⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

I don't have the product, but had seen their indicators off and on for a few years. I went to their website to see their latest stuff. What I did find was some interesting guidance on using their indicators. maybe you will find it interesting as well. https://pyramidindicators.com/education/

-

Hello friends There are two excellent and comprehensive (8-9 hours each) video courses on Bollinger Bands by John Bollinger himself. These are- 1: Bollinger on Bollinger Bands 2013 - The 30th Anniversary Seminar. (https://www.bollingerbands.com/30-anniversary-dvd-set) 2: BOLLINGER ON BOLLINGER BANDS 2011 DVD. (https://www.bollingerbands.com/bb-trading-2011-dvd-set) There are no active downloadable links for these courses on this site as well as elsewhere that I could find of. Can somebody please share these two courses or even one of them? Thank you.

- Today

-

Hello friends There is a massive collection of CMT association webinars numbering more than 800 and with combined size of 120 GB. This collection is being sold by many course-reselling websites. Few examples are 1: https://coursocean.co/product/download-cmt-association-entire-webinars/ 2: https://wsotradingcourses.com/product/cmt-association-entire-webinars-course/ 3: https://www.gigacourses.com/product/cmt-association-entire-webinars/ 800+ videos from 2005 till date covering every single aspect of technical analysis by renowned traders, analysts and mentors like: Larry Connors Scott Carney Robert Miner Jeff Greenblatt Martin Pring Mark Minervini Michael Jenkins Robert Prechter And many more. It will be great if someone can share this excellent massive collection. Thank you.

-

- cmt

- technical analysis

-

(and 2 more)

Tagged with:

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

⭐ monkeybusiness reacted to a post in a topic:

Required: Rubén Villahermosa - Advanced Wyckoff Course + Volulme Profile

⭐ monkeybusiness reacted to a post in a topic:

