⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

Here you go! AdvancedVolumeProfile.zip

-

Anas223 joined the community

- Today

-

Mahesh reacted to a post in a topic:

Millennium Star Trax 7.2 – The Professional ‘Do It All’ Astrology Program

Mahesh reacted to a post in a topic:

Millennium Star Trax 7.2 – The Professional ‘Do It All’ Astrology Program

-

Mahesh reacted to a post in a topic:

Millennium Star Trax 7.2 – The Professional ‘Do It All’ Astrology Program

Mahesh reacted to a post in a topic:

Millennium Star Trax 7.2 – The Professional ‘Do It All’ Astrology Program

-

Whoever helps me with this is asking me to update the emulator https://workupload.com/file/KaXAACbmgVL

-

Learning and becoming independent is one of the best achievements and a step towards successful future's trader.

-

BOND DAS joined the community

-

https://nexusfi.com/local_links.php?action=ratelink&catid=27&linkid=2720 Thanks.

-

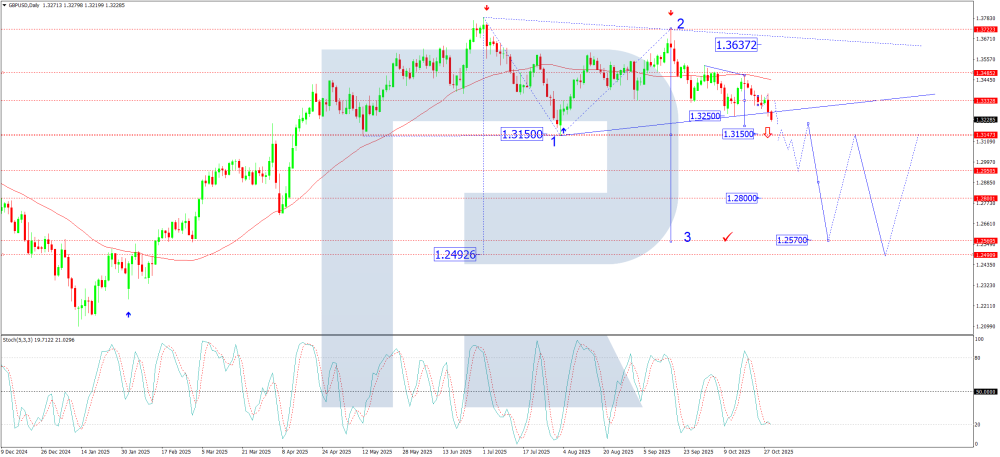

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBPUSD decline accelerates amid weak economic data The GBPUSD pair continues to weaken amid disappointing UK inflation data and expectations of BoE rate cuts, with the price currently at 1.3220. Find out more in our analysis for 29 October 2025. GBPUSD technical analysis On the daily chart, the GBPUSD pair has completed a wide consolidation range around 1.3485 and resumed its downward movement. The current structure indicates the development of the third wave of a medium-term downtrend. The GBPUSD rate remains under pressure within a descending channel. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY will need strength ahead of central bank meetings The USDJPY pair is consolidating around 151.98 midweek as traders shift their focus towards upcoming Federal Reserve and Bank of Japan decisions. Discover more in our analysis for 29 October 2025. USDJPY forecast: key trading points The USDJPY pair is saving its strength ahead of key policy meetings from the Fed and the BoJ Yen weakness continues to support Japan’s export-oriented sectors USDJPY forecast for 29 October 2025: 151.50–152.50 Fundamental analysis The USDJPY rate edged up to 151.98 on Wednesday as investors await the Bank of Japan’s meeting, where policymakers are widely expected to keep interest rates unchanged. Officials are set to discuss conditions for a potential resumption of the rate-hike cycle, as tariff-related risks gradually ease, although inflationary pressures still complicate the policy outlook. Earlier, the yen strengthened by about 0.5% following a meeting between Japanese Finance Minister Satsuki Katayama and US Treasury Secretary Scott Bessent, who urged Japan to pursue a sound monetary policy. Markets interpreted his remarks as a subtle criticism of Japan’s slow pace in tightening monetary conditions. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 351 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 29th October 2025. NASDAQ Forecast: Earnings And Market Drivers. The NASDAQ climbed to a new all-time high on Tuesday and surpassed the DAX for the first time in 2025. The NASDAQ is now the second best-performing index of the year so far, behind the Nikkei225 and slightly ahead of the German DAX. The bullish price movement gathered momentum after NVIDIA’s CEO expressed optimism about the artificial intelligence (AI) and Technology sectors. The trend was also fuelled by expectations of easing US–China trade tensions. Optimism grew further ahead of major quarterly earnings reports from leading technology companies. Earnings Forecasts-Microsoft and OpenAI Strike New Deal Market participants are focusing on the quarterly earnings reports from the ‘Magnificent-Seven’. After the market closes, Microsoft, Alphabet and Meta