All Activity

- Past hour

-

tbs8877 reacted to a post in a topic:

orderflow-trader.com

tbs8877 reacted to a post in a topic:

orderflow-trader.com

-

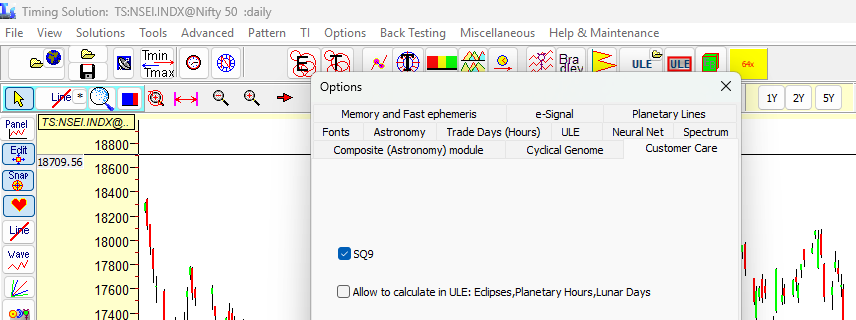

Thank you. I am not a user but I tested your solution and it works. SQ9 appears under Tools and not TI. Hope that was what Sunny was looking for.

-

VHailors joined the community

-

⭐ RichardGere reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

⭐ RichardGere reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

-

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

gfinance replied to TickHunter's topic in Ninja Trader 8

You’re a kind soul. Thank you -

gfinance reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

gfinance reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

- Today

-

Kermit 1981 reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

Kermit 1981 reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

-

⭐ QuBit reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

⭐ QuBit reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

-

https://t.me/+Qe4jaseqPG05ZTRh

-

I believe John Snow at the top of the threads carries it, I have not seen free versions with out issues, only paid ones with up dates!

-

⭐ QuBit reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

⭐ QuBit reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

-

Hi all, does anyone have the manual for this? I purchased from an educator here and while it works, I can’t seem to figure out how to get followers to trade via orders and not executions. thanks in advance

-

Hi sunny_16977, In options Menu go to Timing Solution options-->> Customer care And enable SQ9. After this in tools menu square of nine is available.

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

GBPUSD under pressure: US labour market data crushes bulls’ hopes The GBPUSD rate is falling amid US dollar strength following robust US labour market data. The price currently stands at 1.3504. Find out more in our analysis for 4 June 2025. GBPUSD forecast: key trading points US job openings rose to 7.391 million in April Robust JOLTS data boosted support for the USD The ADP private sector employment report is due today GBPUSD forecast for 4 June 2025: 1.3450 and 1.3600 Fundamental analysis The GBPUSD rate is declining for the second consecutive session. Sellers re-entered the market after testing the key resistance level at 1.3565. On the daily chart, a Double Top reversal pattern appears to be forming, increasing the likelihood of a move down towards the next target at 1.3445. The US dollar gained support from the latest labour market data. On Tuesday, the JOLTS job openings report showed an unexpected rise to 7.391 million in April, well above the consensus forecast of 7.167 million. This indicates continued resilience of the US labour market and reinforces expectations for a more hawkish Federal Reserve stance, putting pressure on the GBPUSD rate. Investor focus now shifts to the upcoming US data. The ADP private sector employment report is due today, followed by the key May employment data on Friday, which could heavily influence the pair’s next move. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 253 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

