⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

(Req) Crush Topstep’s Trading Combine PREMIUM

⭐ RichardGere replied to Robin's topic in Forex Clips & Movie Request

These videos are marked as private? -

⭐ epictetus reacted to a post in a topic:

Metastock 18 end of day c*****d.

⭐ epictetus reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

SARVATOBHADRA CHAKRA COURSE for Financial Astrology

⭐ FFRT replied to setare's topic in Ask For Help

mention atleast author name, publisher meanwhile, you can explore https://www.scribd.com/document/146255535/Sarvatobhadra-Chakra-and-Astrological-Predictions-Chi-FF https://www.scribd.com/document/651618011/Stock-Market-Analysis-Krishnan-Chi https://www.scribd.com/document/452528970/101-Astro-Combination-For-Nifty-Prediction -

Hi Atomo12345 i found an elliot wave analyzer 4 software it has a crack but it dosent analyze any data after 2008 can you edit the crack

- Today

-

⭐ apmoo reacted to a post in a topic:

Bestorderflow MBO Alternative

⭐ apmoo reacted to a post in a topic:

Bestorderflow MBO Alternative

-

PK2 reacted to a post in a topic:

Latest versions of some Ninz@ indicators 1 (They need to be educated)

PK2 reacted to a post in a topic:

Latest versions of some Ninz@ indicators 1 (They need to be educated)

-

PK2 reacted to a post in a topic:

Ultimate A.I. PRO Indicator

PK2 reacted to a post in a topic:

Ultimate A.I. PRO Indicator

-

PK2 reacted to a post in a topic:

Latest versions of some Ninz@ indicators 2 (They need to be educated)

PK2 reacted to a post in a topic:

Latest versions of some Ninz@ indicators 2 (They need to be educated)

-

⭐ rcarlos1947 reacted to a post in a topic:

Bestorderflow MBO Alternative

⭐ rcarlos1947 reacted to a post in a topic:

Bestorderflow MBO Alternative

-

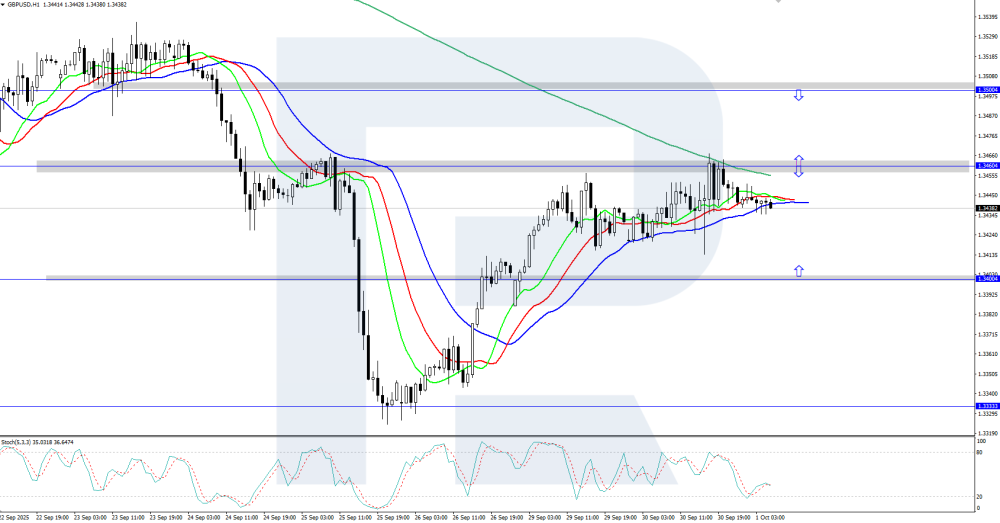

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBPUSD: pair holds above 1.3400 The GBPUSD pair consolidated above the 1.3400 mark amid the expected U.S. government shutdown and ahead of the ADP U.S. employment data release. Full details in our analysis for 1 October 2025. GBPUSD technical analysis On the H4 chart, GBPUSD shows moderate growth, consolidating above the 1.3400 level. The Alligator indicator is pointing upward, suggesting the bullish movement could continue. The key support for the uptrend is at 1.3333. The GBPUSD pair has climbed above 1.3400. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 30 forecast: the upward trend continues, the resistance level has not yet been breached After reaching a new all-time high, the US 30 index trend remains fragile. The outlook for today is positive. US 30 forecast: key trading points Recent data: US JOLTS Job Openings for September came in at 7.23M Market impact: confirms economic resilience and revenue support for cyclical companies Fundamental analysis The JOLTS report showed 7.23M job openings versus a forecast of 7.19M and 7.21M in the previous month. This points to sustained labour demand and underlines the resilience of the job market. Although the increase was modest, it reduces the likelihood of a swift easing of labour market tightness and could maintain upward pressure on wages and core services inflation. The small upside surprise strengthens the case for the Federal Reserve to take a cautious approach to policy easing. Expectations for aggressive rate cuts in the near term have diminished, while long-term bond yields may stay elevated. This increases the sensitivity of equity markets to rate dynamics and inflation expectations. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 331 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Re upload please, thank you!

