A financial crisis is one of the most dreaded buzzwords that is heard or read around the world. Either an economy is facing a recession or an economic crisis, or there is a fear that it may be headed towards one, depending on several macroeconomic indicators.

These indicators show marked declines in the per capita consumption, GDP, trade, money flow, energy consumption, and employment rate.

Even the most powerful and economically strong nations in the world have gone through some devastating recessions in the past.

Let us look at some of the worst global financial crises the world has faced so far:

1. The Tulip Mania of 1634

Event

This is one of the first recorded market crises of the early period, which occurred in Holland when the price of tulip buds rose to six times the average man's salary.

The flowers originally imported from Turkey were considered exotic in Europe and by everyone. The affluent and the aspiring affluent, even middle-class citizens, wanted to have tulips, which were one of the most delicate flowers that perished quickly and could take about 12 years to flower from a seed.

The Tulip business became so crucial in Holland that traditional agriculture was impacted. The price of tulips rose to as much as 5500 florins, which is approximately equal to $ 825000.

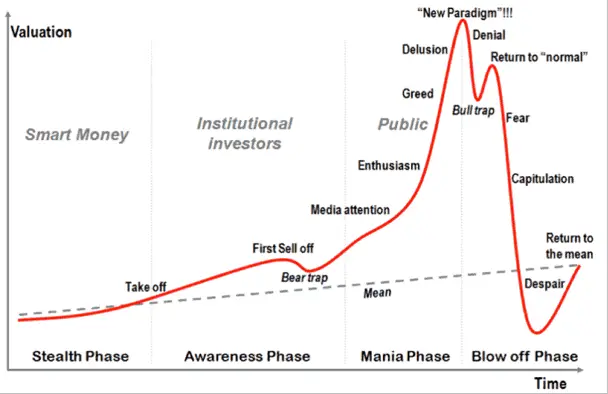

Stages of a bubble

Consequences

The prices, however, declined steeply by 1637, and those who had loaned to grow tulips with the expectation of selling at a higher price became bankrupt. This led to a financial meltdown.

Watch this video documentary about Tulip Mania - The first economic bubble.

2. The Panic of 1772

Â

Â

Event

This was also known as the Panic of 1772 or the Credit Crisis. It originated in London when one of the partners in a major bank, Neale, James, Fordyce, and Down, escaped to France, having forfeited £ 300000.

Consequences

The bank collapsed, and people lost faith in the banking institution, which was a pivotal part of the economy. This crisis later spread across Europe after the bank collapsed in London, followed by the collapse of 20 other banks. The total number of bankruptcies in London was 556 in 1773.

Watch this video:

3. The Panic of 1797

Â

Â

Event

This recession occurred in the US as the land speculation bubble burst after the American Revolution. The aftermath of the UK and France wars led to the insolvency of the Bank of England, and the impact spread to the shores of North America and the Caribbean.

Consequences

These events together led to this great financial panic. It lasted three years until 1800, and although the situation began to improve thereafter, it had a lasting impact on people's minds.

4. The Post-Napoleonic depression of 1815

The post-Napoleonic depression of 1815

The post-Napoleonic depression of 1815

Event

After the Napoleonic wars, in England and Wales, there was a steep cut in wages, and especially the weavers were greatly impacted due to this. Their wages fell to less than half of what they had earned before this period. This percolated slowly to the entire textile industry and then to the economic situation across the countries.

The condition was further aggravated due to the Corn Laws, which were passed at this time. The intent was to keep out foreign goods and promote English agriculture, which was already impacted due to the depression. This resulted in people having to purchase subpar local products at inflated prices.

Consequence

A famine and unemployment followed, which also spread to Scotland. This depression led to the collapse of export markets and had an effect on the Panic of 1819 in the United States.

5. The great depression of 1929

The great depression of 1929

Event

This recession, considered one of the worst recessions in the world, provided a textbook case study on financial crises. It lasted from 1929 to 1939, occurring in two phases: from 1929 to 1933, and another phase from 1937 to 1939. The intervening years had seen some growth in production due to a change in leadership on the political front in the US.