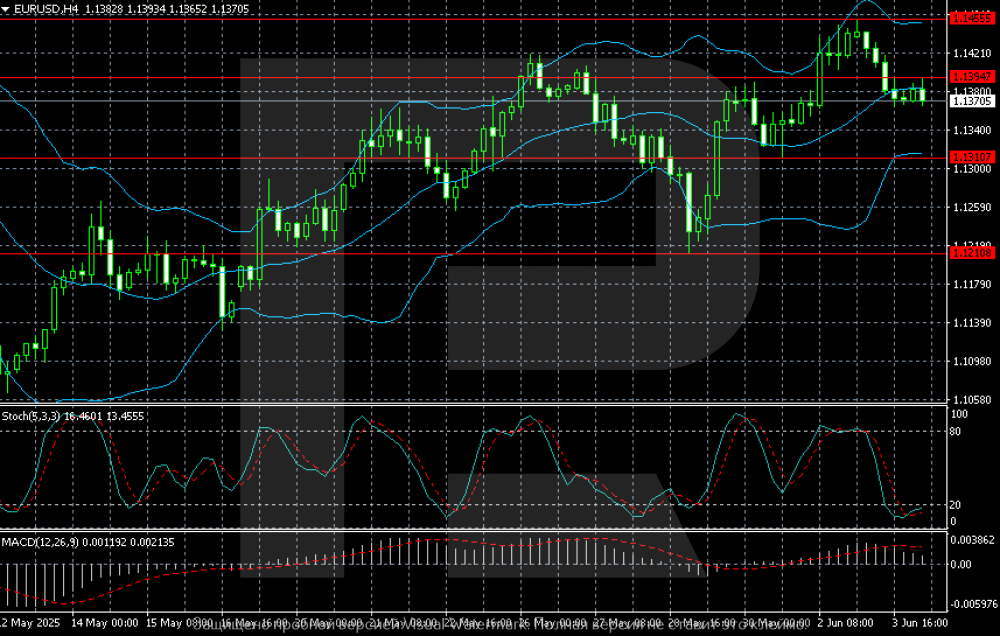

EURUSD halts correction: key data ahead The EURUSD pair is hovering around 1.1369 on Wednesday as markets await US labour market data. Find more details in our analysis for 4 June 2025. EURUSD technical analysis On the H4 chart, the EURUSD pair is hovering around the key support level of 1.1370. If this level does not break, buyers could return with a target at 1.1455 and then 1.1500. After a recent peak, the EURUSD pair declined, awaiting a catalyst from US labour market data. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

Mr_Wall replied to TickHunter's topic in Ninja Trader 8

When you load ultimate scalper indicator, you can scroll down the options and see what version you have running. I have real old version, but if you are running a newer version, that info might not be shown. -

⭐ option trader reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

⭐ option trader reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

-

shyan reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

shyan reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

-

ALE_00_ reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

ALE_00_ reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

-

Discover how Forex VPS Hosting enhances trading efficiency with low latency, 24/7 uptime, and uninterrupted order execution. This guide explains the benefits of using Forex VPS services for expert advisors, scalping, and high-frequency trading, especially for MT4/MT5 platforms. Ideal for serious traders aiming for speed and stability.

-

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

thanos replied to TickHunter's topic in Ninja Trader 8

From Clubbing: https://www.sendspace.com/file/zj0ii1 -

May i know where to get [educated Ninja]?

-

I have used a few brokers like HFM and XM. They both work fine for me. I like that they are regulated and easy to use. HFM has more promotions, while XM has better education tools. If you live in Australia, you should check if they accept your location first.

-

Ben6985 joined the community

-

I used it, it's not locked. Works on educated Ninja

- Yesterday

-

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

AllIn replied to TickHunter's topic in Ninja Trader 8

How did you go about figuring that out? -

new is latest version V2 proedgetrading.com

Ninja_On_The_Roof replied to david's topic in Ninja Trader 8

I looked at it. For the bottom indicator, you can also use the MFIProZone indicator. Essentially, the same. https://limewire.com/d/P1jt1#Xf0YsDSv5N -

new is latest version V2 proedgetrading.com

Ninja_On_The_Roof replied to david's topic in Ninja Trader 8

Need original files for me to educate this. Not one that has been assigned or locked up with someone's ID machine. -

Version 1.1.3 is out already. Does anyone have it?

-

@apmoo@kimsam

-

Si vous obtenez une version crackée de ninjatrader 8, cela fonctionnera très bien dessus.

-

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

Karmaloop replied to TickHunter's topic in Ninja Trader 8

I agree with this and have made a personal commitment to do so. -

Historical Quotes Downloader version 2.32.5

⭐ Atomo12345 replied to ⭐ Atomo12345's topic in Trading Platforms

New link: https://e.pcloud.link/publink/show?code=XZxS1tZjDD2o1bAcV0kAj5CesNvgY5CgKOV -

