All Activity

- Past hour

- Yesterday

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

Crabylawliet joined the community

-

⭐ RichardGere reacted to a post in a topic:

How to Spot and Capitalize on Impulse Waves

⭐ RichardGere reacted to a post in a topic:

How to Spot and Capitalize on Impulse Waves

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

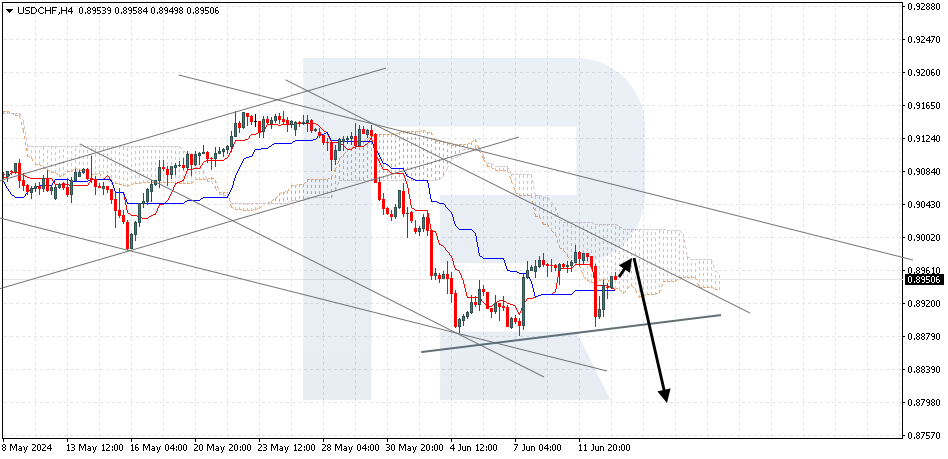

Ichimoku Cloud Analysis 13.06.2024 (GBPUSD, XAUUSD, USDCHF) GBPUSD, “Great Britain Pound vs US Dollar” GBPUSD is correcting after rebounding from the upper boundary of the bullish channel. The pair is moving above the Ichimoku Cloud, suggesting an uptrend. A test of the Cloud’s lower boundary at 1.2745 is expected, followed by a rise to 1.2925. A rebound from the upper boundary of the bearish channel would be an additional signal confirming the increase. The scenario could be cancelled by a breakout of the Cloud’s lower boundary, with the price securing below 1.2715, indicating a further decline to 1.2625. XAUUSD, “Gold vs US Dollar” Gold is bouncing off the resistance level. The instrument is moving below the Ichimoku Cloud, suggesting a downtrend. A test of the Cloud’s lower boundary at 2340 is expected, followed by a decline to 2230. A rebound from the upper boundary of the bearish channel would be an additional signal confirming the fall. This scenario could be cancelled by a breakout above the upper boundary of the Cloud, with the price securing above 2355, indicating a further rise to 2395. Conversely, a decline could be confirmed by a breakout below the lower boundary of the ascending channel, with the price gaining a foothold below 2300. USDCHF, “US Dollar vs Swiss Franc” USDCHF is rising after rebounding from the lower boundary of the Head and Shoulders reversal pattern. The pair is moving inside the Ichimoku Cloud, indicating a sideways trend. A test of the resistance area at 0.8960 is expected, followed by a decline to 0.8795. A rebound from the upper boundary of the bearish channel would signal the decline. The scenario could be cancelled by a breakout of the upper boundary of the Cloud, with the price securing above 0.9055, indicating a further rise to 0.9145. Conversely, a decline could be confirmed by a breakout below the lower boundary of the Head and Shoulders pattern, with the price establishing itself below 0.8865. Read more - Ichimoku Cloud Analysis (GBPUSD, XAUUSD, USDCHF) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD experienced significant volatility. Overview for 13.06.2024 The primary currency pair is looking for support after a turbulent rise on Thursday. The current EURUSD exchange rate stands at 1.0805. Yesterday, the EURUSD pair faced a massive flow of data from both the US Federal Reserve and statistical reports. The Fed’s June meeting ended neutrally, with the interest rate remaining at 5.25% per annum, which was in line with expectations. However, the Federal Reserve’s comments, hinting at a rate cut this year closer to December, and the perceived aggressiveness of the Fed’s rhetoric regarding steps in 2025, have left the market in a state of anticipation for an active interest rate reduction. The US Consumer Price Index dropped in May, exceeding forecasts. Inflation stood at 3.3% year-on-year, remaining flat on a month-to-month basis. Core inflation decreased to 3.4% year-on-year from the previous 3.6%. This development indicates the easing of price pressure, a positive signal for the economy and the Federal Reserve. The market has become overly sensitive to statistical data releases. The US Federal Reserve created this foundation, having previously stated that it planned to gather as much data as possible to identify patterns. Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website. Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 32 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

I have solved definitively the problem. In Regedit delete only this two registry keys: Value "ModernViewStatePersist" in "HKEY_CURRENT_USER\Software\Microsoft\Windows\Curr entVersion\Explorer\Advanced" Value "ModernViewStatePersistent" in "HKEY_CURRENT_USER\Software\Microsoft\Windows\Curr entVersion\Explorer\Advanced" Dont delete the folder below: "HKEYCURRENT USER\Software\Microsoft\Windows\CurrentVersion\ Explorer\CLSID\{949ECF34-5756-4b9c-9692-2decAA8b91a2} Now AmiBroker dont go nevermore to unregistered. Greetings. Ciao!