will all release theirearnings reports. The most influential report will be from Microsoft and Alphabet due to holding a higher weight. Together, the three companies hold a weight of 25%. Microsoft - Rose +1.98% on Tuesday - Earnings Per Share Prediction = $3.65 Alphabet - Fell .67% on Tuesday - Earnings Per Share Prediction = $2.26 Meta - Rose +0.08% on Tuesday - Earnings Per Share Prediction = $6.61 If all three companies exceed expectations and provide upbeat guidance for the next quarter, the NASDAQ is likely to maintain its bullish momentum. Lastly, on Thursday investors will shift their attention to earnings reports from Apple and Amazon, which are also part of the ‘Magnificent-Seven’. One of the reasons why Microsoft has seen stronger gains over the past 24 hours is the new agreement with OpenAI. The new agreement allows the ChatGPT creator to shift from its non-profit origins and prepare for a potential IPO to fund Sam Altman’s ambitious AI and data centre plans. Under the new structure, OpenAI will operate as a public benefit corporation still overseen by a nonprofit. Altman stated that an IPO is the most likely route to raise the funds needed for advanced AI development. Microsoft stocks are also rising a further 0.50% during this morning’s pre-market trading session. NVIDIA and Jensen Wong Investor sentiment has improved significantly with President Trump’s Asia tour, his agreement with China, and the upcoming meeting with President Xi. However, another key price driver has been NASDAQ’s most influential stock: NVIDIA. NVIDIA’s CEO, Jensen Huang, told journalists that he has no concerns about an artificial intelligence (AI) bubble. Mr Huang stated that NVIDIA's latest chips remain strong and on schedule. He also revealed that, due to US export controls, NVIDIA’s market share in China has dropped from 95% to effectively zero, remarking ‘we are 100 % out of China.’ NVIDIA’s stocks rose 4.98% on Tuesday and have since gained a further 1.69% during this morning’s Asian Session. NVIDIA is due to release its quarterly earnings report on 19 November after the market closes. The stock has risen 45% so far in 2025. Federal Reserve Investors are focused on tonight’s US Federal Reserve meeting, where a 25-basis-point rate cut from 4.25% to 4.00% is widely expected to support a cooling labour market. With inflation steady at 3.0%, the Fed has room to ease policy, although uncertainty remains due to limited economic data. Markets will also watch for signals of another potential rate cut later this year and in January. NASDAQ (US100)-Technical Analysis NASDAQ Daily Chart The NASDAQ continues to form higher highs and higher lows following the classic bullish trend pattern. The index is also trading above the main trendlines as well as above the day’s volume-weighted average price (VWAP). Most momentum-based indicators continue to point towards further upward price movement. However, investors should also be aware of the risks associated with the prices trading at all-time highs as well as a potential change in sentiment if earnings reports fail to meet expectations. A decline of more than 5% would suggest that the upward trend may be at risk. Key Takeaways: NASDAQ hits a new all-time high, surpassing the DAX and becoming 2025’s second-best-performing index behind the Nikkei 225. Tech optimism surges after NVIDIA’s CEO dismisses AI bubble fears, while Microsoft and OpenAI announce a major restructuring deal. Focus shifts to ‘Magnificent Seven’ earnings, with Microsoft, Alphabet, and Meta expected to drive short-term NASDAQ momentum. The Federal Reserve meeting remains in focus, with a 25-basis-point rate cut expected and investors watching for signals of further easing. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

