Date: 28th November 2025.

Three Critical December Events That Will Shape Gold and the US Dollar.

November has been one of the few months where Gold and the US Dollar have simultaneously risen in value. Over the past 30 days Gold has risen 4.00% and the US Dollar by 1.15%. However, since 1 November the US Dollar has outperformed the precious metal.

The two instruments rarely rise simultaneously in value due to the inverse correlation. However, the US shutdown has made it possible for both assets to advance. Traders are now reassessing the outlook for both assets over the next one to two months, noting that both are unlikely to keep rising. Economists tend to support that one of the two tends to give way for the other to continue increasing.

The performance of the US Dollar Index and Gold will almost entirely depend on the next three days.

US Dollar Index 12-Hour Chart

10 December

On 10 December, the Federal Reserve will make its decision on interest rates for the last time in 2025. The decision will be made three days after the release of the US Core PCE Price Index, therefore, their decision will also depend on this release. However, the US Core PCE Price Index has not seen any shocking releases over the past few months.

Currently, economists and investors are almost certain that the Federal Reserve will cut interest rates by 0.25%. According to the Chicago exchange, almost 80% of market participants believe the Fed will cut interest rates. The exchange also notes that 24% of traders believe the Fed will cut again in January 2026.

If the Federal Reserve cuts rates in December, Gold is likely to gain further, particularly if FOMC members point to economic or employment weakness. Simultaneously, the US Dollar Index may decline. Due to the rate adjustment already, economists and large institutions will largely be focused primarily on commentary about future rate adjustments. This is likely to be the biggest price driver, but the upcoming NFP figures may change how the Fed views interest rates in the first quarter of 2026.

16 December

This is likely to be the most volatile day for the US Dollar Index, Gold and US indices. Due to the government shutdown, the previous NFP data had not been made public. On 16 December, the US will release the NFP Employment Change for both October and November. The release is a rare event where the US releases two months worth of data at once.

If the NFP report shows rising unemployment and weak job creation, the Federal Reserve may consider a larger rate cut. This could potentially include a 50-basis-point cut in January 2025. If the data is weak but the Fed does not opt for a larger cut, it will likely move towards smaller but more frequent rate reductions.

Another reason why 16 December is likely to be the most volatile day of the year is that, in addition to the NFP releases, the US will also publish its PMI data and ADP Weekly Employment Change. Therefore, investors will have plenty of data to analyse and digest. The most impactful news will be the NFP release, Unemployment Rate, PMI reports, Average Salary Earnings and then the ADP Weekly Employment Change.

18 December

Only two days after the NFP release, markets are likely still adjusting their portfolios to reflect the new economic outlook, meaning volatility may remain elevated. However, the US is also set to publish its latest Consumer Price Index. Which will provide fresh insight into affordability, demand, and the Federal Reserve’s next steps.

If inflation reads lower than expectations or in line with expectations, Gold could potentially witness higher demand. Whereas, higher inflation paired with a cautious Fed would support the US Dollar.

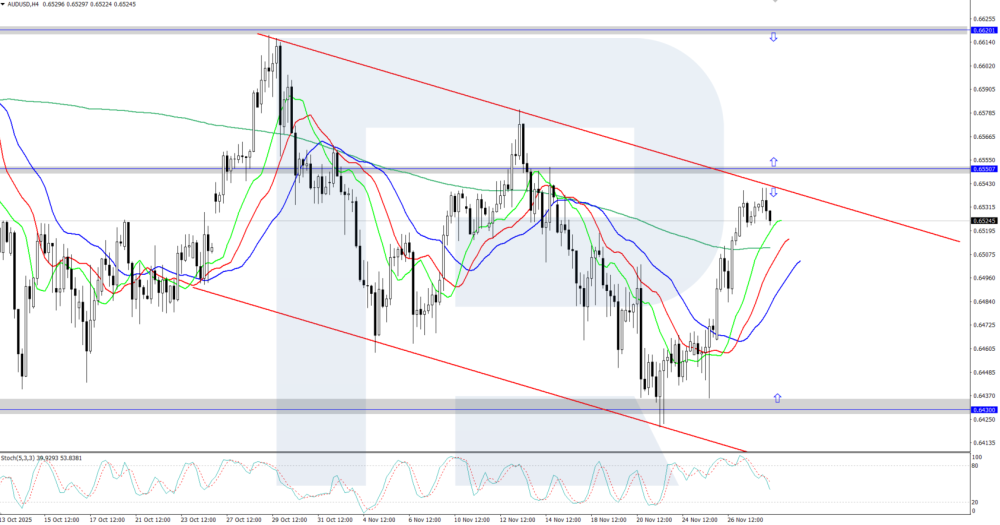

Gold (XAUUSD)

If the new releases support a dovish Federal Reserve for the first quarter of 2026, the price of Gold may potentially rise.

Possible targets include price ranges between: $4,381.30 and $4,555.00

HFM-Gold Daily Chart

US Dollar Index

On the other hand, if the Federal Reserve is likely to opt for a prolonged pause due to higher inflation data and strong employment figures, the US Dollar potentially may rise instead of Gold.

In that case, Gold may potentially fall to prices between $3,831.00 and $3,605.50

Key Takeaway Points:

Gold and the US Dollar rose together in November, but both are unlikely to continue climbing in the coming months.

Markets expect a Fed rate cut on 10 December, with guidance on future policy being the main focus.

16 December could be highly volatile, with two months of NFP data released alongside major economic reports.

Weak NFP figures may push the Fed toward larger or more frequent cuts, supporting Gold and pressuring the Dollar.

The 18 DecemberCPI release will guide early-2026 expectations and determine whether Gold or the Dollar gains momentum.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.