-

still not able to get amibroker 6.4 or above.. very expensive??!!

-

Elliott waves help you quickly spot the trend, set the risk with precision, etc. Yet sometimes, making heads or tails of a move on a price chart can be a challenge. Our friends at Elliott Wave International want to help... For a very limited time, you can get free access to their online course, "How to Spot and Capitalize on Impulse Waves" ($99 value) In about 1 hour, you'll learn: "What do I look for?" — just what, exactly, should you look for on a price chart? See an easy way to spot an impulse wave. "What does it tell me?" — Impulse waves are great at showing you the direction of the larger trend (which, as you know, is "your friend"!) "Are there variations?" — Most impulse waves are simple, but some are… well, different. You'll see how to quickly distinguish one from another. Start watching now — free!

- Last week

-

gomos reacted to a post in a topic:

Ticino trader package sierrachart

gomos reacted to a post in a topic:

Ticino trader package sierrachart

-

Thank you

-

SignalTime reacted to a post in a topic:

REQ: Ultimate Scalper

SignalTime reacted to a post in a topic:

REQ: Ultimate Scalper

-

SignalTime reacted to a post in a topic:

Ninjatrader 8 Trade Copier

SignalTime reacted to a post in a topic:

Ninjatrader 8 Trade Copier

-

Thank you

-

SignalTime reacted to a post in a topic:

Multiperiod Candles

SignalTime reacted to a post in a topic:

Multiperiod Candles

-

II VIP Membership - FREE upgrade for OLD and ACTIVE Members

SignalTime replied to MrAdmin's topic in Announcements

Hi Admin, I have been a long time member (Gold). I would like to be a VIP. Thanks -

Thank you D. It is loading faster, pages are formatted better. I like it Good works

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 12th June 2024. Market News – Steady ahead of the Big Day! Economic Indicators & Central Banks: Asian stocks edged up, driven by the technology sector, while the US Dollar remained firm ahead of the US inflation report and Fed policy decision. China’s CPI gains held above zero in May while factory-gate prices remained stuck in deflation, signalling ongoing weak demand. UK GDP stagnated in April. Monthly GDP numbers came in a tad better than anticipated, with activity stagnating, rather than contracting -0.1% m/m, as Bloomberg consensus forecasts had predicted. The recovery remains uneven though. The FOMC began day 1 of its 2-day meeting with the decision and the new quarterly forecasts (SEP) at 21:00 GMT following by Chair Powell’s press conference at 21:30 GMT. The Fed is universally expected to maintain a steady rate stance, leaving all of the focus on the new forecasts, Chair Powell’s press conference, and the policy statement. It is widely expected that the “dovish” dot plot from March that showed three cuts (though it was a close call for two) will be revised toward a more hawkish stance. Asian & European Open: Treasuries steadied after rising on a solid $39 billion sale, which reflected speculation that inflation reading will help make the case for the Fed to cut rates this year. The NASDAQ rebounded and advanced 0.88% into the close to another record at 17,343. Similarly the S&P500 rose 0.27% to 5375, also a new record (27th of the year). A surge in Apple shares (7%) supported. The Dow slumped -0.3%, hurt by financials and industrials that overshadowed a gain in IT. China Evergrande New Energy Vehicle Group plunged 20% after warning of losing assets. Financial Markets Performance: The USDIndex had a good first half, rising to a high of 105.46 before fading to 105.24. However, it’s above the 105 level for a second straight session (first time since May 13,14) and the highest since early May. The EURUSD was down for a fourth session at 1.0737 amid political turmoil in Europe. OIL prices extended gains for a third session, with UKOIL futures up 0.5% to $82.36 a barrel and USOIL up 0.7% to $78.45 a barrel. Industry data pointed to shrinking US crude stockpiles ahead of a report from the IEA on the market outlook. Gold prices edged 0.1% lower to $2,313.72 per ounce. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi Market Analyst HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

