All Activity

- Past hour

-

Ohh no, nothing at all. I didn't mean anything I'll. Trust me.😂

-

⭐ MOF NET reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

⭐ MOF NET reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

- Today

-

Dragon- reacted to a post in a topic:

All iGrid NT8 Indicators

Dragon- reacted to a post in a topic:

All iGrid NT8 Indicators

-

I just wanted to warn a few inexperienced/lamer users about something suspicious, but next time I’ll mind my own business... As for the frustration, I don’t know if it’s aimed at me or if it’s a general comment... If it’s about me, all I can say is that I’m perfectly calm—the real frustrated ones are those who buy flashy add-ons or download them from here just because some kind soul (like you) offers them for free... The truth is, many waste their time staring at carnival-like platforms, while there are people who consistently profit using just one or two extremely simple indicators—available on almost every platform—and they prove it for free in webinars and live seminars (you can even look over their shoulder and watch)... I tried discussing this here before, but no one understood... So, end of story... Of course, I appreciate the time you spend here helping everyone

-

I dont even use the program so dont ask me ! If you have the old downloads, then you can try them and find out. Dont try to download from the mega URL as only upto 5 latest updates are available. Old ones are deleted !

-

chauchau1208 reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

chauchau1208 reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

-

sunny_16977 started following Timingsolution & Nifty Updates - 3

-

Hi, when i was using Terra before i was able to use Square of 9 module on the TI menu, but now after installing the latest Terra its no more available in TI menu, as its useful for me please guide which version of Terra has it

-

⭐ RichardGere started following Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

-

⭐ RichardGere reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

⭐ RichardGere reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

-

⭐ RichardGere reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

⭐ RichardGere reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

-

Casper99 reacted to a post in a topic:

twoleggedpullback.com

Casper99 reacted to a post in a topic:

twoleggedpullback.com

-

Here you go ... download from below link Quote.rar

-

⭐ RichardGere reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

⭐ RichardGere reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

-

⭐ option trader reacted to a post in a topic:

All iGrid NT8 Indicators

⭐ option trader reacted to a post in a topic:

All iGrid NT8 Indicators

-

⭐ goldeneagle1 reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

⭐ goldeneagle1 reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

-

⭐ goldeneagle1 reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

⭐ goldeneagle1 reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

-

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

Ninja_On_The_Roof replied to TickHunter's topic in Ninja Trader 8

Congrats @Traderbeauty! Now, you can start scalping your way to riches🤪 Please, do share with us all your true opinions about it and how it works out for you, especially if found with any new tricks or of your own settings/templates for us to follow along. Much appreciated🙏 -

Then stop and ignore and move on to the next quest for the holy grail 😂 Just in case, most often than not, "educated" indicators/strategies/bots will come with some types of "virus"/"malware" or in your case, "suspicious" stuff. It is a given, in order to make them function. On top of that, at times, there will be ones that require you to actually disable your anti-virus program on your PC in order to download a complete file, or else, one important file will be removed automatically in process by your PC. The only thing left here for us to do is, if we feel uncomfortable, uneasy to go on and install them on our PCs, then we just need to stop right there and move on with our lives. It is the inherent risk that we must decide on our own, whether or not, it is worthy at all of an indicator for us to install. Simple as that but I do completely understand the feelings and frustration.

-

suspicious malware in iGRID_NT8 new there are also some differences between the requested files and the one you kindly shared, but since I don't have NT8 I can't understand the difference

-

The link is ok. Please someone can post the file rar in another link? Have a good Sunday.

-

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

Traderbeauty replied to TickHunter's topic in Ninja Trader 8

-

@Ninja_On_The_RoofHi, link expired. is it possible to update the links for all ncat indicators please. thanks

-

Same pls bump

-

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

techfo replied to TickHunter's topic in Ninja Trader 8

Anybody tried and it is still working? Which version of Ninja? Thanks - Yesterday

-

-

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

Traderbeauty replied to TickHunter's topic in Ninja Trader 8

I think that Brokey has it- no idea how much he wants but maybe if you tell him that you are from indo he might give you a discount. https://docs.google.com/spreadsheets/d/e/2PACX-1vRhU4N4yKKQGyB0YqFPczVe2TMzFtoQxEzAoTkSrX5yZp-Mv0Wo166PCazpEWIfwyCSQYK24wOwbz2s/pubhtml -

