All Activity

- Today

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the correction has ended, further growth is expected The DE 40 stock index is poised to resume upward movement. Today’s DE 40 forecast is positive. DE 40 forecast: key trading points Recent data: Germany’s Producer Price Index (PPI) for June came in at 0.1% Market impact: the value is neutral for the German stock market and the DE 40 index Fundamental analysis Germany’s PPI for June 2025 showed a 0.1% increase, matching forecasts and improving from the previous month’s -0.2%. A moderate rise in producer prices indicates stability in the manufacturing sector and the absence of sharp price surges, which reduces risks for corporate profitability within the index. This supports investor confidence in sectors such as industrials, engineering, and chemicals, as their cost base is not significantly affected by inflationary shocks. Overall, the PPI data confirms expectations of a stable economic backdrop without abrupt inflationary spikes, which supports a positive outlook for the German stock market in both the short and medium term. Investors may expect a continued moderate rise in shares of leading DE 40 companies, while maintaining a balance between risks and opportunities. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 282 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

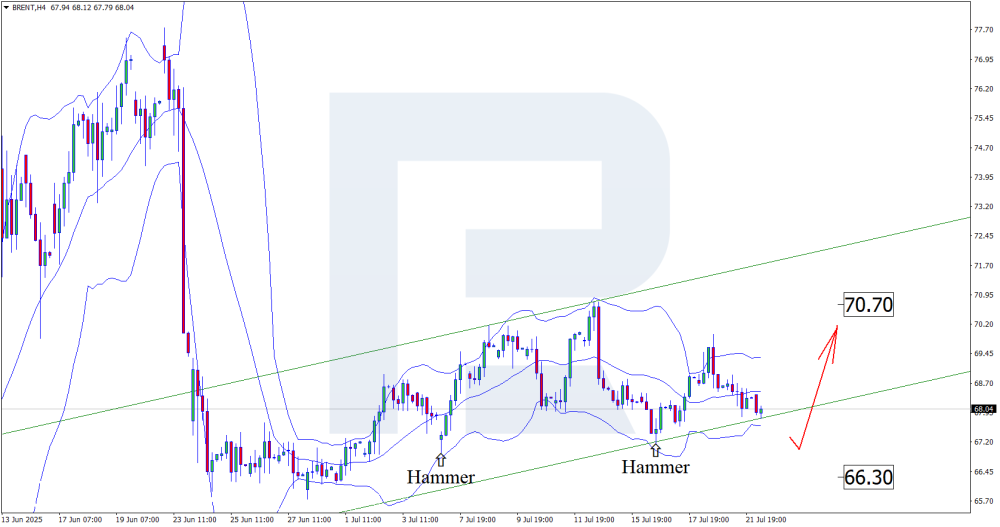

Brent prices on the edge: OPEC+ floods the market Brent quotes may regain ground and test the resistance level around the 70.70 USD mark. Discover more in our analysis for 22 July 2025. Brent technical analysis On the H4 chart, Brent prices tested the lower Bollinger Band and formed a Hammer reversal pattern. Having partially fulfilled the signal, quotes are now undergoing a correction. The Brent price forecast for 22 July 2025 suggests a growth target at 70.70 USD. A breakout above the resistance level would open the door to a stronger upward wave. Brent prices are testing the lower boundary of the ascending channel and may be gearing up for another bullish wave amid geopolitical tensions. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

⭐ FFRT reacted to a post in a topic:

Dynamic Trader Version VI

⭐ FFRT reacted to a post in a topic:

Dynamic Trader Version VI

-

really missed, that's good to know that latest version 8 is also cured. My bad. Can someone confirm, if DT8 is safe to use? DT6 had clean patch. this version appears to have crack ! Just asking if someone could clarify. Certainly, if it is cured by rooster, it would be clean.

-

fxzero.dark reacted to a post in a topic:

H.FT_S.PECTRE_L.ITE_V2.1

fxzero.dark reacted to a post in a topic:

H.FT_S.PECTRE_L.ITE_V2.1

-

⭐ sapperindi reacted to a post in a topic:

Anyone can educate with Viper Trading Indicator?

⭐ sapperindi reacted to a post in a topic:

Anyone can educate with Viper Trading Indicator?

-

He’s using it with reverse function, so a failed breakout of the 55 donchain channel. so if you have a crystal ball, you can set it to reverse instead of normal

-

I think it was already posted here. If not, I can share it.

-

Anyone can educate with Viper Trading Indicator?

roddizon1978 replied to Tasfy's topic in Ninja Trader 8

Ready your You tuber download it will be remove in 2 to 3 days -

AR, Material requests are something we do in our time. The downloads come in the responder’s time. Patience.

-

That's such a valid point, Roddizon1978! Would you please mind sharing the Ultimate scalper file/template. I'll also dig what I might have downloaded from Telegram, that hasn't been mentioned/posted here previously, right now I am mostly using Viper with Ninza Renko trading manually, but really want to automate trading a bit for few good scalps a day. Thank you!

-

Traderbeauty reacted to a post in a topic:

Anyone can educate with Viper Trading Indicator?

Traderbeauty reacted to a post in a topic:

Anyone can educate with Viper Trading Indicator?

-

Traderbeauty reacted to a post in a topic:

Anyone can educate with Viper Trading Indicator?

Traderbeauty reacted to a post in a topic:

Anyone can educate with Viper Trading Indicator?

-

Can someone share the IBD courses please?

-

⭐ sapperindi reacted to a post in a topic:

Anyone can educate with Viper Trading Indicator?

⭐ sapperindi reacted to a post in a topic:

Anyone can educate with Viper Trading Indicator?

