⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

thx boss, but i dload amidata v14.12 which i found, and this crack not working bcoz of version v14.07. again thx to you for help boss.

- Today

-

⭐ FFRT reacted to a post in a topic:

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

⭐ FFRT reacted to a post in a topic:

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

-

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

⭐ laser1000it replied to ngatho254's topic in Ninja Trader 8

https://[email protected]/file/4lhfpphzpieteff/nt.rar/file -

Try with 9 30 am to 11 am, pretty good results. i can't backtest prev month, will appreciate if you can,

-

⭐ FFRT reacted to a post in a topic:

need NSE EOD data

⭐ FFRT reacted to a post in a topic:

need NSE EOD data

-

Thanks, but due to several unkown restrictions at my end, i wanted, these entire bunch as zipped file on mediafire or upload.ee

-

⭐ ajeet reacted to a post in a topic:

Educate request: thetradeengine.com/products/momentumtrack - files attached

⭐ ajeet reacted to a post in a topic:

Educate request: thetradeengine.com/products/momentumtrack - files attached

-

⭐ ajeet reacted to a post in a topic:

emeraldsedge.net

⭐ ajeet reacted to a post in a topic:

emeraldsedge.net

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

GBPUSD holds above 1.3300 ahead of the Fed decision The GBPUSD pair has stabilised above 1.3300 ahead of today’s Federal Reserve rate decision. Discover more in our analysis for 10 December 2025. GBPUSD forecast: key trading points Market focus: the market expects the Fed to lower rates by 25 basis points today Current trend: moderate upward momentum GBPUSD forecast for 10 December 2025: 1.3400 and 1.3250 Fundamental analysis Today, market participants expect the Federal Reserve to deliver another 25-basis-point rate cut. Investors will also focus on comments from Fed Chair Jerome Powell, who may take a cautious stance regarding further policy easing amid persistent inflationary pressures. Expectations for next week’s Bank of England rate decision remain largely unchanged, with the likelihood of a rate cut around 84%, despite signs of accelerating wage growth in the UK. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 380 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

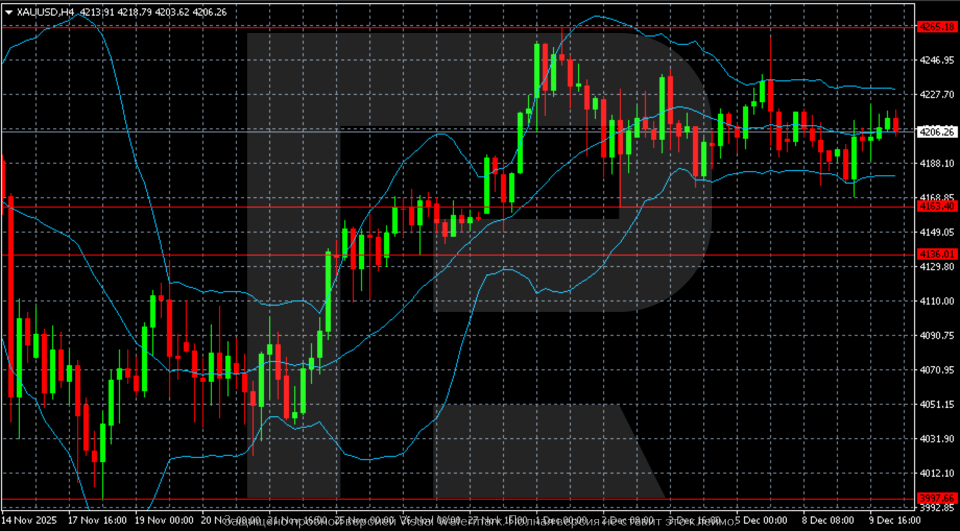

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold (XAUUSD) in waiting mode: the decision is up to the Federal Reserve Gold (XAUUSD) stalled near 4,210 USD. The Fed will define the near-term outlook. Find out more in our analysis for 10 December 2025. XAUUSD technical analysis On the H4 chart, gold (XAUUSD) continues its sideways movement following the earlier bullish impulse that lifted prices towards the 4,265 resistance level. Quotes continue to fluctuate within the 4,163–4,240 range, without forming a clear trend as the market awaits the Federal Reserve decision. XAUUSD quotes are hovering within a range ahead of the Fed decision. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

⭐ ahmed ibrahim reacted to a post in a topic:

Metastock 18 end of day c*****d.

