All Activity

- Past hour

-

Anybody have the Rancho Dinero set of Volume Profile ?

-

Aurra Official changed their profile photo

- Today

-

⭐ laser1000it reacted to a post in a topic:

Grok

⭐ laser1000it reacted to a post in a topic:

Grok

-

⭐ monkeybusiness reacted to a post in a topic:

Pars Fortuna - You Can Thank Your Lucky Stars with Olga Morales

⭐ monkeybusiness reacted to a post in a topic:

Pars Fortuna - You Can Thank Your Lucky Stars with Olga Morales

-

Word is that Deepseek contains a type of spyware.

-

In terms of data handling and processing is concerned, GROK is way better than any other AI. While Gemini and ChatGPT tells me that there is too much of data and they can not handle it, when i upload text data in customised format line by line for further analysis and select few among the crowd based on my criterias, GROK does amazing job.

- Yesterday

-

babeonidi reacted to a post in a topic:

S & D strategy

babeonidi reacted to a post in a topic:

S & D strategy

-

supa2003 joined the community

-

Chidiroglou reacted to a post in a topic:

Grok

Chidiroglou reacted to a post in a topic:

Grok

-

After years of use, the NinjaTrader 8 AI API is a real headache at every line. It doesn't follow CSharp version coding rules. Each CSharp has its own logic and syntax, which can be confusing. For large coding, Gemini Pro is a genius at troubleshooting errors and large code. Deepseek is a king; its thinking is mind-blowing and it finds solutions to every puzzle. The .perplexity.ai for Deepseek works flawlessly for large code. perfectly CLAUDE is good, but it needs good responsiveness. It doesn't remember coding history and doesn't correct errors. GPT is good for debugging and fixing some problems, but not for coding... Grok offers good propaganda ads , bad experiences, and missing code issues, but it's only suitable for small code like RSI or MACD. qwen.ai is really good for big data.

-

The major update in Amibroker 6.93 c****ed, AFLWIZ.

tony01 replied to ⭐ Atomo12345's topic in Amibroker

I need AmiBroker 6.9; if someone cracks the program, I can pay $50 via PayPal. Also, at least 10 more people will be interested in it, so the cracker can collect at least $500, not bad for him. Thanks. -

Problem with anything involving data ,volume, ticks on nt8 and you do playback you trade 1 second agregated data so for me always been a waste of time you can only test live else is gonna be a huge down in realtime ... For example machine learning daytrading on playback is one thing realtime complete disaster as orderbook events on playback are worthless.. still no matter what ai to use tocode or modify they hesitate and make tons of mistakes so relying in only 1 is a downfall try chatllms where you have 20 ai in 1 place .. still amazed on how this orderflow analitica l2azimuth gets those high winning days using ML..

-

Hi/ pls. can anyone renew the link of optuma2.2 because all the links of mega, 4shared and mediafire are dead. thank you all

-

Aws joined the community

-

I’ve been using all the models and all the versions for over a year now, and my conclusion is that currently, to achieve decent results in NT8 with AI, you need to use a combination of advanced models such as Claude 4.1, ChatGPT Pro, and Grok. The latter is almost the same as GPT Pro. Claude Ultra is also very similar, though a bit more focused on conversation. If anyone is interested in having private discussions or programming together with GPT Pro, we have a group where seats are available to use the PRO version of GPT at a very low cost. The group is exclusively focused on trading and code. Best regards,

-

does anyone still have his dvd? the youtube one suddenly disappeared.. thank you in advance ~

-

⭐ vinko reacted to a post in a topic:

orderflowlabs.com

⭐ vinko reacted to a post in a topic:

orderflowlabs.com

-

⭐ vinko reacted to a post in a topic:

My Future Success

⭐ vinko reacted to a post in a topic:

My Future Success

-

⭐ vinko reacted to a post in a topic:

My Future Success

⭐ vinko reacted to a post in a topic:

