meanwhile, Japan’s services PMI for April 2025 was revised upwards to 52.4 from a preliminary 52.2, marking the fastest pace of new order growth in nearly a year and indicating steady domestic demand. These figures could push the USDJPY pair lower as part of today’s forecast. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

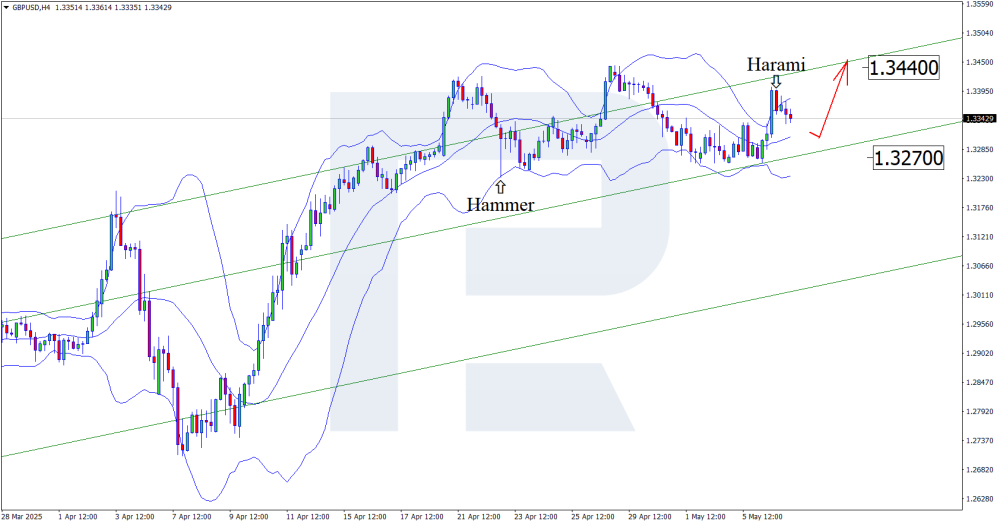

GBPUSD on the brink: weak PMI and US rate expectations could shake the market The upcoming Federal Reserve rate decision could propel the GBPUSD pair towards 1.3440. Discover more in our analysis for 7 May 2025. GBPUSD technical analysis Having tested the upper Bollinger Band, the GBPUSD price has formed a Harami reversal pattern on the H4 chart. It is now developing a corrective wave following the received signal. Since the pair remains within an ascending channel, and given today’s fundamental data from both the US and UK, the bullish wave will likely develop following a correction. Alongside the GBPUSD technical analysis, a weaker UK construction PMI and the upcoming Federal Reserve rate decision suggest growth to 1.3440 after a correction. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