⭐ ahmed ibrahim reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

alexstar3224 reacted to a post in a topic:

https://www.alphaquantalgos.com

alexstar3224 reacted to a post in a topic:

https://www.alphaquantalgos.com

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 10th December 2025. Job Data Point Towards a Hawkish Cut. Most assets are trading sideways after the US JOLTS Job Openings came in much higher than previous expectations. Investors were previously hoping the figure would remain low to prompt a dovish Federal Reserve. However, the stronger labour data indicates the Fed may indeed cut rates but stick to a pause thereafter. For this reason, Job Openings did not provide clarity on how the Federal Reserve may view its monetary policy. The market believes the Federal Reserve will decrease interest rates by 25-basis-points at tonight’s announcement. However, the guidance provided at the press conference thereafter is still not certain. If the Chairman, Jerome Powell, signals a pause for January, the US Dollar may rise while Gold and stocks decline. NASDAQ & S&P500 - Lack of Direction Due to the JOLTS Job Opening figures increasing the risk of the Federal Reserve opting for a ‘hawkish cut’, both indices traded sideways with a downward tilt. Out of the S&P 500 and NASDAQ, the NASDAQ performed better due to its exposure to growth stocks. However, the comments after tonight’s rate decision will be key to the performance of stocks over the next week. The JOLTS Job Openings for October were 7.66 million, while for November they rose slightly to 7.67 million. Both announcements were significantly higher than what the market was expecting. November Job Openings were the highest seen since July 2025. Due to the positive data, the possibility of a rate cut tonight fell by 2%, and by 5% for a cut in January 2026. A rate cut could provide some upward momentum, but as it's priced in, the guidance will be the main driver. Economists advise if the Fed indicates a pause for January, the S&P 500 could decline to $6,665. However, if rate cuts are likely to be frequent in 2026, the index could rise to $6,926.50 or even to an all-time high. HFM - NASDAQ 1-Hour Chart The US Dollar The best-performing currencies of the past week have been the Australian Dollar and New Zealand Dollar. The worst-performing has been the Japanese Yen. For this reason, if the US Dollar declines, many investors will monitor the AUDUSD or EURUSD. The Euro has been the best performing currency of 2025. Whereas, if the US Dollar is to increase in value, investors may see opportunities within the USDJPY. Some analysts expect policymakers to continue easing monetary policy in January, while others believe the current ‘dovish’ phase may pause for an extended period. The former scenario is viewed as more favourable for risk-on assets. In this context, it’s worth highlighting recent remarks from President Donald Trump. He told Politico that he would require any nominee for Federal Reserve Chair to support an immediate cut to borrowing costs. The President also said he would permit Nvidia to sell its H200 AI chips to ‘approved customers’ in China. The US government would allow this only if the company pays a 25% share of the profits from those transactions. According to Trump, Chinese President Xi welcomed the decision, suggesting an easing of tensions between the two economies. The easing of tensions between the US and China is supporting the US Dollar, but its price movement would depend on the Federal Reserve. HFM - USDJPY 1-Hour Chart Key Takeaway Points: Higher-than-expected JOLTS data increased uncertainty over the Federal Reserve’s next policy steps. A 25-basis-point rate cut is expected, but Jerome Powell’s guidance will drive markets. NASDAQ and S&P 500 traded sideways amid fears of a ‘hawkish cut.’ Markets may fall if the Fed signals a January pause, but the US Dollar can benefit from this. USD movement depends on Fed guidance and easing US-China tensions supporting sentiment. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Any news of this product?

-

babeonidi reacted to a post in a topic:

Metastock 18 end of day c*****d.

babeonidi reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

Durrrr1 joined the community

-

⭐ FFRT started following Pirate trader - Markets and mind

-

you can try this, install V 14.07 and replace this cracked file

-

Feel free to try your own settings. Some previous months are actually very bad.

-

ocxmart joined the community

-

Big Bump @TRADER good looking out

-

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

roddizon1978 replied to ngatho254's topic in Ninja Trader 8

I did post a Ninjacator Elliot wve count , sometime in here, just find it -

it does not have commissions. with commissions the draw down is 2205 and total profit is 485

-

Sharing my template for MGC 1 min chart, 2 micros: https://limewire.com/d/v97EZ#cBzyTBEVn7

-

The ninjapassbot is for passing evaluation during highly volatile events like CPI?

-

https://workupload.com/file/sTwjFK8cBQ9 @apmoo @kimsam

-

techfo reacted to a post in a topic:

ninjacators signal lab

techfo reacted to a post in a topic:

ninjacators signal lab

-

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

⭐ RichardGere replied to ngatho254's topic in Ninja Trader 8

Here is the link posted by ajeet in other thread for NT 8.0.28 (non profit wala version) https://drive.google.com/file/d/19mlw5M1tyI_hBXfcqWaxnLF2NMwd6Bpu/view -

techfo reacted to a post in a topic:

does anyone have Trinitas trading orderlow package?

techfo reacted to a post in a topic:

does anyone have Trinitas trading orderlow package?

-

Please any one have elliot wave count indicator of a ninjatrader 8

-

Check this video for reference:

- Yesterday

-

Yes, that's right, we have to examine everything carefully. There is no such thing as free money, but we can try to earn it with the facilities available at the broker. I got a bonus account, the proceeds of which we can withdraw as real money. Everything requires a process and, of course, terms and conditions.

-

Here it is: https://www.mediafire.com/file/g3di70zn30nnv8o/MSRT19.exe/file

-

ask for login and password