⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

Luke SteelWolf reacted to a post in a topic:

Ninza stuffs - AIO

Luke SteelWolf reacted to a post in a topic:

Ninza stuffs - AIO

-

@redux@kimsam@apmoo@N9T Can you please try to edu these? Thank you in advance

-

shyan reacted to a post in a topic:

Ninza stuffs - AIO

shyan reacted to a post in a topic:

Ninza stuffs - AIO

-

shyan reacted to a post in a topic:

Ninza stuffs - AIO

shyan reacted to a post in a topic:

Ninza stuffs - AIO

-

@shyan Yes I use Predator to test just about everything I find compatible. Lets keep all predatot discussions in the Predator topic. This is the version I use:

-

⭐ QuBit reacted to a post in a topic:

Windows Server 2025 In VMWare Series

⭐ QuBit reacted to a post in a topic:

Windows Server 2025 In VMWare Series

-

are you using predator to automate ninza indicator? is this version?

-

@N9T, @Luke SteelWolfsent you a DM yesterday, If you get a chance, please read.

- Today

-

Will have a closer look at the latest Resource file this weekend if I find some time.

-

kimsam reacted to a post in a topic:

twst.store

kimsam reacted to a post in a topic:

twst.store

-

Mahesh reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

Mahesh reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

-

So no one on this site has login credentials for the AMI website and can download the latest to share?

-

In fairness to @N9T, the Ninza add-ons that He provided with his AIO are some that He may have seen some value. Although We all wish We had the single resource file for old and new ninza products, perhaps patience and collaboration is the key. I don't know if @N9T, @redux, @kimsam, and @apmoo are in communication, but WE can hope. Anyway, the ones provide in the AIO download are worth studying. Use PredatorX, StrategyBuilder, Captain Optimus, or whatever you chose to help you see if there is value in your trading. For example: https://workupload.com/file/vFbsChu2sKC

-

-

ynr reacted to a post in a topic:

quantvue.io

ynr reacted to a post in a topic:

quantvue.io

-

AllIn reacted to a post in a topic:

ninza fibonacci mastery needs to educate

AllIn reacted to a post in a topic:

ninza fibonacci mastery needs to educate

-

Does anyone have the new FusionBot or the ATM market analyzer? I know Rhoit has it available for sale.

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US Tech forecast: the index enters a sideways trend The US Tech index failed to renew its all-time high and has moved into a sideways range. The US Tech forecast for next week is positive. US Tech forecast: key trading points Recent data: the US core PCE price index increased to 2.8% year-on-year Market impact: the data has a moderately positive effect on the technology sector Fundamental analysis The core PCE price index came in at 2.8% year-on-year, fully in line with market expectations, but accelerated compared with the previous reading of 2.7%. Since the PCE is the Federal Reserve’s key gauge of inflation pressure, the fact that inflation has picked up relative to the prior month is perceived as a moderately negative signal for equities. It increases the likelihood of a more cautious approach to monetary easing and supports the scenario of interest rates remaining relatively high for longer. For the US equity market as a whole, the release can be described as neutral in terms of the headline figure, but slightly negative in trend direction, as an acceleration in core inflation, even by 0.1 percentage point, reduces investor confidence in a rapid decline in borrowing costs. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 403 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

File has been banned. Is this automated strategy any good?

-

⭐ FFRT reacted to a post in a topic:

Comprehensive Market Profile Seminar by Alexander Trading

⭐ FFRT reacted to a post in a topic:

Comprehensive Market Profile Seminar by Alexander Trading

-

bump

-

Anyone have Zenith-X and the updated Imbalance Volume Sensor (no tick replay needed)?

-

Ninja; Get well soon. : )

-

Hi, first of all, I am very sorry to hear about your illness. I hope you can find a cure and win this battle! I wanted to reply to what you wrote: I respect your opinion, but I believed that creating a single resource file for all ninZa products would be the ultimate solution to avoid issues, simply updating it as new ones are added. In your list, I already see some excellent indicators that are also present in the package I shared; if I may, I would suggest adding these as well: VWMA FLux Quantum Vol- Delta Infinity Algo Engine William Fractal Pro Sonarlike Iceberg Finder Dwin Reversal Super JumpBoo$t Order Flow Presentation v2 Fibonacci Mistery Imbalance Profile Lidar Multi-timeframe fu$ion AAA - Trend Sync ATR - TradeShield In my opinion, these are excellent. I am also attaching the package I mentioned in another thread, but some of yours will need to be added as they are missing from it. Please take a look if you like. https://workupload.com/file/9C9Vxs5N9tS Thank you, and above all, I wish you the best!

