⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

-

Posts

1,288 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Everything posted by RBFX Support

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

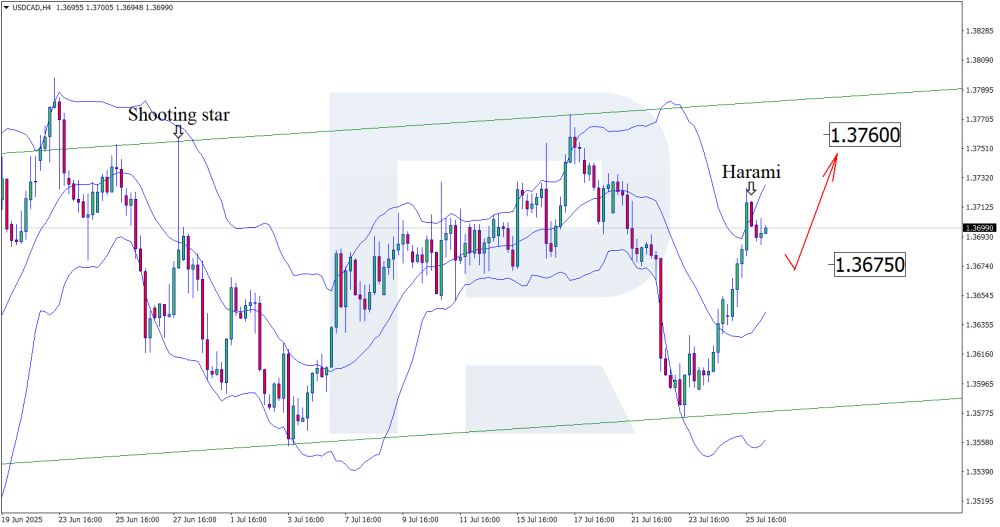

USDCAD under pressure? Investors turning towards CAD After forming a corrective wave, USDCAD quotes may continue their upward movement towards 1.3760. Discover more in our analysis for 28 July 2025. USDCAD technical analysis On the H4 chart, the USDCAD price has formed a Harami reversal pattern near the upper Bollinger Band. The pair is currently forming a corrective wave following the signal from this pattern. Since the quotes remain within the boundaries of the ascending channel, a pullback to the nearest support at 1.3675 is possible. Anticipation of interest rate decisions in both the US and Canada is boosting the Canadian dollar. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY climbs above 148.00, Fed and Bank of Japan rate decisions in focus The USDJPY pair is moderately strengthening, rising above 148.00 ahead of this week’s key monetary policy decisions from the Bank of Japan and the US Federal Reserve. Find out more in our analysis for 28 July 2025. USDJPY forecast: key trading points Market focus: this week, attention turns to interest rate decisions by the Bank of Japan and the Federal Reserve Current trend: upward momentum persists USDJPY forecast for 28 July 2025: 149.18 or 147.00 Fundamental analysis The Japanese yen is weakening moderately following trade agreements with the US. This week, the market will focus on the monetary policy decisions from the Federal Reserve and the Bank of Japan. The Fed is expected to keep rates unchanged on Wednesday, although markets will be closely watching for signals on a possible rate cut in September. The Bank of Japan will announce its policy decision on Thursday. Rates are also expected to remain unchanged amid ongoing concerns about the economic impact of US trade tariffs. However, the central bank is likely to revise its inflation forecast upwards in its quarterly outlook, reflecting persistent price pressures. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

