All Activity

- Past hour

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 19th August 2025.[/b] [b]German Economy Between Tariffs and Investment Boost.[/b] Economic Contraction in the Second Quarter The German economy is once again showing signs of strain, with activity contracting in the second quarter of 2025. Revised production figures revealed deeper weakness than initially reported, underlining the persistent struggles of Germany’s flagship manufacturing sector. The newly signed trade agreement with the United States is expected to bring additional headwinds, especially for automakers, while Berlin’s recently announced investment boost in infrastructure and defence will take time to filter through into actual production growth. At the same time, the surge in spending across the European Union may force the European Central Bank (ECB) to rethink its monetary policy sooner than expected. Manufacturing Sector Under Pressure For much of the past year, Germany’s growth figures have been flattered by businesses front-running anticipated U.S. tariffs. While GDP expanded during the last quarter of 2024 and the first quarter of 2025, much of that momentum came from exporters rushing orders ahead of tariff deadlines. As many analysts warned, this left a demand gap that became visible in the second quarter, when the economy contracted by 0.1% quarter-on-quarter. To make matters worse, first-quarter growth was revised lower to 0.3% from the previously reported 0.4%, confirming that overall momentum in the first half of the year was weaker than thought. The industrial sector remains the hardest hit. Preliminary data point to a sharp contraction, with production plunging 1.9% in June. Adding to the gloom, May’s figures were revised drastically lower to just 0.1% growth from an initial 1.2%. This leaves industrial activity at its weakest level since May 2020. Much of the revision came from updated reports in the automobile sector, where uncertainty over tariff regimes has clouded output and investment decisions. Tariffs Challenge German Automakers It is worth noting that seasonal factors, such as Easter falling later in the quarter, may have slightly distorted the numbers. However, the broader trend is clear: Germany’s manufacturing sector continues to struggle. Purchasing Managers’ Index (PMI) readings confirm the weakness, and ongoing uncertainty over future trade relations with the U.S. has weighed heavily on sentiment. While some clarity has emerged since the deal was signed, the reality is that new tariffs will curb exports, particularly in the critical auto industry, while also disrupting supply chains that are central to German manufacturing. German automakers, including BMW and Mercedes, had hoped for exemptions given their extensive U.S. investments. Reports even suggested that industry representatives travelled to Washington to propose a reciprocal arrangement: tariff-free imports of EU-made cars in exchange for every U.S.-produced vehicle shipped to Europe. Yet, such proposals failed to gain traction, and manufacturers are now facing the reality of a 15% tariff on U.S. imports of German goods. Behind the scenes, lobbying efforts are expected to continue, but for now, automakers must prepare for a more challenging trade environment. Berlin’s Investment Boost in Infrastructure and Defence Against this backdrop, Berlin’s new government has attempted to counteract the drag with an ambitious fiscal program. Having taken office in March, the administration moved swiftly to abandon strict debt limits and pledge a sweeping investment boost, with a particular focus on defence and infrastructure. These efforts build on the rearmament drive that began under the previous government in response to Russia’s invasion of Ukraine, but have now accelerated with additional funds. The results are already visible in the orders data, although volatility remains high due to the presence of large-ticket defence and infrastructure contracts. In June, orders fell by 1.0% month-on-month, following a 0.8% decline in May. Yet, thanks to large-scale contracts, overall orders rose by 3.1% in the second quarter, offering some hope for stronger growth later this year. Stripping out these large orders, however, paints a more modest picture, with demand rising just 0.1% quarter-on-quarter. This suggests that any positive impact on GDP may not be immediate. Orders Data Show Mixed Signals A closer look at orders data reveals the deep impact of tariffs and shifting trade relations. Orders from abroad fell by 3.0% month-on-month in June, driven by a sharp 7.8% plunge in demand from non-Eurozone countries. By contrast, orders from within the Eurozone rose 5.2%, while domestic demand increased by 2.2%. The divergence underscores Germany’s growing dependence on European and local demand to cushion against the decline in U.S.-linked trade. Fiscal Expansion and ECB Policy Outlook The central question now is whether government spending can compensate for the tariff shock. If fiscal stimulus is supported by structural reforms and measures to encourage private investment, it could set the stage for a recovery. However, if higher public spending is not matched by efficiency gains and red-tape reduction, Germany’s fiscal expansion risks backfiring. Bond markets are already signalling concern, with the 30-year German yield climbing to its highest level since 2011. For the ECB, the shifting policy landscape complicates the outlook. The combination of higher German yields, broader EU defence spending, and resilient inflation pressures could force policymakers to halt the easing cycle earlier than planned. While another rate cut in December remains on the table, markets are increasingly speculating that the ECB may be compelled to raise rates again in the second half of 2025. Germany at a Crossroads In short, Germany finds itself at a crossroads. Tariffs and global trade shifts are undermining its traditional export model, while domestic investment is only just beginning to gain traction. Whether the government’s spending spree can offset external headwinds remains uncertain, but the stakes are high—not just for Germany, but for the entire Eurozone economy. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. - Today