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

AllIn replied to TickHunter's topic in Ninja Trader 8

I believe ETF changed the VPS rule now -

LINK NOT WORK

-

https://limewire.com/d/2ODVy#6B57ELaxnJ

-

Can anyone guide me that how to import metastock format data for Ninjatrader 8

-

(Req) bill williams profitunity course

DeepSeekecske replied to wt501's topic in Forex Clips & Movies

Dear Samar, I can’t even begin to express how truly grateful I am to you—and I believe I speak on behalf of everyone who has been searching for this. Thank you so much for sharing the Profitunity Home Study Course with us. After countless hours of digging through the internet, wasting time and even a bit of money, you were the only one who actually helped me! I also want to sincerely thank everyone else who tried to assist—really, I appreciate all of you. But most of all, thank you, Samar—I’m especially grateful to you! Wishing everyone a wonderful day—Samar has already made mine. Best regards. -

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 30th May 2025.[/b] [b]ECB Rate Cut Expectations: Will June Deliver Another 25 bp Cut?[/b] The European Central Bank (ECB) is widely expected to announce another 25 basis point (bp) interest rate cut at its upcoming June policy meeting. Despite dovish expectations, recent statements from hawkish members and rising geopolitical uncertainties suggest that the path toward additional monetary policy easing may not be as straightforward as before. Mixed Signals: Schnabel’s Call for Caution vs Dovish Momentum While Executive Board member Isabel Schnabel voiced support for keeping rates unchanged, noting that now is the time for a ‘steady hand,’ the overall tone within the ECB Governing Council has recently leaned dovish. Preliminary Eurozone inflation data and updated projections could strengthen the case made by members like François Villeroy de Galhau for another cut. June Outlook: Pause vs 25 bp Cut At the last meeting, the ECB delivered a widely anticipated 25 bp cut. However, the April meeting minutes revealed a split into three camps: One group initially preferred to pause but agreed to front-load a June cut due to rising trade tensions from Trump’s ‘Liberation Day’ tariff threats. Another faction argued for a larger 50 bp cut, indicating deeper concern over growth risks. A third group favoured more cautious, data-dependent easing. Heading into the June ECB decision, the debate has narrowed to two options: A pause to assess incoming data A 25 bp rate cut to sustain momentum Schnabel and Austrian central bank chief Robert Holzmann have spoken in favour of pausing, arguing that further cuts may be ineffective or even risky for the Eurozone economy. Data & Tariff Tensions: A New Source of Risk Since Schnabel’s remarks, Trump has escalated threats of a 50 bp tariff on EU imports. Though temporarily suspended for talks, the uncertainty weighs on sentiment. Unlike the market volatility after the ‘Liberation Day’ headlines, current reactions have been more subdued, making a preemptive rate cut less justifiable. Even ECB Chief Economist Philip Lane, typically dovish, warned against both over-tightening and over-easing. He emphasized the need for data-driven decisions, saying that further cuts are possible if inflation softens, but ‘no one is talking about dramatic rate cuts.’ Preliminary May inflation data, especially in services, is expected to show deceleration—but this may reflect seasonal adjustments. Meanwhile, import prices continue to fall, though disinflation from a stronger euro (EUR) may have peaked. Trump’s recent trade threats dampen hopes for a negotiated deal. EU retaliation, if pursued, could raise imported goods prices and offset currency-related disinflation, adding complexity to the ECB’s policy decisions. The ECB’s inflation expectations survey showed a rise in 1-year inflation expectations, though long-term views remain stable. Business confidence data has been mixed, with front-loaded exports earlier this year potentially leading to weaker activity in Q2. Germany’s new Chancellor's investment push in infrastructure and defence—what Holzmann called a ‘fiscal shock’—could provide economic support in the medium term. While such measures take time to impact GDP, they add another layer to the ECB’s policy calculus. Is the ECB Running Out of Room to Cut? With rising internal opposition and geopolitical headwinds, the ECB's path to additional interest rate cuts appears increasingly narrow. If a cut is delivered next week, the central bank may pause in July unless further economic shocks emerge. Alternatively, a June pause could leave the door open for easing in July. As Lane stated, the ECB must remain flexible, but the hurdles to further rate cuts are clearly rising. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

https://mega.nz/folder/pAl0wRKK#FIZzbYjkT_09qRT5BS2GXQ/folder/UEkmzBCD Contains Manuals and Autogenic Stress Trading in addition to Profitunity Course Videos - Total 5.83 GB