batmanrulzz40 joined the community

-

can you have the Amibroker 6.35.1 x64, the above one is x86 only

-

even jhon snow stopped selling the new update

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

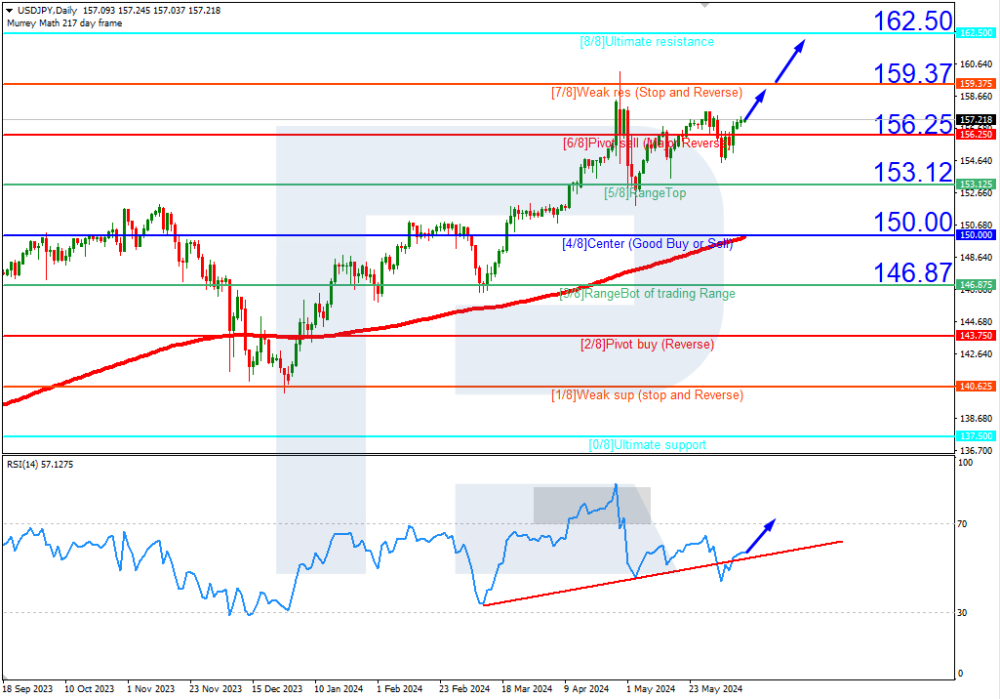

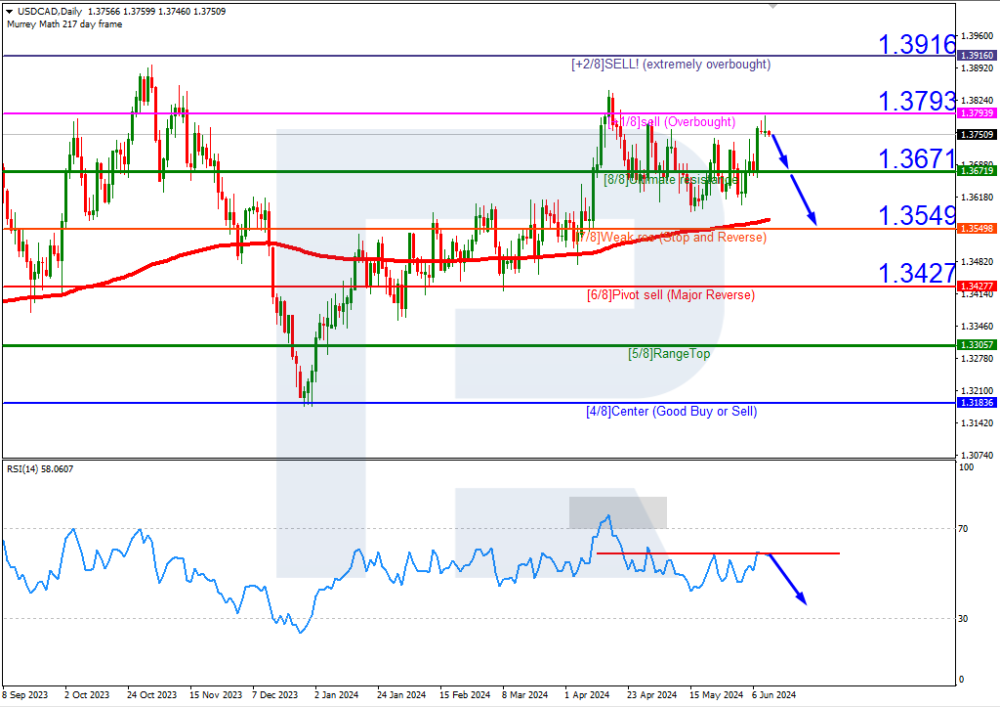

Murrey Math Lines 12.06.2024 (USDJPY, USDCAD) USDJPY, “US Dollar vs Japanese Yen” USDJPY quotes are above the 200-day Moving Average on D1, indicating a prevailing uptrend. The RSI has breached the resistance line. In this situation, the price is expected to test the 7/8 (159.37) level, break above it, and rise to the resistance at 8/8 (162.50). A breakout below the 5/8 (153.12) support level could cancel this scenario, leading to a potential decline to 4/8 (150.00). On M15, a breakout above the upper line of the VoltyChannel would provide an additional signal supporting the price increase. USDCAD, “US Dollar vs Canadian Dollar” USDCAD quotes are in the overbought area on D1. The RSI is testing the resistance line. In this situation, the price is expected to break the 8/8 (1.3671) level and decline to the support at 7/8 (1.3549). Surpassing the +1/8 (1.3793) level could cancel this scenario, leading to a potential rise to the +2/8 (1.3916) resistance level. Read more - Murrey Math Lines (USDJPY, USDCAD) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD declines. Overview for 12.06.2024 The primary currency pair is dropping lower on Wednesday. The current EURUSD exchange rate stands at 1.0740. Political instability in France is significantly impacting the euro. President Emmanuel Macron’s position has become shaky following the far-right party’s victory in the European Parliament elections. Rumours are circulating that Macron might also lose the forthcoming elections, which would jeopardise France’s financial stability. This factor is now adding to the euro’s imbalance. The US Federal Reserve meeting is underway. The decision on the interest rate will be announced on Wednesday evening, and it is expected to remain unchanged at 5.25% per annum. The market is keen for fresh and relevant assessments of the economy and outlook. The most crucial information the financial world awaits is the timing of the first easing of monetary conditions, with general forecasts currently referring to November. Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website. Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 32 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

it's not pre cracked ,so we need to patch (exe maybe modified) and the patched exe support feeded licence , so we do it manually,

-

⭐ option trader reacted to a post in a topic:

Convert2MS 2.2 cracked

⭐ option trader reacted to a post in a topic:

Convert2MS 2.2 cracked

-

⭐ option trader reacted to a post in a topic:

Convert2MS 2.2 cracked

⭐ option trader reacted to a post in a topic:

Convert2MS 2.2 cracked

-

Req - The Law of Vibration by The Planets by Lorrie Bennett

⭐ FredUrble replied to Ragul's topic in Forex Clips & Movies

No worries! Hope we can find the full document at some point! -