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

Octet Design Journal explores the most useful Figma plugins that every designer should know to improve their creative process. These plugins are carefully curated to help streamline daily tasks, boost collaboration, and add more power to design projects without wasting time on repetitive work. By highlighting tools that enhance productivity and creativity, the journal empowers designers to build smarter workflows, craft engaging user experiences, and stay ahead in the fast-evolving design industry.

-

Octet Design Journal joined the community

-

I agree, Demo accounts are very important for new traders. You can practice all your strategies without any risk. It is the best way to understand how the market and your broker's platform work before you put your real money in.

-

fxzero.dark reacted to a post in a topic:

orderflowlabs.com

fxzero.dark reacted to a post in a topic:

orderflowlabs.com

-

fxzero.dark reacted to a post in a topic:

TDUAlgoSuite

fxzero.dark reacted to a post in a topic:

TDUAlgoSuite

-

MrAdmin reacted to a post in a topic:

Happy Birthdays to Our Members

MrAdmin reacted to a post in a topic:

Happy Birthdays to Our Members

-

Simple and sure way to crack TimingSolution.

⭐ RichardGere replied to ⭐ Atomo12345's topic in Trading Platforms

https://indo-investasi.com/topic/93412-timingsolution-nifty-updates-3/#comment-719494 - Yesterday

-

⭐ mangrad reacted to a post in a topic:

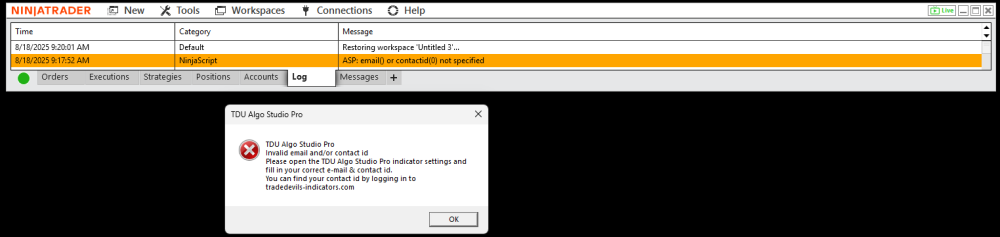

TDUAlgoSuite

⭐ mangrad reacted to a post in a topic:

TDUAlgoSuite

-

⭐ nadjib reacted to a post in a topic:

Simple and sure way to crack TimingSolution.

⭐ nadjib reacted to a post in a topic:

Simple and sure way to crack TimingSolution.

-

Simple and sure way to crack TimingSolution.

Hockman replied to ⭐ Atomo12345's topic in Trading Platforms

could you pls share the download link for TimingSolution as well -

Simple and sure way to crack TimingSolution.

⭐ Atomo12345 replied to ⭐ Atomo12345's topic in Trading Platforms

I tried without success with Optuma. Sorry! -

I suspect that folks will be reluctant to post their true birth-dates on an internet forum..... irrelevant to me though since, along with my sister, Athena, I sprung full grown out of the head of Zeus. 😲 "After a time Zeus developed the mother of all headaches. He howled so loudly it could be heard throughout the earth. The other gods came to see what the problem was. Hermes realized what needed to be done and directed Hephaestus to take a wedge and split open Zeus's skull. Out of the skull sprang Athena, full grown and in a full set of armor. Due to her manor of birth she has dominion over all things of the intellect."

