⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Today

-

⭐ ralph kabota reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

⭐ ralph kabota reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

-

⭐ ralph kabota reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

⭐ ralph kabota reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

-

kidpe reacted to a post in a topic:

advancedsoftwarefeatures.com

kidpe reacted to a post in a topic:

advancedsoftwarefeatures.com

-

1P Algorithms - Premium Maximize Profits with AI-Driven Trading Bots

⭐ laser1000it replied to david's topic in Ninja Trader 8

Working well thanks to ampoo , we had to wait (at least in my case as I rarely use NT8) for the market live data -

1P Algorithms - Premium Maximize Profits with AI-Driven Trading Bots

david replied to david's topic in Ninja Trader 8

AMcharts 5-minute Bot NQ8AM -

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 1st September 2025. Euro Strengthens Amid Dollar Weakness, ECB Stability, and French Political Uncertainty. The Euro is the day’s best-performing currency, while the US Dollar is currently struggling to maintain its value. Due to the momentum, the EURUSD is trading at a 9-day high after the exchange rate rose 0.33% during this morning’s Asian Session. Traders should also note that the US is currently closed for the Labour Day Bank Holiday. EURUSD - The Euro’s Bullish Trend The Euro continues to be 2025’s best-performing currency as investors look to mitigate risk away from the Dollar. The main alternative to the US Dollar is the Euro, which continues to be supported by the expansionary fiscal policy announced earlier in the year. Some of the latest news impacting the Euro is coming from Germany’s inflation data and the political turmoil in France. Germany’s preliminary August inflation data showed mixed results. The consumer price index slowed to 0.1% MoM (from 0.3%) and rose to 2.2% YoY (from 2.0%), slightly above forecasts. The harmonised index also rose to 2.1% YoY, higher than expected. While inflation ticked up, it remained close to the ECB’s 2% target, suggesting rates may stay unchanged until at least November. The data shows stability and continues to support the Euro. However, European investors are also closely monitoring the political turmoil which continues to grip France. French Prime Minister Bayrou has announced a confidence vote scheduled for September 8th. The move was a result of the government’s inability to agree on a budget. Businesses within France are warning that political instability, which continues to reappear, including growing opposition to Bayrou’s austerity plans, can drag the country towards recession. ECB President Christine Lagarde called a potential French government collapse ‘worrying’ for the eurozone, stressing fiscal discipline while assuring that the banking sector remains resilient. The development is not yet hurting the Euro. However, if the instability grows, economists warn that the Euro can potentially witness a different trend. PCE Index and The US Dollar Investors are closely watching the July personal consumption expenditure (PCE) price index, a key indicator for the US Federal Reserve. The index eased from 0.3% to 0.2% MoM and held steady at 2.6% YoY, while the core measure rose from 2.8% to 2.9%. Overall, inflationary pressures are building amid rising trade tariffs. However, uncertainty remains over future moves, as most officials stress that decisions will depend on incoming data. Fed Governor Christopher Waller, however, signalled he expects a shift to a more dovish stance as early as next month. Currently, most economists expect 2 rate cuts in 2025. Meanwhile, Fed official Lisa Cook, dismissed by President Trump, is challenging her removal in court, arguing it was unlawful and based on clerical errors in mortgage records. Trump has asked the court to validate his actions. The tensions between the Federal Reserve and the White House, as well as the expectations of interest rate cuts, are pressuring the US Dollar Index. The US Dollar Index has fallen 1.26% over the past 2 weeks and is pressuring the support level at 97.45. EURUSD - Technical Analysis EURUSD 4-Hour Chart On most timeframes, the EURUSD is obtaining indications of a bullish trend on momentum-based indicators. However, the resistance level at 1.17310 is key and buy signals may remain weak if the level remains intact. However, the upward price movement will also largely depend on the expectations of rate cuts and the political situation in France. Key Takeaways: The Euro is the strongest currency today, with EURUSD hitting a 9-day high amid Dollar weakness and a US holiday. Germany’s inflation data remains near the ECB’s 2% target, supporting the Euro and signalling stable monetary policy. Political instability in France, including Prime Minister Bayrou’s upcoming confidence vote, is being closely monitored. However, the development has not yet pressured the Euro. US rate cut expectations and Fed tensions, including Lisa Cook’s legal challenge, are pressuring the Dollar. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index enters a downtrend within the correction phase The growth momentum of the DE 40 index has slowed. The DE 40 forecast for today is positive. DE 40 forecast: key trading points Recent data: Germany’s unemployment rate for July 2025 stood at 6.3% Market impact: this supports consumer stocks Fundamental analysis Germany’s unemployment rate for August 2025 came in at 6.3%, in line with both forecasts and the previous reading. The stability of the indicator confirms that the German labour market remains resilient despite internal and external economic challenges. For the German stock market, this stability is highly significant. A steady unemployment rate points to sustained household demand, which underpins domestic consumption. For the DE 40, the impact of this figure varies by sector. The financial sector reacts positively to labour market stability as it reduces credit risks. Industrial companies and exporters benefit indirectly since steady domestic demand can offset fluctuations in external markets. The consumer sector also stands to gain as stable employment supports household solvency and drives demand for goods and services. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 309 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