II VIP Membership - FREE upgrade for OLD and ACTIVE Members

aclient21 replied to MrAdmin's topic in Announcements

Admin, I know, I missed the window. I would like to become a VIP. Thanks -

Thank you NQ but this is a very old version 2.72 and does not include all the new updates on version 3.0

-

patryona joined the community

-

kkreg joined the community

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 11th June 2024. Market News – Inflation reports dominates! Economic Indicators & Central Banks: The selloff in Treasuries continued ahead of the FOMC decision tomorrow, though losses were moderate. Disappointment that the continued strength in the labor market will push back any easing until at least September at the earliest continued to weigh. Chinese stocks dropped after traders returned from a long weekend, weighed down by weak travel spending and renewed concerns over the property sector, raising doubts about the sustainability of China’s economic recovery. Developer Dexin China Holdings gets liquidation order from a Hong Kong court adding to a growing number of legal victories for creditors involving overdue debt. Geopolitical risks also affected shares of electric vehicle makers as traders awaited the European Commission’s decision on provisional duties expected this week. Australian business confidence turned negative in May, and conditions slipped to below-average levels, indicating that elevated interest rates and a worsening consumer outlook are weighing on the corporate sector. Markets are also closely monitoring potential fallout from political upheavals in Europe. Asian & European Open: All three major indexes closed higher on Monday, with the S&P500 and Nasdaq both hitting new records. The Dow ended the day up about 0.2%, following a modest finish to a winning week. The CSI 300 Index of mainland shares fell up to 1.4% after reopening from the Dragon Boat Festival holiday, while Hong Kong-listed Chinese shares were among Asia’s biggest decliners, dropping as much as 2%. Apple Inc. sank despite unveiling new artificial intelligence features. The company’s suppliers also dropped after Apple’s latest AI platform was seen as disappointing. Billionaire Elon Musk stated he would ban Apple devices from his companies if OpenAI’s software is integrated at the operating system level, calling it a security risk. Financial Markets Performance: The USDIndex has caught a bid with the push back to rate cut expectations. It closed at 105.150, back with a 105 handle for the first time since May 14. The EURUSD stalled at 1.0770, while GBPUSD declined slightly today after the tight labor data. USOIL held the biggest jump since March ahead of an OPEC report that will provide a snapshot on the market outlook. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi Market Analyst HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

⭐ levelupdown reacted to a post in a topic:

Can someone please share "Orderflows Trader 7.0 For NinjaTrader 8"

⭐ levelupdown reacted to a post in a topic:

Can someone please share "Orderflows Trader 7.0 For NinjaTrader 8"