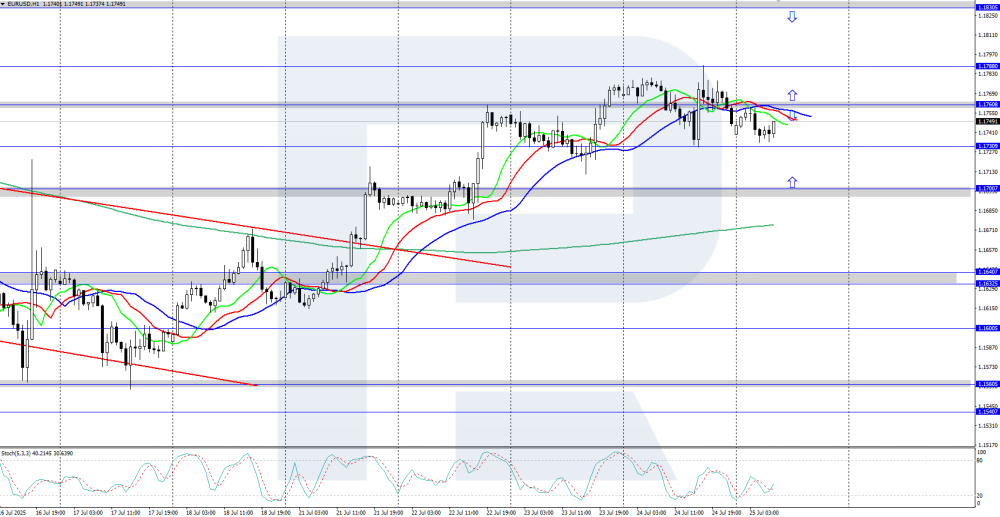

EURUSD declines after ECB decision The EURUSD rate corrected towards the 1.1730 area following the ECB's decision to keep interest rates unchanged. The market awaits the outcome of trade agreement negotiations between the US and the EU. Find out more in our analysis for 25 July 2025. EURUSD technical analysis On the H4 chart, EURUSD is undergoing a downward correction, falling this morning to the 1.1730 area, with further decline towards the 1.1700 support level possible. The daily trend for the pair remains upward, so after the correction ends, the rally may continue. The EURUSD pair corrected to the 1.1730 area following the ECB’s decision to leave rates unchanged. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

The Fed exposed! Azoria Capital demands transparency – what is next for XAUUSD Amid a lawsuit against the Federal Reserve and deteriorating US economic indicators, XAUUSD may test the 3,420 USD level. Discover more in our analysis for 25 July 2025. XAUUSD forecast: key trading points Azoria Capital filed a lawsuit against the US Federal Reserve US durable goods orders: previously at 16.4%, projected at -10.4% XAUUSD forecast for 25 July 2025: 3,420 Fundamental analysis Today’s XAUUSD analysis shows that gold is trading around 3,358 USD per ounce, pulling back after reaching the 3,431 USD resistance level earlier this week. Azoria Capital, a financial management company, has filed a lawsuit against the Federal Reserve, including Chairman Jerome Powell and other central bank officials. The claim argues that the Fed violates the 1976 federal law by holding closed meetings on interest rate decisions. Azoria Capital demands that all such meetings be made public starting next week. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index has entered a sideways channel The JP 225 stock index has formed a sideways channel within an overall uptrend. Today’s JP 225 forecast is positive. JP 225 forecast: key trading points Recent data: Japan’s core CPI came in at 3.3% in June Market impact: this signals slower price growth, which may positively affect the Japanese stock market Fundamental analysis Japan’s core Consumer Price Index (core CPI) for July 2025 stood at 3.3% year-on-year, below the forecast of 3.4% and the previous reading of 3.7%. Lower inflation reduces pressure on the Bank of Japan to tighten monetary policy. This creates a positive environment across most sectors. Consumer companies stand to benefit the most, as the risk of falling real incomes lessens. Technology and export-oriented firms also benefit, since weak inflation increases the likelihood of continued accommodative monetary policy. The financial sector, on the other hand, may be at a disadvantage because easing inflation reduces the odds of interest rate hikes, thus capping banks’ margin growth. Meanwhile, the construction and real estate segments may gain support amid expectations of continued low borrowing costs. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

