⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

-

Posts

1,288 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by RBFX Support

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

GBPUSD under pressure: chance of retesting lows The GBPUSD pair remains under pressure near 1.3440. Macroeconomic data and lingering trade deal uncertainties with the US weigh on the pound. Discover more in our analysis for 18 June 2025. GBPUSD forecast: key trading points The GBPUSD pair tested May lows and paused Investors await UK inflation data for May GBPUSD forecast for 18 June 2025: 1.3414 Fundamental analysis The GBPUSD rate attempts to stabilise near 1.3440 on Wednesday after recent heavy selling. Markets are keeping a close eye on Middle East tensions while also awaiting May inflation data, due later today, and a possible rate change on Thursday. The pound remains weighed down by recent data and external factors such as US trade tariffs. Earlier, US President Donald Trump signed a deal easing some tariffs on British goods, confirming quotas and duties on vehicles and eliminating aerospace sector tariffs. However, steel and aluminium issues remain unresolved. Today’s inflation data in the UK could show a slight decline to 3.4%, which would be a moderately positive signal. Overall, current high inflation is seen as temporary, and a comprehensive US-UK trade agreement could help reduce associated risks. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold (XAUUSD) holds firm on geopolitical tensions, traders gear up for further gains XAUUSD remains resilient, supported by continued demand from central banks, with prices currently at 3,386 USD. Discover more in our analysis for 18 June 2025. XAUUSD technical analysis XAUUSD quotes are correcting after rebounding from the upper boundary of the ascending channel but remain above the Moving Averages – a sign of ongoing bullish pressure. Today's XAUUSD analysis suggests a rebound from the lower boundary of the bullish channel and a potential rise towards 3,475 USD. Despite a local correction, demand for gold remains robust due to persistent geopolitical risks and central bank interest. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent poised for further growth after rebound from EMA-65 Brent quotes remain highly volatile amid escalating Middle East tensions, with prices currently at 72.92 USD. Find out more in our analysis for 17 June 2025. Brent technical analysis Brent prices are climbing after rebounding from the EMA-65, maintaining a strong bullish impulse. According to today’s Brent forecast, a bearish correction to the channel’s lower boundary remains possible before the uptrend continues towards the target of 78.25 USD. Fundamental analysis highlights the ongoing risk of Brent price increases amid geopolitical tensions Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY set to extend rally: yen remains under pressure The USDJPY pair climbed to 144.76, with the yen facing pressure from the lack of a trade deal with the US. Find more details in our analysis for 17 June 2025. USDJPY forecast: key trading points The USDJPY pair continues to rise for the third consecutive day The Bank of Japan kept interest rates unchanged at 0.5% There is no progress in Japan-US trade talks so far USDJPY forecast for 17 June 2025: 145.13 and 145.47 Fundamental analysis The USDJPY rate rose to 144.76, with a variety of key developments surrounding the Japanese yen. Firstly, markets reacted to the Bank of Japan's neutral stance on interest rates. On Tuesday, the central bank held the rate steady at 0.5% per annum. In its statement, the BoJ confirmed it will gradually scale back government bond purchases, in line with prior guidance. Second, Japanese Prime Minister Shigeru Ishiba and US President Donald Trump failed to reach a tariff agreement during the G7 summit in Canada. Meanwhile, the US dollar continued to strengthen amid rising geopolitical tensions and inflation concerns, increasing demand for safe-haven assets. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDCAD at eight-month low, driven by oil rally The USDCAD pair pulled back to 1.3600. The market favours CAD strength amid the oil price rally and domestic news from Canada. Find out more in our analysis for 16 June 2025. USDCAD forecast: key trading points The USDCAD pair drops to its lowest level in eight months Oil rally and domestic signals support the CAD USDCAD forecast for 16 June 2025: 1.3566 Fundamental analysis The USDCAD rate declined to 1.3600 on Monday, marking a fresh eight-month low. Several factors bolster the Canadian dollar. Firstly, support comes from the oil price rally, with Brent prices rising due to Middle East instability. This is particularly important for Canada, where oil is a major export commodity. Secondly, there is growing speculation that the US Federal Reserve may resume rate cuts if the US economy starts losing momentum again. Additional backing for the Canadian currency came from the announcement of an early increase in defence spending. Prime Minister Mark Carney stated that Canada would meet NATO’s 2% of GDP defence spending target in the current fiscal year, five years ahead of schedule. This news may help reduce friction in the upcoming trade negotiations with the US. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Euro retreats, but the uptrend in EURUSD remains intact The EURUSD rate has declined for the second consecutive trading session, pulling back after rebounding from the key resistance level at 1.1580. Discover more in our analysis for 16 June 2025. EURUSD technical analysis The EURUSD rate is undergoing a correction within a descending channel. Today’s EURUSD forecast suggests a brief decline towards the support level, after which the pair could resume its upward movement targeting 1.1710. The US dollar strengthened on geopolitical tensions and robust macroeconomic data, putting pressure on the EURUSD rate. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