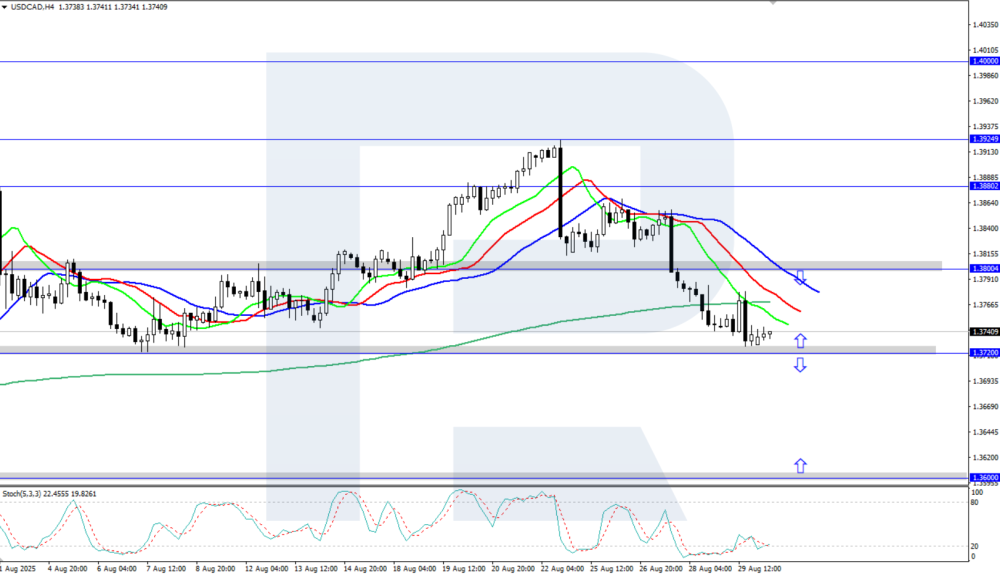

USDCAD drops to support at 1.3720 The USDCAD rate declined towards the 1.3700 area amid the current weakness of the US dollar. This week’s focus is on US labour market data. Discover more in our analysis for 1 September 2025. USDCAD technical analysis The USDCAD H4 chart shows a bearish trend. The Alligator indicator is confidently pointing downwards, confirming the current downtrend. The key support level that could temporarily halt the decline is at the daily level of 1.3720. The USDCAD rate is falling, testing the 1.3720 support level. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

volumetrade2022 reacted to a post in a topic:

rizecap.com

volumetrade2022 reacted to a post in a topic:

rizecap.com

-

volumetrade2022 reacted to a post in a topic:

marketxero.com

volumetrade2022 reacted to a post in a topic:

marketxero.com

-

volumetrade2022 reacted to a post in a topic:

Xtrend Algo

volumetrade2022 reacted to a post in a topic:

Xtrend Algo

-

volumetrade2022 reacted to a post in a topic:

advancedsoftwarefeatures.com

volumetrade2022 reacted to a post in a topic:

advancedsoftwarefeatures.com

-

volumetrade2022 reacted to a post in a topic:

advancedsoftwarefeatures.com

volumetrade2022 reacted to a post in a topic:

advancedsoftwarefeatures.com

-

volumetrade2022 reacted to a post in a topic:

1P Algorithms - Premium Maximize Profits with AI-Driven Trading Bots

volumetrade2022 reacted to a post in a topic:

1P Algorithms - Premium Maximize Profits with AI-Driven Trading Bots

-

Should we join forces with TGF Community? [Answer please]

soussay replied to MrAdmin's topic in Announcements

It is commendable that you inform your members on this subject. So congratulations, I am sure that you will take the right decision in this regard soussay -

santosh26_80 reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

santosh26_80 reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

Thank you Kesk, for all your time and effort. You have always helped others selflessly and we appreciate all that you have given to the members here for the past many years. Thank you again.