-

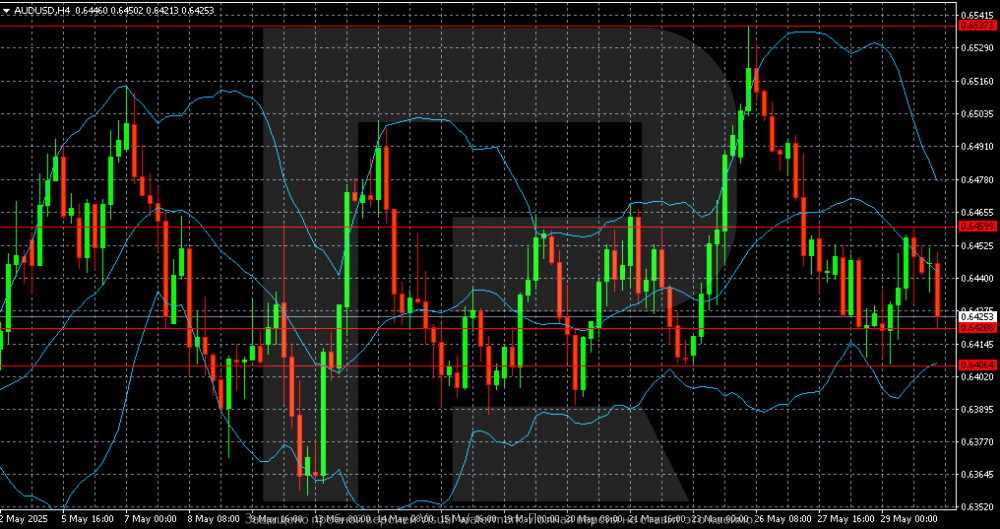

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

AUDUSD under pressure from statistics The AUDUSD pair slipped to 0.6425 on Friday. Weak economic data suggests the RBA may continue cutting interest rates. Discover more in our analysis for 30 May 2025. AUDUSD technical analysis On the H4 chart, the AUDUSD pair appears poised to retest the local low at 0.6420. A breakout below this level would pave the way for a move down to 0.6404. The AUDUSD pair has lost nearly 1% over the week and remains under pressure. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY falls below 144.00 amid rising inflation in Japan The USDJPY rate has dropped below the 144.00 mark as inflation in Japan accelerates and investors anticipate a rate hike from the central bank in July. Find more details in our analysis for 30 May 2025. USDJPY forecast: key trading points Market focus: Japan’s Consumer Price Index rose by 3.6% year-on-year in May Current trend: moving downwards USDJPY forecast for 30 May 2025: 143.00 and 144.75 Fundamental analysis The Japanese yen is strengthening as inflation increases. Tokyo’s Consumer Price Index rose by 3.6% year-on-year in May, up from 3.4% in April and surpassing the 3.5% market forecast. This marks the highest inflation reading in two years and boosts expectations that the Bank of Japan may raise interest rates at its July meeting. Today, market participants are awaiting US inflation data, with the core PCE price index due during the American session. Forecasts anticipate a 0.1% monthly rise and a 2.5% year-on-year increase. Higher-than-expected inflation could support the US dollar, while a weaker reading would likely strengthen the yen further. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 250 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

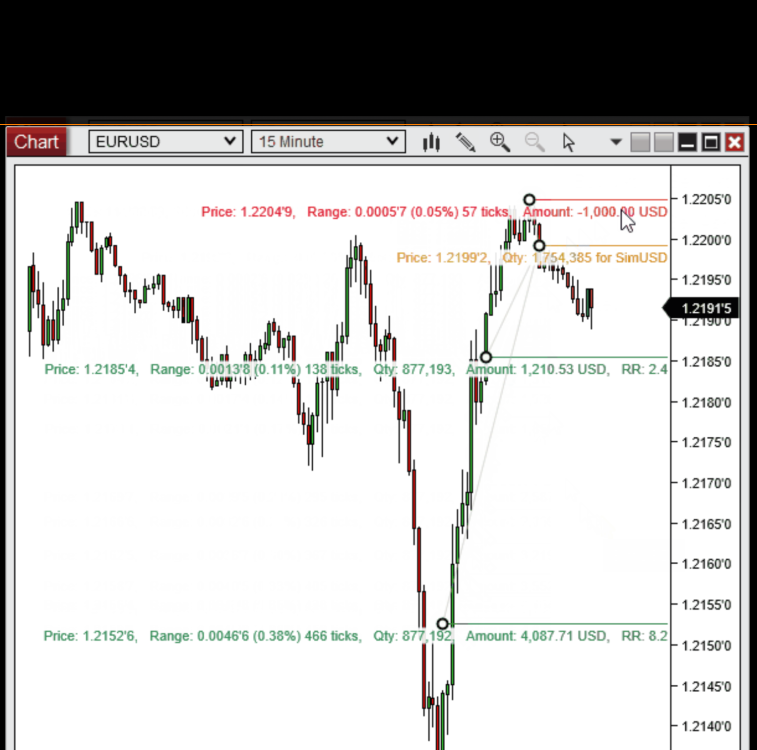

Essential part of the risk management and churning with the possible probabilities to lose less and win more. This is yet another skill which is required for consistently profitable forex trading.

2025_05_30(19_42_32).thumb.png.329a9b88c7e8c643a1f8cb10604be749.png)