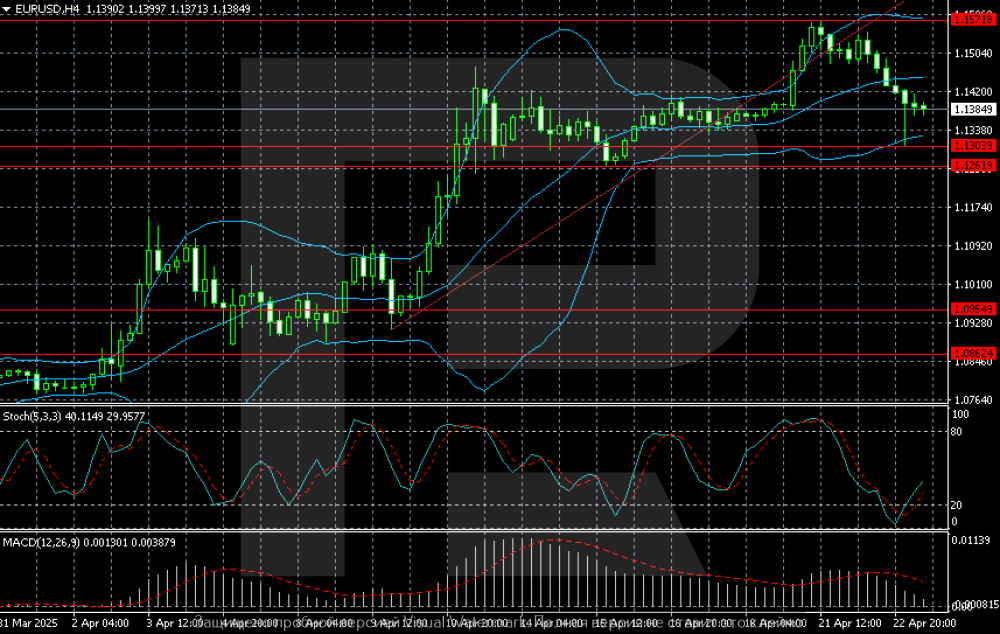

Markets hold breath ahead of Fed decision: EURUSD poised for growth The EURUSD pair is regaining ground, with bulls aiming to test the 1.1495 resistance level. Discover more in our analysis for 6 May 2025. EURUSD forecast: key trading points The ISM services PMI in the US rose in April, exceeding analyst expectations The Federal Reserve’s two-day policy meeting, concluding on Wednesday, will be one of the week’s key events Most market participants do not expect any change in the interest rate EURUSD forecast for 6 May 2025: 1.1615 Fundamental analysis The EURUSD rate is showing moderate recovery as buyers keep the pair above the key support level at 1.1265. The US ISM services PMI rose to 51.6 in April from 50.8 in March, beating the forecast of a drop to 50.6. Although a reading above 50.0 signals expansion, the upbeat data only briefly supported the US dollar. The main focus of the week is the Federal Reserve’s two-day meeting, which concludes on Wednesday. Investors are looking for signals regarding potential monetary easing. Despite strong US labour market data, most market players expect the Fed to leave rates unchanged. This supports a moderately bullish outlook for the EURUSD pair. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