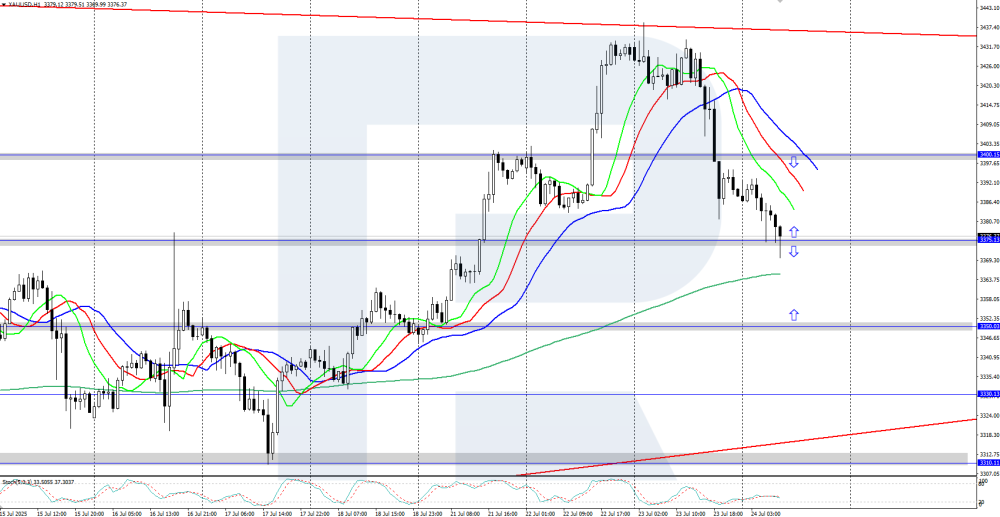

Gold (XAUUSD) falls below 3,400 USD amid correction XAUUSD prices reversed downwards and dropped below 3,400 USD amid optimism surrounding trade agreements between the US and its key partners. Discover more in our analysis for 24 July 2025. XAUUSD technical analysis XAUUSD quotes are in a downward correction, having fallen below 3,400 USD. Earlier this week, gold reversed from a local daily high at 3,438 USD. Once the correction is complete, the uptrend may resume. Gold entered a downward correction, slipping below 3,400 USD. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: index hits a new all-time high US 500 approached a resistance level and may enter a downward correction before resuming its upward movement. The forecast for US 500 today remains positive. US 500 forecast: key trading points Recent data: US Leading Economic Index (LEI) for June declined by 0.3% Market impact: This is a negative signal for equities, as the LEI consists of 10 components reflecting future economic activity Fundamental analysis The US Leading Economic Index (LEI) dropped by -0.3% in June, compared to expectations of -0.2% and a flat reading the previous month. The decline in the LEI serves as a warning of a potential slowdown in economic activity over the next 6–12 months. While the drop isn’t critical, it signals a weakening growth momentum in the US economy. This could limit risk appetite in the stock market and strengthen expectations of Federal Reserve rate cuts. The decline in the LEI, against already subdued expectations, supports a more cautious approach. In the short term, investors may rotate from cyclical into defensive sectors. If signs of slowing growth persist, this could increase the likelihood of more accommodative monetary policy, potentially supporting the tech sector. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBPUSD: the pair surged above 1.3500 The GBPUSD rate climbed above 1.3500, as markets anticipate the signing of a free trade agreement between the UK and India. Full details in our analysis for 23 July 2025. GBPUSD technical analysis On the H4 chart, GBPUSD shows a clear upward momentum, having bounced from daily support at 1.3370. The Alligator indicator is pointing upwards and rising steadily, suggesting the uptrend may continue. GBPUSD confidently rose above 1.3500. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the correction has ended, further growth is expected The DE 40 stock index is poised to resume upward movement. Today’s DE 40 forecast is positive. DE 40 forecast: key trading points Recent data: Germany’s Producer Price Index (PPI) for June came in at 0.1% Market impact: the value is neutral for the German stock market and the DE 40 index Fundamental analysis Germany’s PPI for June 2025 showed a 0.1% increase, matching forecasts and improving from the previous month’s -0.2%. A moderate rise in producer prices indicates stability in the manufacturing sector and the absence of sharp price surges, which reduces risks for corporate profitability within the index. This supports investor confidence in sectors such as industrials, engineering, and chemicals, as their cost base is not significantly affected by inflationary shocks. Overall, the PPI data confirms expectations of a stable economic backdrop without abrupt inflationary spikes, which supports a positive outlook for the German stock market in both the short and medium term. Investors may expect a continued moderate rise in shares of leading DE 40 companies, while maintaining a balance between risks and opportunities. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