The recession had started with the fall of Wall Street. The over-optimistic loans by bankers led to a shortage of money supply when the lenders defaulted on payments. Loans were called in, and it affected the entire system—lack of regulations, fiscal policies, and deposit insurance led to this large-scale collapse.

Consequences

The Great Depression of America caused wide-scale unemployment, poverty, and emigration from the USA. There was a massive price deflation (Willard W. Cochrane, Farm prices: myth and reality (U of Minnesota Press, 1958), and crop prices fell below 60%. The impact was seen worldwide, and unemployment rose to 25% in the US and up to 33% worldwide.

6. The weird 1945 recession

The weird 1945 recession

The weird 1945 recession

Event

This recession started in February 1945 and lasted through the eight months to October 1945. The impact, however, lasted much longer. This recession was expected following World War II, and there was a significant drop in demand for wartime goods, including weapons.

Consequence

Other countries reeled under the impact of the war and were still recuperating from their losses, while the US GDP fell to a negative figure of -11.6% in 1946. Government spending was also significantly reduced, and the impact was evident in the economy.

7. The oil crisis of 1973

The oil crisis of 1973

Event

This was one of the most dangerous crises in the world that led to one of the top 10 recessions in the world. The OPEC members (Organization of the Petroleum Exporting Countries) revolted against the USA and its allied nations. The United States of America had sent armed troops to Israel against the Arab countries.

Consequence

The Gulf countries, also known as the Arab nations, constitute the majority of OPEC members. They joined hands to raise the price of oil. This, in turn, created a huge shortage of oil supply, and the energy industries were directly impacted. Also, the other businesses suffered, and huge inflation was caused, which proved to be drastic for the world's economy.

8. The Asian Financial Crisis of 1997

The Asian Financial Crisis of 1997

The Asian Financial Crisis of 1997

Event

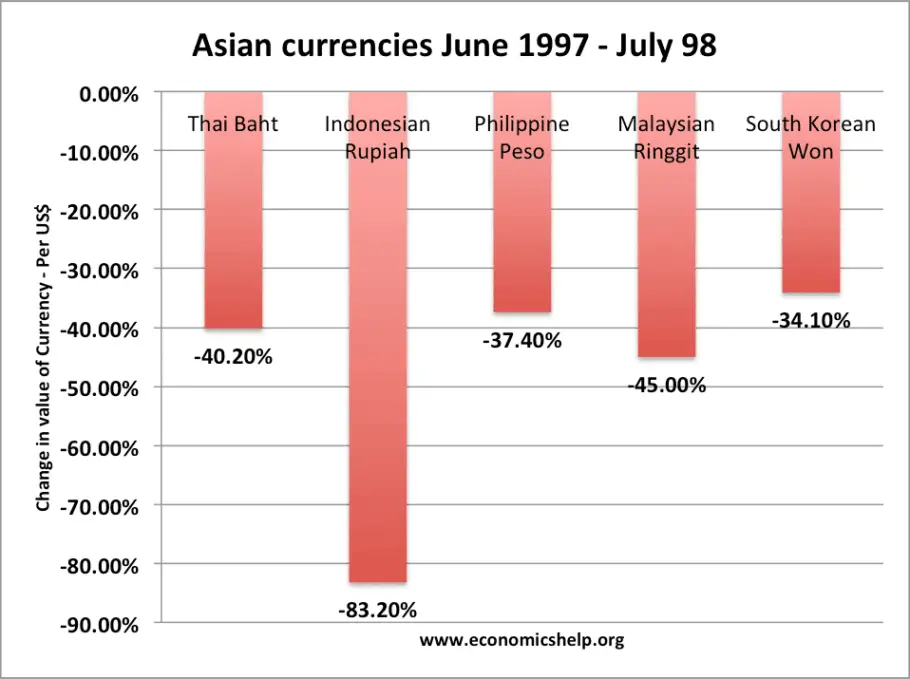

Overextension of financial credit in Thailand and all its trading economies led to this critical situation in Asia. It began in Thailand in 1997 when it had to give up the fixed exchange rate with American dollars owing to a lack of foreign currency supply.