-

MetaStock 18 is installed and working fine. I have MetaStock 11 data that I want to use. I don't know. Can someone help me with this? A picture or video would be better. Thanks everyone

-

PK2 reacted to a post in a topic:

A new diamond in the rough- a very good educator

PK2 reacted to a post in a topic:

A new diamond in the rough- a very good educator

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 1st October 2025. Gold Shines Bright: Record Surge Amid Fed Uncertainty and US Shutdown. Gold prices surged to an all-time high on Wednesday, climbing above $3,875 an ounce, as the United States entered its first government shutdown in seven years. The metal’s rally, fueled by central bank demand, ETF inflows, and expectations of further Federal Reserve rate cuts, highlighted mounting investor anxiety over political gridlock and economic disruption. While gold stole the spotlight, Asian stock markets delivered a mixed performance, with Japan sliding on political uncertainty and Chinese markets closed for the weeklong National Day holiday. Asian Stock Markets Mixed Amid Japan’s Political Transition Asian equities moved in different directions on Wednesday, with trading volumes thinner as China’s mainland markets remain closed from October 1–8 for the National Day holiday. Japan’s Nikkei 225 index fell 1.2% to 44,411.26 after the Bank of Japan’s Tankan survey showed a slight improvement in business sentiment among major manufacturers. The results reinforced expectations that the BOJ may raise interest rates soon, as inflation has consistently stayed above the central bank’s 2% target. Uncertainty also lingered in Japan, with the ruling Liberal Democratic Party set to appoint a new leader and prime minister to replace Shigeru Ishiba later this week. Elsewhere in the region, South Korea’s Kospi gained 0.8% to 3,450.62, while Taiwan’s Taiex advanced 1.3%, supported by strong buying in semiconductor shares. In contrast, Australia’s S&P/ASX 200 slipped 0.4% to 8,812.90. The People’s Bank of China said it will inject liquidity through a 1.1 trillion yuan ($160 billion) reverse repo operation on October 9, aimed at supporting consumer spending and business investment. US Shutdown Fuels Gold Price Surge to Record Levels The spotlight was on gold prices, which climbed to a historic $3,875.53 an ounce, extending gains for a fifth straight session. The rally came as the US government entered a shutdown after lawmakers failed to pass a temporary funding bill. Federal agencies were instructed to implement “orderly closure” plans, threatening to delay the release of key economic data, including the crucial non-farm payrolls report scheduled for Friday. So far in 2025, gold has soared over 47%, putting it on track for its strongest annual performance since 1979. The surge has been fueled by central bank buying, ETF inflows, and expectations of further Federal Reserve rate cuts. According to Bloomberg data, gold-backed ETFs saw their largest monthly inflows in three years this September. Silver also rallied, jumping as much as 2% to $47.56 an ounce, less than 5% from its all-time high, and is now up over 60% this year amid tight supply and robust investor demand. By early afternoon in Singapore, spot gold traded slightly lower at $3,864.60 an ounce, while silver gained nearly 1%. Platinum and palladium moved lower. Federal Reserve Policy Uncertainty Adds to Volatility Markets are closely watching signals from the Federal Reserve. Boston Fed President Susan Collins said additional rate cuts may be needed due to labor market weakness, while Dallas Fed President Lorie Logan cautioned against easing too quickly, pointing to persistent inflation. Concerns over central bank independence also weighed on sentiment. Attorneys for Fed Governor Lisa Cook petitioned the US Supreme Court last week to block President Trump’s effort to remove her from office. Meanwhile, the US labor market remains under scrutiny. Job openings in August were little changed from July, keeping conditions in a “low-hire, low-fire” state. A separate survey showed consumer confidence fell below expectations, reflecting worries about high inflation and weaker job prospects. Wall Street Extends Gains Despite Shutdown Despite political turmoil, US stocks posted gains. The S&P 500 climbed 0.4% to 6,688.46, marking its fifth consecutive monthly advance after setting a record last week. The Dow Jones Industrial Average rose 0.2% to a new record of 46,397.89, while the Nasdaq Composite gained 0.3% to 22,660.01. The shutdown has cast uncertainty over future data releases. The Department of Labor confirmed that the Bureau of Labor Statistics would suspend operations during the closure, delaying key reports. The agency was already under pressure following President Trump’s dismissal of BLS Commissioner Erika McEntarfer in August, after July data revealed slower hiring trends. Adding to the turmoil, the White House withdrew the nomination of E.J. Antoni to lead the bureau, according to Associated Press sources. Commodities and Currency Markets In energy markets, oil prices remained subdued, pressuring energy shares. Baker Hughes dropped 3.6%, while Schlumberger fell 2.1%. Early Wednesday, US crude edged up 11 cents to $62.48 per barrel, and Brent crude rose 12 cents to $66.15 per barrel. In forex trading, the US dollar ticked up to 147.98 yen from 147.94 yen, while the euro inched higher to $1.1738 from $1.1734. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