-

Bambang Sugiarto changed their profile photo

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

Learning forex from YouTube provides free and quick access, but the material is often fragmented and unstructured. Paid courses are usually more systematic, offer mentors, and provide hands-on practice. The choice depends on your needs: self-study is cost-effective, or you can take a course for intensive guidance and more focused learning discipline. So which one will you choose?

- 1 reply

-

- forex

- forex forum

-

(and 1 more)

Tagged with:

-

Bambang Sugiarto joined the community

-

Announcement After trying for 3 days and getting information from others, looks like the online part cant be bypassed. The updates will be stopped from now on and better stick to the Jul 2025 version without internet checks. If there is a breakthrough, will inform here. This thread will stop updating the program but the discussion on using the software can continue with constructive ideas and findings. Good luck to all.

-

1P Algorithms - Premium Maximize Profits with AI-Driven Trading Bots

RanaJee replied to david's topic in Ninja Trader 8

Sir there is new version right now i thinks can you look it up and edu for us thanks -

Eagleeye76 joined the community

-

More than 2000 usd bonus without initial deposit

hhduy replied to maxbox's topic in Trading Contests & Bonuses

Some brokers never let you withdraw bonus itself, only profits. This is normal in the industry. The bonus works like extra balance to support positions. I think traders should accept this. If you only want free money, you will be disappointed. Better to focus on trading skills. -

Are prizes and awards from brokers real?

hhduy replied to hafidfx's topic in Trading Contests & Bonuses

I see many brokers like HFM, XM use contests as marketing. It attracts new traders quickly. People like the idea of winning while learning. It is also good for the broker, because active traders bring more volume. Both sides win in this system. This is why contests are common now. - Yesterday

-

1P Algorithms - Premium Maximize Profits with AI-Driven Trading Bots

⭐ rcarlos1947 replied to david's topic in Ninja Trader 8

As is always the case, what works for one person does not always work for everyone. That's why I don't ask for templates. When I test I first run the default, then I try different bar types (time, Renko, Volume, etc), then try different bar settings. If I find something interesting, then I take that one to Strategy Analyzer. Luckily, these bots do not have 30+ parameters to test. You might find something that works for you. Happy hunting !!!! -

1P Algorithms - Premium Maximize Profits with AI-Driven Trading Bots

fchot33 replied to david's topic in Ninja Trader 8

It can’t be right .. they charge quite the money for it.. something def wrong.. -

1P Algorithms - Premium Maximize Profits with AI-Driven Trading Bots

tdktown replied to david's topic in Ninja Trader 8

yeah i got pretty negative results as well. unless someone has some optimized settings -

1P Algorithms - Premium Maximize Profits with AI-Driven Trading Bots

⭐ mangrad replied to david's topic in Ninja Trader 8

@david Is this the new version? How did you know its producing excellent results? -

1P Algorithms - Premium Maximize Profits with AI-Driven Trading Bots

⭐ mangrad replied to david's topic in Ninja Trader 8

Yes, negative in the long run, some positive months. I am not sure if the code is aligned with the strategy that 1P teaches. -

1P Algorithms - Premium Maximize Profits with AI-Driven Trading Bots

fchot33 replied to david's topic in Ninja Trader 8

Dos someone testes the strategies ? They All showing up very negative total profit.. same for everyone ? -

TDU Footprint & Footprint Trader 2.0.0.12 beta 3

Gérard Lenorman replied to ⭐ rcarlos1947's topic in Ninja Trader 8

Up !!! 😊 -

Here is the image https://postimg.cc/FddDcXk8 https://i.postimg.cc/d1nXbqss/082925-GC-trade.png

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.