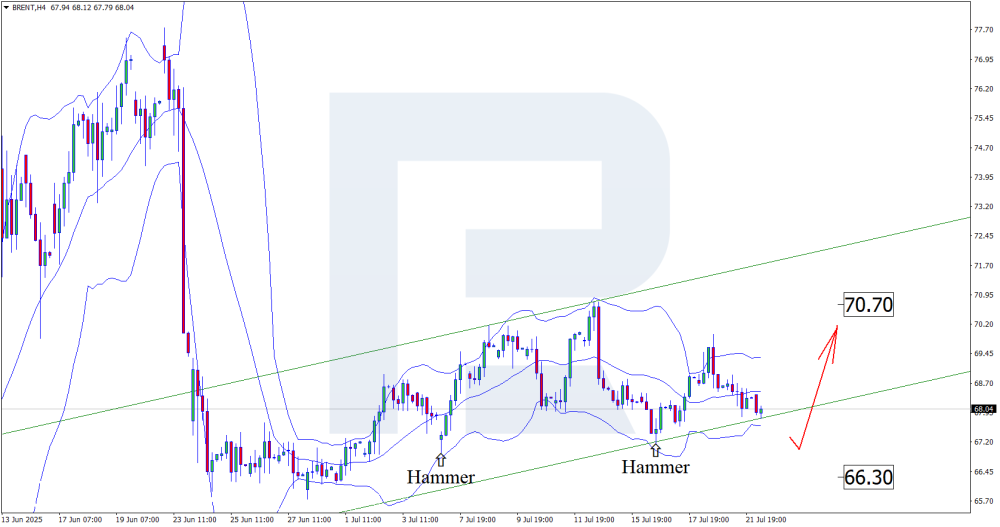

Brent prices on the edge: OPEC+ floods the market Brent quotes may regain ground and test the resistance level around the 70.70 USD mark. Discover more in our analysis for 22 July 2025. Brent technical analysis On the H4 chart, Brent prices tested the lower Bollinger Band and formed a Hammer reversal pattern. Having partially fulfilled the signal, quotes are now undergoing a correction. The Brent price forecast for 22 July 2025 suggests a growth target at 70.70 USD. A breakout above the resistance level would open the door to a stronger upward wave. Brent prices are testing the lower boundary of the ascending channel and may be gearing up for another bullish wave amid geopolitical tensions. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDCAD in a Triangle – a breakout below 1.3665 could open the way to new lows The USDCAD rate remains under bearish pressure amid expectations of a Federal Reserve rate cut, currently standing at 1.3717. Discover more in our analysis for 21 July 2025. USDCAD technical analysis The USDCAD rate remains within a descending channel, with quotes consolidating below the 1.3755 resistance level, suggesting ongoing bearish pressure. Today’s USDCAD forecast points to a potential decline towards the lower boundary of the Triangle pattern, targeting the 1.3605 area. Despite short-term support for the US dollar, expectations of a Fed rate cut increase the risk of further weakening in the medium term. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD dipped to the 1.1600 area; will the decline continue? The EURUSD rate has fallen to the 1.1600 area as part of a downward correction and in anticipation of new tariffs on EU goods. Find out more in our analysis for 21 July 2025. EURUSD forecast: key trading points Market focus: this week, the ECB interest rate decision is in the spotlight Current trend: correcting downwards EURUSD forecast for 21 July 2025: 1.1700 or 1.1600 Fundamental analysis The EURUSD pair is declining amid a moderate recovery in the US dollar. The latter strengthens as expectations for a Federal Reserve rate cut at the upcoming meeting decrease following US inflation data and President Trump’s statement that he will not dismiss Federal Reserve Chairman Jerome Powell. Markets remain focused on the new trade tariffs, maintaining some optimism that a US-EU deal might still be reached before 1 August. President Trump has announced 30% tariffs on imports from the European Union starting next month, but later expressed willingness to negotiate. In response, the EU reaffirmed its commitment to reaching a trade agreement. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY in the eye of the storm, yen loses balance As Japan awaits the upper house elections, the USDJPY pair may continue its upward movement towards 149.60. Find out more in our analysis for 18 July 2025. USDJPY forecast: key trading points Nationwide core Consumer Price Index in Japan: previously at -3.7%, currently at -3.3% Yen awaits upper house elections USDJPY forecast for 18 July 2025: 149.60 Fundamental analysis The USDJPY fundamental analysis for 18 July 2025 shows that the pair remains in an upward channel, having consolidated near the 148.60 level. Strong macroeconomic data from the US and political uncertainty in Japan continue to pressure the yen. US retail sales reports and a drop in jobless claims further support the dollar – both as a reflection of domestic economic resilience and as a safe-haven asset. Expectations for a near-term Federal Reserve rate cut have weakened. On the Japanese side, the market is pricing in risks related to the upcoming upper house parliamentary elections. A decline in the core CPI and growing political pressure on the current administration are adding to USDJPY volatility. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