PK2 reacted to a post in a topic:

A new diamond in the rough- a very good educator

PK2 reacted to a post in a topic:

A new diamond in the rough- a very good educator

-

elliottwaveforamibroker.com indicator - require decompile

Moh replied to omrangassan's topic in Amibroker

We have tried everything. Thank you, sir. Atomo12345 You are a wonderful person. Windows 11 Pro 64 -

setare started following SARVATOBHADRA CHAKRA COURSE for Financial Astrology

-

Who has this course for sale? I am the buyer at a lower cost.

-

Bravomike joined the community

-

(Req) Crush Topstep’s Trading Combine PREMIUM

roddizon1978 replied to Robin's topic in Forex Clips & Movie Request

New Folder: Live Session -

Still need the original files..

-

Puzzle reacted to a post in a topic:

Metastock 18 end of day c*****d.

Puzzle reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

(Req) Crush Topstep’s Trading Combine PREMIUM

roddizon1978 replied to Robin's topic in Forex Clips & Movie Request

TopStep2020 JoeRokop Goal6of8 TopStep2020 JoeRokop Goal7of8 TopStep2020 JoeRokop Goal8of8 TopStep2020 JoeRokop Intro -

anyone have it ? please share it is many thanks

-

Thank you buddy. Excuse me for delayed response. I usually see, a very low activity here in this forum. So my frequency of visit here is low. Surprisingly i made it too before going to bed and found your response. That is really a informative response and another good friend of mine gave me the same. He suggested me to go with GoCharting for forex also ( GoCharting was my previous charting platform for financial markets ). Yes you are right... Forex never happens on a single centralized platform causing the fluctuations. But i really dont see any other effective Technical Analysis better than Order Flow or foot prints. All support & Resistance, Trend line, SMCs, FVG, etc did not convince me to take a confident manual trade in Forex or commodity...hence going back to OrderFlow, which was convincing for me. Meanwhile, Can i please request you to suggest me a good indicator or a system or a method to take successful manual trades in Forex or Commodity please... It will be very helpful for a beginner like me... And i would love to learn from experts like you and others here...🙏 Thank you buddy... Awaiting your response...

-

Si tu est francaise je suis contant que tout va bien . Bonne nuit.

-

elliottwaveforamibroker.com indicator - require decompile

⭐ Atomo12345 replied to omrangassan's topic in Amibroker

I am very sorry Moh but I don't know how other to do. Have you put my vc++ x86 file? In your movie I saw some carachter in Arabian. It can be that this software is incompatible. What Windows system have you installed? -

Thank you very much for your help it works

- Yesterday

-

Marie please run metastockemu.exe as administrator. Run the program Metastock. Click to Advanced login menu. Set Hostname to http://127.0.0.1:7983/ (copy this line and put it). Write any username and password. Bonne nuit.

-

(Req) Crush Topstep’s Trading Combine PREMIUM

roddizon1978 replied to Robin's topic in Forex Clips & Movie Request

TopStep2020 JoeRokop Goal1of8https TopStep2020 JoeRokop Goal2of8 TopStep2020 JoeRokop Goal3of8 TopStep2020 JoeRokop Goal4of8 TopStep2020 JoeRokop Goal5of8 more to come