My Future Success

-

I used paid chatgpt (200 USD X MOUNTH) but I find deepseek better

-

If you have a good idea, great things can happen. All the AIs I've tested take shortcuts when things get tough, for example, if you get a few errors during a comprehensive imbalance test, they switch to the simplest imbalance calculation method and won't tell you they're doing it. Therefore, you should know what you're doing, or at least understand what the code does. Grok is one of the best at this; it can even help you with reverse engineering. Most AIs won't help you even if you express permission to do so. Using free, open-source, Chinese AI tools (like DeepSeek) for trading is a bold move, to say the least. If you think that AI models trained with millions of dollars are being shared free and open-source solely for the benefit of humanity, you're naive, to say the least. If you're only going to do coding, get a Github Co-Pilot membership. It's only $10 per month. Because it runs on closed servers, there's no data leakage, and almost all AIs (openai-claude-geminini?) are available to you.

-

I found this comment about deepseek, I didn't see any more comments on this issue. "WOLFE WAVE roddizon1978 replied to Chidiroglou's topic in Ninja Trader 8 Be carefull with Deepseek , I used it to correct this file now, I am getting problem in my Ninja editor, it embedded a file that I cannot find in the program, I think it is either a Virus or a spy files, I cannot find it, but the compiler see it. April 30 34 replies "

-

if you want to waste some time try to compare with Deepseek , from my side is the best

-

I just tried it with a rank correlation index ( RCI ), I had to add some lines and a brush to the alerts but it took me less than 5 minutes from idea to working code : using System; using System.ComponentModel; using System.ComponentModel.DataAnnotations; using System.Windows.Media; using System.Xml.Serialization; grok_rci_indicator.cs

-

Anyone please share ARC CWAP Algo h t tps://architectsai.com/product/cwap-algo/ and ARC BOSFib Algo h t tps://architectsai.com/product/bosfib-algo/ PLEASE thanks

-

Anyone using Grok? I think it is the answer to a lot of dreams .... ;--) Question to Grok and answer :: "are you able to translate code to ninjatrader c#" Answer :: Yes, I can help translate code into NinjaTrader's C# (NinjaScript) format, provided you share the source code or describe the logic you want to implement. NinjaTrader uses a specific subset of C# with its own classes, methods, and conventions for trading strategies, indicators, or other scripts. If you provide the code or a clear description of the functionality (e.g., a trading strategy, indicator, or condition), I can: 1. Translate code from another language (e.g., Python, Java, MQL4/5, etc.) into NinjaScript C#. 2. Adapt existing C# code to work within NinjaTrader's framework. 3. Write new NinjaScript code for NinjaTrader based on your requirements. ### Steps to Help You: - **Share the Code or Logic**: Provide the source code you want to translate or a detailed description of the functionality (e.g., "I want a strategy that buys when RSI crosses above 70 and sells when it crosses below 30"). - **Specify NinjaTrader Version**: Let me know if you're using NinjaTrader 7, 8, or 9, as the syntax and features differ slightly (e.g., NinjaTrader 8 introduced new methods and removed some older ones). - **Clarify Script Type**: Indicate whether you need a strategy, indicator, or other script type (e.g., market analyzer, drawing tool). - **Include Any Constraints**: Mention any specific NinjaTrader objects (e.g., `Close`, `Open`, `SMA`, `Trade`) or conditions you want to incorporate. ### Example Translation Process If you provide something like this (pseudocode): ``` If 50-period SMA crosses above 200-period SMA, buy 1 contract. If price drops 2% below entry price, sell. ``` I can translate it into NinjaScript for NinjaTrader 8 like this: ```csharp protected override void OnBarUpdate() { // Calculate SMAs double sma50 = SMA(Close, 50)[0]; double sma200 = SMA(Close, 200)[0]; double sma50Prev = SMA(Close, 50)[1]; double sma200Prev = SMA(Close, 200)[1]; // Check for cross above if (CrossAbove(sma50, sma200, 1)) { EnterLong(1, "LongEntry"); } // Exit if price drops 2% below entry price if (Position.MarketPosition == MarketPosition.Long) { double entryPrice = Position.AveragePrice; if (Close[0] <= entryPrice * 0.98) { ExitLong("LongExit"); } } } ``` ### Notes: - NinjaScript has specific methods like `EnterLong`, `ExitLong`, `SMA`, `CrossAbove`, etc., which I’ll use appropriately. - If you share code in another language, I’ll map it to NinjaTrader’s equivalent methods and structure (e.g., `OnBarUpdate` for per-bar logic). - If the code involves external libraries or complex logic, I may need clarification on how to adapt it, as NinjaTrader has limitations (e.g., no direct support for certain external APIs). - If you want real-time data or external data (e.g., from X posts or web searches), I can incorporate that if you enable DeepSearch mode, but NinjaTrader scripts typically rely on internal data (e.g., `Close`, `Open`). Please share the code or logic you want to translate, and I’ll provide the NinjaScript C# equivalent tailored to your needs! Cool!