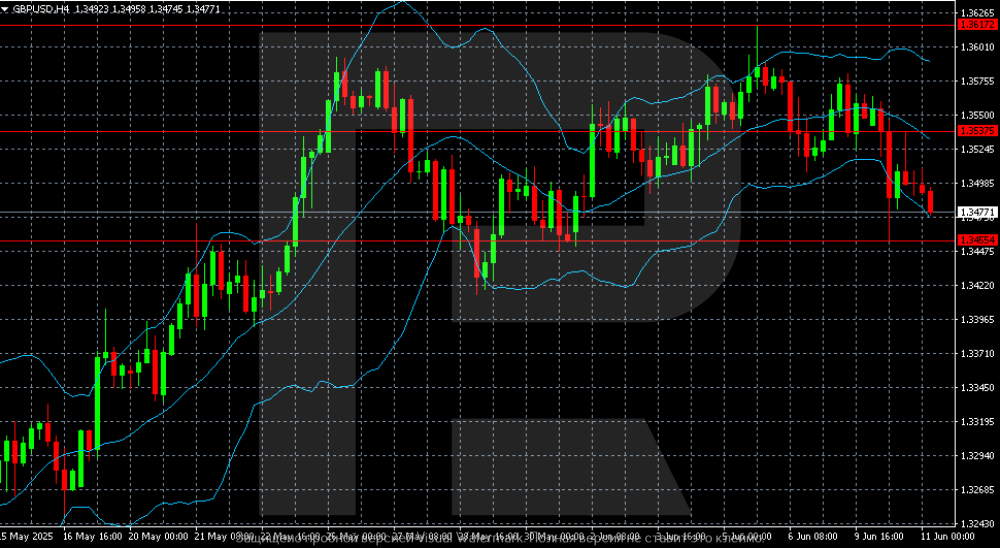

GBPUSD stabilises: market absorbs UK labour data The GBPUSD pair found support near 1.3478. Markets are regaining balance following weak employment data. Discover more in our analysis for 11 June 2025. GBPUSD technical analysis On the H4 chart, GBPUSD shows potential for a retest of the 1.3455 level, followed by a possible rebound towards 1.3498. The GBPUSD pair is pricing in the UK’s employment data. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US budget blowout and inflation surprise – gold (XAUUSD) poised to soar The US federal budget deficit could trigger a rally in XAUUSD towards the 3,400 USD level. Find more details in our forecast for 11 June 2025. XAUUSD forecast: key trading points US Consumer Price Index (CPI): previously at 2.3%, projected at 2.5% US federal budget statement: previously at 258.0 billion, projected at -314.3 billion Current trend: moving upwards XAUUSD forecast for 11 June 2025: 3,400 Fundamental analysis Fundamental XAUUSD analysis for today, 11 June 2025, takes into account that gold prices hold steady above 3,300 USD per troy ounce, maintaining their upward trajectory amid lingering uncertainty in US-China trade relations. The XAUUSD forecast for 11 June 2025 suggests the CPI could rise to 2.5% from the previous 2.3%, but this projection may not materialise given the index has shown consistent declines in past reports. A weaker-than-expected CPI could put additional pressure on the US dollar. Additionally, the US federal budget statement is projected to show a drop to -314.3 billion USD. The negative value indicates the budget deficit, which may further weaken the US dollar. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Deal of the century or a bubble? Brent pushes to new highs Brent prices have reached their highs and may extend gains towards 68.50 USD. Discover more in our analysis for 10 June 2025. Brent forecast: key trading points Brent has surpassed its May peak OPEC+ increases oil production Brent forecast for 10 June 2025: 68.50 Fundamental analysis Fundamental analysis of Brent for today, 10 June 2025, takes into account that prices have renewed their May highs, climbing to 66.90 USD per barrel ahead of the results of another round of negotiations between Washington and Beijing. Optimism surrounding the resolution of trade tensions fuels demand for commodities and reinforces price momentum. Iran is preparing a counterproposal for the US regarding the nuclear deal. Against this backdrop and following the breakout above the recent high, Brent shows resilience despite ongoing uncertainty. The Brent forecast also takes into account increased OPEC+ production, with Iraq lagging, and Saudi Arabia and the UAE continuing to ramp up output. However, caution remains warranted – an oversupply by the end of 2025 could weaken the market and trigger a correction in Brent prices. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