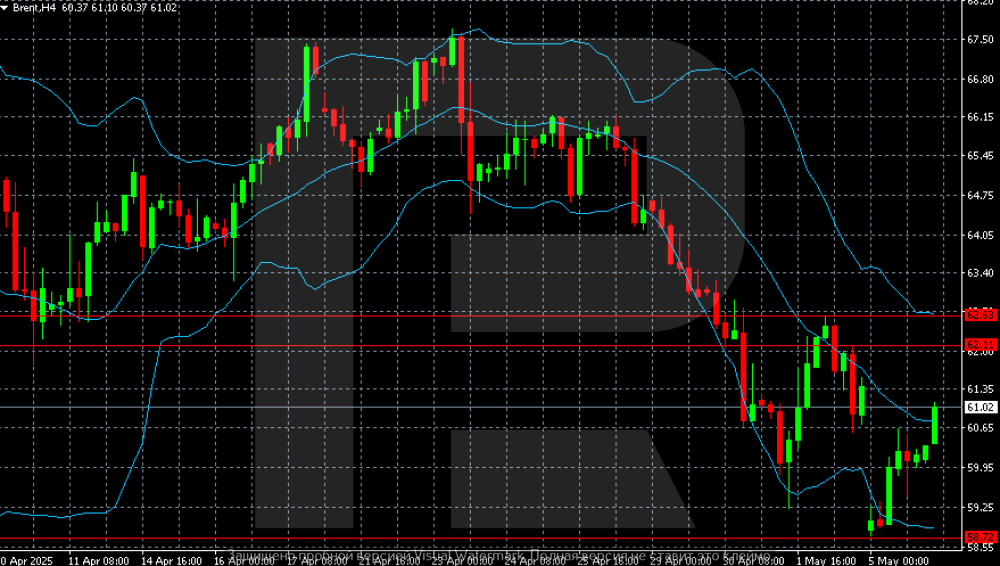

Brent rebounds slightly, but the sell-off is not over yet Brent oil has recovered to 61.17 USD. The sharp two-day drop has paused. Discover more in our analysis for 6 May 2025. Brent technical analysis On the H4 chart, Brent prices have rebounded from a local low of 58.72 and moved up towards 61.00. For the bounce to transition into a sustained reversal, prices must consolidate above 62.11. This would pave the way for further gains towards 62.63. Brent prices have recovered after a steep drop, but still trade near four-year lows. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) in the green: demand for safe-haven assets on the rise Gold (XAUUSD) prices have risen to 3,260 USD. With elevated risk levels, the precious metal finds strong support. Discover more in our analysis for 5 May 2025. XAUUSD forecast: key trading points Gold (XAUUSD) is on the rise, driven by demand for safe-haven assets The market closely follows US-China trade tensions, awaiting concrete developments XAUUSD forecast for 5 May 2025: 3,276 Fundamental analysis Gold (XAUUSD) prices climbed to 3,260 USD on Monday. Amid high uncertainty surrounding US-China trade talks, demand for safe-haven assets is increasing. This is an environment in which gold traditionally thrives. The core issue lies in the lack of clarity. US President Donald Trump claims China is inclined to strike a deal, while Beijing insists specific conditions must be met before any discussions can proceed. The ongoing holidays in China add further ambiguity. Gold also finds support in the weakening of the US dollar, making the metal more attractive to investors using other currencies. Looking ahead, the Federal Reserve is set to hold its policy meeting this week. Although a rate cut would benefit gold, such a move is unlikely at this stage. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Shock to the market: why weak PMI could crash USDJPY A decline in the US services PMI could trigger a further correction in the USDJPY rate towards the 143.31 support level. Find out more in our analysis for 5 May 2025. USDJPY technical analysis Having tested the upper Bollinger band, the USDJPY price has formed a Hanging Man reversal pattern on the H4 chart. At this stage, it continues to form a corrective wave following the pattern signal. Since the pair continues to decline within a descending channel, it could reach the 143.31 level. Weakening US economic data could drive USDJPY lower. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

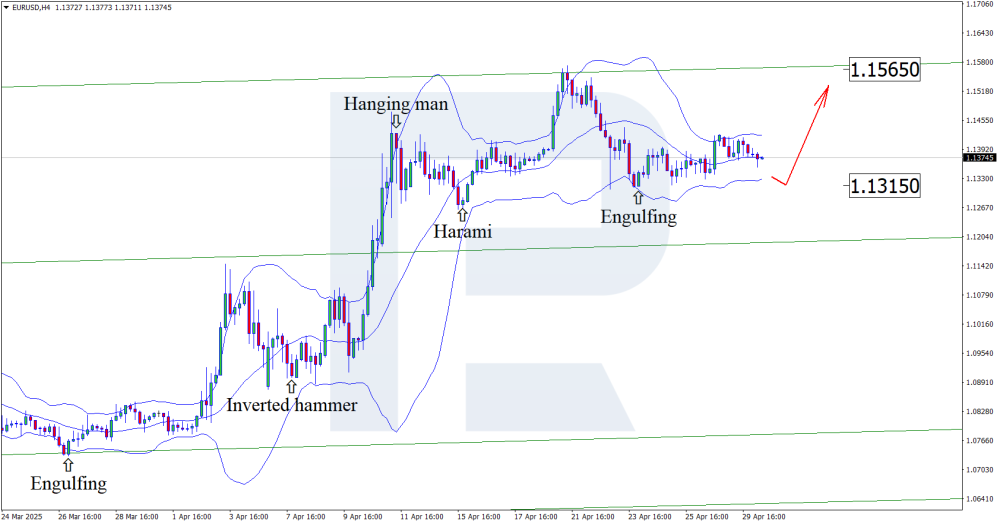

US and EU GDPs collapse, what is next for EURUSD A decline in US GDP could offer the euro an opportunity to strengthen, pushing EURUSD quotes towards 1.1565. Discover more in our analysis for 30 April 2025. EURUSD technical analysis On the H4 chart, the EURUSD pair has formed an Engulfing reversal pattern near the lower Bollinger band. The pair currently maintains its upward trajectory in response to this signal. Since the price remains within an ascending channel, further growth towards the nearest resistance at 1.1565 is expected. A breakout above this level would open the path for continued bullish momentum. Amid weakening US economic data, today's EURUSD forecast is rather optimistic. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