AUDUSD rises, but closes the week under pressure The AUDUSD pair climbed to 0.6505. A sharp rally in iron ore prices has become a key support factor. Discover more in our analysis for 18 July 2025. AUDUSD technical analysis On the H4 chart, the AUDUSD pair is testing local resistance at 0.6510. The upward move began from the 0.6453 low, where the price found support after a sell-off. The AUDUSD pair has stabilised and may resume gains if the market focuses on supportive factors. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) in consolidation: safe-haven assets out of favour for now Gold (XAUUSD) prices are hovering around 3,340 USD. Interest in the US dollar continues to rise. Find more details in our analysis for 17 July 2025. XAUUSD forecast: key trading points Gold (XAUUSD) quotes rose in response to uncertainty and fell once doubt was removed A rebound in the US dollar reduces gold's appeal for investors XAUUSD forecast for 17 July 2025: 3,360 Fundamental analysis Gold (XAUUSD) prices retreated to 3,340 USD per ounce, reversing the previous session’s gains. The metal came under pressure as the US dollar rebounded following reduced uncertainty surrounding the Federal Reserve Chairman: rumours about Jerome Powell’s possible dismissal were not confirmed. Donald Trump called such a move unlikely, although he again expressed dissatisfaction with current interest rate levels. Another factor was the neutral US Producer Price Index (PPI) data for June. The reading remained unchanged, signalling stable wholesale prices and easing concerns about strong inflationary pressure from tariffs. These new figures contrast with the previously recorded rise in consumer inflation. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Fundamental storm, waiting for EURUSD reaction Amid strengthening USD, the EURUSD pair may decline towards 1.1555. Discover more in our analysis for 17 July 2025. EURUSD technical analysis On the H4 chart, the EURUSD pair formed a Harami reversal pattern near the lower Bollinger Band. At this stage, the pair may continue its corrective wave in response to this signal. Given that the price remains within a descending channel, a further decline towards the nearest support at 1.1555 can be expected. Today’s EURUSD forecast favours the USD. Combined with EURUSD technical analysis, stronger US economic indicators suggest a likely decline towards the 1.1555 support level after a corrective move. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