Consequence

This had a domino effect on the Southeast Asian partners of Thailand, Malaysia, Singapore, Indonesia, South Korea, Hong Kong, and soon, the word spread about the sad plight of these economies. The situation persisted for the next three years, and the International Monetary Fund (IMF) had to intervene to prevent a financial meltdown.

9. The Lost Decade (1990 - 2000)

The Lost Decade (1990 - 2000)

Event

The fall of land and asset prices in Japan in the early 1990s is referred to as The Lost Decade, which made the prices stagnant for a decade, and several firms went insolvent. It lasted until 2001 and witnessed one of the major slowdowns of a rapidly growing economy.

Consequence

The four years before the decade saw dangerously inflated stock prices, and this precarious bubble was burst in 1991, and land prices dropped to more than 15.5% from their peak. (Land Economic and Construction and Engineering Industry Bureau, Ministry of Land, Infrastructure, Transport and Tourism, 2004). Survey on average housing land prices by use and prefecture.) Japan's GDP decreased from $5.33 trillion to $4.36 trillion between 1995 and 2000.

Watch this video:

10. Great Recession of 2008

The Great Recession of 2008 in numbers

The Great Recession of 2008 in numbers

Event

This is the most recent financial recession the world has seen and one of the fiercest since the Great Depression. The hallmark event that marked the onset of this depression was the collapse of one of the world's biggest investment companies - Lehman Brothers.

The Housing Bubble in the USA was created due to the optimism of banks and lending institutions, which led to excessive credit, resulting in a significant void due to defaults.

Consequence

The entire financial system collapsed, and a government buyout was required to save face. This impacted several international businesses, leading to the downfall of companies and resulting in job losses. It took almost another five years to recover from the losses completely.

Watch this video where Warren Buffett explains the 2008 financial crisis:

VICE on HBO examines the factors that led to the 2008 financial crisis and the efforts made by then-Treasury Secretary Henry Paulson, Federal Reserve Bank of New York President Timothy Geithner, and Federal Reserve Chair Ben Bernanke to save the United States from an economic collapse. The feature-length documentary explores the challenges these men faced, as well as the consequences of their decisions.

11. Upcoming Massive Global Recession of 2025-2026

Governments borrowed heavily to fund stimulus, leading to record sovereign debt levels during the COVID pandemic. U.S. debt rose above $37 trillion, which makes it around $324,000 per US taxpayer.

Near-zero interest rates and QE increased liquidity in markets, which resulted in asset price inflation: stocks, real estate, and cryptocurrencies surged beyond fundamentals.

The world avoided a collapse during COVID by massive stimulus and coordinated policy.

But the combination of lingering debt and asset vulnerabilities, AI-driven mass layoffs, and supply chain fragility creates a perfect storm for a potential global crisis in 2025–2026.

Conclusion

In almost all of the above cases, the recessions have been caused by overvaluation of commodities, unjustified optimism on the stock market increase, irregular banking systems, or political mismanagement.

With time, better financial system regulations have been able to get a grip on the economy. It has helped prevent a steady economic downfall or a total collapse of the financial system.

Organizations like the IMF (International Monetary Fund) exist to monitor global economic changes. But recessions are periodic, and completely avoiding one has not been possible. Uncontrollable situations like an epidemic, natural disasters, or calamity can throw an economy off balance, and an unpredictable financial crisis could arise.

Sources:

- https://www.investopedia.com/terms/d/dutch_tulip_bulb_market_bubble.asp

- https://en.m.wikipedia.org/wiki/Crisis_of_1772

- https://www.google.ae/publicdata/explore

- Frank, Robert H.; Bernanke, Ben S. (2007). Principles of Macroeconomics (3rd ed.). McGraw-Hill/Irwin.)

Recommended Comments

There are no comments to display.