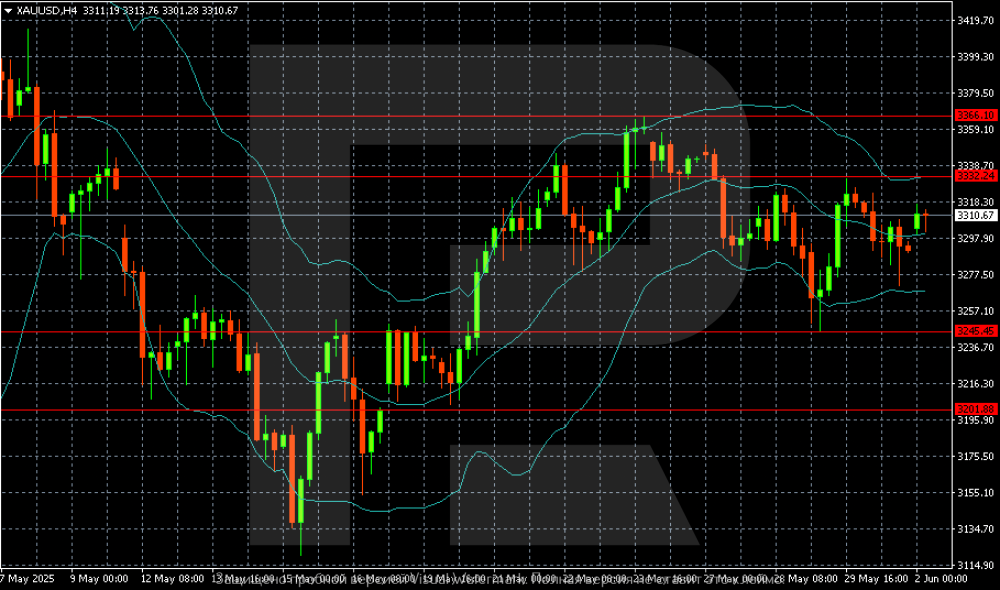

Gold (XAUUSD) nears reversal: bulls gearing up for a surge XAUUSD prices are declining on Tuesday, although buyers continue to defend the key support level. The quotes currently stand at 3,309 USD. Discover more in our analysis for 10 June 2025. XAUUSD technical analysis XAUUSD quotes are bouncing off the 3,300 support level. The XAUUSD price forecast suggests the pair could resume its upward impulse, with the next target at 3,345. Technical indicators support the bullish scenario, with prices remaining within the demand area and breaking out of a descending channel. Renewed interest in gold is supported by declining US inflation expectations. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

The dollar falls – EURUSD rises: what’s next? The drop in Nonfarm Payrolls has hit the US dollar, with EURUSD continuing its upward move towards 1.1460. Discover more in our analysis for 9 June 2025. EURUSD forecast: key trading points Nonfarm Payrolls data weakened the US dollar The ECB may pause its rate adjustments EURUSD forecast for 9 June 2025: 1.1460 Fundamental analysis Today’s EURUSD forecast favours the European currency. After the release of the Nonfarm Payrolls report, the dollar keeps losing ground against the euro. The actual figure came in at 149K, down from 142K in the previous period. While the drop might seem marginal at first glance, combined with other weak US macro data, it exerted pressure on the dollar and triggered an upward move in EURUSD. Investors are growing cautious about the weakening US dollar and seeking safe havens for their assets. Meanwhile, after initiating a rate cut cycle, the ECB has signalled a possible pause in further rate moves, which has strengthened the euro and supported the current rally in EURUSD. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