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 20th August 2025. NASDAQ Slides Amid AI Profit Concerns: Will The Decline Continue?. The NASDAQ declines for a sixth consecutive day, measuring a total decline of 3.00%. The decline is largely due to the poor performance of NVIDIA, Broadcom, Palantir Technologies and AMD Stocks. Since April, the NASDAQ has enjoyed a strong run without experiencing a similar lasting decline. So what’s driving the pullback in the tech sector? Technology Stocks Drag The NASDAQ Lower The decline is primarily attributed to a speech by OpenAI CEO Sam Altman and a report from the Massachusetts Institute of Technology. The OpenAI CEO told journalists that the amount of demand which the technology sector is obtaining, mainly due to AI, could be a bubble. ‘When bubbles happen, smart people get overexcited about a kernel of truth,’ Altman said. However, experts advise that Mr Altman was not referring to all companies investing in AI. Mr Altman’s message, economists note, highlights a growing trend. Investors are actively pouring money into companies simply because they’re tied to AI, whether startups or struggling firms, assuming that AI involvement guarantees potential. However, Altman cautions that this belief is misguided. The report from the MIT (Massachusetts Institute of Technology) is of concern for the NASDAQ and the SNP500. The report revealed a troubling reality: 95% of companies are failing to generate returns from their generative AI investments, casting significant doubt on the technology’s profitability. Investors are concerned that the capital being invested ‘is not bearing fruit and will negatively impact the Return On Equity ratio. Lastly, traders should note that the decline is also partially due to poor economic data from the week before. This includes extremely high Producer Inflation and a lower Retail Sales figure. Of the most influential stocks, the stocks witnessing the largest declines are Palantir Technologies (-9.35%) and AMD (-5.44%). On Tuesday, only 35% of the most influential stocks saw a price increase. Will The NASDAQ’s Decline Continue? When looking at technical analysis, it is understandable that indicators and price action will provide a bearish bias due to the bearish momentum. The price is trading below the Moving Averages, the day’s VWAP and is not trading at any significant support level. However, on larger timeframes, the price is not forming more than a retracement, meaning traders should keep in mind a rebound is possible. The average size of retracements over the past 3 months is 3.56%. This also suggests that investors may still view the current downward price movement as a retracement or temporary pause. USA100 2-Hour Chart Another factor which investors will be keeping a close eye on is global political tensions. Ongoing negotiations between the US, Russia, the EU, and Ukraine have given investors hope for a potential peace agreement, though its details remain unclear. Experts see a possible trilateral summit between the US, Russia, and Ukraine to address key disputes. If this becomes more likely over the upcoming days, the market’s risk sentiment can increase, boosting the NASDAQ. Key Takeaway Point: The NASDAQ fell for a sixth straight day, dropping 3%, largely due to weak performances from NVIDIA, Palantir, and AMD. OpenAI CEO Sam Altman and an MIT report warn that much of the AI-driven investment is not generating returns. The development is raising doubts about the tech sector's profitability. High Producer Inflation and weak Retail Sales contributed to the tech sell-off, with only 35% of major stocks seeing gains. Technical indicators suggest the decline may be a temporary retracement, while ongoing US-Russia-Ukraine negotiations could improve market sentiment if progress occurs. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Dear candyman,

