⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

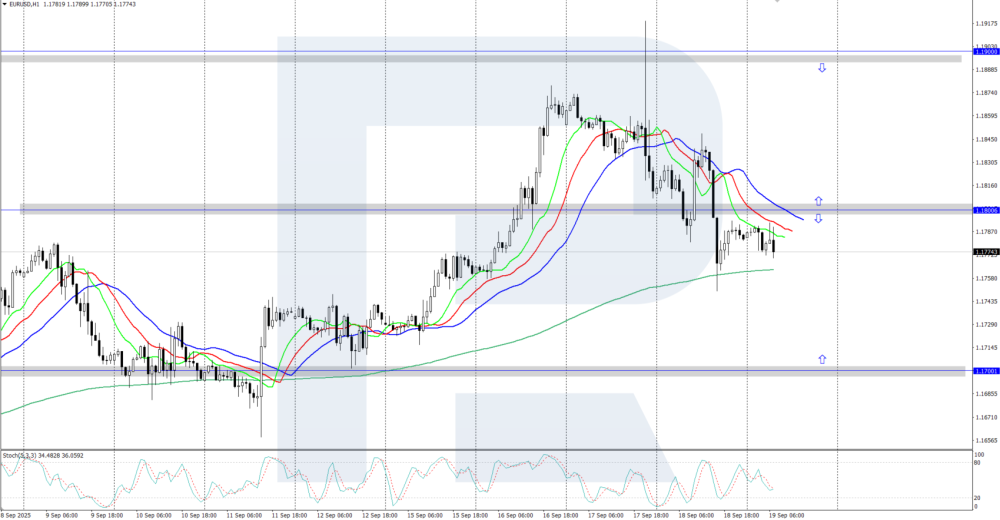

EURUSD dips below 1.1800 The EURUSD pair is correcting after recent gains, slipping below the 1.1800 level as the US dollar strengthens. Discover more in our analysis for 19 September 2025. EURUSD technical analysis On the H4 chart, the EURUSD pair turned lower after failing to break above the 1.1900 resistance level. The market is now in a local correction phase, with growth likely to continue once the correction is complete. The key support level is located at 1.1700. The EURUSD pair is moderately correcting, dropping below 1.1800. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY steady: volatility fades, but risks remain The USDJPY pair has stabilised around 148.00. Although inflation data improved slightly, market tension remains. Find more details in our analysis for 19 September 2025. USDJPY forecast: key trading points The USDJPY pair recouped losses and is stabilising The market awaits the Bank of Japan’s decision and assesses fresh inflation data USDJPY forecast for 19 September 2025: 148.26 Fundamental analysis The USDJPY rate is consolidating at 148.00 on Friday amid expectations of the Bank of Japan decision. The market generally expects the key rate to remain at 0.5%, although the likelihood of a 25-basis-point hike in October is gradually increasing amid economic resilience. Core inflation in Japan slowed to 2.7% in August, the lowest since November 2024. The decline is mainly due to the resumption of government subsidies for electricity and gas, as well as price adjustments for food products. At the same time, the rise in rice prices remains the main factor of inflationary pressure: in August, the price increased by 68.8% year-over-year, following jumps of almost 100% in June and 90.7% in July. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 323 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

- Today

-

Forex Basics 4 Advanced&Beginner Traders

arabitech replied to StefGrig's topic in General Forex Discussions

Just adding ema to your charts can give sharp identifications of market turning points because i have heard that the EMA is being used by professional traders. -

We can use demo account for back-testing and then forward testing before going to trade with live funds.

-

It works bro, not sure if you downloaded it properly

-

Forex Trading in Indonesia – Experiences & Tips?

binaryowner replied to zennie90's topic in General Forex Discussions

Pick liquid majors with tight spreads during your active session and test withdrawals/process with small amounts before committing size. This is how I started my trading journey with HFM. Asia can be range-heavy—plan for breakouts into London, or lean into mean-reversion with strict risk. -

⭐ FFRT reacted to a post in a topic:

Tom Alexander Videos

⭐ FFRT reacted to a post in a topic:

Tom Alexander Videos

-

yes, that's what i am looking for, thank you very much👌👍 @laser1000it 🙂

-

Primal Wisdom reacted to a post in a topic:

Tom Alexander Videos

Primal Wisdom reacted to a post in a topic:

Tom Alexander Videos

- Yesterday

-

⭐ goldeneagle1 reacted to a post in a topic:

Edge Runner Auto (from Pro Edge Trading)

⭐ goldeneagle1 reacted to a post in a topic:

Edge Runner Auto (from Pro Edge Trading)

-

⭐ goldeneagle1 reacted to a post in a topic:

got this see if it works scalpersoftware.com

⭐ goldeneagle1 reacted to a post in a topic:

got this see if it works scalpersoftware.com

-

⭐ goldeneagle1 reacted to a post in a topic:

MBOX Wave Like It or Dislike It ?