-

⭐ sapperindi reacted to a post in a topic:

Anyone can educate with Viper Trading Indicator?

⭐ sapperindi reacted to a post in a topic:

Anyone can educate with Viper Trading Indicator?

-

Anyone can educate with Viper Trading Indicator?

roddizon1978 replied to Tasfy's topic in Ninja Trader 8

Ready your You tuber download it will be remove in 2 to 3 days -

Anyone can educate with Viper Trading Indicator?

roddizon1978 replied to Tasfy's topic in Ninja Trader 8

Guys , who are looking for video training for Viper system. I will load it in my you tube video. Ready your You Tube downloader because it will stay there for 3 to 5 days and I will take it of, to prevent being charge of copyrights. Let start - Yesterday

-

eddygarod reacted to a post in a topic:

HFT SPECTRE Group Buy

eddygarod reacted to a post in a topic:

HFT SPECTRE Group Buy

-

eddygarod reacted to a post in a topic:

HFT SPECTRE Group Buy

eddygarod reacted to a post in a topic:

HFT SPECTRE Group Buy

-

Ninja_On_The_Roof reacted to a post in a topic:

HFT SPECTRE Group Buy

Ninja_On_The_Roof reacted to a post in a topic:

HFT SPECTRE Group Buy

-

Yep.

-

I don't use Spectre, it is a BS Bot.Here this is today early morning

-

indo-investasi

-

What's the password to download it? Thank you

-

its taking opposite trade off signals?

-

⭐ klhk started following HFT SPECTRE Group Buy

-

Have you managed to figure it out mate?

-

??? You didn't see the post above yours? 😄

-

Best of the best software for - Fibonacci User

-

Anyone having working Dynamic Trader ver 6 or later please

-

Anyone having working Dynamic Trader ver 6 or later please.

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 21st July 2025. Can The NASDAQ Maintain Its Bullish Trend? The NASDAQ rose to a new all-time high on Friday, almost bringing its 2025 gains to double-digit figures. The index’s gains for 2025 are currently 9.96% and are the 3rd best performing index after the DAX and Euro Stoxx 50. The NASDAQ is also performing well during this morning’s Asian Session, rising a further 0.33%. Will the NASDAQ end the week on a high? EU vs US: Trade Battle In 2025, most of the trade negotiations were focused on China, as were economists and investors. However, the EU’s volume of trade with the US is very similar to that of China. Therefore, investors will be eager to see if the two parties can negotiate an agreement or at least agree to a later deadline. President Trump is applying pressure to raise tariffs on European goods, and the deadline is approaching. According to Bloomberg, the US is likely to harden its stance in the last days of negotiations. Ongoing negotiations with both the EU and China aim to avert further escalation ahead of the key August 1st deadline. This week will be key for negotiations and is likely to trigger a lot of volatility, but so far, it has not sparked a decline. However, if an agreement is not reached, the most likely response will be to sell stocks as investors will instantly fear the repercussions of higher tariffs. This was also something seen in February, March and April and resulted in a stock market crash. The price has now fully corrected and risen to new all-time highs. However, this is only likely to continue if tariffs are avoided or reduced. The SNP500 and Nasdaq have been able to reach new highs over the past week only due to strong retail sales, falling jobless claims, and improved business sentiment, while Treasury yields dipped on Fed policy speculation. Retail Sales rose to 0.6% and Weekly Unemployment Claims were 12,000 lower than projections. Quarterly Earnings Reports Even though trade negotiations are stealing the spotlight, earnings reports will continue to create volatility. They will also help investors determine potential price movements in the coming days and weeks. The main quarterly earnings reports will come from Tesla and Alphabet (Google). Alphabet is due to release its quarterly earnings report on Wednesday after the market closes. Currently, the stock holds a weight of 7.50% making the company the 4th most influential company for the NASDAQ. In the previous quarter, the stock easily beat the earnings per share projections, but the price came under a lot of pressure from the 2025 stock market crash. Currently, the stock is still trading 2.45% lower in 2025. However, if the revenue and earnings per share again beaten expectations, the stock is likely to rise. The average increase seen when the company has beat earnings is 4.00%. Tesla is also due to release their earnings report after market close on Wednesday. The stock has been on a rollercoaster ride, partially due to sales figures but also due to external factors. The stock is currently trading 13% lower in 2025. Tesla's earnings projections are only $0.28 per share. This is even lower than the first quarter's projections, but the price volatility will depend on whether the actual figures are higher than the current projections. Buyers would like the earnings per share to rise to at least $0.35, which was the earnings from the projections for the previous quarter. NASDAQ (USA100) - Technical Analysis NASDAQ 15-Minute Chart Despite risks from potential bad earnings reports and trade tensions between the EU, China and the US, technical analysis continues to point to bullish price movements. The price continues to form higher highs and lows as well as remain above Moving Averages and the VWAP. The RSI also remains above 50.00 and is not witnessing signs of divergence. Other signals of bullish price movement are the VIX index, which is trading 1.50% lower during today’s Asian Session. All global indices are also trading higher, except the Euro Stoxx 50 and the Put/Call ratio slightly dips. All these factors support a ‘risk-on’ sentiment, but earnings and trade negotiations will need to continue to support this. Key Takeaway Points: NASDAQ nears double-digit 2025 gains, hitting record highs and rising further in the Asian session. US–EU trade tensions escalate ahead of the August 1st tariff deadline, risking market volatility. The NASDAQ’s performance is deeply entwined with the outcome of these negotiations. Earnings from Tesla and Alphabet this week could drive sharp price moves depending on results. Technical indicators remain bullish, with rising prices, low VIX, and strong RSI despite macro risks. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

the link require password