[REQUEST] MBO MARKET BY ORDER INDICATORS - bestorderflow.com

kimsam replied to UTS's topic in Ninja Trader 8

No, I can't do that , it's protected by a new v. -

ampf reacted to a post in a topic:

[REQUEST] MBO MARKET BY ORDER INDICATORS - bestorderflow.com

ampf reacted to a post in a topic:

[REQUEST] MBO MARKET BY ORDER INDICATORS - bestorderflow.com

-

kimsam reacted to a post in a topic:

Did Not Find Marker Plus 2025

kimsam reacted to a post in a topic:

Did Not Find Marker Plus 2025

-

VolumeDetector.zip

-

https://theindicatormarket.com/depot/Markers_System/Markers_Plus_Single_ID_2025 Does anybody have the uneducated files so that @ampoo or @kimsam can work their magic?

-

[REQUEST] MBO MARKET BY ORDER INDICATORS - bestorderflow.com

indicat replied to UTS's topic in Ninja Trader 8

neither v1 nor v2 came with any .cs file https://best0rderfl0w.com/userguide/errors https://best0rderfl0w.com/userguide/install/mboindicators There are some files on how to call it programmatically, but no .cs files that are part of the install... -

SHARE..Mark Leibovit's Volume Reversal ToolKit

⭐ FFRT replied to niftymover's topic in Trading Platforms

Can someone share the Metastock Add On Mark Leibovit Volume Reversal, shared in the first post again here. Book could be accessed here https://www.scribd.com/document/398474649/Traders-Book-of-Volume-Mark-Leibovit iF DOWNLOADED, ITS FILE SIZE IS 244 MB, if someone could compress without compromising the quality of pdf , - welcome. -

If TOS is not available then use this https://menthorq.com/ instead of doing it manually on excel it does put all the levels 0DTE and gamma GMX on to the charts and auto calculates

-

ampf started following [REQUEST] MBO MARKET BY ORDER INDICATORS - bestorderflow.com

-

[REQUEST] MBO MARKET BY ORDER INDICATORS - bestorderflow.com

ampf replied to UTS's topic in Ninja Trader 8

Does the original comes with any .cs file? -

Ninja448 reacted to a post in a topic:

TheVwap Full code

Ninja448 reacted to a post in a topic:

TheVwap Full code

-

Guys you mis understand me, there is no SMM in Think or Swim, what I am saying is that I beat it using another way of getting my trade by using Think or Swim and applying it to an excel spreadsheet where I get my information how to trade https://imgur.com/a/iKuYoXM

-

that would be appreciated! 😁

-

looknowhere reacted to a post in a topic:

SMM Metrics Time filter refined

looknowhere reacted to a post in a topic:

SMM Metrics Time filter refined

-

PK2 reacted to a post in a topic:

.NinZa-VoluTankArmy

PK2 reacted to a post in a topic:

.NinZa-VoluTankArmy

- Yesterday

-

⭐ FredUrble reacted to a post in a topic:

[Req] Traders handbook

⭐ FredUrble reacted to a post in a topic:

[Req] Traders handbook

-

⭐ RichardGere reacted to a post in a topic:

[Req] Traders handbook

⭐ RichardGere reacted to a post in a topic:

[Req] Traders handbook

-

https://nexusfi.com/local_links.php?action=ratelink&catid=27&linkid=2721

-

@roddizon1978 Please can you show me how to get the Thinkorswim Version (Thinkscript)? Thanks

-

⭐ goldeneagle1 reacted to a post in a topic:

SPX Gamma Dashboard Review

⭐ goldeneagle1 reacted to a post in a topic:

SPX Gamma Dashboard Review

-

you had to have an Think or swim account, I could show you the right path

-

No one has the updated version?

-

Looks like this was updated. https://funwiththinkscript.com/indicators/spx-gamma-dashboard/

-

can you share the file.. thxs

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.