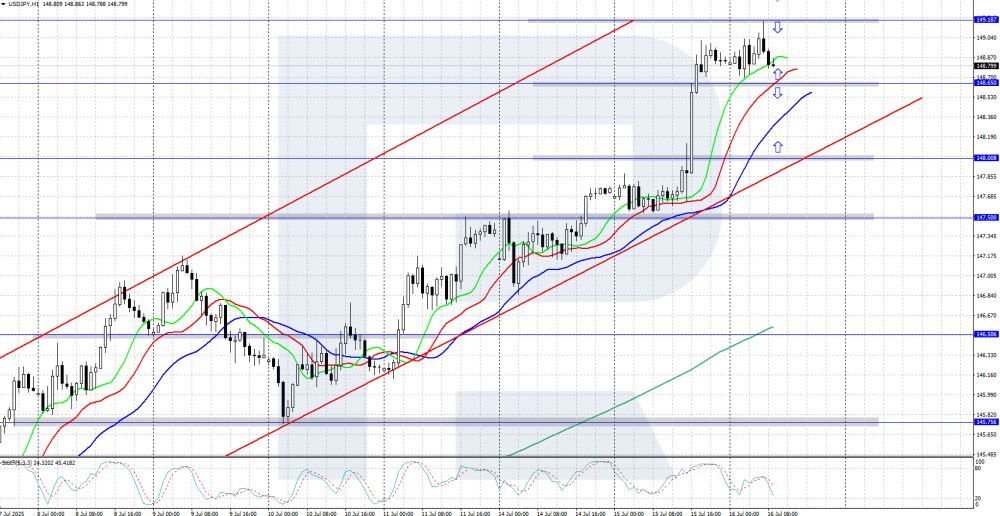

USDJPY jumps above 149.00 on US inflation data The USDJPY rate climbed into the 149.00 area as the dollar strengthened moderately after the release of US consumer inflation statistics. Find out more in our analysis for 16 July 2025. USDJPY technical analysis On the H4 chart, the USDJPY pair continues to climb confidently, hitting an intraday high at 149.18. The Alligator indicator is trending upwards, confirming the current bullish momentum. However, the Stochastic indicator signals overbought conditions, which may trigger a corrective pullback. The USDJPY pair climbed to the 149.00 area during the ongoing uptrend. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Rebound or failure? GBPUSD hangs in the balance In anticipation of data from the UK and the US, GBPUSD quotes may reverse and head towards the 1.3500 mark. Discover more in our analysis for 16 July 2025. GBPUSD forecast: key trading points UK Consumer Price Index (CPI): previously at 3.4%, projected at 3.4% US Producer Price Index (PPI): previously at 0.1%, projected at 0.2% GBPUSD forecast for 16 July 2025: 1.3500 Fundamental analysis The GBPUSD forecast for 16 July 2025 takes into account that the pair remains in a correction phase and is currently near the support level of the ascending channel. The UK Consumer Price Index reflects changes in the cost of goods and services for consumers and helps assess consumer behaviour trends and potential stagnation in the economy. Generally, if the CPI exceeds expectations, it has a positive impact on the national currency. The forecast for 16 July 2025 suggests the CPI for June 2025 may remain at 3.4%. Any increase would support the British pound. The US PPI is expected to rise to 0.2%, up from 0.1% previously. However, the increase is modest, and the actual figure may differ significantly from the forecast. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY rises to 147.65: tariffs and data weigh on the yen The USDJPY pair continues to climb as the market reacts to trade-related risks. Find more details in our analysis for 15 July 2025. USDJPY forecast: key trading points The USDJPY pair continues to rise, hitting fresh two-month highs Further details on tariffs and Japanese economic data will provide more insight into yen movements USDJPY forecast for 15 July 2025: 148.00 Fundamental analysis On Tuesday, the USDJPY rate rose to 147.65, marking a new two-month high, as trade risks from new US measures persist. Washington plans to impose 25% tariffs on Japanese goods starting 1 August, while Tokyo has yet to announce any retaliatory action. Negotiations between the two parties have effectively stalled. One Japanese official warned of potential economic consequences if the tariffs are enforced. Investors now await upcoming trade and inflation data from Japan, which will help assess the scale of pressure on the domestic economy. In addition, market focus also turns to the US inflation report, which could influence the Federal Reserve's future rate decisions. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent hovers at key support – market awaits a reversal Brent quotes remain under pressure due to fears of a global economic slowdown, currently standing at 68.43 USD. Discover more in our analysis for 15 July 2025. Brent technical analysis Brent quotes remain within the ascending channel despite a local decline. Prices have fallen to the channel’s lower boundary near the 68.25 USD support level. Reduced drilling capacity in the US and potential underinvestment in the sector provide long-term support for oil prices Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD under pressure: Trump hits markets with new tariffs The US tariffs on imports from the EU are weighing on the EURUSD rate, pushing it lower. The price currently stands at 1.1666. Discover more in our analysis for 14 July 2025. EURUSD forecast: key trading points Trump’s trade initiative escalates global trade tensions Markets await US inflation data due on Tuesday Traders expect the Federal Reserve to cut rates by around 50 basis points by the end of the year EURUSD forecast for 14 July 2025: 1.1825 Fundamental analysis The EURUSD rate continues to decline on Monday, consolidating below the key support level at 1.1685. The pair is under pressure from a stronger US dollar amid new statements from US President Donald Trump on tariff policy. Trump announced a 30% tariff on imports from the European Union and Mexico, effective from 1 August. This move adds to the already tense global trade environment. Nevertheless, investor reaction remains restrained – the market increasingly ignores such threats, as their actual impact on the US dollar has been limited. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold (XAUUSD) dropped to the 3,350 USD area, but the rally may continue While gold (XAUUSD) prices declined to the 3,350 USD area amid a downward correction, the trend remains bullish, and growth may resume. Find out more in our analysis for 14 July 2025. XAUUSD technical analysis XAUUSD quotes are undergoing a downward correction, falling to the 3,350 USD support level. Last week, gold reversed to the upside, breaking out of the downward price channel. After the correction is complete, the upward movement could resume. Gold has pulled back to the 3,350 USD support level amid a downward correction. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