GBPUSD breaks three-year highs The GBPUSD rate continues to climb confidently, setting a new three-year high at 1.3443. Market participants are awaiting key US data today, including ADP employment figures and Q1 GDP. Find more details in our analysis for 30 April 2025. GBPUSD forecast: key trading points Market focus: ADP employment data and Q1 GDP figures will be released during the American session today Current trend: uptrend in place GBPUSD forecast for 30 April 2025: 1.3443 and 1.3300 Fundamental analysis The GBPUSD pair surged to a three-year high, driven by expectations that the Bank of England will proceed more cautiously with rate cuts compared to other major central banks. Markets are currently pricing in around 85 basis points of easing for 2025, similar to the Fed’s outlook. Today’s spotlight is on key US economic indicators, with April’s ADP employment report and the Q1 GDP reading scheduled for release. The ADP reading is expected to grow by 118 thousand, with GDP up 0.2%. Stronger-than-expected results could support the US dollar and lead to a pullback in the GBPUSD pair, while weaker data would likely fuel further gains for the pound. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD back at the forefront of demand: markets eye a new wave of risk The EURUSD pair is hovering around 1.1387 on Tuesday. Risks of a US trade war weigh against the US dollar. Find out more in our analysis for 29 April 2025. EURUSD forecast: key trading points The EURUSD pair is poised to resume growth due to US trade risks China states it is not holding talks with the US, despite Washington’s claims Market risks are taking centre stage again EURUSD forecast for 29 April 2025: 1.1427 and 1.1442 Fundamental analysis The EURUSD rate is holding near 1.1387. The currency market is poised to return to buying as external uncertainty surrounding US-China trade relations intensifies. Yesterday, China reiterated that it is not currently engaged in negotiations with Washington. Meanwhile, US Treasury Secretary Scott Bessent said that easing tensions depends on China, emphasising that Chinese exports to the US significantly exceed imports. The market is now focused on upcoming US economic data due later this week. On Wednesday, the first estimate of Q1 2025 GDP will be released alongside the crucial core PCE inflation component – a key metric for the Federal Reserve. On Friday, labour market data for April will be published. These figures will provide investors with numerous signals for evaluating the prospects of the Fed’s monetary policy. Should the data point to weakening economic indicators, expectations for an imminent monetary easing by the Federal Reserve would rise. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold (XAUUSD) retreats into correction; will the decline continue? XAUUSD quotes have entered a correction after hitting an all-time high of 3,500 USD. The US dollar is finding support amid easing trade tensions. Discover more in our analysis for 29 April 2025. XAUUSD technical analysis Gold is undergoing a downward correction within a broader uptrend after rebounding from the record high of 3,500 USD. The quotes are currently trading around the key support level at 3,270 USD. A breakout below this level could lead to the formation of a Triangle pattern and a further decline towards 3,200 USD. XAUUSD prices are undergoing a downward correction amid easing trade tensions. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY rises above 143.00; will growth continue? The USDJPY pair climbed to the 144.00 area amid easing trade tensions and ongoing negotiations. Find out more in our analysis for 28 April 2025. USDJPY forecast: key trading points Market focus: ongoing tariff negotiations between the US and Japan Current trend: correcting upwards USDJPY forecast for 28 April 2025: 144.00 and 143.00 Fundamental analysis The USDJPY rate climbed into the 144 yen per dollar area on Monday, driven by easing global trade tensions. Japan's chief trade negotiator, Ryosei Akazawa, is expected to visit Washington this week for a second round of bilateral talks. Meanwhile, the Bank of Japan is scheduled to hold its policy meeting this Thursday. The regulator is widely expected to maintain its benchmark interest rate at 0.5%, as policymakers continue to assess the potential impact of newly imposed US tariffs on Japan’s export-oriented economy. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