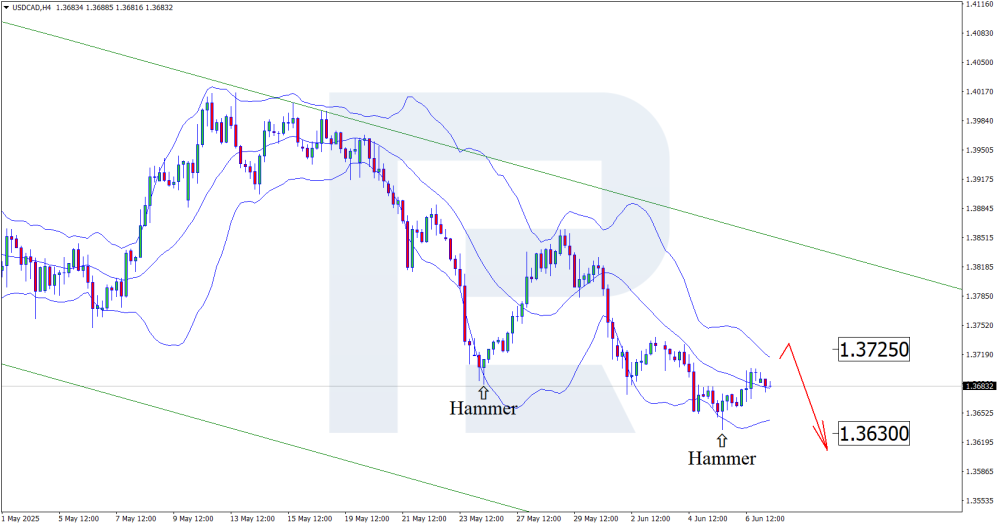

The dollar falls, the loonie celebrates: what’s next for USDCAD A stronger Canadian labour market supports the loonie and could push USDCAD down towards the support level at 1.3630. Discover more in our analysis for 9 June 2025. USDCAD technical analysis On the H4 chart, USDCAD formed a reversal pattern – Hammer – near the lower Bollinger Band. The pair is currently developing a correction from this signal. As prices remain within the descending channel, a move towards the nearest resistance at 1.3725 is possible. All macroeconomic factors currently favour the Canadian dollar. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