⭐ goldeneagle1 reacted to a post in a topic:

MBOX Wave Like It or Dislike It ?

-

⭐ goldeneagle1 reacted to a post in a topic:

MBOX Wave Like It or Dislike It ?

⭐ goldeneagle1 reacted to a post in a topic:

MBOX Wave Like It or Dislike It ?

-

⭐ goldeneagle1 reacted to a post in a topic:

LegendaryTrader Indicator - Newest Versions

⭐ goldeneagle1 reacted to a post in a topic:

LegendaryTrader Indicator - Newest Versions

-

⭐ goldeneagle1 reacted to a post in a topic:

NinZaSuperJumpBoost_NT8 needs edu

⭐ goldeneagle1 reacted to a post in a topic:

NinZaSuperJumpBoost_NT8 needs edu

-

⭐ goldeneagle1 reacted to a post in a topic:

Anyone can educate with Viper Trading Indicator?

⭐ goldeneagle1 reacted to a post in a topic:

Anyone can educate with Viper Trading Indicator?

-

⭐ goldeneagle1 reacted to a post in a topic:

Controlling Updates and Reboots

⭐ goldeneagle1 reacted to a post in a topic:

Controlling Updates and Reboots

-

hb22f joined the community

-

Hey, it says file not found.

-

No password needed once downloaded extract and dragand drop in your desktop then import

-

I don't know if its educated (I have not NT installed) and I don't really trust files downloaded from shady Telegram channels, anyway psw=123456

-

Thanks for sharing Roddizon :). Unfortunately that was the old version, without the updated content. But really appreciate you helping me finding it 🙂 For thos who dont know, the course was released in 2018/19, but they updated it in 2024. with extra contents. the contents of the updated course should look something similar below.

-

Hello, what is the password please?

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: prices approach the upper boundary of the upward channel The JP 225 index continued to rise within the upward channel and hit a new all-time high. The JP 225 forecast for today is positive. JP 225 forecast: key trading points Recent data: Japan’s balance of trade for August came in at -242.5 billion JPY Market impact: this result carries a positive signal for the Japanese equity market Fundamental analysis Japan’s balance of trade for August 2025 stood at -242.5 billion JPY, better than the forecast of -513.6 billion JPY but weaker than the previous reading of -118.4 billion JPY. Although the trade deficit remained, the gap turned out nearly half as small as expected. This indicates stronger external economic conditions than anticipated and reduces concerns about pressure on the trade sector. For the JP 225 index, the impact is mixed: on the upside, the result exceeded expectations, which supports confidence in Japanese companies’ export activity. On the downside, the deficit still widened compared to last month, reflecting reliance on energy and raw material imports. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 323 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

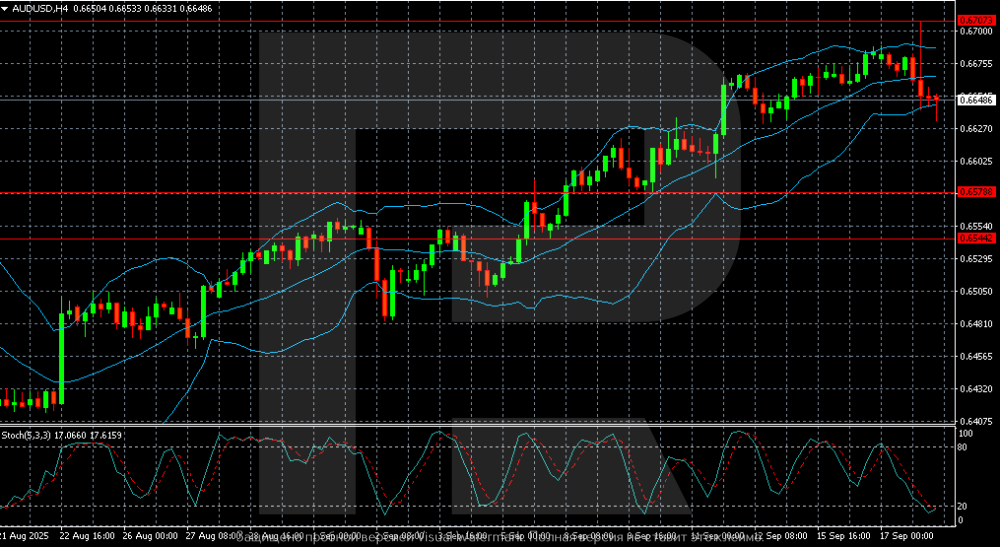

AUDUSD struggles under weak labour market signals The AUDUSD pair slipped to 0.6648, with the Australian dollar pressured by employment data. Find out more in our analysis for 18 September 2025. AUDUSD technical analysis On the H4 chart, the AUDUSD pair shows a downward correction after testing the 0.6707 resistance level. The recent trading range is narrowing. The AUDUSD pair is correcting amid fundamental data. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

do you need this ? h**ps://www.mediafire.com/file/wzdlbti932t6e7v/Practical_Trading_Applications_of_Market_Profile_%28Tom_Alexander%29.rar/file