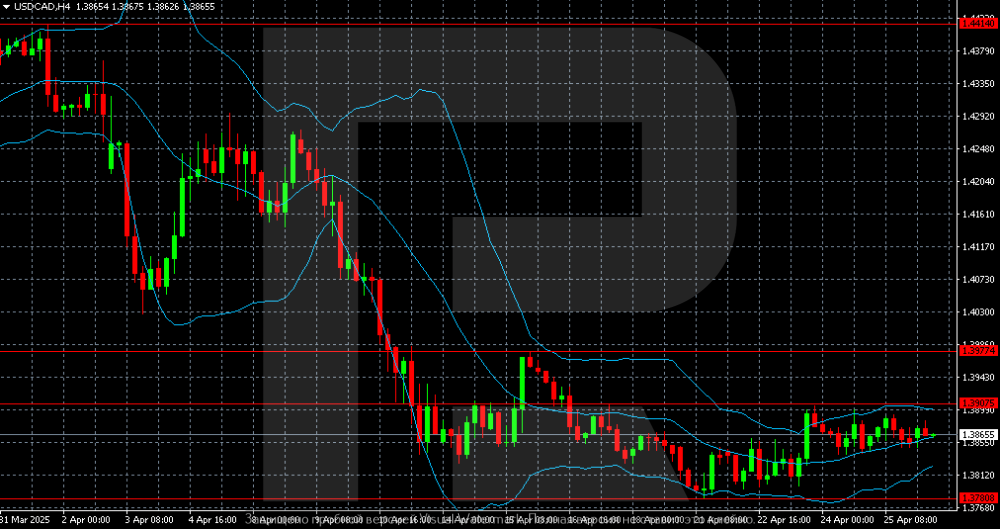

USDCAD: sideways movement for now, but further decline expected The USDCAD pair is hovering around 1.3863. The market is assessing the prospects of easing US-China trade tensions and closely following the Canadian elections. Discover more in our analysis for 28 April 2025. USDCAD technical analysis On the USDCAD H4 chart, the sideways range is limited by the 1.3780 and 1.3907 levels. A breakout above the upper boundary could trigger a corrective move towards 1.3977. The USDCAD pair has temporarily halted its decline but retains a bearish outlook. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