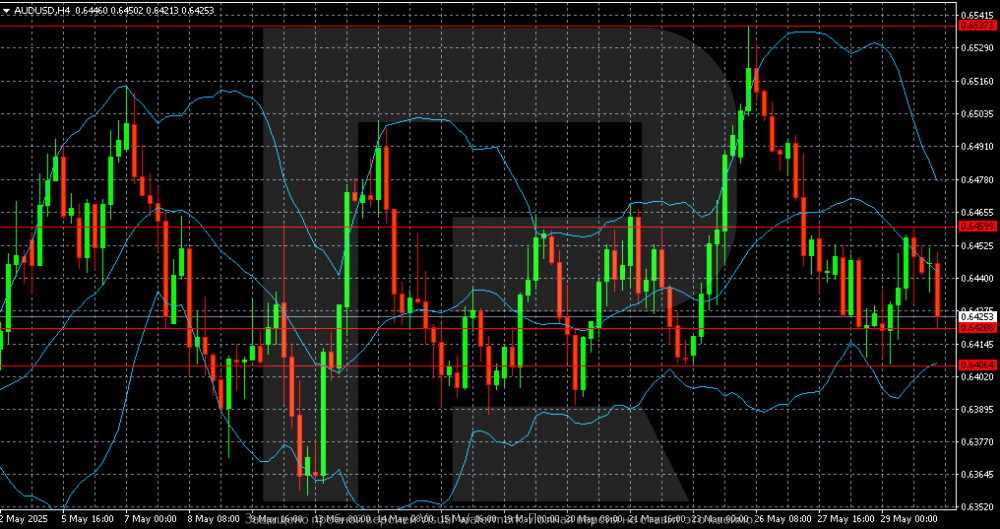

Shock time for the market: NFP data may shake the AUDUSD rate The forecast for 6 June 2025 favours the Australian dollar, with the pair potentially extending a correction towards 0.6475. Find more details in our analysis for 6 June 2025. AUDUSD technical analysis Having tested the upper Bollinger Band, the AUDUSD pair formed a Shooting Star reversal pattern on the H4 chart. The pair is currently undergoing a corrective wave in response to this signal, with a downside target at the 0.6475 support level. If today’s NFP data disappoints, the AUDUSD pair may continue its correction. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY climbs: what should traders expect from the US jobs report? The USDJPY pair continues to strengthen ahead of the key US jobs report release, currently trading at 143.93. Discover more in our analysis for 6 June 2025. USDJPY forecast: key trading points Investors adopt a wait-and-see approach ahead of the US Nonfarm Payrolls release Speculation of BoJ policy tightening grows but remains insufficient to lift the yen USDJPY forecast for 6 June 2025: 145.35 Fundamental analysis The USDJPY rate is rising for the second consecutive session, staying within a sideways range between 142.50 and 144.20. The chart continues to indicate the potential formation of a Double Bottom reversal pattern, which could signal further strengthening of the US dollar. The Japanese yen remains under pressure as investors wait for the crucial US employment report. Additional support for the US dollar came from news of a phone call between Donald Trump and Xi Jinping, in which both leaders agreed to continue trade negotiations. Meanwhile, BoJ Governor Kazuo Ueda reiterated the central bank’s readiness to raise interest rates if economic and inflation targets are met. Although this has raised expectations of a cautious but steady policy tightening, it remains insufficient to boost the yen, according to today’s USDJPY forecast. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent fears oversupply: sell-off possible Brent prices fell below 65 USD on Thursday as the market grew uneasy about a global oil glut. Find more details in our analysis for 5 June 2025. Brent technical analysis On the H4 chart, Brent is setting up for a decline towards 64.04. A breakout below the 64.00-64.05 area could pave the way for further selling down to 63.63. Brent prices are falling, with the market having plenty of justification. Read more -Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

The Fed under pressure, market on hold: gold (XAUUSD) poised for rally Gold continues to form a pullback, and prices may fall to 3,338 USD as part of a corrective wave. Discover more in our analysis for 5 June 2025. XAUUSD forecast: key trading points US initial jobless claims: previously at 240 thousand, projected at 236 thousand Current trend: moving upwards XAUUSD forecast for 5 June 2025: 3,338 and 3,410 Fundamental analysis The XAUUSD outlook for 5 June 2025 considers gold maintaining resilience, trading near 3,370 USD per troy ounce. Investors remain cautious ahead of the US Non-Farm Payrolls report (NFP), which could shape market direction. Gold prices are supported by weak US economic data, including a decline in the services PMI to 49.9 and ADP employment growth of just 37 thousand. These figures reinforce expectations of a Federal Reserve rate cut. US initial jobless claims represent the number of people who claimed unemployment benefits for the first time during the previous week. This indicator measures the labour market climate, with an increase in initial jobless claims indicating rising unemployment. The previous reading stood at 240 thousand, with the XAUUSD price forecast suggesting a slight drop to 236 thousand. Although the change is marginal, if the actual figure matches or exceeds expectations, it could affect XAUUSD quotes. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

GBPUSD under pressure: US labour market data crushes bulls’ hopes The GBPUSD rate is falling amid US dollar strength following robust US labour market data. The price currently stands at 1.3504. Find out more in our analysis for 4 June 2025. GBPUSD forecast: key trading points US job openings rose to 7.391 million in April Robust JOLTS data boosted support for the USD The ADP private sector employment report is due today GBPUSD forecast for 4 June 2025: 1.3450 and 1.3600 Fundamental analysis The GBPUSD rate is declining for the second consecutive session. Sellers re-entered the market after testing the key resistance level at 1.3565. On the daily chart, a Double Top reversal pattern appears to be forming, increasing the likelihood of a move down towards the next target at 1.3445. The US dollar gained support from the latest labour market data. On Tuesday, the JOLTS job openings report showed an unexpected rise to 7.391 million in April, well above the consensus forecast of 7.167 million. This indicates continued resilience of the US labour market and reinforces expectations for a more hawkish Federal Reserve stance, putting pressure on the GBPUSD rate. Investor focus now shifts to the upcoming US data. The ADP private sector employment report is due today, followed by the key May employment data on Friday, which could heavily influence the pair’s next move. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