Required: Rubén Villahermosa - Advanced Wyckoff Course + Volulme Profile

-

elliottwaveforamibroker.com indicator - require decompile

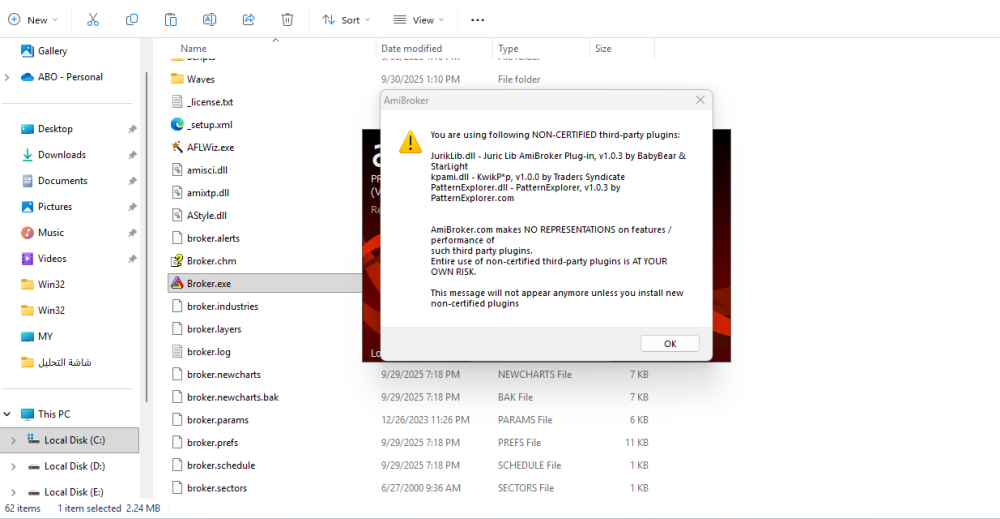

Moh replied to omrangassan's topic in Amibroker

I worked, sir. You can watch the video. -

Hello friends Joe Rabil is an excellent trader and teacher predominantly focussed on stocks for swing and position trading. Joe has provided technical stock research to some of the largest institutional money managers in the world for the past 30 years. He is an expert in the use of multiple time frame analysis and momentum characteristics of trends. During his career, he has identified and implemented methods to help improve stock selection and timing. Rabil Stock Research is dedicated to providing unbiased analysis of stocks and markets. By using a bottom-up approach, and looking at thousands of individual stock charts each week, we attempt to identify the stocks that have the best chance of assisting money managers in achieving returns over their benchmark and peer group. He is a regular on StockCharts youtube channel and gives great insights on trading. However I am unable to find any of his three courses or his book. It will be great if someone can get these resources available for all. The three courses as described on his website (https://rabilstockresearch.com/services/) are The Trend and Momentum course covers: Candlesticks, Price Structure, Price Structure in Multiple Time Frames, 1-2-3 Reversal, Special Patterns, Moving Averages, MACD, ADX, RSI, Putting It All Together, Questions and Answers, Trade and Money Management. – $250 for lifetime access The Swing Trading Course covers: The Most Powerful Financial Weapon, Guidelines for this Approach, Reframe Your Mindset, What it Looks Like – Daily and Weekly, Compression, Using ATR, Volume, Monster Candle, Using the 4MA, The OPEN, Entry, 2nd Entry, Getting Organized, Screening, Example Setups, Targets-Stops-Raising Stops, Decide Who You Are – $150 for lifetime access The Trend & Volatility course covers: Introduction and Approach Basics, Trend and Volatility Condition Details, Charts and Market Condition Examples, Sector Focus, Implementing and Summary – $150 for lifetime access His book "Invest like a Pro" is also not available as a free PDF copy anywhere. (https://rabil-stock-research.kit.com/products/invest-like-a-pro). He references this book in his videos often and it seems it is a great book for swing/position trading stocks. I was able to find two course re-sellers selling the second and third course (but expensive at 120 USD each). Their URLs are as follows: https://tradingaz.org/joe-rabil-compression-based-swing-trading-course/ https://tradingaz.org/joe-rabil-trend-and-volatility-trading-the-proper-timeframe/ It will be great if someone can share any or all of the three courses of Joe Rabil and his book. Any resource shared will help us all. Thank you.

-

- joe rabil

- invest like pro

-

(and 2 more)

Tagged with:

-

elliottwaveforamibroker.com indicator - require decompile

⭐ Atomo12345 replied to omrangassan's topic in Amibroker

This message is normal it appeared the first time. Press OK and all it works. -

Bene reacted to a post in a topic:

autofuturestrading.com

Bene reacted to a post in a topic:

autofuturestrading.com

-

@Ninja_On_The_Roof Can you share the v29 ...

-

daddypenguin joined the community

-

Hello friends I have been searching for these two excellent courses for a very long time but unable to get them for free. I can't afford to buy them even from re-sellers now. It will be great if someone can share these two excellent courses. 1: Python for Quant Finance - Jason Strimpel Original course URL - https://www.pyquantnews.com/getting-started-with-python-for-quant-finance Course re-seller URL - https://udcourse.com/product/jason-strimpel-python-for-quant-finance/ 2: How To Backtest Bootcamp - Unbiased Trading Original course URL - https://howtobacktestbootcamp.carrd.co/ Course re-seller URL - https://udcourse.com/product/unbiased-trading-how-to-backtest-bootcamp/ Kindly help Thank you.

-

Hello friends I have been searching for these two excellent courses for a very long time but unable to get them for free. I can't afford to buy them even from re-sellers now. It will be great if someone can share these two excellent courses. 1: Python for Quant Finance - Jason Strimpel Original course URL - https://www.pyquantnews.com/getting-started-with-python-for-quant-finance Course re-seller URL - https://udcourse.com/product/jason-strimpel-python-for-quant-finance/ 2: How To Backtest Bootcamp - Unbiased Trading Original course URL - https://howtobacktestbootcamp.carrd.co/ Course re-seller URL - https://udcourse.com/product/unbiased-trading-how-to-backtest-bootcamp/ Kindly help Thank you.