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

@kimsam is it possible to get it fixes please ? Thank you 👍

-

sophiabennett joined the community

-

Qkronos is Tradingview strategy and I dont think anyone can crack TV strategies

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

Adarsh Kumar started following ⭐ iatin

-

Adarsh Kumar joined the community

-

Does anyone have de Q_Kronos strategy cracked ? Many thanks

-

This is the last version that I've found that has been educated and shared by Val1312q on his Telegram channel before He was booted. It does work but is lacking many of the advanced tools found in these new versions. So if you want to play with it, enjoy !!!!! https://workupload.com/file/528yXqcpY5q

-

ok sorry....I understood that it was 30 days free trial.....However, you should set a fixed value to the file ....edu or no_edu.....I'm not talking about you but for all users

-

Leeladhar007 started following setare

-

-

It doesn't even load it...it gives errors continuously

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

@TRADER, I have tried Bloodhound/Blackbird, but since you have to define the trading logic in Bloodhound and the define the trades and money management in Blackbird, that seems to add more cpu/memory load then TDU does. At least with the earlier versions that I tried.

-

BeingSimple joined the community

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Trump pressures, inflation rises: how Powell will determine the fate of EURUSD The euro continues to strengthen ahead of the Federal Reserve’s interest rate decision, with the EURUSD rate likely to climb further to 1.1800. Find more details in our analysis for 18 August 2025. EURUSD forecast: key trading points The euro continues to strengthen Financial markets await the Jackson Hole Symposium EURUSD forecast for 18 August 2025: 1.1800 Fundamental analysis The euro is holding steady around 1.1700 as markets remain wary of geopolitical developments. The upcoming Jackson Hole Symposium is expected to feature a speech by Jerome Powell, which could shed light on the Federal Reserve’s future actions. Powell is caught between calls for rate cuts (particularly from Trump) and the risks of rising inflation. His ability to maintain the Fed’s independence by relying on data rather than political pressure is crucial. Following strong US fundamentals (growth in wholesale prices and retail sales), markets adjusted expectations for a significant September rate cut. This has provided the euro with additional stability against the dollar, fuelling further EURUSD gains. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 299 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY rises as all eyes remain on geopolitics The USDJPY pair started the week climbing towards 147.50. Investors are awaiting signals from the Jackson Hole Symposium. Discover more in our analysis for 18 August 2025. USDJPY technical analysis On the H4 chart, the USDJPY pair is trading near 147.40, holding within a narrow range after sharp moves in late July. The key support level lies around 146.20, the mid-August low. The resistance levels are 147.60 and 148.50, with a higher barrier at 150.95, where the market previously set a peak. The USDJPY pair rises as investors favour a stronger US dollar. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

HFM demo contest … win 1K’ sounds solid - does the prize come as withdrawable cash or as credit with turnover requirements? From my contest experience, fills/spreads can differ from live, so I treat them as practice for execution speed, not a proof of edge