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

Trading system Vantage Point 7 with all the modules

⭐ laser1000it replied to ⭐ Atomo12345's topic in Trading Platforms

to evaluate the software out of personal interest, but I I ran into problems with the SQL Server installation and at the end therefore I am not moving on this issue -

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 18th September 2025. Global Markets Digest: Fed Cuts Rates, Asia Bonds Mixed, and Tech Leads Equities. Asian bond markets opened mixed on Thursday, reflecting investor caution after the Federal Reserve’s first rate cut of 2025. Chinese government bond yields edged lower as traders bet that US easing could give Beijing more room to support growth. Japanese government bonds saw mild selling pressure as the yen firmed and investors reassessed the Bank of Japan’s next steps. South Korean and Australian yields were largely unchanged, highlighting a wait-and-see mood ahead of other central bank meetings. Fed Cuts Rates but Stays Cautious The Federal Reserve trimmed the federal funds target range by 25 bp (4.25%–4.00%), its first reduction since December. The vote was 11–1, with newly appointed Governor Stephen Miran dissenting in favor of a 50-bp cut. The Fed’s updated projections (“dot plot”) suggest an additional 50 bp of easing in 2025, but the committee remains divided: six policymakers see no further cuts this year, nine expect one more, and one anticipates larger reductions up to 125 bp. Chair Powell framed the move as a “risk management” cut, stressing a meeting-by-meeting, data-dependent approach. He highlighted that the rapid slowdown in supply and demand in the labor market was the central concern, while economic activity remains resilient. Consumption is holding up, and manufacturing continues to benefit from AI investment. Powell also noted the Fed does not have a “right or wrong” level of asset prices and does not currently see structural vulnerabilities. Despite the easing, Powell pushed back against market expectations for aggressive cuts, noting there was no widespread support for a 50-bp reduction at this meeting. He emphasized that policy decisions will remain data-driven, leaving markets uncertain about the exact pace of future easing. Market Reaction Asia Bonds: Chinese yields eased; Japanese yields ticked higher; South Korea and Australia largely unchanged. US Treasuries: Yields initially fell but reversed. The 2-year closed 5 bp higher at 3.553% (after touching 3.465%), while the 10-year finished up 5.5 bp at 4.083% (after 3.987%). Dollar: DXY rebounded to 97.027 from an intraday low of 96.218. Equities: Dow Jones +0.57%, S&P 500 –0.10%, NASDAQ –0.33%. Equities and Tech Lead the Way Tech shares are driving US equities, with Nasdaq futures up roughly 0.7%. Wall Street saw a mixed session yesterday: the Dow rose 0.6% while tech-heavy stocks struggled. Intraday volatility increased when Powell offered a less dovish tone, prompting a brief selloff. Dip buyers quickly returned, betting on continued rate cuts in October and December. The Fed’s dot plot remains complex: aside from Miran’s aggressive 50-bp cuts, 10 policymakers expect at least two further cuts, while nine see just one more. Powell’s cautious messaging leaves investors without a clear signal, underscoring that post-COVID equities often adapt narratives to maintain optimism. Asia-Pacific: Economic Data and Central Bank Moves New Zealand: Q2 GDP contracted 0.9% q/q, weaker than expected. Governor Hawkesby indicated faster cuts could follow if conditions remain soft. Markets now expect a 50-bp cut in October to 2.5%, followed by 2.25% in November, pressuring NZDUSD. Hong Kong: Monetary Authority lowered its base rate 25 bp in line with the Fed. China: People’s Bank kept its seven-day reverse repo rate at 1.4%, signaling no urgency to ease. Australia: August labor figures showed a net loss of jobs, mainly full-time positions. Unemployment held at 4.2%, while participation slipped. The weak labor tone marginally advanced expectations for the next RBA cut, though no action is expected in September. AUDUSD dipped initially but recovered most losses. Crypto Update The US SEC approved new spot crypto ETF standards, allowing faster approvals (about 75 days) for products tied to Solana, XRP, and Dogecoin. Launches could begin as early as October, providing fresh momentum for the crypto market. Bottom Line The September Fed meeting reflects a shift from a high-for-longer stance to a balanced, data-dependent approach, but it stops short of signaling an aggressive cutting cycle. US labor market risks remain the key driver of policy, while inflation remains above target. Asian bond markets, US equities, and regional central banks are all adjusting to this cautious easing narrative. Investors should expect continued volatility as markets weigh US economic data, Fed messaging, and central bank decisions across the globe. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

akilaishan joined the community

-

Forex Trading in Indonesia – Experiences & Tips?

arabitech replied to zennie90's topic in General Forex Discussions

Asian traders have particularly more trading opportunities and brokers as compared to the other regions so if you are looking for trading opportunity, you have choose the right path for your career. All you need is to do some of your own research before moving forward and keep us posted. Good Luck!