⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

⭐ QuBit reacted to a post in a topic:

phoenixtraders.ca phoenix-indicators (educated)

⭐ QuBit reacted to a post in a topic:

phoenixtraders.ca phoenix-indicators (educated)

- Today

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD): volatility eases, but demand persists Gold (XAUUSD) remains volatile around 4,010 USD. While risk sentiment has improved, investor interest in the precious metal persists. Find more details in our analysis for 31 October 2025. XAUUSD forecast: key trading points Reduced geopolitical risk is weighing on gold (XAUUSD) October ends on a positive note, with gold up roughly 50% year-to-date XAUUSD forecast for 31 October 2025: 4,045 Fundamental analysis Gold (XAUUSD) prices have retreated to around 4,010 USD per troy ounce, marking the second consecutive week of losses. The metal remains under pressure due to shifting expectations around the timing of future Federal Reserve rate cuts and news of the US-China trade truce. The two countries reached a one-year agreement on rare earth metals and strategic resources. Donald Trump announced a 10% reduction in tariffs on fentanyl-related products, while Beijing pledged to curb mining output and resume imports of US soybeans. However, the long-term stability of the deal remains uncertain. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 353 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

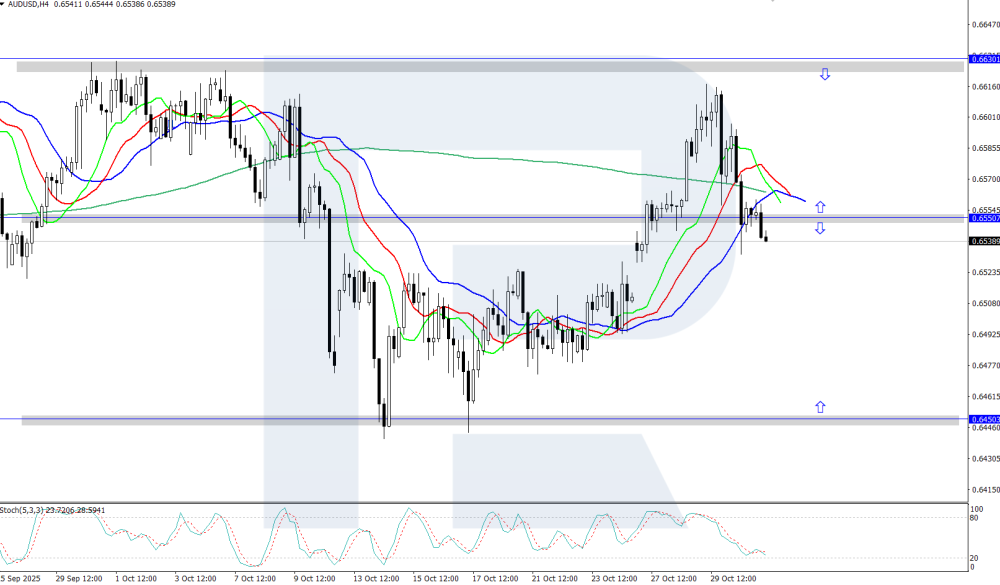

AUDUSD consolidates within a sideways range The AUDUSD rate is trading around 0.6550 amid moderately rising inflation in Australia. Find more details in our analysis for 31 October 2025. AUDUSD technical analysis The AUDUSD pair is trading within a limited price range between 0.6450 and 0.6630 following a period of strong upward momentum. The direction of the next breakout will determine the future trajectory of the pair. The AUDUSD pair is consolidating within a price range between 0.6450 and 0.6630. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

For the AddDataSeries/BarsPeriod error and missing buttons, matching NT 8.1.x, installing the SniperBars, and enabling Chart Trader (not collapsed) usually fixes it. If playback looks great but evals bleed, that screams overfit—cut entries, cap daily loss, and disable “reverse” after consecutive losers

-

Filtering noise is everything. From many traders’ journals, demo is great for mechanics, but a tiny live account trains emotions—use both deliberately. If price action is the focus, what single book/course would you commit to for 90 days without mixing sources?