-

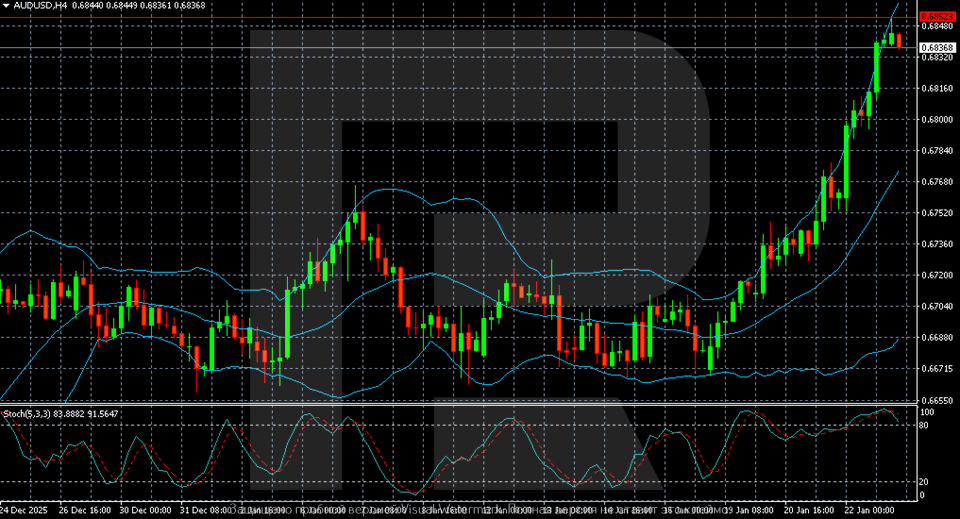

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

AUDUSD at a 16-month high: the rally is not stopping yet The AUDUSD pair rose to 0.6836, with the Aussie supported by solid domestic data. Discover more in our analysis for 23 January 2026. AUDUSD technical analysis The AUDUSD H4 chart shows a pronounced upward momentum. After an extended consolidation in the 0.6670–0.6720 range, the pair began to accelerate upwards in the second half of the week. Buyers are consistently reaching new local highs, while the price structure is forming a sequence of higher lows and higher highs. The AUDUSD pair continues to rise and shows no signs of slowing. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

In my own trading with hfm I survived only after I capped risk at 1% per idea and cut position size when my equity curve dipped. The edge is in staying alive, not swinging big

-

@ngatho254 Is the OFT8 educated? Can you share please?

-

Put it simply, looking for the holy grail, an indicator that will make you wealthy and be sold to you for a few dollars. Irony.

-

Good morning guys, so do you have any updates on this? @N9T @kimsam 💪 Based on this comment and the lack of a response, I assume you were referring to what we are discussing here. Great! If anyone thinks this is too complicated, it's no problem at all: just say so and we can find a solution together. Perhaps we could just add a specific few, because I believe there are some important products in that package that could really make a difference, and it would be fantastic to have them working alongside the others. Just my humble opinion, of course! Let me know what you think. Thanks as always!

-

I do think it is human nature. We keep lifting stones, in search for new things. It is an endless cycle. Nothing is wrong with that. It might just be counter productive since to actually see the true results from an indicator, a strategy, a bot, one must spend a decent amount of time studying it, learning it, plugging in the right numbers, the right time frames and so on... Reality is, most would get excited seeing a new indicator. Jump on it. Install it. Try it for a day or two. A week long perhaps. All with negative profits right off the bat. Then quickly enough, say..Ahh, this one aint good. Next to the next. The cycle repeats itself.🤗

-

Exactly this. That's why I only spend time on things that I may find useful.