-

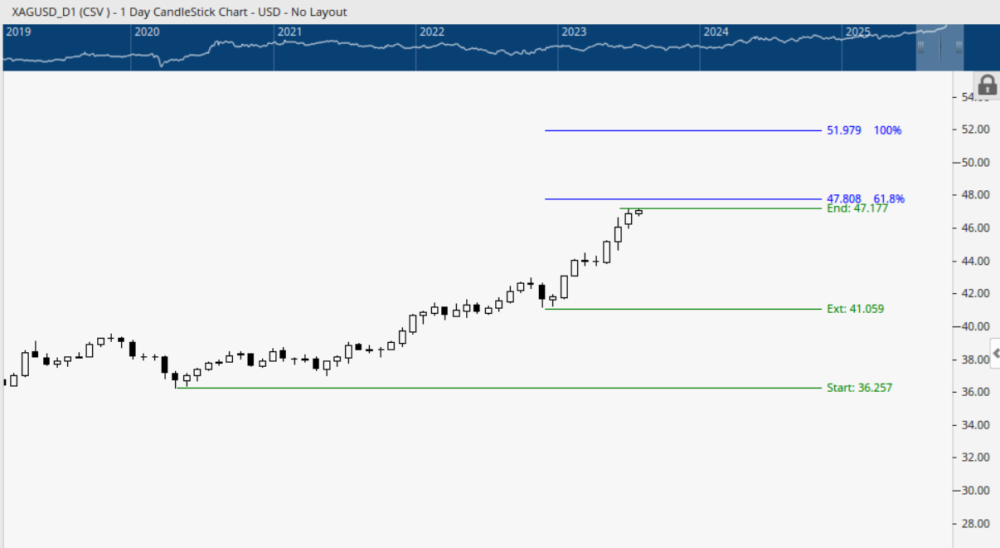

Dear binaryowner, You gave a very difficult explanation (volatility filters ?) . I wish you would have posted a picture or chart. I am not a coder for MetaTrader 4.I need only a robot range .I choose the settings and range myself, and it doesn't matter what method is used to buy and sell within this range. For example, I only know that silver is supposedly at 46 right now and will suffer to 42 in the next few days, although I doubt it will test a new high tomorrow.

-

setare reacted to a post in a topic:

MetaTrader 4 robot/expert/strategy/indicator specifically for silver

setare reacted to a post in a topic:

MetaTrader 4 robot/expert/strategy/indicator specifically for silver

-

⭐ RichardGere reacted to a post in a topic:

elliottwaveforamibroker.com indicator - require decompile

⭐ RichardGere reacted to a post in a topic:

elliottwaveforamibroker.com indicator - require decompile

-

⭐ RichardGere reacted to a post in a topic:

Required: Rubén Villahermosa - Advanced Wyckoff Course + Volulme Profile

⭐ RichardGere reacted to a post in a topic:

Required: Rubén Villahermosa - Advanced Wyckoff Course + Volulme Profile

-

⭐ RichardGere reacted to a post in a topic:

Required: Rubén Villahermosa - Advanced Wyckoff Course + Volulme Profile

⭐ RichardGere reacted to a post in a topic:

Required: Rubén Villahermosa - Advanced Wyckoff Course + Volulme Profile

-

elliottwaveforamibroker.com indicator - require decompile

Moh replied to omrangassan's topic in Amibroker

I appreciate your work, my friend Atomo12345 haohaonguyen and all my friends but it still doesn't work. https://workupload.com/file/E4avc9UMzWs -

I have posted the link on your topic of requesting Advanced Wyckoff course. Please download it from there.