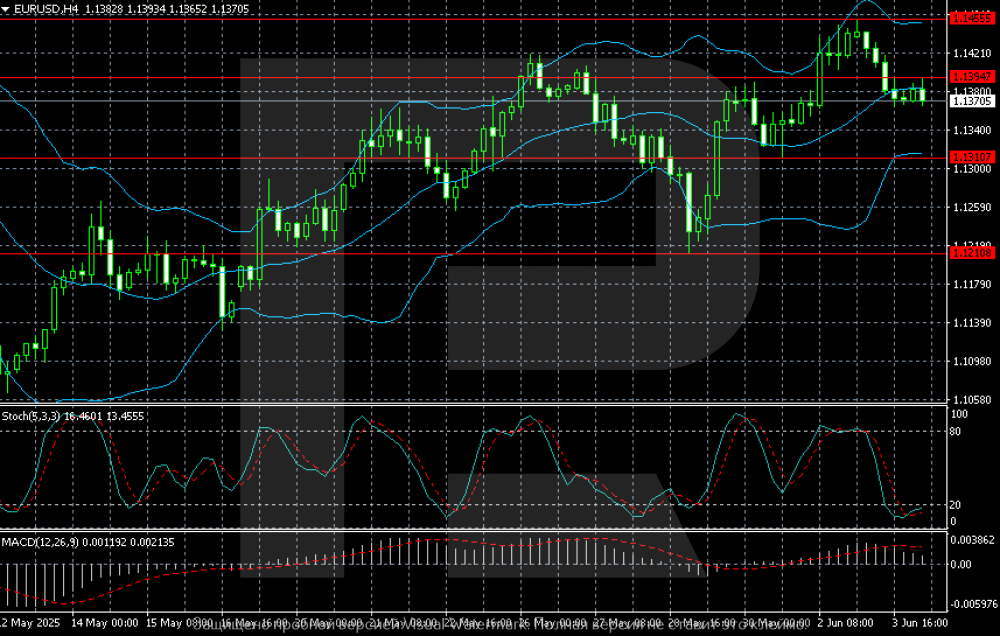

EURUSD halts correction: key data ahead The EURUSD pair is hovering around 1.1369 on Wednesday as markets await US labour market data. Find more details in our analysis for 4 June 2025. EURUSD technical analysis On the H4 chart, the EURUSD pair is hovering around the key support level of 1.1370. If this level does not break, buyers could return with a target at 1.1455 and then 1.1500. After a recent peak, the EURUSD pair declined, awaiting a catalyst from US labour market data. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Oil on the verge of a breakout: Brent may test 66.50 USD today A drop in US crude oil inventories may trigger a rise in Brent prices towards 66.50 USD. Find out more in our analysis for 3 June 2025. Brent forecast: key trading points Brent crude oil is forming a correction Weekly US crude oil stockpiles (API): previously at -4.236 million barrels Brent forecast for 3 June 2025: 63.50 and 66.50 Fundamental analysis Fundamental analysis of Brent for today, 3 June 2025, takes into account that oil prices are moderately rising, reaching 65.00 USD per barrel. Key support factors include the weakening US dollar and geopolitical risks, such as tensions around Iran and supply disruptions from Canada due to wildfires. Although OPEC+ decided to maintain the July output increase at 411,000 barrels per day, below market expectations, Brent quotes hit the 65.00 USD resistance level and are now entering a correction. According to the American Petroleum Institute (API), US crude oil inventories fell by 4.236 million barrels last week. A further drop in stocks in the current reporting period could propel Brent prices towards 66.50 USD. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY rebounds, but downtrend remains dominant The USDJPY rate is gaining strength following a statement from the Bank of Japan's governor, with the price currently at 142.91. Discover more in our analysis for 3 June 2025. USDJPY technical analysis The USDJPY rate continues to move within a descending channel, maintaining potential for further decline. The latest growth attempt stalled at the resistance level of 143.35. Today’s USDJPY forecast suggests a move lower towards 141.35. The Stochastic Oscillator confirms the bearish scenario, with the indicator is bouncing off a descending trendline, signalling ongoing selling pressure. The USDJPY rate has bounced from the support level, yet the risk of further downside remains due to expectations that the Bank of Japan will hold rates steady and the upcoming US jobs data. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD starts the week steadily: all eyes on risk The EURUSD pair is hovering around 1.1358 on Monday as investors assess risk levels at the start of a new week. Find out more in our analysis for 2 June 2025. EURUSD forecast: key trading points The EURUSD rate is edging up modestly as overall market sentiment remains weak Concerns about deteriorating global trade relations re-emerge EURUSD forecast for 2 June 2025: 1.1390 and 1.1424 Fundamental analysis The EURUSD pair is trading close to 1.1358 at the start of the week and the new month. Market sentiment has deteriorated due to renewed concerns over global trade tensions. On Friday, Donald Trump said he might introduce 50% tariffs on steel and aluminium imports starting from 4 June. Meanwhile, US-China relations have worsened again as Beijing rejected Washington’s claims of breaching the temporary trade agreement. This has cast doubt on the likelihood of further trade talks between the two nations. Still, negotiations could resume as early as this week. Market focus now shifts to fresh US economic data, particularly Friday’s Non-Farm Payrolls report for May. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold (XAUUSD) rises: the world seeks shelter from risk Gold (XAUUSD) prices have climbed to 3,310 USD as news flows grow increasingly concerning. Discover more in our analysis for 2 June 2025. XAUUSD technical analysis On the H4 chart, Gold (XAUUSD) is setting up for a gradual rise towards 3,332 USD. To maintain this upward momentum, prices must consolidate above that level and receive support from fundamental developments. Gold (XAUUSD) prices moved higher as external conditions deteriorated and market participants grew increasingly concerned about capital preservation. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

AUDUSD under pressure from statistics The AUDUSD pair slipped to 0.6425 on Friday. Weak economic data suggests the RBA may continue cutting interest rates. Discover more in our analysis for 30 May 2025. AUDUSD technical analysis On the H4 chart, the AUDUSD pair appears poised to retest the local low at 0.6420. A breakout below this level would pave the way for a move down to 0.6404. The AUDUSD pair has lost nearly 1% over the week and remains under pressure. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY falls below 144.00 amid rising inflation in Japan The USDJPY rate has dropped below the 144.00 mark as inflation in Japan accelerates and investors anticipate a rate hike from the central bank in July. Find more details in our analysis for 30 May 2025. USDJPY forecast: key trading points Market focus: Japan’s Consumer Price Index rose by 3.6% year-on-year in May Current trend: moving downwards USDJPY forecast for 30 May 2025: 143.00 and 144.75 Fundamental analysis The Japanese yen is strengthening as inflation increases. Tokyo’s Consumer Price Index rose by 3.6% year-on-year in May, up from 3.4% in April and surpassing the 3.5% market forecast. This marks the highest inflation reading in two years and boosts expectations that the Bank of Japan may raise interest rates at its July meeting. Today, market participants are awaiting US inflation data, with the core PCE price index due during the American session. Forecasts anticipate a 0.1% monthly rise and a 2.5% year-on-year increase. Higher-than-expected inflation could support the US dollar, while a weaker reading would likely strengthen the yen further. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent breaks out of Wedge pattern as bullish momentum builds Brent prices are rising amid easing trade tensions following the removal of global tariffs in the US and OPEC+’s confirmation of extended production caps. Discover more in our analysis for 29 May 2025. Brent technical analysis Brent quotes have broken out of a Wedge reversal pattern, confirming the end of a sideways correction. Today’s Brent price forecast suggests continued upward movement with a target at 68.90 USD, the upper boundary of the ascending channel. A consolidation above the Wedge’s upper edge further reinforces bullish sentiment and the potential for a strong upward impulse. Brent’s fundamentals point to a solid bullish momentum supported by both supply constraints and improved demand outlook. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team