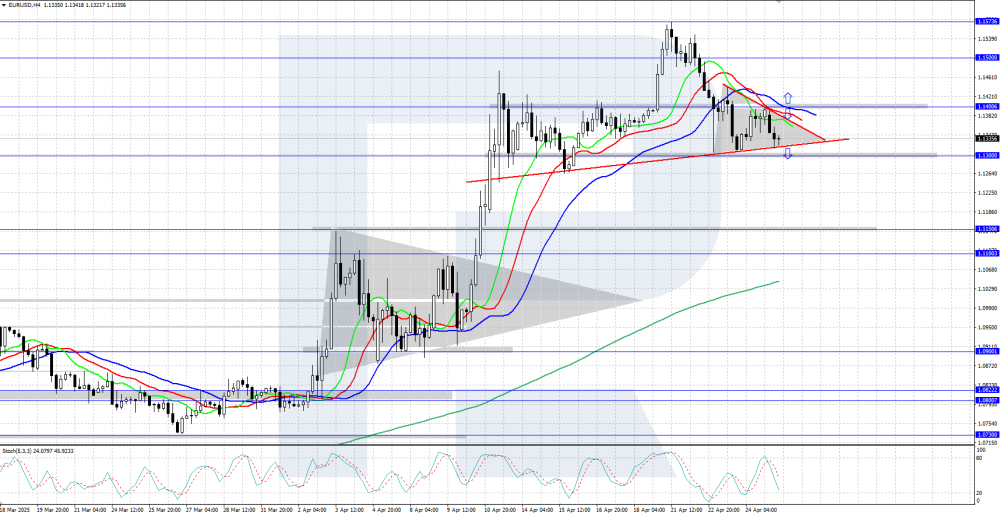

EURUSD retreats into correction; will the decline continue? The EURUSD pair sharply entered a corrective phase after hitting 1.1573. A reversal pattern may form on the chart. Find more details in our analysis for 25 April 2025. EURUSD technical analysis On the H4 chart, the EURUSD rate is undergoing a bearish correction after reaching a yearly high of 1.1573. A Head and Shoulders reversal pattern could form if the price consolidates below 1.1300. In this scenario, the next downside target will be the 1.1150 support level. The EURUSD pair has entered a downward correction after reaching its yearly high of 1.1573. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Traders brace for a correction in AUDUSD The AUDUSD rate continues its upward momentum, currently trading at 0.6404. Discover more in our analysis for 25 April 2025. AUDUSD forecast: key trading points Private sector activity in Australia continued to rise in April Markets expect the Reserve Bank of Australia to cut interest rates in May AUDUSD forecast for 25 April 2025: 0.6315 Fundamental analysis The AUDUSD rate is rising for the second consecutive session, although buyers have yet to break above the 0.6435 resistance level. Trader sentiment shifted after US President Donald Trump stated that trade talks with China would continue, despite denials from Beijing. This uncertainty is capping further gains in the Australian dollar. Domestic data shows continued growth in Australia’s private sector activity in April, with positive results observed in both manufacturing and services. The S&P Global composite PMI slipped slightly from 51.6 to 51.4, but remains in growth territory. Despite the encouraging data, markets expect the Reserve Bank of Australia to cut the cash rate by 25 basis points in May. This is seen as a preventive move amid concerns about the potential negative impact of the newly implemented US trade tariffs. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Two days of decline behind: Gold (XAUUSD) gears up for an upward spurt XAUUSD is rebounding from the support level, currently trading at 3,331 USD. Discover more in our analysis for 24 April 2025. XAUUSD forecast: key trading points Strong fundamental factors drive demand for Gold Investors view buying on price declines as the optimal strategy in current conditions XAUUSD forecast for 24 April 2025: 3,465 Fundamental analysis XAUUSD quotes are recovering after two days of losses. The decline was driven by rising risk appetite, following statements from Donald Trump about potentially lowering tariffs on Chinese goods and reaching a trade agreement with Beijing. US Treasury Secretary Scott Bessent said on Wednesday that the current level of tariffs between the US and China is unsustainable and should be reduced before new talks can begin. However, he stressed that Trump has no plans to unilaterally lift tariffs on Chinese imports. Market participants believe the bullish trend in Gold will continue unless the White House demonstrates a genuine shift in its trade policy. For now, strong fundamentals continue to support demand for Gold, with buying on dips remaining the preferred strategy. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY may come under pressure: yen to regain its role as a safe-haven asset The USDJPY pair is hovering near 142.76 on Thursday. The market is once again seeking safe-haven assets, which supports the yen. Find out more in our analysis for 24 April 2025. USDJPY technical analysis On the H4 chart, the USDJPY pair shows potential for a decline towards 142.00 from the current 142.75. Strategically, the pair may form a sideways channel between 139.88 and 143.59. After two strong sessions, the USDJPY pair began to decline. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD loses bullish momentum: US dollar regains the lead The EURUSD pair declined to 1.1378. The White House made efforts to calm investors. Find more details in our analysis for 23 April 2025. EURUSD technical analysis The EURUSD H4 chart shows a possible corrective wave developing towards 1.1303. After this decline, the market is expected to resume growth, aiming for 1.1425 and then 1.1504. The EURUSD pair has reached another three-year high before entering a correction. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