-

KB247 reacted to a post in a topic:

quantvue.io

KB247 reacted to a post in a topic:

quantvue.io

-

⭐ RichardGere reacted to a post in a topic:

Sniper Auto Trader v29

⭐ RichardGere reacted to a post in a topic:

Sniper Auto Trader v29

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

Liquiditation joined the community

-

nanop reacted to a post in a topic:

phoenixtraders.ca

nanop reacted to a post in a topic:

phoenixtraders.ca

-

nanop reacted to a post in a topic:

phoenixtraders.ca

nanop reacted to a post in a topic:

phoenixtraders.ca

-

Bene reacted to a post in a topic:

Eds Retrace Plan

Bene reacted to a post in a topic:

Eds Retrace Plan

-

Bene reacted to a post in a topic:

quantvue.io

Bene reacted to a post in a topic:

quantvue.io

-

⭐ mangrad reacted to a post in a topic:

quantvue.io

⭐ mangrad reacted to a post in a topic:

quantvue.io

- Yesterday

-

Playr101 reacted to a post in a topic:

.NinZa-VoluTankArmy

Playr101 reacted to a post in a topic:

.NinZa-VoluTankArmy

-

⭐ goldeneagle1 reacted to a post in a topic:

quantvue.io

⭐ goldeneagle1 reacted to a post in a topic:

quantvue.io

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 30th October 2025. Alphabet Leads Tech Gains as US–China Deal Lifts Market Sentiment. Investors have plenty to digest this week, with volatile earnings results, interest rate cuts, and hawkish comments from central banks. The Federal Reserve and Bank of Japan have announced their interest rate decisions and held press conferences. In addition, tech giants including Alphabet, Microsoft and Meta have released their quarterly earnings reports. Some aspects of the latest developments have been positive, while others have been negative. As a result, most asset classes have experienced mixed price movements. However, the main factor driving optimism is the trade agreement between the US and China. US-China Trade Agreement US President Donald Trump’s tour of Asia which is drawing to a close. Before returning to the US, President Trump met with Chinese President Xi Jinping at Busan Airport amid heightened tensions over tariffs, TikTok, and rare earth minerals. Political analysts have expressed optimism about the outcome of the meeting and comments made from both sides. President Xi stated that the two countries had reached an agreement to resolve ‘major trade issues.’ China has agreed to pause new rare-earth export restrictions for one year, with annual reviews planned. Trump said the issue is ‘settled’ for now, while China has also resumed purchases of US soybean, signaling a renewal in agricultural trade. Maintaining stability is now the main priority, as past periods of trade optimism have often been followed by renewed tariffs and tensions. This development is having a positive impact on the market’s risk appetite. This is reflected in the VIX index, which is trading 1.50% lower, and the Put/Call Ratio, which has again declined towards the 0.60 level. However, technical analysts warn that if the Put/Call Ratio falls below 0.60, the stock market may experience profit-taking and resistance. Earnings Reports Investors had been eagerly awaiting for the earnings reports from major technology companies. In the first half of the year, the NASDAQ experienced a market decline of 26% and within six months recovered only 6-7%. The index was lagging behind Asian and European stocks with most investors suggesting that the US market required stronger bullish catalysts-potentially from earnings results. On Wednesday, after market close, Microsoft, Alphabet and Meta released their third-quarter earnings reports. The main takeaways are as follows: Microsoft stocks Fall 3.95% After Earnings Release-the company’s revenue and earnings per share were slightly above expectations but not enough to significantly boost demand. Microsoft’s record $35 billion AI spending raised concerns over margins, while its forecast of persistently high costs unsettled investors. Alphabet stocks rise 6.70% After Earnings Report-the company's revenue was higher than predictions set by analysts. The Earnings per share came in 7% higher than previous forecasts. Meta stocks fall 7.40% After Earnings Report-the company was unable to beat earnings and revenue expectations. However, the main concern for investors was that tax-related charges reduced earnings and the company warned that expenses would increase in 2026. The standout performer was Alphabet which not only impressed with beating earnings expectations but also through user growth. Alphabet reported record quarterly revenue of $102.3 billion, up 16% year on year and above expectations, driven by growth in its Cloud and YouTube divisions. The company’s record $91–93 billion in capital spending highlights its aggressive investment in AI infrastructure. NASDAQ (US100)-Technical Analysis NASDAQ (USA100) 30-Minute Chart During the US trading session the NASDAQ experienced three major price waves on the shorter timeframes. The first when the Federal Reserve confirmed its decision to cut rates by 0.25% which triggered a brief decline. The price quickly recovered but then fell again as Jerome Powell’s press conference was more hawkish than markets had anticipated. The index later rebounded following the announcement of Alphabet’s earnings report, which drove the price to a new all-time high. The key support level can be seen at $25,929.30 and the resistance level at $26,287.65. Although the index was unable to maintain its bullish impulse wave momentum, it has remained above key technical levels and the VWAP. Key Takeaways: Markets remain volatile as investors react to earnings results, rate cuts, and hawkish central bank commentary. The new US-China trade agreement boosts global risk appetite, easing tensions over tariffs and rare-earth exports. Alphabet leads technology gains with strong earnings and record AI investment, while Microsoft and Meta stocks decline. The NASDAQ reaches a new all-time high after Alphabet’s results, supported by optimism despite mixed market sentiment. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Eva Grey joined the community