I would like to use the refined elliott trader program, which was previously shared in this forum, for a study. However, I have not reached the full version of the program. I would be very grateful if you can share a version that I can analyze the end-of-day data without date limit. I ask for your support because I cannot download it because the anonfile server is not working.

thanks

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) falls ahead of the Fed’s Jackson Hole Symposium Gold (XAUUSD) prices continue to decline, moving towards 3,317 USD. Demand for safe-haven assets has weakened significantly. Find more details are in our analysis for 20 August 2025. XAUUSD forecast: key trading points Gold (XAUUSD) is edging down, preparing to reach a new three-week low Easing geopolitical tensions and a surging USD have drawn part of market interest away from gold XAUUSD forecast for 20 August 2025: 3,311 and 3,265 Fundamental analysis On Wednesday, gold (XAUUSD) prices fell to 3,317 USD per troy ounce, nearing their three-week low. Pressure on the metal came from expectations of easing geopolitical tensions and a stronger US dollar. Earlier, US President Donald Trump stated that he does not plan to send ground troops but admitted the possibility of air support as part of efforts to resolve the conflict with Russia. Investors now focus on the upcoming speech by Federal Reserve Chairman Jerome Powell at Jackson Hole. Additional market cues may also come from the FOMC minutes due later on Wednesday. Rate futures indicate the likelihood of two Fed rate cuts of 25 basis points each by the end of the year, with the first possibly coming in September. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 301 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

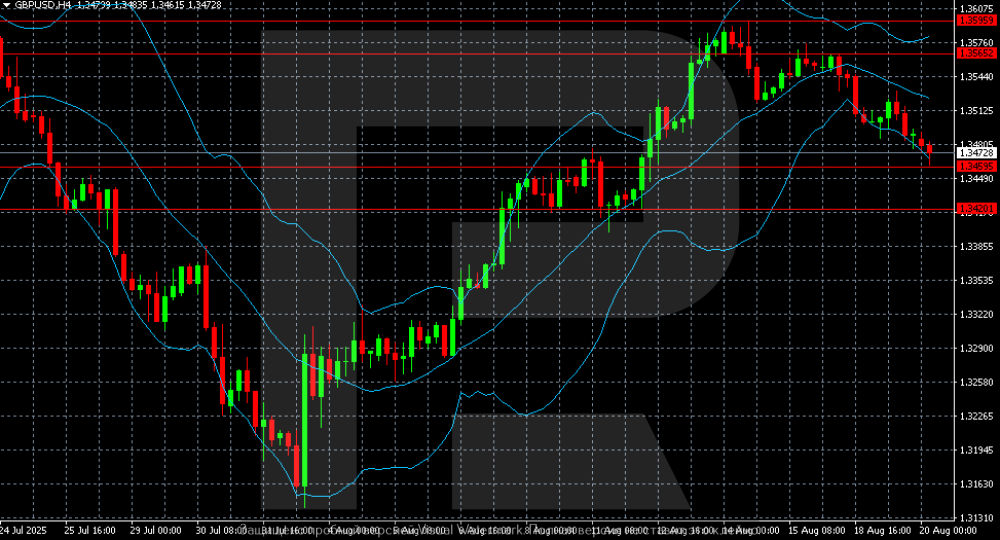

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBP awaits inflation, market assesses Bank of England policy outlook The GBPUSD pair dropped to 1.3472. UK inflation data will provide more clarity on the BoE’s policy outlook. Discover more in our analysis for 20 August 2025. GBPUSD technical analysis The GBPUSD pair is correcting after recent growth, trading near 1.3472. Earlier, the pair failed to hold above 1.3565 and rolled back, coming under selling pressure. The nearest support level is at 1.3420, and a breakout could open the way towards 1.3340. The GBPUSD pair is edging lower after recent gains. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team