No rescue mission needed: falling PMI will not stop GBPUSD's climb Positive UK data may trigger a GBPUSD rally towards 1.3420. Discover more in our analysis for 23 April 2025. GBPUSD forecast: key trading points UK services PMI: previously at 52.2, projected at 51.5 US services PMI: previously at 54.4, projected at 52.8 GBPUSD forecast for 23 April 2025: 1.3420 and 1.3240 Fundamental analysis The services Purchasing Managers’ Index (PMI) is a vital economic barometer, reflecting the health of the largest sector in the economy. Based on surveys of purchasing managers, it captures trends in new orders, employment, business confidence, and overall activity. A reading above 50.0 indicates expansion, while a value below 50.0 signals contraction. Given the dominant role services play in the UK GDP, the indicator is considered crucial for assessing the country’s economic health. Its release often causes strong fluctuations in the national currency exchange rate. The forecast for 23 April 2025 anticipates a slight dip in UK services PMI to 51.5 points. The decrease is not critical, with the reading remaining above the key 50.0 threshold, which may be potentially positive for the pound. Fundamental analysis for 23 April 2025 also takes into account the release of the US services PMI, which is expected to decline from 54.4 to 52.8. Today’s GBPUSD forecast considers all US and UK data, which could support the GBP and spur further gains in the GBPUSD rate once the correction is complete. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