-

Not sure what happened to this, uninstalled - reinstalled. Stop working.

-

Sorry seemed to miss the post.

-

Hello Brother, can you share it here

-

phoenixtraders.ca phoenix-indicators (educated)

⭐ RichardGere replied to nanop's topic in Ninja Trader 8

Thanks nanop. However apmoo just reposted the same a few hours ago. -

it seems. but when I enable the strategy and apply, it disables (or turns off) by itself. did you you not experience that?

-

It seems like he was educated correctly....what I don't understand is how to get the template

-

thanks apmoo. is this educated? the strategy turns off as soon as it is enabled.

-

Educated version DL Link https://workupload.com/file/NJ3vJLuAVEq Official website https://phoenixtraders.ca/

-

I second this request. 😁

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD at a crossroads: Fed split and EU CPI data to decide the course Amid expectations of fundamental data from the US and the EU, the EURUSD rate may rise towards 1.1715. Discover more in our analysis for 30 October 2025. EURUSD forecast: key trading points Eurozone Consumer Price Index (CPI): previously at 2.0%, projected at 2.0% Publication of FOMC minutes EURUSD forecast for 30 October 2025: 1.1715 Fundamental analysis The eurozone CPI reflects changes in the cost of goods and services for consumers, helping to assess purchasing trends and the level of stagnation in the economy. A stronger-than-expected indicator would support the euro. The EURUSD forecast for 20 August 2025 suggests that the index may remain flat at 2.0%. However, if the actual figure exceeds the forecast, it could affect the EURUSD rate and strengthen the euro. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 353 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

@apmoo @kimsam

-

thank you

-

https://workupload.com/file/c4hbdyZX5ys Thanks

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY extends gains following central bank decisions The USDJPY pair maintains its upward momentum amid the ongoing monetary policy divergence between the Federal Reserve and the Bank of Japan. The rate currently stands at 153.05. Discover more in our analysis for 30 October 2025. USDJPY technical analysis The USDJPY pair continues to recover after rebounding from the lower boundary of its ascending channel. Prices remain above the EMA-65, confirming bullish momentum and sustained buying interest. The combination of the BoJ’s dovish stance and the Fed’s cautious tone continues to support demand for the US dollar. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team