-

nimsha joined the community

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 30th September 2025. US Stock Futures Flat as Shutdown Looms; Gold Prices Hit Record High. US stock futures held near unchanged levels on Tuesday, with investors bracing for the possibility of a US government shutdown as early as Wednesday. Futures tied to the Dow Jones Industrial Average, the S&P 500, and the Nasdaq 100 were little changed. A Monday meeting between PresidentDonald Trump and Democratic leaders ended without progress on a funding deal, leaving Congress until 12:01 a.m. ET on Wednesday to avert a shutdown. Vice President JD Vance warned after the talks: ‘I think we’re headed to a shutdown.’ If the government closes, the Bureau of Labour Statistics (BLS) will cease operations, delaying critical data releases on jobs and inflation. This comes at a sensitive time for the Federal Reserve, which is weighing further interest rate cuts. Only one of the agency’s 2,055 employees would remain active during the shutdown. The immediate focus is whether the September jobs report, due Friday, will be released. With the Fed having already delivered its first rate cut of the year, investors are counting on this report to guide expectations for more cuts. However, divisions among policymakers and mixed data have already cast doubt on a clear path forward. Despite political deadlock and new tariffs announced Monday, Wall Street managed modest gains to start the week. Investors are also watching for Nike’s earnings after Tuesday’s close, along with the latest job openings data from the BLS. Asian Markets Trade Cautiously Asian equities were mostly flat on Tuesday as markets prepared for the potential impact of a US shutdown. Japan’s Nikkei 225 edged down less than 0.1% to 45,023.48. Hong Kong’s Hang Seng Index was steady at 26,624.16. China’s factory activity data disappointed, signalling persistent weakness as trade tensions with the US weigh on exports. Shanghai Composite Index rose 0.4% to 3,878.88. Australia’s ASX 200 gained 0.1%, while South Korea’s Kospi rose 0.2%. While past shutdowns had minimal market impact, analysts warn that this one could delay critical economic data, adding fresh uncertainty. Some also note that the administration may pursue large-scale federal layoffs, amplifying risks. Stephen Innes of SPI Asset Management commented: ‘It feels as though traders have picked apart every angle of the shutdown story, but with less than a day before Washington shuts down, the theme refuses to die.”’ Wall Street Recap: Tech Stocks Lead Gains On Monday, Wall Street closed higher as technology stocks rebounded. S&P 500 rose 0.3% to 6,661.21. Dow Jones Industrial Average added 0.1% to 46,316.07. Nasdaq Composite climbed 0.5% to 22,591.15. Amazon gained 1.1% after sharp losses last week, while Microsoft rose 0.6%, helping lift the broader market. The focus now turns to Friday’s nonfarm payrolls report, which could sway the Fed’s rate-cut path. Strong job numbers may reduce the likelihood of further cuts, while weak data could heighten recession fears. Separately, Electronic Arts (EA) surged 4.5% after confirming a $55 billion all-cash buyout, the largest deal of its kind to take a company private. Gold Prices Hit Another Record High Gold prices continued their record-breaking rally on Tuesday, extending Monday’s surge as the looming US government shutdown added to economic uncertainty. Spot gold jumped as much as 0.9% to $3,867.25 per ounce, surpassing the previous session’s record close. The lack of progress in Washington has fueled fears that a shutdown could block the release of crucial data, complicating the Fed’s monetary policy decisions ahead of its next meeting. Meanwhile, industry news added to gold market focus: Newmont Corp. confirmed the departure of CEO Tom Palmer at year-end, while Barrick Mining Corp. announced the surprise exit of Mark Bristow. Both companies are the world’s largest gold producers. Gold has surged 47% year-to-date, on pace for its biggest annual gain since 1979, driven by central-bank buying and Fed rate cuts. Analysts at Goldman Sachs and Deutsche Bank expect the rally to extend further. US Treasuries gained on Monday, while the US dollar weakened, supporting bullion. Lower bond yields make non-yielding assets like gold more attractive, and a softer dollar reduces costs for global buyers. Silver, Platinum, and Palladium in Focus Other precious metals saw mixed trading on Tuesday: Silver and platinum paused after multi-year highs but remain up 63% and 76% year-to-date. Palladium held firm, supported by supply shortages. Tight markets have driven lease rates for silver, platinum, and palladium sharply higher, signaling dwindling inventories in London. Inflows into ETFs backed by these metals have added to the supply crunch. Oil and Currency Markets In energy trading, crude oil prices slipped: WTI crude fell 45 cents to $63.00 per barrel. Brent crude declined 51 cents to $66.58 per barrel. In currency markets: The US dollar eased to 148.54 yen from 148.60. The euro slipped to $1.1725 from $1.1727. Markets remain on edge as the US shutdown deadline approaches, with gold prices surging to record highs, US stock futures flat, and global markets cautious. Investors now await Friday’s jobs report, which could shape the Fed’s path on interest rate cuts and set the tone for the weeks ahead. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent falls into the hands of the bears: rising supply signals nothing good Brent slipped to 66.42 USD per barrel. The market is filled with negativity ahead of additional supply entering the market. Discover more in our analysis for 30 September 2025. Brent forecast: key trading points Brent crude declines under pressure from geopolitics and OPEC+ rhetoric Additional supply on the global market will push prices down even faster Brent forecast for 30 September 2025: 65.40 Fundamental analysis Brent crude fell to 66.42 USD per barrel on Tuesday, extending the decline of the previous session. Prices are under pressure from expectations of increased global supply and discussions of a possible ceasefire in Gaza. Media reports suggest that at Sunday’s meeting, OPEC+ may approve an additional output increase of at least 137,000 barrels per day starting in November. Another factor was the resumption of oil exports from Iraqi Kurdistan. Flows through the Iraq–Turkey pipeline were restored on Saturday after a US-brokered agreement between regional authorities, Baghdad, Turkey, and foreign companies. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 330 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Head and Shoulders pattern formation threatens EURUSD bulls The EURUSD rate continues to strengthen amid pressure on the US dollar and growing expectations of further Fed easing. The rate currently stands at 1.1741. Find out more in our analysis for 30 September 2025. EURUSD technical analysis While the EURUSD rate remains within an upward channel, the current strengthening is capped by the resistance zone near 1.1745. The chart shows the formation of a Head and Shoulders reversal pattern. Additional pressure on the pair comes from the Stochastic Oscillator signal, where the indicator lines have approached overbought territory and are showing readiness to turn downwards. Fundamental factors support euro growth; however, technical analysis of EURUSD points to a high risk of a bearish scenario with a breakout below the support level and a decline towards 1.1645. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

(Req) Crush Topstep’s Trading Combine PREMIUM

Robin replied to Robin's topic in Forex Clips & Movie Request

$10 here, please share - https://cheapcourseszone.com/product/simpler-trading-crush-topsteps-trading-combine-premium -

-

A better chart of S&P500: https://workupload.com/file/uS2DFBXvVp2