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 18th August 2025. Week Ahead: Smoke Signals from Jackson Hol. It is Jackson Hole time again, with the central banker symposium taking place from August 21–23, 2025. The theme, "Labour Markets in Transition: Demographics, Productivity, and Macroeconomic Policy," is highly relevant as policymakers face shifting global dynamics in the age of Trump tariffs. Investors will be watching closely for Jerome Powell’s Jackson Hole speech, which could provide hints on whether the Federal Reserve is leaning toward a September rate cut. The July U.S. jobs report showed a surprise weakening in employment, fueling speculation about easier policy. At the same time, a hot PPI reading raised concerns that tariff-driven inflationary pressures may be starting to filter into the economy. We do not expect Powell to provide clear signals, but his tone will be crucial. Globally, most core central banks are cautiously easing policy to offset growth risks, though persistent inflation continues to complicate decisions. North America: Powell in the Spotlight The Jackson Hole symposium will dominate market sentiment this week, with Powell facing the delicate task of balancing labour market weakness with emerging inflation risks. At his July press conference, Powell highlighted inflation concerns over unemployment. However, the July payrolls report shocked markets with a sharp slowdown in hiring, raising the question of whether this is a temporary setback or the start of a more troubling trend. With producer price inflation rising, tariffs appear to be filtering into price measures, complicating the Fed’s mandate. Powell is likely to adopt a cautious stance, warning of both employment risks and inflation risks, while avoiding any suggestion of political pressure from the White House. His “smoke signals” may be deliberately vague, stressing the importance of incoming data before any firm decisions are made. While Jackson Hole will overshadow the US economic calendar, a series of housing reports will provide additional insights. Housing starts and building permits for July are expected to show further weakness, hovering near multi-year lows. Existing home sales are projected to edge higher but remain well below last December’s pace, while the median sales price will likely post a seasonal decline from June’s record level. The leading economic index is expected to remain at its nine-year low, underscoring broader economic fragility. Alongside Powell, a number of Fed officials will also be speaking this week, including Governor Bowman, Governor Waller, and Atlanta Fed President Bostic, while the release of the FOMC minutes will provide additional context on the central bank’s current thinking. In Canada, attention turns to inflation and retail sales after the Bank of Canada kept rates unchanged at 2.75% in July. While the weak July jobs report raised speculation of a rate cut in September, stronger-than-expected retail sales and persistently firm core inflation suggest Governor Macklem may hesitate to ease further. Inflation has been running above target, with median and trim rates holding near 3%, adding weight to the case for holding policy steady at the September 17 decision. Europe: PMIs and Inflation in Focus In the Eurozone, geopolitics and trade continue to dominate sentiment. Preliminary PMI reports are due and are expected to confirm a sluggish growth outlook. Manufacturing activity is likely to slip further into contraction territory, while the services sector may see only a marginal slowdown. The composite PMI is projected to show very weak but ongoing growth. Meanwhile, the second estimate of German Q2 GDP should confirm a small contraction, reflecting weaker external demand after prior quarters were boosted by efforts to front-run tariffs. Inflation pressures in the region appear to be moderating. Eurozone CPI is expected to remain at 2.0% year-over-year, with core CPI at 2.3%. Even Bundesbank President Nagel has signaled less concern over inflation, particularly as German PPI has turned negative. Still, this does not imply additional rate cuts, as policymakers remain cautious about pushing rates below neutral. In the United Kingdom, stronger growth has reinforced the Bank of England’s cautious stance. July CPI is expected at 3.8% year-over-year, keeping inflation well above target. This reading will likely support hawkish voices within the BoE, even as growth prospects remain mixed. PMI data should show manufacturing still contracting, though with a slight improvement, while services remain steady. Retail sales growth likely slowed in July after a strong June, while public finance data may raise further concerns about the need for tax increases in the autumn budget. Asia: Central Banks and Signs of a China Slowdown In New Zealand, the Reserve Bank is expected to resume cutting rates, trimming by 25 basis points to 3.00%. The decision follows weak jobs data, a rise in unemployment, and softer inflation expectations, all of which support further easing. By contrast, Bank Indonesia is expected to leave rates unchanged at 5.25% after its surprise July cut, as policymakers remain cautious about currency stability. In China, commercial banks are set to announce loan prime rates, but no changes are expected after the PBoC held policy steady. However, liquidity injections have increased sharply this year, targeting key sectors such as technology, green development, and the digital economy. Despite these efforts, economic data continues to weaken. Industrial activity slowed to its weakest pace since November, retail sales growth cooled, and both new and existing home prices fell again. The combination of a property sector slump and the drag from tariffs has added further strain on domestic growth. Japan will release CPI, trade data, the tertiary index, and PMI surveys. While GDP growth has strengthened in recent quarters, tariff-related headwinds are evident in weaker exports. CPI remains above 3%, keeping the Bank of Japan inclined toward gradual tightening, though action at the upcoming September policy meeting appears unlikely given global uncertainties. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

https://whop.com/realtradertim-x-rise/ If anyone can solve it or has already done so, I'm interested. I have all the necessary mentoring available.

.thumb.jpg.9328cd821b00f14cfe2ce957c760062b.jpg)