Historical Quotes Downloader version 2.32.5

samar replied to ⭐ Atomo12345's topic in Trading Platforms

Link expired!!! -

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 3rd June 2025.[/b] [b]Global Markets Under Pressure: Japanese Outflows, China’s Slump, and Trade War Fallout Shake Sentiment.[/b] Global markets are facing renewed uncertainty as a combination of trade tensions, weak economic data, and policy recalibrations fuel volatility across equities, currencies, and bonds. Japan: Historic Fund Outflows and Rebalancing Pressures Japanese equity funds witnessed their largest weekly outflows in nearly 18 years, with $7.49 billion pulled in the week to May 28, according to LSEG Lipper data. This marked the heaviest withdrawal since July 2007. Analysts attribute the exodus to profit-taking after April’s market dip and May’s rebound, along with cautious sentiment around forward earnings. Domestic investors were the primary drivers, accounting for $7.55 billion of the outflows, while foreign funds saw a modest $59 million in inflows. Daisuke Motori of Morningstar Japan noted this pattern of ‘buying the dip and selling the rally’ has repeated in recent months. Rebalancing by large institutional investors such as pension funds and life insurers likely added to the sell-off. A strengthening yen—up 10% against the dollar year-to-date—is also clouding Japan’s export outlook. LSEG data shows analysts have downgraded forward 12-month earnings forecasts by 1.8% in the past 30 days. Meanwhile, Bank of Japan Governor Kazuo Ueda reaffirmed the central bank’s commitment to tapering its bond-buying and cautiously normalizing policy, even as uncertainty looms large. While inflation reached 4.6% in April, underlying inflation remains below the BOJ’s 2% target. The next rate-setting meeting on June 16–17 is expected to review the bond tapering plan extending into fiscal 2026. Ueda also flagged concerns about US tariffs and their impact on Japan’s economy, warning of potential hits to exports, corporate profits, and wage negotiations heading into winter. Australia: Tariff Warnings and Rate Cuts The Reserve Bank of Australia (RBA) is also on high alert. Assistant Governor Sarah Hunter warned that higher US tariffs could depress global trade, investment, and employment. While the precise effects remain unclear due to policy unpredictability, Hunter confirmed that these downside risks were a key factor in the RBA’s recent rate cut to a two-year low of 3.85%. The central bank remains open to further easing, particularly if global trade deteriorates. Interestingly, the RBA sees the tariff pressure as disinflationary for Australia, given cheaper imported goods as Chinese suppliers redirect exports. Headline inflation remained at 2.4% in Q1, with core inflation easing back into the target band for the first time since 2021. China: Manufacturing Slumps Despite Tariff Truce In China, the manufacturing sector endured its steepest decline since September 2022, according to the Caixin/S&P Global PMI, which fell to 48.3 in May, well below the 50 threshold signalling contraction. The reading sharply diverged from the official PMI and surprised analysts, suggesting that smaller and medium-sized exporters, particularly in the private sector, are suffering disproportionately despite the recent US-China tariff truce. Economists attributed the discrepancy to timing differences in data collection and methodology. Nonetheless, the Caixin results point to intensifying economic pressure, with falling export orders and production weighing on sentiment. The trade war’s ripple effect extended to other Asian economies, with Vietnam, Indonesia, Taiwan, Japan, and South Korea all reporting declines in manufacturing output. Currency Markets: Dollar Sinks on Trade War Woes Currency markets reflected investor unease as the US dollar hit a six-week low on Tuesday amid signs of fragility in the US economy. The dollar index dropped to 98.58—its lowest level since late April—before partially rebounding. Rodrigo Catril, senior FX strategist at National Australia Bank, said, 'Trade tensions are not really improving… we’ve seen the dollar getting hammered widely.’ The Aussie and Kiwi outperformed, with New Zealand’s dollar hitting a year-to-date high of $0.6054 before retreating. The greenback weakened following a third straight month of US manufacturing contraction, while upcoming factory orders and jobs data may shed further light on the economic toll of ongoing tariff battles. The euro briefly touched a six-week high of $1.1454 before retreating, while investors also await this week’s European Central Bank policy decision. Adding further pressure, US tariffs on steel and aluminium are set to double to 50% this week, even as the Trump administration pushes for tougher trade negotiations globally. The global economy is showing renewed signs of strain under the weight of trade uncertainty, export weakness, and policy recalibrations. While central banks across Japan, Australia, and China remain cautious, markets are increasingly sensitive to any signs of economic softness or policy missteps. As the BOJ, ECB, and US data dominate the agenda in the coming days, traders will be watching closely for signs of stabilization—or deeper fragmentation—in an already fragile global landscape. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.