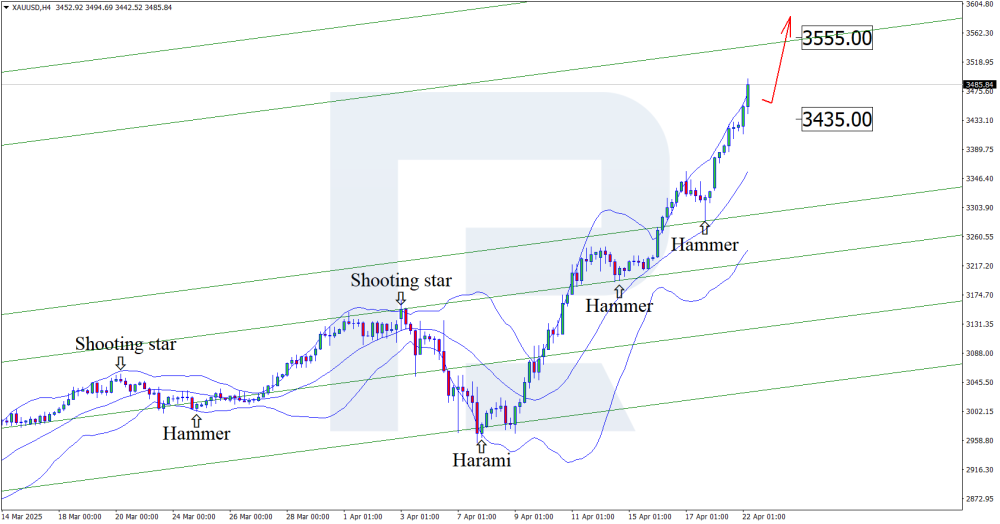

Gold (XAUUSD) in focus, Harker’s speech could trigger a golden wave An upcoming speech by a FOMC member may boost XAUUSD quotes further to 3,555 USD. Discover more in our analysis for 22 April 2025. XAUUSD technical analysis On the H4 chart, XAUUSD prices have formed a Hammer reversal pattern near the middle Bollinger band. The price is now building a bullish wave in response to that signal. The uptrend will likely continue as XAUUSD quotes have broken above the ascending channel. The immediate upside target could be the 3,555 USD resistance level. Amid the FOMC member’s speech, today’s outlook for XAUUSD remains bullish, with technical analysis suggesting continued upward momentum after a minor correction. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD surges as pressure mounts on Jerome Powell The EURUSD rate is gaining for the third consecutive trading session, currently trading at 1.1530. Find out more in our analysis for 22 April 2025. EURUSD forecast: key trading points President Donald Trump intensifies criticism of Fed Chairman Jerome Powell Traders are concerned about growing tension between the White House and the Federal Reserve EURUSD forecast for 22 April 2025: 1.1630 Fundamental analysis The EURUSD rate continues to rally after rebounding from the 1.1475 support level. Pressure on the US dollar has increased following fresh verbal attacks by President Donald Trump on Federal Reserve Chairman Jerome Powell. On Monday, Trump escalated his calls for immediate rate cuts. Market participants are increasingly concerned about the rising tension between the White House and the Fed. Trump’s actions could be perceived as an attempt to pressure the Fed’s independence, with speculation around a possible replacement of Powell adding to uncertainty and fear in the market, undermining confidence in the US dollar. Additional support for the EURUSD rally came from investor disappointment over stalled US-China trade negotiations. Beijing accused Washington of misusing tariffs and warned other nations about entering trade deals with the US, which has increased tensions and further weighed on the US dollar. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Fed under fire — USDCAD tumbles amid policy chaos USDCAD is falling sharply, with the pair trading at 1.3791. Full breakdown in our forecast for 21 April 2025. USDCAD technical analysis USDCAD is breaking lower after falling through the 1.3825 support level. Today’s outlook anticipates a short-lived corrective pullback toward the upper boundary of the descending channel, followed by a move down toward 1.3735. The outlook for USDCAD remains bearish as political instability in the US and tariff uncertainty continue to erode confidence in the dollar. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Crash or opportunity? IMF meeting and falling LEI weigh on USDJPY The IMF meeting and weak US LEI data may spark a correction in USDJPY before a potential drop to the 140.00 level. Full forecast for 21 April 2025 below. USDJPY forecast: key trading points IMF Spring Meetings begin today US Leading Economic Index (LEI): previous – -0.3%, forecast – -0.5% USDJPY forecast for 21 April 2025: 140.00 and 141.50 Fundamental analysis As of 21 April 2025, markets are focused on the start of the IMF Spring Meetings. Amid persistent global headwinds — including high inflation, geopolitical risks, and sluggish growth in major economies — this event may deliver crucial policy statements regarding global financial stability, support for developing economies, and central banks’ future strategies. In parallel, attention is on the US Leading Economic Index (LEI), a composite of 10 indicators designed to forecast turning points in the economic cycle. It includes metrics like jobless claims, new orders, and consumer expectations. A further decline in LEI to -0.5%, as forecasted, would reinforce fears of a slowing US economy or even a looming recession — potentially undermining the dollar and bolstering safe-haven demand for the yen. The fundamental backdrop for USDJPY remains fragile, with downside pressure likely to persist. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) resumes rally — next target: 3,405 USD XAUUSD has broken above the upper channel boundary, signalling an end to the recent pullback. The current quote is 3,327 USD. Full analysis for 18 April 2025 below. XAUUSD forecast: key trading points Gold remains in demand amid uncertainty over US trade policy Central banks and private investors continue to accumulate gold Goldman Sachs forecasts gold at 3,700 USD by year-end XAUUSD forecast for 18 April 2025: 3,405 USD Fundamental analysis XAUUSD is regaining strength following a short-term pullback, still trading firmly within an upward channel. Demand for gold remains high as market participants seek refuge from ongoing US trade policy uncertainty. Investors are reacting to shifting signals from the Trump administration, which is reportedly considering new tariffs on semiconductor and pharmaceutical imports. Meanwhile, renewed trade talks with China are back in focus, with Beijing expressing willingness to resume dialogue — albeit under certain conditions. Analysts highlight continued strong demand for gold from both central banks and private investors. This provides a robust foundation for further price appreciation. According to Goldman Sachs, gold could reach 3,700 USD by the end of 2025. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

.thumb.png.3413051f240a66bc8ad4c82933f4736c.png)