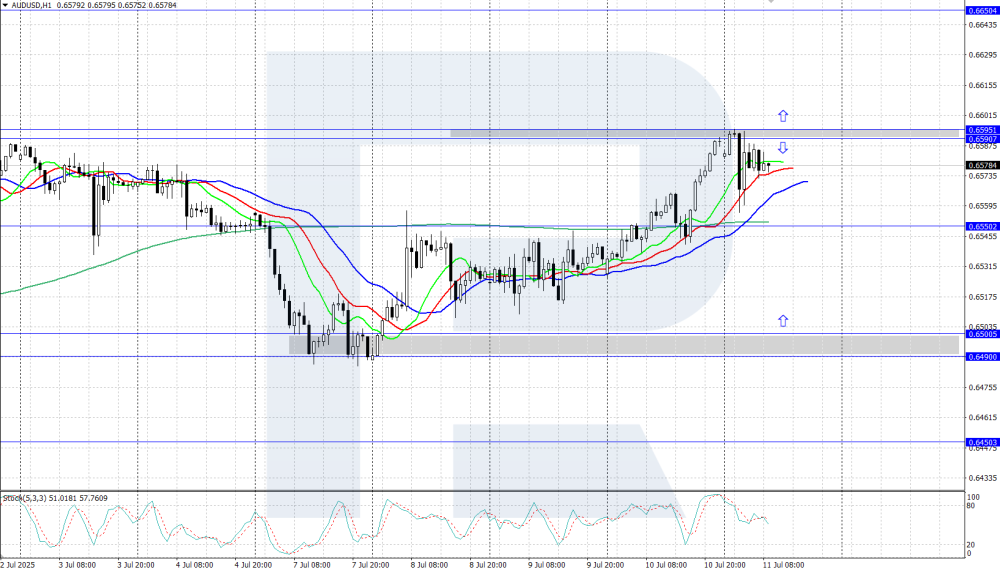

AUDUSD: the pair has updated its yearly high AUDUSD is rising, setting a new yearly high today at 1.6595. Details – in our analysis for 11 July 2025. AUDUSD technical analysis AUDUSD is showing confident growth within its upward trend, currently trading near 0.6590. The Alligator indicator confirms the bullish price movement momentum. Key resistance is at the yearly high of 0.6595. AUDUSD set a new yearly high at 1.6595. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) at a stabilization point: many risks, but no one is afraid Gold (XAUUSD) price consolidates at 3,333 USD. Trump’s trade policy worries the market, but there is no panic. Details – in our analysis for 11 July 2025. XAUUSD forecast: key trading points Gold (XAUUSD) price has changed little over the week The market is focused on trade risks but is not yet ready to re-evaluate them XAUUSD forecast for 11 July 2025: 3,345 Fundamental analysis Gold (XAUUSD) price remains stable near 3,333 USD on Friday. Overall, the precious metal attempts to rise for the third day in a row. Market focus remains on demand for safe-haven assets amid escalating trade tensions. President Donald Trump announced the introduction of a 35% tariff on imports from Canada starting 1 August and spoke about plans to introduce large-scale tariffs of 15-20% for most other trading partners. Previously, there were threats against Brazil and proposals to impose tariffs on copper, semiconductors, and pharmaceutical products. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 411 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

XAUUSD rises for the second day in a row – is a new upward wave starting? The XAUUSD price is forming a Triangle pattern, reflecting consolidation before a potential breakout. Current quote – 3,322 USD. Details – in our analysis for 10 July 2025. XAUUSD technical analysis XAUUSD quotes are strengthening after rebounding from the lower boundary of the Triangle pattern. Despite seller pressure in the first half of the week, the price is recovering, remaining above the key support level at 3,285. Weakness in the US dollar, expectations of rate cuts, and political pressure on the Fed create a favourable environment for further gold growth. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team